Professional Documents

Culture Documents

Construction Contract Revenue Recognition

Uploaded by

Devine Grace A. MaghinayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Contract Revenue Recognition

Uploaded by

Devine Grace A. MaghinayCopyright:

Available Formats

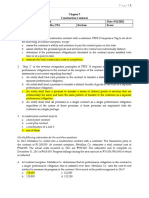

MODULE 4: Construction Contracts

1. Apply the principles under PFRS 15 to account for revenues from construction contracts.

Focused Listing:

Summary of the Revenue recognition Principles under PFRS 15:

(CPTAR)

a) Identify the contract with the customer (written or oral).

b) Identify the performance obligations in the contract.

c) Determine the transaction price.

d) Allocate the transaction price.

e) Recognize revenue

Satisfaction of performance obligations either OT (overtime) or APT (At a Point of Time)

OT if one of the criteria is met:

The customer simultaneously receives and consumes the benefits.

The entity’s performance create/enhances an asset that the customer controls as the asset

is created/enhances

Entity’s performance does not create an asset with an alternative use to the entity and the

entity has the enforceable right to payment for performance completed to date.

2. Account for construction contract: Documented Problem Solutions:

1. George Co. enters into a contract to build an apartment for jungle Co. for fixed fee of

P20,000,000. At contract inception, George Co. assesses its performance obligations in the contract

and concludes that is has single performance obligation that is satisfied over time. George Co.

determines that the measure of progress that the best depicts its performance in the contract is input

method based on costs incurred. George estimates that the total contract cost would amount to

P16,000,000 over the construction period. George incurs contract costs P2,000,000 during the year.

How much revenue is recognized for the year?

a. 2,000,000 c. 4,000,000

b. 2,500,000 d. 0

Solution:

Fixed Fee 20M

Multiply:

Contract Cost/ estimates contract cost 2M/16M

Revenue Recognized for the year 2, 500, 0000

2. 2. On May 1, 20x1, Pressure Co. entered into a P3M fixed price contract to construct a gym for a

customer. Pressure Co. appropriately accounts for this contract using the percentage of completion

method based on costs. Information on the contract is as follows:

20x1 20x2

Percentage of completion 20% 60%

Estimated total cost at completion 2,000,000 2,400,000

Profit recognized to date 150,000 360,000

How much are the revenue and cost of construction recognized in 20x2?

Revenue Cost of construction

a. 1,200,000 990,000

b. 1,800,000 600,000

c. 1,800,000 1,200,000

d. 600,000 450,000

Solution: 20x1 20x2

Total contract price 3M 3M

Percentage of completion * 20% * 60%

Contract revenue 600, 000 1, 800, 000

CR prior Year (600, 000)

CR for the year 600, 000 1, 200, 000

Cost of construction (squeeze) (450,000) (990,000)

Profit recognized to date 150,000 360,000

3. Nourish your Soul: Draw your success journey.

4. Quiz: Diagnostic Learning Log

The five steps in the recognition of revenue from contracts is very important in solving construction

contracts.

You might also like

- Long Quiz:: Construction Contracts Name: Date: Professor: Section: ScoreDocument12 pagesLong Quiz:: Construction Contracts Name: Date: Professor: Section: ScoreNahwi KimpaNo ratings yet

- Quiz 3 Construction ContractsDocument7 pagesQuiz 3 Construction ContractsMarinel Mae Chica100% (2)

- Construction Contracts ReviewDocument7 pagesConstruction Contracts ReviewRojin TingabngabNo ratings yet

- 13 Long Term Construction ContractsDocument2 pages13 Long Term Construction ContractsJem ValmonteNo ratings yet

- Quiz On Construction Contracts 11.19.2022Document7 pagesQuiz On Construction Contracts 11.19.2022Julian CheezeNo ratings yet

- TG Chapter 7Document8 pagesTG Chapter 7Faith EsguerraNo ratings yet

- Revenue Recognition Construction ContractsMultiple Choice1. a2. a 3. b4. a5. c 6. a7. b8. a9. b 10. c11. c12. d13. d14. b15. aDocument10 pagesRevenue Recognition Construction ContractsMultiple Choice1. a2. a 3. b4. a5. c 6. a7. b8. a9. b 10. c11. c12. d13. d14. b15. aErwin Labayog MedinaNo ratings yet

- Accounting For LTCCDocument5 pagesAccounting For LTCCRoland CatubigNo ratings yet

- Acc110p2quiz 2answers Construction Contracts 1 PDF FreeDocument10 pagesAcc110p2quiz 2answers Construction Contracts 1 PDF FreeMichael Brian TorresNo ratings yet

- Toaz - Info Acc110 p2 Quiz 2 Answers Construction Contracts 1 PRDocument10 pagesToaz - Info Acc110 p2 Quiz 2 Answers Construction Contracts 1 PRKimberly Claire AtienzaNo ratings yet

- LTCC and Franchise Long Exam PDFDocument9 pagesLTCC and Franchise Long Exam PDFChristine Joy Original50% (2)

- Afar302 A - ConstructionDocument8 pagesAfar302 A - ConstructionNicole TeruelNo ratings yet

- Long Term Construction Contracts - QuizDocument10 pagesLong Term Construction Contracts - QuizEliza BethNo ratings yet

- Accounting for Construction ContractsDocument7 pagesAccounting for Construction Contractsgenevieve sicatNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- LTCCDocument7 pagesLTCCGenesis Dizon67% (6)

- LTCC Work BookDocument49 pagesLTCC Work BookHannah NolongNo ratings yet

- ACC110 P2 Q2 Answer - Docx 2Document13 pagesACC110 P2 Q2 Answer - Docx 2Sherwin SarzueloNo ratings yet

- Revenue Recognition for Construction ContractsDocument12 pagesRevenue Recognition for Construction ContractsShane TorrieNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Cabigon - Chapter 8 MCDocument16 pagesCabigon - Chapter 8 MCGianrie Gwyneth Cabigon50% (4)

- Construction Contract AccountingDocument7 pagesConstruction Contract AccountingVernnNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Construction Contracts: Problem 1: True or FalseDocument45 pagesConstruction Contracts: Problem 1: True or FalseMs VampireNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Longterm Conat QuizDocument3 pagesLongterm Conat QuizKurtNo ratings yet

- Day 3 - Lecture Examples - Chapter 6Document5 pagesDay 3 - Lecture Examples - Chapter 6NikolaNikoloskiNo ratings yet

- Long-Term Construction QuizDocument4 pagesLong-Term Construction QuizCattleyaNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- 2816 Solution To Long Term Construction ContractsDocument47 pages2816 Solution To Long Term Construction ContractsPhoeza Espinosa Villanueva100% (1)

- Quiz ConstructionDocument1 pageQuiz ConstructionErjohn PapaNo ratings yet

- 5 LT CONSTRUCTION CONTRACT HandoutDocument2 pages5 LT CONSTRUCTION CONTRACT HandoutDJAN IHIAZEL DELA CUADRANo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- Midterm 138 - BDocument6 pagesMidterm 138 - BJoyce Anne IgotNo ratings yet

- 08 Long Term Construction ContractsDocument2 pages08 Long Term Construction ContractsErineNo ratings yet

- ADVANCED ACCOUNTING 1 - Chapter 7: Construction Contracts James B. Cantorne Problem 1. T/FDocument11 pagesADVANCED ACCOUNTING 1 - Chapter 7: Construction Contracts James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Long-Term Construction ContractsDocument9 pagesLong-Term Construction ContractsRoi Martin A. De VeyraNo ratings yet

- Construction contract problemsDocument15 pagesConstruction contract problemsRechelle DalusungNo ratings yet

- CPA Review: Advanced Financial Accounting SelftestDocument7 pagesCPA Review: Advanced Financial Accounting SelftestJennifer RueloNo ratings yet

- P2 Construction Contract - GuerreroDocument22 pagesP2 Construction Contract - GuerreroCelen OchocoNo ratings yet

- LTCCDocument16 pagesLTCCandzie09876No ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- c10 Revenue Recognition Contracts With Customer Long Term Construction Solution Dayag 2021 EditionDocument10 pagesc10 Revenue Recognition Contracts With Customer Long Term Construction Solution Dayag 2021 EditionKaizu KunNo ratings yet

- AFAR - Revenue Recognition 2019Document4 pagesAFAR - Revenue Recognition 2019Joanna Rose DeciarNo ratings yet

- Revenue Recognition Under Cost-to-Cost MethodDocument2 pagesRevenue Recognition Under Cost-to-Cost MethodRandelle James FiestaNo ratings yet

- Step 1: Identify The Contract With The Customer: AcctranDocument8 pagesStep 1: Identify The Contract With The Customer: AcctranPrecy Joy TrimidalNo ratings yet

- Construction Contract Income CalculationDocument4 pagesConstruction Contract Income Calculationangel caoNo ratings yet

- 207A Midterm ExaminationDocument5 pages207A Midterm ExaminationAldyn Jade Guabna100% (1)

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- CPA REVIEW SCHOOL PHILIPPINESDocument9 pagesCPA REVIEW SCHOOL PHILIPPINESFrancis Vonn Tapang100% (1)

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Final AFSTDocument7 pagesFinal AFSTCatherine ValdezNo ratings yet

- Accounting for Special Transactions ExamDocument9 pagesAccounting for Special Transactions Examjessica amorosoNo ratings yet

- ICDS - 3 Construction ContractsDocument13 pagesICDS - 3 Construction Contractskavita.m.yadavNo ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Sol Man Chapter 7 Construction Contracts 2020 EditionDocument38 pagesSol Man Chapter 7 Construction Contracts 2020 EditionTricia AranillaNo ratings yet

- LONG TERM CONSTRUCTION ACCOUNTINGDocument3 pagesLONG TERM CONSTRUCTION ACCOUNTINGLee SuarezNo ratings yet

- Investment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsFrom EverandInvestment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Grace-AST Module 9Document2 pagesGrace-AST Module 9Devine Grace A. MaghinayNo ratings yet

- How Interest Rates Change Over TimeDocument1 pageHow Interest Rates Change Over TimeDevine Grace A. MaghinayNo ratings yet

- Max AreaDocument7 pagesMax AreaDevine Grace A. MaghinayNo ratings yet

- Hyperbola Example ProblemsDocument3 pagesHyperbola Example ProblemsDevine Grace A. MaghinayNo ratings yet

- Grace-AST Module 10Document5 pagesGrace-AST Module 10Devine Grace A. MaghinayNo ratings yet

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- Adapt and Act Upon - Grace MaghinayDocument3 pagesAdapt and Act Upon - Grace MaghinayDevine Grace A. MaghinayNo ratings yet

- Nourish Your Soul - The Lake Princess - Grace MaghinayDocument3 pagesNourish Your Soul - The Lake Princess - Grace MaghinayDevine Grace A. MaghinayNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- Partnership Formation and OperationDocument12 pagesPartnership Formation and OperationDevine Grace A. MaghinayNo ratings yet

- Adapt and Act UponDocument8 pagesAdapt and Act UponDevine Grace A. MaghinayNo ratings yet

- MODULE 5: Accounting For Franchise Operations - Franchisor: RequirementsDocument2 pagesMODULE 5: Accounting For Franchise Operations - Franchisor: RequirementsDevine Grace A. Maghinay67% (3)

- Financial Market Module 2 - Ms. MaghinayDocument3 pagesFinancial Market Module 2 - Ms. MaghinayDevine Grace A. MaghinayNo ratings yet

- Cultural Differences in BusinessDocument27 pagesCultural Differences in BusinessDevine Grace A. MaghinayNo ratings yet

- SMN1 Answer The Essay QuestionsDocument1 pageSMN1 Answer The Essay QuestionsDevine Grace A. MaghinayNo ratings yet

- The Parable of Unforgiving ServantDocument1 pageThe Parable of Unforgiving ServantDevine Grace A. MaghinayNo ratings yet

- Business Risk, Business Failures, Reorganization and LiquidationDocument87 pagesBusiness Risk, Business Failures, Reorganization and LiquidationDevine Grace A. MaghinayNo ratings yet

- Are We Like Sheep?: Prepared By: G - McslowDocument19 pagesAre We Like Sheep?: Prepared By: G - McslowDevine Grace A. MaghinayNo ratings yet

- C1 - Introduction of Financial MGTDocument35 pagesC1 - Introduction of Financial MGTDevine Grace A. MaghinayNo ratings yet

- Audit Procedure For Account ReceivablesDocument1 pageAudit Procedure For Account ReceivablesDevine Grace A. MaghinayNo ratings yet

- Summary For Account ReceivablesDocument6 pagesSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- Nourish Your Life - Love of MoneyDocument1 pageNourish Your Life - Love of MoneyDevine Grace A. MaghinayNo ratings yet

- Devine Grace A. Maghinay July 8, 2018Document9 pagesDevine Grace A. Maghinay July 8, 2018Devine Grace A. MaghinayNo ratings yet

- Deductions From Gross EstateDocument16 pagesDeductions From Gross EstateJebeth RiveraNo ratings yet

- Nippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportDocument36 pagesNippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportRahiNo ratings yet

- Ch07 Beams10e TBDocument29 pagesCh07 Beams10e TBjeankoplerNo ratings yet

- Ratio Analysis Project of ManjuDocument108 pagesRatio Analysis Project of Manjupriyanka repalleNo ratings yet

- Corp Account - Liquidators StatementDocument3 pagesCorp Account - Liquidators StatementAnanth RohithNo ratings yet

- Lapis Compounders Contest 13.05.2019Document2 pagesLapis Compounders Contest 13.05.2019Yash NyatiNo ratings yet

- DT Sample 1Document5 pagesDT Sample 1Nafis AlamNo ratings yet

- Inflation Reduction Act 2022Document273 pagesInflation Reduction Act 2022Maria MeranoNo ratings yet

- Pontipedra Rex Cotoner CVDocument4 pagesPontipedra Rex Cotoner CVCassandra LopezNo ratings yet

- Project On Sharekhan Investors Behavior For Investing in Equity Market in Various SectorDocument120 pagesProject On Sharekhan Investors Behavior For Investing in Equity Market in Various Sectorashish88% (26)

- IBA Karachi Course Outlines PDFDocument38 pagesIBA Karachi Course Outlines PDFDr. Abdullah0% (1)

- HSBC Immigration - Brochure For Global Use PDFDocument4 pagesHSBC Immigration - Brochure For Global Use PDFBubblyDeliciousNo ratings yet

- Estate Duty Calculation for Late Mr Jones MpofuDocument17 pagesEstate Duty Calculation for Late Mr Jones Mpofukelvin mkweshaNo ratings yet

- Report On Wealth ManagementDocument68 pagesReport On Wealth ManagementSANDEEP ARORA69% (13)

- Dynamic Swing Trader Position Size CalculatorDocument3 pagesDynamic Swing Trader Position Size CalculatorHicham HasnaouiNo ratings yet

- Accounting Details: Quality Costs - Types, Analysis and PreventionDocument7 pagesAccounting Details: Quality Costs - Types, Analysis and PreventionTuba KhanNo ratings yet

- Income For Life - Walter Updegrave July 2002Document7 pagesIncome For Life - Walter Updegrave July 20024cinvestorNo ratings yet

- Pas 21 The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21 The Effects of Changes in Foreign Exchange RatesJanaisa BugayongNo ratings yet

- The value of B if interest is compounded semi-annually is 1,260,875.183Document58 pagesThe value of B if interest is compounded semi-annually is 1,260,875.183nonononowayNo ratings yet

- Deed of Reconstitution PartnershipDocument11 pagesDeed of Reconstitution Partnershipvinodkshahca_4744486No ratings yet

- Marketing FunctionsDocument25 pagesMarketing FunctionsSuny JubayerNo ratings yet

- Stock Markiet.Document87 pagesStock Markiet.deepti singhalNo ratings yet

- A Study On The Analysis of Financial Performance With Special Reference To Ramco Cement LTDDocument8 pagesA Study On The Analysis of Financial Performance With Special Reference To Ramco Cement LTDTJPRC PublicationsNo ratings yet

- Retirement Planner TemplateDocument4 pagesRetirement Planner TemplateAmaliaAvramNo ratings yet

- Finance and Treasury Centre Incentive: Singapore Economic Development Board ("EDB") WWW - Edb.gov - SGDocument2 pagesFinance and Treasury Centre Incentive: Singapore Economic Development Board ("EDB") WWW - Edb.gov - SGK58-ANH 2-KTDN NGUYỄN THỊ PHƯƠNG THẢONo ratings yet

- Ketan Parekh Scam MergedDocument48 pagesKetan Parekh Scam MergedKaushal RautNo ratings yet

- Valuation of GoodwillDocument34 pagesValuation of GoodwillGamming Evolves100% (1)

- Cash Flow StaementDocument14 pagesCash Flow StaementKhizar Hayat JiskaniNo ratings yet

- Auditing Lecture 8 VouchingDocument40 pagesAuditing Lecture 8 VouchingMr BalochNo ratings yet

- Financial Accounting Report Income and Expenditure SummaryDocument4 pagesFinancial Accounting Report Income and Expenditure SummaryLabi LabiNo ratings yet