Professional Documents

Culture Documents

Chapter 10 PDF

Chapter 10 PDF

Uploaded by

Fely Maata0 ratings0% found this document useful (0 votes)

1K views23 pagesOriginal Title

chapter 10.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views23 pagesChapter 10 PDF

Chapter 10 PDF

Uploaded by

Fely MaataCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 23

chapter 10 - Compensation income

CHAPTER 10

COMPENSATION INCOME

LL

Chapter Overview and Objectives

‘This chapter discusses the employee benefits considered as compensation income.

It discusses the types of employees, and exempt and taxable benefits. It also

delineates the gap between the compensation income subject to regular income

taxand the fringe benefits subject to fringe benefit tax.

After this chapter, readers are expected to demonstrate:

1. Understanding of the concept of an employer-employee relationship

2, Knowledge of the classifications of employees and the tax treatment of their

compensation income and fringe benefits

3. Mastery of the list of employee benefits exempted under the NIRC and special

laws and the de minimis list

4. Knowledge of the condition for exemption of employee benefits under treaty

or international agreements

5. Understanding of the concept of "employer convenience” rule and the

“necessity of the employer” rule

6. Understanding of the conditions of exemption of a minimum wage earner

7, Knowledge of the classification rules for items of gross taxable compensation

income

8, Mastery of the composition of "13° month pay and other benefits” for rank and

file employees and managerial or supervisory employees

9. Comprehension of the fringe benefits subject to regular tax and fringe benefits

subject to fringe benefits tax

EMPLOYER-EMPLOYEE RELATIONSHIP

Employer ~ refers to any person for whom an individual performs any service of

whatever nature as employee of such person.

‘An employer is the person who has control over the payment of the employee

remuneration. However, if such person is a non-resident not engaged in trade or

business in the Philippines, the employer is deemed the person paying

remuneration in their behalf.

Employee - refers to any individual who is a recipient of wages and includes

officer, employee or elected official of the Government of the Philippines or any

Political subdivisions, agency or instrumentality thereof. The term also includes

4n officer of a corporation.

317

oer: 0 omer and employee bsp under ca

tr selection and engagement of employees ~ There If 2 sc

‘employees to hire

2. Payment of wages ~The employer usually fixes and

wages.

3. Power of dismis

when incurring.

- Employer has power to retrench or terminate

wy losses or other reasonable basis.

ela

4. Power of con - The employer has power to contol the emp aye gg

means and methods by which the work is accomplished.

‘an arrangement which do not manifest all the elements is not an

e

“employee relationship but an independent contract for the provision of seen

1. Consultants

2. Directors without management function

3. Talents and artists on TV shows or radio broadcasts (Sonza ys

AB

Broadcasting Corporation, GR. No. 138051) SCH

‘he income or fees of these individuals are not compensation income but sy

business or professional income,

‘TVPES OF EMPLOYEES AS TO FUNCTION

1. Managerial employees - Those who are given powers or prerogatives toy

down and execute managerial policies and/or to hire, transfer, suspend iy.

(ff, recall, discharge, assign or discipline employees

2. Supervisory employees ~ Those who effectively recommend such managen

actions ifthe exercise of such authority is not merely routinary or clenealt

nature but requires the use of independent judgment

3. Rank and file employees - Those who hold neither managerial nor supervsoy

functions

‘TYPES OF EMPLOYEES AS TO TAXABILITY

1. Minimum wage eorners - Employees who are recipients of minimum wage

They are exempt from income tax on their compensation,

2. Regular employees - Employees who are subject to the regular progress

income tax

Itamust be noted thatthe “special allen” classification was removed into law by vite

of presidental vet tothe TRAIN low. The special lender te old law oat

‘treated as regular employees.

318

chapter 10 - Compensation Income

Minimum Wage Earner

im wage earner refers to a

Private sector who is paid the

‘with compensation income

ose with salary grade 1 to 3)

igned.

‘The statutory minimum wage refers to rate fixed by the Regional Tri

nd Productivity ard of the. Departmen of Labor and Emyment ar

5,000/month of P60,000/year, whichever s higher. om

‘THE TAX MODEL ON COMPENSATION INCOME

Gross compensation income

Less: Non-taxable compensation

‘Taxable compensation income

(GROSS COMPENSATION INCOM!

{Gross compensation income gen

‘an employer-employee relatio

NON-TAXABLE COMPENSATION

‘A. Mandatory deductions

‘These includes employees’ mandatory contribution to GSIS, SSS, PhilHealth,

HOME, and union dues

includes all remunerations received under

Exempt benefits

1. Benefits excluded and/or exempted under the NIRC and special laws

2. Benefits exempt under treaty or

3. Benefits necessary to the trade, busi

employer

4, Benefits for the convenience or advantage ofthe employer

EXEMPT BENEFITS UNDER THE NIRC, AS AMENDED, AND SPECIAL LAWS

eceived as incidents of employ

2. De minimis benefits

3. 13 month pay and other benefits not exceeding P90,000

319

chapter 10 - Compensation Income

vage earners

‘4. Certain beneftsofainimum WaBe ©

De minimis benefits ies or privileges such a5 entertainment, mp

De minimis beefs are (ache Tages that are of relatively small yye

‘services, ot courtesy discount rely as a means of Promoting the pest!

me 2 hea

ae furshed by the en cy of is employees. DE tims benef ft

wil, contentment, OF

sete ng bene exert rom income

cuherpety fringe benefits which fall Within the puny

eee x part of te de minimis lst aCe normally treated ay

ri are also exempt from income 3%

nt of Finance changed the rule unde

However the BIR and te Department of Finance change ne under ig.

tower sem the term “de minimis benefs” was restricted tO mean ony jy

following:

1. Monetized unused yacation leave credits of private employees nq

exceeding 10 days during the year

2. Monetized unused vacation and sick leave credits paid to governmen,

officials and employees

3, Medical eash allowance to dependents of employees not exceeding Pa.

per employee per semester, or P375 per month

Rice subsidy not exceeding B2,000 or 1 sack of S0-kg rice per month

amounting to not more than P2,000

Uniform and clothing allowance not exceeding P6,000 per annum (Res.

2012)

‘Actual Medical Assistance, eg. medical allowance to cover medical and

healthcare needs, annual medicai/executive check-up, maternity assistance,

and routine consultations not exceeding P10,000 per annum

‘Laundry allowance not exceeding P300 per month

Employee achievement award, eg for length of service or safety

achievement, which must be in the form of tangible property other than cash

or gift certificates, with an annual monetary value not exceeding P1000

the employee under an established written plan which does nt

favor of highly paid employees.

Gifts given during Christmas and major anniversary celebrations not

exceeding P5,000 per employee per annum (ie, Christmas git and

anniversary gifts)

Dally meal allowance for overtime work and night or graveyard shift nit

exceeding 25% of the basic minimum Se regen ass (2

overtime meal wage on a per region basis (te

As originally conceived,

ex

11. Benefits received by an employee by vi

ree by virtue of a collective bargalning

‘agreement (CBA) and productivity incentive schemes provided that the

320

chapter 10 - Compensation Income

total annual monetary value received from both CBA and productivity

incentive schemes combined do not exceed P10,000 per employee per taxable

year:

benefits and productivity incentives amounting to P10,000 or less

1¢ amount exceeds P10.000, the entire ameunt is a taxable “other

iue that are not included in the list of de

‘Treatment of taxable de minimis benefits

a

For rank and file employees ~ taxable de minimis is treated as other

compensation income under the category “134 month pay and other benefits”

». For managerial and supervisory employees - taxable de minimis is treated as

fringe benefit subject to final fringe benefit tax (RRS-2011 and RMC20-2011)

‘Alexander, private employee who is paid 2 P600 daly rate, receives the following.

benefits during the year 2019:

Monetized unused vacation leave credits

Monetized unused sick leave credits

Says

days

Medical assistance P 7,000

Rice subsidy (P2,500 per month) 30,000

Clothing allowance 9,000

Laundry allowance 6.000

Required: Determine the taxable amount of de-minimis benefits.

Solution:

Monetized unused VL ’

—Actwal_ __Limit_ _Excess_

5400 F 6000 PO

Monetized unused SL 5400 S400

7900 10,000 °

30000 24000 6,000

000 “6,000 3.000

Laundry allowance 6000 3600 _2.400

Taxable de minimis as “other benefits” Esso

Note: Private employees

1. The actual value ofthe monetized unused V was computed as P600 x9 while the limit was

600° 10.

321

Chapter 10 - Compensation Income

2. The 10-day rule applies ony to vacation eaves. Monetization of sick fay

Employees taxable. (IR Ruling No. 227-2013. june 20,2013).

ny allowance were hikewise anoualzed by multiplyin

OF iy

3, Thence siya be

aoe se temmroentswithn elise emp rom get

stration2

Mastration2 ent cankand fle employee, received the following bene

‘Monetized unused vacation leave credits (10 days) P 6,000

Moneteed unused sick leave reds (15 2375) 3100

000

Uniform allowance

Laundry allowance 4800

Required: Determine the amount to be included in other benefits.

Solution:

Actual Limit _Excess_

Monetized unused VL F 6000 exempt PO

Monetized unused St. 9,000 exempt 0

Uniform allowance 5900 6,000 0

Laundry allowance 4900 3.600 __1.z00

‘Taxable de minimis as “other benefits” E1200

Note: ts clear under RRS: © vacotion leave and sick leave of government employe,

are not subject othe 10-day lim

Mlustration 3

Professor Radvic was one of the Hall of Fame awardees of Youbee University. He ws

ranted P25,000 cash as loyalty award for his 30 years of service. He was also gen

$10,000 Christmas gut no an additional P20,000 gift during the institutions

Founding Day Anniversars tesides, he was also given free lunch meals with a toad

value of P15,000 during the same year.

Required: Compute tne total taxable de-minimis benefits as other benefits.

Solution:

Actual _Limit_ _Excess_

Loyalty orserviceaward F-25000 P= P2500,

Christmas and anniversary git 20,000 $,000— 5,000

Meals "5,000 0 _ i500

Total taxable de minimis 2s “other benefits” Ese.000

loyalty or service awards applies only

overtime or graveyard shifts are co

are po longer consisered ue minimis,

322

gnapter 10 - Compensation Income

Note that in all three illustrations, ifthe employee is a managerial or supervis

Naployee, the entre excess de minimis shal be coniiced as caer Wao,

Senefits subject to fringe benefits tax oN

Commutation of accumulated leave credits

‘The terminal leave pay or the commutation of unused leave

unused leave eredits due

cay separation fcom employment of the enploye & ws teed ode

‘and is no longer exempt

ds part of exempt termination benefits,

1301 month pay and other benefits notin excess of? 90,000

The composition of the “13th month pay and other ber i

under taxable benefits nefits” will be discussed later

BENEFITS EXEMPT UNDER TREATY OR INTERNATIONAL AGREEMENTS

fee benefits of non:

ippines from foreign g

international organi

ino nationals and or non-permanent residents of the

"mnments, embassies or diplomatic missions, and

Sin the Philippines are exempt from income tax.

‘Exemption from withholding tax does not mean income tax exemption

Foreign government embassies, diplomatic missions and international

organizations are immune from income tax including the obligation to withhold

income tax by virtue of international comity as embodied in several international

agreements to which the Philippines is a signatory.

However, this exemption from the

income tax exemption of their

international agreements to which the Pt

only to non,

ligation to withhold tax does not mean

Fipino employees of foreign governments, international missions and

organizations are taxable as a rule except only to employees of the following

organizations:

1. United Nations (UN)

2 1ed Agencies of the United Nations

3, Australian Agency for International Development (AUSAID)

4. Food and Agriculture Organization (FAC,

5. World Health Organization (W!

6. United Nations Development

7. International Organization fo

8 International Seabed Authority (ISA)

‘These organrzations have exeraption provisions that extend even to thei Filipina

employees. Other aid agencies or international organizations may have tax free

provisions in their articles of agreement for Filipino empioyees.

323

Chapter 10 - Compensation Income

ce tion of Tax Exemptions

eee of ployees is not automatic. Filipinos ja,

‘exemptions under nder pro

Special laws granting

pplication for confirmation of tax exemption

sanigion (ITAD). The confirmation shall Serve 3s proof of exe

Without the confirmation certificate, the employee s taxable,

an

al Tay

'MPtion

i r offices

Employees of Philippine embassies or consulate

Treen be cecaled that employees working in Philippine embassies

Philippine consulate offices are not considered non-resident citzens ang 4

therefore subject to Philippane income tax.

‘Summary of rules

| Foreign embassy | Philippine embasey |

| missions, or organization |_or consulate office

ilippines

NA

N/A

Taxable

E

*Taspoyer must prove there isan exemption grant under contract or special law.

BENEFITS REQUIRED BY THE NATURE OF, OR NECESSARY TO, THE TRADE,

‘BUSINESS OR CONDUCT OF PROFESSION OF THE EMPLOYER ”

Benefits or allowances furmsued by the employer to the employees to enable

them to appropnately and effectiely execute their duties as required by their

employment are exempt from income tax. This is referred to as “necessity of the

‘employer rule.”

Examples

1. Necessary traveling, transportation, representation, of entertainment expenses

that are to an accounting or liquidation in accordance with specific

requirements of substantiation of expense.

‘Allowances which essentaly co ibursement to gover

fe reimbursement srnment personnel

i__ Rresbese they caren pers mancr afte ates so

{presentation and Transportation Allowance (RATA) of public officers and

employeesunderthe General Appropriation Ace nn PUM

'b. Personne! Economic Relief Allowance (PERA} (RR10.2008)

Reasonable amoun's of relnburstment or advances to employees for eaveling

and representation which are pre-computed on a daily basis 1nd which are paid 19

‘any employee while on assignment or duty.

324

chapter 10 - Compensation Income

‘These amounts given to the employee are not income but are expenses of the

trade, business oF profession of the employer that are incurred or paid through the

Employee. These are not employee benefits since they are mere advances OF

feplenishments of What are supposed to be direct cash outflows from the

Employer; hence, they are not considered as compensation income.

eens bums nner meth ries we we et

examples:

1, Work-related mobile phone allowance and transportation allowance particularly

to employees of call centers which are operated on a 24-hour basis where

ance for empses who wil eos rom fe sie

o ranchse holders for repairs ander nspection of equipment

Ruling No 01 ™ one

fe t0 employees working at

10 employed on-call medical doctors

ants to employees under contract to remain in service for a

:

5, Scholarship

specified period upon completion

Housing privilege of military officials

camps

ity

he AFP located inside or near the military

‘These types of employer spending are regarded as business expenses and are not

considered as employee reward because they are not intended tor the free

personal consumption oF disposal of the employees but as implements of the

Employer's business to ensure the employer's convenience.

However, if the expense is unreasonably excessive making it depart from the

nature of a reasonable business expense such as when itis deliberately granted to

include a benefit for the employee, the portion of the expense representing.

provision or privilege to the employee is considered a taxable fringe benefit. These

pes of expense are regarded as “hybrid expenses” because they are parnally

business expense and partially employee benefits.

COMPOSITION OF TAXABLE COMPENSATION INCOME

1. Regular compensation - This pertains to the fixed remunerations received

by the employee every payroll period.

325

= Compensation Income

oe eval compensation ~ Tis pertains 10 oIher Berfo

2 SupPermnloyct with or wihout egArdto HePaYro) rman

ety

employee benefits not

1

en onl Soe

ein

a Manager received 40,000 regular compensation, P120,000 suppig

eee ee radi gotcha

Parone ga (10008 900)

‘Taxable compensation income

REGULAR COMPENSATION INCOME

The rela compensation clades fixed remunerations du tobe received y

employee every period such as: ”

1 Basksalary

2. Fixed allowances such as cost-of-living allowance, fixed housing allow,

every payroll penod

Fed allowances

‘Allowances whch ae fxed in amounts and regularly received as part ofthe

mont beer wee or ay sles oF wages ae part of wk

5 even fa portion ofthe allowances are actually sed

the employer s busine

xcepuon rule on the taxabilty of allowances:

@ Ordinary and necessary

entertainment expense of e

lowances for travelling, representation «

loyees incurred in the pursuit of the employ

counting o

S advancee are returned t

dated allowances are no subject to tax. Howewee

Fe retained by the employee for himself shal

ord vacation ana sick leave allowances

‘The paid absences of

Be pelt seen ormally nucveeaPpied agnst his vacation or sick leat

creis wh ar ne wed aS part of the regular salary 15 part of BE

326

captor 10 Compensation Income

Non-compensation Items

1 Fees

Retainer fees of consultants, talents, and directors who have no management

function in the business are professional income, not compensation income of,

the recipient

‘Commissions to non-employees such as independent sales agents are business

income to the sales agent

2

2s

s paid directly to an employee by customers of the employer

which are not accounted for by the employee to the employer are not

Considered as compensation income, but are to be reported as “other income”

in the income tax return of the employee,

valuation of compensation paid in kind

‘Compensation in kind is taxable atthe fir value ofthe consideration received. If

served in shares, the fait value ofthe shares at the date services were provided

isused

Mustration 1

‘The following pertains to an employee in 2019:

‘The taxable compensation income shall be computed as follows:

> 100,000

3600

41000

P 60.000

Mandatory weduction 2.000

le compensation income F2g000

dustration 2

mplayee who was terminated in 2019 due 200,000

‘Unpaid 2018 salaries 20,000

Xeimnursement for transportation expenses 10,000

‘ermination pay 100,000

327

cng 1 -Cageston ee

rasa cme compute atolls

‘00K + P20K + PLOOK) P 320,000

fon

Gross compensation ince

Less. Non-taxable com

Non-taxable benefits

‘Taxable compensation income

100.000

2.220.000

oration empense isnot an income tothe employee

ead n gross compensation icome, DUES also dedu

ie eason of termation is beyond the employee's a

scone

SUPPLEMENTARY COMPENSATION

ation includes per

Supplementary ar addtional compensation includes performance.

eayetons to an employee in addition to the regular compensation wy

regard tothe payroll period

‘The following ae the additional compensatson under current tax rules:

1. Overume pay

2. Mazard pay

3. Nightshift differential pay

4. Hobday pay

5. Commissions

6

7

8

seg

th

Fees, including director's fees (if director is an employee)

irement and separation pay

9. Value of ving quarters or meals

10. Gains on exercise of stock opuons (BIR Ruling 119-2012)

11. Profit sharing and taxable bonuses

Overtime, holiday, hazard, and night differential pay

“These constitute additional compensation, except when derived by a minimum wage

nts and honoraria

ves intended to stimulate sales. These may be given as a profe

sharing ot pei ce bonus. Emoluments pertain to any pay in general while

‘ronorana are additional payments for attending to special tasks or assignments.

Living quarters or meals

an employee receives free living quarters or meal in addition to salary for serves

rendered, the value (o the employee of such living quarters or meat ded in

‘compensation income. However, when the same was lurnished to an emplo}

328

chapter 10 - Compensation Income.

ont an

‘Under various stock option plans, employees are given the privilege to buy shares a

re eee ate ney enh pee bay sare a

pave value when the st \e employer increases in value above th

bien es in value above the exercise price

agrexercise date. Th 1€ Option isthe discount at exercise date.

hot taxed at exercise date under the view that the

discount becomes realized only when the stocks are disposed. Under current tax

mies ue de ie. market price -exerase price) at exerese date is viewed as

Tompensation in ki

tn the past, stock options w

‘The gains from the

income, unless they q\

Of stock options constitute a taxable compensation

as fringe benefits subject to fina tax. (RMC8B-2012)

ustration

Mr Anthony met the vesting conéition of his employer's stock option plan where he is

tniitled to Buy 10,000 of his employer's share ata strike price of PLOO. In 2018, Mr.

fanthony exercised the option when the share of his employer was selling P150/share

‘ater two years, he sold the shares for PL80/share.

Fair value of stocks (P150 x 10,000 shares) 1,500,000

Tess Exercise price of option (P100x 10.000) _Lagv099

Compensation income (discount) Espana

“The compensation income shall be reported by Anthony in his 2018 come tax return.

‘Treatment of the subsequent sale of the shares

+ corporation isa

corporation, and the sale ofthe stocks is made:

igh the PSE, the sale is subject to the stock transaction tax of 60% of 196

of the gross selling price. The tax would be computed as

Selling price (P1.80 x 10,000) P 1,800,000

Multiply by: stock transaction taxrate 60%. 19%

‘Stock transaction tax E1809

‘The tax will be withheld by the broker who effected the sale. The gain from

the sale ofthe stocks weuld not be subject to income tax

1b directly to buyer. the net gain on the sale is subject to the 15% capital gains

ax shall be computed as follows.

P 1,800,000

1500.00

“300.000

lst

BL s5.000

Capital gains tax

329

(Chapter 10 « Compansaton Income

im SUbIeC* to the,

net gain on the sale (828

2. Foreign corporation the net pal compen ray

Feguler income tax. The gain subject fo regular (ax!

lowe

P 1,800,000

‘Selling price (P100 x 10.000)

ol Ssoouue

tes ax basis of shares sold ia

pital gains

4 year 0%

Starapy by: Holding period rate (98 607)

Capital gain subject to regular tax EAidowe

‘The rules on dealings of ater capital assets will be discussed tm deta yy.

following chapter.

Profit sharing or taxable bonus

Profi shoring 1 2 reward for churning the business to post a prof,

Compensation for conteollingall he factors that infiuence Profit such as markegne

nd sales, productivity, and administrative factors. It is a reward which can ge

{Enjoyed by indivadual employees such as salesmen, division heads, key offices oy

by all employees collecuvely.

is

a

Bonuses are supplemental ar additional compensation. However, if they are linked

solely to productivity under the productivity incentive plan of the employer

pursuant to RA 6971, they should be considered as de minimis benefits,

Productivity incentive bonus

‘The Productivity Incentive Act of 1990 (RA 6971) encourages private employers

to set-up productivity incentive programs.

[A productivity incentive 1s Inked to improvements in productivity usualy in

terms of cost savings througn waste reduction, efficient labor utiliza

increase m volume of production. Under the NIRC, productivity incentive bonus

considered as part of “other benefits" under "13% month pay and other benef.

Under the revision of RA 10653, productivity incentive Is now a de minimis

benef.

Productivity Incentive distinguished from profit sharing bonus

Producuvity incentwe 1s anchored on improvements inthe factors of production

and is usualy enjoyed collectively by employees due to the inherent difficulty of

tracing productty to individual performance. It 1s based upon cost savings

hence, its payable even the business poses a loss. Profit sharing is payable tly

‘when the business posta profit

13TH MONTH PAY AND OTHER BENEFITS

"13th Month Pay and Other Benefts” includes:

1. 13th month pay

330

chapter 10 - Compensation income

2. Other benefits

‘a. Christmas bonus of privat

b. Cash gifts other than Chris

-mployees

Or anversary gts of pvate employees

ial compensation allowance (ACA) of government personnel

Hone (ACA) of government personnel

a 14 month pay, 15% month pay, ete.

fe Other fringe benefts of rank and jie employees

43th month pay

2. The 12th month pay of government employees consists ofa Christmas bonus

equivalent to one-month salary plus a 5,000 cash pik (RAGOBE os amended

by RA 8441)

‘The 1th month pay of private employees is equivalent to one-month salary.

(P0851)

‘christmas bonus and Christmas gift

tumas bonus of government employees is their 13th month pay. In private

the term "Christmas bonus” may pertam to the 13th month pay, a

13th month pay and other be

2011 includes Christmas gift in

regulations cannot amend the law they imy

interpreted to apply only to Christmas gifts of private employees.

Hence,

‘of the NIRC. RRS-

But since revenue

] Government

Ghrisimas bonus

Chrismas

runes oi | andosher ents

Bonus ve Git

te nonediscretionary tothe employer while 2 gfe 2 gratuity

ployer

331

‘Chapter 10 - Compensation Income

oe ager nue al ther wae tinge benefits not spe,

aerate compensation Income a8 eBUat upPeMeBAY OF 13th many WY

ndother benefits under current tax rules such a8 :

1 Employee personal expenses shouldered by the employer

2 Taxable de minimis benefits such 25:

a. Excess de mini

+. Benefits notinluded inthe de min

ist

Employee personal expenses

grocery, asoaation or club membership dues, Favel oF vacation expense ¢

ion fees, when assumed or paid by the employer, c Inge benefits,

the employee, Ths fact holds true even if the expense is rece1pted in the name

the employer

Taxable de minimis benefits

‘All other benefits of relatvely small value which are not included in the listo dg

fs benefits shall not be considered as de minimis but as ordinary ting

benefits Corollary to this rule, excess de minimis benefits should be considered’

taxable ordinary fringe benefits.

‘Tax Treatment of Other Fringe Benefits

2. For rank and file employees - treated as compensation income as part o

“other benefits" under 134 month pay and other benefits”

b. For managerial or supervisory employee - treated as fringe benefit subject

fringe benefit tax

It must be emphasized that the “other fringe benefits” of managerial or supervisory

‘employees are excluded from their “13th month pay and other benefits."

Mlustration 1

‘The employer pays for the tuition fee of the employee In addition to his regular

compensation

‘The tuition fee paid isa fringe benefit which

1, Asa compensation income as part of

be treated as follows:

=r benefits" under 13 month pay ond

‘other benefits" ifthe employee isa rank and fie employee

2 Asa fringe benefit subject to fringe benefit tax i the employee is 2 managerial er

supervisory employee

3. Asan exempt fringe

piven by the erpioy

employee is req

employer's busin

regardless of the type of employee, if the same was

3s convenvence or business necessity such as when the

study to acquire expertise for the future use of the

332

chapter 10 - Compensation income

usage cece 4 mony ie al

‘employee receives 2 monthly rice allowance of mon! :

‘the P1,000 monthly excess constitutes a taxable de minimis beneft taxable 28

ompensation as part of “other benefits for a rank and fle employee tis a fringe

fenetit subject to final fringe benefit tax fora managerial or supervisory employee,

TAX TREATMENT OF 13TH MONTH PAY AND OTHER BENEFITS

‘AR2-98 provides that 13th month pay and other benefits are exempt from

withholding on compensation provided they do not exceed P90,000. It follows,

therefore, that the excess above P90,000 is subject to the withholding tax on

compensation.

RR3-98, the revenue regulation implementing the fringe benefit tax, also provides

that it does not cover benefits forming part of compensation income subject to the

withholding tax on compensation.

Hence, the excess of "13th month pay and other benefits” over P90,000 should be

treated as compensation income subject to regular income tax.

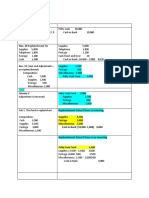

ihustration 1

‘A-government rank and file employee received the following benefits aside from the

basic pay in 2019

P 70,000

5.000

36,000

26000

ized value of vacation leave and sick eave (18 days) 9.000

Uniform and clothing allowance 7,000

Required: Determine the taxable “13th month pay and other benefits”

Solution:

Christmas bonus (13th month pay of gov't employees)

P 70.000

pay and other benefits

Less: Exclusion Threshold

Taxable 13th month pay and other benefits

Note on government employees:

1 Personne! Economie Relief Allowance is oot subyect to income tax and withbolding tax

(Under RRB-2000, as affirmed by RR

2. The P5.000 Christmas gift of gover ioyees is designated by the NIRC tobe part of

“1h month pay and other benefs; hence, itisnota de minimis benef

333

‘Compensaton Income

Chapter 10- x vacation leave and ick Ive credits of

er BRS-2011 the monebuaon ee

3. Under BRS eiewitout regard tothe Dumber of dayy Py

cna is an exempt de mii Be

ation 2

Museen nents wagner OWE SN fn

Aprva Tervedtheflowngbene8 Suing 2019:

13th month pay 72.000

Performance Bonus 00

hrimas gift 30,000

Danger exposure allowance (hazard Pay) 6000

How ace 28000

for and clothing allowan ,

. 6.000

Laundry allowance

‘The housing privilege pertains t0 il

Frralshed by the employer to employees fr staying onsite

Required: Compute the excess 13th month payand other benefits,

Solution:

De Other

minimis _Limit_ Benefits.

CChastnas gift P 30,000 P 5,000 P 25,000

‘Uniform and clothing allowance 8000 6000 2,000

Laundry allowance 6000 3600 __2400

Excess de minimis benefits (other fringe benefits) P 29,400

13th month pay 72.000

‘Total 13th month pay and other benefits P 101,400

Less’ Exclusion threshold 30.009

Tavable 13th month pay and other benefits Bo1s90

Note Private employees

for prvate employees under RRS-2011.

feconvenience of the employer rule

Mustration 3

‘Amanageral employee recewved the following benefits in 2019.

con P 95,000

‘ase on condominium unlt 18,000

ronal body guard 12,000

mR 12,000

ce 32,400

allowance z

7,000

differentia pay 11,000

334

the annust value of the employees living quate,

apter 10 “Compensation Income

eau!

compensa

solutions

tion, and the Fringe benefit subject to fringe benef tax

De Other

minimis _Limit_ fienefits,

pice allowance P 32,400 P 24,000 P8400

Clothing allowance L000 __6000 __1.000

acess de micimis aA

benefits:

Tesdence raid by employer 18000

f personal body gua 2000

‘otal finge benefit subject to fringe benefit tax Eoaeago

P 12,000

1.000

Bozao09

‘gotal 13% month pay and other benefits P 95,000

Less: Exclusion threshold “99000

‘Taxable 13th month pay and other benefits Eso00

INTEGRATIVE ILLUSTRATIONS: COMPENSATION INCOME

‘Integrative Mlustration 1

IR government rank and file employee had the following summary of his compensation

and benefits in 2019:

Gross compensation income P 1,084,000

Less: Employee payroll deductions

Employee conti (oGSIS, PHIC; HDMF P 90,000

Employee deduction for withholding tax 4000 _144.000

Honoraria 15000

Total compensation Pioei009

‘The taxable compensation income shall be computed as follows:

335,

Determine the taxable “13th month pay and other benefits” additional

oe .

mulnimis Taxable Benefits Benefits

Reoular ond supalementany compensating 000

pla compensio 1,044,000 - P80.000) P 964,000

‘Supplemental compensation 15,000

Hee 18,000

moe POP 975000

‘Christmas gift S000)

Excess De minimis:

‘informallowance &12000 26.000 6.000

Total paseriny x

osision threshold (opto P3000) —_90.000-¢-- 90,000

Total Pisgo00 P 8.000

Tora nontaxablecompensation — E.2LR00

Teele excess 13th month pay and other benefits __- 8.000" 8.099

“Tarabe compensation come 2387009

in the Income Tax Return of the employee:

jon income ie, P1,061,000+P144000) —P. 1,205,000

pensation income

uetions P 80.000

138000 ___218.000

‘Taxable compensation income B987,000

Integrative llustration 2

[A private employee derived the following remunerations and benefits in 2019:

Basic compensation, net of P32,000 SSS, PHIC, PhilHealth,

on dues, and P35,000 withholding tax P $33,000

23,000

24,000

12,000

16,000

31200

mth pay 50,000

zed unused leave credit (10 VL and 8 SL) 18,000

‘Total compensation income 2 Fia200

336

Tae neta allows

fora rankand file employee:

De Non: Other Taxable

Mandatory deductions.

Regular compensation (P600,000 - ae

P 568,000

Supplementary compensation

‘Overtime pay 21,000

COLA 12,000

Daily transportation allowance —-P-_16,000

POP 601000

P 50000

24,000

249007200

Monetized VL 10.000

Monetized SL 8.000 - 8000

Uniform allowance —_9.000 __6.990 __3.000

oral ‘ELsH200 P 56.000 P 92,200 P 601,000

Exclusion threshold 20.000 +-90.000

P

146.000 __iza.ono

‘Taxable compensation income

17714200 nat py + (2000+ #35000 pyr dations

337

chapter 10 - Compensation Income

tacome Tax Due vapute slows

soca eax de ofthe employee would Be tad alow

amt nc otappcablebracket 400.000 F 30.000

ore: Check the complete Individual Income Tax Taber Chapter

vor managerial or supervisory employes:

De Non Other ‘Taxable

Minimis Towable. Benefits. Benefits.

Mandatory deductions b32000

Regular compensation

Supplemental compensation

Overtime pay

coua

Dally transportapon allowance 16,000

Total P 601,000

‘Lithmanth pay and other b nefits:

13th month pay P 50,000

Exclusion threshold (up 0 P90,C00) __S0.000 - 50.000

‘Total fringe benefits subject to final tax ba2209

338

‘TAXABILITY OF MINIMUM WAGE EARNERS (MWE)

sre exempt from income tax on the following:

339

fe aieentil pay

exempted benefits, they should be presen

erm amount of txable compenaton 32%

Since the foregoing are legally

Set a

rae munimum wage earner empioyed By CSO Company, derived the fp,

‘benefits during the year: OW,

= se

Ses Shamtpe mee

Te ee P 275,000

‘Less: $55, Phillealth, HDMF contributions 5.000

b_270.900

Net otal

“The taxable compensation income should be computed as follows:

Gross compensation income P 275,000

Less Non-taxable compensation income

Mandatory deductions. = P= 5,000

Exempt benefits

‘Taxable compensation income

inimum wage and HHON are exempt benefit, they must be removed

‘amount of taxable compensation income. The would be no tax duein

seme Court in Soriano et al. vs. Secretary of Finance ari

al Revenue, G.R No. 184450 dated 24 January 2017.

exempt from income tax rom he

‘hey receive other taxable compensation, However

her taxable income exceeds the P250,000 fore

may be subjected to

year.

340,

cnapeer 10 - Compensation Income

tion 1: With other taxable compensation come

rast inimum wage employee, was able to close sales dea for her employer

pasieminimam wage, net of

000 mandatory deductions > 160200

se month py 14000

Hotday pay 4000

70000

ial pay 15.000

sat 10.000

Prottsharng bonus bee

Commision Income ry

Total Eos

-The taxable compensation income should be computed as follows:

Gross compensation e.P655800+ P8000) P_—663,000

{ise Non-taxable compensation income

Mandatory ded > 2000

Exemptbenetts P ytam __ 2o.a00

‘Taxable compensation income cae

Mary's tax due shall be computed as:

—TaxDue_

P 302,000

Lest Lowe im

wherethe taxableineomequalfies 28009 0

excess 7 132,000,

Multy by: 30m 26.400

Total we due Eek

Iustration 2: With business income

rage employee, do part-time business after work. He received total

‘of PLL,000 13% month pay but net of P5000

ved a performance bonus of F20,000 and earned

16. P290K + PSK+P20K) «315,000

8 income

P 5,000

—2e0000 295.000

P2000

——s00.000

‘Taxable income LOL

nore

‘Minimum Wage Earner during a your

aminimum wage carne” dig the yen,

iy on compensation earned before tea sha

me

‘Chapter 10 - Compensation

Rules of change in stabs a5 2

mes

1. When an emplayee beco!

be subject to income tax on

‘munimuum wage earner.

Musee a base pay af P400/day when the minimum waRe was F382 ay ‘

{has reeiing overtime pay ad the yearend 15/8 mon ay. On july 1. git

the Regional Wages and Productivity Boat ibaa minimum Wage by

P22/day to P404/day. Anthonys employer 11 ary ¢0 the minim

recy os

nebo caie fom

Au tb on et ea

Sine we yaa paige 3)

Compenearonstorting fly 1 wcluding overtime pay and yearend 13th monty

‘shall be tax exempt whet b

1e exact amount of income taxes had been withheld by the employer for

1 atone toy ned mo fle a ne x et

psn en fg Mcgee

Foe tage sl eo a or inde

eet

ny 1 fume 30 becouse ny

‘Ths rule may also apply n cases of:

‘a. Transfer to an employer paying salary at the minimum wage

b. Transfer ofemployment toa region with higher minimum wage

2. When an employee ceases to be a minimum wage earner during the year dye

tomecrease in salary, only the income for the rest of the year is taxable

Austration 2

[Andrea ts a minimum wage eamer. She was promoted and was given a salay

raise above the minimum wage starting August 1, 2019.

Andrea shall be exempt from income tox from January 1 to July 31 because sheise

arner. Effective August 1, 2019, Andrea shall be subject to tax Te

rt deducting the withholding tax on compensation from Andra,

the same date

If the employer properly withheld the income tax for the period Aug

December 31, Andrea need not fle an income tax return. Otherwuse, she sh

‘adjustment return reflecang her compensation for the same period and shall pay be

‘due or claim or refund in case of excess withholding

Transfer to an employer paying salary above the minimum wage

. Transfer of employment toa region with lower statutory minimum wage

342

copter 10 - Compensation Income

4. When an employee ceases to be a minimum wage earner during the year by

disqualification ((e.. earning taxable income)

taxable income of the employee does not exceed P250,000 for the

ote that

ear there wal be no income tax due for the period under the tax table

Under RMO23-201

iving Allowance of MWEs

LA which forms part of the new wage rates prescribed to

be the statutory minimum wage should be treated as part of the mmamurn wage

ped shall not be treated as a separate or other benefit.

‘THE WITHHOLDING TAX ON COMPENSATION

‘The withholding tax on compensation is a method of collecting the income tax at

source upon receipt of the income, It applies to all employed individuals whether

‘uizens or aliens. The employer is consttuted as the withholding agent.

Reproduced herein is the withholding tax table for semi-monthly compensation:

a _+__}

Veaas | Picauar P| Pua ana |

"yee |” etce” |’ Shoe

Fiomn | reoanse | rion

Coomoneet | Sapkecer® | 3K one?

geen Leese sonar

‘Chapter 10 - Compensation Income

Procedural computation ofthe withholding fax on compensation

compat monetary and non-monetary, COMPEnsation

for the payroll period: monthly.

ble benefits, mandatory Cr

Segregate non-taxat

that apphes to the regular compensation

period. Determine the basi ta gy OY

of the regular compen

Pensa

2, Determi

‘employee for the applicable payrel

bracket.

43, Add supplemental compensation to the €

Subject the total tothe incremental tax rate

44, Total the basic tax and the incremental

tein AV POPMET apse ty

sron 1: Me a Pe ety. Zn has weir of

£96 Compr Em 8 Peal HONE a Unda

1,000 nen-taxable benefits.

‘andro's taxable compensation shall be computed 2:

Gross compensation P 10,000

Less: Mandatory contributions. «== P= S00

Non-taxable benefits ——1000 ___L500

Paso

‘Taxable income

andro’ P8500 weekly taxable Income qualifies under Column 3 under the west

‘pavzall pexiad) ABC Company shall compute the withholding tax on compensation

follows:

Ta

Regular compensation income P gs00

‘Less: Base amount at Column No.3 - weekly ——2092 P 57692

Exc > 808

Multiply by: Incremental taxrate 259% 20200

Total withholding tax on compensation 27a

‘The amountof compensation income that wil be released to 2andro shall be

Grose compensation

ene oe

Non-tarable benefits ——1000 _1soo00

#50000

27892

ezzo8

Net payroll due to Zandro

344

caster 10 - Compensation Income

strat employs Mr Penoy wth 2 basi

yy employs Mr. Penoy with a basic monthly salary of P70,000 wh)

ry 150 and 30° day ofthe month. For the second hi

y

th, HDMF and union dues were P4,100,

;-monthly regular compensation is P35,000 (ie. P70,000/2).This qualifies

under

the withholding fx

—

Regular compensa 7 Pasion

Reigase amount at Column No, 4~semi-monthly oan PF satée7

we P1667

Jad. Supplemental compensation

Taal P 13,667

Muleiply by: Incremental tax rate

{otal withholding tax on compensation se

‘The amount of compensation income that will be released to Penoy shall be:

-ompensation P 35,000.00

Supplemental compensation 2.000.00

‘Total compensation 47,000.00

less: Mandatory compensation P= 0,00

Nontaxable benefits 40000 __4.10000

‘Taxable income 42,900.00

2516.77

23.383.23

‘The procedures discussed herein are also applicable for daily or monthly payroll

penods but of course using their respective withholding tax table

a Tax Adjustment

‘be noted that the total amount withheld on every payroll date may not

exactly match the annual tax due. Due to this me of the employee needs

to be reckoned 0 adi fe as necessary. ANY

‘employee. An over-

BENEFITS NOT SUBJECT TO WITHHOLDING TAX ON COMPENSATION UNDER

RR2-96, AS AMENDED:

‘employment

1: and paid entir-ly in products of the

‘chapter 10 - Compensation Inoome

ation for domestic services .

3. Remuneration

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exercises 1-14Document26 pagesExercises 1-14Fely Maata100% (2)

- Chapter 13 PDFDocument22 pagesChapter 13 PDFFely MaataNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 1 PDFDocument30 pagesChapter 1 PDFFely MaataNo ratings yet

- Chapter 6-2 PDFDocument3 pagesChapter 6-2 PDFFely MaataNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 12Document21 pagesChapter 12Fely Maata100% (2)

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Chapter 11 PDFDocument16 pagesChapter 11 PDFFely MaataNo ratings yet

- Chapter 6-1 PDFDocument24 pagesChapter 6-1 PDFFely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- CH5Document17 pagesCH5JessaNo ratings yet

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet