Professional Documents

Culture Documents

Banking Breakdown

Uploaded by

jnn sOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Breakdown

Uploaded by

jnn sCopyright:

Available Formats

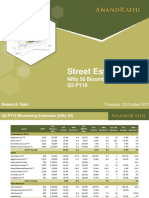

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 17 July 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Mandiri Universe 3,720,575.4 187,305.6 256,075.8 -26.0% 36.7% 19.9 14.5 13.3 11.6 2.1 1.9 3.4% 2.5% 10.5% 13.7% 15.4 15.3 -8.2% 13.3% 24.4% 21.6%

Banking 1,384,653.7 63,760.1 102,414.4 -34.2% 60.6% 21.7 13.5 N.A. N.A. 2.0 1.8 3.2% 1.6% 9.2% 14.2% N.A. N.A. N.A. N.A. N.A. N.A.

BCA BBCA Neutral 24,655 30,600 26,500 754,443.2 22,167.0 29,780.8 -22.4% 34.3% 34.0 25.3 N.A. N.A. 4.3 3.8 1.8% 1.2% 12.6% 15.9% N.A. N.A. N.A. N.A. N.A. N.A.

BNI BBNI Buy 18,649 4,670 5,900 87,089.2 7,073.2 15,323.1 -54.0% 116.6% 12.3 5.7 N.A. N.A. 0.8 0.7 4.4% 2.0% 6.2% 13.3% N.A. N.A. N.A. N.A. N.A. N.A.

BRI BBRI Buy 123,299 3,100 3,000 382,225.4 20,228.8 35,698.8 -41.1% 76.5% 18.9 10.7 N.A. N.A. 2.0 1.7 5.4% 1.6% 10.2% 17.3% N.A. N.A. N.A. N.A. N.A. N.A.

BTN BBTN Buy 10,590 1,305 1,350 13,820.0 1,235.9 1,554.0 490.6% 25.7% 11.2 8.9 N.A. N.A. 0.8 0.7 4.1% 2.1% 6.0% 8.6% N.A. N.A. N.A. N.A. N.A. N.A.

Danamon BDMN Buy 9,585 2,750 4,000 26,357.6 2,703.0 4,751.6 -33.6% 75.8% 9.8 5.5 N.A. N.A. 0.6 0.5 5.4% 3.6% 6.0% 10.0% N.A. N.A. N.A. N.A. N.A. N.A.

Bank BJB BJBR Buy 9,839 910 860 8,953.3 1,260.1 1,438.1 -19.2% 14.1% 7.1 6.2 N.A. N.A. 0.8 0.8 10.3% 10.3% 11.0% 12.8% N.A. N.A. N.A. N.A. N.A. N.A.

Bank Jatim BJTM Buy 14,918 540 590 8,101.3 1,145.5 1,434.0 -16.8% 25.2% 7.1 5.6 N.A. N.A. 0.8 0.8 8.9% 9.0% 12.2% 14.4% N.A. N.A. N.A. N.A. N.A. N.A.

CIMB Niaga BNGA Buy 25,132 780 840 19,602.7 2,340.1 4,211.1 -35.8% 80.0% 8.4 4.7 N.A. N.A. 0.5 0.5 7.4% 4.8% 5.6% 10.1% N.A. N.A. N.A. N.A. N.A. N.A.

BNLI BNLI Sell 28,016 1,275 430 35,754.5 908.9 1,494.2 -39.4% 64.4% 39.3 23.9 N.A. N.A. 1.5 1.4 0.0% 0.0% 3.8% 6.0% N.A. N.A. N.A. N.A. N.A. N.A.

Panin PNBN Buy 24,088 815 1,100 19,631.4 1,976.2 3,507.7 -40.4% 77.5% 9.9 5.6 N.A. N.A. 0.5 0.4 0.0% 0.0% 4.8% 8.3% N.A. N.A. N.A. N.A. N.A. N.A.

BTPS BTPS Buy 7,704 3,190 3,200 24,574.8 1,188.9 1,547.0 -15.1% 30.1% 20.7 15.9 N.A. N.A. 3.9 3.2 1.1% 1.0% 20.3% 22.2% N.A. N.A. N.A. N.A. N.A. N.A.

BFI Finance BFIN Buy 15,967 274 900 4,100.2 1,532.3 1,674.1 6.4% 9.2% 2.7 2.4 N.A. N.A. 0.5 0.4 10.5% 11.2% 19.8% 18.8% N.A. N.A. N.A. N.A. N.A. N.A.

Construction & materials 169,580.6 8,209.4 11,196.3 -33.4% 36.4% 20.7 15.1 11.7 9.5 1.3 1.2 2.0% 1.7% 6.0% 8.2% 17.0 9.2 -3.3% 24.4% 138.1% 138.8%

Indocement INTP Buy 3,681 12,175 14,500 44,819.0 1,672.7 2,003.1 -8.9% 19.8% 26.8 22.4 12.0 10.5 1.9 1.8 1.4% 1.3% 7.1% 8.1% 18.8 13.0 -7.0% 9.9% -34.5% -39.5%

Semen Indonesia SMGR Buy 5,932 9,350 11,020 55,459.7 2,520.2 2,824.6 5.4% 12.1% 22.0 19.6 9.1 8.5 1.6 1.6 2.2% 1.7% 7.6% 8.1% 14.5 9.4 1.6% 3.1% 69.0% 56.5%

Adhi Karya ADHI Neutral 3,561 635 1,120 2,261.1 618.8 592.6 -6.8% -4.2% 3.7 3.8 4.1 4.2 0.4 0.3 5.9% 5.5% 9.4% 9.1% 6.9 2.3 -2.2% -5.4% 68.0% 66.4%

Pembangunan Perumahan PTPP Buy 6,200 985 2,050 6,106.9 980.6 1,320.0 2.4% 34.6% 6.2 4.6 5.1 4.8 0.6 0.5 4.7% 4.8% 8.1% 11.5% 2.1 6.8 11.4% 14.2% 59.6% 69.1%

Wijaya Karya WIKA Buy 8,960 1,250 2,500 11,200.3 1,670.8 1,871.3 -17.2% 12.0% 6.7 6.0 5.1 3.6 0.7 0.7 3.0% 3.3% 10.6% 11.7% 3.4 5.6 13.9% 20.6% 33.5% 14.8%

Waskita Karya WSKT Buy 13,574 725 1,010 9,701.2 (947.9) (869.1) N/M 8.3% -10.2 -11.2 21.9 17.6 0.9 0.9 -2.0% -1.8% -6.5% -8.1% 1.6 3.9 -6.6% 27.2% 546.0% 749.7%

Wijaya Karya Beton WTON Buy 8,715 300 700 2,614.6 585.5 677.5 14.3% 15.7% 4.5 3.9 3.3 2.9 0.7 0.6 5.9% 6.7% 16.6% 16.9% 1.8 5.5 2.5% 14.1% 23.1% 21.2%

Waskita Beton WSBP Buy 26,361 208 360 5,483.1 842.4 954.5 4.5% 13.3% 6.5 5.7 5.7 5.1 0.7 0.6 7.4% 7.7% 10.3% 11.0% 1.9 4.9 8.4% 11.4% 54.7% 50.1%

Jasa Marga JSMR Buy 7,258 4,400 5,900 31,934.6 266.1 1,821.7 -87.9% 584.6% 120.0 17.5 23.8 12.6 1.7 1.6 1.4% 0.2% 1.4% 9.4% -2.4 25.9 -26.6% 101.0% 385.2% 408.4%

Consumer staples 942,472.7 40,952.4 51,121.3 -15.5% 24.8% 23.0 18.4 15.1 12.3 4.9 4.4 3.7% 3.2% 21.8% 25.4% 18.6 17.6 -17.8% 22.1% -2.1% -5.6%

Indofood CBP ICBP Buy 11,662 9,275 10,300 108,164.2 5,388.7 6,005.4 6.9% 11.4% 20.1 18.0 11.8 11.0 3.8 3.4 2.3% 2.5% 20.1% 20.1% 15.9 14.6 5.7% 5.4% -30.1% -33.2%

Indofood INDF Buy 8,781 6,550 8,450 57,508.7 5,244.9 5,573.3 6.9% 6.3% 11.0 10.3 7.1 6.5 1.4 1.3 4.2% 4.5% 13.4% 13.2% 9.2 8.3 -9.9% 8.6% 13.9% 11.1%

Mayora MYOR Buy 22,359 2,220 2,650 49,637.0 2,861.3 2,744.6 43.9% -4.1% 17.3 18.1 12.3 11.0 4.2 3.7 1.5% 2.2% 26.7% 21.8% 51.5 10.4 15.7% 7.5% 35.8% 12.6%

Unilever UNVR Buy 38,150 8,125 9,500 309,968.8 7,495.3 8,037.7 1.4% 7.2% 41.4 38.6 29.5 27.3 61.1 58.6 2.4% 2.4% 144.7% 155.1% 39.6 32.6 -3.4% 7.9% 65.3% 44.8%

Gudang Garam GGRM Buy 1,924 49,600 63,450 95,434.8 7,421.7 10,320.8 -31.8% 39.1% 12.9 9.2 8.4 6.6 1.8 1.6 5.2% 5.2% 14.2% 18.4% 7.4 14.7 -26.3% 31.7% 19.1% 24.0%

HM. Sampoerna HMSP Buy 116,318 1,840 2,400 214,025.3 8,342.4 13,384.0 -39.2% 60.4% 25.7 16.0 20.0 11.9 7.0 6.0 6.3% 3.8% 25.2% 40.4% 21.6 15.8 -44.4% 64.5% -42.9% -54.9%

Kalbe Farma KLBF Buy 46,875 1,465 1,650 68,672.1 2,763.6 2,985.1 10.2% 8.0% 24.8 23.0 16.9 15.4 3.9 3.6 2.0% 2.2% 16.6% 16.4% 19.0 22.4 3.8% 8.8% -20.7% -21.7%

Sido Muncul SIDO Buy 15,000 1,210 1,450 18,150.0 871.8 946.7 7.9% 8.6% 20.8 19.2 15.4 14.2 5.7 5.4 4.0% 4.6% 27.8% 29.0% 20.4 18.8 1.1% 8.6% -29.4% -29.5%

Multi Bintang MLBI Buy 2,107 9,925 14,650 20,912.0 562.7 1,123.8 -53.3% 99.7% 37.2 18.6 18.8 12.1 26.0 15.3 4.3% 2.7% 57.7% 103.6% 13.3 24.2 -42.8% 52.9% 16.4% -17.5%

Healthcare 50,211.7 1,041.8 1,270.7 3.5% 22.0% 48.2 39.5 16.5 14.0 3.8 3.5 0.1% 0.2% 8.0% 9.2% 26.0 23.4 9.2% 16.5% -12.0% -16.9%

Mitra Keluarga MIKA Buy 14,551 2,280 2,600 33,175.7 693.1 815.4 -5.1% 17.6% 47.9 40.7 32.1 26.7 7.1 6.4 0.0% 0.0% 15.4% 16.5% 43.0 40.7 -3.4% 19.4% -29.7% -32.0%

Siloam Hospital SILO Buy 1,625 5,050 7,150 8,206.3 44.4 100.1 107.0% 125.6% 184.9 82.0 6.8 5.4 1.3 1.3 0.0% 0.0% 0.7% 1.6% 13.5 12.0 16.6% 13.9% -16.0% -25.9%

Hermina HEAL Buy 2,973 2,970 5,200 8,829.8 304.3 355.2 19.4% 16.7% 29.0 24.9 10.9 9.6 3.9 3.4 0.8% 0.9% 14.1% 14.6% 16.1 13.6 17.3% 16.2% 36.4% 37.5%

Consumer discretionary 301,856.2 18,209.0 25,232.8 -39.6% 38.6% 16.6 12.0 9.4 8.4 1.5 1.4 4.2% 2.9% 9.3% 12.2% 5.0 11.8 -18.2% 11.2% 19.8% 17.8%

Ace Hardware Indonesia ACES Neutral 17,150 1,635 1,500 28,040.3 710.8 1,055.3 -31.0% 48.5% 39.5 26.6 30.4 21.6 5.7 5.0 1.8% 1.3% 14.7% 20.0% 22.9 49.7 -31.7% 40.4% -39.6% -38.1%

Matahari Department Store LPPF Buy 2,918 1,350 1,800 3,939.2 50.4 496.7 -96.3% 884.6% 78.1 7.9 6.6 2.6 2.2 1.7 0.0% 0.4% 2.8% 24.4% 56.4 4.8 -78.5% 116.9% -58.8% -70.2%

MAP Aktif MAPA Buy 2,850 2,250 3,850 6,413.4 54.4 606.1 -92.1% 1013.2% 117.8 10.6 16.1 5.5 2.1 1.8 0.0% 0.3% 1.8% 18.0% 11.1 31.3 -71.2% 193.3% -35.8% -33.0%

Mitra Adiperkasa MAPI Buy 16,600 700 1,000 11,620.0 (1,704.4) 543.3 N/M N/M -6.8 21.4 -113.6 7.2 2.8 2.4 1.8% 0.0% -32.8% 12.1% -13.0 14.6 N/M N/M 39.5% 52.1%

Ramayana RALS Buy 7,096 565 700 4,009.2 (131.9) 142.9 N/M N/M -30.4 28.1 -45.7 9.6 1.1 1.1 9.5% -2.1% -3.5% 3.9% -32.1 11.1 N/M N/M -45.9% -54.3%

Erajaya Swasembada ERAA Buy 3,190 1,455 1,500 4,641.5 140.3 355.3 -52.5% 153.2% 33.1 13.1 14.0 9.1 0.9 0.9 0.6% 1.5% 2.9% 7.0% -104.3 8.1 -25.5% 52.7% 52.2% 47.6%

Astra International ASII Buy 40,484 5,200 5,000 210,514.5 14,709.9 17,215.6 -32.2% 17.0% 14.3 12.2 9.1 9.2 1.4 1.3 4.6% 3.1% 9.8% 10.9% 3.8 12.2 -9.3% -0.5% 25.5% 24.5%

Surya Citra Media SCMA Buy 14,622 1,235 1,800 18,188.7 1,565.6 1,693.2 35.7% 8.1% 11.6 10.7 8.1 7.7 3.1 2.8 6.0% 6.5% 28.6% 27.4% 11.4 9.9 29.8% 2.8% -13.6% -16.3%

Media Nusantara Citra MNCN Buy 13,047 900 2,200 11,163.4 2,427.2 2,593.1 24.1% 6.8% 4.6 4.3 3.4 3.0 0.8 0.7 3.3% 3.5% 19.7% 18.0% 4.7 4.2 16.9% 3.6% 16.7% 2.5%

MNC Studios MSIN Buy 5,202 256 650 1,331.7 267.2 315.5 16.3% 18.1% 5.0 4.2 2.9 2.8 0.9 0.8 10.0% 11.8% 18.5% 19.8% 3.7 6.3 15.9% 13.8% -5.7% 1.9%

Sarimelati Kencana PZZA Buy 3,022 660 900 1,994.4 119.4 215.7 -40.3% 80.6% 16.7 9.2 6.3 4.6 1.5 1.3 5.0% 3.0% 8.8% 15.0% 9.4 5.2 -23.7% 43.5% 7.8% 12.9%

Commodities 232,157.5 21,423.8 22,942.2 -11.8% 7.1% 10.8 10.1 4.1 3.7 1.0 0.9 3.6% 3.7% 9.4% 9.6% 5.1 5.5 -9.7% 2.3% -2.2% -10.7%

United Tractors UNTR Buy 3,730 18,450 22,500 68,821.0 8,961.5 9,194.8 -20.8% 2.6% 7.7 7.5 3.4 2.9 1.1 1.0 3.9% 4.0% 14.6% 13.6% 6.1 4.9 -14.7% 1.3% -8.8% -20.1%

Adaro (USD) ADRO Neutral 31,986 1,155 1,350 36,943.8 372.2 353.0 -7.9% -5.2% 6.9 7.4 2.9 2.7 0.7 0.6 5.1% 4.7% 9.7% 8.7% 3.5 3.5 -6.9% -4.1% 4.2% -4.7%

Harum Energy (USD) HRUM Neutral 2,661 1,210 1,300 3,105.6 17.4 13.6 -5.9% -21.7% 12.5 16.1 0.3 0.0 0.7 0.7 4.4% 3.4% 5.5% 4.2% 6.0 8.9 -2.4% -13.7% -93.3% -96.3%

Indika Energy (USD) INDY Neutral 5,210 975 910 5,079.9 1.6 6.4 N/M 286.9% 215.5 56.2 1.7 1.3 0.4 0.4 0.1% 0.4% 0.2% 0.7% 0.9 1.4 -14.4% 2.4% 27.6% 9.0%

Indo Tambangraya Megah (USD) ITMG Neutral 1,108 7,850 10,450 8,608.0 100.2 101.0 -20.8% 0.9% 6.0 6.0 1.7 1.6 0.7 0.7 14.1% 14.1% 11.4% 11.4% 2.2 3.8 -16.1% 0.9% -29.8% -32.5%

Bukit Asam PTBA Neutral 11,523 2,140 2,350 24,658.2 3,481.8 3,496.3 -18.3% 0.4% 7.0 7.0 4.4 4.3 1.3 1.3 10.6% 10.6% 18.8% 18.3% 5.3 6.8 -12.6% 1.5% -21.7% -21.2%

Antam ANTM Buy 24,031 660 700 15,860.3 (21.8) 196.7 N/M N/M -728.4 80.6 13.4 12.3 0.7 0.7 0.0% 0.4% -0.1% 0.9% 26.3 12.0 -29.1% 8.0% 16.3% 14.1%

Vale Indonesia (USD) INCO Buy 9,936 3,200 3,500 31,796.3 87.8 132.7 53.0% 51.1% 25.3 16.9 7.2 5.8 1.1 1.0 0.0% 0.0% 4.4% 6.3% 8.4 11.1 13.8% 17.0% -21.6% -25.6%

Timah TINS Neutral 7,448 640 670 4,766.6 (419.9) 246.4 31.3% N/M -11.4 19.3 37.2 9.1 0.9 0.9 -3.1% 1.8% -8.1% 4.6% 1.7 4.1 -53.0% 289.3% 149.7% 134.5%

Merdeka Copper Gold (USD) MDKA Buy 21,360 1,485 1,450 32,517.9 79.8 85.1 9.9% 6.6% 28.5 27.0 10.2 9.4 4.0 3.5 0.0% 0.0% 15.0% 13.8% 22.6 13.2 4.6% 1.9% 25.4% -5.3%

Property & Industrial Estate 85,826.1 7,211.0 9,743.6 -4.7% 35.1% 11.9 8.8 8.6 7.9 0.7 0.6 2.4% 2.0% 5.7% 7.2% -247.4 12.4 4.8% 8.7% 31.5% 29.4%

Alam Sutera Realty ASRI Sell 19,649 134 80 2,633.0 150.1 938.1 -85.2% 524.8% 17.5 2.8 6.8 5.3 0.2 0.2 1.5% 1.5% 1.4% 8.5% 4.4 2.5 -19.6% 19.4% 66.7% 57.5%

Bumi Serpong Damai BSDE Buy 21,171 745 1,160 15,772.7 1,398.9 2,049.5 -54.4% 46.5% 11.3 7.7 9.6 9.0 0.5 0.5 0.0% 0.6% 4.6% 6.3% -15.9 -15.3 -9.0% 10.7% 23.9% 24.3%

Ciputra Development CTRA Buy 18,560 645 1,120 11,971.4 831.7 1,094.2 -28.2% 31.5% 14.4 10.9 9.8 8.4 0.7 0.7 1.2% 1.1% 5.3% 6.6% 71.4 17.4 -17.2% 17.1% 33.6% 31.6%

Jaya Real Property JRPT Buy 13,750 418 670 5,747.5 997.4 1,064.6 -1.9% 6.7% 5.8 5.4 5.1 4.5 0.7 0.6 4.6% 0.1% 13.4% 12.7% 227.2 5.2 1.0% 6.2% -6.3% -9.2%

Pakuwon Jati PWON Buy 48,160 424 670 20,419.7 1,791.2 2,394.9 -34.1% 33.7% 11.4 8.5 7.6 6.1 1.2 1.1 1.4% 1.4% 11.4% 13.7% 8.2 6.3 -20.5% 22.7% -0.5% -5.9%

Summarecon Agung SMRA Buy 14,427 590 960 8,511.8 419.8 603.6 -18.5% 43.8% 20.3 14.1 9.9 8.9 1.1 1.0 0.8% 0.8% 5.6% 7.6% 18.6 7.5 -1.7% 9.4% 96.6% 85.2%

Lippo Karawaci LPKR Neutral 70,592 141 200 9,953.5 73.9 391.2 N/M 429.7% 134.8 25.4 10.6 10.8 0.3 0.3 0.7% 0.7% 0.3% 1.4% -2.1 -33.5 334.6% 2.5% 46.4% 49.0%

Puradelta Lestari DMAS Buy 48,198 200 390 9,639.6 1,441.4 1,085.7 81.9% -24.7% 6.7 8.9 6.2 8.5 1.4 1.3 12.0% 10.1% 20.8% 15.2% 9.2 10.7 91.2% -25.5% -9.7% -6.6%

Bekasi Fajar BEST Neutral 9,647 122 130 1,177.0 106.6 121.8 -72.0% 14.2% 11.0 9.7 6.0 8.7 0.3 0.3 2.9% 0.8% 2.4% 2.6% 2.2 9.9 -25.6% -26.1% 26.0% 29.1%

Telco 431,747.6 23,251.8 25,821.1 -10.4% 11.1% 18.6 16.7 6.2 5.7 2.8 2.6 4.4% 4.6% 15.0% 16.2% 6.1 5.5 4.1% 9.4% 102.6% 102.5%

EXCEL EXCL Buy 10,688 2,850 3,400 30,460.7 2,037.3 912.4 185.9% -55.2% 15.0 33.4 6.1 5.9 1.5 1.4 0.7% 2.0% 10.2% 4.3% 5.4 5.1 19.5% 8.4% 211.5% 215.2%

Telkom TLKM Buy 99,062 3,060 3,800 303,130.4 18,519.6 20,942.4 -5.0% 13.1% 16.4 14.5 5.6 5.1 2.9 2.8 5.5% 5.5% 17.9% 19.7% 5.9 5.2 1.4% 8.6% 38.4% 37.3%

Indosat ISAT Buy 5,434 2,560 3,000 13,910.9 (1,760.4) (1,027.0) N/M 41.7% -7.9 -13.5 5.1 4.5 1.3 1.4 0.0% 0.0% -14.9% -9.8% 2.4 2.1 0.7% 18.6% 303.5% 367.3%

Link Net LINK Buy 3,043 2,040 5,500 5,940.0 979.9 1,017.3 -3.3% 3.8% 6.2 5.9 2.8 2.6 1.1 1.0 8.2% 8.6% 19.3% 18.2% 3.2 2.9 4.9% 4.6% 9.4% 5.3%

REDS- Research Equity Database System Page 1 of 2

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 17 July 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Tower Bersama TBIG Buy 22,657 1,125 1,250 24,334.9 1,007.6 1,193.5 23.0% 18.4% 24.2 20.4 11.2 10.5 4.5 4.1 2.5% 2.5% 19.4% 20.9% 12.4 12.3 7.3% 6.7% 444.5% 411.3%

Sarana Menara TOWR Buy 51,015 1,075 1,070 53,970.7 2,467.7 2,782.5 0.1 0.1 21.9 19.4 11.9 10.9 5.4 4.7 0.0 2.2% 26.4% 25.8% 12.7 13.1 11.6% 8.1% 185.3% 155.0%

Chemical 1,748.0 135.7 163.2 29.5% 20.3% 12.9 10.7 6.0 5.4 0.5 0.5 0.0% 0.0% 4.2% 4.8% 4.9 4.5 4.4% 6.3% 69.9% 60.4%

Aneka Gas AGII Buy 3,067 570 700 1,748.0 135.7 163.2 29.5% 20.3% 12.9 10.7 6.0 5.4 0.5 0.5 0.0% 0.0% 4.2% 4.8% 4.9 4.5 4.4% 6.3% 69.9% 60.4%

Airlines 2,428.1 539.7 836.7 30.0% 55.0% 4.5 2.9 4.1 2.5 0.4 0.4 0.0% 0.0% 9.8% 13.9% 3.9 1.1 29.4% 20.4% 65.0% 32.3%

GMF AeroAsia (USD) GMFI Neutral 28,234 86 275 2,428.1 37.8 59.0 26.1% 56.3% 4.5 2.9 4.1 2.5 0.4 0.4 0.0% 0.0% 10.1% 13.9% 4.1 1.1 25.5% 21.4% 65.0% 32.3%

Transportation 2,464.6 (175.2) 251.0 -155.7% N/M -14.1 9.8 10.6 4.3 0.5 0.5 -1.8% 2.5% -3.3% 4.8% 4.7 3.5 -70.1% N/M 5.4% 21.2%

Blue Bird BIRD Buy 2,502 985 1,700 2,464.6 (175.2) 251.0 N/M N/M -14.1 9.8 10.6 4.3 0.5 0.5 -1.8% 2.5% -3.3% 4.8% 4.7 3.5 -70.1% 217.9% 5.4% 21.2%

Poultry 115,428.6 2,746.2 5,082.7 -50.5% 85.1% 42.0 22.7 17.7 12.2 3.3 3.0 1.8% 1.0% 8.0% 13.8% 114.0 9.6 -31.4% 36.8% 42.2% 21.1%

Charoen Pokphand Indonesia CPIN Buy 16 6,125 5,500 100,437.8 2,057.7 3,377.9 -43.4% 64.2% 48.8 29.7 25.1 18.0 4.7 4.2 1.5% 0.9% 9.7% 14.8% 83.4 14.7 -31.9% 33.6% 18.3% -2.6%

Japfa Comfeed JPFA Buy 12 1,160 1,100 13,602.8 645.8 1,565.6 -63.4% 142.4% 21.1 8.7 8.5 5.4 1.2 1.1 3.8% 1.4% 5.9% 13.4% -23.7 2.9 -32.6% 43.9% 82.8% 58.3%

Malindo Feedmill MAIN Buy 2 620 675 1,388.0 42.7 139.2 -72.0% 225.6% 32.5 10.0 5.9 4.7 0.6 0.6 1.0% 3.2% 2.0% 6.4% 3.6 2.8 -18.7% 24.1% 73.8% 69.5%

Note : - *) means Company Data is using Bloomberg Data

- (USD) means Account under USD (USD Cents for Per Share Data)

- N/M means Not Meaningful

- N.A. means Not Applicable

REDS- Research Equity Database System Page 2 of 2

You might also like

- (Please Make This Viral) "THE PRESENT LAW FORBIDS" Member Banks of The Federal Reserve System To Transact Banking Business, Except...Document2 pages(Please Make This Viral) "THE PRESENT LAW FORBIDS" Member Banks of The Federal Reserve System To Transact Banking Business, Except...in1or95% (20)

- Age of The MajorityDocument3 pagesAge of The MajoritylandmarkchurchofhoustonNo ratings yet

- Secretary's Certificate Sample Additional Paid Up CapitalDocument1 pageSecretary's Certificate Sample Additional Paid Up CapitalBilly Arupo100% (4)

- Currency Trader Magazine 2011-08Document34 pagesCurrency Trader Magazine 2011-08Lascu Roman0% (1)

- 92-FIRST PB-AUD ExamDocument11 pages92-FIRST PB-AUD ExamReynaldo corpuzNo ratings yet

- DCF Valuation and WACC CalculationDocument1 pageDCF Valuation and WACC CalculationJennifer Langton100% (1)

- Veil-Piercing Unbound: Reconceiving Piercing via Constructive TrustDocument49 pagesVeil-Piercing Unbound: Reconceiving Piercing via Constructive TrustSalome BeradzeNo ratings yet

- Kathleen Gilles Seidel Mirrors and MistakesDocument114 pagesKathleen Gilles Seidel Mirrors and MistakesSeetal Sunassee60% (10)

- Matriks Valuasi Saham 18 May 2020Document2 pagesMatriks Valuasi Saham 18 May 2020hendarwinNo ratings yet

- Matriks Valuasi Saham 22 Juni 2020 PDFDocument2 pagesMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiNo ratings yet

- Equity Valuation and Financial Ratios of Major Indonesian CompaniesDocument2 pagesEquity Valuation and Financial Ratios of Major Indonesian CompaniesKadek ArdianaNo ratings yet

- Equity Valuation and Financial Ratios for Indonesian CompaniesDocument2 pagesEquity Valuation and Financial Ratios for Indonesian CompaniessrijokoNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Document6 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaNo ratings yet

- Matriks Valuasi Saham Syariah 23112020Document2 pagesMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aNo ratings yet

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliNo ratings yet

- Equity Valuation Metrics and Ratings for Top Indonesian CompaniesDocument1 pageEquity Valuation Metrics and Ratings for Top Indonesian CompanieshendarwinNo ratings yet

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinNo ratings yet

- Matrix Valuasi Saham Syariah 1 Mar 21Document1 pageMatrix Valuasi Saham Syariah 1 Mar 21haji atinNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- Analysis of stock valuation metrics and financial ratiosDocument34 pagesAnalysis of stock valuation metrics and financial ratiosAmri RijalNo ratings yet

- Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersDocument1 pageFigure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersEno CasmiNo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Ambuja Cements 1QCY10 Results Update EBITDA GrowthDocument8 pagesAmbuja Cements 1QCY10 Results Update EBITDA Growth张迪No ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- Nifty50 Q2 FY18 Quarterly EstimatesDocument8 pagesNifty50 Q2 FY18 Quarterly Estimatessrinivas NNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- 2019 Q4 Financial Statement ENDocument17 pages2019 Q4 Financial Statement ENPinkky GithaNo ratings yet

- DBS Group│Singapore Banks Flash Note│July 31, 2013Document6 pagesDBS Group│Singapore Banks Flash Note│July 31, 2013phuawlNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Reino Unido - AlexisDocument8 pagesReino Unido - AlexisAalexiis Ignacio TorresNo ratings yet

- Portfolio SnapshotDocument63 pagesPortfolio Snapshotgurudev21No ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- Financial Model - Customize ItDocument46 pagesFinancial Model - Customize ItShujat AliNo ratings yet

- Business Valuation - ROTIDocument21 pagesBusiness Valuation - ROTITEDY TEDYNo ratings yet

- CASA growth and robust liquidity drive BCA's strong 1H20 resultsDocument3 pagesCASA growth and robust liquidity drive BCA's strong 1H20 resultsErica ZulianaNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- Analisa Agen No RepeatDocument1 pageAnalisa Agen No Repeatirfan edisonNo ratings yet

- Banks - Sector Update - 22 Dec 21Document86 pagesBanks - Sector Update - 22 Dec 21Kaushal ShahNo ratings yet

- Coal Heat RateDocument38 pagesCoal Heat Rateanon_116184023No ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- TMW Co. Ltd Financial ProjectionsDocument15 pagesTMW Co. Ltd Financial ProjectionsgabegwNo ratings yet

- Roches ExcelDocument4 pagesRoches ExcelJaydeep SheteNo ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- FORECAST ANALYSISDocument12 pagesFORECAST ANALYSISWbok ZapztwvNo ratings yet

- UPS1Document6 pagesUPS1Joana BarbaronaNo ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Valuation ModelsDocument11 pagesValuation ModelsPIYA THAKURNo ratings yet

- Bronch AdDocument23 pagesBronch AdAbdelrahman NazmiNo ratings yet

- Malaysia Banking 070322Document31 pagesMalaysia Banking 070322yennielimclNo ratings yet

- PORTFOLIO_PERFORMANCEDocument51 pagesPORTFOLIO_PERFORMANCEgurudev21No ratings yet

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullNo ratings yet

- Chair & TableDocument10 pagesChair & TableDushyant PratapNo ratings yet

- NAG_FijiDocument20 pagesNAG_Fijiwilliamlord8No ratings yet

- XLS EngDocument4 pagesXLS EngShubhangi JainNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- TS - MSCI Indonesia Nov-21 Rebalancing PreviewDocument6 pagesTS - MSCI Indonesia Nov-21 Rebalancing PreviewAdri KhosasihNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Nifty 50 Quarterly Estimates Q4FY23Document9 pagesNifty 50 Quarterly Estimates Q4FY23gann wolfNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Flash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking StatementDocument3 pagesFlash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking Statementjnn sNo ratings yet

- Flash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20Document2 pagesFlash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20jnn sNo ratings yet

- Flash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20Document2 pagesFlash - Perusahaan Gas Negara: Read-Across From Operational Data in May - Jun-20jnn sNo ratings yet

- AnalisaDocument10 pagesAnalisajnn sNo ratings yet

- STATADocument58 pagesSTATARiska GrabeelNo ratings yet

- Fire & Consequential Loss Insurance 57Document15 pagesFire & Consequential Loss Insurance 57surjith rNo ratings yet

- S11&12 StudentDocument14 pagesS11&12 StudentSameer MajhiNo ratings yet

- Accounting Concepts and Principles ExplainedDocument4 pagesAccounting Concepts and Principles ExplainedNicoleMendozaNo ratings yet

- Taking A Gamble?: The Valuation EditionDocument20 pagesTaking A Gamble?: The Valuation EditionSiddhu AroraNo ratings yet

- Income Tax NotesDocument17 pagesIncome Tax NotesShafiqMuhammad100% (1)

- UTI and Reliance Capital: India's leading financial organizationsDocument4 pagesUTI and Reliance Capital: India's leading financial organizationsKarishma KolheNo ratings yet

- International Accounting StandardsDocument67 pagesInternational Accounting Standardsshah md musleminNo ratings yet

- General Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshDocument47 pagesGeneral Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshMoyan HossainNo ratings yet

- EGG PAPER Summarizes DeFi Opportunities via COCORICOS PlatformDocument6 pagesEGG PAPER Summarizes DeFi Opportunities via COCORICOS Platformwendi royNo ratings yet

- Laporan Keuangan Konsolidasi: Suatu: Pengantar Oleh: Atik Isniawati, SE, Ak., M.SiDocument41 pagesLaporan Keuangan Konsolidasi: Suatu: Pengantar Oleh: Atik Isniawati, SE, Ak., M.Siniken diahNo ratings yet

- JiksDocument3 pagesJiksmelinda skiNo ratings yet

- Waguespack and Flores Introduce Sunshine Ordinance To Improve Transparency and Accessibility of TIF Redevelopment AgreementsDocument5 pagesWaguespack and Flores Introduce Sunshine Ordinance To Improve Transparency and Accessibility of TIF Redevelopment AgreementsjkalvenNo ratings yet

- CHECKLIST Goods-2Document4 pagesCHECKLIST Goods-2Jea-an Bala-onNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- Miami Shores Village - Police-Minutes 1-29-2019.revDocument4 pagesMiami Shores Village - Police-Minutes 1-29-2019.reval_crespoNo ratings yet

- Date: November 9, 2020: Bill To: Wuhan Fiberhome International Technologies Philippines, LNCDocument2 pagesDate: November 9, 2020: Bill To: Wuhan Fiberhome International Technologies Philippines, LNCMartine Amos AntonioNo ratings yet

- Tesla Inc - Research CaseDocument8 pagesTesla Inc - Research CaseJui ShindeNo ratings yet

- Rental Agreement - 1Document2 pagesRental Agreement - 1Shridha AgarwalNo ratings yet

- A+Framework+for+CRM WinerDocument19 pagesA+Framework+for+CRM Winerjoki90No ratings yet

- Amandeep Singh Dang: Career ObjectiveDocument3 pagesAmandeep Singh Dang: Career Objectiveamandeep singhNo ratings yet

- Public-Private Partnerships in Health-The Northern Samar ExperienceDocument25 pagesPublic-Private Partnerships in Health-The Northern Samar ExperienceADB Health Sector GroupNo ratings yet