Professional Documents

Culture Documents

About Mahindra and Mahindra

About Mahindra and Mahindra

Uploaded by

Rohit Kumar0 ratings0% found this document useful (0 votes)

11 views32 pagesOriginal Title

28737110 About Mahindra and Mahindra

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views32 pagesAbout Mahindra and Mahindra

About Mahindra and Mahindra

Uploaded by

Rohit KumarCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 32

1

MAkkL1ING LAN CN MAnINDkA SCCkIC

Submitted by

kLLS (098A128)

A PR0}FCT RFP0RT

Submitted in partial fulfillment of

the requirements for the

TFRH PAPFR

Under the guidance of

Dr CLLMLN1 SUDnAkAk M8A Mh|| hD

AssoclaLe rofessor

School of ManagemenL

%eclared as a deemed Lo be unlverslLy under sec 3 of Lhe uCC AcL 1936)

karunya nagar ColmbaLore641 114

NCVLM8Lk 2009

CLk1IIICA1L

1hls ls Lo cerLlfy LhaL Lhe ro[ecL enLlLled 'Market|ng |an Cn Mah|ndra Scorp|o' submlLLed

by Mr kees (keg No 098A128) for Lhe Lerm aper ln MasLer of 8uslness AdmlnlsLraLlon Lo Lhe

karunya unlverslLy karunya nagar ColmbaLore 641 114 ls a record of 8onaflde work carrled ouL

by hlm durlng Lhe perlod 9

Dr SAMULL CSLn Dr CLLMLN1 SUDnAnAk

%AdmlnlsLraLlve CoordlnaLor) %aculLy Culde)

lace

aLe

CerLlfled LhaL Lhe candldaLe was examlned by us ln Lhe ro[ecL work and vlvavoce LxamlnaLlon

held on _______________________ aL karunya unlverslLy karunya nagar ColmbaLore 641 114

3

ACkNCWLLDGLMLN1

We glve all Lhe glory Lo our LCkD GCD AlmlghLy for guldlng and belng wlLh us and helplng us

compleLe Lhls pro[ecL successfully

We Lhank our Chancellor Dr au| Dh|nakaran for hls consLanL prayer and supporL We also

Lhank Lhe vlceChancellor Dr au| Appasamy and Lhe 8eglsLrar Dr Anne Mary Iernandez for her

supporL

We Lhank Lhe lrecLor of Lhe School of ManagemenL Dr S Samue| oseph We are also

Lhankful Lo our menLor for Lhe guldance he gave for our pro[ecL

We are lndebLed Lo our ro[ecL Culde and Class advlsor Dr C|ement Sudhakar M8A

Mh|| hD for hls valuable guldance and lnLeresL LhroughouL Lhls pro[ecL

lnally we Lhank our beloved arents hearLlly for Lhelr consLanL supporL prayer and

encouragemenL We also Lhank our Ir|ends for Lhelr supporL and encouragemenL

4

bout Mahindra & Mahindra

Type Public Company

Founded 1945

Headquarters Mumbai, India

Key people Keshub Mahindra (Chairman),

Anand Mahindra (Vice-Chairman & Managing Director)

Industry Automotive,Farm Equipment

Revenue US$ 10 billion (2009 H1).

Employees 16,000 plus

Website Mahindra.com

Mahindra & Mahindra Limited is part oI the Mahindra Group, an automotive, Iarm

equipment, Iinancial services, trade and logistics, automotive components, aIter-market, IT

and inIrastructure conglomerate. The company was set up in 1945 as Mahindra &

Mohammed. Later, aIter the partition oI India, Ghulam Muhammad returned to Pakistan and

became that nation's Iirst Iinance minister. Hence, the name was changed Irom Mahindra &

Mohammed to Mahindra & Mahindra in 1948.

Initially set up to manuIacture general-purpose utility vehicles, Mahindra & Mahindra

(M&M) was Iirst known Ior assembly under licence oI the iconic Willys Jeep in India. The

company later branched out into manuIacture oI light commercial vehicles (LCVs) and

agricultural tractors, rapidly growing Irom being a manuIacturer oI army vehicles and tractors

to an automobile major with a growing global market. At present, M&M is the leader in the

utility vehicle (UV) segment in India with its Ilagship UV, the Scorpio (known as the

Mahindra Goa in Italy).

M&M is India's largest SUV maker.

Business

Mahindra & Mahindra grew Irom being a maker oI army vehicles to a major automobile and

tractor manuIacturer. It has acquired plants in China and the United Kingdom, and has three

assembly plants in the USA. M&M has partnerships with international companies like

Renault SA, France and International Truck and Engine Corporation, USA.

3

M&M has a global presence

|

and its products are exported to several countries. Its global

subsidiaries include Mahindra Europe Srl. based in Italy, Mahindra USA Inc., Mahindra

South AIrica and Mahindra (China) Tractor Co. Ltd.

M&M is one oI the leading tractor brands in the world. It is also the largest manuIacturer oI

tractors in India with sustained market leadership oI over 25 years. It designs, develops,

manuIactures and markets tractors as well as Iarm implements. Mahindra Tractors(China)

Co. Ltd. manuIactures tractors Ior the growing Chinese market and is a hub Ior tractor

exports to the USA and other nations. M&M has a 100 subsidiary, Mahindra USA, which

assembles products Ior the American market.

M&M made its entry into the passenger car segment with the Logan in April 2007 under the

Mahindra Renault joint venture. M&M will make its maiden entry into the heavy trucks

segment with Mahindra Navistar, the joint venture with International Truck, USA.

M&M's automotive division makes a wide range oI vehicles including MUVs, LCVs and

three wheelers. It oIIers over 20 models including new generation multi-utility vehicles like

the Scorpio and the Bolero.

At the 2008 Delhi Auto Show, Mahindra executives said the company is pursuing an

aggressive product expansion program that would see the launch oI several new platIorms

and vehicles over the next three years, including an entry-level SUV designed to seat Iive

passengers and powered by a small turbodiesel engine. True to their word, Mahindra &

Mahindra launched the Mahindra Xylo in January 2009, and as oI June 2009, the Xylo has

sold over 15000 models.

Also in early 2008, Mahindra commenced its Iirst overseas CKD operations with the launch

oI the Mahindra Scorpio in Egypt, in partnership with the Bavarian Auto Group. This was

soon Iollowed by assembly Iacilities in Brazil. Vehicles assembled at the plant in Bramont,

Manaus, include Scorpio Pik Ups in single and double cab pick-up body styles as well as

SUVs.

The US based Reputation Institute recently ranked Mahindra among the top 10 Indian

companies in its 'Global 200: The World's Best Corporate Reputations' list.

Mahindra is currently gearing up to sell the Scorpio SUV and pickup starting in the Fall oI

2009 in North America, through an independent distributor, Global Vehicles USA, based in

Alpharetta, Georgia. Mahindrahas announced it will import pickup trucks Irom India in

knockdown kit (CKD) Iorm to circumvent the Chicken tax. CKDs are complete vehicles that

will be assembled in the U.S. Irom kits oI parts shipped in crates.

ards

1. Bombay Chamber Good Corporate Citizen Award Ior 2006-07

2. Businessworld FICCI-SEDF Corporate Social Responsibility Award 2007

3. Deming Prize

6

4. Japan Quality Medal in 2007

Models

O Mahindra Bolero

4 Mahindra Bolero Camper

4 Mahindra Bolero Inspira

4 Mahindra Bolero Stinger Concept

O Mahindra Scorpio

4 Mahindra Scorpio Getaway

4 Mahindra Scorpio First

O Mahindra Xylo

O Mahindra Legend

O Mahindra MM550 XD

O Mahindra-Renault Logan (in cooperation with Renault)

O Mahindra Axe

O Mahindra Major

4 Mahindra Souvenir Concept

O Mahindra Commander

O Mahindra Grand Vitara

O Mahindra DI

O Mahindra Cab Chassis

ore Business ctivities

O Automotive

O Farm Equipment

O Systech

O Financial Services

O InIormation Technology

O InIrastructure Development

O AIter-Market

O Two-wheelers

O Mahindra Partners Division

O Specialty Services

Commun|ty In|t|at|ves

O Mahindra United World College oI India

O Mahindra United, a Iootball club based in Mumbai, Maharashtra

O Mahindra Foundation

O K. C. Mahindra Education Trust: Nanhi Kali

bout Mahindra Scorpio

The Mahindra Scorpio is an SUV manuIactured by Mahindra & Mahindra Limited, the

Ilagship company oI the $6.3 billion Mahindra Group. It was the Iirst SUV Irom the company

built Ior the global market. The Scorpio has been successIully accepted in international

markets across the globe, and will shortly be launched in the US.

The Scorpio was conceptualized and designed by the in-house integrated design and

manuIacturing (IDAM) team oI M&M. The car has been the recipient oI three prestigious

awards - the "Car oI the Year" award Irom Business Standard Motoring, the "Best SUV oI

the Year" by BBC World Wheels and the "Best Car oI the Year" award, again, Irom BBC

World Wheels.

The making of the Mahindra Scorpio

Prior to the mid-nineties, Mahindra & Mahindra was an automobile assembly company. The

company manuIactured Willys Jeeps and its minor modiIied versions (modiIications carried

out in India). In 1996, the company planned to enter the SUV segment with a new product

which could compete globally. Since M & M didn't have the technical know-how to make a

new age product, they devised a whole new concept among Indian auto companies. Roping in

new executives such as Dr. Pawan Goenka and Alan Durante who had worked in the auto

industry in western countries, the company broke the rule that says automakers must design,

engineer and test their own vehicles (spending millions oI dollars in the process). The new

Mahindra Scorpio SUV had all oI its major systems designed directly by suppliers with the

only input Irom Mahindra being design, perIormance speciIications and program cost. Design

and engineering oI systems was done by suppliers, as was testing, validation and materials

selection. Sourcing and engineering locations were also chosen by suppliers. The parts were

later assembled in a Mahindra plant under the Mahindra Badge (as Mahindra is a well known

brand in India in the MUV segment). Using this method the company was able to build a

Irom scratch a new vehicle with virtually 100 percent supplier involvement Irom concept to

reality Ior $120 million, including improvements to the plant. The project took 5 years to

move Irom concept to Iinal product.

In April 2006, the company launched an upgraded Scorpio dubbing it the 'All-New'

Scorpio. In June 2007, Mahindra launched a pick-up version in India known as the Scorpio

Getaway.Recently, M & M has launched a Iace liIted version oI the model.

Exports

The Mahindra Scorpio is sold across the world in countries such as:

O India

O Italy

O France

O Spain

O Turkey

O Sri Lanka

O Nepal

O Bangladesh

O Egypt

O Russia

O Malaysia

O South AIrica

O Qatar

O Brazil

O Chile: The Scorpio Pick Up is the Iirst passenger vehicle oI the Mahindra brand to be

oIIered in Chile, and both were presented to the press the night oI July 25, 2007.

In Western Europe, so as not to conIuse the vehicle with a previous Ford vehicle oI the same

name, it is called the Mahindra Goa.

Safety

A new Mahindra Pick-Up model being introduced to Australia mid-09 will have additional

saIety Ieatures to the current model, such as ABS Brakes and Airbags which should elevate

its rating to a minimum oI 3 stars Irom the current 2 star ANCAP rating.

Future

Soon aIter the success oI the Scorpio, Mahindra launched an upgraded Scorpio with plush

seats and rear centre arm rest, dual tone exterior colour and various minor changes.

At the Auto Expo 2006, Delhi, Mahindra showcased their Iuture plans on the Scorpio model

by showcasing a Hybrid Scorpio with CRDe engine and a Scorpio based on a pick-up truck.

The Hybrid, the Iirst such vehicle developed in India was developed by Arun Jaura, a Iormer

Ford employee. His senior, Dr. Pawan Goenka, a Iormer GM engineer currently heads

Mahindra's automotive division and looks aIter the overall Scorpio project.

In November 2007, Mahindra launched a teaser campaign Ior their new Scorpio Model, the

mHawk on their oIIicial website.

On April 14, 2008, Mahindra revealed a concept oI a diesel-electric hybrid version oI their

Scorpio SUV at the 2008 SAE World Congress.

21st Sep 2008 Mahindra launched their latest Scorpio with 6 speed automatic transmission

gears.

Mahindra has Ior a while had plans on exporting to the United States, possibly with a diesel-

electric hybrid. In 2006 it entered into an agreement with Global Vehicles USA to import and

distribute Mahindra vehicles. It now plans to release a modiIied Pick-up version oI the

Scorpio (currently unnamed due to copyright issues with the Ford Scorpio) in the US by the

end oI 2009. This vehicle is projected to cost in the low $20,000s.

9

First year of launch

O 8Scorpio to capture 22 per cent oI the premium hard top market in F03 (9 months)

O Sell 12000 Scorpios in F03 (9 months)

O Mahindra unaided brand recall score to increase by 22 pts (deIined in terms oI Brand

Track study scores)

O Scorpio brand recall score to achieve 50 points (in W4)

nd generation

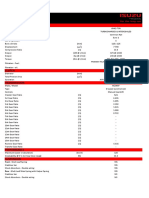

SpeciIications: 120 horsepower

6-speed auto

O Wheelbase: 105.5 in (2,680 mm)

O Length: 176.9 in (4,493 mm)

O Width: 71.5 in (1,816 mm)

O Height: 77.8 in (1,976 mm)

O Base curb weight: 3,850 lb (1,750 kg) (CG estimate)

ithin three years of launch

O Scorpio to capture 45 per cent oI the premium hard top market

O Scorpio to sell 24,000 units in F04

O Mahindra to emerge as a true urban player

vervie Mahindra Scorpio's:

Make Mahindra

Model Scorpio

Variant 2.6 LX 9-seater

Body Type SUV

Number of doors 5

Fuel EIIiciency

ity Mileage 9.4 kmpl

Highay Mileage 13.9 kmpl

Fuel apacity 60 litre

Fuel Type Diesel

Fuel Grade -

1

Engine Parameters

isplacement 2609 cc

Bore 94 mm

Stroke 94 mm

ylinder onfiguration 4-inline

Valve Gear peration Pushrod

ompression Ratio 18.5:1

No. f Valves 8

spiration Turbo-charged

Fuel System CRDi

Horse Poer 1153800 psrpm

Torque 277.522200 Nmrpm

Steering and Suspension

Steering Type Rack and pinion, power assist

Poer Steering Yes

Front Suspension 2WD Independent, Coil Spring,Anti Roll Bar

Rear Suspension Multilink, Coil Spring

imensions

Length 4495 mm

Height 1975 mm

idth 1817 mm

heelbase 2680 mm

learance 180 mm

11

ST nalysis

Strength

O India's Iirst BS IV Car.

O Revolutionary Micro-Hybrid Technology.

O PowerIul mHawk Diesel Engine.

eakness

O EIIortless Acceleration.

O Fire Retardant Upholstery.

O Excellent Driving Experience.

Threats

O Automatic Transmission only on Top-End Variant.

pportunities

Mahindra vehicles have gone on display to auto enthusiasts around the world,

participating in prestigious automobile shows in Paris, Rome, Bologna, Johannesburg

and So Paulo.

STP nalysis

Segment

A BRAND is a thought, and launching brands can be a great growth strategy Ior any

corporate. But, it takes two to tango. A brand Iounded on a good idea needs to be built with

an ever-evolving gameplan. A case in point is the launch oI the sports utility vehicle (SUV),

Scorpio, by Mahindra & Mahindra (M&M).

When Scorpio hit the streets, it arrived as an SUV with a `car plus' package. Two-and-a-halI

years later, it has caused a paradigm shiIt in its category. Equipped with a savvy marketing

strategy, the brand has not only grown the SUV market, but almost touched base with the `C'

class cars segment (Rs 5 lakh and upwards.)

According to automobile manuIacturers' data, the premium utility vehicle segment grew at

approximately 14 per cent up to June 2002.

With the launch oI Scorpio, the growth rate Irom July 2002 to March 2003 rose to about 51

per cent. Between April 2003 and March 2004, the segment grew by 33 per cent.

Positioning

1

attract a lot oI cross-over customers. Unlike Ior its competitors in the UV category, people

who wished to purchase a C class car would also consider a Scorpio," says Hormazd

Sorabjee, Editor, :9ocar India.

Cut to market expansion oI premium utility vehicles against `C' class cars. Out oI the total

number oI premium utility vehicles and `C' segment cars put together, premium UVs

accounted Ior about 21 per cent during the year 2000. The Iigure touched 49 per cent this

year.

"The Scorpio launch did play a signiIicant role in driving the UV market up. This to me is the

ultimate measure oI success - the ability oI a company to drive the growth oI markets,"

remarks Abraham Koshy, ProIessor oI Marketing, Indian Institute oI Management,

Ahmedabad.

Marketing gurus suggest that the positioning oI Scorpio was also very bold and innovative.

Mahindra Scorpio Pick Up secures third position in T2 category oI Rally dos Sertoes in

Brazil

Target

The track monitors `high value' consumers, and registers those who are in the SEC A and B

categories, while 67 per cent oI the sample size is Irom the top eight metros; the rest Irom the

next 50-60 towns across India.

Sales too has been zooming, says the company. According to brand-wise data, the company

claims to be matching sales oI most C segment cars, even outselling some oI them. In the last

six months, M&M sold 14,389 Scorpios, against a total C segment sales oI 79,346, according

to company data.

PEST nalysis

Political

O Taxation Policy

O Government Policy

Social

O Give good quality to their customers

O Providing oIIers to its retailer and customers

13

O Providing liIe style product

O Change the customer attitudes and opinions

Economy

O Launch low cost car in rural areas

O Launch economy related brand

O Launch power Iull car in the market so customers make good image in their mind

Technological

O Provide new innovative product to their customers

O Provide the compete ting technology

O Provide new technology to their worker

14

Market Mix

The soIt tops sales, which were Mahindra`s strength, were stagnating. Hard top vehicles like

Sumo and Qualis were garnering market share. The urban market was showing more

potential Ior vehicle sales and UVs were gaining higher acceptability in urban cities. The

competition was getting tougher with international UVs entering the market. And also

operating in the urban market meant competing with cars.

The market was moving Irom traditional multi utility, non-luxurious vehicles to luxurious

vehicles. M&M had launched Bolero in 2000 to cater to this newly emerging segment.

However, to add to the category`s woes, it declined at the rate oI 3.1 percent in year 2001

over year 2000. UVs as a percentage oI the overall passenger car market was just 16 per cent

in 2001. This simply meant that Ior attaining the volumes, Scorpio needed to look beyond

UVs in terms oI competitive Iramework to decide on a marketing strategy.

ompetitive

The conventional UV market was too small in size. The UV market in urban markets was

even smaller a percentage. The trend was that the UVs operating in the urban market were

eating into the car share, primarily the cars which operated in the same price bracket. Qualis

was taking market away Irom midsize cars. With these Iacts in place the whole oI automobile

market was studied in details.

In the arena oI cars, A-segment cars, which have been the leaders in terms oI volumes and

grew at the rate oI 55.2 percent in the year 1999, were having a reduced growth rate oI 34.2

13

percent in the year 2001. It was Iound that the Iastest growing segment (growing at the rate oI

42.9 per cent) in year 2001 was semi luxurious cars or B segment cars. And the luxurious car

segment i.e. C segment cars were also growing at a healthy rate oI 14.2 percent in that year.

However, super premium cars termed as segment D and E cars, were not growing at such

healthy rates and did not oIIer volume in terms oI number oI cars sold.

It was imperative Ior Scorpio to look beyond UVs. Apart Irom appealing to a typically UV

buyer, it was also necessary to appeal to a wider target audience - prospective car buyers

belonging to 5 lakh and 5 lakh segment. The midsize car market (C class) which was in the

Rs. Five to Seven lakh price bracket had grown in F`00 at 36 per cent and in F`01 at 22 per

cent, and small luxury car segment (B class) which was up to Five lakh segment was also

showing a healthy growth.

Analysis showed that the volumes in the automobile industry were coming Irom B and C

segment cars. This meant that the mid size car market was the competitive arena Ior Scorpio

Ior it to attain the volume growth and market share it was looking Ior. It was decided that the

oIIer had to appeal to segment C buyer and should be aspirational Ior segment B buyers.

ThereIore, an analysis oI the oIIers oI all the segment C cars and the relevant UVs was done.

The table below summarises the analysis:

Interpretations: All the vehicle are Ieature packed within a price range oI Rs. 6-8 Lakhs. All

oI them, including UVs, are with a proposition oI luxury and comIort, with no diIIerentiation.

Implication: With this analysis it came out clearly that the positioning oI Scorpio has to be

such that it should communicate that the vehicle is better than any oI these cars and is a better

buy in terms oI money.

onsumer

Having deIined the competitive Iramework, the next task undertaken was that oI analyzing

the consumer. Consumer segments oI B and C category car buyers were analyzed in terms oI

their expectations Irom a car, their perceptions about cars and their relationship. Proprietary

techniques oI research, oI the advertising agency InterIace Communications, like Mind &

Mood, ICON and VIP were used to understand this consumer. The Iindings were:

Size matters-

O big size stands Ior status

O Consumers seek latest technology

O Imagery but at aIIordable price

O The sheer thrill and passion oI driving an SUV

O Power oI the vehicle makes a statement

O But along with the others, luxury was a very important parameter

O International vehicles deIine imagery

16

O SUVs like Pajero, Land Cruiser and Prado are seen as urban vehicles Ior the rich and

Iamous

O Consumers aspire to own these vehicles as the imagery oI these vehicles has become

very desirable

The Key Consumer Insight that emerged Irom all the consumer analysis and which

was used Ior strategy development was 'Consumers want to consume premium

imagery at prices aIIordable to them

ompany

The Mahindra Scorpio is an SUV manuIactured by Mahindra & Mahindra Limited, the

Ilagship company oI the $6.3 billion Mahindra Group. It was the Iirst SUV Irom the company

built Ior the global market. The Scorpio has been successIully accepted in international

markets across the globe, and will shortly be launched in the US.

The Scorpio was conceptualized and designed by the in-house integrated design and

manuIacturing (IDAM) team oI M&M. The car has been the recipient oI three prestigious

awards - the "Car oI the Year" award Irom Business Standard Motoring, the "Best SUV oI

the Year" by BBC World Wheels and the "Best Car oI the Year" award, again, Irom BBC

World Wheels.

ontext

SUVs in India have a tough terrain to navigate given that competition means a traIIic jam oI

car brands on the road. It`s in this context that a SUV brand like Scorpio deserves mention. It

had its glorious era, but it doesnt match with the new age and new look suvs oI the modern

times. Tavera, Innova, Tuscan, Endeavour and to some extent Scorpio rank much better in

looks.Scoprio may loose somewhat in comIort, but saIari seems overall out oI context. OII

course, these are my personal views.

ollaborator

Deliver value through integration, collaboration and synergy within the Mahindra group.

"We have been an advocate oI technology as a pivotal pillar on our journey towards enabling

business excellence," said Mr. Arvind Tawde, Senior Vice- President and CIO, Mahindra &

Mahindra, "We cherish the continuing evolution oI this long-standing relationship; together

we hope to take this relationship to newer heights oI collaboration and co-innovation."

This agreement extends SAP's position as a leader in providing comprehensive enterprise

soItware Ior the automotive and manuIacturing industries. The ability to rapidly integrate

new operations resulting Irom mergers and acquisitions, shiIt supplies due to changing

demand and collaborate across a business network oI partners is vital to companies as they

strive Ior market share and greater proIitability in the industry.

1

Place

Mahindra & Mahindra has emerged as a well-known tractor brand in the US. It is now

planning to launch the Scorpio in the US sports utility vehicle market.

Mahindra Automobiles have a strong and growing presence in international markets

Yugoslavia,

Bangladesh

Sri Lanka

Australia

Uruguay

South AIrica in 2004 (Mahindra South AIrica)

Europe in 2005 (Mahindra Europe)

Mahindra vehicles have gone on display to auto enthusiasts around the world,

participating in prestigious automobile shows in Paris, Rome, Bologna, Johannesburg

and So Paulo.

In 2006 Mahindra announced that it would be the Iirst Indian automobile

manuIacturer to enter the world`s most demanding and critical market USA.

Price

MODEL PRICE (in INR)**

LX 735500

M2DI 691100

SLE 834500

SLX-4WD 972100

VLX BS3 2WD 938700

VLX BS3 2WD-Air Bag 958000

1

VLX BS3 4WD 1015100

VLX BS3 4WD-Air Bag 1034400

*Note : Any other levies or taxes iI applicable are extra.

For exact prices, please contact our dealerships.

Prices are applicable within the speciIied city limits only.

All prices are subject to change, and Mahindra Scorpio reserves the right to modiIy the prices

at its discretion at any point in time.

Promotion

The creative strategy was to drive home the Car Plus` positioning Iorward. There was a need

to leverage on product strengths. And a need to establish car plus story. Hence the product

was to be the hero in all communications

The tone and manner was to help associate the brand with the modern and urban liIestyle.

The TVCs as well as the press still-shots were shot in Australia to provide an international

city Ieel. This brought in the international, premium, up-market association Ior the brand.

Product

O Mahindra Scorpio

4 Mahindra Scorpio Getaway

4 Mahindra Scorpio First

Model

O LX

O M2DI

O SLE

O SLX-4WD

O VLX BS3 2WD

O VLX BS3 2WD-Air Bag

O VLX BS3 4WD

VLX BS3 4WD-Air Bag

19

Market summary

The conventional SUV market was too small in size. The SUV market in urban markets was

even smaller a percentage. The trend was that the SUVs operating in the urban market were

eating into the car share, primarily the cars which operated in the same price bracket. Qualis

was taking market away Irom midsize cars. Mahindra vehicles have gone on display to auto

enthusiasts around the world, participating in prestigious automobile shows in Paris, Rome,

Bologna, Johannesburg and So Paulo. In 2006 Mahindra announced that it would be the Iirst

Indian automobile manuIacturer to enter the world`s most demanding and critical market

USA. The tone and manner was to help associate the brand with the modern and urban

liIestyle. The TVCs as well as the press still-shots were shot in Australia to provide an

international city Ieel. This brought in the international, premium, up-market association Ior

the brand. Since the Scorpio was targeted at an urban clientele it needed a stronger

distribution presence in Metros and urban areas. Hence, the distribution channel had to Iocus

on providing an appealing experience Ior modern car buyers and on oIIering international

standards oI auto retail.

evelopment

Made survey and collect customer preIerence and perception Ior designee and Ieature

Introduction oI quality Iunction development (qId) process

Create the benchmark according to word class suva`s

O Big size

O Latest technology

O AIIordable size

O Have thrill and passion in driving

O Have luxury

O International vehicles deIine image

riticism

Some companies said that Mahindra & Mahindra did not have the capacity to provide

vehicles in house

No crash testing

Mahindra & Mahindra did not re-designed its product

Technology

Collapsible steering column & split intrusion beams

Crash protecting crumple zones and child locks

Fire resistant upholstery

Voice assist system, vehicle security system & remote locking/unlocking

Tubeless tyres

Poly coated grand deck

STYLE

Bonnet scoop

Air extractor

Two tone interiors

Sporty decal

Full wheel caps

MFRT

Tilt able steering

Full Iabric seats

Individual armrests on 1st row seats

Heating, ventilation & AC with rear vents

ORVM manual remocon & swivel interior lamp

NVENIENE

Power steering

Power windows

Spaces Ior storage on centre bezel, IP & console

Mobile charging Iacility Ior the Iront and middle row seats

Intelligent Iront wipers

Follow me home' lamps

Theatre style interior illumination

Illuminated key ring

Side step

Head lamp levelling switch

Front Iog lamps

SETING

5 Seater

1

Brand Strategy - Parent brand relationship defining

A study oI international brand names was done and a classiIication oI brand names oI

midsize cars and SUVs was done into groups. International brand naming trends and

strategies were analysed. New names were generated. These brand names were researched

massively Iirst by qualitative techniques and then by quantitative techniques.

The name that emerged as most popular, and which was also the most liked name internally

at Mahindra was SCORPIO.

Brand Endorsement Strategy

The relation between Scorpio and the mother brand Mahindra was also deliberated upon. The

strategy chosen Ior Brand Endorsement was - Scorpio Irom Mahindra - shadow endorsement,

one which does not shout 'Mahindra.

The Mahindra brand image was not modern and young. There was a need to create a strong

distinct modern brand. Hence Mahindra as a Masterbrand could not contribute towards

enhancing the Value Proposition. Yet Mahindra had to provide source reassurance. Also the

distribution would be through Mahindra dealerships. Hence it became a shadow endorser.

dvertising and Promotions Strategy

The creative strategy was to drive home the Car Plus` positioning Iorward. There was a need

to leverage on product strengths. And a need to establish car plus story. Hence the product

was to be the hero in all communications

The tone and manner was to help associate the brand with the modern and urban liIestyle.

The TVCs as well as the press still-shots were shot in Australia to provide an international

city Ieel. This brought in the international, premium, up-market association Ior the brand.

Media Strategy

O Role oI Media

O Dramatic and high impact launch

O High visibility

O Push brand image even by the media vehicle

Building impact through multiple-media

O PR, Mass Media, Direct Marketing, Events

Public Relations

Pre-launch excitement and buzz was created by a Iull blown PR program. Media coverage on

the IDAM process, the people behind the Scorpio, the obsession, the world class technology,

etc set the tone Ior the hyped up launch. PR was also the Iirst tool used Ior launching the

Scorpio. The coverage oI the launch was massive. It got Iour cover stories

Mass Media

While the media targets would be achieved through the right selection oI the media mix, the

Scorpio media posture was to ensure that Scorpio was present on the decided media but with

a diIIerence.` Scorpio would use media innovations to create diIIerentiation on the traditional

media and do things in a bigger and better` manner.

ustomer Relationship Management (RM)

CRM as a tool was used to create positive word-oI-mouth, to monitor customer experiences

and generate reIerrals. A series oI CRM activities were implemented with regular direct

communication, events and customer research. The CRM plan included a welcome Pack on

Iilling up Scorpio Club (Top Gear) Iorm, satisIaction surveys, Events, Festive oIIers,

Rewards Program, etc.

Pricing Strategy: to be a premium brand yet having universal appeal

Scorpio was to compete with the midsize cars like Hyundai Accent, Ford Ikon, Opel Corsa,

Maruti Suzuki Esteem on the one side and UVs like Toyota Qualis, Tata SaIari and the Tata

Sumo on the other. Scorpio adopted the penetrative pricing strategy positioned in the

psychological price barrier oI Rs. 5 -7 Lakhs.

istribution Strategy - Serve less markets at a time but serve them ell

Since the Scorpio was targetted at an urban clientele it needed a stronger ditribution presence

in Metros and urban areas. Hence, the distribution channel had to Iocus on providing an

appealing experience Ior modern car buyers and on oIIering international standards oI auto

retail.

3

Strategic Branding pproach -

Identifying the need gap and occupying it

There existed a gap that wasn`t tapped. There was no SUV in the country that the masses

could buy. To make SUVs a mass concept in India - UVs needed to be seen as comIortable,

easy-Ior-city driving and should have imagery comparable to international brands.

ThereIore, as a strategy it was decided that Scorpio would not take the traditional UV

imagery oI tough, oII-roading and 4x4. A 4x4 approach would be a very niche category and

would not generate numbers. To appeal to a car buyer, the Scorpio needed to be seen as a car

that oIIers much more.

A Scorpio had to be seen as providing car-like driving pleasure and at the same time

providing the edge over cars in space, power, style, Iuel eIIiciency, luxury and comIort. In

short, to provide status oI a Pajero (international SUV) at the price oI midsize car

The Scorpio product package oIIered - Superior technology, Dynamic Looks, Car-like

product and great value Ior the price Value Proposition Ior Scorpio:

To capture the identiIied need -gap, the value proposition oI Scorpio was deIined as -

ar plus`

Rational beneIits: World class vehicle, good looks, car like comIort, great value

Emotional beneIits: Ownership experience oI thrill, excitement and power

Relational beneIits: Young modern, premium, city companion / extension oI liIestyle.

Brand Promise: Luxury oI a car. Thrill oI an SUV`

This brand positioning addresses the key consumer Insight and the product delivers the

promise. The position is also a unique proposition, which will help the brand have a distinct

image in the consumers` mind.

Baseline - ~Nothing Else ill do

The baseline captures the essence oI the brand, which is superiority and uncompromising

attitude. It also summarises the spirit behind the making oI the Scorpio.

Phased Launch

The Scorpio was launched in a phased manner - Iirst in Metros Mumbai, Delhi, Bangalore,

Chennai. Twenty cities were included over a period oI 4 months and within a year 50 cities

were covered. This ensured attention to main markets and to ensure that initial production oI

4

the vehicle could match demand. Dealerships were revamped prior to launch in a particular

city.

Shoroom Experience

The showroom revamp was centred around the intention to provide a uniIorm customer

experience at all the touch points and to provide the customer with a unique 'experience and

not just a 'product. ThereIore the back oIIice would remain outside the customer`s line oI

vision because the customer would be concerned with the product and not with the

paperwork.

Infrastructure

Thirty-Iive showrooms across the country were redone entirely with the same look and

identity and a decor built around movement, technology and sportiness. The theme Iocussed

on giving the customer a memorable experience.

Response - The strategy delivered

Volumes and Market Shares: Scorpio achieved its targets on market share and achieved a

volume oI 12000 vehicles in the Iirst 9 months oI its launch.

Image: Scorpio advertising had a very high recall Ior the Mahindra brand (Exhibit 3) as well

as Ior the product (Exhibit 4). Apart Irom this, advertising actually positioned Scorpio as a

powerIul vehicle with a sporty look, solidly built with good cargo capacity amongst the

premium car consumers and sports utility vehicle consumers.

Overall response to the Scorpio was stupendous. The product was well received across the

country and got rave reviews across media. More importantly the product and the strategy

delivered in terms oI the various objectives set beIore launch. FootIalls in the showrooms had

been massive and demand had Iar exceeded supply oI vehicles with a waiting period oI three

months.

Impact on Mahindra Image:

The saliency oI Mahindra increased considerably. Mahindra enjoyed stronger recall as a

manuIacturer oI personal vehicles and stronger customer perceptions on the Iollowing

attributes

O Well-respected manuIacturers

O Technologically advanced

O Suitable Ior city driving

O Great to drive

O Makes VFM vehicles

O Proud to own

3

O Makes good quality vehicles

Scorpio Brand Recall

In the SUV/MUV segment, Scorpio has the second-largest awareness and has emerged as a

strong brand in the C & sub-C car segment, however as compared to Qualis, it needed higher

recall. Scorpio advertising had been able to create a good impression on appearance and

styling oI the vehicle.

Scorpio buyer profile

Scorpio managed to pull out customers Irom the C segment oI vehicles. The product,

communication and the retail experience oI the Scorpio passed the stringent test oI luxury car

buyers and the buyer proIile was exactly as per the target proIile. The strategy delivered with

more and more small and midsize car buyers choosing the Scorpio over the others.

ards

The Scorpio was awarded various awards Irom various bodies

Mahindra achieved the objectives it set out to achieve. M&M has more than 39 per cent oI

market share in hard tops, sold 11800 Scorpio in Iirst nine months oI operation and due to

this campaign, Mahindra image improved.

Scorpio Impact on M&M

Scorpio was launched on June 19, 2002. At that time Mahindra was losing market share and

the share prices were also at an all time low at around Rs. 100. The Mahindra share oI

business was largely Irom the semi-urban and rural market oI India and the markets where

Mahindra was strong were stagnating.

With the launch oI Scorpio, things started looking up Ior Mahindra. There was an

improvement in the bottom line as well as the return to the shareholder. The revenue Ior

M&M Auto Sector increased Irom Rs. 1827 Cr. in F 02 to Rs. 2511 Cr. in F 03, a growth oI

37 per cent. The proIits beIore Interest and Tax (PBIT) too zoomed up Irom Rs. 102 Cr. in F

02 to Rs. 147 Cr. in F 03, an increase oI 43 per cent. In F04 the scenario has Iurther

improved. The halI-yearly results show a growth oI 54 per cent in revenue and 218 per cent

increase in PBIT. The share prices have outperIormed the Sensex and Share prices have

zoomed Irom Rs. 100 to Rs. 400 by December 03.

As regards Mahindra image in the customers mind, the post launch study conducted gave the

Iollowing improvements (Brand track Study - Nov 2002 - IMRB):

O The Mahindra saliency scores improved by 27 points among MUV/ SUV owners and

by 29 points among all car-owners.

6

O The overall positive opinion about Mahindra also moved up by 18per cent among

MUV/ SUV owners and by 11per cent among all car owners.

O Mahindra Scorpio has Iared excellently in overall opinion as against its key

competitors.

Future irections - orld class product goes global

Having done well in the domestic market, Mahindra and Mahindra is now moving Iorward on

its path to become a global niche player. i.e, it is stretching its activities in Ioreign markets.

The company is in the process oI negotiating joint ventures in markets like Spain, Italy, South

AIrica, Indonesia, Russia, Equador Ior marketing oI Scorpio.

Mahindra Scorpio`

Activity: Banners, Shoshkele & Direct Mailer

Objective: To generate test drive leads and Branding

Est. Spends: Rs. 15 lacs

Mahindra Scorpio on ET

The Scorpio ~2nd Anniversary promotion campaign Banner and Pop Under

Mahindra on Economic Times

Scorpio Shoshkele on ET on 5-04-06 Total Spend is 5 Lakhs for 1 Month

Mahindra on Indiatimes

Scorpio Mouse ver Banners

9

Mahindra Innovations

ne-Year Total Return:

65.6

Site: www.mahindra.com

3

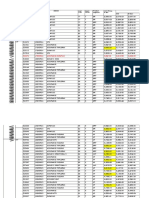

8a|ance sheet

Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05

Sources of funds

Owner's Iund

Equity share capital 272.62 239.07 238.03 233.40 116.01

Share application money - - - - -

PreIerence share capital - - - - -

Reserves & surplus 4,959.26 4,098.53 3,302.01 2,662.14 1,881.93

Loan funds

Secured loans 981.00 617.26 106.65 216.68 336.82

Unsecured loans 3,071.76 1,969.80 1,529.35 666.71 715.80

Total 9,284.64 6,924.66 5,176.05 3,778.92 3,050.56

Uses of funds

Fixed assets

Gross block 4,893.89 3,552.64 3,180.57 2,859.25 2,676.51

Less : revaluation reserve 12.09 12.47 12.86 13.33 14.32

Less : accumulated depreciation 2,326.29 1,841.68 1,639.12 1,510.27 1,335.56

Net block 2,555.51 1,698.49 1,528.59 1,335.65 1,326.63

Capital work-in-progress 646.73 649.94 329.72 205.46 133.93

Investments 5,786.41 4,215.06 2,237.46 1,669.09 1,189.79

Net current assets

Current assets, loans & advances 5,081.20 3,816.41 3,916.94 2,805.04 2,356.41

Less : current liabilities & provisions 4,797.76 3,468.77 2,854.20 2,254.37 1,980.58

Total net current assets 283.44 347.64 1,062.74 550.66 375.83

Miscellaneous expenses not written 12.55 13.53 17.55 18.05 24.38

Total 9,284.64 6,924.66 5,176.05 3,778.92 3,050.56

Notes:

Book value oI unquoted investments 4,305.50 1,429.16 1,515.23 1,419.01 1,047.67

Market value oI quoted investments 3,218.81 7,669.90 10,285.25 2,030.85 240.83

Contingent liabilities 1,220.39 985.35 1,008.27 946.36 758.14

Number oI equity sharesoutstanding (Lacs) 2726.16 2390.73 2380.33 2334.00 1116.48

Profit and Loss ccount

Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05

Income

Operating income 13,125.98 11,310.37 9,921.34 8,136.59 6,594.69

31

Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05

Expenses

Material consumed 9,365.00 7,814.71 6,930.76 5,782.01 4,655.24

ManuIacturing expenses 174.05 164.68 134.00 111.90 100.65

Personnel expenses 1,024.61 853.65 666.15 551.78 464.25

Selling expenses 575.34 804.51 635.10 458.32 369.72

Adminstrative expenses 937.56 561.66 466.22 387.57 317.79

Expenses capitalised -42.83 -46.49 -47.10 -26.53 -31.84

Cost oI sales 12,033.73 10,152.72 8,785.12 7,265.04 5,875.81

Operating proIit 1,092.25 1,157.65 1,136.22 871.54 718.88

Other recurring income 305.98 364.05 404.87 195.82 186.46

Adjusted PBDIT 1,398.23 1,521.70 1,541.09 1,067.36 905.34

Financial expenses 134.12 87.59 19.80 26.96 30.24

Depreciation 291.51 238.66 209.59 200.01 184.05

Other write oIIs - 0.59 0.33 0.28 0.15

Adjusted PBT 972.60 1,194.86 1,311.37 840.12 690.89

Tax charges 199.69 303.40 350.10 242.40 201.50

Adjusted PAT 772.91 891.46 961.28 597.72 489.39

Non recurring items 63.87 211.91 126.30 259.38 23.28

Other non cash adjustments 4.07 - -19.19 - -

Reported net proIit 840.85 1,103.37 1,068.39 857.10 512.67

Earnigs beIore appropriation 3,807.00 3,228.45 2,544.13 1,853.50 1,255.52

Equity dividend 278.83 282.61 282.23 243.97 150.81

PreIerence dividend - - - - -

Dividend tax 33.23 38.48 42.50 34.22 21.15

Retained earnings 3,494.94 2,907.36 2,219.40 1,575.31 1,083.55

ash Flo Statement

Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05

ProIit beIore tax 1,026.20 1,241.57 1,315.69 889.49 700.62

Net cashIlow-operating activity 1,631.30 825.83 1,168.95 686.90 379.21

Net cash used in investing activity -1,941.00 -2,075.08 -950.39 -502.66 -174.30

Netcash used in Iin. Activity 696.91 811.34 418.08 -89.78 192.45

Net inc/dec in cash and equivlnt 387.21 -437.91 636.64 94.47 397.36

Cash and equivalnt begin oI year 1,174.62 1,361.79 725.15 630.69 233.33

Cash and equivalnt end oI year 1,561.83 923.88 1,361.79 725.15 630.69

3

onclusion:

Thus Scorpio` has proved as a Milestone Ior Mahindra & Mahindra and the Indian

Automobile Industry. It has given a unique place to Mahindra & Mahindra in Indian market

because; it was innovated with High quality, Reliability, Flexibility, Style, Driving ComIort...

etc. In short it oIIered a customized product. Hence, again Operation`s components: Time,

quality& technology made a success story.

Reference:

1. hLLp//wwwslldeshareneL/vlvekSharma/scorplofrommahlndra

2. hLLp//economlcLlmeslndlaLlmescom/eaLures/8randLqulLy/WhaLmakesMMsScorploas

hlghesLselllngSuvbrand/arLlcleshow/4939cms

3. hLLp//bloggaadlcom/blog43Mahlndra_Scorplo_A1_8evlew

4. hLLp//wwwmouLhshuLcom/revlew/Mahlndra_Scorplo311hLml

5. hLLp//auLosmaxabouLcom/cvld36/mahlndra_scorplo_m_hawk_aspx

You might also like

- Renesas SRS by CANDocument1 pageRenesas SRS by CANamagdtoonyNo ratings yet

- Main ProjectDocument87 pagesMain ProjectGayathriNo ratings yet

- A541e Automatic TransaxleDocument132 pagesA541e Automatic TransaxleHuey_7480% (10)

- Análisis de Diagramas Eléctricos Automotrices - KIA Motors® PDFDocument29 pagesAnálisis de Diagramas Eléctricos Automotrices - KIA Motors® PDFcasifuentesNo ratings yet

- Final Project MAHINDRADocument69 pagesFinal Project MAHINDRARahul BattooNo ratings yet

- A Project Report On Mahindra Tractors: Self DeclarationDocument61 pagesA Project Report On Mahindra Tractors: Self DeclarationGaurav Shukla0% (2)

- Chandan MB-1442 (Consumer Behaviour Towards Honda Cars)Document101 pagesChandan MB-1442 (Consumer Behaviour Towards Honda Cars)SoniaNo ratings yet

- Project Report FinalDocument48 pagesProject Report Finalnilratan86100% (1)

- A Project On "Customer Satisfaction Towards Hyundai Motors"Document73 pagesA Project On "Customer Satisfaction Towards Hyundai Motors"Neelima ChauhanNo ratings yet

- A Study On Consumer Satisfaction Towards Non-Gear Two Wheeler of Honda in Nodia MarketingDocument103 pagesA Study On Consumer Satisfaction Towards Non-Gear Two Wheeler of Honda in Nodia MarketingUmesh JoshiNo ratings yet

- Executive Summary: A Study of Advertising and Sales Promotion of Hero Two WheelersDocument55 pagesExecutive Summary: A Study of Advertising and Sales Promotion of Hero Two WheelersAkanksha chandrakarNo ratings yet

- Summer Training Project Report ON Title of Project Report Undertaken atDocument65 pagesSummer Training Project Report ON Title of Project Report Undertaken atGaurav ChauhanNo ratings yet

- Boney Hector D Cruz Am Ar U3com08013 Final ProjectDocument63 pagesBoney Hector D Cruz Am Ar U3com08013 Final ProjectthinckollamNo ratings yet

- Mahindra Lost Sales AnalysisDocument79 pagesMahindra Lost Sales AnalysisDominic Savio100% (1)

- Mahindra Mahindra Project ReportDocument72 pagesMahindra Mahindra Project ReportManjeet SinghNo ratings yet

- RKL Tata-Motors-Consumer-Behaviour bHARTIDocument73 pagesRKL Tata-Motors-Consumer-Behaviour bHARTIsspmNo ratings yet

- Consumer's Perception Towards FOUR WHEELER INDUSTRYDocument91 pagesConsumer's Perception Towards FOUR WHEELER INDUSTRYShubhamprataps0% (1)

- I Ntroduction To OrganizationDocument82 pagesI Ntroduction To OrganizationVanshaj PadhaNo ratings yet

- Final ProjectDocument81 pagesFinal ProjectHimanshu ShokeenNo ratings yet

- Project Report On Totota Kirloskar Motor by Piyush PrasannaDocument64 pagesProject Report On Totota Kirloskar Motor by Piyush PrasannaPiyush Singh Prasanna100% (3)

- Project Report On ChaverletDocument68 pagesProject Report On ChaverletRajan MehtaNo ratings yet

- A Study On The Marketing Strategies of Maruti Suzuki Swift"Document40 pagesA Study On The Marketing Strategies of Maruti Suzuki Swift"Rohit KumarNo ratings yet

- Customer Satisfaction of Mahindra BoleraoDocument56 pagesCustomer Satisfaction of Mahindra BoleraoRAJUGOKULRAJNo ratings yet

- Romsons Trade DocumentationDocument86 pagesRomsons Trade DocumentationSalman QureshiNo ratings yet

- Customer Satisfaction in Big BazaarDocument76 pagesCustomer Satisfaction in Big BazaarAditya VermaNo ratings yet

- A Study On Consumer Satisfaction in Honda Two WheelersDocument32 pagesA Study On Consumer Satisfaction in Honda Two WheelersJayasudhan A.SNo ratings yet

- CRM Maruthi Varun MaotorsDocument54 pagesCRM Maruthi Varun MaotorsPrathapReddyNo ratings yet

- A M MotorsDocument43 pagesA M MotorsGokul KrishnanNo ratings yet

- BBA Bajaj Vs Hero Honda Project ReportDocument53 pagesBBA Bajaj Vs Hero Honda Project Reportmahendrakaya33% (3)

- A Study On Employee Welfare Measures in Engineering and Automobile Industries in Pune Region and Its Impact On Retention and Empolyee BondingDocument49 pagesA Study On Employee Welfare Measures in Engineering and Automobile Industries in Pune Region and Its Impact On Retention and Empolyee BondingVidyasagar Tiwari100% (1)

- Roopa Rani - Final PDFDocument52 pagesRoopa Rani - Final PDFSrinivas SeenuNo ratings yet

- KIIT Project ReportDocument55 pagesKIIT Project ReportvipinNo ratings yet

- A Study On Customer Satisfaction Towards LIC With Special Reference To Nagercoil CityDocument19 pagesA Study On Customer Satisfaction Towards LIC With Special Reference To Nagercoil CityCHEIF EDITORNo ratings yet

- A Project Report On Cargo MotorsDocument61 pagesA Project Report On Cargo Motorsvarun_bawa251915No ratings yet

- A Study On Employee Job Satisfaction at Metro Cash and Carry, Bengaluru.Document74 pagesA Study On Employee Job Satisfaction at Metro Cash and Carry, Bengaluru.noel sannaNo ratings yet

- Dissertation On T&P of M&M Ltd.Document49 pagesDissertation On T&P of M&M Ltd.sampada_naradNo ratings yet

- Maruti SuzukiDocument86 pagesMaruti SuzukiSureshJaiswalNo ratings yet

- A Case Study Report ON "Mahindra and Mahindra": Presented byDocument39 pagesA Case Study Report ON "Mahindra and Mahindra": Presented bySourabh RaoraneNo ratings yet

- Arunkumar ProjectDocument67 pagesArunkumar ProjectanushwaryaNo ratings yet

- A Study On Sales & Promotion With Special Reference To HyundaiDocument102 pagesA Study On Sales & Promotion With Special Reference To HyundaiShakti Singh RawatNo ratings yet

- Project Report-Pranav TaloleDocument80 pagesProject Report-Pranav TaloleRana RanaNo ratings yet

- Anjali BbaDocument81 pagesAnjali BbaGaurav100% (1)

- A Project Report OnDocument67 pagesA Project Report OnRidhima KatiyarNo ratings yet

- Marketing Strategy in Hero Moto CorpDocument97 pagesMarketing Strategy in Hero Moto Corpnawaz50% (2)

- MARKETING STRATEGIES & BUSINESS PROMOTION OF HERO MOTOCORP'S LTD - Delhi (AGBS-BBA)Document82 pagesMARKETING STRATEGIES & BUSINESS PROMOTION OF HERO MOTOCORP'S LTD - Delhi (AGBS-BBA)Tushar SharmaNo ratings yet

- Customer Satisfaction Hyundai MotorsDocument72 pagesCustomer Satisfaction Hyundai MotorshariharaNo ratings yet

- Synopsis On RahulDocument13 pagesSynopsis On RahulChandrashekhar GurnuleNo ratings yet

- Hero ProjectDocument94 pagesHero ProjectShivshankar RaiNo ratings yet

- Mamura Server 2110 Rahul Chauhan PDFDocument90 pagesMamura Server 2110 Rahul Chauhan PDFRAHULNo ratings yet

- Kajal Tyagi ProjectDocument73 pagesKajal Tyagi ProjectHimanshuNo ratings yet

- Mahindra Bolero - RM FinalDocument38 pagesMahindra Bolero - RM FinalanuragkamNo ratings yet

- Marketing Strategy of Maruti SuzukiDocument88 pagesMarketing Strategy of Maruti SuzukiApoorva KohliNo ratings yet

- King NARZARY BBA PROJECT 6Document80 pagesKing NARZARY BBA PROJECT 6Sunny SinghNo ratings yet

- Internship Report On Performance Appraisal (Harshita Singh Rathore)Document73 pagesInternship Report On Performance Appraisal (Harshita Singh Rathore)Divyansh VermaNo ratings yet

- Marketing Strategy of Tata MotorsDocument59 pagesMarketing Strategy of Tata MotorsVarun KhannaNo ratings yet

- Mahindra Customers Satisfaction After SalesDocument85 pagesMahindra Customers Satisfaction After Sales2562923No ratings yet

- Hrd Practices in Apsrtc: A Case Study with Special Reference to Vizianagaram ZoneFrom EverandHrd Practices in Apsrtc: A Case Study with Special Reference to Vizianagaram ZoneNo ratings yet

- Mahindra & Mahindra: With You Hamesh ADocument27 pagesMahindra & Mahindra: With You Hamesh APushpa PrakashNo ratings yet

- M&M Term PaperDocument14 pagesM&M Term Paperrajendratripathi47No ratings yet

- Mahindra and Mahindra LTD: Seminar Report OnDocument15 pagesMahindra and Mahindra LTD: Seminar Report OnTopesh PatelNo ratings yet

- Mahindra Duro ProjectsDocument34 pagesMahindra Duro ProjectsMayank Jain NeerNo ratings yet

- Mahindra & Mahindra ReportDocument57 pagesMahindra & Mahindra ReportMahesh NukalaNo ratings yet

- Mahindra & MahindraDocument18 pagesMahindra & MahindraPushan DattaNo ratings yet

- For The Term PaperDocument1 pageFor The Term PaperreesmechNo ratings yet

- Review of The Annual Monetary Policy 2009Document10 pagesReview of The Annual Monetary Policy 2009reesmechNo ratings yet

- Biomass Briquet Ting PlantDocument6 pagesBiomass Briquet Ting PlantreesmechNo ratings yet

- Marketing Plan On Mahindra Scorpio: J.REES (09BA128)Document3 pagesMarketing Plan On Mahindra Scorpio: J.REES (09BA128)reesmechNo ratings yet

- About Mahindra BCG and SwotDocument13 pagesAbout Mahindra BCG and Swotreesmech50% (2)

- OPL Based On CT (Goodyear) - 2016 ZamboDocument54 pagesOPL Based On CT (Goodyear) - 2016 ZamboJaybethGeminaBetinolNo ratings yet

- Sham (Price List)Document6 pagesSham (Price List)Wish StazienNo ratings yet

- Pressure Regulators (DRV Valve) Suitable ForDocument4 pagesPressure Regulators (DRV Valve) Suitable ForNOUREDDINE BERCHAOUANo ratings yet

- Symphonyste5manual1 4Document4 pagesSymphonyste5manual1 4Uppacking parkNo ratings yet

- Engine: Front: Multi Leaf SpringDocument3 pagesEngine: Front: Multi Leaf SpringKasidinNo ratings yet

- Payment Invoice 566829 Sss1Document2 pagesPayment Invoice 566829 Sss1asa625gangNo ratings yet

- PCX 160 (Ultimate Excellence) : Honda Premium Matic Day (HPMD) #Cari - AmanDocument4 pagesPCX 160 (Ultimate Excellence) : Honda Premium Matic Day (HPMD) #Cari - AmanMUHAMMAD RIDHO AZHARNo ratings yet

- 2008 Sequoia QRG LR PDFDocument36 pages2008 Sequoia QRG LR PDFDerek SharmanNo ratings yet

- Renault Trucks PartsDocument8 pagesRenault Trucks PartsDimaNo ratings yet

- Silca TransponderDocument37 pagesSilca TransponderMonete FlorinNo ratings yet

- Automobile Drag CoefficientsDocument5 pagesAutomobile Drag CoefficientsPramod DhaigudeNo ratings yet

- 2008 Commander PDFDocument478 pages2008 Commander PDFkillakymNo ratings yet

- Evo Tyre Test 2007 PDFDocument2 pagesEvo Tyre Test 2007 PDFAmandaNo ratings yet

- Product:Denso Condensor: Denso Cool Gear Code Product Code Product NO. Brand Car ModelDocument1 pageProduct:Denso Condensor: Denso Cool Gear Code Product Code Product NO. Brand Car ModelSafety WaxyNo ratings yet

- Case Study - Oct 08Document23 pagesCase Study - Oct 08lokeshgoyal2001100% (2)

- Ford Taurus 1997 WiringDocument7 pagesFord Taurus 1997 Wiringrichard100% (59)

- Spider (105-115) PDFDocument184 pagesSpider (105-115) PDFBlagoja PetrovskiNo ratings yet

- Formul 1Document7 pagesFormul 1api-27477209No ratings yet

- CatálogoWEB FiltrosGonher 2023Document137 pagesCatálogoWEB FiltrosGonher 2023Hector VallarNo ratings yet

- ScorpioDocument17 pagesScorpiobholu436100% (1)

- Antifreeze Coolant TimelineDocument1 pageAntifreeze Coolant TimelineCristina LunguNo ratings yet

- NAMCO HistoryDocument4 pagesNAMCO HistoryGeorge AvramidisNo ratings yet

- XG25-XG30: 44208060100 REV.003 03/2008 This Catalogue Is Valid For Trucks As From Serial NumbersDocument153 pagesXG25-XG30: 44208060100 REV.003 03/2008 This Catalogue Is Valid For Trucks As From Serial Numbersalexandre donizetiNo ratings yet

- En GBDocument9 pagesEn GBOvidiu Gabriel StoicaNo ratings yet

- AMS-Merlo - DBM3500-4 25 22Document2 pagesAMS-Merlo - DBM3500-4 25 22CarlosNo ratings yet

- IATF and RulesDocument7 pagesIATF and RulesRoberto VeroNo ratings yet

- WOSSNER CatalogueDocument104 pagesWOSSNER CatalogueBenoit Hillaire75% (4)