Professional Documents

Culture Documents

Results Tracker: Tuesday, 31 July 2012

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Tracker: Tuesday, 31 July 2012

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

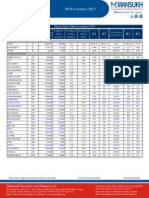

Results Tracker

Tuesday, 31 July 2012

make more, for sure.

Q1FY13

Results to be Declared on Tuesday, 31st July 2012

COMPANIES NAME

7SEAS TECH

Aaswa Trading

ACCLAIM IND

Advance Multi

Advance Petro

Amani Trading

Amco India

Amit Securities

Ancent Soft

Ankush Finstock

ANS LTD

Arex Inds

Arihant Tour

Ashutosh Paper

Asian Flora

Associated Fin

Auto Pins

Autopal Inds

Balaji Tele

Bansisons Tea

Basil Infra

BEE Electronic

Bhagyashree Lease

Bharat Bijlee

Bhilwara Tex

Bhushan Steel

Bijoy Hans

BKV Inds

Blue Star

Bobshell Elect

Brand Rlty

Caprihans India

Ceejay Finance

Ceeta Inds

Cethar Inds

Chaman Lal Setia

Chennai Petro

Cipla

Clarus Finance

Colinz Lab

Cosco India

Country Cond

Cressanda Sol

Delta Corp

Dhanalaxmi Roto

Dishman Pharma

Dr Agarwals

Dynemic Prod

EASTERN GAS

EID Parry

Elecon Engr

Elegant Marb

Entegra

Epsom Prop

Explicit Fin

Fairfield Atlas

Farry Inds

Fischer Chemic

Flora Textiles

Fortune Fin

Frontline Securities

Gagan Polycot

Galaxy Brngs

GEE

Global Offshore

Godfrey Phil

Gopala Poly

Grand Foundry

Graviss Hospitality

Gravity India

GSL Securities

GTL

Gujarat Fluo

Gujarat Mnrl

Gujarat Narm Val

HB Portfolio

Hexaware Tech

Highland Inds

Himgiri Foods

Hindustan Adhsv

Hindustan Oil

Hipolin

Hira Auto

Hittco Tools

Hotel Rugby

HS India

IDBI Bank

IKF Finance

Inani Sec

Indo Gulf Inds

Inter Globe Fin

IPCA Lab

Ishita Drugs

IYKOT Hitech

Jagatjit Inds

Jainco Proj

Jainex Aamcol

Jaiprakash Asso

Jattashankar Inds

Jauss Polymers

Please refer to important disclosures at the end of this report

Jenburkt Pharma

Jindal Capital

JK Sugar

Jolly Plast

Jupiter Inds

Jyoti Resins

Kallam Spin

Kalyani Forge

Kanumanek Trad

Karma Ind

Karur Vysya Bank

KEC Intl

Kedia Constr

Khandelwal Extr

Khyati Multi

Kirloskar Multi

Kovalam Invest

Kreon Finnancial

KSE

Linear Poly

LWS Knitwear

Madhusudan Sec

Magna Electo

Mahashree Trad

Mahindra Forg

Man Inds

Mangalya Soft

Manraj Hous

Mapro Inds

Marathwada Refrac

Mayur Uniquoter

Mid East Portf

Milgray Fin

Modern Dairies

Modern Mall

Monsanto India

MSP Steel

Muthoot Cap

Naina Semi

Nath Pulp

Nath Seeds

NB Footwear

NCL Inds

NDTV

Nextgen Animation

Nicco Corp

Nikki Global

Nimbus Inds

Nippo Battr

Nitin Alloy

NOCIL

Omkar Pharma

Onida Saka

Onmobile Global

Orbit Exports

Oscar Invest

Oswal Leasing

PACHELI ENT

Panasonic Carb

Parshwanath Corp

Pet Plastics

Petronet LNG

PHOENIX MILL

Photon Capital

Photoquip India

Pioneer Agro

Poly Medicure

Praveen Prop

Precious Trad

Premier Cap

Prima Agro

Prima Inds

Prime Property

Procal Elect

Radico Khaitan

Rai Saheb Rekh

Rajkamal Syn

Rama Pulp

Rammaica India

Redington India

REIL Elect

Reliance Chem

Religare Tech

Repro India

Revathi Equip

Royal Cushion

Sacheta Metals

Safari Inds

Sainik Finance

Scenario Media

Schneider Elec

SG Glob Exports

Shoppers Stop

Shree Ajit Paper

Shree Steel Wire

Shree Surgovind

Shree Vatsa Fin

Shreyas Inter

Shri Jagdamba

Silverline Tech

SIP Inds

SJ Corp

Sobhagya Merc

Soma Papers

SP Capital

Standard Surf

Stocknet Intl

Subhash Silk

Sugal & Damani Shr

Sun Pharma Adv

Suniti Comm

Super Crop

Supertex Inds

Suprajit Engr

Surana Inds

Suryodaya Allo

Svam Software

Swaraj Engines

Sylph Tech

SYMPHONY

Tarrif Cine

Tatia Global

Teesta Agro

Themis Medicare

Thirdwave Fin

TIL

Tinna Overseas

Tirupati Star

Titan Inds

Trade Wings

Trishakti Elect

Triumph Intl

Tyroon Tea

Umang Dairies

Union Quality

Unistar Multi

Unjha Form

Usha Martin

Ushdev Intl

Venlon Enter

Vikalp Sec

Vinayak Vanij

Vivid Glob

Vyapar Inds

Warden Constr

Washington Soft

Williamson Fin

Wyeth

York Exports

Zodiac JRD MKJ

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

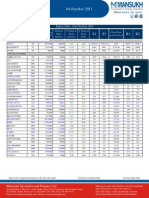

Results Tracker

Q1FY13

make more, for sure.

Results Announced on 30th July 2012 (Rs Million)

Oriental Bank

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

35965.2

42871.6

35965.2

% Var

19.2

201203

42871.6

% Var

19.2

201206

Interest Earned

158148.8

120878.2

% Var

30.83

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

4084.1

31613.2

6377.1

5644.2

3321.2

1730

3914.2

3238.4

25782.4

6377.1

0

3142.7

1324

3547

26.11

22.62

17.93

0

5.68

30.66

10.35

4084.1

31613.2

6377.1

5644.2

3321.2

1730

3914.2

3238.4

25782.4

5407.5

0

3142.7

1324

3547

26.11

22.62

17.93

0

5.68

30.66

10.35

12402.5

115990.9

23154.6

14257.6

17148.2

2842

11415.6

9600.7

79102.6

18924.9

0

12065.3

5357.4

15028.7

29.18

46.63

22.35

0

42.13

-46.95

-24.04

Equity

OPM

2917.6

20.91

2917.6

22.28

0

-6.15

2917.6

20.91

2917.6

22.28

0

-6.15

2917.6

19.86

2917.6

26.85

0

-26.03

The June 2012 quarter revenue stood at Rs. 42871.60 millions, up 19.20% as compared to Rs. 35965.20 millions during the corresponding

quarter last year.A humble growth in net profit of 10.35% reported in the quarter ended June 2012 to Rs. 3914.20 millions from Rs.

3547.00 millions.

Bank Of Baroda

Quarter ended

Year to Date

201206

201106

Interest Earned

85576.1

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

7708

57595.4

13156.9

13469.4

8938

2080.8

11388.6

Equity

OPM

4123.8

26.33

Year ended

201206

201106

66317.7

% Var

29.04

201203

201103

66317.7

% Var

29.04

296737.2

218859.2

% Var

35.58

85576.1

6408.7

43345.8

13156.9

0

3910.5

3943.7

10328.5

20.27

32.87

18.88

0

128.56

-47.24

10.26

7708

57595.4

13156.9

13469.4

8938

2080.8

11388.6

6408.7

43345.8

11067.8

0

3910.5

3943.7

10328.5

20.27

32.87

18.88

0

128.56

-47.24

10.26

34223.3

193567.1

51089.7

60258

25548.2

10188.4

50069.6

28091.8

130836.6

46298.3

0

13312.9

14086.4

42416.8

21.83

47.95

10.35

0

91.91

-27.67

18.04

3928.1

27.61

4.98

-4.65

4123.8

26.33

3928.1

27.61

4.98

-4.65

4123.8

29.08

3928.1

31.9

4.98

-8.83

The sales for the June 2012 quarter moved up 29.04% to Rs. 85576.10 millions as compared to Rs. 66317.70 millions during the

corresponding quarter last year.Modest increase of 10.26% in the Net Profit was reported from. 10328.50 millions to Rs. 11388.60

millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Indian Overseas Bank

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

39925.82

50261.59

39925.82

% Var

25.89

201203

50261.59

% Var

25.89

201206

Interest Earned

178970.84

121014.65

% Var

47.89

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

3766.89

36978.84

8581.81

3263.58

5204.25

929.22

2334.36

3391.89

28049.51

8581.81

0

5449.48

520.76

2055.81

11.06

31.83

18.5

0

-4.5

78.44

13.55

3766.89

36978.84

8581.81

3263.58

5204.25

929.22

2334.36

3391.89

28049.51

7242.15

0

5449.48

520.76

2055.81

11.06

31.83

18.5

0

-4.5

78.44

13.55

16810.43

128809.12

31630.7

12977.08

22364.38

2475.82

10501.26

12251.02

78934.39

25724.95

0

11862.36

5196.85

10725.43

37.22

63.19

22.96

0

88.53

-52.36

-2.09

Equity

OPM

7969.98

16.85

6187.49

20.1

28.81

-16.19

7969.98

16.85

6187.49

20.1

28.81

-16.19

7969.98

19.75

6187.49

23.64

28.81

-16.46

A decent increase of about 25.89% in the sales to Rs. 50261.59 millions was observed for the quarter ended June 2012. The sales figure

stood at Rs. 39925.82 millions during the year-ago period.Profit saw a slight increase of 13.55%to Rs. 2334.36 millions from Rs. 2055.81

millions.

Syndicate Bank

Quarter ended

Year to Date

201106

Year ended

42425

33985.4

% Var

24.83

42425

33985.4

% Var

24.83

152683.5

114508.6

% Var

33.34

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

2355.6

29233.7

7136.6

3282.3

5128

-1119.9

4402.2

2913.8

22881.4

7136.6

0

3266.3

730.1

3429.1

-19.16

27.76

8.26

0

57

-253.39

28.38

2355.6

29233.7

7136.6

3282.3

5128

-1119.9

4402.2

2913.8

22881.4

6592.3

0

3266.3

730.1

3429.1

-19.16

27.76

8.26

0

57

-253.39

28.38

10758.8

101833.2

28141.2

14273.2

19194.7

1139.3

13133.9

9151.2

70681

25481

0

14642.5

2375.8

10479.5

17.57

44.07

10.44

0

31.09

-52.05

25.33

Equity

OPM

6019.5

19.82

5732.9

21.85

5

-9.27

6019.5

19.82

5732.9

21.85

5

-9.27

6019.5

21.92

5732.9

24.01

5

-8.72

Interest Earned

201206

201206

201106

201203

201103

The Revenue for the quarter ended June 2012 of Rs. 42425.00 millions grew by 24.83 % from Rs. 33985.40 millions.The company has

announced a 28.38% increase in its profits to Rs . 4402.20 millions for the quarter ended June 2012 compared to Rs. 3429.10 millions in

the corresponding quarter in the previous year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Allahabad Bank

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

35498.4

44581.6

35498.4

% Var

25.59

201203

44581.6

% Var

25.59

201206

Interest Earned

155232.8

110146.9

% Var

40.93

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

3095.5

31522.9

6598.1

6424.6

3131.5

1284.3

5140.3

2859.3

23742.9

6598.1

0

3196.7

1518.2

4181.3

8.26

32.77

15.38

0

-2.04

-15.41

22.94

3095.5

31522.9

6598.1

6424.6

3131.5

1284.3

5140.3

2859.3

23742.9

5718.6

0

3196.7

1518.2

4181.3

8.26

32.77

15.38

0

-2.04

-15.41

22.94

12986.8

103606.3

26913.9

21629.8

16069.6

2961.9

18667.9

13704.1

69922.2

23383

0

11238.7

5076

14231.1

-5.23

48.17

15.1

0

42.98

-41.65

31.18

Equity

OPM

5000.3

21.44

4762.2

25.06

5

-14.47

5000.3

21.44

4762.2

25.06

5

-14.47

5000.3

24.29

4762.2

27.73

5

-12.43

The sales surged to Rs. 44581.60 millions, up 25.59% for the June 2012 quarter as against Rs. 35498.40 millions during the corresponding

quarter previous year.The Company has registered profit of Rs. 5140.30 millions for the quarter ended June 2012, a growth of 22.94%

over Rs. 4181.30 millions millions achieved in the corresponding quarter of last year.

Corporation Bank

Quarter ended

Year to Date

201206

201106

Interest Earned

36506.22

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

3276.13

28421.92

4661.83

4532.6

2166.01

830

3702.6

Equity

OPM

1481.29

18.35

Year ended

201206

201106

29783.21

% Var

22.57

201203

201103

29783.21

% Var

22.57

130177.84

91352.48

% Var

42.5

36506.22

2664.69

22707.61

4661.83

0

1440.32

577.01

3514.51

22.95

25.16

10.77

0

50.38

43.84

5.35

3276.13

28421.92

4661.83

4532.6

2166.01

830

3702.6

2664.69

22707.61

4208.43

0

1440.32

577.01

3514.51

22.95

25.16

10.77

0

50.38

43.84

5.35

14926.19

98708.85

17835.5

0

9504.55

3994.7

15060.43

12558.77

61955.05

16417.1

0

6202.72

5203.7

14132.68

18.85

59.32

8.64

0

53.23

-23.23

6.56

1481.31

18.57

0

-1.21

1481.29

18.35

1481.31

18.57

0

-1.21

1481.29

21.94

1481.31

27.96

0

-21.53

The revenue zoomed 22.57% to Rs. 36506.22 millions for the quarter ended June 2012 as compared to Rs. 29783.21 millions during the

?orresponding quarter last year.Modest increase of 5.35% in the Net Profit was reported from. 3514.51 millions to Rs. 3702.60 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

GAIL India

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

111120

378

19602.9

587.8

19015.1

2169.2

16845.9

5508.1

1016.5

11337.8

88890

646.5

16418.3

207.9

16210.4

1781.3

14429.1

4582.4

1165.5

9846.7

Equity

PBIDTM(%)

12684.8

17.64

12684.8

18.47

Year to Date

201206

201106

-41.53

19.4

182.73

17.3

21.78

16.75

20.2

-12.78

15.14

111120

378

19602.9

587.8

19015.1

2169.2

16845.9

5508.1

1016.5

11337.8

88890

646.5

16418.3

207.9

16210.4

1781.3

14429.1

4582.4

1165.5

9846.7

0

-4.49

12684.8

17.64

12684.8

18.47

% Var

25.01

Year ended

201203

201103

-41.53

19.4

182.73

17.3

21.78

16.75

20.2

-12.78

15.14

403979.5

4318.8

62471.8

1164.6

61307.2

7907.1

53400.1

16861.7

1354

36538.4

325365.2

4407

59731

828.6

58902.4

6502.5

52399.9

16788.6

2436.8

35611.3

0

-4.49

12684.8

15.46

12684.8

18.36

% Var

25.01

% Var

24.16

-2

4.59

40.55

4.08

21.6

1.91

0.44

-44.44

2.6

0

-15.76

The Sales for the quarter ended June 2012 of Rs. 111120.00 millions rose by 25.01% from Rs. 88890.00 millions.A humble growth in net

profit of 15.14% reported in the quarter ended June 2012 to Rs. 11337.80 millions from Rs. 9846.70 millions.OP of the company witnessed

a marginal growth to 19602.90 millions from 16418.30 millions in the same quarter last year.

Muthoot Finance

Sales

Quarter ended

201206

201106

12874.6

9125.85

% Var

41.08

Year to Date

201206

12874.6

201106

9125.85

% Var

41.08

Year ended

201203

45366.72

201103

23015.05

% Var

97.12

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

63.25

10707.85

6963.35

3744.5

102.65

3641.86

1180.81

0

2461.05

70.86

7367.13

4406.93

2960.2

60.4

2899.8

995.29

0

1904.51

-10.74

45.35

58.01

26.49

69.95

25.59

18.64

0

29.22

63.25

10707.85

6963.35

3744.5

102.65

3641.86

1180.81

0

2461.05

70.86

7367.13

4406.93

2960.2

60.4

2899.8

995.29

0

1904.51

-10.74

45.35

58.01

26.49

69.95

25.59

18.64

0

29.22

123.84

37340.63

23698.99

13641.64

329.17

13312.47

4392.23

0

8920.24

143.62

18175.96

10382.87

7793.09

180.98

7612.11

2670.34

0

4941.76

-13.77

105.44

128.25

75.05

81.88

74.89

64.48

0

80.51

Equity

PBIDTM(%)

3717.13

83.17

3717.13

80.73

0

3.03

3717.13

83.17

3717.13

80.73

0

3.03

3717.13

82.31

3202.13

78.97

16.08

4.22

The sales surged to Rs. 12874.60 millions, up 41.08% for the June 2012 quarter as against Rs. 9125.85 millions during the corresponding

quarter previous year.Net Profit recorded in the quarter ended June 2012 rise to 29.22% to Rs. 2461.05 millions compared to R. 1904.51

millions in corresponding previous quarter.Operating profit for the quarter ended June 2012 rose to 10707.85 millions as compared to

7367.13 millions of corresponding quarter ended June 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Havells India

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

10353.1

2.4

1224.4

102

1122.4

118.1

1004.3

203.5

0

800.8

8235.4

20.3

974.4

93.8

880.6

86.1

794.5

146.6

0

647.9

Equity

PBIDTM(%)

623.9

11.83

623.9

11.83

Year to Date

201206

201106

-88.18

25.66

8.74

27.46

37.17

26.41

38.81

0

23.6

10353.1

2.4

1224.4

102

1122.4

118.1

1004.3

203.5

0

800.8

8235.4

20.3

974.4

93.8

880.6

86.1

794.5

146.6

0

647.9

0

-0.05

623.9

11.83

623.9

11.83

% Var

25.71

Year ended

201203

201103

-88.18

25.66

8.74

27.46

37.17

26.41

38.81

0

23.6

36220

7.8

4628.6

443.9

4184.7

446.6

3738.1

683.8

0

3054.3

28886

107.7

3582.7

191.1

3391.6

293.4

3098.2

682.4

0

2415.8

0

-0.05

623.9

12.78

623.9

12.4

% Var

25.71

% Var

25.39

-92.76

29.19

132.29

23.38

52.22

20.65

0.21

0

26.43

0

3.03

The sales figure stood at Rs. 10353.10 millions for the June 2012 quarter. The mentioned figure indicates a growth of about 25.71% as

compared to Rs. 8235.40 millions during the year-ago period.Net profit stood at Rs. 800.80 millions compared to Rs. 647.90 millions in

the corresponding previous quarter,high by 23.60%.Operating profit for the quarter ended June 2012 rose to 1224.40 millions as compared

to 974.40 millions of corresponding quarter ended June 2011.

Spice Jet

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

14666.92

9456.41

% Var

55.1

201203

9456.41

% Var

55.1

201206

14666.92

39979.72

29377

% Var

36.09

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

121.62

883.26

250.16

761.74

137.32

624.42

62.91

0

561.51

33.43

-604.02

90.25

-694.27

25.37

-719.64

0

0

-719.64

263.8

-246.23

177.19

-209.72

441.27

-186.77

0

0

-178.03

121.62

883.26

250.16

761.74

137.32

624.42

62.91

0

561.51

33.43

-604.02

90.25

-694.27

25.37

-719.64

0

0

-719.64

263.8

-246.23

177.19

-209.72

441.27

-186.77

0

0

-178.03

211.42

-4972.19

522.57

-5747.7

309.98

-6057.68

0

0

-6057.68

262.15

1475.21

104.42

1370.79

89.1

1281.69

247.37

0

1034.32

-19.35

-437.05

400.45

-519.3

247.9

-572.63

0

0

-685.67

Equity

PBIDTM(%)

4843.5

6.02

4053.78

-6.39

19.48

-194.28

4843.5

6.02

4053.78

-6.39

19.48

-194.28

4414.5

-12.44

4053.78

5.02

8.9

-347.66

Sales

The turnover soared 55.10% to Rs. 14666.92 millions for the June 2012 quarter as compared to Rs. 9456.41 millions during the

corresponding quarter last year.The Total Profit for the quarter ended June 2012 of Rs. 561.51 millions grew from Rs.-719.64 millions

Operating profit Margin for the quarter ended June 2012 improved to 883.26% as compared to -604.02% of corresponding quarter ended

June 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Bharat Electronics

Quarter ended

Year to Date

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

7969.2

1632.43

569.42

3.12

566.3

306.13

260.17

66.91

0

193.25

9309.22

1540.75

1965.24

3.24

1962

293.23

1668.77

440.72

0

1228.05

Equity

PBIDTM(%)

800

7.15

800

21.11

% Var

-14.39

Year ended

201206

201106

5.95

-71.03

-3.7

-71.14

4.4

-84.41

-84.82

0

-84.26

7969.2

1632.43

569.42

3.12

566.3

306.13

260.17

66.91

0

193.25

9309.22

1540.75

1965.24

3.24

1962

293.23

1668.77

440.72

0

1228.05

0

-66.15

800

7.15

800

21.11

% Var

-14.39

201203

201103

5.95

-71.03

-3.7

-71.14

4.4

-84.41

-84.82

0

-84.26

57676.41

5854.91

11962.46

6

11956.46

1207.99

10748.48

2449.5

0

8298.98

55850.93

2759.8

12839.22

7.34

12831.88

1220.42

11611.46

2996.78

0

8614.68

0

-66.15

800

20.74

800

22.99

% Var

3.27

112.15

-6.83

-18.26

-6.82

-1.02

-7.43

-18.26

0

-3.66

0

-9.78

Net sales declined -14.39% to Rs. 7969.20 million from Rs. 9309.22 millions.A radical decline of -84.26% was reported in the net profit of

the company for the quarter ended June 2012 to Rs. 193.25 millions from Rs. 1228.05 millions.The company reported a degrowth in

operating Profit to 569.42 millions from 1965.24 millions.

Kansai Nerolac Paint

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

7235

67

1036

0

1036

156

880

247

44

633

6520

71

982

0

982

120

862

250

21

612

Equity

PBIDTM(%)

539

14.32

539

15.06

Year to Date

201206

201106

-5.63

5.5

0

5.5

30

2.09

-1.2

109.52

3.43

7235

67

1036

0

1036

156

880

247

44

633

6520

71

982

0

982

120

862

250

21

612

0

-4.93

539

14.32

539

15.06

% Var

10.97

Year ended

201203

201103

-5.63

5.5

0

5.5

30

2.09

-1.2

109.52

3.43

26006

243

3616

1

3615

564

3051

892

32

2159

21413

225

3132

1

3385

494

2891

831

-19

2060

8

15.45

0

6.79

14.17

5.53

7.34

-268.42

4.81

0

-4.93

539

13.9

539

14.63

0

-4.94

% Var

10.97

% Var

21.45

A fair growth of 10.97% in the revenue at Rs. 7235.00 millions was reported in the June 2012 quarter as compared to Rs. 6520.00 millions

during year-ago period.Net profit showed a marginal rise at Rs. 633.00 millions for the quarter ended June 2012, as compared to

corresponding quarter of last year.OP of the company witnessed a marginal growth to 1036.00 millions from 982.00 millions in the same

quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Group Name Student Name Company Name Industry CodeDocument5 pagesGroup Name Student Name Company Name Industry Codenishantjain95No ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionDocument5 pagesQ2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- India Top500Companies2016Document624 pagesIndia Top500Companies2016Sandeep ElluubhollNo ratings yet

- Results Tracker 12.07.2012Document2 pagesResults Tracker 12.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Assignment - Company AnalysisDocument2 pagesAssignment - Company AnalysisJuhi BansalNo ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Indian Companies Result CalendarDocument12 pagesIndian Companies Result Calendarkpratik41No ratings yet

- WEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Document6 pagesWEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Mansukh Investment & Trading SolutionsNo ratings yet

- SR No Pop Reg No POP NameDocument4 pagesSR No Pop Reg No POP Nameramanath011No ratings yet

- Results Tracker 10.07.2012Document2 pagesResults Tracker 10.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Sr. No. Organization Key Decision Maker/Clien: Saumil ParonigarDocument60 pagesSr. No. Organization Key Decision Maker/Clien: Saumil ParonigarLukasNo ratings yet

- Contacts MumbaiDocument63 pagesContacts MumbaiAnonymous rtDlncdNo ratings yet

- Sr. No. POP Reg. No. POP NameDocument8 pagesSr. No. POP Reg. No. POP NameAshutosh SinhaNo ratings yet

- Ceo Ranking 1Document3 pagesCeo Ranking 1web3241No ratings yet

- Orgs ExistDocument15 pagesOrgs Exist32587412369No ratings yet

- MBL No. DataDocument38 pagesMBL No. DataAngel AnKuNo ratings yet

- Name Company/Group Rank 2010 2009Document3 pagesName Company/Group Rank 2010 2009Kamal Kannan GNo ratings yet

- Pune ConfirmationDocument13 pagesPune Confirmation123bmwaudiNo ratings yet

- Results Tracker 17.07.2012Document2 pagesResults Tracker 17.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- 17062011GroupChangeBSE-Annexure To NoticeDocument14 pages17062011GroupChangeBSE-Annexure To NoticeNoratanmal RampuriaNo ratings yet

- Company CeoDocument7 pagesCompany CeoHappy RanaNo ratings yet

- Daily Note: Market UpdateDocument3 pagesDaily Note: Market UpdateAyush JainNo ratings yet

- Results Tracker 10.01.13Document2 pagesResults Tracker 10.01.13Mansukh Investment & Trading SolutionsNo ratings yet

- Consolidated Data On Commission and Expenses Paid To Distributors During FY 2011-12Document7 pagesConsolidated Data On Commission and Expenses Paid To Distributors During FY 2011-12pal_arjun051086No ratings yet

- Gujarat MP DatabaseDocument114 pagesGujarat MP DatabaseAkshata Ghorpade100% (1)

- Airline Contact Detail and AddressDocument21 pagesAirline Contact Detail and Addresskrishna kumarNo ratings yet

- Ceo Directors UaeDocument15 pagesCeo Directors UaeKiran Kabir83% (6)

- Weekly Market Outlook 23.04.12Document5 pagesWeekly Market Outlook 23.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 11.07.2012Document2 pagesResults Tracker 11.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 25.03.13Document5 pagesWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Marketing: Ponnuswamy M K Proprietor Feeds India 04286 220030 Adka K.Sreesh Managing Partner Ideal Stores 2557013Document15 pagesMarketing: Ponnuswamy M K Proprietor Feeds India 04286 220030 Adka K.Sreesh Managing Partner Ideal Stores 2557013BirlaNo ratings yet

- Indias Top 500 Companies 2018Document502 pagesIndias Top 500 Companies 2018ayush guptaNo ratings yet

- Indias Leading Infrastructure Companies 2016 PDFDocument204 pagesIndias Leading Infrastructure Companies 2016 PDFMujahid PatwegarNo ratings yet

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Confirms PuneDocument10 pagesConfirms Pune123bmwaudi33% (3)

- BM 201 AssignmentDocument12 pagesBM 201 AssignmentMukul SuryawanshiNo ratings yet

- New UpdatingDocument12 pagesNew UpdatingVarghese AlexNo ratings yet

- Hero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016Document3 pagesHero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016FiqriNo ratings yet

- Phone ListDocument1 pagePhone ListINSAN MAULANANo ratings yet

- Cuts From DataBaseDocument258 pagesCuts From DataBaseNikhitesh HenrageNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Pune ConfirmationsDocument6 pagesPune Confirmations123bmwaudiNo ratings yet

- Results Tracker 12.01.12Document2 pagesResults Tracker 12.01.12Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18.07.2012Document2 pagesResults Tracker 18.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- AdminDocument12 pagesAdminrockmountain678e340% (1)

- Before You Start The Exam, Please Fill The Following Details Below: Name: Roll Number: CompanyDocument12 pagesBefore You Start The Exam, Please Fill The Following Details Below: Name: Roll Number: CompanyKamisetty SudhamshNo ratings yet

- Delhi Database With EmailDocument76 pagesDelhi Database With Emailyohithasoumy0% (1)

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- MENA Mining Report - Q1 2023Document60 pagesMENA Mining Report - Q1 2023saim siam100% (1)

- Gregory Alan Smith Wire Fraud Guilty PleaDocument2 pagesGregory Alan Smith Wire Fraud Guilty PleaKHOUNo ratings yet

- Ast Lesson Plan Financial Ratios Year11Document13 pagesAst Lesson Plan Financial Ratios Year11Ankita kumariNo ratings yet

- Factors Affecting International Equity ReturnsDocument12 pagesFactors Affecting International Equity Returnsrishabh jainNo ratings yet

- IntEco Case 99-Mexico FordDocument22 pagesIntEco Case 99-Mexico FordVarun GargNo ratings yet

- Mutual Funds and Emerging Indian EconomyDocument4 pagesMutual Funds and Emerging Indian EconomyYuvraj GogoiNo ratings yet

- PT Indo Premier Sekuritas Trade ConfirmationDocument1 pagePT Indo Premier Sekuritas Trade ConfirmationDhan RamadhanNo ratings yet

- Project Management Fundamentals CourseDocument31 pagesProject Management Fundamentals CourseSachin ParmarNo ratings yet

- Early Floyd Family Virginia To Modern Floyd Family Pulaski County GeorgiaDocument174 pagesEarly Floyd Family Virginia To Modern Floyd Family Pulaski County GeorgiaMargaret Woodrough67% (3)

- Nism XB V Imp Case Studies and Short NotesDocument145 pagesNism XB V Imp Case Studies and Short NotesSBIMF KOTA0% (1)

- UntitledDocument251 pagesUntitledmrNo ratings yet

- Entrepreneur Development NotesDocument20 pagesEntrepreneur Development NotesAnish YadavNo ratings yet

- Ananlysis Report On Term PlanDocument17 pagesAnanlysis Report On Term PlanshashikanthNo ratings yet

- GBIDocument6 pagesGBIAnanth VybhavNo ratings yet

- 25 Casti Complexity An IntroductionDocument35 pages25 Casti Complexity An Introductiongerman332No ratings yet

- Working Capital Ppt-3Document34 pagesWorking Capital Ppt-3bala muraliNo ratings yet

- ECC Investment Banking PresentationDocument9 pagesECC Investment Banking PresentationSumant NaikNo ratings yet

- An Internship Report On: Supervised byDocument8 pagesAn Internship Report On: Supervised byarshed_69No ratings yet

- Indiamart Case StudyDocument35 pagesIndiamart Case StudyGrim ReaperNo ratings yet

- Financial Statement Analysis ToolsDocument33 pagesFinancial Statement Analysis Toolsmarjannaseri77No ratings yet

- Fdi in ChinaDocument3 pagesFdi in ChinaVinod JoshiNo ratings yet

- Griffon Hoverwork Case StudyDocument2 pagesGriffon Hoverwork Case StudyUKTI South EastNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- GE 9 Cell MatrixDocument10 pagesGE 9 Cell MatrixMr. M. Sandeep Kumar0% (1)

- Mother Dairy: Creating A National Footprint: POLITICAL FactorsDocument2 pagesMother Dairy: Creating A National Footprint: POLITICAL FactorsAkankshaAhujaNo ratings yet

- ConfigGuide AADocument46 pagesConfigGuide AAfungayingorimaNo ratings yet

- Privatization Can Be of Three Prominent TypesDocument2 pagesPrivatization Can Be of Three Prominent TypesLeslin BruttusNo ratings yet

- Case 2Document5 pagesCase 2tranduythai152272592% (13)

- WWW - Bazaartrading.in: in Which Bazaar Trading Had Mentioned Itself AsDocument27 pagesWWW - Bazaartrading.in: in Which Bazaar Trading Had Mentioned Itself AsPratim MajumderNo ratings yet

- Contents of A Feasibility Study: InvestmentDocument6 pagesContents of A Feasibility Study: InvestmentRukudzo Rukwata-NdoroNo ratings yet