Professional Documents

Culture Documents

Taxable On Receipt Basis No Deduction and No Loss Adjustment Against Salary

Uploaded by

Ali FarooqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxable On Receipt Basis No Deduction and No Loss Adjustment Against Salary

Uploaded by

Ali FarooqCopyright:

Available Formats

taxable on receipt basis

No deduction and no loss adjustment against salary

Employment exercised in Pakistan

Pakistan source if

Paid by Government

foreign income tax paid

Salary, exempt if

Citizen of Pakistan leaves Pakistan during the tax year

and remains abroad during that tax year

Basics

Citizen of Pakistan

Foreign source Income (including Salary), expempt for 2 tax years Conditions

Non-resident for 4 consecutive tax years

resident individual solely by reason of his employment

Income (including salary), exempt if

Present in Pakistan not more than 3 years

S-1

May be taxed @ average rate of 3 preceeding tax years

Compensation on termination of employment

at the option of the taxpayer

Right option disposed off Consideration received less Consideration paid for grant of right

grant of right

Shares issued Fair value of shares Less Consideration paid

purchase of shares

grant of right

Employee share scheme Lock-in period Fair value of shares at the end of lock-in period Less Consideration paid

purchase of shares (Excercise price)

grant of right

Consideration paid

Captal Gain Consideration Less Cost of shares (FV at issue) purchase of shares (Excercise price)

taxable amount representing gain

for official use only No addition

Conveyance for personal and official use 5% of Cost or FMV (in case of leased vehicle)

for personal use only 10% of Cost or FMV

Fair Market Rent

Accomodation higher of

45% of MTS or basic salary

Utilities and domestic servants Fair Market Value Less any payment made by employee

10% if no interest is charged

Interest free loan Differential if rate is less than 10%

except for loans not exceeding Rs.1000,000

Other assets given e.g laptop Depreciation or rental paid by employer

Government employees

fully exempt

Gratuity fund approved by commiss ioner

Rs.300,000 Gratuity scheme approved by board

S-2 Perquisites

Payment not received in Pakistan

Gratuity Received by director

Received by non- resident

Lower of 75,000 & 50% of amount receivable Unapproved gratuity scheme / fund Except

From same employer or its associate

Employee who has already received any gratuity

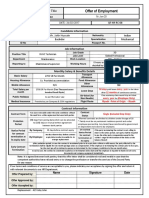

provided for official duty exempt

Conveyance allowance

provided for personal purposes taxable

food by hotels or restuants

by educational institution

education

examples to employee's childern

by hospital / clinic

medical treatment

to its emplyees

Perquisites without margial cost to employer exempt

Govt PF Exempt

employees contribution No treatment

Rs.150,000

employer's contribution limit lower of

1/10th of BS+DA

Rec PF

16% Accumulated balance

interest credited higher of

Provident fund 1/3rd of BS +DA

Payment of accumulated balance exempt

employee's contribution

No treatment employer's contribution

Unrec PF

interest credited

Payment of accumulated balance employer's contribution & interest credited Taxable in the year of receipt

employer's contribution exempt

Interest credited expempt

Approved superannuation fund

after beneficiary's death exempt

S-3 payment of accumulated balance

during his lifetime taxable

Special allowance granted for official expenses e.g TADA expempt

facility or reimbursement exempt

Medical exempt upto 10% of basic salary

allowance

fully taxable if provided in addition to

Benevolent grant expempt

WPPF fully exempt

Exempt except when the person cotinues to work for the same employer or its associate

higher exempt

more than one pensions

Age > 60 years All such pensions Exempt

Pension

50% exempt

Pension fund May be taxed @ average rate of 3 preceeding tax years

50% taxable Compensation on termination of employment

at the option of the taxpayer

You might also like

- PCP HR Policy PDFDocument27 pagesPCP HR Policy PDFAdnan QamarNo ratings yet

- PCP HR Policy PDFDocument27 pagesPCP HR Policy PDFAdnan QamarNo ratings yet

- Commissioner of Internal Revenue, Petitioner, GENERAL FOODS (PHILS.), INC., RespondentDocument5 pagesCommissioner of Internal Revenue, Petitioner, GENERAL FOODS (PHILS.), INC., RespondentYvon BaguioNo ratings yet

- Balance Sheet Income StatementDocument2 pagesBalance Sheet Income StatementKamaljit Singh100% (1)

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit SagarNo ratings yet

- Eopt Act Comparative SummaryDocument6 pagesEopt Act Comparative Summarybbc.moniqueNo ratings yet

- Invoice: Payment Your SWIFT InvoiceDocument4 pagesInvoice: Payment Your SWIFT InvoiceClément MinougouNo ratings yet

- Taxation of Non-Bank Financial Intermediaries PhilippinesDocument12 pagesTaxation of Non-Bank Financial Intermediaries Philippinesjosiah9_5No ratings yet

- Import ProcurementDocument23 pagesImport ProcurementGirish Raj100% (1)

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Mr. Ibrahim: Income From SalaryDocument7 pagesMr. Ibrahim: Income From SalaryDavidNo ratings yet

- Definition of SalaryDocument2 pagesDefinition of SalaryJaikishan FabyaniNo ratings yet

- 04 - Income Which Do Not Form Part of Total IncomeDocument41 pages04 - Income Which Do Not Form Part of Total IncomeTushar RathiNo ratings yet

- Share Options and EIS, SEIS, VCT - AnnotatedDocument31 pagesShare Options and EIS, SEIS, VCT - AnnotatedDr SafaNo ratings yet

- 2 Salary - Control Sheet - SirTariqTunio - ARTTDocument1 page2 Salary - Control Sheet - SirTariqTunio - ARTTZari MaviNo ratings yet

- Tax Law 3Document39 pagesTax Law 3vishnu000No ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- CandidateDocument2 pagesCandidateleelamrs48No ratings yet

- Ch-3 Income Not Part of Total IncomeDocument44 pagesCh-3 Income Not Part of Total Incomerinkal jethiNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax - Notes - Inclusions and ExclusionsDocument11 pagesTax - Notes - Inclusions and ExclusionsCamille Danielle BarbadoNo ratings yet

- 3 Income From Other SourcesDocument4 pages3 Income From Other SourcesIshani MukherjeeNo ratings yet

- Kenya Tax CardDocument2 pagesKenya Tax Cardwebryan2kNo ratings yet

- Fringe and de Minimis BenefitsDocument14 pagesFringe and de Minimis BenefitsIrish D DagmilNo ratings yet

- Emerging Issues in Employee Stock Option Plan ( ESOP') Taxation DimensionsDocument17 pagesEmerging Issues in Employee Stock Option Plan ( ESOP') Taxation DimensionsjagpritNo ratings yet

- Module 2. Lesson 4. Inclusions To Gross IncomeDocument13 pagesModule 2. Lesson 4. Inclusions To Gross IncomeRaniel AnidoNo ratings yet

- Types of Cooperative SharesDocument6 pagesTypes of Cooperative SharesAmon KhosaNo ratings yet

- Chapter-5 (Input Tax Credit)Document30 pagesChapter-5 (Input Tax Credit)pronab sarkerNo ratings yet

- Cheating Sheet - AccountsDocument4 pagesCheating Sheet - AccountsTrishul enterprisesNo ratings yet

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Document7 pagesANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNo ratings yet

- Cfas EquityDocument3 pagesCfas EquityKeith SalesNo ratings yet

- AP CEO Package Termsheet YS DiscDocument1 pageAP CEO Package Termsheet YS Discaddo.terrenceNo ratings yet

- Offer Letter - Jahir Hussain - HVAC TechDocument1 pageOffer Letter - Jahir Hussain - HVAC TechPrasanna Gopalrathinam100% (1)

- Candidate 1Document2 pagesCandidate 1Fascino WhiteNo ratings yet

- Tax Calculator 2010-2011Document8 pagesTax Calculator 2010-2011Muhammad AzamNo ratings yet

- Ande - Financing OptionsDocument3 pagesAnde - Financing OptionsVipul RastogiNo ratings yet

- Zero Rated Supplies Under GST: CA Sachin Kumar JainDocument3 pagesZero Rated Supplies Under GST: CA Sachin Kumar Jainparam.ginniNo ratings yet

- Old Regime Proof Option GuidelinesDocument23 pagesOld Regime Proof Option GuidelinesUmang MandyNo ratings yet

- Proposal FormDocument13 pagesProposal FormKushal BhatiaNo ratings yet

- Audit of Shareholders Equity DiscussionsDocument5 pagesAudit of Shareholders Equity DiscussionsGwyneth TorrefloresNo ratings yet

- FTC Na Chat 217000Document4 pagesFTC Na Chat 217000ravi kanthNo ratings yet

- 02.CA Inter Audit BHASKAR Regular Notes Vol 2Document317 pages02.CA Inter Audit BHASKAR Regular Notes Vol 2Shivam GoyalNo ratings yet

- Comparison of Old Vs New Tax RegimeDocument9 pagesComparison of Old Vs New Tax RegimeMani Shankar RajanNo ratings yet

- CBDT Notifies Final Rules With Respect To Buy-Back of SharesDocument3 pagesCBDT Notifies Final Rules With Respect To Buy-Back of SharespratikNo ratings yet

- Esop & RsuDocument9 pagesEsop & RsuTushar GuptaNo ratings yet

- Decision Tree (Withholding Tax)Document1 pageDecision Tree (Withholding Tax)Loudie Ann MarcosNo ratings yet

- Bonds PayableDocument1 pageBonds PayableHeaven HeartNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- Buy Back of SecuritesDocument26 pagesBuy Back of Securitesaryanrnair2003No ratings yet

- Annexure 3 Compensation FeeDocument3 pagesAnnexure 3 Compensation FeeTech TipsNo ratings yet

- Class Notes - IFRS 2 Share Based PaymentsDocument14 pagesClass Notes - IFRS 2 Share Based Paymentsmohammadhamzakhan51No ratings yet

- Overview of Personal Home TaxDocument21 pagesOverview of Personal Home TaxShlok SharmaNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcesyatin rajputNo ratings yet

- (Megafileupload) Tax Calculator 2009-2010Document8 pages(Megafileupload) Tax Calculator 2009-2010faslam1No ratings yet

- Qucik RFR On CL (Sec 123 To 148)Document10 pagesQucik RFR On CL (Sec 123 To 148)visshelpNo ratings yet

- PDF 15aug23 0724 SplittedDocument1 pagePDF 15aug23 0724 SplittedAshish ChaudharyNo ratings yet

- Calculation of Salary IncomeDocument3 pagesCalculation of Salary IncomeIqra HayatNo ratings yet

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument15 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionPrashant GavadeNo ratings yet

- 74798bos60498 cp3 U5Document51 pages74798bos60498 cp3 U5Raj ThakurNo ratings yet

- Income From Property Part2Document8 pagesIncome From Property Part2aisha jabeenNo ratings yet

- Gross IncomeDocument4 pagesGross IncomeNoroNo ratings yet

- EXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument11 pagesEXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanarghyahsNo ratings yet

- Income From SalariesDocument7 pagesIncome From SalariesSneha PotekarNo ratings yet

- Allowances Allowable To Tax PayerDocument13 pagesAllowances Allowable To Tax PayerbabakababaNo ratings yet

- MO 0039 - Cel Muhammad Yaqoob AwanDocument29 pagesMO 0039 - Cel Muhammad Yaqoob AwanAli FarooqNo ratings yet

- Energy Production in Pakistan (Good Info)Document51 pagesEnergy Production in Pakistan (Good Info)saraNo ratings yet

- Role of Pakistani Media in Educating The Masses: Analyzing Need For National Media PolicyDocument10 pagesRole of Pakistani Media in Educating The Masses: Analyzing Need For National Media PolicyAli FarooqNo ratings yet

- Pakistans Power Future December 2018Document38 pagesPakistans Power Future December 2018aaaattNo ratings yet

- Javaid Et Al (2011) Electrical Energy Crisis in Pakistan and Their Possible SolutionsDocument3 pagesJavaid Et Al (2011) Electrical Energy Crisis in Pakistan and Their Possible SolutionsAli FarooqNo ratings yet

- Role of Media in Promoting Peace and Harmony: KeywordsDocument16 pagesRole of Media in Promoting Peace and Harmony: KeywordsHafiz ShoaibNo ratings yet

- 11 55 1 18 PDFDocument15 pages11 55 1 18 PDFhafiz uamir hanifNo ratings yet

- New Era of MediaDocument25 pagesNew Era of MediaAli FarooqNo ratings yet

- Critical Analysis of Press Freedom in PakistanDocument9 pagesCritical Analysis of Press Freedom in PakistanAli FarooqNo ratings yet

- Critical Analysis of Press Freedom in Pakistan: Full Length Research PaperDocument3 pagesCritical Analysis of Press Freedom in Pakistan: Full Length Research PaperAli FarooqNo ratings yet

- The Media and Conflict Case Study Overview Reporting On The Kashmir Conflict Between India and PakistanDocument4 pagesThe Media and Conflict Case Study Overview Reporting On The Kashmir Conflict Between India and PakistanAli FarooqNo ratings yet

- Use of Print Media For Conflict Esolution and Peace Building: A Case Study of Kashmir DisputeDocument20 pagesUse of Print Media For Conflict Esolution and Peace Building: A Case Study of Kashmir DisputeAli FarooqNo ratings yet

- New Era of MediaDocument25 pagesNew Era of MediaAli FarooqNo ratings yet

- Role of Media in Statecraft: A Case Study of Pakistan: Mehvish Nigar QureshiDocument23 pagesRole of Media in Statecraft: A Case Study of Pakistan: Mehvish Nigar QureshiAli FarooqNo ratings yet

- Challan Form For Non Teaching PostsDocument1 pageChallan Form For Non Teaching PostsAli FarooqNo ratings yet

- Companies Ordinance, 1984 PDFDocument434 pagesCompanies Ordinance, 1984 PDFUsman AhmadNo ratings yet

- Provincial Assembly of The Punjab: 1. Personal InformationDocument3 pagesProvincial Assembly of The Punjab: 1. Personal InformationAli FarooqNo ratings yet

- Companies Act 2017Document430 pagesCompanies Act 2017Abdul MuneemNo ratings yet

- University of The Punjab: Job ApplicationDocument5 pagesUniversity of The Punjab: Job ApplicationAli FarooqNo ratings yet

- Companies Act 2017Document430 pagesCompanies Act 2017Abdul MuneemNo ratings yet

- Pay CircularDocument8 pagesPay CircularRizwan Bin RafiqNo ratings yet

- Companies Act 2017Document430 pagesCompanies Act 2017Abdul MuneemNo ratings yet

- Taxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryDocument3 pagesTaxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryAli FarooqNo ratings yet

- General Provident Fund Rules PDFDocument65 pagesGeneral Provident Fund Rules PDFMuhammad ImranNo ratings yet

- General Provident Fund Rules PDFDocument65 pagesGeneral Provident Fund Rules PDFMuhammad ImranNo ratings yet

- Pay CircularDocument8 pagesPay CircularRizwan Bin RafiqNo ratings yet

- Payment of Wages ActDocument21 pagesPayment of Wages Actshahidtoor1100% (2)

- 08 Activity 1Document2 pages08 Activity 1Cj MoontonNo ratings yet

- US and Canada Tax ChangesDocument11 pagesUS and Canada Tax ChangesGANYA JOKERNo ratings yet

- Tax ReviewerDocument3 pagesTax ReviewerGlendaMendozaNo ratings yet

- FF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686Document2 pagesFF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686arshadnsdl8No ratings yet

- Income TaxDocument84 pagesIncome TaxA Jalaludeen100% (1)

- Diluted Earnings Per Share QDocument2 pagesDiluted Earnings Per Share Qjano_art210% (4)

- U.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Document4 pagesU.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Stephanie Dube DwilsonNo ratings yet

- Invoice 38722531Document1 pageInvoice 38722531ernestozagNo ratings yet

- Contoh Rincian BillingDocument10 pagesContoh Rincian BillingCruise MardionoNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsLearning WebsiteNo ratings yet

- ANZ Personal Banking Account Fees and ChargesDocument20 pagesANZ Personal Banking Account Fees and ChargesmmirpuriNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mûkêsh Kàñnâñ AJ0% (1)

- ZGF HC 9 Idr Jxe DW WPDocument14 pagesZGF HC 9 Idr Jxe DW WPjayabarathi srinivasanNo ratings yet

- ICCT Colleges Foundation, Inc.: - Activity / AssignmentDocument2 pagesICCT Colleges Foundation, Inc.: - Activity / AssignmentDamayan XeroxanNo ratings yet

- Alpha Group Company Profile 12.8.21Document28 pagesAlpha Group Company Profile 12.8.21Laeth HarebNo ratings yet

- Baug CARP Beneficiaries Multi Purpose Cooperative (BCBMPC) : I. HistoryDocument5 pagesBaug CARP Beneficiaries Multi Purpose Cooperative (BCBMPC) : I. HistoryElla Louella LavadorNo ratings yet

- Soal Latihan LiabilitiesDocument2 pagesSoal Latihan Liabilitieskpop 123No ratings yet

- Income From Other SourcesDocument29 pagesIncome From Other SourcesSatish BhadaniNo ratings yet

- Directions Credit Union Online Banking PDFDocument1 pageDirections Credit Union Online Banking PDFTyler GroveNo ratings yet

- ApplicationformDocument3 pagesApplicationformShehryar07No ratings yet

- Vendor Opening Form - Format REVISEDDocument1 pageVendor Opening Form - Format REVISEDFarhan SaghirNo ratings yet

- Deposit - WithdrawalDocument2 pagesDeposit - WithdrawalMuhd K AsyrafNo ratings yet

- Marubeni Corporation v. CIRDocument2 pagesMarubeni Corporation v. CIRBrylle Garnet DanielNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Krishiv Infotech: Tax InvoiceDocument3 pagesKrishiv Infotech: Tax InvoiceRiviera SarkhejNo ratings yet