Professional Documents

Culture Documents

ATW ABR 2019 Atw201904-Dl

Uploaded by

Ismar AdrianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATW ABR 2019 Atw201904-Dl

Uploaded by

Ismar AdrianCopyright:

Available Formats

THE CORSIA EFFECT

Carbon offset decisions to be made

REGULATORY REFORM

US and Europe pursue different paths

CEO INTERVIEW

IAG’s Willie Walsh

APRIL 2019 | atwonline.com

THE CHANGING AIR FRANCE-KLM PARTNERSHIP

FOR BETTER

OR WORSE

00 ATW APRIL_19__COVER fin.indd 1 3/13/19 12:50 PM

Where are

your next pilots

coming from?

Right here.

Every year, we train 135,000+ pilots in our

50+ training centers worldwide. Add the

1,200 experienced pilots on assignment

with airlines, placed by our aviation recruitment

team, and the 1,500 new pilots graduating from

our aviation academies yearly, and answering

the question has never been so easy.

Follow us @CAE_Inc

ATW_PM_04.indd 2 3/15/2019 8:02:28 AM

Volume 56 / Number 3 April 2019

CONTENTS

This issue online atwonline.com/magazine-issues/atwonline

ON THE COVER

14 FOR BETTER OR WORSE 14

Air France-KLM Group adapts under a new

CEO and with a new government stakeholder

By Karen Walker

KLM

FEATURES

20 ACADEMY GROWTH

Pilot training facilities are

ramping up worldwide.

By Robert Moorman

ROB FINLAYSON

23 CRITICAL CHOICES

Questions loom over aviation’s

global carbon emissions scheme.

By Henry Canaday

20

30 TRADING UP

New narrowbodies and a growing

middle-income market fuel Cebu’s expansion.

By Chen Chaunren

32 WHEN LESS IS MORE

US steps back on airline rulemaking;

Europe stands firm.

By Ben Goldstein and Kerry Reals

CAE

34 CABIN INNOVATIONS

Traditional and new industry players

explore the aircraft interiors space.

By Alan Dron

36 CONNECTIVITY CONVERSATION

The debate on how to improve onboard Wi-Fi

CHEN CHAUNREN

and make money continues.

30

By Victoria Moores

38 AH, DE HAVILLAND!

The Q400 turboprop’s new owner

resurrects a famous brand.

By Graham Warwick

40 DOORS TO OPEN

Can a new push for African aviation

liberalization fare better than the first?

By Alan Dron

36

VIASAT

Cover photo: Air France

atwonline.com | April 2019 | ATW 1

p1-3_TOC.indd 1 3/15/19 2:48 PM

ATW_PM_04.indd 2 3/15/2019 8:02:51 AM

CONTENTS April 2019 | Volume 56/ Number 3

BUSINESS/AUDIENCE

DEVELOPMENT

CONTACT INFORMATION

GETTY IMAGES/STEPHEN BRASHEAR

PUBLISHER,

AIR TRANSPORT WORLD

MANAGING DIRECTOR,

AMERICAS,

AVIATION WEEK

KURT HOFMANN

Beth Wagner

Aviation Week Network

2121 K Street, NW, Suite 210

7 44 Washington, DC 20037

Tel. 202-517-1061

beth.wagner@informa.com

PRESIDENT

12 AVIATION WEEK

Gregory Hamilton

greg.hamilton@informa.com

AUDIENCE DEVELOPMENT

SENIOR DIRECTOR

Abi Ahrens

TEL: +1 913-967-1686

abi.ahrens@informa.com

AUDIENCE DEVELOPMENT

MANAGER

Tyler Motsinger

AERION

TEL +1 913-967-1623

tyler.motsinger@informa.com

SUBSCRIPTIONS

5 EDITORIAL 13 QUOTABLES Printed in USA Copyright © 2019 by

Informa Media, Inc., all rights reserved.

China called it first Best quotes heard from Air Transport World (ISSN 0002-2543)

By Karen Walker industry leaders is published monthly except for combined

issues in July/August & December/

January by Informa Media, Inc., 9800

7 NEWS BRIEFS 41 TRENDS

Metcalf Ave., Overland Park, KS 66212-

2216, USA. Periodicals Postage Paid

at Kansas City, MO, and at additional

US lawmakers seek FAA mailing offices.

Submit payment for subscriptions and/

oversight review in wake 43 CUSTOMER SERVICES or single copies via http://atwonline.

of MAX groundings com/catalog. One-year subscription

rates start at US$69 for the digital

edition, and at US$89 for US and

43 ADVERTISERS’ INDEX US$129 outside the US for the print

What US airlines and edition. Single issues are US$15/copy.

The annual World Airline Report issues

associations said about are US$50/copy. For subscription

the Boeing MAX grounding 43 ADVERTISERS’ WEBSITES related questions or for alternate

payment options, please contact

atwplus@informa.com.

9, 10 Airline News

44 INTERVIEW Qualified subscriptions are limited to

management personnel in airlines and

selected industries at the discretion of

12 ANALYSIS In for the long haul the publisher.

Supersonic Reimagined Willie Walsh Canadian GST #R126431964 Canada

Post Publications Mail Agreement

Can a supersonic airliner be CEO, International Airlines Group No: 40612608. Canada return address:

IMEX Global Solutions, P.O. Box 25542,

environmentally acceptable? By Kurt Hofmann London, ON N6C 6B2, Canada.

POSTMASTER: Send address changes to

By Graham Warwick Customer Service, Air Transport World,

P.O. Box 2100, Skokie, Ill. 60076-7805, USA.

CONNECT WITH ATW

Facebook Twitter LinkedIn

facebook.com/ @ATWOnline www.linkedin.com/ An Informa business

AirTransportWorld groups/

Air-Transport-World

atwonline.com | April 2019 | ATW 3

p1-3_TOC.indd 3 3/15/19 2:50 PM

Thank you to our sponsors Congratulations to

for your support of the our 2019 Winners!

45th Annual Airline Industry Airline of the Year:

Lufthansa

Leadership Excellence:

Achievement Awards William “Bill” Franke, Indigo

Partners

Eco-Airline of the Year:

ATW Airline Industry Awards are the most coveted honor an Air New Zealand

airline or individual can receive. Value Airline of the Year:

Spirit Airlines

2019 PLATINUM SPONSOR: Airline Market Leader:

airBaltic

Airport of the Year:

Dallas Fort Worth International

Passenger Experience

Achievement:

Air New Zealand

2019 SPONSORING PARTNERS: Joseph S. Murphy Service

Award:

Airlink

Aviation Technology

Achievement:

Airbus A220

2020 Nominations Coming Soon!

For more information on 2020 nominations visit:

awards.atwonline.com

ATW_PM_04.indd 4 3/15/2019 8:02:57 AM

EDITORIAL

China called

it first

EDITORIAL STAFF Karen Walker | Editor-in-Chief

Editor-in-Chief karen.walker@informa.com

Karen Walker

+1 703-656-6300

karen.walker@informa.com

Managing Editor

Jack Wittman

jack.c.wittman@informa.com

News & Online Editor

W hatever is ultimately Unfortunately, as happened with

Linda Blachly

linda.blachly@informa.com

concluded about the the 2013 groundings of the Boeing

Europe Bureau Chief

Victoria Moores Lion Air and Ethiopian 787 after a series of fires related to

Tel: +44 (0) 7966 389 339 Airlines Boeing 737 MAX crashes, its lithium ion batteries, FAA, DOT,

victoria.moores@informa.com

the response to the second acci- Boeing—and, indeed, Boeing’s US

Europe/Middle East Editor

Alan Dron dent was an aviation regulatory airline customers—looked uncom-

South East Asia & China Editor gamechanger. fortably too much in lockstep as they

Chen Chuanren Typically, the US—and FAA unilaterally agreed, after each non-

US Congressional Editor in particular—is the global leader US grounding, that they were right

Ben Goldstein

when it comes to major safety deci- to keep the MAX in the air.

Senior Editors

Sean Broderick

sions, such as issuing an emergency Since 2005, when FAA changed

Bill Carey grounding order. That is especially its certification procedures to allow

Jens Flottau

Mark Nensel

true where a US-made and certified qualified manufacturers to select

Adrian Schofield aircraft is involved. their own employees to certify their

Director, Editorial Production In this case, of course, the oppo- own aircraft, FAA has been more reli-

Michael Lavitt site was true. By the time the US ant on those manufacturer decisions.

Production Editors issued its grounding order, it was the And when a major event happens—

Bridget Horan

Michael Johnson last to do so. China, where slightly such as two airliners of the same type

Contributing Editors more MAXs are installed than in crashing within five months—US

Helen Massey-Beresford the US, was quickest to take the regulators seem unable to stand clearly

Henry Canaday

Kurt Hofmann “safe not sorry” approach. Other at arm’s length from the US manu-

Polina Montag-Girmes countries with well-regarded avia- facturer. But as AFA president Sara

Robert W. Moorman

tion authorities, including Australia Nelson said, “America in international

Contributing Photographers

Rob Finlayson and Singapore, followed suit, as did aviation means the larger world more

Joe Pries EASA and then Canada. Agree or generally—that we set the standard

Art Direction & Design disagree with their approach when so for safety, competence, and honesty in

Unconformity, LLC.

little was known about the second, governance of aviation.”

Ethiopian, crash, the fact remains That is still true, but FAA, DOT

that none of those countries or regu- and Boeing should take careful note

© Air Transport World 2019. All Rights Reserved.

Permission is granted to users registered with the latory authorities felt it necessary to of how the sands shifted with the

Copyright Clearance Center, Inc. (CCC) to be guided by where FAA stood in tragic Ethiopian crash. Convenient

photocopy any article, with the exception of those

for which separate copyright ownership is indicated making the call to ground. For the as it may be, it is not enough to say

on the first page of the article, for a base fee of $1.25 most part, the public—and affected that China and the rest of the world

per copy of the article and 60 cents per page, paid

directly to the CCC, 222 Rosewood Dr., Danvers, non-US airlines—agreed with them. bowed to emotional pressure while

Mass. 01923, U.S.A. (Code No. 0002-2543/04 This is a new world order that FAA the US waited for facts. The world

$1.25 + .60). Microfilm of Issues and reproduc-

tions of issues or articles can be ordered from The will find difficult to fold back, espe- also wants clear evidence that major

Proquest Company, 300 North Zeeb Rd, PO Box cially if any major design fix is found safety decisions are made without any

78, Ann Arbor, Mich. 48106, USA.; Tel: +1 800-

521-0600. to be necessary for the MAX. political or economic pressure.

atwonline.com | April 2019 | ATW 5

p5_Editorial_April2019.indd 5 3/15/19 3:08 PM

THE GROUND.

FLY

WE MAKE IT

No matter how busy the fight, your

passengers will feel like they’re in a

world of their own thanks to our

beautifully designed Airspace cabins.

HD in-fight entertainment throughout,

quieter, and with soothing LED ambient

lighting, Airspace delivers frst class

comfort for every passenger. And not

only is it available across our newest

widebody feet, it’s also being rolled

out across our single aisle A320

family too.

Tranquility. We make it fy.

airbus.com

ATW_PM_04.indd 6 3/15/2019 9:39:22 AM

Airline News

For daily news stories,8-9

go to atwonline.com/dailynews NEWSBRIEFS

NEWSBRIEFS

For daily news stories, go to atwonline.com/dailynews

US lawmakers seek FAA oversight review in wake of MAX groundings

The crash of an Ethiopian Airlines’ Boeing 737 MAX 8 became a ties—especially EASA—diverged from FAA was unprecedented.

watershed moment for US aviation regulatory oversight after sharp At 2:30 p.m. US ET March 13, about three hours after the

divisions emerged about when an aircraft type should be grounded Canadian announcement—the US did a U-turn. The way in

and who makes that decision. which it announced that it was also grounding the MAX, with

The crash of Ethiopian flight 302 minutes after taking off from immediate effect, was also unusual in that it was made not by

Addis Ababa March 10 triggered an unprecedented chain of DOT or FAA, but by US President Donald Trump.

groundings because of similarities with another MAX crash in FAA acting administrator Dan Elwell held a press conference

Indonesia less than five months earlier. Like flight 302, Lion Air soon after, explaining that refined satellite tracking data, com-

MAX 8 flight 610 had just taken off in good weather conditions, bined with some undefined physical evidence from the wreck-

appeared to encounter severe control problems almost imme- age of the Ethiopian Airlines crash site, prompted the change of

diately that prompted the pilot to request emergency clearance opinion.

for a return to the airport, and then the aircraft went into a rapid FAA’s emergency order stated the new information concern-

and steep descent. All 189 ing “the aircraft’s configu-

people onboard flight 610 ration just after takeoff

and all 157 people on flight that, taken together with

302 were killed. newly refined data from

Both crash investigations satellite-based tracking of

are ongoing, but one focus the aircraft’s flight path,”

area of the Indonesia event indicated similarities with

is the MAX’s maneuvering what happened to the Lion

characteristics augmenta- Air flight.

tion system (MCAS), soft- “Suffice it to say the

ware developed specifically evidence found on the

for the MAX because of ground made it more likely

GETTY IMAGES/STEPHEN BRASHEAR

its heavier weight. MCAS that the flight path was

is designed to automati- closer to Lion Air,” Elwell

cally kick in if the aircraft’s told reporters.

angle of attack becomes The order’s language

too high, risking a stall. suggested the discovery of

There is an MCAS override wreckage that established

switch. the aircraft’s flight-control

The erratic flight path surface positions. Flight

of flight 610, with the pilot appearing to be fighting sharp nose- 610 began to experience flight-control issues shortly after

down turns with nose pulls, prompted a closer examination of retracting its flaps after takeoff. Those issues are the focus of

MCAS. that ongoing investigation.

While no cause has yet been established for the flight 610 The refined satellite data, meanwhile, came from space-

crash, airlines and countries that operate the MAX almost imme- based ADS-B provider Aireon.

diately began grounding the aircraft after the Ethiopian crash, “The way the [initial] data was presented, it was not showing

citing concern about two catastrophic accidents of the same new credible movement of an aircraft,” Elwell said.

aircraft type in months and the need for an abundance of caution. The resulting track, including flight 302’s altitude variations,

China was the first country to issue a grounding, doing so lined up closely with flight 610’s known track. This suggests 302

the day after the Ethiopian crash. There are more than 70 was struggling to maintain altitude and then dove rapidly to

MAXs in the fleets of Chinese airlines. In the next 48 hours, the impact, as happened with 610.

groundings rapidly expanded, issued by countries that included Elwell, explaining why the agency was the last to issue a

Australia, Indonesia, Singapore and several European coun- MAX grounding, said, “we are a fact-driven, data-based orga-

tries. On March 12, Europe’s aviation authority, EASA, issued a nization. We make actions based on data, findings and risk

European Union-wide grounding order. On the morning of March assessment. That data coalesced today, and we made the call.”

13, Canada’s transport ministry announced a similar ban, citing But questions were soon asked about why the US was last

new evidence that, while not conclusive, showed “similarities to make a grounding call, and US lawmakers began calling for

that exceed a certain threshold in our minds.” oversight of FAA’s decision-making processes.

This left the US as the lone exception still permitting the US House transportation and infrastructure committee chair

MAX to fly. Throughout the three days after the crash, the US Peter DeFazio (Dem-Oregon) and House aviation subcommittee

Department of Transportation (DOT), FAA, Boeing and the US chair Rick Larsen (Dem-Washington) issued a statement say-

airlines that operate the MAX—American Airlines, Southwest ing, “despite repeated assurances from the FAA in recent days,

Airlines and United Airlines—had issued various statements it has become abundantly clear to us that not only should the

standing by their belief in the safety of the MAX and reiterating 737 MAX be grounded but also that there must be a rigorous

there was not enough evidence to link or know the cause of the investigation into why the aircraft, which has critical safety sys-

crashes. tems that did not exist on prior models, was certified without

Almost 60 MAXs with US airlines continued to fly. FAA’s stance requiring additional pilot training. While a lot of data has yet to

was particularly notable because the aircraft was designed and be recovered that will help explain why Ethiopian Airlines flight

built by an American company, and because when a major ground- 302 went down, as chairs of the committee and subcommittee

ing occurs, it typically starts with an FAA order. While there is with jurisdiction over the FAA and NTSB, we plan to conduct

precedent for other authorities to make the first call on a ground- rigorous oversight with every tool at our disposal to get to the

ing, the speed and scale with which significant aviation authori- bottom of the FAA’s decision-making process.”

atwonline.com | April 2019 | ATW 7

p7-10 Newsbriefs.indd 7 3/15/19 3:02 PM

NEWSBRIEFS

What US airlines and associations said about the Boeing MAX grounding

In the days following the March ators, has been phenomenal. We’ve have acted in the best interests of

10 crash of an Ethiopian Airlines operated over 40,000 flights cover- aviation safety. ALPA continues to

Boeing 737 MAX 8 in Addis Ababa, ing almost 90,000 hours. … Based monitor the situation and is working

FAA and the three US airlines on all the extensive data that we, alongside aviation authorities in the

that operate the MAX—American our US counterparts, and the FAA United States and Canada to uphold

Airlines, Southwest Airlines and have access to, there is no reason to the safety and integrity of our air

United Airlines—stood by the US’ question the safety of our MAX air- transportation system. We strongly

initial decision to not ground the planes. That makes sense because encourage the investigative authori-

aircraft, and all expressed con- that’s the way our aerospace and ties responsible to expedite the

fidence in the MAX’s safety, as aviation system is designed to work. investigation of Ethiopian Airlines

did major pilot associations. Two History proves—air travel is extraor- Flight 302 and identify any correc-

large US unions representing flight dinarily safe.” tive action, if necessary, in order to

attendants, however, called on FAA American, which has 24 MAX 8s, return this aircraft to service,” ALPA

to ground the aircraft. said in its statement on the airline’s said.

On March 13, the US became the site that it averaged 85 flights per The Association of Flight

last to issue a grounding order after day with the type, out of 6,700 Attendants (AFA), which had ear-

satellite and wreckage evidence departures. lier called on FAA to ground the

indicated potential similarities “American regularly monitors MAX, welcomed the US decision.

with the Oct. 29, 2018, crash of a aircraft performance and safety “The 737 MAX will now get

Lion Air MAX 8 in Indonesia. The parameters across our entire fleet, the focus it needs to address the

grounding was expected to last including extensive flight data col- concerns of undetermined safety

weeks, perhaps months. lection. This data, along with our issues. We must focus on the

Here are summaries of what analysis, gives us confidence in the needed fix, rather than the uncer-

some of the US airlines and airline safe operation of all of our aircraft, tainty of flight,” AFA president

union associations said about the and contributes to American’s Sara Nelson said. “Lives must

grounding. exemplary safety record. American come first always. But a brand is

Southwest, which had 34 MAX has flown more than 2.5 million at stake as well. And that brand is

8s in service, was the only airline to passengers—during 46,400 oper- not just Boeing. It’s America. What

put a name to its statement, which ating hours encompassing nearly America means in international

was signed by CEO Gary Kelly and 18,000 flights—safely on our MAX aviation and by extension in the

placed on the airline’s website. 8 fleet since the first one was larger world more generally—that

“We have been continually work- delivered in Sepember 2017 and we set the standard for safety,

ing with the FAA, Boeing, and began commercial service later that competence, and honesty in gover-

others within the US government. November,” American said. nance of aviation.”

I have been in contact daily. This United, which has 14 MAX 9s Norwegian, meanwhile was the

afternoon, the FAA issued its accounting for about 40 flights a first airline to publicly confirm it

order to ground the MAX, with our day, said, “We have and will con- would be seeking compensation for

knowledge and support,” Kelly said. tinue to be in close contact with the groundings. The airline has 18

“Safety is our top priority. It always investigators as well as Boeing to MAX 8s and grounded them volun-

has been. It always must be. ... share data and fully cooperate with tarily March 12. It is putting Boeing

Southwest has a long history with regulatory authorities.” 787s on some MAX transatlantic

the 737 and a stellar safety record. The Air Line Pilots Association routes. CEO Bjorn Kjos, in a video

In 48 years, it’s the only aircraft (ALPA), which represents 61,000 released by the company, said, “It

we’ve flown. We’ve been part of the pilots at US and Canadian airlines, is quite obvious that we will not

Boeing 737 story as it’s developed said it supported the FAA and take the cost related to the new

over time. The MAX is the latest Transport Canada groundings. aircraft that we have to park tem-

version. ... Our experience with the “Out of an abundance of cau- porarily. We will send this bill to

MAX, along with the other US oper- tion, North American regulators those who produce this aircraft.”

Say yes to new payment methods.

Say yes to new revenue streams. And say yes

to opening doors to new markets.

Learn more at UATP.com

8 ATW | April 2019 | atwonline.com

p7-10 Newsbriefs.indd 8 3/15/19 3:02 PM

For daily news stories, go to atwonline.com/dailynews NEWSBRIEFS

AIRLINE NEWS » FULL NEWS COVERAGE AT WWW.ATWONLINE.COM

NORTH AMERICA Transportation issued fines Airbus A321 flights from E170 service from May 28.

of $1 million to American Moscow Zhukovsky to Paris

American Airlines is targeting Airlines and $750,000 to Charles de Gaulle from April Belavia Belarusian Airlines

$1.3 billion in “profitability ini- Delta Air Lines for extended 23. It will start 2X-weekly will launch 4X-weekly Minsk-

tiatives” in 2019, with $1 billion tarmac delay incidents at air- Zhukovsky-Nice A320 service Tallinn Embraer E175 service

coming via revenue-generation ports across the US over the from May 4. The carrier also from May 30.

strategies. One initiative last several years. plans to launch 3X-weekly

includes adding 100 depar- Moscow Domodedovo- Azur Air received its second

tures at home hub Dallas Fort United Airlines named Robert Bordeaux A320 service Boeing 777-300ER and will

Worth International Airport Rivkin as SVP and general from June 1 and Moscow operate to Dubai (UAE),

with 15 new gates coming counsel. Domodedovo-Montpellier then to Varadero (Cuba) and

online midyear, giving it about A320 service from June 2. Cancun (Mexico).

910 daily flights. Ural Airlines will resume

MIDDLE EAST/AFRICA daily domestic Zhukovsky- Saudi Arabian Airlines

JetBlue Airways revised its Kaliningrad A321 service from (Saudia) CEO Jaan Albrecht

first-quarter RASM guidance Omani LCC SalamAir will open June 3-Oct. 26. told ATW the carrier is evalu-

downward, citing several areas a second operations center at ating a major widebody fleet

of weakness. The new guid- Salalah Airport, in the south- Aeroflot Airline will launch order within the next six

ance has year-over-year (YOY) west of the Arabian nation. daily Krasnodar-Simferopol months, such as either an

RASM declining 1.5%-3.5%. The airline, which began ser- and Volgograd-Sochi Boeing Airbus A350 or Boeing 787.

Previous guidance, issued vices in 2017, operates to 14 737-800 service from June 2.

in January, saw a 2% YOY destinations in the Middle East Utair Aviation is develop-

decline to a 1% bump. The and the Indian subcontinent S7 Airlines resumes 3X-weekly ing its domestic network

New York-based carrier con- with a fleet of three Airbus Moscow Domodedovo-Vienna from Khanty-Mansiysk when

tinues to make market-driven A320s and an A320neo, Airbus A320 service from it begins 3X-weekly Ufa,

changes to its network and with plans to add five more April 30. The carrier will also 2X-weekly Omsk and Kogalym

capacity plans. A320neos in the 2029 first launch 3X-weekly Novosibirsk- ATR 72 service in the summer

half. Astana (Kazakhstan) Embraer 2019.

Southwest Airlines received

FAA approval to conduct Turkish leisure car-

Hawaii services, linking rier Corendon Airlines will

San Francisco Oakland establish a base in May at

International Airport and Germany’s Cologne Bonn

Honolulu Daniel K. Inouye Airport, with Boeing 737 MAX

International Airport, with a 8s, operating 25X-weekly

single daily frequency. The

Dallas-based carrier will

flights to 11 destinations.

partner

of choice

steadily add flights on other Air Seychelles will end ser-

routes—including intrastate vice to Abu Dhabi May 11

runs—through midyear. and increase frequencies to

Mumbai, India, from 5X- to

North Carolina-based Eastern 6X-weekly beginning May 12; to streamline

Air Lines is seeking permis- and to Johannesburg, South

sion from the US Department Africa, from 6X-weekly to daily your supply chain.

of Transportation to operate beginning June 3.

twice-weekly roundtrip Boeing

767-300ER services from New

York to Jinan, China, with a RUSSIA

technical stop in Anchorage,

Alaska. The Irkutsk region

Development Corp. will

Alaska Air Group regional acquire 51% of IrAero Airline

carrier Horizon Air started and plans to invest in the

scheduled services from a carrier’s further growth. The

new passenger terminal at airline will be developed with

Paine Field Snohomish County Ramport Aero, which oper-

Airport (PAE) north of Seattle, ates Zhukovsky International

Washington state. Alaska Airport near Moscow.

Airlines plans to operate 18

daily departures from PAE to Pobeda Airlines plans to

Las Vegas, Phoenix, Portland, increase traffic by 40% and

San Diego, Los Angeles, carry at least 10 million pas-

San Francisco, San Jose and sengers in 2019 as the Aeroflot

Orange County, California. The LCC subsidiary expands its

carrier acquired eight 76-seat aircraft fleet and network. ajw-group.com

Embraer E175s to serve PAE.

Yekaterinburg-based Ural

The US Department of Airlines will launch 3X-weekly

atwonline.com | April 2019 | ATW 9

p7-10 Newsbriefs.indd 9 3/15/19 3:03 PM

NEWSBRIEFS

AIRLINE NEWS » FULL NEWS COVERAGE AT WWW.ATWONLINE.COM

ASIA-PACIFIC Air Show in July 2018. The options) for British Airways. fleet with second-hand aircraft

first MAX 8 is expected to be If all options are exercised, the and refurbishing the cabins of

Japan Airlines named its new delivered in the fourth quarter deal is valued at $18.6 billion the new arrivals at a cost of

medium- to long-haul LCC of 2019. at list prices. €10 million ($14.1 million) per

Zipair and revealed plans to aircraft.

begin service on two routes, Cathay Pacific Airways con- Central and Eastern European

from Tokyo Narita to Bangkok firmed it was in active negotia- LCC Wizz Air took delivery Scandinavian Airlines (SAS)

and Seoul in summer 2020. tions to potentially purchase of the first of 184 Airbus will begin testing smaller-

Zipair will initially use two a stake in LCC Hong Kong A321neos it has on order. The scale, long-haul flights start-

Boeing 787-8s. Express, which is controlled by aircraft is powered by Pratt ing in summer 2020 with

HNA Group. & Whitney GTF engines and three Airbus A321LRs, which

Thai AirAsia owner Asia has a 239-seat, single-class are expected to produce

Aviation dropped negotiations Vietnam-based startup layout. 15%-18% lower emissions.

to acquire shares in Thai LCC Bamboo Airways finalized The aircraft will offer a three-

Nok Air and said it would not the purchase of 10 Boeing Eurowings is moving a large class cabin product of busi-

proceed further. 787-9s. The privately owned part of its long-haul opera- ness, premium economy and

airline plans to operate on tions to Frankfurt and Munich, economy.

The South Korean government medium-haul destinations in the group’s main hub, as part

granted approval for three new Japan, South Korea, Singapore of a wider strategy to rethink EasyJet appointed Neil Slaven

LCCs—Cheongju-based Aero and Australia before launching of how to tackle the leisure as UK country director to drive

K, Seoul-based Air Premia and long-haul operations to Europe travel market. As part of the the LCC’s UK strategy. The

Yangyang-based Fly Gangwon. and North America. move, the Lufthansa Group UK carrier is also converting

LCC will base four Airbus 3,000 flight attendant licenses

India’s Jet Airways was forced Air Vanuatu ordered two A330-200s in Frankfurt and and aircraft spare parts into

to ground a total of 25 aircraft Airbus A220-100s and two three in Munich. Eurowings its Austrian air operator’s cer-

because of lease payment -300s, becoming the first has also initiated union talks tificate.

defaults, as negotiations con- carrier in the Pacific region to about merging its various air

tinue over a bailout plan and order the type. First delivery is operator’s certificates to gain Swedish regional carrier

an ownership reshuffle for the scheduled for June 2020. efficiencies after a period of Braathens Regional Airlines

Mumbai-based carrier. strong growth. will automatically include

China Eastern Airlines “climate compensation” for all

Thailand’s startup airline appointed former VP Li Swiss International Air Lines carbon dioxide (CO2) emis-

Kom Airlines firmed an order Yangmin as president of the (SWISS) completed the first of sions from flights in its ticket

for six SSJ100 regional jets state-owned Shanghai-based five nose-to-tail Airbus A340- prices, from April 1.

from Sukhoi Civil Aircraft Co. carrier. 300 cabin refurbishments. The

All six aircraft, in a single- renovated A340s will have Scottish regional airline

class 100-seat configuration, Vietnam Airlines will move 223 seats—eight in first class, Loganair added new services

will be delivered between its Moscow flights from 47 in business and 168 in linking three Scottish destina-

2019 and 2020, with the first Domodedovo to Sheremetyevo economy class—and should be tions with London Southend

arriving in the third quarter. International Airport completed by summer 2019. Airport. The Glasgow-based

Total list price value is $300 Terminal D from July 2. carrier will launch a 3X-daily

million. Brussels Airlines is upgrading weekday service from

the cabins and introducing a Aberdeen May 12, followed

Vietnam LCC Vietjet Air con- EUROPE premium economy class on its by the same frequency from

firmed an order for 20 Boeing newly acquired Airbus A330- Glasgow May 28. Services

737 MAX 8s and 80 737 MAX International Airlines Group 330s. The Lufthansa Group from Stornoway will connect

10s. The order was initially ordered up to 42 Boeing 777-9 subsidiary is replacing seven with the Glasgow service en

announced at the Farnborough aircraft (18 firm orders and 24 leased A330s in its long-haul route to London Southend. All

services will be operated by

49-seat Embraer E145s.

Lufthansa ordered 20 addi-

tional Airbus A350-900s and

has decided to return six of its

14 A380s in 2022 and 2023

as it invests in smaller wide-

bodies.

EasyJet CEO Johan Lundgren

is pressing ahead with plans to

partner directly with hotels to

boost ancillary revenue.

Dublin-based LCC Ryanair

plans to open 22 new French

routes early in winter 2019

for Stowage Bins because of strong demand, as

it pushes ahead with its plan

Passenger Convenience & Shorten Aircraft Turnaround Komy Co., Ltd www.komy.com to expand rapidly in France.

10 ATW | April 2019 | atwonline.com

p7-10 Newsbriefs.indd 10 3/15/19 3:04 PM

asm-global.com

Learn from the world’s leading route Consulting &

development consultants Representation

As the founder of Routes, ASM supports airports, airlines,

tourism authorities and governments in the development

of new routes through consultancy and training programs.

Our team’s experience extends across airlines, airports,

tourism and marketing, and our primary aim is to help Data &

Analytics

you achieve your individual and company air service

development objectives. Training

Join us for one of our North American training sessions hosted in 2019

and equip your team for success.

Data Analytics, Leakage Studies and Route

The Fundamentals of Air Service Development

Forecasting

This course will enable delegates to understand the

This course equips delegates with the practical tools most up-to-date techniques to generate both short and

and techniques to attract new routes and growth from long-term traffc forecasts, how to utilise appropriate

airlines. market data and understanding how successful your

target route can be.

Chicago Mexico City Chicago Mexico City

14-15 28-29 16-17 30-31

May May May May

Marketing to Airlines & Incentives

Gain insight into how to create distinctive marketing Washington DC Caribbean

communications and incentives for your airport or tourist

organisation, ensuring a true competitive advantage in attracting 30-31 3-5

airlines. July December

*Details Coming Soon

To fnd out more, visit aviationweek.com/asmtraining

or contact melissa.crum@aviationweek.com

ATW_PM_04.indd 11 3/15/2019 8:03:00 AM

ANALYSIS

Supersonic Can a supersonic airliner be

Reimagined environmentally acceptable?

BY GRAHAM WARWICK

AIREON AS2 supersonic

aircraft concept

AERION

F

ifty years after the frst fight of the Anglo- Boeing Global Services.

French Concorde, supersonic air travel Boeing has long worked with NASA on supersonic

could be poised to make a comeback. But transport technology, most recently on low-sonic-

environmental groups are questioning boom designs, but has shown no inclination in the

whether a return to high-speed fight is appropriate past few decades to develop its own aircraft. Now

with commercial aviation coming under increasing it has aligned the Aerion investment under its NeXt

pressure to reduce its emissions. business unit, formed to pursue future urban, regional

Boeing’s announcement in February of a and global mobility initiatives, from air taxis to

“signifcant investment” in Aerion vaulted the hypersonic airliners. And Aerion may be starting with

supersonic business-jet developer from struggling a supersonic business jet, but it wants to apply its

startup to serious contender. Of the companies hoping technology to larger aircraft over time.

to feld a new-generation supersonic transport by the “We are focused on disrupting every segment of

mid-2020s, Aerion now looks most likely to be frst. aviation with effcient supersonic aircraft,” Aerion

On the heels of news that it will provide CEO Tom Vice says. “We at Aerion, and at Boeing,

engineering and manufacturing support for Aerion’s have continued to study the market, economics

AS2, Spirit AeroSystems, Boeing’s biggest supplier, and technology required for commercial airliners.

announced it would design the pressurized fuselage I believe it is just going to take time to create a

for the Mach 1.6 business jet. Aerion already has sustainable commercial supersonic airline market.”

GE Aviation onboard, developing the engine, and

Honeywell, providing the avionics. More supplier NOISE RULES

announcements are expected shortly. Supersonic aircraft need more thrust, with implications

Boeing’s investment was a surprise, and its value for fuel burn, noise and emissions. Aerion’s technology

not disclosed, but its scale can be inferred from the is focused on producing an aircraft that can meet the

fact that two people on Aerion’s new fve-member same Stage 5 landing and takeoff noise limits as newly

board are senior Boeing executives. And who they certifed subsonic airliners, while fying as effciently

are is revealing: Mike Sinnett, VP-product strategy and cleanly as possible at both supersonic and subsonic

and future airplane programs at Boeing Commercial speeds. Unlike Denver-based startup Boom Supersonic,

Airplanes, and Ken Shaw, VP-supply chain at Aerion is not pushing for special supersonic noise rules.

12 ATW | April 2019 | atwonline.com QQ

To comment on this article, contact the editor at karen.walker@informa.com

ATWApril2019 ANALYSIS.indd 12 3/13/19 12:38 PM

“We have to meet today’s strict regulatory and QUOTABLES

certification requirements while we also build

sustainable supersonic flight that not only the

regulatory agencies can accept, but the public will

“We’re flying bigger planes,

embrace,” Vice explains. “And Aerion airliners—

Aerion Boeing airliners—will have to be as

but into more congested skies

environmentally responsible as our business jet.” here in the US. So we’re building

The AS2 is not a low-boom design, and bigger tubes and bigger airports,

Aerion’s business case—like that of Boom for its but not new runways and not

55-seat Mach 2.2 Overture airliner—is based on new places to go.”

flying supersonically over water, but subsonically

Delta Air Lines CEO Ed Bastian

over land. But if, as hoped, rules are amended

eventually to permit flight above Mach 1 over

land, Aerion plans to exploit a phenomenon called ”Our industry has built incredible

Mach cutoff to fly at Mach 1.2 without producing Ferraris, but the [US] ATC system

a discernable boom on the ground—a capability it makes them operate on gravel

calls boomless cruise. roads.”

“We do not advocate the lifting of the restriction United Airlines CEO Oscar Munoz

on overland supersonic flight without there first

being an acceptable technical and operational

approach that attenuates the noise generated by the

“I don’t begrudge competition;

sonic boom,” Vice says. “We actively oppose any that’s part of the miracle of

company that takes an irresponsible approach to aviation in the US.”

the elimination of Mach 1 overflight restrictions.” Alaska Air Group chairman and CEO Brad Tilden

Vice believes there are only two valid

approaches that will lead to supersonic flight “Qatar Airways is not a

over land: low boom and no boom. “I think it

will take decades for [low-boom] technology to

Mickey Mouse airline.”

find its way into production aircraft,” he says. “I Qatar Airways CEO Akbar Al Baker

believe boomless cruise will be the first operational

capability that will reliably achieve supersonic “China is … er … we fly there.”

flight over the US that the regulator will accept and American Airlines chairman and CEO Doug Parker, on

the public will embrace.” the US-China market. American canceled its loss-making

Europe already is lining up against the US to Chicago-Beijing services, saying there was too much capacity

oppose any relaxing of noise rules to enable a in the market.

renaissance of supersonic flights, and there are

no such aircraft programs active on the continent. “Many people have this mistaken

Environmental groups also are painting dire notion that if you reduce cost or

pictures of the noise and emission impacts— burdens, you are reducing safety

assessments Boom disputes.

Ensuring supersonic transports return to stay

or consumer protections. We reject

will require more than just high speed. The AS2 that notion.”

US Department of Transportation deputy secretary Jeffrey Rosen

“provides the first environmentally responsible

platform that can begin a long, sustainable

design cycle that will allow us to grow in speed “I don’t want Albert Einstein

responsibly,” Vice says. to be my pilot.”

Boeing’s backing suggests the commercial US President Donald Trump

aircraft giant believes Aerion is on the right

track to a sustainable return of supersonic air

travel.

atwonline.com | April 2019 | ATW 13

ATWApril2019 ANALYSIS.indd 13 3/13/19 12:39 PM

FOR BETTER

OR WORSE

Air France-KLM Group adapts under a new CEO and

with a new government stakeholder. BY KAREN WALKER

AIR FRANCE KLM BOEING

Airbus A320 787-9

ROB FINLAYSON

KLM

A

lmost all marriages go through rough patch- try said it wanted “a position which is similar to the posi-

es. The nearly 19-year-old Air France-KLM tion of the French state . . . to be able to exercise direct in-

Group partnership has probably endured fuence over future developments at the Air France-KLM

one of its rockier periods this past year as holding company to ensure that Dutch public interests

strikes, competition and management changes impacted are optimally assured. . . . It has become apparent that

earnings and led to boardroom and political friction. Like signifcant decisions about the strategy of KLM have in-

any long-lasting marriage, however, the group’s partners creasingly been taken at the level of the Air France-KLM

seem to recognize they are better off together than apart. holding company.”

Formed in 2004, the Air France-KLM alliance Te move rufed feathers, especially as it followed a

came under scrutiny in February when it emerged that letter from Dutch fnance minister Wopke Hoekstra,

the Dutch government had acquired a 14% stake in who wrote two weeks earlier to the KLM Royal Dutch

the group, nearly matching the French state’s 14.3% Airlines board expressing support for KLM CEO Pieter

stake. Until then, the Dutch government had a 5.9% Elbers when it was rumored he could be forced out.

stake in KLM only. Other key group shareholders in- Air France-KLM CEO Ben Smith, who took the helm

clude Delta Air Lines and China Eastern Airlines, which of the company in August 2018, subsequently renewed

each have a 10% stake. Elbers’ contract and made him joint group CEO along-

Explaining the move, the Netherlands Finance Minis- side Air France CEO Anne Rigail.

14 ATW | April 2019 | atwonline.com

ATW_APRIL 14-18 COVER STORY.indd 14 3/15/19 2:53 PM

Tat seemed to calm the situation and dispel concerns

of a rift between Elbers and Smith, a former Air Canada

senior executive who is the frst non-French national to

head the group.

But some analysts were not convinced, and they have

questioned whether long-simmering tensions between

Air France and its smaller, but more proftable, sister

carrier reached a fashpoint. KLM’s €1.07 billion ($1.22

billion) full-year 2018 operating proft overshadowed the

€266 million operating proft posted by Air France. Te

group’s overall full-year operating proft, meanwhile, de-

clined by almost €600 million to €1.3 billion in 2018,

AIR FRANCE-KLM

mostly because of industrial action by Air France workers

in early 2018 that led to the resignation of Smith’s prede-

cessor, Jean-Marc Janaillac, in May. AIR FRANCE-KLM CEO Ben

Bernstein analyst Daniel Roeska reiterated in a re- Smith (above) and KLM CEO

Pieter Elbers

KLM

search note that reducing tensions and making the power

balance between the two airlines more even were “key

prerequisites” to moving Air France-KLM forward. He Restructuring

added, however, that the impact of the increased Dutch Air France-KLM is being restructured under Smith, and

stake was unknown. he has made considerable progress in his frst months,

“With the Dutch government now joining the fray on most notably securing new labor deals with all of Air

an ownership level, and likely securing more infuence in France’s employee groups—a feat that eluded his prede-

the group board, we wonder whether this will be benef- cessors. Industrial action cost the company some €300

cial or detrimental to reconciling the diferences between million last year.

Paris and Amsterdam,” Roeska said. Smith has also made changes to the group’s gover-

Other industry observers feel the corporate and po- nance structure, streamlining it and creating a CEO

litical frictions have yet to be resolved, noting that El- committee of himself, Elbers, Rigail and group CFO

bers and Smith did not shake hands at a February press Frederic Gagey.

conference, and that Dutch fnance and transportation Other key early moves have included the shutting

secretaries were summoned to Paris to “explain” the down of the short-lived hybrid French airline Joon,

group stake. which is being reintegrated into the mainline carrier,

“Te [Dutch] government is now demanding an extra and the rebranding of regional carrier HOP! as Air

Dutch nonexecutive ofcer seat in the group’s board, but France Hop.

that will probably meet with strong resistance on the part Smith’s next mission is to simplify the group’s feet

of the French,” an industry source told ATW. “Te Dutch and network, and to more closely integrate the two

government bought its shares out of the free foat, and main airlines. But some believe that job could be made

rumor has it that nearly half of that was taken over from more difcult by the recent politics.

a large investor who wanted to sell its share of about 6% “We worry that national, diverging interests will

for a premium. slow the group down in its much-needed restructuring,”

“Rumors were that the French government was going Roeska said, noting that it could make Smith’s job “sig-

to reduce its stake and the Dutch government could buy nifcantly more challenging than it was to begin with.”

an amount from the French, but that did not happen. In Full-year 2018 trafc fgures released by the group

the aftermath of the recent ‘turbulence’ around the re- show a continued disconnect between the carriers’ in-

appointment of Elbers, the Dutch government decided it dividual performances, with the smaller Dutch unit

wanted more infuence at the group level and so bought a experiencing the strongest growth while Air France’s

total of 14% group shares, although still with only about fgures, as with its fnancials, were negatively afected by

10% of voting rights.” the strikes. KLM saw a 4.5% increase in passenger num-

atwonline.com | April 2019 | ATW 15

ATW_APRIL 14-18 COVER STORY.indd 15 3/15/19 2:55 PM

Group and airline 2018 full-year results

Operating

Revenues Operating Net debt

Capacity Change result Change Change Change

(€ m) margin (€ m)

(€ m)

+2.5% 16,073 +1.2% 266 -69.2% 1.7% -3.8 pt 3,556 -36

+2.3% 10,955 +5.0% 1,073 -0.5% 9.8% -0.5 pt 2,826 -454

+2.4% 26,515 +2.5% 1,332 -30.7% 5.0% -2.4 pt 6,164 -195

2017 restated for implementation of the new IFRS accounting standards

SOURCE: AIR FRANCE-KLM GROUP

bers, to 34.2 million, compared to the 0.4% rise at Air Lufthansa Group and International Airlines Group

France and HOP! to 51.4 million. Te group said anti- (IAG) in the face of a tough operating environment for

government protest movements in France at the end of network carriers? Tat’s an especially tough call when

last year also had a negative impact on revenue of about Air France-KLM—essentially because of Air France—

€15 million. KLM’s full-year trafc, measured in RPKs, is behind Lufthansa and IAG on restructuring, cost cut-

rose 4% against a 3.2% increase in capacity, resulting in ting and LCC competitiveness.

a 0.7-point increase in load factor to 89.1%. Conversely,

Air France and HOP!’s trafc in 2018 increased 1.9% Minister working group

on 1.4% capacity growth, leading to a 0.5-point load One potentially positive sign that the new Dutch stake

factor rise to 86.2%. might ultimately prove to be a help, not a hindrance,

A strong performer in 2018 was the group’s Transa- that supports the group’s strategic plan came in early

via carrier, which saw trafc increase by 10.1% on an March when French and Dutch government ofcials an-

8.4% growth in capacity, causing load factors to rise 1.4 nounced that they would work together to strengthen

points to 92%. cooperation on the future strategy of the group, aiming

Combined, trafc across Air France, KLM, HOP! and to announce joint recommendations by the end of June.

Transavia grew 3.5% on 2.7% more capacity, resulting French economy and fnance minister Bruno Le

in a 0.7-point load factor increase to 87.9%. Te group as Maire and the Netherlands’ Hoekstra said they shared

a whole recorded a 2.8% increase in full-year passenger the priority of strengthening the airline group and im-

numbers, exceeding 100 million for the frst time. proving its competitiveness. Tey also expressed sup-

Financially, the group reported a 2018 net proft port for Smith, and said they stood behind “all the deci-

of €409 million, more than double 2017’s €163 mil- sions taken by the board of directors” to modernize the

lion, on a 2.5% year-over-year increase in revenue to group’s governance.

€26.5 billion. Le Maire and Hoekstra will establish a working group

So there have been plenty of pockets of good news headed by Martin Vial, director general of France’s state

and positive trends in the group’s 2018 numbers, de- participation agency, and Christiaan Rebergen, treasurer

spite the strikes and politics. And whatever their per- general of the Dutch Finance Ministry.

sonal compatibility, Smith and Elbers are each widely Te working group will focus on “strengthening the

regarded as among some of the industry’s most ca- cooperation between France and the Netherlands, with

pable leaders. the objectives of good governance of the Air France-

Te question is, how do Smith and his executive KLM Group, its continued development, its growth

team navigate the group through the politics and fnd and improved results of the group,” the ministers said.

ways to improve competitiveness relative to peers like “In the spirit of partnership,” they added, they will

16 ATW | April 2019 | atwonline.com

ATW_APRIL 14-18 COVER STORY.indd 16 3/15/19 2:55 PM

Behind the ‘Seens’

It's what you don't see that matters

We have a history of providing cabin electronics and management systems.

These systems can encompass many things – all contributing to a better

flight experience for passengers and crews. Our products aren’t seen,

but you’ll be glad they’re on board.

baesystems.com/intellicabin

ATW_PM_04.indd 17 3/15/2019 8:03:01 AM

“We wonder whether this will be benefcial or detrimental to reconciling

the differences between Paris and Amsterdam.”

Daniel Roeska, Bernstein analyst

examine a number of issues, including the stakes the competitiveness of France’s major airports over the

of both states in Air France-KLM and the group’s next 20 to 25 years.

capital structure, the composition of the board of di- Other parts of the strategy plan include operation-

rectors, the defense of interests at the Paris Charles al processes in the areas of feet and network strategy,

De Gaulle (CDG) and Amsterdam Schiphol (AMS) commercial and alliances strategy, human resources,

hubs, and the two countries’ “respective visions on purchasing, and digital and data management that will

the long-term strategy” being deployed by the airline be simplifed.

group’s management.

“Te fnal outcome must be a fair and balanced one Fleet and cabins

for all sides. We are frmly committed to reaching a On the long-haul feet front, the group will take deliv-

conclusion on that fnal outcome before the end of ery of three Airbus A350-900s and six Boeing 787-9s

June 2019,” the ministers said. during 2019. Air France will retire its last Airbus A340

Smith, meanwhile, is not putting any part of what in 2020, and KLM will retire its last Boeing 747 the

the company describes as its “go forward strategy” on following year. In a bid to “improve operational ro-

ice while the government shareholders work out how bustness,” Air France will add “additional reserve air-

to work together. craft,” Smith said.

Smith’s strategy plan received unanimous approval Air France will also accelerate its cabin retroft pro-

when presented to the group’s board of directors ear- gram to ensure that its premium product mirrors that

ly this year. It was this plan that established the new of KLM by ofering fully fat seats to all business-class

CEO committee, and which aims to increase collabora- passengers “as soon as possible.”

tion across all of Air France-KLM’s business units to Internationally, the European Commission in Feb-

improve overall group proftability. In other words, the ruary approved a transatlantic joint venture agreement

plan—and proft growth—hinges on the group becom- among Air France-KLM, Delta Air Lines and Virgin

ing more closely aligned. At the same time, Smith wants Atlantic that will see the group acquire a 31% stake in

to leverage the brands of Air France, KLM and Transa- Virgin Atlantic.

via in their respective markets. Tis means Air France- Te three have already begun a codeshare partner-

KLM “can now rely on two strong brands,” supported ship, marking a step toward closer cooperation targeted

on the regional side by Air France Hop and KLM City- under their expanded joint venture with Delta, a fellow

hopper, and on the LCC side by Transavia, Smith said. SkyTeam global alliance member.

Smith also wants to reinforce the group’s position at Te new codeshare deal ofers Virgin Atlantic cus-

its CDG and AMS hubs. tomers up to 58 new routes from 18 UK airports across

With Paris, Smith has asked the French Senate for the Atlantic via Paris and Amsterdam, while Air France

improvements at CDG and Orly airports, hoping the and KLM customers will have access to 24 new Vir-

ongoing privatization process will be an opportunity. gin Atlantic or Delta-operated North American routes

Wait times frustrate Air France customers at Paris air- departing the UK, including connections via London

ports, Smith said, as do 30- to 40-min. walking times to Heathrow or Manchester.

catch connecting fights. Gagey described the group’s full-year results as “re-

“We do not have those problems at [Amsterdam] silient,” but added that “many of our problems are now

Schiphol,” Smith pointed out. “It may be the most ef- behind us.” Elbers noted he looked to 2019 “with con-

fcient airport in Europe. Tere is no problem at im- fdence” and Smith stressed the “real progress” that has

migration or security checks; everything is much more taken place over the last fve months. He also looked to

streamlined.” the future, stating that the group’s goal was “to position

An alignment between Air France, civil authorities ourselves as the leading airline in Europe.”

and the main airport has yet to be found, Smith said, If beating the competition, not each other, is the

but privatizing Groupe Aeroports de Paris would put goal, the Air France-KLM partnership may be renewing

Air France on an equal footing with its competitors. its vows by year end.

Smith also said the planned construction of a new

terminal at CDG, with an anticipated capacity of 30 Helen Massy-Beresford and Kerry Reals contributed to this

million to 40 million passengers annually, was key to article.

18 ATW | April 2019 | atwonline.com

ATW_APRIL 14-18 COVER STORY.indd 18 3/15/19 3:57 PM

TWO UNRIVALED FAMILIES

ONE WIDEBODY LEADER

The 777X is generations ahead of its class in both efficiency and passenger experience. The same is true of the

787 Dreamliner. Combine these two twin-aisle families—the opportunity for greater network versatility is undeniable.

That’s what you can expect from Boeing, the widebody leader.

boeing.com/widebody

ATW_PM_04.indd 19 3/15/2019 8:03:03 AM

ACADEMY

GROWTH

Pilot training facilities are ramping up

worldwide. BY ROBERT MOORMAN

CAE

CAE AIRBUS A350 full

flight simulator

T

he numbers tell the story. CAE projects a ing Flight Services has three pro forma fight training

total requirement for 255,000 new airline campuses located in Singapore, near London Gatwick

pilots over the next decade, while Airbus Airport and in Miami.

forecasts 94,000 new pilots will be needed Airbus is opening the Airbus Flight Academy Eu-

in Europe alone. Boeing sees a need for more than rope in Angoulême, France, which will add ab initio

30,000 new pilots each year over the next 15 years. instruction to its portfolio of training services. Plans

Aircraft manufacturers are directly supporting the call for the academy to train up to 200 pilot cadets an-

multiple eforts to recruit and train those pilots. Boe- nually, using a feet of single- and multi-engine aircraft

20 ATW | April 2019 | atwonline.com

ATW_APRIL 20-22 simulation & training.indd 20 3/14/19 2:10 PM

“Airlines are getting involved much earlier in the pilot creation process.”

Nick Leontidis, CAE

equipped with full digital cockpit technology. Te facil- easyJet. Under the agreement, all easyJet pilots will train

ity also will house full fight simulators (FFS) and fight at CAE’s training centers at Gatwick, Manchester and

training devices (FTDs). Milan. Tese centers will begin training in the second

But it is among the specialized training and simula- half of 2019 and will house nine Airbus A320-family

tor providers where the ramping up of pilot programs FFSs and three FTDs.

and facilities are really seen.

“Airlines are getting involved much earlier in the pi- Ab initio

lot creation process,” CAE group president-civil avia- L3 Commercial Training Solutions (L3 CTS) expects to

tion training solutions Nick Leontidis said. “Tey are train about 1,700 pilots in 2019. In some instances, ab

looking for training to their unique professional stan- initio training comes with a provisional job ofer from

dards from day one. Airlines

are not just looking for frst of-

fcers to fll the right seat. Tey’re

looking for candidates with the

potential to become captains

within the organization.”

Flight training academies are

producing an increasing propor-

tion of the pilots fying in today’s

commercial airlines, Leontidis

said. More objective assessments

for ab initio training are being

enabled.

“Te industry is moving to-

ward the inclusion of the unique

operators’ cultural reality as se-

lection criteria,” he said.

CAE works with over 300

L3 COMMERCIAL TRAINING SOLUTIONS

airlines and trains more than

135,000 pilots annually. To meet

growing demand, the Canadian

company has launched more

than 10 pilot creation programs

worldwide over the last two

years. Tey include an 18-month L3 CTS

program launched with Aeromexico in May; an AirA- one of L3 CTS’ partner airlines; hiring is contingent on Boeing

787-9

sia multi-crew pilot license cadet training program that the cadet passing all ground and fight school courses. full flight

started in August; an 18-month American Airlines pro- “We’re seeing diferent rates of growth globally, but simulator

gram launched in April; and a CityJet mentored cadet the underlining rate for us is about 6.5% per year,” L3

training program launched in June 2016. In February, CTS president Robin Glover-Faure said. “Pilot demand

CAE acquired Avianca’s share of their training joint remains very high and is fueled by the growth of new

venture, which includes Avianca’s training assets, as part commercial aircraft coming into the global feet, which

of a 15-year training outsourcing agreement. in turn is fueled by the underlying GDP growth that is

In November 2018, CAE signed a C$170 million occurring globally.”

($127 million), 10-year training contract with LCC A challenge for trainers, Glover-Faure said, is the

atwonline.com | April 2019 | ATW 21

ATW_APRIL 20-22 simulation & training.indd 21 3/14/19 2:10 PM

Dual growing trend of first officers transitioning to captain in

Benefits less time—five or six years—to keep up with demand.

UK-based L3 CTS has training centers in Bangkok,

Tailand, Southampton, and the soon to be fully op-

Regional airlines work together erational London Training Center near Gatwick. L3

to grow pilot base. BY BILL CAREY also has airline academy sites, which focus on ab initio

training, in Sanford, Florida; Hamilton, New Zealand;

US REGIONAL AIRLINE Cape Air and express cargo carrier Ponte de Sor, Portugal; and at three sites in the UK.

Mountain Air Cargo have announced a pilot “pathway” program TRU Simulation and Training supplies 737 MAX

that allows pilots to transition between the two airlines to gain and 777 flight training suites to Boeing and A320 FFSs

flight hours and experience. to Airbus.

Under the new program, Cape Air twin-engine piston pilots can “We will continue to invest heavily to enhance our

transition into Mountain Air ATR 42/72 twin-engine turboprops to products and customer support services, all the while

gain pilot in command (PIC) turbine time. Mountain Air Cargo pilots collaborating with our growing customer base,” TRU

who fly Cessna C208B Caravan single-engine turboprops can gain air transport division VP and general manager George

PIC multi-engine flight time as captains at Cape Air. Karam said. Te US-based company has developed evi-

After fulfilling their commitments as captains, Cape Air pilots dence- and competency-based training courses as well

will be hired and paid as ATR captains but will serve as second in as environment-specific simulation courses for weather

command on the ATR until gaining 200 hours of flight time prior to and air traffic control.

acting as PIC. Caravan captains or ATR first officers at Mountain “As airlines continue to struggle with a global pilot

Air Cargo can transition to Cape Air as captains. shortage, less expensive, lower-level devices that are

A scheduled and Part 135 carrier based at Barnstable Municipal fully compliant with new international standards will

Airport, Massachusetts, Cape Air operates a fleet of Cessna 402C likely become part of the solution for a subset of cus-

and Britten-Norman Islander BN2 twin-engine piston aircraft. tomers,” Karam said.

In September 2017, it announced an order for 100 new Tecnam

P2012 Traveller 11-seat piston twins, the first 20 of which are due Diversity

to arrive this year. Training companies are also casting a wider net in

Cape Air and JetBlue Airways started a university “gateway” where they look for potential pilot recruits. L3 CTS

pilot training effort in 2007 that is considered a model pathway launched its Pilot Pathways program to attract a more

program. In September, it announced the Cape Air-Spirit Jetway diverse group of prospective airline pilots from vari-

Program to train pilots for careers at Florida-based ultra-LCC ous markets. Te program includes a new female pilot

Spirit Airlines. scholarship program, and the first three recipients will

“We have worked hard internally, and with our partners, to devel- be announced this year.

op these various pathways to suit the growing and ever-changing “Tis is not just the right thing to do; we won’t get

needs of the industry,” Cape Air president Linda Markham said. “It the number of quality pilots needed unless we reach

is our goal to identify, train and nurture our employees throughout out to a more diverse group,” Glover-Faure said.

their careers in order to sustain a healthy pilot base and most Similarly, CAE has a Women in Flight scholarship

importantly, a safe operation.” program that it operates with Aeromexico, AirAsia,

Mountain Air Cargo, based in North Carolina, participates in the CityJet, easyJet and an unnamed carrier.

Purple Runway pathway program with cargo carrier FedEx Express. “As part of this first edition, CAE will provide fi-

The program provides a means for students with two or four-year nancial support to aspiring female pilots by awarding

college degrees to begin their pilot careers with Mountain Air Cargo five full scholarships to one of CAE’s selected airline-

and transition to FedEx. mentored cadet pilot training programs across our

“The industry needs more of these types of agreements to global training network,” Leontidis said. “With

ensure we can meet the needs of the marketplace and the needs of women currently representing less than 5% of pilots,

the pilots,” Mountain Air Cargo president Craig Bentley said. we want to take a proactive approach to promote a

better gender balance and tap into a wider pool of

talent.”

22 ATW | April 2019 | atwonline.com

ATW_APRIL 20-22 simulation & training.indd 22 3/14/19 2:10 PM

CRITICAL

CHOICES

Questions loom over aviation’s global carbon

emissions scheme. BY HENRY CANADAY

I

CAO in March made what it said was “another CORSIA in 2021,” ATAG executive director Michael

set of important decisions” toward implementa- Gill said. “It is important for the industry that strong

tion of the Carbon Offsetting and Reduction sustainability standards are applied for the types of eli-

Scheme for International Aviation (CORSIA). gible ofsets. Tis will ensure that CORSIA is an efec-

Te ICAO Council reached an agreement for put- tive climate measure, which has always been a key prior-

ting into operation the Technical Advisory Body (TAB), ity for the industry.”

a group of experts nominated by states with a mandate Airlines are keen to have clarifcation about which

to make recommendations to the council regarding eli- types of units they will be allowed to buy to ofset their

gible emissions units for use by airlines in CORSIA, the excess emissions as part of CORSIA.

scheme designed to address the increase in total CO2 Te ICAO announcements came just a few days after

emissions from international aviation above 2020 lev- European Union (EU) ofcials urged ICAO to agree

els, ICAO said. at its assembly in September on a “long-term goal” to

Te group added that it had also approved terms address the aviation industry’s rising CO2 emissions be-

of reference for the advisory body, including tasks and yond the shorter-term scope of CORSIA, an objective

working methods. that industry representatives, including ATAG, believe

Te council also approved the Emissions Units Cri- may be difcult to achieve. ATAG believes it could take

teria (EUC) that the advisory body will use to assess another three years for ICAO to negotiate such a deal.

which emissions unit programs are eligible under the

scheme. Decision time

ICAO said it would issue an open invitation on the CORSIA will start to bite in 2021 with CO2 ofset pay-

ICAO CORSIA website, through which emissions unit ments. At present, CORSIA is having modest impacts

programs that wish to be considered by TAB for eligi- on both airline trafc and CO2 emissions. But there

bility in CORSIA can apply. are big decisions to be made, on airline participation,

“Tese decisions related to TAB are critical to the on eligible ofset markets and on Europe’s reaction to

Council’s adoption of eligible units for CORSIA, rep- the program. Further, CORSIA’s efectiveness and costs

resenting another milestone in fulflling the requests will also depend on the wider adoption of CO2 pricing

made by the 2016 Assembly,” ICAO Council president around the world.

Olumuyiwa Benard Aliu said. ICAO’s goal is to hold international air travel’s net

Geneva-based Air Transport Action Group (ATAG), CO2 emissions fat from 2020 to 2040, after which

which represents the commercial aviation sector on sus- new aircraft technology might actually reduce emis-

tainable growth issues, welcomed what it described as sions. With trafc expected to grow between 3% and

“another signifcant milestone” in the development of 4% annually through 2040, and improvements in fuel

CORSIA. efciency and operations only partially trimming emis-

Te decision was “fundamental in providing cer- sions, stability requires another tool. So airlines will pay

tainty to carbon markets as they develop projects ready others to reduce CO2 on the ground, where emission

to be supported by airlines ahead of the pilot phase of reduction is easier than at 35,000 feet, or replace car-

atwonline.com | April 2019 | ATW 23

ATW_APRIL 23-28 carbon offsets.indd 23 3/14/19 3:10 PM

bon-based jet fuels with less carbon-intensive fuels. Net from 2001 through 2018—about 6% of the CO2 the

CO2 growth should be zero. world produces annually. Te Imperial College of Lon-

Tat is the basic idea of CORSIA. Participation is don surveyed frms that were voluntarily buying ofsets

voluntary until 2027 and supposed to be mandatory and found ofsets generated signifcant economic ben-

afterward, except for a few small underdeveloped or efts, but the college did not independently verify CO2

landlocked nations. By mid-January 2019, 78 countries reductions. US Stanford University researchers found

whose airlines represent 77% of international air travel that a California program of ofsets by reforestation was

had voluntarily committed to CORSIA from its outset. reducing CO2.

Others, including China, Russia, Brazil and India, are But a German environmental consultancy, Oeko

not yet on board. Since CORSIA applies only to routes Institut, found that most CO2 ofsets it reviewed were

between two participating states, the portion of interna- either overestimated or were payments for CO2 reduc-

tional trafc so far covered is substantially less than 77%. tions that would have occurred anyway and thus were

Each airline from a participating state pays for not additional benefts of the ofset program. Te Oeko

its share of the CO2 increase. For the frst decade, consultants reported that ofsets from renewable energy

CORSIA treats every airline as if it grew at the aver- projects such as wind, hydroelectric, waste heat recov-

age pace of all airlines. In the 2030s, payments become ery and fossil fuel switches were the least likely to re-

based more on each airline’s actual growth; fast-growers duce emissions.

pay more per average gallon of jet fuel. Rapidly expand- Te challenge of ensuring valid ofsets is well known

ing international LCCs will be at least slightly disad- to environmental advocates. Jialiang Zhang is a con-

vantaged against their more slowly growing legacy rivals sultant for Navigant, which has supported the World

and will see this disadvantage coming. Bank’s carbon pricing report for seven years. Jialang

How much will CORSIA cost? Like a trading checks of the criteria valid ofsets should meet: “Tey

scheme and unlike a carbon tax, CORSIA imposes pay- should be measurable, additional to what would other-

ments for only the increase in fuel use, not all fuel burn. wise occur, avoid double counting, and be permanent

ICAO estimates refect several assumptions on CO2 and independently verifed.”

volumes to be ofset and on ofset prices. At the outset, Similarly, replacing oil with alternative fuels can

expected prices range from about $7 to $22 per ton of be tricky. Some alternatives are already used in trivial

CO2, at 2018 price levels, rising to $13 to $40 per ton quantities by airlines. But objective experts must calcu-

by 2035. Airlines’ total payments would be $2 billion late the real avoidance of CO2 emissions, recognizing

to $7 billion in 2025, rising to $6 billion to $26 billion all production and transportation requirements over the

in 2035. entire lifecycle, before this avoidance should be credited

Tese are not trivial sums, but they work out to only against ofset obligations.

0.2% to 1.5% of revenue from international aviation. ICAO, therefore, must still decide on its criteria for

Since one barrel of oil yields nearly half a ton of CO2, eligible ofsets and how to turn these criteria into a list

CORSIA would cause the price of fuel to rise by $7 to of specifc projects airlines can secure as CORSIA cred-

$20 per barrel in 2035, but only on the increase in fuel its. Te tighter the criteria and the tougher their en-

burn. If airlines price fares by average costs, that would forcement, the more CORSIA will actually accomplish

cut cumulative growth in air trafc by a percent or two its goals. But that probably also means higher ofset

by the mid-2030s. If they price by marginal costs, the prices.

cut would be deeper.

But there are still plenty of questions about how ETS ft

CORSIA will work in practice. First, ICAO must still Next up is an EU decision on how its Emission Trading

decide on the CO2 ofsets and replacement fuels eligible System (ETS) will ft with CORSIA. North American

for purchase. airline lobbying organization Airlines for America (A4A)

wants US carriers to pay only for CORSIA ofsets, not

Offset challenges the ETS allowances currently costing $23 to $29 per ton

Carbon ofsets have a long and mixed history. Te Unit- of CO2, when fying to and between EU nations. IATA

ed Nation’s “Achievements of the Clean Development and Airlines for Europe (A4E) want the same exclusion

Mechanism” manifesto says that ofsets saved almost for all airlines fying between EU member states.

2 billion metric tons of CO2 in the developing world Te problem is CORSIA only seeks to fatten CO2

24 ATW | April 2019 | atwonline.com

ATW_APRIL 23-28 carbon offsets.indd 24 3/14/19 3:10 PM

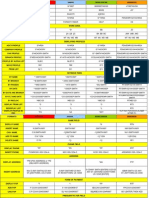

Summary map of regional, national and subnational carbon pricing

CARBON PRICING INITIATIVES initiatives implemented, scheduled for implementation and under

consideration (ETS and carbon tax).

NORTHWEST TERRITORIES SASKATCHEWAN

ALBERTA MANITOBA

ICELAND

CANADA ONTARIO

EU KAZAKHSTAN REPUBLIC

BRITISH QUéBEC NEWFOUND-

UKRAINE OF KOREA

COLUMBIA LAND AND

LABRADOR

WASHINGTON PRINCE

RGGI

OREGON EDWARD JAPAN

ISLAND

CALIFORNIA

VIRGINIA NOVA SCOTIA

NEW TURKEY CHINA

BRUNSWICK

MEXICO MASSACHUSETTS

THAILAND VIETNAM

COLOMBIA

CôTE D’IVOIRE

BRAZIL

RIO DE JANEIRO

SãO PAULO

NEW

CHILE SOUTH AFRICA AUSTRALIA ZEALAND

ARGENTINA

NORWAY SWEDEN

DENMARK FINLAND

BEIJING

UK TIANJIN SAITAMA

ESTONIA

TOKYO

IRELAND LATVIA

HUBEI

POLAND SHANGHAI

CHONGQING FUJIAN

GUANGDONG TAIWAN

PORTUGAL

SHENZHEN

CATALONIA SLOVENIA SINGAPORE

FRANCE LIECHTENSTEIN

SWITZERLAND