Professional Documents

Culture Documents

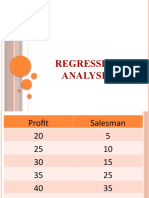

The Regression Model For The Above Problem Could Be Stated As Under

Uploaded by

rhulpandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Regression Model For The Above Problem Could Be Stated As Under

Uploaded by

rhulpandeyCopyright:

Available Formats

Ans (i) :

The regression model for the above problem could be stated as under :

Y= β0 +β1 X+ ε

Where,

The dependant variable Y=Business

X=Advertisement & Publicity Expenditure

β0=Intercept

β1=Slope

ε = error term

Ans (ii) :

Results of ICICI Bank :

We consider the following hypothesis :

H0: There exists a influence on business by Advertisement & Publicity Expenditure

(The null hypothesis)

H1 : No significant change on business by Advertisement & Publicity Expenditure

(The alternative hypothesis)

Using the t stat value for testing of significance, we get :

Calculated t stat value= 0.3534488202

Tabulated value of t stat at (n-1),i.e, 5 degreees of freedom at 95% significance = 2.571

Since the calculated value of tstat is less than the table value of tstat, it shows that the provided regression model is significant.

We now accept the null hypothesis, i.e,

There exists a influence on business by Advertisement & Publicity Expenditure

Now, the results of HDFC Bank:

We consider the following hypothesis :

H0: There exists a influence on business by Advertisement & Publicity Expenditure

(The null hypothesis)

H1 : No significant change on business by Advertisement & Publicity Expenditure

(The alternative hypothesis)

Using the t stat value for testing of significance, we get :

Calculated t stat value= 2.460347159

Tabulated value of t stat at (n-1),i.e, 5 degreees of freedom at 95% significance = 2.571

Since the calculated value of tstat is less than the table value of tstat, it shows that the provided regression model is significant.

We now accept the null hypothesis, i.e,

There exists a influence on business by Advertisement & Publicity Expenditure

Ans (iii) :

As per the scatter diagram & the tstat value, we come to conclusion that the results of icici bank is more strenghtened than compared to HDFC.

The scatter diagram of ICICI bank results shows a more strong correlation where as the low value of tstat 0.353 as compared to 2.46 of HDFC establishes th

Also, the p value of the results of icici bank is higher than that of HDFC & the standard error estimates value is very low as compared to the corresponding va

Ans (iv) :

ICICI BANK :

The required regression equation for estimation as per the calculated values is as follows :

Y=79548.6+483.75X

132.48

Assuming a growth of 20% in expenditure, the Value X will become= 132.48+.20*132.48= 158.976

Therefore the estimated business growth(Y) = 79548.6+483.75*158.976=

156453.24 Approx

HDFC BANK :

The required regression equation for estimation as per the calculated values is as follows :

Y=130835.7+1082.426X

Total Advertisement & Publicity Expenditure in 2011-12= 154.83

Assuming a growth of 20% in expenditure, the Value X will become= 154.83+0.20*154.83= 185.796

Therefore the estimated business growth(Y) = 130835+1082.426*185.796

331945.42 Approx

Regression Analysis Output for ICICI BANK :

Business(Y) Advertisement & Publicity Expenditure(X)

426375.78 217.74

470047.13 207.86

436658.67 140.28

383222.2 110.8

441968.01 148.75

509227.62 132.48

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.1740277286

R Square 0.03028565032

Adjusted R Square -0.2121429371

Standard Error 46693.82886

Observations 6

ANOVA

df SS MS F Significance F

Regression 1 272378012.9

272378012.9

0.1249260685

0.7415936786

Residual 4 8721254614

2180313653

Total 5 8993632627

Coefficients Standard Error t Stat P-value Lower 95%Upper 95%

Intercept 417286.1047 79548.601285.245674945

0.006315781113

196423.78 638148.4293

X Variable 1 170.9793006 483.7455690.3534488202

0.7415936786

-1172.113716

1514.072318

Regression Analysis Output for HDFC BANK :

Business(Y) Advertisement & Publicity Expenditure(X)

115242.72 74.88

164195.5 114.73

241694.63 108.68

293235.03 83.12

368569.08 161.86

442126.48 154.83

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.7759645732

R Square 0.6021210189

Adjusted R Square

0.5026512736

Standard Error86846.14019

Observations 6

ANOVA

df SS MS F Significance F

Regression 1 45655575835

45655575835

6.053308141

0.06966542986

Residual 4 30169008267

7542252067

Total 5 75824584102

Coefficients

Standard Error t Stat P-value Lower 95%Upper 95%Lower 95.0%Upper 95.0%

Intercept -39012.75081130835.7005

-0.2981812355

0.7804121244

-402270.891

324245.3893

-402270.891

324245.3893

X Variable 1 2663.142737 1082.425595

2.460347159

0.06966542986

-342.1525078

5668.437982

-342.1525078

5668.437982

You might also like

- Decision Science - AssignmentDocument6 pagesDecision Science - AssignmentShilpi SinghNo ratings yet

- Regression AnalysisDocument6 pagesRegression Analysisyoonmaythu234No ratings yet

- RegressionDocument4 pagesRegressionNirav DeliwalaNo ratings yet

- Module Four Bivariate RegressionsDocument4 pagesModule Four Bivariate RegressionsYatindra Prakash SinghNo ratings yet

- Sale Force Size (In Thousand Employees) Residual Plot: Regression StatisticsDocument5 pagesSale Force Size (In Thousand Employees) Residual Plot: Regression StatisticsAishwary DubeyNo ratings yet

- 1Document6 pages1prem rajNo ratings yet

- Infra Budget and Econ GrowthDocument7 pagesInfra Budget and Econ Growthsatria setiawanNo ratings yet

- ExcelDocument6 pagesExcelleonaNo ratings yet

- Module Five - Multivariate RegressionsDocument4 pagesModule Five - Multivariate RegressionsYatindra Prakash SinghNo ratings yet

- SPI PredictionDocument13 pagesSPI PredictionSaurabh SharmaNo ratings yet

- Regression AnalsysisDocument9 pagesRegression AnalsysisFarnood RumiNo ratings yet

- Session - 20-Problem Set-Solution - PKDocument43 pagesSession - 20-Problem Set-Solution - PKPANKAJ PAHWANo ratings yet

- Name Praful Jain Sap ID 80303190054 Section BDocument22 pagesName Praful Jain Sap ID 80303190054 Section BJain ChiragNo ratings yet

- Big Data AssignmentDocument8 pagesBig Data Assignmentshruti aroraNo ratings yet

- No. of Years' Experience (X) 1 Performance Score (Y) 0.7342823073672 1Document11 pagesNo. of Years' Experience (X) 1 Performance Score (Y) 0.7342823073672 1Merupranta SaikiaNo ratings yet

- Program Per-Year Tuition ($) Mean Starting Salary Upon Graduation ($) A. at The 0.01Document8 pagesProgram Per-Year Tuition ($) Mean Starting Salary Upon Graduation ($) A. at The 0.01Rachana SontakkeNo ratings yet

- Bel RegresiDocument5 pagesBel RegresiAsepNo ratings yet

- Regression Statistics: Output of Rocinante 36Document5 pagesRegression Statistics: Output of Rocinante 36prakhar jainNo ratings yet

- Marketing Management: Assignment - 1Document8 pagesMarketing Management: Assignment - 1Samarth LahotiNo ratings yet

- B9ZqHTBpXtizFKLec1t3exemplos Modelagem Receita PreenchidoDocument10 pagesB9ZqHTBpXtizFKLec1t3exemplos Modelagem Receita PreenchidoCaio Palmieri TaniguchiNo ratings yet

- 2Document3 pages2lk2022cukaiNo ratings yet

- MGS3100: Exercises - ForecastingDocument8 pagesMGS3100: Exercises - ForecastingJabir ArifNo ratings yet

- A Paper - DS Final Exam With SolutionDocument9 pagesA Paper - DS Final Exam With SolutionDhruvit Pravin Ravatka (PGDM 18-20)No ratings yet

- REGRESSIONDocument3 pagesREGRESSIONAalok GhoshNo ratings yet

- Tugas 1Document10 pagesTugas 1Audita NasutionNo ratings yet

- FM302 Financial Management in The Pacific Region: Week 4: Lecture 7 - Major Assignment Some Discussions and DirectionsDocument15 pagesFM302 Financial Management in The Pacific Region: Week 4: Lecture 7 - Major Assignment Some Discussions and DirectionsHitesh MaharajNo ratings yet

- Analysis Pre FinalDocument64 pagesAnalysis Pre FinalAbhishek ModiNo ratings yet

- A Simple Regression Model With Paint SalesDocument4 pagesA Simple Regression Model With Paint SalesAhmed AbdirahmanNo ratings yet

- Anel Peralta Participation Activity 2Document7 pagesAnel Peralta Participation Activity 2Indira AlfonsoNo ratings yet

- Anel Peralta Participation Activity 2Document7 pagesAnel Peralta Participation Activity 2Indira AlfonsoNo ratings yet

- Anel Peralta Participation Activity 2Document7 pagesAnel Peralta Participation Activity 2Indira AlfonsoNo ratings yet

- Tgs PemodelanDocument13 pagesTgs PemodelanDwi PrayogaNo ratings yet

- Statistics PresentationDocument20 pagesStatistics PresentationChoton AminNo ratings yet

- ClassOf1 Regression Prediction Intervals 8Document7 pagesClassOf1 Regression Prediction Intervals 8ClassOf1.comNo ratings yet

- Regression 07.01.2023Document13 pagesRegression 07.01.2023MONIKA KUMARNo ratings yet

- Decision ScienceDocument8 pagesDecision ScienceHimanshi YadavNo ratings yet

- RegressionDocument6 pagesRegressionian92193No ratings yet

- Analisis Regresi - Citra Amanda (612010122126)Document9 pagesAnalisis Regresi - Citra Amanda (612010122126)Citra AmandaNo ratings yet

- Regression On Gold PricesDocument2 pagesRegression On Gold PricesArbab Niyaz KhanNo ratings yet

- EXCEL Output: Regression StatisticsDocument21 pagesEXCEL Output: Regression StatisticsFranklin NguyenNo ratings yet

- Sasin DECS 434 Session 4 - Rate of Change and BenchmarkingDocument52 pagesSasin DECS 434 Session 4 - Rate of Change and BenchmarkingrawichNo ratings yet

- Regression ModelDocument1 pageRegression Modelapi-3712367No ratings yet

- Tugas Anggaran Perusahaan X y Tahun Ke Penjualan: Regression StatisticsDocument2 pagesTugas Anggaran Perusahaan X y Tahun Ke Penjualan: Regression Statisticsadi anggoroNo ratings yet

- EDADocument9 pagesEDALos BastardosNo ratings yet

- Lampiran Output EviewsDocument11 pagesLampiran Output EviewsGreynaldi GasraNo ratings yet

- Summary Output: Regression StatisticsDocument8 pagesSummary Output: Regression StatisticshesoyamyecgaaaNo ratings yet

- Regression AnalysisDocument11 pagesRegression AnalysisBISHAL AdhikariNo ratings yet

- Section - B - Stock Market Data - ModifiedDocument49 pagesSection - B - Stock Market Data - ModifiedCHINMAY KEKRE Student, Jaipuria IndoreNo ratings yet

- Sagar S QNMDocument6 pagesSagar S QNMsagar gokuNo ratings yet

- Apollo Hospital Specializes in Outpatient Surgeries For Relatively Minor ProceduresDocument3 pagesApollo Hospital Specializes in Outpatient Surgeries For Relatively Minor ProceduresElliot Richard100% (1)

- Total (CF) 17,500,000.0 550,000 5,000,000 550,000 5,000,000 600,000 5,000,000 650,000 5,000,000 700,000 5,000,000 IRR Jumlah 4,450,000Document5 pagesTotal (CF) 17,500,000.0 550,000 5,000,000 550,000 5,000,000 600,000 5,000,000 650,000 5,000,000 700,000 5,000,000 IRR Jumlah 4,450,000Devania PratiwiNo ratings yet

- Assignment - DL Answer 2Document1 pageAssignment - DL Answer 2Ain SherinNo ratings yet

- Regression (Class 3)Document10 pagesRegression (Class 3)Naveera ZahirNo ratings yet

- Excel Sheet 16 March 2021Document4 pagesExcel Sheet 16 March 2021anum fatimaNo ratings yet

- Decision ScienceDocument11 pagesDecision ScienceRachita RajNo ratings yet

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Safari 3Document4 pagesSafari 3Bharti SutharNo ratings yet

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNo ratings yet

- Lady M SolutionDocument4 pagesLady M SolutionRahul VenugopalanNo ratings yet

- Jurnal - Penerapan Model Inquiri Terbimbing Berbasis Scaffolding Metakognitif Upaya Meningkatkan Kemampuan Berpikir Reflektif Matematis Berdasarkan Tahapan Perkembangan Kognitif Siswa SmaDocument17 pagesJurnal - Penerapan Model Inquiri Terbimbing Berbasis Scaffolding Metakognitif Upaya Meningkatkan Kemampuan Berpikir Reflektif Matematis Berdasarkan Tahapan Perkembangan Kognitif Siswa SmaAnissa Listiana MaharaniNo ratings yet

- Infosys Placement Sample Paper 1Document25 pagesInfosys Placement Sample Paper 1RAJESHNo ratings yet

- Multiple Regression PDFDocument19 pagesMultiple Regression PDFSachen KulandaivelNo ratings yet

- SPSS Assignment 3 1.: Paired Samples TestDocument2 pagesSPSS Assignment 3 1.: Paired Samples TestDaniel A Pulido RNo ratings yet

- Predicate (First Order) LogicDocument29 pagesPredicate (First Order) LogicAbG Compilation of VideosNo ratings yet

- ACJC Time - Answer Scheme - Updated 11 Jan 24Document6 pagesACJC Time - Answer Scheme - Updated 11 Jan 24Tan GkNo ratings yet

- Simple Linear RegressionDocument31 pagesSimple Linear Regressiondolly kate cagadasNo ratings yet

- Expert Systems Past Papers CombinedDocument44 pagesExpert Systems Past Papers CombinedGerryNo ratings yet

- Brandom, Robert B - Tales of The Mighty Dead - 2Document221 pagesBrandom, Robert B - Tales of The Mighty Dead - 2vladtarkoNo ratings yet

- Deductive Reasoning: Phil Johnson-LairdDocument10 pagesDeductive Reasoning: Phil Johnson-LairdDylan MoraisNo ratings yet

- Practice On T-Distribution: Exercises For One Sample T-TestDocument4 pagesPractice On T-Distribution: Exercises For One Sample T-TestAlejandro SanhuezaNo ratings yet

- Barretts Taxonomy ColourDocument2 pagesBarretts Taxonomy Colourafnan fathiNo ratings yet

- Lecture11 - REVISION - FINAL EXAMDocument21 pagesLecture11 - REVISION - FINAL EXAMHiền NguyễnNo ratings yet

- Pearson Correlation CoefficientDocument7 pagesPearson Correlation CoefficientRonitsinghthakur SinghNo ratings yet

- One-Way Analysis of VarianceDocument21 pagesOne-Way Analysis of VarianceboodinNo ratings yet

- MMW ActDocument23 pagesMMW ActAngeline Andale MinaNo ratings yet

- Barriers of CommunicationDocument12 pagesBarriers of CommunicationAdamImanNo ratings yet

- Panic!: Breaking Apart The Toefl Reading Section: The 3 Question Types You Need To KnowDocument7 pagesPanic!: Breaking Apart The Toefl Reading Section: The 3 Question Types You Need To KnowSao Nguyễn ToànNo ratings yet

- Chap 6 1&2Document22 pagesChap 6 1&2Douglas AtkinsonNo ratings yet

- Tugas Biostatiska Annisa RahmawatiDocument8 pagesTugas Biostatiska Annisa RahmawatiAnnisa RahmawatiNo ratings yet

- Arguments in Ordinary LanguageDocument5 pagesArguments in Ordinary LanguageStephanie Reyes GoNo ratings yet

- Long Quiz 4th QuarterDocument2 pagesLong Quiz 4th QuarterRhen Degracia Panaligan100% (1)

- Backward Elimination and Stepwise RegressionDocument5 pagesBackward Elimination and Stepwise RegressionNajwa AmellalNo ratings yet

- Quantitative Business (EBC2025), 2020-2021: Statistical FormulasDocument3 pagesQuantitative Business (EBC2025), 2020-2021: Statistical FormulasPaolina NikolovaNo ratings yet

- AnovaDocument2 pagesAnovaapplesbyNo ratings yet

- Linear Regression ModelsDocument3 pagesLinear Regression ModelsMehdi RachdiNo ratings yet

- Heather Walen-Frederick SPSS HandoutDocument13 pagesHeather Walen-Frederick SPSS HandoutshmmalyNo ratings yet

- Gisela Striker - From Aristotle To Cicero - Essays in Ancient Philosophy-Oxford University Press (2022)Document270 pagesGisela Striker - From Aristotle To Cicero - Essays in Ancient Philosophy-Oxford University Press (2022)Juan Pablo Prieto IommiNo ratings yet

- Tarka SamgrahaDocument42 pagesTarka SamgrahaManoj SankaranarayanaNo ratings yet

- 10 TH Grade Vocabulary Worksheets SampleDocument12 pages10 TH Grade Vocabulary Worksheets SampleKenny FongNo ratings yet