Professional Documents

Culture Documents

AAM - European Select 2019-3Q

Uploaded by

ag rOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AAM - European Select 2019-3Q

Uploaded by

ag rCopyright:

Available Formats

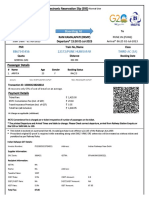

EQUITY - INTERNATIONAL/GLOBAL PORTFOLIOS

Series 2019-3Q, ADT 1959

European Select Portfolio

Fee-Based Account UIT Fact Card

Morningstar Equity Style BoxTM

Investment Objective & Strategy

The European Select Portfolio, a Cyrus J. Lawrence LLC (“CJL”) trust, is a unit investment trust

(UIT) that seeks to provide above-average total return by investing in a diversified portfolio of stocks

of companies organized in Europe. The trust will use a “European Select” strategy that has a dual

focus of targeting companies that will be potential beneficiaries of global accelerating economic

growth but also companies geared toward a sustainable European recovery.

Ticketing Information Portfolio Consultant: C.J. Lawrence® (“CJL”)

CJL is a New York-based investment management boutique providing customized portfolios to

Fee-Based CUSIP (Cash/Reinvest) 00778V606 / 614

Ticker Symbol EURSWX individuals, families, and institutions. With a legacy that dates back to 1864, CJL was

re-established in 2015 as an independent SEC registered investment advisor. The firm combines

Essential Information the talents of a highly experienced portfolio management team with an environment centered on

Unit price at inception (per unit) $9.8650 only delivering optimal investment advice. CJL’s managers have a long-term record of utilizing their

Initial redemption price (per unit) $9.8650

Initial date of deposit 8/13/2019 portfolio strategy expertise to build innovative portfolios that can potentially benefit from longer term

Portfolio ending date 11/16/2020 market trends.

Distribution frequency Monthly, if any

Historical 12-Month Distribution Why Own European Equities?

Rate of Trust Holdings* 1.95%

*The distribution rate paid by the trust may be higher or lower

than the amount shown above due to factors including, but not

limited to, changes in the price of trust units, changes (including

reductions) in distributions paid by issuers, changes in actual

trust expenses and sales of securities in the portfolio. There is

no guarantee that the issuers of the securities included in the

trust will pay any distributions in the future. The Historical 12-

Month Distribution Rate of Trust Holdings is calculated by

taking the weighted average of the regular income distributions

paid by the securities included in the trust’s portfolio over the 12

months preceding the trust’s date of deposit reduced to account

for the effects of trust fees and expenses. The percentage

shown is based on a $9.865 unit price. This historical rate is for

illustrative purposes only and is not indicative of amounts that

will actually be distributed by the trust.

Fee-Based Accounts Sales Charge and

Expenses

(Based on initial Fee-Based Account unit price of $9.865)+

As % of

Fee-Based Amount per unit

Public (based on initial

Offering Price unit price)

Creation & Development Fee 0.51% $0.050

Organizational Costs + 0.50% $0.049

Total One-Time Expense 1.00% $0.099

Divided by Term of Trust equals

Amortized One-Time Charges

Key Viewpoints to Consider:

Amortized One-Time Charges 0.80% $0.079

European Export Recovery European Financial Conditions Equity Market Dynamics

Estimated Annual Operating + 0.53% +$0.052 Aggressive open-ended

Expense Global export leaders at accommodative monetary policy Attractive valuations relative

Estimated Average 1.33% $0.131 the core underway by the European to the U.S.

Amortized Annual Expenses Central Bank

+All amounts are as of 8/12/2019 and may vary thereafter. Progress in structural European leaders being forced to

The Creation & Development Fee is fixed at $0.05 per unit Many European securities

and is paid at the end of the initial offering period (anticipated competitiveness at confront economic decline with

under-owned

to be approximately three months). The Organization Costs the periphery structural pro-growth measures

are fixed at $0.049 per unit and are paid at the end of the

initial offering period or after six months, if earlier. The above Sovereign bond yields at record lows

table is for illustrative purposes only to illustrate how esti- Relative weakness of Many high-quality global

mated trust fees and expenses translate on an annualized across Europe, many countries lower

basis. The above does not reflect the amount or how all fees European currencies companies undervalued

than U.S. Treasuries

and expenses will actually be paid. You should consult the

prospectus for a full description of applicable sales charges

and expenses of the trust, including those applicable to Ongoing harmonization of European Positive fund flows into

purchasers eligible for the fee-based account discount. The Global recovery in trade banking industry intended to ensure European equities

one-time charges shown (the Creation & Development Fee future stability may continue

and Organization Costs) are paid on a one-time basis as

described and are not actually amortized over the life of the FOR USE ONLY WITH INVESTOR ACCOUNTS ELIGIBLE FOR THE “FEE-BASED ACCOUNT”

trust. The amount shown for “Amortized One-Time Charges”

are calculated by taking the one-time dollar amounts and SALES CHARGE DESCRIBED ON PAGE 3 Page 1 of 3

dividing them by the anticipated life of the based on the

trust’s inception date and mandatory termination date. The

“Estimated Average Amortized Annual Expenses” is taken by Advisors Asset Management, Inc. (AAM) is a SEC registered investment advisor and member FINRA/SIPC.

adding the “Amortized One-Time Charges” amount and

“Estimated Annual Operating Expense” amounts.

European Select Portfolio Series 2019-3Q, ADT 1959

Fee-Based Account UIT Fact Card

Portfolio Holdings (as of date of deposit)

Ticker Market Value Ticker Market Value

Symbol Issue Name Per Share* Symbol Issue Name Per Share*

Consumer Discretionary - (17.12%) Health Care - (11.40%)

ADS GR adidas AG $293.12 AZN UN AstraZeneca PLC $44.36

CPG LN Compass Group PLC 25.04 PHG UN Koninklijke Philips N.V. 46.15

RACE UN Ferrari N.V. 158.03 NVS UN Novartis AG 91.10

KER FP Kering SA 501.61 ROG SW Roche Holding AG 280.09

MC FP LVMH Moet Hennessy Louis Vuitton SE 398.30 Industrials - (8.55%)

MONC IM Moncler SpA 39.31 SU FP Schneider Electric SE 81.63

Consumer Staples - (14.31%) HO FP Thales SA 113.05

BUD UN Anheuser-Busch InBev SA/NV 96.27 DG FP Vinci SA 105.04

DEO UN Diageo PLC 164.72 Information Technology - (20.09%)

OR FP L'Oreal SA 262.71 ADYEN NA Adyen NV 749.77

NESN SW Nestle SA 109.55 ASML UQ ASML Holding N.V. 214.45

UN UN Unilever N.V. 57.46 CAP FP Capgemini SE 122.26

Energy - (5.72%) DSY FP Dassault Systemes SE 143.48

BP UN BP PLC 36.65 NOK UN Nokia Oyj 5.31

RDS/B UN Royal Dutch Shell PLC 57.32 SAP UN SAP SE 119.10

Financials - (14.30%) ERIC UQ Telefonaktiebolaget LM Ericsson 8.61

ALV GR Allianz SE 223.97 Materials - (8.51%)

SAN UN Banco Santander SA 3.91 AI FP Air Liquide SA 137.93

DB1 GR Deutsche Boerse AG 142.13 BBL UN BHP Group PLC 43.11

SLHN SW Swiss Life Holding AG 479.52 JMAT LN Johnson Matthey PLC 34.54

ZURN SW Zurich Insurance Group AG 359.89

*As of 8/12/2019 and may vary thereafter.

FOR USE ONLY WITH INVESTOR ACCOUNTS ELIGIBLE FOR THE “FEE-BASED ACCOUNT”

SALES CHARGE DESCRIBED ON PAGE 3

Page 2 of 3

Intelligent Investments. Independent Ideas.

European Select Portfolio Series 2019-3Q, ADT 1959

Fee-Based Account UIT Fact Card

Sector Breakdown* Country of Organization* Holdings Summary*

% of Portfolio % of Portfolio % of Portfolio

Information Technology 20.09% France 25.71% Large-Cap Blend 22.91%

Consumer Discretionary 17.12% United Kingdom 19.95% Large-Cap Growth 34.17%

Consumer Staples 14.31% Switzerland 14.29% Large-Cap Value 17.15%

Financials 14.30% Netherlands 14.28% Mid-Cap Blend 2.82%

Health Care 11.40% Germany 11.51% Mid-Cap Growth 2.84%

Industrials 8.55% Finland 2.87% Mid-Cap Value 2.94%

Materials 8.51% Sweden 2.86% Small-Cap Growth 5.72%

Energy 5.72% Spain 2.85% Small-Cap Value 8.58%

Source: Global Industrial Classification Standard

Belgium 2.84% N/A 2.87%

*As of 8/12/2019 and may vary thereafter. Breakdowns are Italy 2.84% Source: Morningstar

based on the sources shown and may differ from any

Source: Bloomberg

category definitions used in selecting the trust portfolio.

Unit Investment Trusts (UITs) are sold only by prospectus. You should consider the trust’s investment objectives, risks, charges and expenses carefully

before investing. Contact your financial professional or visit Advisors Asset Management online at www.aamlive.com/uit to obtain a prospectus, which

contains this and other information about the trust. Read it carefully before you invest.

Risks and Considerations: Unit values will fluctuate with the portfolio of underlying securities and may be worth more or less than the original purchase price at the

time of redemption. There is no guarantee that the objective of the portfolio will be achieved. Additionally, the trust may terminate earlier than the specific termination

date as stated in the prospectus. Consult your tax advisor for possible tax consequences associated with this investment. An investment in this unmanaged unit

investment trust should be made with an understanding of the risks associated therewith that includes, but is not limited to: Dividend Payment Risk: An issuer of a

security may be unwilling or unable to pay income on a security. Common stocks do not assure dividend payments and are paid only when declared by an issuer’s

board of directors. The amount of any dividend may vary over time. Foreign Securities: Securities of foreign issuers present risks beyond those of U.S. issuers

which may include market and political factors related to the issuer’s foreign market, international trade conditions, less regulation, smaller or less liquid markets,

increased volatility, differing accounting practices and changes in the value of foreign securities. European Issuer Concentration: The trust invests in securities

issued by companies in Europe and is subject to certain risks associated specifically with Europe. A significant number of countries in Europe are member states in

the European Union, and the member states no longer control their own monetary polices by directing independent interests rates for their currencies. The value of

the trust is more susceptible to fluctuations based on factors that impact a particular industry because the portfolio concentrates in companies within Europe.

The Morningstar Equity Style Box™: This table provides a graphical representation of the investment style of a trust based on holdings as of the date of deposit

which may vary thereafter. The Morningstar Equity Style Box™ placement is based on the Morningstar market capitalization classification (determined relative to

other stocks in the same geographic area) of the stocks in the trust's portfolio (vertical axis), and by comparing the growth and value characteristics of the stocks in

the trust's portfolio with growth and value factors developed by Morningstar (horizontal axis). Value, blend and growth are types of investment styles. Growth investing

generally seeks stocks that offer the potential for greater-than-average earnings growth, and may entail greater risk than value or blend investing. Value investing

generally seeks stocks that may be sound investments but are temporarily out of favor in the marketplace, and may entail less risk than growth investing. A blended

investment combines the two styles. ©2019 Morningstar, Inc. All Rights Reserved. The information contained herein relating to the Morningstar Equity Style Box™: 1)

is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither

Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. For Use Only with Eligible Fee-Based

Account Investors: During the trust’s initial offering period, investors who purchase units through registered investment advisers, certified financial planners or

registered broker-dealers who in each case either charge investor accounts periodic fees for brokerage services, financial planning, investment advisory or asset

management services, or provide such services in connection with an investment account for which a comprehensive “wrap fee” charge is imposed may be eligible to

purchase units of the trust in fee-based accounts that are not subject to the transactional sales fee but will be subject to the creation and development fee that is

collected by the sponsor (i.e. the “Fee-Based Account” sales charge). You should consult your financial advisor to determine whether you can benefit from these

accounts and whether your unit purchases are eligible for this discount. To purchase units in these accounts, your financial advisor must purchase units designated

with one of the Fee Account CUSIP numbers, if available. The amounts shown are different from what would be applicable for units purchased in other accounts (i.e.

commission-based accounts) not eligible for this discount. See your prospectus and consult your financial advisor for more information about eligibility and

applicability of the fee-based account discount. This communication may only be used with investors that are eligible for this discount

Securities are available through your financial professional. Not FDIC Insured. Not Bank Guaranteed. May Lose Value.

For informational purposes only and not a recommendation to purchase or sell any security.

©2019 Advisors Asset Management

Advisors Asset Management, Inc. (AAM) is a SEC registered investment advisor and member FINRA/SIPC.

18925 Base Camp Road | Monument, CO 80132 | www.aamlive.com | CRN: 2019-0205-7238 R Link 5812

FOR USE ONLY WITH INVESTOR ACCOUNTS ELIGIBLE FOR THE

Page 3 of 3 “FEE-BASED ACCOUNT” SALES CHARGE

Intelligent Investments. Independent Ideas.

You might also like

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enDocument2 pagesUcits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enja1220087No ratings yet

- CohenSteers Convertible Inc 2019-4 FCDocument2 pagesCohenSteers Convertible Inc 2019-4 FCA RNo ratings yet

- Pimco Dynamic Multi Asset FundDocument4 pagesPimco Dynamic Multi Asset Fundtgpmfq48trNo ratings yet

- Balanced Portfolio 2019-3 FCDocument3 pagesBalanced Portfolio 2019-3 FCA RNo ratings yet

- 富達環球科技基金 說明Document7 pages富達環球科技基金 說明Terence LamNo ratings yet

- CohenSteers Convertible Inc 2019-3 FCDocument2 pagesCohenSteers Convertible Inc 2019-3 FCA RNo ratings yet

- CCR Arbitrage Volatilité 150: Volatility StrategyDocument3 pagesCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNo ratings yet

- USAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017Document4 pagesUSAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017anthonymaioranoNo ratings yet

- Balanced Portfolio 2019-4 FCDocument3 pagesBalanced Portfolio 2019-4 FCA RNo ratings yet

- SP Ishares Core Msci Total International Stock Etf 7 31Document16 pagesSP Ishares Core Msci Total International Stock Etf 7 31colt williamsNo ratings yet

- Key Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesDocument2 pagesKey Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesAl BoscoNo ratings yet

- CohenSteers Convertible Inc 2019-2 FCDocument2 pagesCohenSteers Convertible Inc 2019-2 FCA RNo ratings yet

- Balanced Portfolio 2020-1 FCDocument3 pagesBalanced Portfolio 2020-1 FCA RNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4A RNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3A RNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2A RNo ratings yet

- Balanced Portfolio 2020-2 FCDocument3 pagesBalanced Portfolio 2020-2 FCA RNo ratings yet

- HSBC Global Investment Funds - US Dollar BondDocument2 pagesHSBC Global Investment Funds - US Dollar BondMay LeungNo ratings yet

- Balanced Portfolio 2019-2 FCDocument3 pagesBalanced Portfolio 2019-2 FCA RNo ratings yet

- CohenSteers Covered Call 2020-1 FCDocument2 pagesCohenSteers Covered Call 2020-1 FCA RNo ratings yet

- CohenSteersGlobalCovCall 2019 3FCDocument2 pagesCohenSteersGlobalCovCall 2019 3FCA RNo ratings yet

- CohenSteersGlobalCovCall 2019 4FCDocument2 pagesCohenSteersGlobalCovCall 2019 4FCA RNo ratings yet

- CohenSteers Covered Call 2019 3 FCDocument2 pagesCohenSteers Covered Call 2019 3 FCA RNo ratings yet

- Key Investor Fund DetailsDocument2 pagesKey Investor Fund DetailsKrisssszNo ratings yet

- Cost of Capital - MarkedDocument8 pagesCost of Capital - MarkedSundeep MogantiNo ratings yet

- CohenSteersGlobalCovCall 2019 2FCDocument2 pagesCohenSteersGlobalCovCall 2019 2FCA RNo ratings yet

- Robeco Sept 2018Document4 pagesRobeco Sept 2018ouattara dabilaNo ratings yet

- Columbia Research Enhanced Value Etf: March 1, 2021Document8 pagesColumbia Research Enhanced Value Etf: March 1, 2021miguelNo ratings yet

- Professional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Document7 pagesProfessional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Rithi JantararatNo ratings yet

- Kiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enDocument2 pagesKiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enxacaxaNo ratings yet

- Balanced Portfolio 2019-1 FCDocument3 pagesBalanced Portfolio 2019-1 FCA RNo ratings yet

- Cohen & Steets - Dynamic Income 2020-1Document3 pagesCohen & Steets - Dynamic Income 2020-1ag rNo ratings yet

- 3.1 Leverage and Capital StructureDocument50 pages3.1 Leverage and Capital StructureLou Brad Nazareno IgnacioNo ratings yet

- Dynamic Income 2018-4Document3 pagesDynamic Income 2018-4ag rNo ratings yet

- Docrep O00000908 00000039 0001 2022 02 18 Ki en 0000Document2 pagesDocrep O00000908 00000039 0001 2022 02 18 Ki en 0000Geeta RawatNo ratings yet

- Eu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enDocument3 pagesEu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enAllanNo ratings yet

- LUX ProspectusDocument24 pagesLUX Prospectusdicky bhaktiNo ratings yet

- Product Highlights Sheets-Dynamic Income FundDocument7 pagesProduct Highlights Sheets-Dynamic Income FundCheeseong LimNo ratings yet

- Global Multi-Asset Income Fund overviewDocument3 pagesGlobal Multi-Asset Income Fund overviewJeffrey Ru LouisNo ratings yet

- Update The Barclays Euro Government Inflation-Linked Bond EGILB IndexDocument6 pagesUpdate The Barclays Euro Government Inflation-Linked Bond EGILB IndexabandegenialNo ratings yet

- Mrs - Fidelity Asian Bond Fund Usd - Class 9: M1 - Medium Risk/returnDocument2 pagesMrs - Fidelity Asian Bond Fund Usd - Class 9: M1 - Medium Risk/returnemirav2No ratings yet

- Fairholme Fund and Focused Income Fund DisclosuresDocument28 pagesFairholme Fund and Focused Income Fund Disclosuressandy_caponeNo ratings yet

- CORPFIN 7040: Fixed Income Securities (M) Embedded Research ProjectDocument12 pagesCORPFIN 7040: Fixed Income Securities (M) Embedded Research Project邓媛No ratings yet

- BBA2Document2 pagesBBA2Govardhan RaoNo ratings yet

- Alliance Portfoliopractice-Dividend-Stocks Jan 2011Document16 pagesAlliance Portfoliopractice-Dividend-Stocks Jan 2011Connie SinNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- KID - My Choice - Higher Fund 2021Document3 pagesKID - My Choice - Higher Fund 2021AntNE Property ServicesNo ratings yet

- CohenSteers Senior Variable 2019-3 FCDocument2 pagesCohenSteers Senior Variable 2019-3 FCA RNo ratings yet

- Eaton Vance Tax-Mgd Div Eq Inc Fund (ETY)Document32 pagesEaton Vance Tax-Mgd Div Eq Inc Fund (ETY)ArvinLedesmaChiongNo ratings yet

- Utilities 2Q 2022Document3 pagesUtilities 2Q 2022ag rNo ratings yet

- 2020 BP Cost of Capital EVADocument17 pages2020 BP Cost of Capital EVAPhuc NguyenNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- IE00B18GC888Document4 pagesIE00B18GC888a28hzNo ratings yet

- Money For Old HopeDocument50 pagesMoney For Old Hoperitu6687No ratings yet

- Kid - De000a1nzlj4 - Wisdomtree Agriculture - Eur Daily Hedged - enDocument3 pagesKid - De000a1nzlj4 - Wisdomtree Agriculture - Eur Daily Hedged - enfraknoNo ratings yet

- Financial Management I Sem 4Document60 pagesFinancial Management I Sem 4trashbin.dump123No ratings yet

- Kiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enDocument2 pagesKiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enfraknoNo ratings yet

- Fidelity GMAI Feb 2021Document2 pagesFidelity GMAI Feb 2021tytaityNo ratings yet

- USAA Precious Metals and Mineral Fund - USAGX - 4Q 2022Document2 pagesUSAA Precious Metals and Mineral Fund - USAGX - 4Q 2022ag rNo ratings yet

- USAA Growth Fund - USAAX - 4Q 2022Document1 pageUSAA Growth Fund - USAAX - 4Q 2022ag rNo ratings yet

- Dividend Schedule 2022Document1 pageDividend Schedule 2022ag rNo ratings yet

- USAA Nasdaq-100 Index Fund - USNQX - 4Q 2022Document2 pagesUSAA Nasdaq-100 Index Fund - USNQX - 4Q 2022ag rNo ratings yet

- USAA Growth Fund - USAAX - 4Q 2022Document2 pagesUSAA Growth Fund - USAAX - 4Q 2022ag rNo ratings yet

- Financial Opportunities 2Q 2022Document3 pagesFinancial Opportunities 2Q 2022ag rNo ratings yet

- USAA Tax Exempt Short-Term Fund 2Q 2022Document2 pagesUSAA Tax Exempt Short-Term Fund 2Q 2022ag rNo ratings yet

- Minimum Volatility 3Q 2022Document4 pagesMinimum Volatility 3Q 2022ag rNo ratings yet

- Energy Opportunities 1Q 2022Document3 pagesEnergy Opportunities 1Q 2022ag rNo ratings yet

- Advisors Asset Management - Income Growth Fund OutlookDocument3 pagesAdvisors Asset Management - Income Growth Fund Outlookag rNo ratings yet

- Utilities 2Q 2022Document3 pagesUtilities 2Q 2022ag rNo ratings yet

- HealthCare Opportunities 2022Document4 pagesHealthCare Opportunities 2022ag rNo ratings yet

- USAA Growth and Tax Strategy Fund 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund 2Q '22ag rNo ratings yet

- USAA Tax Exempt Short-Term Fund 2Q 2022Document2 pagesUSAA Tax Exempt Short-Term Fund 2Q 2022ag rNo ratings yet

- USAA Tax Exempt Money Market Fund 2Q 2022Document2 pagesUSAA Tax Exempt Money Market Fund 2Q 2022ag rNo ratings yet

- USAA Tax Exempt Long-Term Fund 2Q 2022Document2 pagesUSAA Tax Exempt Long-Term Fund 2Q 2022ag rNo ratings yet

- USAA Tax Exempt Money MarketDocument3 pagesUSAA Tax Exempt Money Marketag rNo ratings yet

- Victory INTGY Small/MID Cap Value Fund 2022 - 1QDocument2 pagesVictory INTGY Small/MID Cap Value Fund 2022 - 1Qag rNo ratings yet

- USAA Tax Exempt Intermediate-Term Fund 2Q '22Document2 pagesUSAA Tax Exempt Intermediate-Term Fund 2Q '22ag rNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- USAA Tax Exempt Long-Term Fund 2Q '22Document2 pagesUSAA Tax Exempt Long-Term Fund 2Q '22ag rNo ratings yet

- Victory INTGY Discovery Fund 2022 - 1QDocument2 pagesVictory INTGY Discovery Fund 2022 - 1Qag rNo ratings yet

- USAA Intermediate-Term Bond Fund 2Q '22Document3 pagesUSAA Intermediate-Term Bond Fund 2Q '22ag rNo ratings yet

- Bitcoin and BeyondDocument4 pagesBitcoin and Beyondag rNo ratings yet

- Victory INTGY Mid Cap Val Fund 2022 - 1QDocument2 pagesVictory INTGY Mid Cap Val Fund 2022 - 1Qag rNo ratings yet

- Victory INTGY Small/MID Cap Value Fund 2022 - 1QDocument4 pagesVictory INTGY Small/MID Cap Value Fund 2022 - 1Qag rNo ratings yet

- Victory INCR Investment Grade Convertible Fund 2022 - 1QDocument2 pagesVictory INCR Investment Grade Convertible Fund 2022 - 1Qag rNo ratings yet

- Victory INTGY Mid Cap Val Fund 2022 - 1QDocument4 pagesVictory INTGY Mid Cap Val Fund 2022 - 1Qag rNo ratings yet

- Victory INTGY Discovery Fund 2022 - 1QDocument3 pagesVictory INTGY Discovery Fund 2022 - 1Qag rNo ratings yet

- Victory INCR Investment Grade Convertible Fund 2022 - 1QDocument3 pagesVictory INCR Investment Grade Convertible Fund 2022 - 1Qag rNo ratings yet

- Mocha Pro UserGuideDocument441 pagesMocha Pro UserGuideHamidreza DeldadehNo ratings yet

- Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test BankDocument46 pagesManagerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test Bankmable100% (18)

- Informações de Distribuição de CargaDocument15 pagesInformações de Distribuição de CargaSergio StoffelshausNo ratings yet

- Varrsana Details FinalDocument5 pagesVarrsana Details FinalAmarjeet RoyNo ratings yet

- Exam 2 Guidelines 2019Document6 pagesExam 2 Guidelines 2019Sri VeludandiNo ratings yet

- Pri Dlbt1201182enDocument2 pagesPri Dlbt1201182enzaheerNo ratings yet

- Stud Bolt Coating - XYLAN - 10701Document3 pagesStud Bolt Coating - XYLAN - 10701scott100% (2)

- 22172/pune Humsafar Third Ac (3A)Document2 pages22172/pune Humsafar Third Ac (3A)VISHAL SARSWATNo ratings yet

- What Makes Online Content ViralDocument15 pagesWhat Makes Online Content ViralHoda El HALABINo ratings yet

- List of Private Medical PractitionersDocument7 pagesList of Private Medical PractitionersShailesh SahniNo ratings yet

- Module Code & Module Title CC6051NI Ethical Hacking Assessment Weightage & Type Weekly AssignmentDocument7 pagesModule Code & Module Title CC6051NI Ethical Hacking Assessment Weightage & Type Weekly AssignmentBipin BhandariNo ratings yet

- 06-08 Civic Grid Charger 1 - 1Document4 pages06-08 Civic Grid Charger 1 - 1MilosNo ratings yet

- RESIDENT NMC - Declaration - Form - Revised - 2020-2021Document6 pagesRESIDENT NMC - Declaration - Form - Revised - 2020-2021Riya TapadiaNo ratings yet

- Ruini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectDocument4 pagesRuini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectISSSTNetwork100% (1)

- Bair Hugger 775 Operator ManualDocument23 pagesBair Hugger 775 Operator Manualpiotr.lompartNo ratings yet

- FPC Challanges and Issues by MANAGEDocument36 pagesFPC Challanges and Issues by MANAGESuresh KumarNo ratings yet

- Arid Agriculture University, Rawalpindi: MultimediaDocument22 pagesArid Agriculture University, Rawalpindi: MultimediaAshh Ishh100% (1)

- Ch3.2 - HomeworkDocument2 pagesCh3.2 - HomeworkArcherDash Love GeometrydashNo ratings yet

- International Journal of Hospitality ManagementDocument10 pagesInternational Journal of Hospitality ManagementrobertNo ratings yet

- Installing Wilson Yagi Antenna 301124Document4 pagesInstalling Wilson Yagi Antenna 301124SentaNo ratings yet

- These Are The Top 10 Machine Learning Languages On GitHubDocument3 pagesThese Are The Top 10 Machine Learning Languages On GitHubAbeer UlfatNo ratings yet

- Marquez Vs Comelec GR 112889Document1 pageMarquez Vs Comelec GR 112889JFA100% (1)

- Purpose: IT System and Services Acquisition Security PolicyDocument12 pagesPurpose: IT System and Services Acquisition Security PolicysudhansuNo ratings yet

- Calimlim Vs RamirezDocument3 pagesCalimlim Vs RamirezMoon BeamsNo ratings yet

- Curran-Santos Complaint FiledDocument32 pagesCurran-Santos Complaint FiledJoe EskenaziNo ratings yet

- NTP Dummy ConfigDocument1 pageNTP Dummy Configastir1234No ratings yet

- LTC Bill Form-G.a.r. 14-cDocument10 pagesLTC Bill Form-G.a.r. 14-cpraveen reddyNo ratings yet

- HL300SDocument128 pagesHL300SElizabeth Octagon100% (1)

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Document1 page5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathNo ratings yet

- Ap04-01 Audit of SheDocument7 pagesAp04-01 Audit of Shenicole bancoroNo ratings yet