Professional Documents

Culture Documents

Chapter 6-2 PDF

Chapter 6-2 PDF

Uploaded by

Fely Maata0 ratings0% found this document useful (0 votes)

464 views3 pagesOriginal Title

chapter 6-2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

464 views3 pagesChapter 6-2 PDF

Chapter 6-2 PDF

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

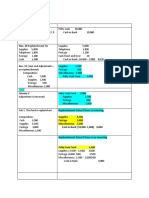

Chapter 6 - Capital Gains Taxation

mst t tt e ot

2 fem ttm eas op

15,000 shares for P12/

inon the wash sels

apt apap 600

Teper cartes 3000

i bran sipzoo00 .

4 waco on 15000 hares cia ee preceding problem?

opis oso

B ricoo00 Gereo%

of stocks of Achievers Corporation direct :

ares shares was P85, Isidro purchased the shares for Bgp

‘shares had a selling price of P120 per share.

7. Isidro sold 1,500 sh

1 share's par value per

‘each. On the date of sale. the

‘What isthe capital gains taxon the sale?

a P2625 P6607

b. P2250 @.Puia7s

6. Mr Pangan prcated domestic toc which were priced at 150% above thee

remarry He sold the tocks when ther fale vale Zoe fe

Faas tay soeeoury samp and 30000 Ih cOMMsHON expences on ie

sale

Compute the selling price of the stocks

a P3,000000 -P 1,500,000

b, P2500000 4.P 1,000,000

9, Compute the capital gains tax

a P1432,

b. 152750

©. P 153,725

4.P222375

10. On june 20, 2019, Mr. Lito led the capital gains tax return involving the sale of

domestic stocks on February 20, 2019. The net gain was P140,000. Compute the

total amount due including penalties except compromise penalty,

a P26880 cP

b. P21,500 ap

Multiple Choice Problems: Part 3

1. A taxpayer purchased building to be used as a future plant site. The buldng

femained used or 3 ye decline in customer's demand in

product of the taxpayer. The taxpayer eventually disposed the property. What i

{he classification of the property” oes

a Ordinary asset kither A or B atthe di

Capital asset 46

the BIR

Ar B depending on the intent of the buyet

26

‘Chapter 6 - Capital Gains Taxation

Assuming the same data in the preceding number exc

th wat

not disposed of but the same was used as a sales out shh tbe

ayer is not engage in rea estate business

the taxpayer is not engaged in realestate business

3. Anderson disposes a vacant lat for P3,000,000. The lot has an Assessor's fair value

‘of F 2,800,000, zonat value of 3.200.000, and an appraisal value of P3,500,000.

‘What isthe capital gains tax?

a PO ©. 192,000

bP 180,000 4.P 210.000

Puerto Princesa Company sold ts parking lot for P2,000,000. The lot has a zonal

value of P2,500,000 and appraisal value of P1,800,000. The capital gains tax on

© P.120000

b. P108,000 4.P 150,000

5, Mr. Antonio disposed his principal residence for P2,000,000 and immediately

‘acquired 4 new one for P1,800,000. The old residence cost Mr. Antonio

1,000,000 and had a fair market value of P2,500,000 on the date of sae,

‘Compute the capital gains tax to be deposited in escrow.

a Po ©. 320,000

b. P60,000 .P150,000

6, What would be the tax basis of Mr. Antonio's new residence?

a P1,300,000 © P900,000,

b. P1.000,000 4P 800,000

How much ofthe capital gains tax

a. P150,000

€.120,000

b P135,000 4.P15,000

‘On August 15, 2020, Ms. Mones sold a 5U0-square meter residential house and lot

for P3,000,000. The house was acquired in 2005 at P2,000,000. The Assessor's

fair market values of the house and lot, respectively, were 1,500,000 and

1,000,000. The zonal value of the lot was P5,000 per square meter.

is the capital gains tax?

80,000 150,000

20,000 4.P240,000

27

chapter 6 - Captal Gans Tarator

do nec i pina GENCE (NSE ang iyg

. athe rome hd = Pra

9. Manny, eset pe of P10

arehase

its ongin

valle at tat tie.

severe not invested ithe NeW PFINCIpl residence

soo.000 were used to construct by,

capal pains

ibe proved of he

ae es st

¥ €,P750,000

a PO

660,000 4.780.000

re baced onthe following information:

[Numivers 10 through 120

ta with far market vatue of 12,000,000 fy

Me. Pepto sold his residenbal and in Ma]

10,000,000.

ofthe P10,000,000 in buying a house and lot to be used,

fence, the final tax due from him is a

©. P120,000

» P600,000 aro

11 f Me Pepto tized only P7,000,000 from the proceeds ofthe sale im acquiring

new resience, the ial a de from hm is

a P720.000 P2180,000

b P216.000 aro

12. Thedocumentary stamp tax due onthe sale is

a PI79.895 €.P149,905,

b P180,000 4.P150,000

Carmen Corporation for the shares

jon. The stocks acquired by Mr. Quirino represent

3,000,000

5,000,000,

4,500,000,

Whar isthe capita gas tax?

2 PO

.P145.000

14.P22¢ 000

tothe mesial preceding problem, what isthe asso the stocks received by

a PO

3,000,000

«©-P4500,000

«.P5,000,000

218

chapter 6- Capital Gains Taxation

exchanged his DEF shares for the shares of EFG pursuant toa plan of,

Mieager Mr Eller bought his shares for P300,000, The shares hod fair value

71 300.000 on the date of exchange. Mr Eller received EFG shares with flr

fale Pi, 300.00 plus cash 200,000.

Compute the capital gains tax

a PO

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 13 PDFDocument22 pagesChapter 13 PDFFely MaataNo ratings yet

- Chapter 12Document21 pagesChapter 12Fely Maata100% (2)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Exercises 1-14Document26 pagesExercises 1-14Fely Maata100% (2)

- Chapter 11 PDFDocument16 pagesChapter 11 PDFFely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- CH5Document17 pagesCH5JessaNo ratings yet

- Chapter 10 PDFDocument23 pagesChapter 10 PDFFely MaataNo ratings yet

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- Chapter 6-1 PDFDocument24 pagesChapter 6-1 PDFFely MaataNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet