Professional Documents

Culture Documents

Fair Price Gold Calculator

Uploaded by

Sacred Mind0 ratings0% found this document useful (0 votes)

57 views8 pagesCopyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views8 pagesFair Price Gold Calculator

Uploaded by

Sacred MindCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 8

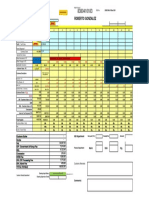

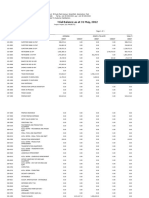

Fair Price Gold Calculator (for India)

INPUT only yellow shaded portion with latest numbers. You will get the Fair price which takes into account Import duty and also Valu

be taking official invoice from the dealer. If you are buying without official bill, reduce Fair Price by 2%. You may compare the price

change the value in greyboxes. They will be automatically calculated

BASIC SAMPLE DATA

CONSTANTS

One Troy Ounce = Constant 31.1035 31.1035

Gold Purity Constant 0.9999 0.9999

Import Duty in Rs/10 gram Constant - Input 100 100

Insurance Cost Constant 0.50% 0.50%

VAT (Vaue Added Tax) Constant - Input 2% 2%

Dealer's Margin (Maximum) Constant - Input 3% 3%

VARIABLES

Gold In. Price $/Troy Ounce - 0.9999 Variable - Input 1,142.00

Gold Px $/ 10 Gram - 0.9999 Formula - Locked 0 367.1613

Exchange Rate Rs/$ Variable - Input 46.3

Gold Price Rs /10 Gram - 0.9999 Formula - Locked 0.00 16,999.57

ADD: Import Duty Formula - Locked 100 100

ADD: Insurance Cost Formula - Locked 0.00 85.00

LANDED COST (CIF in Rs) Formula - Locked 100.00 17,184.56

ADD: Value Added Tax (VAT) Constant 2.00 343.69

ADD: Dealer's Margin in Rs Formula - Locked 3.00 515.54

Fair Price in Rs per 10 Gm - 0.9999 (Inclusive of

Import Duty+ VAT + Dealer's Margin Formula - Locked 105.00 18,043.79

LOCAL GOLD PRICES

Purity Offered in India - X say, 0.9950 Variable - Input 0.9950

Gold Price in Rs /10 Gram - X Purity (Ex- VAT) Variable - Input 17,900.00

Gold Price Equivalent Intl. 0.9999 (Ex-VAT) Formula - Locked #DIV/0! 17,988.15

Gold Price Equivalent Intl. 0.9999 (Inc-VAT) Formula - Locked #DIV/0! 18,331.84

Parity Difference Rs (Local Px - Fair Px) Inc VAT Formula - Locked #DIV/0! 288.05

Parity Difference Rs % (< 2% okay) Formula - Locked #DIV/0! 1.60%

NOTE:Item 30-31 shows amount overcharged.

Negotiate this sum. We are presuming that the

dealer issues his official invoice (inclusive of VAT).

If he does not issue invoice, you are overcharged

even more by VAT already considered in formula

FACTS

Amount Paid by / Required from you (ex-VAT) Variable - Input 35,800.00

Grams bought by / Offered to you Variable - Input 20.00

Amount in Rs/10 grams (ex-VAT) Formula - Locked #DIV/0! 17,900.00

Using this Calculator for other Countries:

Each country has different Import duty, taxation rates, dealer's margin, exchange rates and weight units. If you want to

please do the following:

1. Go to Edit menu, select "Move or Copy sheet", a box will appear.

2. Select "Sheet2" under "Before Sheet", and click box "Creat the copy"

3. Press Okay. Sheet2 will be complete replica of this sheet. It will appear before Sheet2

4. Go to the bottom, and rename the Sheet2 as "Japan" if you are from Japan.

5. Change under "Basic" Item No. 10,12 and 13 as suitable to your country .

6 Copy the changes to all next 4 columns. eg: If Import duty is "0", C10 = 0 and it will be copied to all next 4 columns.

7. Dealer's margin remain same in all countries. If it varies, use that number & Copy to all columns

8. Replace "Rs" with symbols of your currency. eg: If you are in Singapore, go to edit column, use "Replace" function a

9. You are now ready to use this calculator for your Country. Replace title "India" with "your country" before use.

10. CAUTION: Before you use modified sheet for your country, Test it a few times before relying on it. This is IMPORTA

11. This tool is offered for download "without any responsibility or liability on the part of the Author" This is pre-condition

USE IT AT YOUR OWN RISK.

12. Prepared by Kalidas for use on its blog http://anilselarka.com and offered for free download subject to above limita

4. Go to the bottom, and rename the Sheet2 as "Japan" if you are from Japan.

5. Change under "Basic" Item No. 10,12 and 13 as suitable to your country .

6 Copy the changes to all next 4 columns. eg: If Import duty is "0", C10 = 0 and it will be copied to all next 4 columns.

7. Dealer's margin remain same in all countries. If it varies, use that number & Copy to all columns

8. Replace "Rs" with symbols of your currency. eg: If you are in Singapore, go to edit column, use "Replace" function a

9. You are now ready to use this calculator for your Country. Replace title "India" with "your country" before use.

10. CAUTION: Before you use modified sheet for your country, Test it a few times before relying on it. This is IMPORTA

11. This tool is offered for download "without any responsibility or liability on the part of the Author" This is pre-condition

USE IT AT YOUR OWN RISK.

12. Prepared by Kalidas for use on its blog http://anilselarka.com and offered for free download subject to above limita

r (for India)

unt Import duty and also Value Added Tax. It is presumed that you will

. You may compare the price from 3 dealers - Scenario 1 to 3. DO NOT

matically calculated

Scenerio - 1 Scenerio - 2 Scenerio - 3

31.1035 31.1035 31.1035

0.9999 0.9999 0.9999

100 100 100

0.50% 0.50% 0.50%

2% 2% 2%

3% 3% 3%

0.0000 0.0000 0.0000

0.00 0.00 0.00

100 100 100

0.00 0.00 0.00

100.00 100.00 100.00

2.00 2.00 2.00

3.00 3.00 3.00

105.00 105.00 105.00

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

weight units. If you want to tailor this calculator for your country,

pied to all next 4 columns. DO NOT FORGET to copy

olumns

n, use "Replace" function and replace Rs with SGD or S$

country" before use.

ying on it. This is IMPORTANT

Author" This is pre-condition before use.

oad subject to above limitations

pied to all next 4 columns. DO NOT FORGET to copy

olumns

n, use "Replace" function and replace Rs with SGD or S$

country" before use.

ying on it. This is IMPORTANT

Author" This is pre-condition before use.

oad subject to above limitations

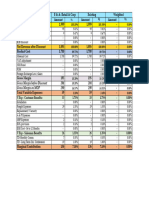

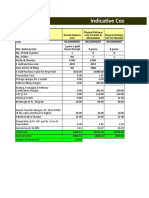

Fair Price Gold Calculator (for Singapore)

INPUT only yellow shaded portion with latest numbers. You will get the Fair price which takes into account Import duty and also Valu

be taking official invoice from the dealer. If you are buying without official bill, reduce Fair Price by 2%. You may compare the price

change the value in greyboxes. They will be automatically calculated

BASIC SAMPLE DATA

CONSTANTS

One Troy Ounce = Constant 31.1035 31.1035

Gold Purity Constant 0.9999 0.9999

Import Duty in S$/10 gram Constant - Input 0 0

Insurance Cost Constant 0.50% 0.50%

VAT (Vaue Added Tax) Constant - Input 7% 7%

Dealer's Margin (Maximum) Constant - Input 3% 3%

VARIABLES

Gold In. Price $/Troy Ounce - 0.9999 Variable - Input 1,142.00

Gold Px $/ 10 Gram - 0.9999 Formula - Locked 0 367.1613

Exchange Rate S$/$ Variable - Input 1.3869

Gold Price S$ /10 Gram - 0.9999 Formula - Locked 0.00 509.22

ADD: Import Duty Formula - Locked 0 0

ADD: Insurance Cost Formula - Locked 0.00 2.55

LANDED COST (CIF in S$) Formula - Locked 0.00 511.76

ADD: Value Added Tax (VAT) Constant 0.00 35.82

ADD: Dealer's Margin in S$ Formula - Locked 0.00 15.35

Fair Price in S$ per 10 Gm - 0.9999 (Inclusive of

Import Duty+ VAT + Dealer's Margin (Fair Price) Formula - Locked 0.00 562.94

LOCAL GOLD PRICES

Purity Offered in Singapore - X say, 0.9950 Variable - Input 0.9999

Gold Price in S$ /10 Gram - X Purity (Ex- VAT) Variable - Input 535.00

Gold Price Equivalent Intl. 0.9999 (Ex-VAT) Formula - Locked #DIV/0! 535.00

Gold Price Equivalent Intl. 0.9999 (Inc-VAT) Formula - Locked #DIV/0! 570.82

Parity Difference S$ (Local Px - Fair Px) Inc VAT Formula - Locked #DIV/0! 7.89

Parity Difference S$ % (< 2% okay) Formula - Locked #DIV/0! 1.40%

NOTE:Item 30-31 shows amount overcharged.

Negotiate this sum. We are presuming that the

dealer issues his official invoice (inclusive of VAT).

If he does not issue invoice, you are overcharged

even more by VAT already considered in formula

FACTS

Amount Paid by / Required from you (ex-VAT) Variable - Input 535.00

Grams bought by / Offered to you Variable - Input 10.00

Amount in S$/10 grams (ex-VAT) Formula - Locked #DIV/0! 535.00

Using this Calculator for other Countries:

Each country has different Import duty, taxation rates, dealer's margin, exchange rates and weight units. If you want to

please do the following:

1. Go to Edit menu, select "Move or Copy sheet", a box will appear.

2. Select "Sheet2" under "Before Sheet", and click box "Creat the copy"

3. Press Okay. Sheet2 will be complete replica of this sheet. It will appear before Sheet2

4. Go to the bottom, and rename the Sheet2 as "Japan" if you are from Japan.

5. Change under "Basic" Item No. 10,12 and 13 as suitable to your country .

6 Copy the changes to all next 4 columns. eg: If Import duty is "0", C10 = 0 and it will be copied to all next 4 columns.

7. Dealer's margin remain same in all countries. If it varies, use that number & Copy to all columns

8. Replace "Rs" with symbols of your currency. eg: If you are in Singapore, go to edit column, use "Replace" function a

9. You are now ready to use this calculator for your Country. Replace title "India" with "your country" before use.

10. CAUTION: Before you use modified sheet for your country, Test it a few times before relying on it. This is IMPORTA

11. This tool is offered for download "without any responsibility or liability on the part of the Author" This is pre-condition

USE IT AT YOUR OWN RISK.

12. Prepared by Kalidas for use on its blog http://anilselarka.com and offered for free download subject to above limita

4. Go to the bottom, and rename the Sheet2 as "Japan" if you are from Japan.

5. Change under "Basic" Item No. 10,12 and 13 as suitable to your country .

6 Copy the changes to all next 4 columns. eg: If Import duty is "0", C10 = 0 and it will be copied to all next 4 columns.

7. Dealer's margin remain same in all countries. If it varies, use that number & Copy to all columns

8. Replace "Rs" with symbols of your currency. eg: If you are in Singapore, go to edit column, use "Replace" function a

9. You are now ready to use this calculator for your Country. Replace title "India" with "your country" before use.

10. CAUTION: Before you use modified sheet for your country, Test it a few times before relying on it. This is IMPORTA

11. This tool is offered for download "without any responsibility or liability on the part of the Author" This is pre-condition

USE IT AT YOUR OWN RISK.

12. Prepared by Kalidas for use on its blog http://anilselarka.com and offered for free download subject to above limita

or Singapore)

unt Import duty and also Value Added Tax. It is presumed that you will

. You may compare the price from 3 dealers - Scenario 1 to 3. DO NOT

matically calculated

Scenerio - 1 Scenerio - 2 Scenerio - 3

31.1035 31.1035 31.1035

0.9999 0.9999 0.9999

0 0 0

0.50% 0.50% 0.50%

7% 7% 7%

3% 3% 3%

0.0000 0.0000 0.0000

0.00 0.00 0.00

0 0 0

0.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

weight units. If you want to tailor this calculator for your country,

pied to all next 4 columns. DO NOT FORGET to copy

olumns

n, use "Replace" function and replace Rs with SGD or S$

country" before use.

ying on it. This is IMPORTANT

Author" This is pre-condition before use.

oad subject to above limitations

pied to all next 4 columns. DO NOT FORGET to copy

olumns

n, use "Replace" function and replace Rs with SGD or S$

country" before use.

ying on it. This is IMPORTANT

Author" This is pre-condition before use.

oad subject to above limitations

You might also like

- R & D Converter: InputsDocument6 pagesR & D Converter: InputsKarthi KeyanNo ratings yet

- Usman Institute of TechnologyDocument4 pagesUsman Institute of TechnologyHafsa ParkerNo ratings yet

- R&D Expense Converter SpreadsheetDocument5 pagesR&D Expense Converter SpreadsheetJosé Manuel EstebanNo ratings yet

- HMITagsDocument6 pagesHMITagsTruong Huy ThinhNo ratings yet

- هايبر وان للتجارة-70089Document2 pagesهايبر وان للتجارة-70089Muhammed QutopNo ratings yet

- DHL KE CUSTOMS DUTY CALCULATION WORKSHEETDocument1 pageDHL KE CUSTOMS DUTY CALCULATION WORKSHEETJose MartinNo ratings yet

- WacccalcDocument41 pagesWacccalcHellery FilhoNo ratings yet

- REF Price Approval FEB 11 2024_25 March 2024 - CopyDocument1 pageREF Price Approval FEB 11 2024_25 March 2024 - Copymahmoodrasel228No ratings yet

- As 22 With IfrsDocument21 pagesAs 22 With IfrsraunakkrjindalNo ratings yet

- Costing For E GoldDocument2 pagesCosting For E Goldashish_kumar488No ratings yet

- Hp0183jc - Dicavi - MXP - Mty - 3125 KgsDocument1 pageHp0183jc - Dicavi - MXP - Mty - 3125 Kgsরীযোড্াম তীদযোNo ratings yet

- ECO 101 Problem Set #4 Short-Run Costs & Factor InputsDocument6 pagesECO 101 Problem Set #4 Short-Run Costs & Factor InputsSanaa2510No ratings yet

- Trading Summary Profit and LossDocument1 pageTrading Summary Profit and LossSHEIKHAYUBNo ratings yet

- M9 U2 A3 ANAS Subejercicio-SobreejercicioDocument30 pagesM9 U2 A3 ANAS Subejercicio-SobreejercicioLaura ArandaNo ratings yet

- Marketplace Profit CalculatorDocument2 pagesMarketplace Profit CalculatorVIVEK KOKATENo ratings yet

- Apuração Mensal Analítica - Com DadosDocument77 pagesApuração Mensal Analítica - Com DadosSidney PaivaNo ratings yet

- M9 U2 A3 AKMC Subejercicio SobrejercicioDocument49 pagesM9 U2 A3 AKMC Subejercicio SobrejercicioArmando Ramirez100% (1)

- Copia de U2 A3 Estados Financieros Subejercicio Sobre EjercicioDocument9 pagesCopia de U2 A3 Estados Financieros Subejercicio Sobre Ejerciciosamuel HernandezNo ratings yet

- READ ME: Spreadsheet Guide: Only WhiteDocument17 pagesREAD ME: Spreadsheet Guide: Only WhiteNicholas LutfiNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- 3 NGDMS CR FCS HPCDocument13 pages3 NGDMS CR FCS HPCkaryabersama dumaiNo ratings yet

- Order Number: 16425877: Invoice TimeDocument3 pagesOrder Number: 16425877: Invoice TimeNilesh SethNo ratings yet

- ProjectionReport_20240331Document3 pagesProjectionReport_20240331IaM Rajesh RajNo ratings yet

- NR26Q Q2Document82 pagesNR26Q Q2Sachin KumarNo ratings yet

- BU BS CF 2018. ProjekcijeDocument3 pagesBU BS CF 2018. ProjekcijeMerjema SalatovicNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Purchase InvoiceDocument156 pagesPurchase Invoicefahaddar_88No ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- Trade Log and Performance AnalysisDocument921 pagesTrade Log and Performance AnalysissachinNo ratings yet

- BusinessPlan 2022 01 31Document13 pagesBusinessPlan 2022 01 31Komal GuptaNo ratings yet

- Special Provisions Appendix For Amendment To The 2020 Standard Specifications For Highway Construction UpdatedDocument3 pagesSpecial Provisions Appendix For Amendment To The 2020 Standard Specifications For Highway Construction UpdatedRashedul KabirNo ratings yet

- GST Numericals2Document11 pagesGST Numericals2Kautilya VithobaNo ratings yet

- Professionl Tax Challan (Employee)Document2 pagesProfessionl Tax Challan (Employee)ssca111No ratings yet

- Mr. White Champion IndustriesDocument9 pagesMr. White Champion IndustriesPrabhuNo ratings yet

- Integra - Business Case GeneratorDocument27 pagesIntegra - Business Case GeneratorAmigo SecretoNo ratings yet

- April2023BOQ 12621Document6 pagesApril2023BOQ 12621Rishya ShringaNo ratings yet

- VAT Return InstructionsDocument6 pagesVAT Return Instructionsnasar_kottopadamNo ratings yet

- Investment Declaration Guidelines SummaryDocument1 pageInvestment Declaration Guidelines SummarySunny KhavleNo ratings yet

- Trial Balance As at 31 May, 2022Document10 pagesTrial Balance As at 31 May, 2022Mae Ann AguilaNo ratings yet

- Invoice of 44500Document1 pageInvoice of 44500Partho BoraNo ratings yet

- Topic 3 Options Shorter VersionDocument29 pagesTopic 3 Options Shorter VersionAngie Natalia Llanos MarinNo ratings yet

- ExportDocument8 pagesExportamousaNo ratings yet

- Instructions and Data Sheet for Agri Gold Loan ProposalDocument233 pagesInstructions and Data Sheet for Agri Gold Loan Proposalsundara ramanNo ratings yet

- MBill 9789772009 MAY '09Document11 pagesMBill 9789772009 MAY '09SkreddyNo ratings yet

- VAT 201 - VAT Returns: Taxable Person DetailsDocument2 pagesVAT 201 - VAT Returns: Taxable Person Detailsankit surtiNo ratings yet

- India Budget Highlights Finance Bill, 2021Document861 pagesIndia Budget Highlights Finance Bill, 2021vaishnavi aNo ratings yet

- Important - Addendum For New DropShip and FBLDocument4 pagesImportant - Addendum For New DropShip and FBLDee PingNo ratings yet

- Value Added TaxDocument56 pagesValue Added TaxMinh TragNo ratings yet

- Trial Balance: Margaria - Keziasulistio - 5150111005Document3 pagesTrial Balance: Margaria - Keziasulistio - 5150111005Kezia SulistioNo ratings yet

- A8ZUYZ9tReL58evU5E2S EXCEL Stock Analysis Spreadsheet 10YR 2021 Vers 3.1Document13 pagesA8ZUYZ9tReL58evU5E2S EXCEL Stock Analysis Spreadsheet 10YR 2021 Vers 3.1Santhosh KumarNo ratings yet

- 1701-E-000438 Eyevex 50000Document1 page1701-E-000438 Eyevex 50000Manoj GaikwadNo ratings yet

- Boq MX960Document6 pagesBoq MX960Vaibhav SinghNo ratings yet

- CBS 1000007234Document1 pageCBS 1000007234tarekNo ratings yet

- All India CW Pricelist Wef 01.05.2021Document6 pagesAll India CW Pricelist Wef 01.05.2021Sameer PadhyNo ratings yet

- Fundamentals of VATDocument30 pagesFundamentals of VATNikhil YadavNo ratings yet

- Flujo de Caja Por InversionesDocument25 pagesFlujo de Caja Por InversionesAlesso RossiNo ratings yet

- G2C Service Revenue and Tax ReportDocument10 pagesG2C Service Revenue and Tax ReportTilak ChattopadhyayNo ratings yet

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeNo ratings yet

- The Difference Between Great and Near GreatDocument3 pagesThe Difference Between Great and Near GreatSacred MindNo ratings yet

- The Best Time To Change - Right NowDocument2 pagesThe Best Time To Change - Right NowSacred MindNo ratings yet

- The Danger of DenialDocument3 pagesThe Danger of DenialSacred MindNo ratings yet

- Letting Go PDFDocument3 pagesLetting Go PDFSacred MindNo ratings yet

- The Best Advice I Ever ReceivedDocument3 pagesThe Best Advice I Ever ReceivedSacred MindNo ratings yet

- Is Winning Everything?Document3 pagesIs Winning Everything?Sacred MindNo ratings yet

- Stop in The Name of LeadershipDocument3 pagesStop in The Name of LeadershipSacred MindNo ratings yet

- Stuck On Suck-UpsDocument3 pagesStuck On Suck-UpsSacred MindNo ratings yet

- It's Hard To Leave PDFDocument3 pagesIt's Hard To Leave PDFSacred MindNo ratings yet

- Why Sharing Information is Better than WithholdingDocument3 pagesWhy Sharing Information is Better than WithholdingSacred MindNo ratings yet

- Making A Resolution That Matters PDFDocument3 pagesMaking A Resolution That Matters PDFSacred MindNo ratings yet

- Bashing The BossDocument3 pagesBashing The BossSacred MindNo ratings yet

- Let It Go PDFDocument3 pagesLet It Go PDFSacred MindNo ratings yet

- Questions That Make A Difference Every DayDocument3 pagesQuestions That Make A Difference Every DaySacred MindNo ratings yet

- Making A Resolution That Matters PDFDocument3 pagesMaking A Resolution That Matters PDFSacred MindNo ratings yet

- It's Hard To Leave PDFDocument3 pagesIt's Hard To Leave PDFSacred MindNo ratings yet

- Let It Go PDFDocument3 pagesLet It Go PDFSacred MindNo ratings yet

- Top 20 Bad Leadership BehaviorsDocument4 pagesTop 20 Bad Leadership BehaviorsSacred MindNo ratings yet

- IsWinningEverything PDFDocument3 pagesIsWinningEverything PDFSacred MindNo ratings yet

- Making A Resolution That Matters PDFDocument3 pagesMaking A Resolution That Matters PDFSacred MindNo ratings yet

- Enthusiasm Is Contagious PDFDocument2 pagesEnthusiasm Is Contagious PDFSacred MindNo ratings yet

- Choosing ChangeDocument3 pagesChoosing ChangeSacred MindNo ratings yet

- Behave Yourself: Alent Anagement AgazineDocument3 pagesBehave Yourself: Alent Anagement AgazineSacred MindNo ratings yet

- Letting Go PDFDocument3 pagesLetting Go PDFSacred MindNo ratings yet

- Acting Like A Professional orDocument3 pagesActing Like A Professional orSacred MindNo ratings yet

- A Conversation About TalentDocument3 pagesA Conversation About TalentSacred MindNo ratings yet

- 16 Things You Should Do at The End of Every Work DayDocument4 pages16 Things You Should Do at The End of Every Work DaySacred MindNo ratings yet

- PMBOK 4th Edition Changes To 3rd Edition 082308Document7 pagesPMBOK 4th Edition Changes To 3rd Edition 082308edserrot4134No ratings yet

- Blindsided!: Talent Management Magazine, Marshall Goldsmith LogoDocument2 pagesBlindsided!: Talent Management Magazine, Marshall Goldsmith LogoSacred MindNo ratings yet

- Creative Communication-Tips For Workplace PDFDocument6 pagesCreative Communication-Tips For Workplace PDFGraceNo ratings yet

- IE00B18GC888Document4 pagesIE00B18GC888a28hzNo ratings yet

- Emerging Trends and Comparative Analysis of Retail in IndiaDocument83 pagesEmerging Trends and Comparative Analysis of Retail in IndiaSyed Shadab Ali100% (1)

- FOREX PIPS CHASER - Powerful Strategy To Capture 150+ Pips With Less Than 10 MinutesDocument25 pagesFOREX PIPS CHASER - Powerful Strategy To Capture 150+ Pips With Less Than 10 MinutesMohd Yazel Md Sabiai100% (1)

- MGT201 Fall 2006 Assignment 08 SolutionDocument2 pagesMGT201 Fall 2006 Assignment 08 SolutionEdahwati HalimNo ratings yet

- Pas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition MeasurementDocument4 pagesPas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition Measurementmarilyn wallaceNo ratings yet

- Volume Vs Open InterestDocument17 pagesVolume Vs Open InterestVivek AryaNo ratings yet

- Randall's Advertising & Sales Promotion Case Study AnalysisDocument6 pagesRandall's Advertising & Sales Promotion Case Study Analysiskiller dramaNo ratings yet

- CowlDocument3 pagesCowlPrasetyo Indra SuronoNo ratings yet

- Direct Marketing Personal SellingDocument22 pagesDirect Marketing Personal SellingShruti bansodeNo ratings yet

- Chapter 8 StuDocument24 pagesChapter 8 StuLakshman RaoNo ratings yet

- File 86Document4 pagesFile 86itik meowmeowNo ratings yet

- Magic Formula White PaperDocument5 pagesMagic Formula White PaperOld School Value100% (3)

- Marketing Plan of AarongDocument64 pagesMarketing Plan of AarongInjamulAhmedShad100% (1)

- Ozzy Paradise Operational PlanDocument3 pagesOzzy Paradise Operational PlanSuresh KumarNo ratings yet

- Introduction To Consumer Behaviour 1: Sesión 2Document2 pagesIntroduction To Consumer Behaviour 1: Sesión 2Alejandro Cruz OsorioNo ratings yet

- Consulting Case: Business TurnaroundDocument72 pagesConsulting Case: Business TurnaroundJerryJoshuaDiazNo ratings yet

- Business PlanDocument3 pagesBusiness PlanEricka Mae TayamoraNo ratings yet

- Stock Market Crash and An Individual Inv PDFDocument7 pagesStock Market Crash and An Individual Inv PDFSaloni Jain 1820343No ratings yet

- Invoice Emergency LightDocument1 pageInvoice Emergency LightAyush BhartiNo ratings yet

- Pricing Meaning, Objectives, Factors & PoliciesDocument56 pagesPricing Meaning, Objectives, Factors & Policiespankajdeshwal@gmail.comNo ratings yet

- SST Holiday Homework 2022Document14 pagesSST Holiday Homework 2022Bunny XingqiuNo ratings yet

- Afar FCDocument2 pagesAfar FCRyan Julius RullanNo ratings yet

- Emerging Europe ReportDocument49 pagesEmerging Europe ReportSandra ValentimNo ratings yet

- Marijuana Life Sciences Index Etf: HorizonsDocument4 pagesMarijuana Life Sciences Index Etf: HorizonsAlex CajelaisNo ratings yet

- Grab Food Food Panda RRL LDocument4 pagesGrab Food Food Panda RRL LAui PauNo ratings yet

- International Financial Management-1Document180 pagesInternational Financial Management-1Ramu LaxmanNo ratings yet

- Industrial Environment: Chapter OutlineDocument13 pagesIndustrial Environment: Chapter OutlineRevti sainNo ratings yet

- Economics Course Summary Module 1-3Document23 pagesEconomics Course Summary Module 1-3monkaratNo ratings yet

- Black Book On Competitive Analysis On Customer Relationship Management of Shoppers Stop V/s WestsideDocument89 pagesBlack Book On Competitive Analysis On Customer Relationship Management of Shoppers Stop V/s WestsideNeha DaveNo ratings yet

- KOSPI Market Business Regulation (20170208) PDFDocument103 pagesKOSPI Market Business Regulation (20170208) PDFusamaali12No ratings yet