Professional Documents

Culture Documents

Matriks Valuasi Saham Syariah 23112020

Uploaded by

Naikerretaapi Sempit'aOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matriks Valuasi Saham Syariah 23112020

Uploaded by

Naikerretaapi Sempit'aCopyright:

Available Formats

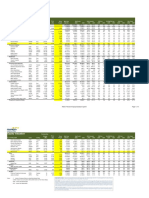

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 20 November 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Mandiri Universe 4,125,952.0 184,652.5 256,813.4 -26.9% 39.1% 22.3 16.1 14.6 12.4 2.3 2.1 3.0% 2.3% 10.1% 13.5% 16.1 16.8 -11.7% 17.1% 25.1% 22.8%

Banking 31,585.2 1,188.9 1,547.0 -35.2% 60.6% 26.1 16.2 N.A. N.A. 2.4 2.1 2.5% 1.3% 9.0% 13.9% N.A. N.A. N.A. N.A. N.A. N.A.

BTPS BTPS Buy 7,704 4,100 3,200 31,585.2 1,188.9 1,547.0 -15.1% 30.1% 26.6 20.4 N.A. N.A. 5.0 4.1 0.9% 0.8% 20.3% 22.2% N.A. N.A. N.A. N.A. N.A. N.A.

Construction & materials 183,491.2 5,503.8 9,328.3 -73.2% 132.8% 58.6 25.2 16.3 11.9 1.5 1.5 1.5% 0.9% 2.5% 5.9% -2,483.3 12.6 -21.8% 38.9% 146.4% 149.2%

Indocement INTP Buy 3,681 14,400 14,500 53,009.7 1,672.7 2,003.1 -8.9% 19.8% 31.7 26.5 14.7 12.9 2.2 2.1 1.2% 1.1% 7.1% 8.1% 22.2 15.4 -7.0% 9.9% -34.5% -39.5%

Semen Indonesia SMGR Buy 5,932 11,350 11,020 67,322.8 2,520.2 2,824.6 5.4% 12.1% 26.7 23.8 10.5 9.8 2.0 1.9 1.8% 1.4% 7.6% 8.1% 17.6 11.5 1.6% 3.1% 69.0% 56.5%

Adhi Karya ADHI Buy 3,561 920 810 3,276.0 105.1 360.5 -84.2% 243.0% 31.2 9.1 9.4 7.2 0.6 0.5 4.1% 0.6% 1.7% 6.1% 7.7 7.6 -21.7% 32.7% 132.6% 144.3%

Pembangunan Perumahan PTPP Buy 6,200 1,150 1,370 7,129.9 218.9 753.8 -76.5% 244.3% 32.6 9.5 10.5 6.9 0.6 0.6 3.9% 0.9% 1.8% 6.1% 14.1 10.3 -33.1% 55.9% 52.3% 49.1%

Wijaya Karya WIKA Buy 8,960 1,425 1,680 12,768.3 561.1 1,158.6 -75.4% 106.5% 22.8 11.0 8.8 6.8 0.9 0.8 0.9% 1.8% 3.9% 7.7% 8.9 11.8 -21.7% 38.7% 39.0% 45.9%

Wijaya Karya Beton WTON Buy 8,715 318 500 2,771.5 284.8 437.8 -44.4% 53.7% 9.7 6.3 4.3 3.1 0.8 0.7 5.5% 3.1% 8.3% 11.6% 2.7 2.8 -20.6% 29.0% 20.3% 10.8%

Waskita Beton WSBP Buy 26,361 214 195 5,641.3 (115.3) 82.9 N/M N/M -48.9 68.1 21.2 15.0 0.8 0.8 7.1% 0.0% -1.5% 1.1% 9.2 6.2 -64.8% 39.6% 82.1% 85.2%

Jasa Marga JSMR Buy 7,258 4,350 5,690 31,571.7 256.3 1,706.9 -88.4% 566.0% 123.2 18.5 25.3 12.6 1.7 1.6 1.4% 0.2% 1.4% 8.9% -2.4 27.6 -31.1% 113.8% 385.7% 410.5%

Consumer staples 625,457.8 25,372.4 26,808.5 -14.8% 25.0% 22.0 17.6 14.1 11.6 4.7 4.3 3.8% 3.3% 22.0% 25.5% 17.3 16.7 -15.8% 21.1% -2.9% -6.8%

Indofood CBP ICBP Buy 11,662 10,100 12,050 117,785.3 5,977.0 6,319.2 18.6% 5.7% 19.7 18.6 11.6 11.3 4.1 3.7 2.1% 2.5% 22.1% 20.8% 15.9 14.7 16.9% 1.2% -32.2% -35.8%

Indofood INDF Buy 8,781 7,225 9,950 63,435.2 5,919.1 6,306.6 20.6% 6.5% 10.7 10.1 6.6 6.2 1.5 1.4 3.8% 4.6% 15.0% 14.7% 9.1 8.3 3.3% 5.6% 11.5% 7.5%

Mayora MYOR Buy 22,359 2,480 2,600 55,450.3 2,413.2 2,190.5 21.4% -9.2% 23.0 25.3 15.7 14.5 4.9 4.4 1.4% 1.6% 23.0% 18.3% 42.2 13.0 0.5% 4.6% 33.2% 13.1%

Unilever UNVR Buy 38,150 7,725 9,700 294,708.8 7,419.9 8,138.5 0.3% 9.7% 39.7 36.2 27.9 25.6 58.9 54.7 2.5% 2.5% 144.3% 156.7% 37.6 30.5 -2.8% 8.7% 68.4% 42.8%

Kalbe Farma KLBF Buy 46,875 1,495 1,900 70,078.3 2,731.1 2,842.4 9.0% 4.1% 25.7 24.7 17.4 16.5 4.0 3.7 1.9% 2.0% 16.4% 15.7% 18.6 23.9 2.5% 5.3% -21.6% -21.9%

Sido Muncul SIDO Buy 30 800 980 24,000.0 912.1 1,011.4 12.9% 10.9% 26.3 23.7 19.7 17.7 7.4 7.1 3.1% 3.7% 29.0% 30.7% 28.8 24.0 6.1% 11.5% -27.3% -26.7%

Healthcare 53,604.6 841.9 1,080.4 30.2% 28.3% 63.7 49.6 22.4 18.1 4.1 3.9 0.1% 0.1% 6.7% 8.1% 30.5 26.5 -9.5% 22.9% -6.8% -10.3%

Mitra Keluarga MIKA Buy 14,551 2,430 2,750 35,358.3 546.6 658.6 -25.1% 20.5% 64.7 53.7 42.6 34.3 7.8 7.1 0.0% 0.0% 12.4% 13.9% 51.4 50.0 -22.2% 23.6% -28.3% -30.5%

Siloam Hospital SILO Buy 1,625 4,880 5,950 7,930.0 (44.0) 22.2 87.0% N/M -180.3 357.0 10.8 8.4 1.3 1.3 0.0% 0.0% -0.7% 0.4% 17.4 12.0 -16.3% 23.9% -4.9% -9.4%

Hermina HEAL Buy 2,973 3,470 4,000 10,316.3 339.3 399.6 32.9% 17.8% 30.4 25.8 13.1 10.8 4.2 3.7 0.3% 0.5% 14.8% 15.2% 16.8 15.7 15.1% 21.5% 29.7% 24.3%

Consumer discretionary 319,990.3 21,131.7 25,531.1 -29.5% 22.8% 15.6 12.7 10.9 8.6 1.6 1.5 3.8% 3.1% 10.8% 12.5% 4.9 13.0 -25.2% 26.8% 16.7% 15.6%

Ace Hardware Indonesia ACES Neutral 17,150 1,635 1,500 28,040.3 710.8 1,055.3 -31.0% 48.5% 39.5 26.6 30.4 21.6 5.7 5.0 1.8% 1.3% 14.7% 20.0% 22.9 49.7 -31.7% 40.4% -39.6% -38.1%

Matahari Department Store LPPF Buy 2,918 1,050 1,800 3,063.8 50.4 496.7 -96.3% 884.6% 60.7 6.2 4.6 1.7 1.7 1.3 0.0% 0.5% 2.8% 24.4% 43.9 3.7 -78.5% 116.9% -58.8% -70.2%

MAP Aktif MAPA Buy 2,850 2,400 3,850 6,841.0 54.4 606.1 -92.1% 1013.2% 125.6 11.3 17.3 5.9 2.2 1.9 0.0% 0.2% 1.8% 18.0% 11.9 33.3 -71.2% 193.3% -35.8% -33.0%

Mitra Adiperkasa MAPI Buy 16,600 785 1,000 13,031.0 (1,704.4) 543.3 N/M N/M -7.6 24.0 -124.3 7.8 3.1 2.7 1.6% 0.0% -32.8% 12.1% -14.5 16.4 N/M N/M 39.5% 52.1%

Astra International ASII Buy 40,484 5,725 6,300 231,768.3 17,762.5 18,097.9 -18.2% 1.9% 13.0 12.8 10.8 9.2 1.5 1.4 4.2% 3.4% 11.7% 11.2% 3.9 12.8 -19.4% 18.6% 22.4% 21.7%

Surya Citra Media SCMA Buy 14,622 1,495 1,800 22,017.9 1,565.6 1,693.2 35.7% 8.1% 14.1 13.0 9.8 9.4 3.7 3.4 5.0% 5.4% 28.6% 27.4% 13.7 12.0 29.8% 2.8% -13.6% -16.3%

Media Nusantara Citra MNCN Buy 13,047 920 2,200 11,411.5 2,427.2 2,593.1 24.1% 6.8% 4.7 4.4 3.5 3.0 0.9 0.7 3.2% 3.4% 19.7% 18.0% 4.8 4.3 16.9% 3.6% 16.7% 2.5%

MNC Studios MSIN Buy 5,202 298 650 1,550.2 267.2 315.5 16.3% 18.1% 5.8 4.9 3.4 3.2 1.0 0.9 8.6% 10.2% 18.5% 19.8% 4.3 7.3 15.9% 13.8% -5.7% 1.9%

Sarimelati Kencana PZZA Buy 3,022 750 750 2,266.4 (2.1) 129.9 N/M N/M -1,098.5 17.4 12.4 6.6 1.8 1.7 4.4% 0.0% -0.2% 10.0% 49.2 6.6 -55.1% 91.1% 11.9% 15.7%

Commodities 290,108.4 21,056.9 25,414.5 -13.3% 20.7% 13.8 11.4 5.1 4.4 1.2 1.2 2.9% 3.3% 9.2% 10.6% 6.2 6.6 -10.5% 9.4% -3.1% -10.9%

United Tractors UNTR Buy 3,730 21,300 31,700 79,451.9 7,172.4 10,603.3 -36.6% 47.8% 11.1 7.5 4.4 3.2 1.3 1.1 2.7% 4.0% 11.8% 15.8% 7.3 5.6 -25.1% 26.7% -10.3% -17.8%

Adaro (USD) ADRO Neutral 31,986 1,215 1,350 38,862.9 372.2 353.0 -7.9% -5.2% 7.3 7.8 3.1 2.9 0.7 0.7 4.8% 4.5% 9.7% 8.7% 3.7 3.6 -6.9% -4.1% 4.2% -4.7%

Harum Energy (USD) HRUM Neutral 2,661 2,290 1,300 5,877.6 17.4 13.6 -5.9% -21.7% 23.6 30.4 6.1 6.8 1.3 1.3 2.3% 1.8% 5.5% 4.2% 11.4 16.8 -2.4% -13.7% -93.3% -96.3%

Indika Energy (USD) INDY Neutral 5,210 1,170 910 6,095.9 1.6 6.4 N/M 286.9% 258.6 67.4 1.9 1.5 0.5 0.5 0.1% 0.4% 0.2% 0.7% 1.1 1.7 -14.4% 2.4% 27.6% 9.0%

Indo Tambangraya Megah (USD) ITMG Neutral 1,108 10,150 10,450 11,130.0 100.2 101.0 -20.8% 0.9% 7.8 7.8 2.7 2.5 0.9 0.9 10.9% 10.9% 11.4% 11.4% 2.9 4.9 -16.1% 0.9% -29.8% -32.5%

Bukit Asam PTBA Neutral 11,523 2,190 2,350 25,234.3 3,481.8 3,496.3 -18.3% 0.4% 7.2 7.2 4.5 4.4 1.3 1.3 10.3% 10.4% 18.8% 18.3% 5.4 6.9 -12.6% 1.5% -21.7% -21.2%

Antam ANTM IJ Buy 24,031 1,210 1,300 29,077.2 1,106.7 1,320.2 470.9% 19.3% 26.3 22.0 10.8 10.1 1.3 1.3 1.3% 1.6% 5.5% 5.8% 16.3 12.3 45.8% 3.7% 12.1% 7.4%

Vale Indonesia (USD) INCO IJ Neutral 9,936 4,560 4,000 45,309.7 102.5 106.3 78.6% 3.7% 30.9 30.1 9.7 9.3 1.6 1.5 0.0% 0.0% 5.1% 5.1% 11.8 14.0 19.6% 0.1% -21.8% -27.2%

Timah TINS Neutral 7,448 1,105 800 8,229.8 (111.2) 356.6 81.8% N/M -74.0 23.1 19.6 10.8 1.5 1.4 -0.5% 1.5% -2.1% 6.3% 2.6 8.5 10.8% 78.4% 137.5% 125.1%

Merdeka Copper Gold (USD) MDKA Buy 21,360 1,865 2,100 40,839.0 64.1 99.4 -11.8% 55.2% 44.6 29.0 14.2 10.8 5.1 4.4 0.0% 0.0% 12.2% 16.4% 31.2 15.9 -6.0% 23.4% 27.5% -8.1%

Property & Industrial Estate 99,410.3 5,687.8 8,369.1 -28.9% 52.0% 19.2 12.6 11.5 10.1 0.9 0.8 2.2% 1.6% 4.6% 6.6% -97.6 18.5 -11.0% 14.6% 32.9% 31.8%

Alam Sutera Realty ASRI Buy 19,649 236 210 4,637.3 41.8 682.6 -95.9% 1534.2% 111.0 6.8 11.3 8.2 0.4 0.4 0.8% 0.8% 0.4% 6.3% 10.4 8.0 -41.9% 33.0% 67.0% 62.1%

Bumi Serpong Damai BSDE Buy 21,171 1,060 1,160 22,441.6 1,398.9 2,049.5 -54.4% 46.5% 16.0 10.9 12.0 11.1 0.7 0.7 0.0% 0.4% 4.6% 6.3% -22.6 -21.8 -9.0% 10.7% 23.9% 24.3%

Ciputra Development CTRA Buy 18,560 895 1,120 16,611.5 831.7 1,094.2 -28.2% 31.5% 20.0 15.2 12.1 10.3 1.0 1.0 0.8% 0.8% 5.3% 6.6% 99.1 24.1 -17.2% 17.1% 33.6% 31.6%

Jaya Real Property JRPT Buy 13,750 492 670 6,765.0 997.4 1,064.6 -1.9% 6.7% 6.8 6.4 6.0 5.4 0.9 0.8 3.9% 0.1% 13.4% 12.7% 267.4 6.2 1.0% 6.2% -6.3% -9.2%

Pakuwon Jati PWON Buy 48,160 500 700 24,079.8 1,006.9 1,764.4 -63.0% 75.2% 23.9 13.6 14.1 9.9 1.5 1.4 1.2% 1.2% 6.6% 10.7% 18.4 9.8 -48.0% 43.3% 8.3% 7.6%

Summarecon Agung SMRA Buy 14,427 780 960 11,252.9 419.8 603.6 -18.5% 43.8% 26.8 18.6 11.5 10.3 1.5 1.4 0.6% 0.6% 5.6% 7.6% 24.6 9.9 -1.7% 9.4% 96.6% 85.2%

Puradelta Lestari DMAS Buy 48,198 246 300 11,856.7 884.8 988.5 -33.7% 11.7% 13.4 12.0 12.9 11.6 2.0 2.0 13.0% 8.5% 14.4% 17.0% 7.4 9.8 -33.5% 10.4% -9.7% -11.4%

Bekasi Fajar BEST Neutral 9,647 183 130 1,765.5 106.6 121.8 -72.0% 14.2% 16.6 14.5 7.5 10.7 0.4 0.4 1.9% 0.5% 2.4% 2.6% 3.3 14.9 -25.6% -26.1% 26.0% 29.1%

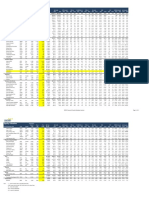

Telco 362,071.7 20,157.2 21,940.0 -5.2% 9.4% 18.7 17.1 6.1 5.7 2.9 2.7 4.0% 4.3% 15.5% 16.3% 6.0 5.4 7.4% 7.1% 108.3% 106.6%

EXCEL EXCL Buy 10,688 2,300 3,600 24,582.3 1,065.0 817.7 49.5% -23.2% 23.1 30.1 4.6 4.3 1.2 1.2 0.9% 1.3% 5.4% 4.0% 3.9 3.4 24.1% 7.3% 163.1% 163.0%

Telkom TLKM Buy 99,062 3,220 3,900 318,980.3 19,402.8 21,026.2 4.0% 8.4% 16.4 15.2 5.8 5.5 3.1 3.0 4.9% 5.3% 19.1% 19.9% 5.9 5.4 5.2% 5.6% 57.8% 56.8%

Indosat ISAT Buy 5,434 2,200 3,200 11,954.7 (1,046.3) (647.6) N/M 38.1% -11.4 -18.5 4.3 3.8 1.0 1.1 0.0% 0.0% -8.6% -5.7% 1.9 1.5 4.4% 16.2% 254.2% 281.1%

Link Net LINK Buy 3,043 2,310 3,300 6,554.4 735.6 743.7 -17.8% 1.1% 8.9 8.8 3.9 3.8 1.3 1.3 6.7% 5.7% 15.5% 14.8% 4.0 3.9 -9.2% 6.0% 22.2% 29.0%

Chemical 2,652.7 135.7 163.2 29.5% 20.3% 19.6 16.3 7.3 6.6 0.8 0.8 0.0% 0.0% 4.2% 4.8% 7.5 6.9 4.4% 6.3% 69.9% 60.4%

Aneka Gas AGII Buy 3,067 865 700 2,652.7 135.7 163.2 29.5% 20.3% 19.6 16.3 7.3 6.6 0.8 0.8 0.0% 0.0% 4.2% 4.8% 7.5 6.9 4.4% 6.3% 69.9% 60.4%

Airlines 2,879.8 539.7 836.7 30.0% 55.0% 5.3 3.4 4.4 2.8 0.5 0.4 0.0% 0.0% 9.8% 13.9% 4.7 1.3 29.4% 20.4% 65.0% 32.3%

GMF AeroAsia (USD) GMFI Neutral 28,234 102 275 2,879.8 37.8 59.0 26.1% 56.3% 5.3 3.4 4.4 2.8 0.5 0.4 0.0% 0.0% 10.1% 13.9% 4.8 1.3 25.5% 21.4% 65.0% 32.3%

Transportation 2,952.5 (175.2) 251.0 -155.7% N/M -16.9 11.8 12.5 4.9 0.6 0.6 -1.5% 2.1% -3.3% 4.8% 5.7 4.1 -70.1% N/M 5.4% 21.2%

Blue Bird BIRD Buy 2,502 1,180 1,700 2,952.5 (175.2) 251.0 N/M N/M -16.9 11.8 12.5 4.9 0.6 0.6 -1.5% 2.1% -3.3% 4.8% 5.7 4.1 -70.1% 217.9% 5.4% 21.2%

Poultry 120,893.9 3,119.8 5,423.9 -46.2% 86.5% 40.9 21.9 18.2 12.3 3.4 3.1 1.3% 1.0% 8.6% 14.8% 22.3 17.9 -32.5% 46.4% 28.0% 21.5%

Charoen Pokphand Indonesia CPIN Buy 16 6,475 6,950 106,177.1 2,775.5 3,728.3 -23.6% 34.3% 38.3 28.5 21.9 17.8 4.7 4.2 1.3% 1.1% 12.7% 15.7% 22.5 26.8 -20.8% 21.8% -1.4% -5.2%

Japfa Comfeed JPFA Buy 12 1,255 1,700 14,716.9 344.3 1,695.5 -80.5% 392.5% 42.7 8.7 10.8 5.6 1.3 1.2 1.6% 0.7% 3.2% 14.4% 42.1 5.9 -45.4% 86.2% 77.9% 65.9%

Oil and Gas 34,059.3 1,510.8 3,133.4 61.2% 107.4% 22.5 10.9 7.3 5.9 0.9 0.9 1.8% 3.7% 4.0% 8.2% 4.4 4.9 -39.3% 22.3% 53.6% 47.4%

Perusahaan Gas Negara (USD) PGAS Buy 24,242 1,405 1,700 34,059.3 105.7 221.0 56.4% 109.1% 22.5 10.9 7.3 5.9 0.9 0.9 1.8% 3.7% 4.1% 8.2% 4.5 4.9 -41.2% 23.3% 53.6% 47.4%

Asset Management 2,744.3 84.0 104.4 1.2% 24.2% 32.7 27.7 26.6 22.8 9.5 9.9 3.1% 3.4% 37.3% 35.9% 38.1 28.9 -4.5% 23.3% -55.1% -13.6%

Ashmore Indonesia AMOR Buy 1,111 2,600 2,500 2,744.3 79.6 88.4 -12.9% 5.6% 34.5 32.7 25.7 27.4 9.6 10.0 3.2% 2.9% 49.0% 30.7% 42.5 36.3 -13.5% 5.8% -130.1% -12.8%

Note : - *) means Company Data is using Bloomberg Data

REDS- Research Equity Database System Page 1 of 2

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 20 November 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

- (USD) means Account under USD (USD Cents for Per Share Data)

- N/M means Not Meaningful

- N.A. means Not Applicable

REDS- Research Equity Database System Page 2 of 2

You might also like

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinNo ratings yet

- Equity Valuation Metrics and Ratings for Top Indonesian CompaniesDocument1 pageEquity Valuation Metrics and Ratings for Top Indonesian CompanieshendarwinNo ratings yet

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinNo ratings yet

- Matriks Valuasi Saham 22 Juni 2020 PDFDocument2 pagesMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerNo ratings yet

- Banking BreakdownDocument2 pagesBanking Breakdownjnn sNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Document6 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaNo ratings yet

- Matriks Valuasi Saham 18 May 2020Document2 pagesMatriks Valuasi Saham 18 May 2020hendarwinNo ratings yet

- Matrix Valuasi Saham Syariah 1 Mar 21Document1 pageMatrix Valuasi Saham Syariah 1 Mar 21haji atinNo ratings yet

- Equity Valuation and Financial Ratios for Indonesian CompaniesDocument2 pagesEquity Valuation and Financial Ratios for Indonesian CompaniessrijokoNo ratings yet

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliNo ratings yet

- Equity Valuation and Financial Ratios of Major Indonesian CompaniesDocument2 pagesEquity Valuation and Financial Ratios of Major Indonesian CompaniesKadek ArdianaNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Investment GuideDocument2 pagesInvestment GuideMoises The Way of Water TubigNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullNo ratings yet

- Portfolio SnapshotDocument63 pagesPortfolio Snapshotgurudev21No ratings yet

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- PORTFOLIO_PERFORMANCEDocument51 pagesPORTFOLIO_PERFORMANCEgurudev21No ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- 2019 Q4 Financial Statement ENDocument17 pages2019 Q4 Financial Statement ENPinkky GithaNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- UPS1Document6 pagesUPS1Joana BarbaronaNo ratings yet

- Analysis of stock valuation metrics and financial ratiosDocument34 pagesAnalysis of stock valuation metrics and financial ratiosAmri RijalNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- AmcDocument19 pagesAmcTimothy RenardusNo ratings yet

- Portflio 3Document33 pagesPortflio 3gurudev21No ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Coal Heat RateDocument38 pagesCoal Heat Rateanon_116184023No ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησης (1)Document43 pagesΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησης (1)agis.condtNo ratings yet

- ACC Cement: Reference ModelDocument21 pagesACC Cement: Reference Modelsparsh jainNo ratings yet

- Portflio 4Document32 pagesPortflio 4gurudev21No ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- Equity AutoDocument33 pagesEquity AutoHashith SNo ratings yet

- Merger and AcquisitionsDocument3 pagesMerger and AcquisitionsSuresh PandaNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Revenue (In RP Bio) Harga Saham Market Cap (In RP Bio)Document78 pagesRevenue (In RP Bio) Harga Saham Market Cap (In RP Bio)lulutzfiaaNo ratings yet

- Valuation ModelsDocument11 pagesValuation ModelsPIYA THAKURNo ratings yet

- Comprehensive Stock Analysis Table with Key MetricsDocument6 pagesComprehensive Stock Analysis Table with Key MetricsJay GalvanNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Daily ReportDocument2 pagesDaily Reportmuhamad fikriNo ratings yet

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDocument4 pagesAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNo ratings yet

- GB3 - Power generation capacity and financial performance of Malakoff's gas-fired plant from 2003-2022Document3 pagesGB3 - Power generation capacity and financial performance of Malakoff's gas-fired plant from 2003-2022jarodsoonNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Statement For AAPLDocument1 pageStatement For AAPLEzequiel FriossoNo ratings yet

- Excel Apple FinalDocument90 pagesExcel Apple FinalDiana Reto ValdezNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Ac 1104 - Partnership OperationsDocument28 pagesAc 1104 - Partnership OperationsNarikoNo ratings yet

- Chapter 3 ReviewDocument11 pagesChapter 3 ReviewGultayaz khanNo ratings yet

- CPA REVIEW EXAMDocument14 pagesCPA REVIEW EXAMZiee00No ratings yet

- Study Note 1 Fundamental of AccountingDocument54 pagesStudy Note 1 Fundamental of Accountingnaga naveenNo ratings yet

- Profe03 - Chapter 4 Consolidated FS Basic Consolidation ProceduresDocument21 pagesProfe03 - Chapter 4 Consolidated FS Basic Consolidation ProceduresSteffany RoqueNo ratings yet

- CVP Analysis 2 Amp Ratios ExcelDocument53 pagesCVP Analysis 2 Amp Ratios ExcelSoahNo ratings yet

- CMA Question August-2013 PDFDocument58 pagesCMA Question August-2013 PDFBarna PaulNo ratings yet

- Acc 15 ADocument9 pagesAcc 15 Akim545No ratings yet

- Audit Property Plant EquipmentDocument5 pagesAudit Property Plant EquipmentMonica GarciaNo ratings yet

- 5 Igcse - Accounting - Depreciation - Revision - Questions - FDocument36 pages5 Igcse - Accounting - Depreciation - Revision - Questions - Fshivom talrejaNo ratings yet

- Departmental Accnts-Jk ShahDocument3 pagesDepartmental Accnts-Jk ShahAnandhu KrishnanNo ratings yet

- Chap13 Leverage and Capital StructureDocument101 pagesChap13 Leverage and Capital StructureBaby KhorNo ratings yet

- Alah Valley Academy of Surala Cotabato, Inc.: Assets Notes Current AssetsDocument15 pagesAlah Valley Academy of Surala Cotabato, Inc.: Assets Notes Current AssetsTERESITAESPARTERONo ratings yet

- Cost II AssignmentDocument4 pagesCost II AssignmentmeazadgafuNo ratings yet

- Acca FR s20 NotesDocument152 pagesAcca FR s20 NotesFreakin Q100% (1)

- Mock Exam Questions 2022Document21 pagesMock Exam Questions 2022ZHANG EmilyNo ratings yet

- HUL & PG Balance SheetDocument8 pagesHUL & PG Balance SheetAnonymous aXFUF6No ratings yet

- Premium Packaging SolutionsDocument27 pagesPremium Packaging SolutionsMiguel Couto RamosNo ratings yet

- ISEM 530 ManagementDocument6 pagesISEM 530 ManagementNaren ReddyNo ratings yet

- Revision For Midterm ExamDocument24 pagesRevision For Midterm ExamMinh Nguyen Thi HongNo ratings yet

- Hyperinflation TOPIC-1Document3 pagesHyperinflation TOPIC-1moNo ratings yet

- MNE Test Paper – Accountancy Chegg IndiaDocument7 pagesMNE Test Paper – Accountancy Chegg IndiaJoel Christian MascariñaNo ratings yet

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNo ratings yet

- Financial Ratios: Arab British Academy For Higher EducationDocument6 pagesFinancial Ratios: Arab British Academy For Higher EducationhirenpadaliaNo ratings yet

- Week 1 - Accounting EquationDocument23 pagesWeek 1 - Accounting EquationJannyfaye RallecaNo ratings yet

- Try This - Cost ConceptsDocument6 pagesTry This - Cost ConceptsStefan John SomeraNo ratings yet

- ACC101 T222 FinalExam MarkingGuideDocument18 pagesACC101 T222 FinalExam MarkingGuideTan IrisNo ratings yet

- FM-2 Presentation on Sun Pharma's Beta CalculationDocument6 pagesFM-2 Presentation on Sun Pharma's Beta CalculationNeha SmritiNo ratings yet

- Strategic Business Analysis Short-term Budgeting ExercisesDocument2 pagesStrategic Business Analysis Short-term Budgeting Exercisesahyenn cabelloNo ratings yet