Professional Documents

Culture Documents

Profile: Family CMA

Uploaded by

grmani1981Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profile: Family CMA

Uploaded by

grmani1981Copyright:

Available Formats

PROFILE

ADMISSION:

ON-LINE : 24 X 7 X 365 & SYLLABUS 2016

OFF-LINE : AT REGIONAL

COUNCILS/ CHAPTERS FOUNDATION COURSE THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

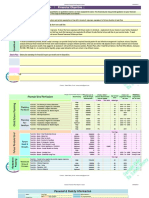

P1 - Fundamentals of Economics & Management (FEM)

CMA - way ahead... P2 - Fundamentals of Accounting (FOA) (Statutory body under an Act of Parliament)

P3 - Fundamentals of Laws and Ethics (FLE)

P4 - Fundamentals of Business Mathematics and Statistics www.icmai.in

FOUNDATION INTERMEDIATE FINAL

(FBMS) BEHIND EVERY

OR

INTERMEDIATE COURSE SUCCESSFUL

INTERMEDIATE FINAL

Group I

P5 - Financial Accounting (FAC)

BUSINESS WELCOME TO THE

P6 - Laws & Ethics (LNE) n e y DECISION

ELIGIBILITY CRITERION FOR

PURSUING COURSES:

P7 - Direct Taxation (DTX)

P8 - Cost Accounting (CAC)

j

A ar

our ds

w

to cess rner IS s

THERE

C

Be

co

me CMA

(I) Admission in Foundation Course

Group II

P9 - Operations Management & Strategic Management c a

su m Le rs ALWAYS

M A a FAMILY

• Passed Class 10 (OMSM) e &

P10 - Cost & Management Accounting and Financial

o

fr ead Be

• Pursuing Graduation L

Management (CMFM) to A B a u N

(II) Registration to Intermediate Course P11 - Indirect Taxation (ITX)

of iness CMA Pa ildin atio

Bus rtn g n

(a) Passed CMA Foundation Examination; P12 - Company Accounts & Audit (CAA)

or er

FINAL COURSE

(b) Qualified Competency Level of Group III

Certified Accounting Technicians

(CAT) Course of the Institute; or

P13 - Corporate Laws & Compliance (CLC)

P14 - Strategic Financial Management (SFM) SYLL

(c) Graduates of any discipline (other than P15 - Strategic Cost Management - Decision Making (SCMD) AB

music, fine arts and performing arts);

or

P16 - Direct Tax Laws and International Taxation (DTI)

Group IV

P17 - Corporate Financial Reporting (CFR)

U

(d) Qualified Engineers or Engineering

S-

P18 - Indirect Tax Laws & Practice (ITP)

Graduates (after qualifying 2nd Year P19 - Cost & Management Audit (CMAD)

studies) P20 - Strategic Performance Management and Business

201 6

(e) Passed ICSI Foundation; or Valuation (SPBV)

(f) Intermediate qualified students of The

Institute of Chartered Accountants of

India HELP LINE: TOLL FREE NUMBER

(g) CIMA, UK (eligible for exemptions) 1800 3450 092 (Monday to Saturday: 10 am - 6.30 pm)

1800 110 910

(h) ACCA, UK (eligible for exemptions)

e-mail: admission@icmai.in

REGISTRATION/ENROLMENT

TO COURSE (FOUNDATION/ CM

INTERMEDIATE/FINAL):

For June Exam 31st January of same

CMA - REGIONAL COUNCIL OFFICES

WESTERN INDIA SOUTHERN INDIA

A

Calendar Year Rohit Chambers CMA Bhawan

4th Floor, Janmabhoomi, 4, Montieth Lane, Egmore,

For December Exam 31st July of same Marg Fort, Mumbai - 400001 Chennai - 600008

Calendar Year Ph: + 91-22-22043416/3406, Ph: + 91-44-28554443,

+ 91-22-22841138 28554326

Fax: + 91- 22-22870763 Fax: + 91-44-28554651

Email: wirc@icmai.in Email: sirc@icmai.in

EXAMINATIONS HELD: www.icmai-wirc.in http://sircoficmai.in

Course Month

EASTERN INDIA NORTHERN INDIA

Foundation/ June and CMA Bhawan CMA Bhawan THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

84, Harish Mukherjee Road, 3, Institutional Area, Lodi Road, (Statutory body under an Act of Parliament)

Intermediate/ Final December Kolkata - 700025 New Delhi - 110003 Headquarters: CMA Bhawan, 12 Sudder Street, Kolkata-700 016

Ph: + 91-33 24553418, 24555957, Ph: + 91-11-24615788,

4563600, 64563601, 64563602, Phone: +91-33-2252-1031/34/35/1602/1492/1619/7373/7143

24626678, 24623792, 24623793

64563603 Fax: +91-33-2252-7993/1026/2392/2871/2872

Fax: + 91-33-2455-7920

Fax: + 91-11-24644630

Email: nirc@icmai.in Delhi Office: CMA Bhawan, 3 Institutional Area, Lodhi Road, New Delhi-110 003

Email: eirc@icmai.in

http://www.eircoficwai.com http://nirc-icmai.in Phone: +91-11-2462-2156/2157/2158

Fax: +91-11-43583642 Follow us on

“….The profession of Cost Accountancy is without doubt one of the most valuable contributions to the cause of industrial

development made by modern methods of training………Cost Accountant is a friend, philosopher and guide of the

management…” – Shri Morarji Desai, Former Prime Minister of India.

THE INSTITUTE OF COST ACCOUNTANTS (C) EXEMPTION FOR WORKING (H) Financial/Business Analyst, Systems Analysis &

OF INDIA EXECUTIVES OR Systems Management

CAREER PROSPECTS AS CMA

PERSONS WITH RELEVANT Auditing, Internal Control

A Statutory body set up under an Act of the Parliament,

QUALIFICATION AND EXPERIENCE: Tax Management (Direct and Indirect Tax)

namely the Cost and Works Accountants Act, 1959 IN SERVICE IN PRACTICE ERP implementation

Distinct role in maintaining governance system in the Computer Training Process Analysis in BPO houses

country’s economy, ensuring transparency, proper Orientation Programme Equity Analyst

INDUSTRY ACADEMIA

disclosure and social security for consumers at large. Practical Training Cost & Budget Executive

2nd Largest Cost & Management Accounting body in the Academia - as Faculties

World. (D) VALUE ADDED SERVICES FOR 1. PRACTICING AVENUES FOR CMAs:

Implementing Business Intelligence Systems

Largest Cost & Management Accounting body in Asia. STUDENTS

More than 5 lac students and 70,000 members serving in Cost Audit, Advising on Cost Records

Live Chats with experts on CMA subjects Maintenance 4. ACADEMIC OPPORTUNITIES FOR CMAs:

different capacities throughout the world.

Special Audit under Customs Act, Central

(A) COST AND MANAGEMENT Webinars on CMA subjects Excise Act, Service Tax Laws, VAT laws of Lecturers/Professors in Accounting & Finance

various states Pursue Ph.D with select Universities in India after

ACCOUNTANTS (CMAs) ARE Certification under Central Excise, Customs,

About 9,000 PPTs covering all subjects qualifying CMA Final Examinations

COMMITTED TO: Service Tax, EXIM Policy

Enrich Cost Competitiveness of Indian Industries. e-learning facilities (24x7) Internal Audit & Concurrent Audit 5. EMERGING AREAS FOR CMAs:

Create awareness and spread the knowledge of Cost & Stock Audit for Banks

Management Accountancy. e-newsletters covering topics of importance Consultancy - Tax; Project Management Total Quality Management (TQM), Statistical

Improve Cost and Management Accounting Literacy. Surveyor and Loss Assessor Quality Control (SQC)

State-of- the-art Courseware (study materials) Recovery Consultant in Banking Sector Enterprise Performance Management

Impart employable skills amongst Youth to serve the

Society besides meeting National requirements. Advisor-Business Valuation; Financial Services Risk Management- Project, Enterprise, Off-

Coaching (Oral/ Postal) and Trainings Balance Sheet Financing

Contribute in Green and Clean Technology. Trustee, Executor, Administrator, Arbitrator

Participate in sustainable and inclusive growth and Mock Test Papers (MTPs) - 2 sets/term/subject

Receiver, Appraiser, Valuer Enterprise Governance

development of the Economy. Compliance Audit of RBI Integrated Reporting

Assignments by the Central or State Government, Independent Practice - Taxation, Internal Audits

(B) SYLLABUS 2016: (E) FEES STRUCTURE Court of Law, Labour Tribunal or any other

A JOURNEY TOWARDS SUCCESS statutory bodies, regulatory bodies etc. 6. TRAINING, CAMPUS AND PLACEMENT:

Course Mode of Coaching

Syllabus 2016 is designed to nurture young business leaders 2. CONSULTANCY SERVICES BY CMAs: Training Scheme designed to meet industry

Oral/Postal

of tomorrow who can convert the dream of ‘MAKE IN requirements

INDIA’ into reality by taking strategic management decisions

Foundation 4,000 Financial planning and policy determination Employment Cell to facilitate effective and need

effectively in both the National and International arena. The Intermediate 20,000* Cost management planning and policy based placement

syllabus 2016 is based on International Standards set by Final 17,000 Capital structure planning and policy Campus placements organized across India to

IFAC (International Federation of Accountants) and IAESB Working capital management facilitate prospective recruiters for placement

*Installment Facility Available, refer www.icmai.in for details

(International Accounting Education Standards Board) and Project reports and feasibility studies

Initial Professional Development - Professional Skills (F) PAYMENT OF FEES & Budgeting and Budgetary Control (I) CMAs ARE RECRUITED BY:

(Revised) through IEG (International Educational Supply Chain Management

REGISTRATION

Guidelines): Inventory management Major Public Sector Undertakings;

FEE PAYMENT

To create awareness and promote cost & management Market research and demand studies Infrastructure Companies;

accounting education. TCM, TQM, BPR, Cost control and Value Public/Private Limited Companies - Manufacturing,

OFF-LINE PAYMENT ON-LINE PAYMENT Analysis Service Industries

To achieve six skill sets - knowledge, comprehension, AND OFF-LINE AND ON-LINE

application, analysis, synthesis and evaluation. Control methods and management information Insurance, Electricity, Banking Companies

REGISTRATION REGISTRATION

Based on four knowledge pillars - management, strategy,

and reporting IT/IT enabled services

regulatory function and financial reporting. Designing Staffing as per Business Process Big Four and other reputed firms

PAY THROUGH SBI, PNB, IDBI, CBI Framing Employee Benefit Measures

To inculcate skills for employability. (J) SOME OF THE COMPANIES WHERE

Increased emphasis on Accounting, Analysis, Reporting & Management, Operational, Quality, Environmental

APPROACH THE REGIONAL COUNCIL and Energy audits CMAs HAVE BEEN PLACED ARE:

Control, Strategy, Performance Measurement, Analysis,

Reporting, Corporate & Allied Laws, Taxation, Ethics and OR CHAPTER OR CMASC TO COMPLETE Valuation in Business Reorganizations

• BHEL • Coal India Ltd. • Saint Gobain • SEBI

Governance. THE PROCESS OF REGISTRATION Strategic Positioning, Integration

• TCS • Flipkart • Ford • TATA Motors • Power Grid

To extend all possible professional expertise to ensure Systems analysis and Design Corporation Ltd. • Nestle • Reliance Industries Ltd.

transparency and governance as desired by the

(G) MEMBERSHIP Advisor on Funds Management • ITC • PWC • Goldman Sachs • KPMG

government. QUALIFY FINAL AFTER 5 YEARS • Allahabad Bank • WIPRO • HCL

EXAMINATION 3. JOB OPPORTUNITIES FOR CMAs IN • BSNL • ICICI Bank

FUNCTIONS OF: • NHPC

“If we

ACQUIRE ELIGIBLE FOR

have to succeed 3 YEARS ACMA Cost Accounting, Financial Management

in the globalized world, we PRACTICAL FCMA

have to enlarge the scope of Cost Audit TRAINING

to cover all aspects of manufacturing and service

sector activities including healthcare and education.”

- APJ Abdul Kalam, Former President of India

You might also like

- Equivalence2013 PDFDocument1 pageEquivalence2013 PDFkhurramNo ratings yet

- Equivalence 2013Document1 pageEquivalence 2013khurramNo ratings yet

- Training Material - 5S & Muda - HindiDocument15 pagesTraining Material - 5S & Muda - HindiAnkurNo ratings yet

- F Firs STC CHO OIC CE: IN NEX XAM TRA Ainin NGDocument7 pagesF Firs STC CHO OIC CE: IN NEX XAM TRA Ainin NGKhanNo ratings yet

- Combined Safe LeanDocument1 pageCombined Safe LeanHARISH BHARADWAJNo ratings yet

- Basic Cy ProDocument1 pageBasic Cy Promalith kmlNo ratings yet

- Maximize Profits with Lean SchedulingDocument16 pagesMaximize Profits with Lean Schedulingsameer@mail.usa.comNo ratings yet

- Noe FHRM PPT Ch10-2022Document42 pagesNoe FHRM PPT Ch10-2022hathu3421No ratings yet

- Quest PresentationDocument26 pagesQuest PresentationSanjay PatelNo ratings yet

- Faculty of Economics & Business Syllabus For: Guru Nanak Dev University AmritsarDocument43 pagesFaculty of Economics & Business Syllabus For: Guru Nanak Dev University Amritsarjubalmedia03No ratings yet

- Plaquette Master Comptabilite Controle Audit DauphineDocument2 pagesPlaquette Master Comptabilite Controle Audit DauphineMathivanan NatarajNo ratings yet

- CGA (Web)Document2 pagesCGA (Web)salman_schonNo ratings yet

- CFP BrochureDocument2 pagesCFP BrochureAnupam Sinha100% (2)

- Corporate VentureDocument1 pageCorporate VentureRASHMI RASHMINo ratings yet

- WWW Mylogicvideos Com CMA USA CMA Part 1Document5 pagesWWW Mylogicvideos Com CMA USA CMA Part 1My LogicNo ratings yet

- Department of Finance and Investment Management: Advance Your CareerDocument1 pageDepartment of Finance and Investment Management: Advance Your CareerjulieNo ratings yet

- ZAP BI For AXDocument4 pagesZAP BI For AXShivshankar IyerNo ratings yet

- 14.test of Detail (MUS Template) - Penentuan SampleDocument7 pages14.test of Detail (MUS Template) - Penentuan SampleMuh HusainNo ratings yet

- CA Foundation Paper 4B BCK Notes Chapter OverviewDocument4 pagesCA Foundation Paper 4B BCK Notes Chapter OverviewVishal DantkaleNo ratings yet

- Posting Travel Expense To AccountingDocument3 pagesPosting Travel Expense To AccountingDavidbanksNo ratings yet

- Strategic Transformation: Business Process Redesign and InterlockDocument25 pagesStrategic Transformation: Business Process Redesign and InterlockWayne JohnsonNo ratings yet

- AXeToaim2017-Brochure 0Document13 pagesAXeToaim2017-Brochure 0rajkiran_bNo ratings yet

- Lead Management in Salesforce - EbookDocument51 pagesLead Management in Salesforce - EbookShashank NaikNo ratings yet

- ACA Syllabus Handbook Certificate Level Accounting 2023Document20 pagesACA Syllabus Handbook Certificate Level Accounting 2023Minh NguyenNo ratings yet

- New SyllabusDocument55 pagesNew SyllabusshraddhapagalNo ratings yet

- Advisian Business Process - MAINDocument10 pagesAdvisian Business Process - MAINDavid PrastyanNo ratings yet

- Master of Science Supply Chain Management: Business AdministrationDocument2 pagesMaster of Science Supply Chain Management: Business AdministrationDaniel AlfonsoNo ratings yet

- SEM I REGULAR ATKT TIME TABLE November 2023 Google SheetsDocument1 pageSEM I REGULAR ATKT TIME TABLE November 2023 Google SheetsDevesh DubeyNo ratings yet

- A Project Report On :business Information Management SystemDocument92 pagesA Project Report On :business Information Management SystemKristen Brown100% (2)

- Entrepreneurship and Communication - SampleDocument54 pagesEntrepreneurship and Communication - Samplefchemtai4966No ratings yet

- US Tax Reform - Timeline (May 8)Document2 pagesUS Tax Reform - Timeline (May 8)Araman JabilNo ratings yet

- PIPFA Career Plan & Syllabus GuideDocument56 pagesPIPFA Career Plan & Syllabus Guideumar441No ratings yet

- Quality Risk Management Ich Q9Document16 pagesQuality Risk Management Ich Q9Abou Tebba SamNo ratings yet

- Ayman Fatima's resume for accounting and finance rolesDocument1 pageAyman Fatima's resume for accounting and finance rolesAyman FatimaNo ratings yet

- YASH Sap E-LearningDocument2 pagesYASH Sap E-Learningakchourasia709No ratings yet

- UST Golden Notes - Criminal ProcedureDocument312 pagesUST Golden Notes - Criminal Procedurehamseya bedialNo ratings yet

- Batco: Telecom & IT SolutionsDocument27 pagesBatco: Telecom & IT SolutionssamehNo ratings yet

- ACA Syllabus Handbook Professional Level Financial Management 2023Document26 pagesACA Syllabus Handbook Professional Level Financial Management 2023lavanya vsNo ratings yet

- Code of Practice on Safe Lifting OperationsDocument6 pagesCode of Practice on Safe Lifting Operationss_bharathkumarNo ratings yet

- 14 Steps To Create Cash Flow FR PDFDocument14 pages14 Steps To Create Cash Flow FR PDFmy.nafi.pmp5283No ratings yet

- CGA-BD SubjectsDocument1 pageCGA-BD SubjectsSyed Fazle ImamNo ratings yet

- CMA®️ Coaching Classes - Course Brochure TWSSDocument17 pagesCMA®️ Coaching Classes - Course Brochure TWSSAwesome AngelNo ratings yet

- Component D Form 4Document7 pagesComponent D Form 4dyllan matandaneNo ratings yet

- Corporate FinanceDocument33 pagesCorporate FinanceSen RinaNo ratings yet

- 07 25 2023 Bir PublicationDocument87 pages07 25 2023 Bir PublicationGamarcha MorenoNo ratings yet

- Accounting framework and first-time adoption comparisonDocument8 pagesAccounting framework and first-time adoption comparisonSharmaine SurNo ratings yet

- Unstop Courses - Learn Anything, Anywhere From The BestDocument1 pageUnstop Courses - Learn Anything, Anywhere From The BestchiduralarevanthNo ratings yet

- Celerity Supply Chain Tribe June 2023 Issue 1685654224Document42 pagesCelerity Supply Chain Tribe June 2023 Issue 1685654224Bharath GowdaNo ratings yet

- Revised - 5 Sept. 14, 2020: Institute of Business Administration, KarachiDocument2 pagesRevised - 5 Sept. 14, 2020: Institute of Business Administration, KarachiVania ShakeelNo ratings yet

- Sample Plan by Satish Mistry: Scope of Personal Financial Plan / Financial ObjectiveDocument147 pagesSample Plan by Satish Mistry: Scope of Personal Financial Plan / Financial ObjectivezobilaNo ratings yet

- Sap Isu ModelDocument4 pagesSap Isu ModelSachin SinghNo ratings yet

- Session 9-10Document20 pagesSession 9-10Dr. Deepti SharmaNo ratings yet

- Filtration Skid OEM Market & Equipment: Insert Photo HereDocument54 pagesFiltration Skid OEM Market & Equipment: Insert Photo HereDhaval ShahNo ratings yet

- SAFe Implementation Roadmap 6.0 Partner 11.7x8.5Document1 pageSAFe Implementation Roadmap 6.0 Partner 11.7x8.5deartoreadbookNo ratings yet

- JYCPK ISO 9001 Certified Computer Training InstituteDocument20 pagesJYCPK ISO 9001 Certified Computer Training InstitutePratyush AryaNo ratings yet

- A New Approach To PMBOK Guide 2000Document6 pagesA New Approach To PMBOK Guide 2000Davi LopesNo ratings yet

- When You Join Zoom, Your Computer Will Automatically Connect To The Audio StreamDocument51 pagesWhen You Join Zoom, Your Computer Will Automatically Connect To The Audio StreamRammohan PushadapuNo ratings yet

- Project Proposal Form: (To Be Submitted To The Project Guide On October 25,2015)Document1 pageProject Proposal Form: (To Be Submitted To The Project Guide On October 25,2015)chandruNo ratings yet

- Icai-Iia Seminar BrochureDocument5 pagesIcai-Iia Seminar Brochuregrmani1981No ratings yet

- MBA Project TitleDocument1 pageMBA Project Titlegrmani1981No ratings yet

- Where Innovation Is A Way of LifeDocument20 pagesWhere Innovation Is A Way of Lifegrmani1981No ratings yet

- Pondicherry University: Directorate of Distance EducationDocument10 pagesPondicherry University: Directorate of Distance Educationgrmani1981No ratings yet

- Pondicherry University: Directorate of Distance EducationDocument10 pagesPondicherry University: Directorate of Distance Educationgrmani1981No ratings yet

- Ashpk Ley PDFDocument7 pagesAshpk Ley PDFLokesh KrishnanNo ratings yet

- Osu 1306962321Document119 pagesOsu 1306962321Leticia JohnsonNo ratings yet

- Self-Introduction - Yuanhui Gao (Kim)Document3 pagesSelf-Introduction - Yuanhui Gao (Kim)api-279994236No ratings yet

- Pre A1 Starters 2018 Speaking Part 4Document16 pagesPre A1 Starters 2018 Speaking Part 4Hisham EzzaroualyNo ratings yet

- Bounce The Myth of TalentDocument6 pagesBounce The Myth of TalentcreativemarcoNo ratings yet

- Ordinance No. 2023 095 Students Day OrdinanceDocument5 pagesOrdinance No. 2023 095 Students Day Ordinancemariel lunaNo ratings yet

- The Indigenous PeoplesDocument11 pagesThe Indigenous Peoplesrujean romy p guisandoNo ratings yet

- 5E Lesson Plan Template: GCU College of EducationDocument3 pages5E Lesson Plan Template: GCU College of Educationapi-546877433No ratings yet

- Chapter 3 LWRDocument13 pagesChapter 3 LWRJannen V. ColisNo ratings yet

- SHRM CertificationDocument40 pagesSHRM Certificationsamirpk100% (1)

- The Effectiveness of Using Facebook in Writing Skill Learning Process Among Indonesian Secondary School StudentsDocument7 pagesThe Effectiveness of Using Facebook in Writing Skill Learning Process Among Indonesian Secondary School StudentsCahyan SetyaniNo ratings yet

- Microskills of Behaviour MGMT 4Document15 pagesMicroskills of Behaviour MGMT 4api-238731696No ratings yet

- Strategic Foresight - The State of The ArtDocument5 pagesStrategic Foresight - The State of The ArtValeriya KozymirNo ratings yet

- Changes and Implications On Contractors & Sub-ContractorsDocument2 pagesChanges and Implications On Contractors & Sub-ContractorsFrd Ohsem Hafr0% (1)

- CV Riza FahmiDocument13 pagesCV Riza FahmiLutfi Abdullah HanifNo ratings yet

- Ella's Valedictorian SpeechDocument7 pagesElla's Valedictorian SpeechSamantha KubotaNo ratings yet

- DFA Prevention Petition 052012Document24 pagesDFA Prevention Petition 052012Alice ChenNo ratings yet

- ECOZI 2016 Newsletter FinalDocument8 pagesECOZI 2016 Newsletter FinalMutsa MvududuNo ratings yet

- Reading and Writing in The Disciplines: Annenberg Learner Course GuideDocument42 pagesReading and Writing in The Disciplines: Annenberg Learner Course GuideLiezel SaldoNo ratings yet

- Evironmental Analysis of Casisang Senior High SchoolDocument4 pagesEvironmental Analysis of Casisang Senior High SchoolNuela S. LucineNo ratings yet

- Beauty Pageant Q & ADocument5 pagesBeauty Pageant Q & Akmem821No ratings yet

- Topic Sentence Lesson PlanDocument6 pagesTopic Sentence Lesson Planapi-397089431100% (1)

- Teaching ResumeDocument2 pagesTeaching Resumeapi-335020661No ratings yet

- Peak PerformanceDocument251 pagesPeak Performancesudhanshu_mishra_26No ratings yet

- ESP TestingDocument11 pagesESP TestingIka AgustinaNo ratings yet

- Old Wine in New BottlesDocument12 pagesOld Wine in New BottlesEdvaldo AraujoNo ratings yet

- CEH Module 00 - Welcome To Certified Ethical Hacker Class! PDFDocument28 pagesCEH Module 00 - Welcome To Certified Ethical Hacker Class! PDFRuben Ramirez MarfilNo ratings yet

- Yr 3 Description RubricsDocument2 pagesYr 3 Description Rubricsapi-217756340100% (1)

- First and Second Language DevelopmentDocument19 pagesFirst and Second Language Developmentarynaa azzahraNo ratings yet

- (Cambridge Applied Ethics) Stephen J. A. Ward-Ethics and The Media - An Introduction-Cambridge University Press (2011)Document299 pages(Cambridge Applied Ethics) Stephen J. A. Ward-Ethics and The Media - An Introduction-Cambridge University Press (2011)Mohammad MirzaeiNo ratings yet

- Curriculum Vitae From Ricardo Abreu (EN)Document7 pagesCurriculum Vitae From Ricardo Abreu (EN)Ricardo AbreuNo ratings yet