Professional Documents

Culture Documents

ARC - Comm Terms & Cond - Indigenous - R1

Uploaded by

Tuff qualityOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ARC - Comm Terms & Cond - Indigenous - R1

Uploaded by

Tuff qualityCopyright:

Available Formats

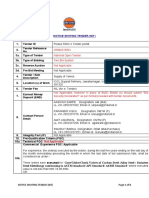

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

RFx No. : dated

Vendor : M/s.

Vendor’s Internal Offer No. : dated

Based on General Condition of Purchase (GCP)

(https://www.gnfc.in/PDFandWORD/GNFCGCP.pdf) of GNFC, following commercial terms &

conditions are agreed & confirmed by the vendor. PLEASE PUT SIGNATURE/SEAL ON

EACH PAGE. THIS DOCUMENT IS TO BE UPLOADED ALONG WITH UN-PRICED

TECHNICAL BID FAILING WHICH YOUR OFFER IS LIABLE FOR REJECTION.

Please note that this is ARC requirement. Please confirm acceptance of following

terms & conditions:

Sr. Description Vendor’s Response

No.

1 Scope Confirmed

The scope of supply and technical requirements shall be in total

conformity with requirement of the technical specifications

including deviations, if any, agreed & accepted by GNFC.

2.a Prices Confirmed

Prices shall be FIRM and without any escalation, whatsoever

during the entire contract period.

2.b PERIOD Confirmed

The period of this contract will be one year from the date of

contract which may be further extended for one more year on

mutually agreed basis.

3 Basis of Prices

3.a Prices are based on delivery at GNFC Stores at Bharuch Confirmed

inclusive of Packing & Forwarding and Freight charges. Delivery

Address: GNFC Limited, P.O. Narmadanagar -392015, Dist.:

Bharuch, Gujarat, India

In case of booking through transporters, delivery shall be on

Door Delivery (Consignee Copy attached) basis.

Any demurrage/wharfage due to any reason, shall be to vendor’s

account.

Unloading at GNFC Stores shall be in scope of GNFC.

3.b All Testing Charges, if any, are included in the quoted prices. Confirmed

4 Taxes: GST shall be applicable extra on the quoted prices. Confirmed

4.a Applicable GST% (IGST / SGST+CGST): Present Rate is

SGST-_______ %

CGST-_______ %

IGST-_______ %

4.b Applicable HSN Code (8 Digit) HSN Code:

_____________

4.c Terms and conditions as applicable under GST shall be as Confirmed

indicated at GST Annexure

4.d Any increase in the taxes beyond contractual delivery period Confirmed

shall be to VENDOR’s account.

5 Delivery

5.a Effective date of order shall be the date of release of LOI/PO Confirmed

(whichever is earlier).

Sign & Seal of Vendor Annexure S2 Rev.0 Page 1 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

5.b Delivery from effective date: ________ Weeks

Delivery date shall be considered as the date of receipt of goods

at GNFC’s site along with required documents as per PO terms. Confirmed

Please furnish your best delivery period, preferably 3-4 weeks.

5.c Time required for the site erection & commissioning work from _________ Weeks

the date of mobilization of site.

6 Delay/Liquidated damages for delayed Confirmed

delivery/completion (Refer Clause No.3.2 of GCP)

In case of delay in delivery/completion beyond agreed period,

the penalty @ 0.5% of the total basic order value shall be levied

for each week delay or part thereof with ceiling of maximum of

5.0% of the total basic order value, as per Clause No. 3.2 of

GCP. Applicable taxes will be charged and paid to Government.

7 Warranties/Guarantees (Refer clause no. 2.4 of GCP) Agreed

The guarantee period shall be 18 months from the date of

commissioning or 36 months from the date of receipt of last

consignment at GNFC’s site, whichever is earlier.

8 Terms of Payment Acceptable

For supply Items:

100% value on pro-rata basis including 100% taxes shall be

released within 30 days of submission of following documents

and Receipt & Acceptance of goods at GNFC-Stores.

(a) Relevant Test Certificates

(b) Set of despatch documents consisting Original

Consignee copy of Lorry Receipt, Original GST Invoice,

Delivery Challan, Packing List, etc.

ALL THE PAYMENTS WILL BE RELEASED BY NEFT/RTGS

ONLY.

9 Part Order/ Part Annual Rate Contract (i.e. Part Item or Acceptable

Part Qty.) without any pre-condition.

10 Insurance Agreed

Transit Insurance will be arranged by GNFC as per Clause No.

3.8 of GCP. Please inform despatch details immediately e-mail.

11 Inspection & Testing

11. Inspection shall be by GNFC / GNFC’s authorized TPI agency, Acceptable

a wherever specified in Enquiry documents.

All charges towards deputation of GNFC official / TPI agency

shall be to GNFC Account.

All charges towards providing the inspection facility including

required testing shall be to Vendor’s Account.

11. Approval and Inspection by statutory authorities, wherever Acceptable

b necessary, shall be arranged by the VENDOR at his cost

including IBR/CCOE etc.

12 Purchase Order/Annual Rate Contract Acceptance Acceptable

In the event of award of Purchase Order/Annual Rate Contract

on you, you will submit order/ARC acceptance within 10 days

from the date of order, failing which the order/ARC shall be

treated as accepted by you.

Sign & Seal of Vendor Annexure S2 Rev.0 Page 2 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

13 Micro, Small, Medium Enterprise status details Acceptable

In the event of Purchase Order on you, we shall indicate your

current status available in our records. In case of any change in

your status, you shall confirm in writing to us with documentary

evidence within 07 days from the date of receipt of PO, failing

which it will be construed as MSMED act doesn’t apply to your

organization and accordingly your status will be updated in our

system.

Further from time to time, should there be any change in your

status, responsibility shall lie with you to let us notify in writing

regarding such changes.

14 Submission of Statement of Accounts Acceptable

In the event of award of Purchase Order having value more than

20 lakh or more, you will submit Statement of Accounts along

with your final invoice, failing which the balance as per GNFC’s

books of accounts will be considered as final for all purposes

including legal disputes.

15 Bank Guarantees

15. Security Deposit Bank Guarantee (SDBG) Acceptable

a In the event of ARC, SDBG shall be submitted for the 10% of

basic ARC value, as per GNFC format from any nationalized bank

within 15 days of the release of the Order (Refer Point No. 15.b).

The proforma of SDBG shall be as given in our GCP.

15. Format of Bank Guarantees Confirmed

b All applicable Bank Guarantee including Advance Payment,

Security Deposit and Performance Bank Guarantee etc. shall be

submitted within GNFC’s Green Ledger Paper Format only. Hard

copy of the same shall be provided at a later stage. Vendor is

required to fill in the blanks provided in the format and affix the

required amount of stamps on the format itself. Any Bank

Guarantee typed on the Stamp Paper as per GNFC format is not

acceptable.

16 Infringement of Patent: Confirmed

Vendor shall warrant that sale or use of goods, supplied under

this offer/order whether designed and manufactured so as to

comply with purchaser’s specifications or otherwise shall be free

of any claim, whether rightful or otherwise, of any person, by

way of Infringement of an patent copy-right, trademark or

industrial design or the like, and shall hold purchaser harmless

and indemnify purchaser and its consultant and their authorized

representatives at its own cost from any and all such claims and

legal proceedings, purchaser makes no warranty that the

production sale or use of the goods designed and manufactured

so as to comply with purchaser’s specification will not give rise

to the claim, whether rightful or otherwise, of any third person

by way of infringement of any patent copy-right, trademark or

industrial design or the like, and in no event shall purchaser or

its consultant be liable to vendor for indemnification in the event

of any action being brought against vendor in connection with

any such claim.

17 Other conditions of Supply Acceptable

All other commercial terms & condition not referred in this

document shall be as per General Condition of Purchase (GCP).

18 Validity of the offered Prices Acceptable

Up to 4 months from the last date of submission of bid

Sign & Seal of Vendor Annexure S2 Rev.0 Page 3 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

19 TEST CERTIFICATE Acceptable

You shall furnish Material test certificate with physical & chemical

properties and all other relevant test certificates along with

material and despatch documents at no extra cost.

20 FALL CLAUSE Agreed

You will not sale the items covered under contract or items of

identical description to any other customer at prices lower than

the prices charged to us and/or should there be any reduction in

the prices observed during the contract period, the prices

charged to us shall stand correspondingly reduced for our orders

from the date from which such reduction in prices has become in

to effect.

21 QUANTITY Acceptable

Quantity mentioned in inquiry is for indicative purpose. Our

actual requirement may vary depending on maintenance /

modification requirement of the plant. GNFC shall not give any

commitment for quantity or value.

22 PARALLEL CONTRACT Acceptable

GNFC reserves their right to either conclude parallel contract

with other vendors or reject all the offers without assigning any

reasons. Please confirm the acceptance of the same, failing

which offer shall be rejected.

23 TITLE and RISK Confirmed

The supply and consequent transfer of ownership of the products

supplied under the contract will be completed only upon

acceptance of the product by the respective authority at GNFC

Site. All risks, liabilities and obligations in the product as related

to product and shipment to prescribed final destination prior to

the acceptance of the products by the respective authority will

be that of the supplier. The supplier shall always ensure that the

goods supplied by it under this contract shall be free of any lien,

charges or other claims

24 SUSPENSION OF CONTRACT Confirmed

In appropriate case, the Company may at its discretion, instead

of terminating contract for breach of any terms or conditions of

contract by Supplier, suspend the contract for specified period.

In case the contract is so suspended, Supplier will be under

obligation to reimburse the Company damages or loss suffered

by the Company on account of Company making alternative

arrangement for procuring supply during period of suspension of

contract and if the supplier fails to reimburse such loss or

damages, the same will be recovered from the Security Deposit

or any other payment to be made to the Supplier either under

the contract/s with the Company

25 TERMINATION Confirmed

The Company may, without prejudice to any other remedy for

breach of contract, by written notice of default sent to the

Supplier, terminate the Contract in whole or in part. Breach of

contract shall include, but shall not be limited to the followings

(a)The Supplier stops supply for 25 days when no stoppage of

supply is shown on the given programme and the stoppage has

not been authorized by the Company, or (b)When the supplier

delays the supply as per schedule partly or fully for more than 6

weeks or (c) If the Supplier fails to promptly correct the defect

in the supplied goods in the time limit given by the Company or

(d)If the Supplier fails to perform any other obligation(s) under

the Contract or (e) The Supplier goes bankrupt or goes into

Sign & Seal of Vendor Annexure S2 Rev.0 Page 4 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

liquidation other than for a reconstruction or amalgamation If

the Contract is terminated the Supplier shall stop supply

immediately. In the event of termination of contract by the

Company on account of breach of any terms and conditions of

the contract by the supplier the entire Security Deposit Bank

Guarantee given by the Supplier will stand forfeited

26 PAYMENT UPON TERMINATION Confirmed

If the Contract is terminated because of a breach of Contract by

the Supplier, the Company shall process payments due to the

supplier less all required deductions. If the total amount due to

the Company exceeds any payment due to the Supplier the

difference shall be a debt payable by the Supplier to the

Company

27 BRIBES, COMMISSION, GIFTS, ETC. Confirmed

Any bribe, commission, gift or advantage given, promised or

offered by or on behalf of the contractor or any one or more of

their partners/ Directors/Agents or servant or any one-else on

their behalf to any officer, servant, representative or agent of

the Company or any person on his or their behalf for showing or

for bearing favour or disfavor to any person in relation to the

contract, shall subject the contractor to the cancellation of this

contract or any other contract with Company and also to

payment of any loss or damage resulting from such cancellation

28 INSPECTION OF RECORDS BY THE COMPANY Confirmed

The Supplier shall permit the Company to inspect the Supplier's

records relating to in relation to the contract and to have them

verified by the Company, if so required by the Company

29 INDEMNITY Confirmed

The Supplier shall indemnify and keep harmless the Company

from and against all actions, proceedings claims , demands,

losses, costs, damages and expenses whatsoever which may be

brought against or suffered by the Company which they may

sustain, pay or incur as a result of or in connection with the

performance/ purported performance/ non-performance of

the Agreement by the Supplier but excluding any such actions,

proceedings, claims demands, losses, costs, damages and

expenses to the extent that they are sustained, paid or incurred

by reason of or are otherwise attributable to the negligence or

willful acts or omissions of the Company, its servants, agents, or

employees

30 Risk Purchase Confirmed

In case you fail to deliver the goods as per delivery schedule

furnished by us, we will have right for risk purchase from open

market at your risk and cost

Notes:

1. This supersedes all other terms and conditions of sales offer of VENDOR.

2 Acceptance of all the Terms & Conditions indicated above and laid down in the GCP are

the governing factors for deciding orders. Any deviation(s) will be viewed unfavorably.

ACCEPTANCE

We hereby accept the above terms & conditions in totality without any deviation and

conditions.

___________________

Sign & Seal of Vendor

Sign & Seal of Vendor Annexure S2 Rev.0 Page 5 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

GST ANNEXURE

► Timely provision of invoices/Debit Note/Credit Note/Other applicable

documents:

Supplier to immediately provide tax invoice/ Debit Note/ Credit Note/ other applicable

documents as per GST Law to enable GNFC to claim tax benefit within timeline as

required by GST Law and ensure that GNFC must be able to claim ITC [Input Tax Credit]

as per applicable provisions & restrictions of GST Law. All necessary adjustment entries

(Credit Note, Purchase Returns, and Debit Notes) shall be made within time limit as

prescribed in GST Law to ensure that GNFC doesn’t suffer any loss due to such

adjustment as per GST Law. Any consequence in terms of tax, interest or penalty on

account of delayed raising of tax invoice or other applicable documents or adjustment

documents as mentioned above shall not to be borne by GNFC;

► HSN/SAC

HSN / SAC for goods & services respectively shall be specifically included in the tax

invoices as required by applicable GST Law provisions with respect to digits of HSN Code.

► In case of receipt of advance, the Supplier undertakes to raise the necessary statutory

document. Further the Supplier declares to raise the prescribed documentation

governing the movement of goods.

► In case of any wrong classification of HSN, GNFC shall not be responsible and shall not

pay any additional taxes, interest or penalty;

► Discounts

Any known post sale discount should form part of terms of the agreement/contract and

any discount given at the time of sale should be recorded on invoice to enable Supplier/

GNFC to claim tax adjustment. In case there is any post sale discount then the credit

note must be issued within time limit as prescribed in applicable provision of GST Law to

enable supplier/GNFC to claim tax adjustments. .

► Manner of issue of invoices

a) Mandatory three copies of the valid tax invoices or other applicable document as per

GST Law need to be issued by suppliers in case of supply of goods (i.e. ‘Original’ for

recipient (GNFC), ‘Duplicate’ for transporter and ‘Triplicate’ for supplier) and wherever

the law requires, an Electronic Invoice Reference Number and QR code for each

invoice. 2 copies of invoice or other applicable document as per GST Law need to be

issued by supplier in case of supply of services (i.e. ‘Original’ for recipient and

‘Duplicate’ for supplier). Further, the invoices for supplies shall be as per the GST Law

&clearly bear the GSTIN No/ UID No along with Purchase Order/Work Order/Service

Order No and date and wherever the law requires, an Electronic Invoice Reference

Number and QR code for each invoice.

b) Supplier shall be responsible to issue documents required for movement of goods

(such as tax invoice, delivery challan, e-way bill, e-invoice etc) and the logistic partner

shall not be liable for any loss arising due to confiscation of goods by government

agencies on account of lack of proper documents or any miss-declaration.

c) Where the supply of goods/ services are liable to GST under reverse charge

mechanism, then the supplier should clearly mention the category under which it has

been registered and also that “the liability of payment of GST is on the Recipient of

Service”. If payment of GST is received by Supplier in spite of Goods or Services

supplied by said supplier is covered under RCM [Reverse Charge Mechanism] and GST

is payable by GNFC, said supplier must return the amount of GST immediately to GNFC

so that default on part of GNFC can be avoided. In case the supplier does not declare

the same or does not return amount as mentioned above then such GST amount shall

be recoverable from them with interest.

d) The invoice should clearly specify abatement if any

e) If any claimed or otherwise from the Taxable Value while calculating the GST.

f) Tax invoice is to be issued by the supplier as per applicable GST Law provisions. .

Sign & Seal of Vendor Annexure S2 Rev.0 Page 6 of 7

Annexure–S2

COMMERCIAL TERMS & CONDITIONS FOR ANNUALRATE CONTRACT(ARC)

(To be uploaded along with Un-priced Technical Bid in SRM Portal)

► Tax Indemnity clause:

Declaration/ Self Certificate stating that Taxes which have been collected/ with-held on

behalf of GNFC have been duly paid/ will be paid to the Government account within the

due dates specified under various Tax Laws (including GST law) in India and Rules made

there under. It may please be noted that if GNFC is not able to avail any tax credit due to

any short coming on the part of the Supplier including mismatch of ITC between invoice

and GST return uploaded by supplier (which otherwise should have been available to GNFC

in the normal course), then the Supplier at his own cost and effort will get the short

coming rectified. If for any reason the same is not possible, then the Supplier will make

‘good’ the loss suffered or potential loss that may be suffered by GNFC due to the tax

credit it lost in that transaction (including any interest and penalty in this regard).If any

shortcoming is communicated by GNFC to Supplier said Supplier shall take prompt action

to rectify the same. GNFC reserves right to recover from outstanding balance of Supplier

without prejudice to above mentioned obligation of Supplier to make ‘good’ the loss

suffered or potential loss that GNFC may suffer by separate transaction as may be directed

by GNFC.

► Other points –

a) Any Liability arising out of dispute on the tax structure, HSN classification, correct

disclosure in return, timely filing of applicable GST returns, raising of correct tax invoice

within statutory timelines and presenting us immediately, calculation, correct valuation

and payment of GST to the Government will be to the Supplier’s account;

b) In case the value of tax invoice or GST rate on tax invoice as mentioned in tax invoice

of Supplier is assessed differently by the department during assessment proceedings or

any other dispute is raised by department resulting in additional liability of Supplier then

GNFC shall not be liable to reimburse any amount of tax or interest or penalty to such

Supplier in relation to such additional liability or any other incidental expenses or

liabilities;

c) The tax invoice or debit note raised by supplier on us must be compulsorily uploaded in

GST return in manner as required by GST Law. Further, GST in respect of such tax

invoice must be paid to government as required by GST Law. In case the same is not

complied with then the Supplier will make ‘good’ the loss suffered or potential loss that

may be suffered by GNFC due to the input tax credit lost in that transaction (including

any interest @ 24% and penalty in this regard).

d) In case the tax invoice is not presented to us immediately on issuance and if GNFC is

not able to claim Input tax credit on account of expiry of statutory timeline then GNFC

shall not make payment of any taxes to Supplier;

e) The PO/SO/WO shall be void, if at any point of time you are found to be a black listed

dealer as per GSTN rating system or if you have not filed GST returns as per applicable

GST Law provisions, no payment shall be entertained in such cases.

f) The Supplier/ Sub contractor shall communicate to GNFC with regard to any change in

the registration details, issue of blacklisting or any non-compliance by Supplier

irrespective of the fact that whether such events are attributable to the Suppliers or not;

g) Any local levies and or other charges levied by any Central/state/local authorities

wherever applicable shall be extra and supplier shall be liable to discharge the same.

GNFC shall not pay or reimburse the same to Supplier.

► Clause on anti-profiteering

Any economic or tax benefit arising out of the implementation of GST is mandatorily

required to be passed on to us by you. Similarly, the benefits enjoyed by your Suppliers

and other players in the supply chain are also required to be passed on to you by them,

which in turn shall be passed on to us by way of price reductions. Accordingly, you are

expected to pass on any direct or indirect benefits arising thereon.

The responsibility to pass on the above benefits vests with you as our ‘Responsible

Suppliers’ and we reserve our right to understand and seek the manner/ mechanism in

which such benefits are passed on to us.

___________________

Sign & Seal of Supplier

Sign & Seal of Vendor Annexure S2 Rev.0 Page 7 of 7

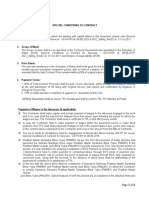

You might also like

- SPL Terms 7 BUYER1-DLRLDocument11 pagesSPL Terms 7 BUYER1-DLRLTrilok ChanduNo ratings yet

- Special Conditions_Volleyball _Tech SpfnDocument8 pagesSpecial Conditions_Volleyball _Tech SpfnHQ NC 2No ratings yet

- Commercial terms and conditionsDocument4 pagesCommercial terms and conditionsadihindNo ratings yet

- TENDER DOCUMENT FOR AIR COMPRESSOR (SC/220197Document23 pagesTENDER DOCUMENT FOR AIR COMPRESSOR (SC/220197BALKISHAN TYAGINo ratings yet

- Protective Cover TenderDocument5 pagesProtective Cover TenderAMM GSD JODHPURNo ratings yet

- A7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFDocument9 pagesA7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFanjan.kaimal4433No ratings yet

- NTPC Limited: Volume - IiDocument5 pagesNTPC Limited: Volume - IiIshaan LuthraNo ratings yet

- Check List For Commercial Terms: CL-E-R02-07-08-2020Document3 pagesCheck List For Commercial Terms: CL-E-R02-07-08-2020rafikul123No ratings yet

- Valves Supply TenderDocument8 pagesValves Supply TenderImran AhmedNo ratings yet

- VOLIIDocument61 pagesVOLIIYogesh KumarNo ratings yet

- Contract ManagementDocument61 pagesContract Managementakashv2018No ratings yet

- Additional Terms and ConditionsDocument10 pagesAdditional Terms and Conditionsrahul singhNo ratings yet

- Tendernotice - 1 (3) 5Document1 pageTendernotice - 1 (3) 5SRARNo ratings yet

- Rubber profile tenderDocument5 pagesRubber profile tenderAMM GSD JODHPURNo ratings yet

- Bharat Petroleum General Purchase ConditionsDocument24 pagesBharat Petroleum General Purchase ConditionsTender 247No ratings yet

- A. Nit HeaderDocument5 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- RFP TollDocument8 pagesRFP Tollnitesh kumarNo ratings yet

- A. Nit HeaderDocument7 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- Tender Terms and ConditionsDocument8 pagesTender Terms and ConditionsVinayak VagheNo ratings yet

- Nalco 8100005766Document4 pagesNalco 8100005766Amarendra PattnaikNo ratings yet

- RFQ-T&C Indegenous-8 WeeksDocument3 pagesRFQ-T&C Indegenous-8 Weeksrseeni2710No ratings yet

- GNFC's General Conditions of Purchase for SuppliersDocument18 pagesGNFC's General Conditions of Purchase for SuppliersTuff qualityNo ratings yet

- Contract Conditions: This Tender Is Proprietary Basis and Only M/s Dorf Ketal Will QuoteDocument4 pagesContract Conditions: This Tender Is Proprietary Basis and Only M/s Dorf Ketal Will Quotekimberlitewaterplus1No ratings yet

- Master agreement format for construction projectsDocument23 pagesMaster agreement format for construction projectsHemant SharmaNo ratings yet

- LP Special Terms & Conditions R-14 of 23-09-2022Document4 pagesLP Special Terms & Conditions R-14 of 23-09-2022for anyNo ratings yet

- MSA Speed Boats Oct 2023Document7 pagesMSA Speed Boats Oct 2023seasonalexportpkNo ratings yet

- Ganz Transformers and Electric Rotating Machines Ltd. General Sales ConditionsDocument11 pagesGanz Transformers and Electric Rotating Machines Ltd. General Sales ConditionsJigneshNo ratings yet

- Section IV. General Conditions of ContractDocument5 pagesSection IV. General Conditions of ContractNationstar Development CorpNo ratings yet

- Section IV. General Conditions of ContractDocument5 pagesSection IV. General Conditions of ContractNationstar Development CorpNo ratings yet

- CipconstructionclaimrevenueDocument5 pagesCipconstructionclaimrevenueIRSNo ratings yet

- 35225370a NitDocument6 pages35225370a NitAMM GSD JODHPURNo ratings yet

- Afghanistan Value Chain - Livestock (AVC-Livestock) : RFQ-AVCL-KBL-23-0008Document18 pagesAfghanistan Value Chain - Livestock (AVC-Livestock) : RFQ-AVCL-KBL-23-0008abdullahNo ratings yet

- Contract Information: High Risk Contract Sexual Harassment Training Required (PerDocument110 pagesContract Information: High Risk Contract Sexual Harassment Training Required (PerUSA TODAY NetworkNo ratings yet

- BBJ Alwire Metallizing TenderDocument3 pagesBBJ Alwire Metallizing TenderpushkarNo ratings yet

- M1 v01 ProcurementDocument10 pagesM1 v01 ProcurementZabri ZakariaNo ratings yet

- GeM IntroductionDocument37 pagesGeM IntroductionYogesh Nandwani100% (2)

- Tender ConditionDocument14 pagesTender Conditionsiraj sNo ratings yet

- A. Nit HeaderDocument5 pagesA. Nit HeaderAMM GSD JODHPURNo ratings yet

- Section Iv - General Conditions of The ContractDocument3 pagesSection Iv - General Conditions of The ContractGreater MchinesNo ratings yet

- Tendernotice 2Document4 pagesTendernotice 2mayankkhatri3No ratings yet

- Dehradun Cold RoomDocument19 pagesDehradun Cold RoomVishal ChavdaNo ratings yet

- Burn Standard Company Limited: Burnstandard@yahoo - Co.inDocument10 pagesBurn Standard Company Limited: Burnstandard@yahoo - Co.inArjun PalNo ratings yet

- Indcon Projects & Equipment Limited Purchase OrderDocument4 pagesIndcon Projects & Equipment Limited Purchase OrderDeepak DayalNo ratings yet

- Annexure 2 SCCDocument6 pagesAnnexure 2 SCCRAYAN FERRAONo ratings yet

- 35225338a NitDocument6 pages35225338a NitAMM GSD JODHPURNo ratings yet

- Section4 - Particular Conditions of ContractDocument5 pagesSection4 - Particular Conditions of Contractri.emon403No ratings yet

- Atc2 6 SandeepacctclkDocument27 pagesAtc2 6 SandeepacctclkSai PrasannaNo ratings yet

- Service TermsDocument2 pagesService TermsPriyanshu JhaNo ratings yet

- Tender for Lock NutsDocument6 pagesTender for Lock NutsAMM GSD JODHPURNo ratings yet

- EcoSport Brochure 13 FebDocument16 pagesEcoSport Brochure 13 Febdvijayakumar_85No ratings yet

- RFQ-AVCP-KBL-23-0040 Provision and Delivery of Solar Equipment Freezers and Aluminum Milk DrumsDocument19 pagesRFQ-AVCP-KBL-23-0040 Provision and Delivery of Solar Equipment Freezers and Aluminum Milk DrumsHashimi Modern ElectronicsNo ratings yet

- GeM Bidding Corr 3224784 1Document2 pagesGeM Bidding Corr 3224784 1Abhi SharmaNo ratings yet

- GCC General Terms and Conditions of Work OrderDocument25 pagesGCC General Terms and Conditions of Work OrderSoniyaSinghNo ratings yet

- Afghanistan Value Chain - Livestock (AVC-Livestock) : RFQ-AVCL-KBL-23-0009Document19 pagesAfghanistan Value Chain - Livestock (AVC-Livestock) : RFQ-AVCL-KBL-23-0009abdullahNo ratings yet

- RFP for Supply of Track Assembly for T-72 TanksDocument4 pagesRFP for Supply of Track Assembly for T-72 TanksPunj CorpNo ratings yet

- 4-GST Special Commercial Terms and Conditions RevisedDocument7 pages4-GST Special Commercial Terms and Conditions Revisedvishal.nithamNo ratings yet

- GeM Bidding 4015816Document5 pagesGeM Bidding 4015816Bhumi ShahNo ratings yet

- Prices in INRDocument8 pagesPrices in INRRafea SalemNo ratings yet

- Transmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateDocument10 pagesTransmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateTender 247No ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- HW 2Document2 pagesHW 2Tuff qualityNo ratings yet

- Handbook of DrawingDocument302 pagesHandbook of DrawingTucc195% (22)

- Lathe Tail StockDocument2 pagesLathe Tail StockShaswata BoseNo ratings yet

- Guide To Drawing PDFDocument21 pagesGuide To Drawing PDFAmigo IncomodoNo ratings yet

- ORF Monograph Fountain Pen StoryDocument40 pagesORF Monograph Fountain Pen StoryTuff qualityNo ratings yet

- Mechanics of Materials: Stress and Strain - Axial LoadingDocument42 pagesMechanics of Materials: Stress and Strain - Axial LoadingTuff qualityNo ratings yet

- First Article Inspection Report: Purchase Order Number Supplier NameDocument8 pagesFirst Article Inspection Report: Purchase Order Number Supplier NameTuff qualityNo ratings yet

- Phthalate Esters and Their Potential Risk in PET Bottled Water Stored Under Common ConditionsDocument13 pagesPhthalate Esters and Their Potential Risk in PET Bottled Water Stored Under Common ConditionsTuff qualityNo ratings yet

- Yu-Tao LIU, Cheng-Hui LI and Ying-Jie ZHANGDocument7 pagesYu-Tao LIU, Cheng-Hui LI and Ying-Jie ZHANGTuff qualityNo ratings yet

- HT Product Catalog 2019-2020Document612 pagesHT Product Catalog 2019-2020Tuff qualityNo ratings yet

- Stress Strain Diagram for Ductile and Brittle MaterialsDocument15 pagesStress Strain Diagram for Ductile and Brittle MaterialsWaqas Qureshi100% (5)

- 01chapters1 2Document45 pages01chapters1 2lewisNo ratings yet

- Pump Types: © Tuthill Corporation. All Rights Reserved. Tuthill ConfidentialDocument67 pagesPump Types: © Tuthill Corporation. All Rights Reserved. Tuthill ConfidentialTemesgenNo ratings yet

- Performance Evaluation of Rotavator BaseDocument9 pagesPerformance Evaluation of Rotavator BasevodounnouNo ratings yet

- Phthalate Esters and Their Potential Risk in PET Bottled Water Stored Under Common ConditionsDocument13 pagesPhthalate Esters and Their Potential Risk in PET Bottled Water Stored Under Common ConditionsTuff qualityNo ratings yet

- India: QM (Rfuoq$emfttrd Af6Document6 pagesIndia: QM (Rfuoq$emfttrd Af6Tuff qualityNo ratings yet

- Independent Auditor'S Report To The Members of HT Mobile Solutions LimitedDocument47 pagesIndependent Auditor'S Report To The Members of HT Mobile Solutions LimitedTuff qualityNo ratings yet

- Choosing The Right School Bag: Association of Paediatric Chartered PhysiotherapistsDocument2 pagesChoosing The Right School Bag: Association of Paediatric Chartered PhysiotherapistsTuff qualityNo ratings yet

- Revised PDW ManualDocument78 pagesRevised PDW ManualGorack ShirsathNo ratings yet

- Athletic Shoes: Tips For Finding The Correct ShoesDocument2 pagesAthletic Shoes: Tips For Finding The Correct ShoesTuff qualityNo ratings yet

- Gait Research Laboratory, Program in Physical Therapy Northern Arizona University PO Box 15015, Flagstaff, AZ, 86011Document4 pagesGait Research Laboratory, Program in Physical Therapy Northern Arizona University PO Box 15015, Flagstaff, AZ, 86011Tuff qualityNo ratings yet

- Hruska Clinic Recommended Shoe List For 2020: Qualities of A Good ShoeDocument2 pagesHruska Clinic Recommended Shoe List For 2020: Qualities of A Good ShoeTuff qualityNo ratings yet

- Circullar On Reducing Weight of BagsDocument2 pagesCircullar On Reducing Weight of BagsNDTVNo ratings yet

- Recommend Athletic ShoesDocument7 pagesRecommend Athletic ShoesolegNo ratings yet

- Circullar On Reducing Weight of BagsDocument2 pagesCircullar On Reducing Weight of BagsNDTVNo ratings yet

- Heavy School Bags PDFDocument2 pagesHeavy School Bags PDFArshad Baig MughalNo ratings yet

- Sports ShoesDocument10 pagesSports ShoesTuff qualityNo ratings yet

- PROJECT PROFILE ON PRINTED JUTE BAG MANUFACTURINGDocument9 pagesPROJECT PROFILE ON PRINTED JUTE BAG MANUFACTURINGafham84No ratings yet

- FMFastener PDFDocument16 pagesFMFastener PDFTuff qualityNo ratings yet

- Jute Bags Jute Sacks Gunny Bags Manufacturing PDFDocument39 pagesJute Bags Jute Sacks Gunny Bags Manufacturing PDFTuff qualityNo ratings yet

- Sales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationDocument1 pageSales Confirmation: Alpha Trading S.P.A. Compagnie Tunisienne de NavigationimedNo ratings yet

- Mananquil v. MoicoDocument2 pagesMananquil v. Moicoangelo prietoNo ratings yet

- A Study On Customer Satisfaction of TVS Apache RTR 160Document11 pagesA Study On Customer Satisfaction of TVS Apache RTR 160Manajit BhowmikNo ratings yet

- Katherine Keesling - The Votive Statues of The Athenian Acropolis - (2003, Camb)Document302 pagesKatherine Keesling - The Votive Statues of The Athenian Acropolis - (2003, Camb)vadimkoponevmail.ru100% (2)

- 9 Sinaq 8Document2 pages9 Sinaq 8Murad QuliyevNo ratings yet

- MMRP Narrative Report FormatDocument3 pagesMMRP Narrative Report FormatClarence Dave TolentinoNo ratings yet

- Agro Processing - APF1443619147Document10 pagesAgro Processing - APF1443619147PatrickNo ratings yet

- EN Sample Paper 19 UnsolvedDocument12 pagesEN Sample Paper 19 UnsolvedRashvandhNo ratings yet

- Soal Mid Ganjil 14Document4 pagesSoal Mid Ganjil 14Anonymous a2C6YgevfNo ratings yet

- Research Project On Capital PunishmentDocument6 pagesResearch Project On Capital PunishmentNitwit NoddyNo ratings yet

- The Coffee House-Group 8Document18 pagesThe Coffee House-Group 8Thanh Huyền TrầnNo ratings yet

- KCIS 2nd Semester Science Fair ProjectsDocument2 pagesKCIS 2nd Semester Science Fair ProjectsCaT BlAcKNo ratings yet

- 5 Integumentary SystemDocument67 pages5 Integumentary SystemchelsealivesforeverNo ratings yet

- MEM05 Header R8.1Document388 pagesMEM05 Header R8.1andysupaNo ratings yet

- + or Cryptopotato - Com or U.today-Domain Domains-UsDocument128 pages+ or Cryptopotato - Com or U.today-Domain Domains-UsMalkeet SinghNo ratings yet

- Business Studies Project: Made By: Rahil JainDocument29 pagesBusiness Studies Project: Made By: Rahil JainChirag KothariNo ratings yet

- EM Complete NotesDocument191 pagesEM Complete NoteswsbwaqhpwpvcwuhajkNo ratings yet

- 9th Science Mcqs PTB PDFDocument25 pages9th Science Mcqs PTB PDFUmar JuttNo ratings yet

- Oracle Analytics Cloud 2018 Solution Engineer Specialist AssessmentDocument4 pagesOracle Analytics Cloud 2018 Solution Engineer Specialist AssessmentRamón MedinaNo ratings yet

- Lenses and Optical Instruments: Major PointsDocument20 pagesLenses and Optical Instruments: Major Points陳慶銘No ratings yet

- Tourist Spot in Ilocos Norte PhilippinesDocument1 pageTourist Spot in Ilocos Norte Philippinescharlie besabellaNo ratings yet

- Manocha Icile Feasibility StudyDocument95 pagesManocha Icile Feasibility StudyAlmadin KeñoraNo ratings yet

- Effects of The Sugar RevolutionDocument9 pagesEffects of The Sugar RevolutionSusan BarriotNo ratings yet

- Automotive Plastic Product Design Interview QuestionsDocument13 pagesAutomotive Plastic Product Design Interview QuestionsAbhijith Alolickal100% (2)

- LING-05 Assets and Liabilities of The English Language Prepared by Mario Pei and John Nist Edited by David F. MaasDocument17 pagesLING-05 Assets and Liabilities of The English Language Prepared by Mario Pei and John Nist Edited by David F. MaasDavid F Maas71% (7)

- Progress Test 1B (Units 1-3)Document6 pagesProgress Test 1B (Units 1-3)SvetlanaNo ratings yet

- Quotes by Swami VivekanandaDocument6 pagesQuotes by Swami Vivekanandasundaram108No ratings yet

- Faculty of Health and Medical Sciences: Academic Terms and Fee Schedule For 2022Document3 pagesFaculty of Health and Medical Sciences: Academic Terms and Fee Schedule For 2022Sadwi MulatsihNo ratings yet

- Step 5 - PragmaticsDocument7 pagesStep 5 - PragmaticsRomario García UrbinaNo ratings yet

- Alora Sealord History, How and Why They Were FormedDocument1 pageAlora Sealord History, How and Why They Were Formedgoddessjanefire003No ratings yet