Professional Documents

Culture Documents

HSL PCG "Currency Daily": 26 October, 2016

Uploaded by

khaniyalalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL PCG "Currency Daily": 26 October, 2016

Uploaded by

khaniyalalCopyright:

Available Formats

HSL PCG CURRENCY DAILY

26 October, 2016

PRIVATE CLIENT GROUP [PCG]

MAJOR CURRENCY VIEW POINT

Prev.

Close

Close

Chg. % Chg. RUPEE CLOSES UP 0.04% TO 66.82 A DOLLAR

USDINR 66.825 66.853 -0.028 -0.04% Rupee volatility has been up in yesterdays trade amid start of FCNR

payment. The rupee maintained its edge over the U.S. dollar for the

DXY INDX 98.743 98.715 0.028 0.03%

second day on Tuesday, appreciating by a modest three paise to

EURUSD 1.089 1.0882 0.001 0.06% close at 66.82.

GBPUSD 1.216 1.2235 -0.007 -0.59%

The 10 year govt. bond yield up by 0.05% to settle at 6.78 after

USDJPY 104.300 104.5 -0.200 -0.19% successful completion of open market operation on yesterday.

DG USDINR 67.128 67.1186 0.009 0.01%

Spot USDINR is having resistance around 67.07 while 66.50 acts as

GLOBAL INDICES support in near term. The overall bias for the pair remains bearish

until it manages to cross 67.27.

Dollar Took a Breath After Nine Month High

Prev.

Close Chg. % Chg. The dollar took a pause in early today, but was still hovering near

Close

nine-month peak against a currency basket as expectations for a

SGX NIFTY 8666.5 8698.0 -32 -0.36% year-end rate hike by the Federal Reserve remained intact. The

NIFTY 8691.3 8709.0 -18 -0.20% market was pricing in a greater than 78% chance that the Fed would

SENSEX 28091.4 28179.1 -88 -0.31% raise rates in December, up from 68% on Friday, according to CME

HANG-SENG 23454.9 23565.1 -110 -0.47% Group's Fed Watch program. The dollar index stood at 98.721 after

NIKKEI 17331.5 17365.3 -34 -0.19% rising as high as 99.119 yesterday, its highest level since Feb. 1.

SHANGHAI 3124.4 3131.9 -8 -0.24% The euro is quoting around $1.0886, after slipping to an almost

eight-month low of $1.0848 on Tuesday. Dollar against the yen,

S&P INDEX 2143.2 2151.3 -8 -0.38%

drifts lower 0.1% to 104.13, down from a roughly three-month high

DOW JONES 18169.3 18223.0 -54 -0.30% of 104.87 yen touched in overnight.

NASDAQ 5283.4 5309.8 -26 -0.50%

U.S. data released on Tuesday by the Conference Board showed the

FTSE 7017.6 6986.4 31 0.45% consumer confidence index dropped to 98.6 in October from a

CAC 4540.8 4552.6 -12 -0.26% downwardly revised 103.5 in September. Also, data from the US

DAX 10757.3 10761.2 -4 -0.04% S&P/Case-Shiller showed that its home price index registered a

5.3% annual gain in August, up from 5.0% last month.

INSTITUTIONAL ACTIVITY (Provisional Rs. In Cr)

BoE Governor Mark Carney cast doubt on expectations for more

monetary stimulus in Europe, saying that the BoE would

Segment 25-Oct-16 24-Oct-16 undoubtedly take sterlings weakness into account at its rate

setting meeting next week.

Equity -391.91 -221.94

The outlook for the dollar remains bullish backed by monetary

Debt 763.82 212.51

tightening as well as technical chart setup. In near term, the buck

could find psychological resistance around 100 mark while support

near 97.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL OUTLOOK

USDINR NOV. FUTURE DAILY CHART

Technical Observations

The USDINR Nov. Future is hovering around 20 SDMA, placed near 67.20. Also, it has been trading well below 200 SDMA implies long

term negative trend.

MACD has been placed near zero line with MACD moving above MACD average suggesting consolidation.

The pair is having resistance around 67.27, the falling trend line adjoining high 68.60 and low of 67.78.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

Near Month Fut. Last Pivot S3 S2 S1 R1 R2 R3

USDINR 67.17 67.18 66.95 67.04 67.10 67.25 67.33 67.40

EURINR 73.17 73.20 73.03 73.09 73.13 73.24 73.30 73.34

GBPINR 82.26 82.25 82.05 82.11 82.19 82.33 82.39 82.47

JPYINR 64.29 64.32 64.01 64.12 64.21 64.40 64.51 64.60

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 66.94 66.66 67.14 66.40 68.79 64.92 66.81 66.69 66.81 67.00 67.08

EURINR 73.64 72.76 75.44 72.66 77.49 70.24 73.01 73.99 74.63 74.79 74.78

GBPINR 82.22 81.18 88.91 81.18 101.87 81.18 81.85 83.17 86.07 88.29 92.33

JPYINR 64.57 63.92 66.78 63.92 68.11 53.32 64.32 64.65 65.35 65.09 62.58

CURRENCY MOVEMENT

Open Chg. In

Currency Open High Low Close Chg. Chg. in OI Volume

Interest Volume

SPOT USDINR 66.93 66.93 66.82 66.83 -0.03 -- -- -- --

USDINR NOV. FUT. 67.12 67.27 67.12 67.17 -0.03 1334841 250999 469552 98153

SPOT EURINR 72.75 72.83 72.69 72.74 -0.12 -- -- -- --

EURINR NOV. FUT. 73.24 73.27 73.16 73.17 -0.13 27874 2152 9198 -2612

SPOT GBPINR 81.68 81.81 81.68 81.75 -0.11 -- -- -- --

GBPINR NOV. FUT. 82.27 82.32 82.18 82.26 -0.07 29426 12375 29064 21445

SPOT JPYINR 64.01 64.09 63.92 63.92 -0.41 -- -- -- --

JPYINR NOV. FUT. 64.42 64.43 64.23 64.29 -0.35 17805 5950 17112 11434

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

10/25/2016 18:30 US FHFA House Price Index MoM Aug 0.40% 0.70% 0.50%

10/25/2016 19:30 US Consumer Confidence Index Oct 101.5 98.6 103.5

10/25/2016 19:30 US Richmond Fed Manufact. Index Oct -4 -4 -8

10/25/2016 19:30 US IBD/TIPP Economic Optimism Oct 47.5 51.3 46.7

ECONOMIC EVENTS TODAY

Date Time Country Event Period Survey Prior

10/26/2016 14:00 UK BBA Loans for House Purchase Sep 37350 36997

10/26/2016 16:30 US MBA Mortgage Applications 21-Oct -- 0.60%

10/26/2016 19:15 US Markit US Services PMI Oct P 52.5 52.3

10/26/2016 19:30 US New Home Sales Sep 600k 609k

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

You might also like

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 21 October, 2016Document6 pagesHSL PCG "Currency Daily": 21 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 15 December, 2016Document6 pagesHSL PCG "Currency Daily": 15 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 February, 2017Document6 pagesHSL PCG "Currency Daily": 14 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 December, 2016Document6 pagesHSL PCG "Currency Daily": 08 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 June, 2016Document17 pagesHSL PCG "Currency Insight"-Weekly: 13 June, 2016Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- Forex Market - Daily Market Report - Fundamental News - Market Overview of Gold & SilverDocument7 pagesForex Market - Daily Market Report - Fundamental News - Market Overview of Gold & Silverneha jainNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- Market Outlook For 09 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 09 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchkhaniyalalNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchkhaniyalalNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- Idirect Bel Q4fy16Document13 pagesIdirect Bel Q4fy16khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- Container Corporation (CONCOR) : Higher Exim Volume Buoys Earnings!!!Document10 pagesContainer Corporation (CONCOR) : Higher Exim Volume Buoys Earnings!!!khaniyalalNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeakhaniyalalNo ratings yet

- Container Corporation (CONCOR) : Short Lived Temporary Problems Recovery AwaitedDocument10 pagesContainer Corporation (CONCOR) : Short Lived Temporary Problems Recovery AwaitedkhaniyalalNo ratings yet

- Tata Ethical Fund: Retail ResearchDocument9 pagesTata Ethical Fund: Retail ResearchkhaniyalalNo ratings yet

- Technical Switch Trades: Retail ResearchDocument2 pagesTechnical Switch Trades: Retail ResearchkhaniyalalNo ratings yet

- Uvs & Scooters Drive Growth in June!!!: Motogaze July 2016Document16 pagesUvs & Scooters Drive Growth in June!!!: Motogaze July 2016khaniyalalNo ratings yet

- Technical Stock Idea: Private Client GroupDocument2 pagesTechnical Stock Idea: Private Client GroupkhaniyalalNo ratings yet

- 11Document6 pages11khaniyalalNo ratings yet

- Systematic Transfer Plan (STP) in Mutual Funds: Retail ResearchDocument4 pagesSystematic Transfer Plan (STP) in Mutual Funds: Retail ResearchkhaniyalalNo ratings yet

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeakhaniyalalNo ratings yet

- Thesis (23 08 2021) Y.J. Romijn S4183657 FinalDocument71 pagesThesis (23 08 2021) Y.J. Romijn S4183657 FinalCarolina MacielNo ratings yet

- Why Do These Foreign Funds Love Adani Group Companies?Document15 pagesWhy Do These Foreign Funds Love Adani Group Companies?Nikhil BalanNo ratings yet

- T o R e C o R D C o S: Cases Revenue Recognition Case 1Document3 pagesT o R e C o R D C o S: Cases Revenue Recognition Case 1Tio SuyantoNo ratings yet

- Ordenes de Servicio Julio: Fecha ProveedorDocument29 pagesOrdenes de Servicio Julio: Fecha ProveedorLeo OONo ratings yet

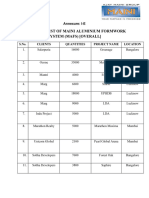

- Customer List of Maini Aluminium Formwork System - MafsDocument6 pagesCustomer List of Maini Aluminium Formwork System - MafsgurushankarNo ratings yet

- Cor 2ndsem2021 2022 212783Document1 pageCor 2ndsem2021 2022 212783Mark Adrian TagabanNo ratings yet

- Rivera V SPS Chua (Nego)Document2 pagesRivera V SPS Chua (Nego)Gieann BustamanteNo ratings yet

- $834.67 Discount BondDocument5 pages$834.67 Discount BondLưu Gia Bảo0% (1)

- Global EconomyDocument1 pageGlobal EconomyDiana CamachoNo ratings yet

- Summary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRDocument1 pageSummary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRabhishek ranaNo ratings yet

- HSBC Germany List of Prices and Services enDocument30 pagesHSBC Germany List of Prices and Services enkss1000_2002No ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Clarisonic ITC ComplaintDocument85 pagesClarisonic ITC ComplaintSarah BursteinNo ratings yet

- A Study On Working Capital Management at Berger Paints LTDDocument6 pagesA Study On Working Capital Management at Berger Paints LTDdanny kanniNo ratings yet

- Analysis of Export Market Structure For Acacia Wooden Furniture in VietnamDocument15 pagesAnalysis of Export Market Structure For Acacia Wooden Furniture in Vietnamfeby febriantiNo ratings yet

- Corporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceDocument3 pagesCorporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceUzzal Sarker - উজ্জ্বল সরকারNo ratings yet

- Business Prospects of Honey MarketingDocument14 pagesBusiness Prospects of Honey MarketingAbubakarr SesayNo ratings yet

- Jones 2018 - Towards A Theory of DisintegrationDocument13 pagesJones 2018 - Towards A Theory of DisintegrationPatrick Prateek WagnerNo ratings yet

- Release Order Notification (Inward Processing) and Bonded TransportationDocument10 pagesRelease Order Notification (Inward Processing) and Bonded TransportationAung LattNo ratings yet

- ch12 Problem Set CDocument2 pagesch12 Problem Set CMutiara TenriNo ratings yet

- Week 7 Week 8 - Intro To Portfolio TheoryDocument24 pagesWeek 7 Week 8 - Intro To Portfolio TheoryJoshua NemiNo ratings yet

- Annual: Kathmandu Holdings LimitedDocument50 pagesAnnual: Kathmandu Holdings Limitedmartino chongasisNo ratings yet

- Assignment 3 Financial Markets Tu Huu Phuc s3812120 1Document10 pagesAssignment 3 Financial Markets Tu Huu Phuc s3812120 1Nguyễn TùngNo ratings yet

- Project Report On Idbi BankDocument45 pagesProject Report On Idbi BankShivkant SinghNo ratings yet

- The Edge FD - 10 November 2016Document33 pagesThe Edge FD - 10 November 2016mohdkhidirNo ratings yet

- Campus PlacementDocument20 pagesCampus PlacementPrasant SharamaNo ratings yet

- ACTDocument3 pagesACTNgô Lan TườngNo ratings yet

- Complete Handouts Batch 2021-1-200Document200 pagesComplete Handouts Batch 2021-1-200CHAITANYANo ratings yet

- O O O O O O: Practice Test 7 MULTIPLE CHOICE: (8 Points)Document5 pagesO O O O O O: Practice Test 7 MULTIPLE CHOICE: (8 Points)Nguyễn Đức MinhNo ratings yet

- The Political Economy of Taxation and State Resilience in ZambiaDocument27 pagesThe Political Economy of Taxation and State Resilience in ZambiamemoNo ratings yet