Professional Documents

Culture Documents

08 Turn Over Cert

08 Turn Over Cert

Uploaded by

Kannan GnanaprakasamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

08 Turn Over Cert

08 Turn Over Cert

Uploaded by

Kannan GnanaprakasamCopyright:

Available Formats

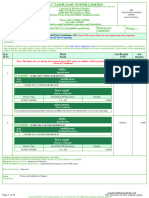

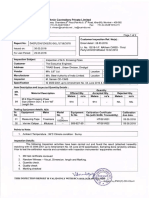

(In Sub-Contractor’s letter Head)

(Applicable for With- material contractor)

CERTIFICATE

This is to certify that we have declared the Turnover which included the value of goods

involved in the execution of works contract relating the work order No EB421WOD4000015

Dated 22-Dec-2014 for their project site at WSS to TNPL site awarded by M/s LARSEN &

TOUBRO LTD. The details are as under:-

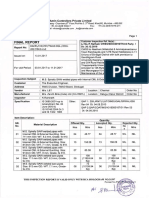

Remarks (Reason for

Asst year Gross Turnover Tax Due & Paid Exemption Claimed

if any)

2014-2015 7651371.01

2015-2016 2363434.35

10014805.36

We further state that we are registered under TNVAT/ CST Acts, on the file of the office of the

Bearing Ref As under

(a) TNVAT No:

(b) CST No:

We further submit that the turnover pertaining to the above said order have been included in

our monthly returns and have discharges the liabilities thereon. However our final Assessment

pending with the assessing Authority.

For……………………………...

Place:

Date:

(Authority Signatory)

Headquarters : Mount Poonamalle Road, Manapakkam. P.B No. 979, Chennai – 600 089. Tel.: 234 2747 / 232 6318

Fax – 044 – 234 2317 E-Mail : ltcg@lntecc.com Website : www.lntecc.com

Regd. Office : L&T House Ballard Estate, P.O. Box 278, Mumbai – 400 001 Tel.: 261 8181 / 82 Fax : +022-262 0223

Website: www.larsentoubro.com

D:\VIN\TURN OVER CERT\Gross Turn.doc

You might also like

- Metamorphoses Prop ListDocument4 pagesMetamorphoses Prop ListJenny BoyleNo ratings yet

- Applications Paper1 of "Changing Unethical Organizational Behavior" by NielsenDocument2 pagesApplications Paper1 of "Changing Unethical Organizational Behavior" by NielsenMingLi JiangNo ratings yet

- Post QualificationDocument2 pagesPost Qualificationqueeneil sagpang80% (5)

- 810 InvoiceDocument19 pages810 InvoiceAnanth BalakrishnanNo ratings yet

- ISRI Metal CodesDocument56 pagesISRI Metal CodesRusman Run100% (1)

- A Passage To India ThemesDocument4 pagesA Passage To India ThemesTalha Basheer100% (1)

- Letter For Advance Tax On SalaryDocument1 pageLetter For Advance Tax On SalarywaqarNo ratings yet

- Mar - Abc-Ff-007Document7 pagesMar - Abc-Ff-007riyazNo ratings yet

- 1ZVN926000-796 - RevA - SPT Revenue Record & Invoice IssuanceDocument7 pages1ZVN926000-796 - RevA - SPT Revenue Record & Invoice IssuanceNguyễn Thành TrungNo ratings yet

- APIIC-WEB Application - Test Scenario - Test Cases - 22 - 11 - Updated - 1124Document37 pagesAPIIC-WEB Application - Test Scenario - Test Cases - 22 - 11 - Updated - 1124kalyanA aNo ratings yet

- 3241 - Demand Letter PDFDocument2 pages3241 - Demand Letter PDFvarshaNo ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalKUKUPEY INVESTMENTSNo ratings yet

- Material SubmittalDocument4 pagesMaterial SubmittalriyazNo ratings yet

- Ir 1241Document1 pageIr 1241Kit ChuNo ratings yet

- Sample DesignDocument707 pagesSample DesignRAMAN RNo ratings yet

- Status Master Services Agreement - Aria Linea Jet - RocketRoute LTDDocument1 pageStatus Master Services Agreement - Aria Linea Jet - RocketRoute LTDTheodore RoeNo ratings yet

- Final Bill S#4Document2 pagesFinal Bill S#4SAURAV KUMARNo ratings yet

- New Connection Registration AcknowledgeDocument3 pagesNew Connection Registration AcknowledgeHT SectionNo ratings yet

- Deactivation Form - GlobeDocument2 pagesDeactivation Form - GlobeaizadgreatNo ratings yet

- CONTRACT COSTING - Chapter 6Document21 pagesCONTRACT COSTING - Chapter 6abhilekh91No ratings yet

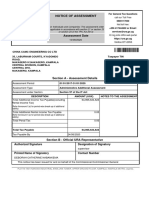

- Income Tax AssessmentDocument3 pagesIncome Tax Assessmentkailong wangNo ratings yet

- 26-d. Utility Expenses, TelephoneCommunication Services & Advertising Expenses-Jv EstrellaDocument80 pages26-d. Utility Expenses, TelephoneCommunication Services & Advertising Expenses-Jv Estrellajohn vincent estrellaNo ratings yet

- AUDT271+SU+12+ +questions+ +2018Document10 pagesAUDT271+SU+12+ +questions+ +2018ilona gabrielNo ratings yet

- 12th RAB During 26.04.2023 To 25.05.2023Document2 pages12th RAB During 26.04.2023 To 25.05.2023SAURAV KUMARNo ratings yet

- Acc G11 Ec Nov 2022 P2 MGDocument8 pagesAcc G11 Ec Nov 2022 P2 MGTshenoloNo ratings yet

- REP-148-AR TW A0501 Invoice VoidedDocument123 pagesREP-148-AR TW A0501 Invoice VoidedRipendra KumarNo ratings yet

- Kalaimani Associates RAB#1 - GrilDocument7 pagesKalaimani Associates RAB#1 - GrilNirmalraj ManoharanNo ratings yet

- Uat Merger ZGST Asset Transfer Buisness 1Document9 pagesUat Merger ZGST Asset Transfer Buisness 1Sandeep YemulNo ratings yet

- viewNitPdf 1239293Document5 pagesviewNitPdf 1239293muj_aliNo ratings yet

- Accounting P2 May-June 2022 MG EngDocument10 pagesAccounting P2 May-June 2022 MG Englindort00No ratings yet

- SS-N-17315-OL-0203-20 - Material Submittal For Pressure Transmitter (MS-I-001) - Rev. 02Document7 pagesSS-N-17315-OL-0203-20 - Material Submittal For Pressure Transmitter (MS-I-001) - Rev. 02Clark HonradoNo ratings yet

- Invitation To Tender - 2Document14 pagesInvitation To Tender - 2Ravindu RansaraNo ratings yet

- Application Complete - Taxing A Vehicle - GOV - UkDocument1 pageApplication Complete - Taxing A Vehicle - GOV - Ukmtnz76qy4qNo ratings yet

- Citizen Charter April 2023Document25 pagesCitizen Charter April 2023Parody CentralNo ratings yet

- Technical Submittal Nest - NewDocument265 pagesTechnical Submittal Nest - Newsenthilonline15No ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisPrakash ChandraNo ratings yet

- RESPONSE SHEET - SHELL NIGERIA EXPLORATION & PRODUCTION COMPANY - THE PROVISION OF WELL ENGINEERING SUPPORT SERVICES FOR SNEPCoDocument10 pagesRESPONSE SHEET - SHELL NIGERIA EXPLORATION & PRODUCTION COMPANY - THE PROVISION OF WELL ENGINEERING SUPPORT SERVICES FOR SNEPCoCHRISTOPHER WEALTHNo ratings yet

- Contractor Prequalification Summary CD 009B: REFERENCE NO.Document13 pagesContractor Prequalification Summary CD 009B: REFERENCE NO.Thomas JohnNo ratings yet

- Request For Quote 10405950Document44 pagesRequest For Quote 10405950david selekaNo ratings yet

- DS 0401 15747Document551 pagesDS 0401 15747Marbe CanumayNo ratings yet

- Rewind Phase 2 - High Level Scenarios - Updated - Nov 6thDocument59 pagesRewind Phase 2 - High Level Scenarios - Updated - Nov 6thDinesh Kumar SNo ratings yet

- CORP ENG PRC 006Rv1Document23 pagesCORP ENG PRC 006Rv1Mohammad SalehNo ratings yet

- DG Set Servicing ContractDocument8 pagesDG Set Servicing Contractnibeditapdhy21@gmail.conNo ratings yet

- Contractor'S Notice of Operation (NOO)Document1 pageContractor'S Notice of Operation (NOO)Oscar WaiharoNo ratings yet

- tender Enquiry No:Enq/Ntpl/21-22/110090/Candp01 (01) /date:28/06/2021 /page - 1Document32 pagestender Enquiry No:Enq/Ntpl/21-22/110090/Candp01 (01) /date:28/06/2021 /page - 1Sravan DasariNo ratings yet

- Electric Bill Backup PDFDocument1 pageElectric Bill Backup PDFfahmad_cmsNo ratings yet

- TO: MMS Co. Lebanon: Number of Pages: 5 (Included This Page)Document3 pagesTO: MMS Co. Lebanon: Number of Pages: 5 (Included This Page)Elias JarjouraNo ratings yet

- Blank CCDocument1 pageBlank CCCosmin AmzaNo ratings yet

- Tender Document Section LLDocument10 pagesTender Document Section LLMark KNo ratings yet

- Elko Organizarion (PVT) LTD (FX12 (E10) ITJ039599) SQ-19009Document4 pagesElko Organizarion (PVT) LTD (FX12 (E10) ITJ039599) SQ-19009Zain KhanNo ratings yet

- Group - C: DA 4104 - Computer Based AccountingDocument10 pagesGroup - C: DA 4104 - Computer Based AccountinghemacrcNo ratings yet

- Upmpl - BPD - Mm3e - Service Receipt - v1 0Document10 pagesUpmpl - BPD - Mm3e - Service Receipt - v1 0Sujith PNo ratings yet

- CRCI-M98-34-M204-DA: Dresser Al-Rushaid Valve & Instrument Co. LTDDocument6 pagesCRCI-M98-34-M204-DA: Dresser Al-Rushaid Valve & Instrument Co. LTDrajindo1No ratings yet

- AL HADAF InvoiceDocument4 pagesAL HADAF InvoiceSaqib SarwarNo ratings yet

- Cat IDocument5 pagesCat Imayur dhandeNo ratings yet

- Accounting Review 2Document2 pagesAccounting Review 2Scouty TheboyNo ratings yet

- 3394 - WFM - KA0060 - Thalathuoya Dialog - Neighbor Complained Generator Noise Too High & It Disturb To ThemDocument6 pages3394 - WFM - KA0060 - Thalathuoya Dialog - Neighbor Complained Generator Noise Too High & It Disturb To ThemCharithNo ratings yet

- Request For Quotation Local Purchase Section: RFQ NumberDocument3 pagesRequest For Quotation Local Purchase Section: RFQ NumberHazemNo ratings yet

- Job Notes-: Eo Cable RearrangementDocument4 pagesJob Notes-: Eo Cable RearrangementConstantin Emilian AvorniceseiNo ratings yet

- Procedure & Project Management Guidelines: Revision RecordDocument6 pagesProcedure & Project Management Guidelines: Revision RecordYit WanNo ratings yet

- Check ListDocument2 pagesCheck ListUbedur RahmanNo ratings yet

- Document Transmittal For Subcotractor Approval PlumbingDocument2 pagesDocument Transmittal For Subcotractor Approval PlumbingAhmed Salah El DinNo ratings yet

- 12 900000 1100014154 BSC Mec Itp 000001Document9 pages12 900000 1100014154 BSC Mec Itp 000001jiyob98635No ratings yet

- CMPC Check List PipelineDocument19 pagesCMPC Check List PipelineKannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000122 DT:21 May 2016Document2 pagesLarsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000122 DT:21 May 2016Kannan GnanaprakasamNo ratings yet

- Your Appointment For Health Check Has Been ConfirmedDocument2 pagesYour Appointment For Health Check Has Been ConfirmedKannan GnanaprakasamNo ratings yet

- ITP CommissioningDocument1 pageITP CommissioningKannan GnanaprakasamNo ratings yet

- Scope Reduction LetterDocument1 pageScope Reduction LetterKannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: Work Order - E8419WOD6000003 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Work Order - E8419WOD6000003 WOMKannan GnanaprakasamNo ratings yet

- Checklist To Be Enclosed Along With Final Bill: Sensitivity: LNT Construction Internal UseDocument3 pagesChecklist To Be Enclosed Along With Final Bill: Sensitivity: LNT Construction Internal UseKannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000122 WOMDocument1 pageLarsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000122 WOMKannan GnanaprakasamNo ratings yet

- 03 SC-Clearance CertificateDocument1 page03 SC-Clearance CertificateKannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Document4 pagesLarsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Kannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000070 DT:14 Apr 2016Document2 pagesLarsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000070 DT:14 Apr 2016Kannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000070 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - E8419FBL6000070 WOMKannan GnanaprakasamNo ratings yet

- NOC From ContractorDocument1 pageNOC From ContractorKannan GnanaprakasamNo ratings yet

- F08. Formwork Material Phy. Stock Reconciliation ReportDocument1 pageF08. Formwork Material Phy. Stock Reconciliation ReportKannan GnanaprakasamNo ratings yet

- 144-Hot CraneDocument5 pages144-Hot CraneKannan GnanaprakasamNo ratings yet

- 698 L&T CalsensDocument15 pages698 L&T CalsensKannan GnanaprakasamNo ratings yet

- XXX - TWAD - Dindigul-MS Pipes (Perumal)Document6 pagesXXX - TWAD - Dindigul-MS Pipes (Perumal)Kannan GnanaprakasamNo ratings yet

- 2670 - L&T - Steel TubesDocument7 pages2670 - L&T - Steel TubesKannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMKannan GnanaprakasamNo ratings yet

- 574 L&T R&D MultiplesDocument46 pages574 L&T R&D MultiplesKannan GnanaprakasamNo ratings yet

- 943 Rev2 - TWAD - Dindigul-MS Pipes With Lining & Guniting - (Ramnath)Document4 pages943 Rev2 - TWAD - Dindigul-MS Pipes With Lining & Guniting - (Ramnath)Kannan GnanaprakasamNo ratings yet

- RWOMBILAnnexure RAB 12Document2 pagesRWOMBILAnnexure RAB 12Kannan GnanaprakasamNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000642 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000642 WOMKannan GnanaprakasamNo ratings yet

- DAO 2011-14 Sinocalan-Dagupan River System WQMADocument6 pagesDAO 2011-14 Sinocalan-Dagupan River System WQMAEton CaguiteNo ratings yet

- The Peace Treaties After Ww1 - Gabriella KaundeDocument4 pagesThe Peace Treaties After Ww1 - Gabriella KaundeJoannaDuncan100% (2)

- STT Hãng Công Cụ Kết Nối: 1 Siemens Tool Siemens Rs232 To Usb (db9 To Usb + rs232 Đực To rs232 Cái)Document2 pagesSTT Hãng Công Cụ Kết Nối: 1 Siemens Tool Siemens Rs232 To Usb (db9 To Usb + rs232 Đực To rs232 Cái)TocXoanBkaNo ratings yet

- Eticket MCVAAG 202846Document3 pagesEticket MCVAAG 202846Abi DardaNo ratings yet

- Civil Procedure Case Digest (Silverio vs. FBCI and Perez vs. Manotok)Document3 pagesCivil Procedure Case Digest (Silverio vs. FBCI and Perez vs. Manotok)Maestro LazaroNo ratings yet

- In The High Court of Karnataka at BengaluruDocument5 pagesIn The High Court of Karnataka at BengaluruKONINIKA BHATTACHARJEE 1950350No ratings yet

- Information Technology Act 2000Document6 pagesInformation Technology Act 2000ganapathy2010svNo ratings yet

- Form 8Document4 pagesForm 8Anonymous QJGyScfne5No ratings yet

- NCCI Vertical and Horizontal Deflection Limits For Multi-Storey Buildings PDFDocument8 pagesNCCI Vertical and Horizontal Deflection Limits For Multi-Storey Buildings PDFHerdean RemusNo ratings yet

- VANET Security Research and Development EcosystemDocument11 pagesVANET Security Research and Development EcosystemDr.Irshad Ahmed SumraNo ratings yet

- Imagine An Innocent Child Thrown Into A Pitiful For Transgressing The LawDocument4 pagesImagine An Innocent Child Thrown Into A Pitiful For Transgressing The LawPhaura ReinzNo ratings yet

- Vak Sept. 18 PDFDocument28 pagesVak Sept. 18 PDFMuralidharan0% (1)

- Agusan Del Norte Field Office: List of Vacant PositionsDocument37 pagesAgusan Del Norte Field Office: List of Vacant PositionsCscfoAgusanDelNorte100% (1)

- Opposition-CommentDocument3 pagesOpposition-CommentGracelle Mae OrallerNo ratings yet

- Bank Ganesha TBKDocument3 pagesBank Ganesha TBKTam sneakersNo ratings yet

- 1987 Philippine Constitution - Art I and IIDocument36 pages1987 Philippine Constitution - Art I and IIlex libertadore100% (4)

- Apc Ups 3000 ManualDocument17 pagesApc Ups 3000 Manualjltb100% (1)

- Rizal Commercial Banking Corporation vs. Hi-Tri Development CorporationDocument20 pagesRizal Commercial Banking Corporation vs. Hi-Tri Development CorporationDianne May CruzNo ratings yet

- Heirs of Sandueta v. RoblesDocument3 pagesHeirs of Sandueta v. RoblesPaul Joshua SubaNo ratings yet

- Mike Hubbard Motion For New TrialDocument39 pagesMike Hubbard Motion For New TrialMike CasonNo ratings yet

- Ambedkar and GandhiDocument2 pagesAmbedkar and GandhiPremAnanthanNo ratings yet

- Banglore To Kolkata TicketDocument2 pagesBanglore To Kolkata Ticketkoushikdey_2011No ratings yet

- Chapter14 SolutionsDocument46 pagesChapter14 Solutionsaboodyuae2000No ratings yet

- Pre-Intermediate 2Document153 pagesPre-Intermediate 2Alex Enrique Arenas OviedoNo ratings yet

- Narcotic Drugs and Psychotropic Substances Act GuyanaDocument103 pagesNarcotic Drugs and Psychotropic Substances Act GuyanaAlvaro Mario RamotarNo ratings yet

- Follow The Money'S Current "Banking Problems" Go Back To..Document8 pagesFollow The Money'S Current "Banking Problems" Go Back To..Cairo AnubissNo ratings yet