Professional Documents

Culture Documents

7707 Manufacturing Accounts PDF

7707 Manufacturing Accounts PDF

Uploaded by

Saeed MahmoodCopyright:

Available Formats

You might also like

- Self Practice ExercisesDocument4 pagesSelf Practice ExercisesGideon SancyNo ratings yet

- Gmail - Important Message About Your Amazon Seller AccountDocument1 pageGmail - Important Message About Your Amazon Seller AccountMuhmmad UmairNo ratings yet

- Individual Assignment 1 AFMDocument4 pagesIndividual Assignment 1 AFMSultan IskandarsyahNo ratings yet

- Chapter 2 - Emergence of Marketing ChannelsDocument11 pagesChapter 2 - Emergence of Marketing ChannelsPamela ZamoraNo ratings yet

- Management Accounting FinalDocument10 pagesManagement Accounting FinalMAGOMU DAN DAVID100% (1)

- ManaccDocument12 pagesManaccCynthia KesumaNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Chapter 1-Problems: Set B: InstructionsDocument3 pagesChapter 1-Problems: Set B: InstructionsPak CareerNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- PPC Set 1Document2 pagesPPC Set 1tatsssjkNo ratings yet

- Acd10403 Solution Tutorial Manufacturing Account 2018Document9 pagesAcd10403 Solution Tutorial Manufacturing Account 2018Atqh ShamsuriNo ratings yet

- Handout No. 2Document4 pagesHandout No. 2Gertim CondezNo ratings yet

- Ch02 Job Order Costing1Document8 pagesCh02 Job Order Costing1Laika Mico MotasNo ratings yet

- Comprehensive Examination Cost Accounting INSTRUCTIONS: Select The Best Answer For Each of The Following Questions. Mark Only One AnswerDocument19 pagesComprehensive Examination Cost Accounting INSTRUCTIONS: Select The Best Answer For Each of The Following Questions. Mark Only One AnswerHardly Dare GonzalesNo ratings yet

- Chapter 21 Job Costing: RequiredDocument20 pagesChapter 21 Job Costing: RequiredMuhammad ZakirNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostHemant AherNo ratings yet

- Cost Accounting and ControlDocument8 pagesCost Accounting and ControlJevbszen RemiendoNo ratings yet

- Final Examination For Each Item - Show Solutions in Good Form If ApplicableDocument8 pagesFinal Examination For Each Item - Show Solutions in Good Form If ApplicableDanielle Faith B GumbaoNo ratings yet

- 19upa514-Cost Accounting-Test-IDocument5 pages19upa514-Cost Accounting-Test-IJaya KumarNo ratings yet

- Commerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDocument4 pagesCommerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDhaval BakliwalNo ratings yet

- Midterm - Ch. 4Document15 pagesMidterm - Ch. 4Cameron BelangerNo ratings yet

- (CC-109 Cost Accounting - 2) - 2019Document4 pages(CC-109 Cost Accounting - 2) - 2019138 -Rajput-AdityaNo ratings yet

- Tutorial 6Document4 pagesTutorial 6NurSyazwaniRosliNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- TUTORIAL 2 Cost ClassificationDocument7 pagesTUTORIAL 2 Cost Classificationsarahayeesha1No ratings yet

- ch01Document27 pagesch01Jimmer CapeNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Job Batch Costing-PQDocument9 pagesJob Batch Costing-PQRohaib MumtazNo ratings yet

- Final CMAC (NA) Midterm Q.Paper Aut-23Document5 pagesFinal CMAC (NA) Midterm Q.Paper Aut-23Hassan TanveerNo ratings yet

- 11-11-21... 4060 GR I... Ni-3124... Costing... QueDocument4 pages11-11-21... 4060 GR I... Ni-3124... Costing... QueVimal Shroff55No ratings yet

- Bac 201: Management Accounting CAT 1Document3 pagesBac 201: Management Accounting CAT 1Jeremiah Kabiru MuthikeNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- ACCT 213 ExerciseDocument5 pagesACCT 213 ExerciseMr MDRKHMNo ratings yet

- ABC Case - PCMR ElectronicsDocument1 pageABC Case - PCMR ElectronicsOrduna Mae Ann0% (1)

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- PMA0064 Midterm (Q) Tri 3 2021Document6 pagesPMA0064 Midterm (Q) Tri 3 2021NABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument4 pagesThe Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Unit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDocument14 pagesUnit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDhanu ShriNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- OBE - COST QB With ANSWERS - FINALDocument92 pagesOBE - COST QB With ANSWERS - FINALPavi NishaNo ratings yet

- Final Cmac Q.paper (B, Rec Live)Document4 pagesFinal Cmac Q.paper (B, Rec Live)NomiNo ratings yet

- 102.COAP - .L I Question CMA Special Examination 2021novemberDocument4 pages102.COAP - .L I Question CMA Special Examination 2021novemberleyaketjnuNo ratings yet

- Project Case Study - Acc116 Oct-Feb 2023Document5 pagesProject Case Study - Acc116 Oct-Feb 2023Vishnu MenonNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- 59 Tea StallDocument2 pages59 Tea StallPrashant Sunali C'naNo ratings yet

- Cost Grand Test 2Document4 pagesCost Grand Test 2moniNo ratings yet

- AFIN210 Sample QuestionDocument3 pagesAFIN210 Sample QuestionWilliam C ManelaNo ratings yet

- Lecture 2 - Cost Concepts - QDocument5 pagesLecture 2 - Cost Concepts - Q1231402960No ratings yet

- 05 Financial Accounting Auditing Paper IV Cost Accounting Introduction and Basic ConceptsIDOL REV 201600037223Document13 pages05 Financial Accounting Auditing Paper IV Cost Accounting Introduction and Basic ConceptsIDOL REV 201600037223Mohit ParekhNo ratings yet

- Bac B203 - Cost AccountingDocument4 pagesBac B203 - Cost AccountingCarol NzauNo ratings yet

- Cost Accounting 3Document3 pagesCost Accounting 3sharu SKNo ratings yet

- Acct202Exam 1 - 2Document9 pagesAcct202Exam 1 - 2Tanvir AhmedNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- 9 Ledger WSDocument4 pages9 Ledger WSSaeed MahmoodNo ratings yet

- 9609 MW Otg Script+i p3Document9 pages9609 MW Otg Script+i p3Saeed MahmoodNo ratings yet

- Lesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Document15 pagesLesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Saeed MahmoodNo ratings yet

- Businesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andDocument6 pagesBusinesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andSaeed MahmoodNo ratings yet

- 9 Revision OADocument12 pages9 Revision OASaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 MYE 20-21 Grade 9 PDFDocument10 pages7707 MYE 20-21 Grade 9 PDFSaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document2 pagesBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- 7100 Consumer Credit PDFDocument16 pages7100 Consumer Credit PDFSaeed MahmoodNo ratings yet

- 7707 Grade 11 December 2020 PDFDocument10 pages7707 Grade 11 December 2020 PDFSaeed MahmoodNo ratings yet

- Chapter Eleven: Sampling: Design and ProceduresDocument28 pagesChapter Eleven: Sampling: Design and ProceduresSaeed MahmoodNo ratings yet

- Chapter 1Document29 pagesChapter 1Saeed MahmoodNo ratings yet

- Chapter Twenty-Four: International Marketing ResearchDocument20 pagesChapter Twenty-Four: International Marketing ResearchSaeed MahmoodNo ratings yet

- Final Quality AssuranceDocument39 pagesFinal Quality AssuranceSaeed MahmoodNo ratings yet

- Marketing Research SubjectiveDocument2 pagesMarketing Research SubjectiveSaeed MahmoodNo ratings yet

- Hina Naveed Sumission#4 Nishat Power LTDDocument10 pagesHina Naveed Sumission#4 Nishat Power LTDSaeed MahmoodNo ratings yet

- Nishat ISDocument11 pagesNishat ISSaeed MahmoodNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Operating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsDocument5 pagesOperating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsSaeed MahmoodNo ratings yet

- Revenue Growth AnalysisDocument6 pagesRevenue Growth AnalysisSaeed MahmoodNo ratings yet

- 24.02.2023 - Tender For Project Management Consultancy ServicesDocument88 pages24.02.2023 - Tender For Project Management Consultancy ServicesArichandran ANo ratings yet

- Squadstack Competition PitchDocument1 pageSquadstack Competition Pitchsharmil_jainNo ratings yet

- Guagua National Colleges Graduate School Master's in Business AdministrationDocument25 pagesGuagua National Colleges Graduate School Master's in Business AdministrationLee K.No ratings yet

- Project Report On Design of Intersection PDFDocument19 pagesProject Report On Design of Intersection PDFBhaskar KumarNo ratings yet

- Capital Budgeting (R)Document32 pagesCapital Budgeting (R)KRISHNENDU JASHNo ratings yet

- Book 2 Go Kiss D WorldDocument7 pagesBook 2 Go Kiss D Worldtinytiya298317100% (1)

- Brought To You by Global ReportsDocument72 pagesBrought To You by Global ReportsJonathan OngNo ratings yet

- Freelance Blueprint PDFDocument12 pagesFreelance Blueprint PDFChinedu OkekeNo ratings yet

- A Study On Consumer Buying Behaviour Towards FMCG ProductsDocument22 pagesA Study On Consumer Buying Behaviour Towards FMCG ProductsRohit SharmaNo ratings yet

- Mariano Marcos State University BSPT 1-A, NSTP 01 Rodessa Van Micah C. EderDocument2 pagesMariano Marcos State University BSPT 1-A, NSTP 01 Rodessa Van Micah C. EderJan Crizza Dale R. FrancoNo ratings yet

- Fin242 Chapter 1 Latest April 2021Document14 pagesFin242 Chapter 1 Latest April 2021laurenNo ratings yet

- Met A Guide To Full Funnel Sales Part 3Document2 pagesMet A Guide To Full Funnel Sales Part 3Suffyan SadiqNo ratings yet

- Mcqs LedgerDocument10 pagesMcqs LedgerUsama SaadNo ratings yet

- CB Draft 1Document7 pagesCB Draft 1SHIVAM RAJUKANo ratings yet

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Document11 pagesCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNo ratings yet

- Bid Documents 2022Document17 pagesBid Documents 2022Arlene VillarosaNo ratings yet

- Ansoff MatrixDocument3 pagesAnsoff MatrixpawanNo ratings yet

- Merck Case AnalysisDocument4 pagesMerck Case Analysisc2ugly0% (2)

- RRC - CaseDocument15 pagesRRC - CaseFrancis VonNo ratings yet

- Unicorn Startups Case StudiesDocument39 pagesUnicorn Startups Case StudiesPranay Singh RaghuvanshiNo ratings yet

- Direct Investment and Collaborative StrategiesDocument23 pagesDirect Investment and Collaborative StrategiesShirley Low50% (2)

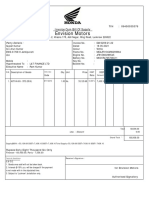

- Envision Motors: Invoice Cum Bill of SupplyDocument1 pageEnvision Motors: Invoice Cum Bill of SupplyEnvision MotorsNo ratings yet

- CSC 2019 Annual ReportDocument100 pagesCSC 2019 Annual ReportchinoytanNo ratings yet

- EnDocument19 pagesEnyetsedawNo ratings yet

- Terms of Contract GEG - DisplayDocument31 pagesTerms of Contract GEG - DisplaySaheed LawansonNo ratings yet

- Gross Price ListDocument120 pagesGross Price ListMark Philip BaliwisNo ratings yet

- MKT318m - Group Assignment BriefDocument3 pagesMKT318m - Group Assignment BriefNgocLOiNo ratings yet

- Geeta Associations & Maharshatra DirectoriesDocument12 pagesGeeta Associations & Maharshatra DirectoriesREACHLaw Chemical Regulatory Training Services0% (1)

7707 Manufacturing Accounts PDF

7707 Manufacturing Accounts PDF

Uploaded by

Saeed MahmoodOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7707 Manufacturing Accounts PDF

7707 Manufacturing Accounts PDF

Uploaded by

Saeed MahmoodCopyright:

Available Formats

1

Manufacturing Accounts

Topic: Distinguish between direct and indirect costs (AT-01)

1) Which is a direct cost?

(A) depreciation of machinery

(B) lighting and heating

(C) raw materials used

(D) supervisor’s wages

May 2011 Q27

2) Which is a direct cost to a manufacturer?

(A) factory cleaner’s wages

(B) factory supervisor’s salary

(C) machine operator’s wages

(D) salesman’s commission

Nov 2013/11 Q27

3) Which is an indirect cost?

(A) carriage inward (B) factory rent

(C) production materials (D) production wages

May 2005 Q37

4) A company makes furniture

What will be treated as a direct cost in the company’s manufacturing account?

(A) depreciation of vehicles that deliver the furniture

(B) insurance of the machinery used to make the furniture

(C) transport costs of bringing in the raw materials to make the furniture

(D) wages of workers maintaining the factory machinery

may 2000 Q36

5) Which type of labour would be classified as direct?

1 factory managers

2 factory office staff

3 factory production workers

(A) 1, 2 and 3

(B) 1 and 3 only

(C) 2 only

(D) 3 only

May 2018/12 Q26

Compiled by: Saeed Mahmood 7707

2

Topic: understand direct material, direct labour, prime cost and factory overheads (AT-

02)

1) Which is a factory overhead?

(A) carriage on raw materials

(B) cost of raw materials

(C) production supervisor’s wages

(D) wages of machine operators

May 2008 Q26

2) Leroy makes one product. He provides the following information.

$

Material cost 5 000

Labour cost 4 000

Factory overheads 2 000

What is the prime cost?

(A) $5 000 (B) $7 000

(C) $9 000 (D) $11 000

May 2004 Q37

3) A manufacturing business provides the following details.

$

Office expenses 14 000

Direct expenses 22 000

Direct labour 18 000

Direct materials 24 000

Factory lighting 2 000

Financial charges 5 000

Total 85 000

What is the prime cost of production?

(A) $64 000 (B) $66 000

(C) $80 000 (D) $85 000

Nov 2004 Q37

4) A Manufacturing Account includes the following:

$

raw materials

Compiled by: Saeed Mahmood 7707

3

opening inventory 300

purchases 9100

closing inventory 500

What is the cost of raw materials?

(A) $8 300 (B) $8 900

(C) $9 100 (D) $9 300

Nov 2006 Q38

5) A manufacturer provides the following information.

$

factory wages 11 000

carriage on raw materials 2 700

machine repairs 3 420

supervisor’s wages 6 000

raw materials used 19 700

What is the prime cost of manufacturing?

(A) $33 400 (B) $36 700 (C) $39 400 (D) $42 820

May 2007 Q37

6) A manufacturing business provided the following information about its first year of trading.

$

Purchases of raw materials 128 000

Closing inventory of raw materials 13 000

Purchases of finished goods 65 000

Closing inventory of finished goods 29 000

Factory direct wages 77 000

Supervisor’s salary 21 000

Depreciation of machinery 19 000

What was the prime cost?

(A) $38 000

(B) $74 000

(C) $152 000

(D) $192 000

0452/ Nov 2015/13 Q1 j

7) The financial year of Msamati Manufacturing ends on 31 January.

Compiled by: Saeed Mahmood 7707

4

The following is the summarised manufacturing account for the year ended 31 January 2017.

$

Prime cost 505 650

Factory overheads 176 390

682 040

Change in work in progress (12 090)

Cost of production 669 950

REQUIRED

(a) Explain the meaning of the term ‘prime cost’.

...................................................................................................................................................

...................................................................................................................................................

...................................................................................................................................................

...............................................................................................................................................[2]

(b) (i) Explain the meaning of the term ‘factory overheads’.

...........................................................................................................................................

...........................................................................................................................................

...........................................................................................................................................

.......................................................................................................................................[2]

(ii) Suggest two items which may be included in the factory overheads.

1 ........................................................................................................................................

2 ....................................................................................................................................[2]

(c) (i) State the meaning of the term ‘work in progress’.

...........................................................................................................................................

.......................................................................................................................................[1]

(ii) State whether the closing work in progress was greater or smaller than the opening work in

progress.

…...................................................... [1]

8) TP Limited manufactures toys.

REQUIRED

(a) Complete the table by inserting a tick (ü) to show how each type of manufacturing cost

should be classified. The first one has been completed as an example.

Direct material Direct labour Factory Overhead

Purchase of plastic toy parts

Rent of factory

Compiled by: Saeed Mahmood 7707

5

Wages of machine operator

Purchase of packaging

Wages of supervisor

[4]

(b) State how prime cost is calculated.

...................................................................................................................................................

.............................................................................................................................................. [2]

9) Complete the sentences below, using the terms

current assets direct labour finished goods

inventory raw materials work in progress

A manufacturing business is one which purchases.............................................and by

using.............................................converts them into.............................................. If some units

of production are only partially complete they are known as............................................. These

appear as.............................................under the .............................................heading in the

statement of financial position. [6]

Compiled by: Saeed Mahmood 7707

6

Topic: understands and make adjustments for work in progress (AT-03)

1) A manufacturing business provided the following information.

$

prime cost 30 500

factory overheads 17 200

cost of goods produced 46 000

office and selling expenses 9 500

opening work-in-progress 5 100

What was the value of the closing work-in-progress?

(A) $1700 (B) $3400 (C) $6800 (D) $16 300

May 2018/12 Q27

2) The work in progress of a manufacturing business increased during the year.

Which effect does this have?

on cost of production on gross profit

(A) decrease increase

(B) decrease no effect

(C) increase decrease

(D) increase no effect

0452/ May 2017/11 Q1 h

3) Why is it necessary for a manufacturing business to make an adjustment for work in

progress in its manufacturing account?

1 to calculate what is needed to complete production

2 to record all factory costs

3 to show only the cost of goods completed

(A) 1 and 2

(B) 1 only

(C) 2 and 3

(D) 3 only

0452/ Feb 2018/12 Q1 c

4) How does a manufacturing business calculate the production cost of completed goods?

(A) prime cost + factory overheads + opening work in progress – closing work in progress

Compiled by: Saeed Mahmood 7707

7

(B) prime cost + factory overheads – opening work in progress + closing work in progress

(C) prime cost – factory overheads + opening work in progress – closing work in progress

(D) prime cost – factory overheads – opening work in progress + closing work in progress

0452/ May 2018/12 Q1 d

5) Name three types of inventory which might be held by a manufacturing business.

1..............................................................................................................................................

2..............................................................................................................................................

3.............................................................................................................................................. [3]

Compiled by: Saeed Mahmood 7707

8

Topic: calculate factory cost of production (AT-04)

1) How is the factory cost of production calculated?

(A) direct material + direct labour

(B) direct material + direct labour + direct expenses

(C) direct material + direct labour + direct expenses + factory overheads

(D) direct material + direct labour + direct expenses + total overheads

May 2010 Q26

2) How is the factory cost of production calculated?

(A) directlabour + direct material

(B) directlabour + factory overheads

(C) direct material + direct labour + factory overheads

(D) direct material + direct labour + total overheads

Nov 2001 Q37/May 2006 Q36

3) How is cost of production calculated?

(A) prime cost less factory overheads

(B) prime cost plus factory overheads

(C) prime cost less factory overheads less increase in inventory of work in progress

(D) prime cost plus factory overheads plus increase in inventory of work in progress

Nov 2003 Q37/ Nov 2009 Q25

4) A manufacturing firm’s costs were as follows.

$

Raw materials 55 000

Direct labour 86 400

Factory overheads 122 000

Depreciation of plant 6 400

Administration costs 8 800

Selling and distribution 12 000

There was closing work-in-progress of $12 400.

What was the factory cost of production?

(A) $257 400 (B) $263 400

(C) $269 800 (D) $278 200

May 2002 Q37

Compiled by: Saeed Mahmood 7707

9

5) A manufacturer has the following costs.

$

Raw material 8 000

Wages : factory workers 4 000

Factory supervisor 1 000

office works 2 000

Fixed overheads : factory 4 500

Office 1 500

What the factory cost of production?

(A) $12 000 (B) $16 500

(C) $17 500 (D) $21 000

Nov 2002 Q38/May 2009 Q28

6) A manufacturer provides the following information for May.

$

Direct material 4 000

Direct labour 2 000

Factory overheads 500

Work in progress 1 May 100

31 May 150

What is the factory cost of production?

(A) $6 050 (B) $6 450

(C) $6 500 (D) $6 550

May 2003 Q38

7) Addae opened a factory making children’s clothes on 1 February 2017.

He provided the following information at the end of his first year of trading.

$

Purchases of raw materials 48 400

Direct factory wages 38 800

Indirect factory wages 27 140

General factory expenses 3 150

Carriage inwards 1 950

Factory heat and light 1 110

Factory insurance 1 860

Inventory at 31 January 2018:

Compiled by: Saeed Mahmood 7707

10

raw materials 5 150

work in progress 7 260

finished goods 5 500

Factory machinery, $75 000, was purchased on 1 February 2017 and is to be depreciated by

20% per annum.

REQUIRED

(a) Define and give one example of each of the following types of inventory in Addae’s business.

(i) Raw materials

Definition ............................................................................................................................

...........................................................................................................................................

Example .........................................................................................................................[2]

(ii) Work in progress

Definition ............................................................................................................................

...........................................................................................................................................

Example .........................................................................................................................[2]

(iii) Finished goods

Definition ............................................................................................................................

...........................................................................................................................................

Example .........................................................................................................................[2]

(b) Prepare the manufacturing account for the year ended 31 January 2018.

Addae

Manufacturing Account for the year ended 31 January 2018

Compiled by: Saeed Mahmood 7707

11

Topic: prepare manufacturing accounts, income statements and statement of financial

position (AT-05)

1) What is the main reason for preparing a manufacturing account?

(A) to calculate the cost of overheads

(B) to calculate the cost of production

(C) to calculate the cost of raw materials used

(D) to calculate the prime cost

Specimen 2000 Q34

2) Which items may appear in the income statement (trading account section) of a

manufacturing business?

(A) cost of production and inventories of finished goods only

(B) cost of production and inventories of work in progress and finished goods

(C) purchases of raw materials and inventories of finished goods only

(D) purchases of raw materials and inventories of raw materials only

0452/ Feb 2016/11 Q1 h

3) The financial year of Paul Bergen, who is a manufacturer, ends on 30 June. On 30 June he

had three inventories _ finished goods, raw material and work in progress.

Where will these inventories appear in Paul Bergen’s financial statements prepared on 30

June 2006?

Manufacturing trading section of income Statement of Financial

account statement Position

(A) finished goods work in progress finished goods

raw material raw material

(B) finished goods work in progress finished goods

raw material raw material

work in progress

(C) raw material finished goods finished goods

work in progress work in progress

(D) raw material finished goods finished goods

work in progress raw material

work in progress

Specimen 2008 Q24

4) What will be included in a manufacturing account?

(A) Bank charges and commission on sales

Compiled by: Saeed Mahmood 7707

12

(B) Depreciation of plant and salesmen’s salaries

(C) Direct labour and factory overheads

(D) Direct labour and office expenses

Nov 2005 Q37

5) What does prime cost in a Manufacturing Account include?

(A) carriage inwards

(B) carriage outwards

(C) factory power

(D) factory rent and rates

May 2002 Q36 / May 2003 Q37

6) A manufacturing business extracts the following information from its books:

Direct materials $14 000

Direct labour $11 000

Indirect expenses $ 4 000

What is the amount of prime cost?

(A) $18 000

(B) $21 000

(C) $25 000

(D) $29 000

Specimen 2000 Q35

7) A firm’s manufacturing costs are shown in the table

Raw materials $10 per unit

Direct wages $5 per unit

Total indirect factory expenses $20 000

20 000 units are manufactured during the year. What is the prime cost.

(A) $100 000 (B) $200 000

(C) $300 000 (D) $320 000

May 2000 Q37

8) In which section of a manufacturing account would a royalty payment appear?

(A) direct expenses

(B) direct labour

(C) direct materials

(D) factory overheads

May 2014/11 Q25

Compiled by: Saeed Mahmood 7707

13

9) At the end of financial year a manufacturer has inventories of finished goods, raw materials

and work in progress.

Which inventories will appear in the Manufacturing Account?

Finished goods Raw materials Work-in-progress

(A) √ √

(B) √ √

(C) √ √

(D) √ √ √

May 2001 Q37

10) Which costs are included in prime cost?

Direct materials direct labour Factory overheads change in work in

progress

(A) .

(B) . ×

(C) × ×

(D) × × ×

May 2017/11 Q26

11) Wages are paid by a manufacturing business to machine operators, factory cleaners and

office staff.

Where are these wages recorded in the financial statements?

machine operators factory cleaners office staff

(A) overheads in income statement income statement

manufacturing account

(B) overheads in overheads in overheads in

manufacturing account manufacturing account manufacturing account

(C) prime cost in overheads in income statement

manufacturing account manufacturing account

(D) prime cost in prime cost in overheads in

manufacturing account manufacturing account

manufacturing account

Nov 2015/11 Q26

Compiled by: Saeed Mahmood 7707

14

12) Sumit and Theo have been in partnership for some years running a manufacturing business.

REQUIRED

(a) Complete the following table indicating with a tick (✓) where each item would appear in their

financial statements.

prime cost section of overheads section of Income

statement

the manufacturing the manufacturing

account account

Office rent

factory supervisor’s salary

carriage on raw materials

purchase of finished goods

salesman’s commission

factory supervisor’s salary

carriage on raw materials

[5]

13) Harrington provided the following information.

$

At 1 January 2014 Inventory – raw materials 5 600

– work in progress 1 900

– finished goods 4 600

For the year ended

31 December 2014 Purchases of raw materials 71 100

Raw materials returned 1 000

Raw materials taken for own use 2 000

Carriage on raw materials 2 100

Carriage outwards 4 050

Direct labour 52 550

Depreciation of machinery 4 400

Depreciation of office equipment 3 200

Discount allowed 3 050

Discount received 1 010

Salesman’s salary 19 840

Administration costs 20 070

Compiled by: Saeed Mahmood 7707

15

Factory rent 20 000

Office rent 10 000

At 31 December 2014 Inventory – raw materials 4 200

– work in progress 1 800

– finished goods 5 500

REQUIRED

(a) Complete the following table. Indicate with a tick (√) which costs from this data appear in the

overheads section of the manufacturing account and which appear in the income statement.

One cost has been shown as an example.

Cost Overheads section of the Income statement

manufacturing account

Office rent

[7]

14) The financial year of Msamati Manufacturing ends on 31 January.

The following is the summarised manufacturing account for the year ended 31 January 2017.

$

Prime cost 505 650

Factory overheads 176 390

682 040

Change in work in progress (12 090)

Cost of production 669 950

Msamati Manufacturing provided the following information for the year ended 31 January 2017.

$

Revenue 816 370

Purchases of finished goods 17 200

Commission received 2 700

Compiled by: Saeed Mahmood 7707

16

Administration expenses 38 160

Selling expenses 28 270

Inventory of finished goods 1 February 2016 56 120

Office equipment at cost 32 000

Delivery vehicles at cost 68 000

Provision for depreciation

Office equipment 14 400

Delivery vehicles 17 000

Loan from A1 Loans received 1 April 2016 15 000

At 31 January 2017

Inventory of finished goods 61 340

Commission receivable outstanding 130

Loan interest at 5% per annum is outstanding

During the year ended 31 January 2017 the owner of the business took finished goods costing

$1620 for his own use.

Depreciation is charged as follows:

Office equipment at 15% per annum using the straight line (equal instalment) method

Delivery vehicles at 25% per annum using the reducing (diminishing) balance method.

REQUIRED

(d) Prepare the income statement for the year ended 31 January 2017.

Compiled by: Saeed Mahmood 7707

17

Msamati Manufacturing

Income Statement for the year ended 31 January 2017

[10]

Complete the following table by writing True or False against each statement.

True or False

Work in progress may appear in Jake’s manufacturing account.

Prime cost appears in Jake’s income statement.

Jake’s business is a service business.

[3]

Compiled by: Saeed Mahmood 7707

18

Topic: make adjustments to financial statements (AT-06)

1) The policy of a manufacturing company is to state its profit fairly.

On which basis should its inventory of finished goods is valued in its accounts?

(A) prime cost, $20 000

(B) cost of production, $50 000

(C) cost of similar goods bought from another supplier, $55 000

(D) price at which goods were transferred from the factory to the warehouse, $60 000.

Specimen 2000 Q36

2) A manufacturing business provided the following information.

$

Opening inventory of finished goods 17 000

Closing inventory of finished goods 12 000

Cost of production for the year 100 000

Purchases of finished goods for the year 70 000

What was the cost of sales for the year?

(A) $75 000

(B) $105 000

(C) $170 000

(D) $175 000

0452/ May 2015/11 Q1 h

3) The rent of a manufacturing business is split 60% factory, 10% offices and 30% showrooms.

Business rent is $40 000 a year and salesmen’s salaries are $12 000 a year.

How much appears in the manufacturing account for these costs?

(A) $24 000

(B) $31 200

(C) $36 000

(D) $46 800

0452/ Nov 2015/11 Q1 i

Compiled by: Saeed Mahmood 7707

19

4)

Compiled by: Saeed Mahmood 7707

20

Compiled by: Saeed Mahmood 7707

21

0452/ FM 2017/22 Q3

Compiled by: Saeed Mahmood 7707

You might also like

- Self Practice ExercisesDocument4 pagesSelf Practice ExercisesGideon SancyNo ratings yet

- Gmail - Important Message About Your Amazon Seller AccountDocument1 pageGmail - Important Message About Your Amazon Seller AccountMuhmmad UmairNo ratings yet

- Individual Assignment 1 AFMDocument4 pagesIndividual Assignment 1 AFMSultan IskandarsyahNo ratings yet

- Chapter 2 - Emergence of Marketing ChannelsDocument11 pagesChapter 2 - Emergence of Marketing ChannelsPamela ZamoraNo ratings yet

- Management Accounting FinalDocument10 pagesManagement Accounting FinalMAGOMU DAN DAVID100% (1)

- ManaccDocument12 pagesManaccCynthia KesumaNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Chapter 1-Problems: Set B: InstructionsDocument3 pagesChapter 1-Problems: Set B: InstructionsPak CareerNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- PPC Set 1Document2 pagesPPC Set 1tatsssjkNo ratings yet

- Acd10403 Solution Tutorial Manufacturing Account 2018Document9 pagesAcd10403 Solution Tutorial Manufacturing Account 2018Atqh ShamsuriNo ratings yet

- Handout No. 2Document4 pagesHandout No. 2Gertim CondezNo ratings yet

- Ch02 Job Order Costing1Document8 pagesCh02 Job Order Costing1Laika Mico MotasNo ratings yet

- Comprehensive Examination Cost Accounting INSTRUCTIONS: Select The Best Answer For Each of The Following Questions. Mark Only One AnswerDocument19 pagesComprehensive Examination Cost Accounting INSTRUCTIONS: Select The Best Answer For Each of The Following Questions. Mark Only One AnswerHardly Dare GonzalesNo ratings yet

- Chapter 21 Job Costing: RequiredDocument20 pagesChapter 21 Job Costing: RequiredMuhammad ZakirNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostHemant AherNo ratings yet

- Cost Accounting and ControlDocument8 pagesCost Accounting and ControlJevbszen RemiendoNo ratings yet

- Final Examination For Each Item - Show Solutions in Good Form If ApplicableDocument8 pagesFinal Examination For Each Item - Show Solutions in Good Form If ApplicableDanielle Faith B GumbaoNo ratings yet

- 19upa514-Cost Accounting-Test-IDocument5 pages19upa514-Cost Accounting-Test-IJaya KumarNo ratings yet

- Commerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDocument4 pagesCommerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDhaval BakliwalNo ratings yet

- Midterm - Ch. 4Document15 pagesMidterm - Ch. 4Cameron BelangerNo ratings yet

- (CC-109 Cost Accounting - 2) - 2019Document4 pages(CC-109 Cost Accounting - 2) - 2019138 -Rajput-AdityaNo ratings yet

- Tutorial 6Document4 pagesTutorial 6NurSyazwaniRosliNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- TUTORIAL 2 Cost ClassificationDocument7 pagesTUTORIAL 2 Cost Classificationsarahayeesha1No ratings yet

- ch01Document27 pagesch01Jimmer CapeNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Job Batch Costing-PQDocument9 pagesJob Batch Costing-PQRohaib MumtazNo ratings yet

- Final CMAC (NA) Midterm Q.Paper Aut-23Document5 pagesFinal CMAC (NA) Midterm Q.Paper Aut-23Hassan TanveerNo ratings yet

- 11-11-21... 4060 GR I... Ni-3124... Costing... QueDocument4 pages11-11-21... 4060 GR I... Ni-3124... Costing... QueVimal Shroff55No ratings yet

- Bac 201: Management Accounting CAT 1Document3 pagesBac 201: Management Accounting CAT 1Jeremiah Kabiru MuthikeNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- ACCT 213 ExerciseDocument5 pagesACCT 213 ExerciseMr MDRKHMNo ratings yet

- ABC Case - PCMR ElectronicsDocument1 pageABC Case - PCMR ElectronicsOrduna Mae Ann0% (1)

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- PMA0064 Midterm (Q) Tri 3 2021Document6 pagesPMA0064 Midterm (Q) Tri 3 2021NABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument4 pagesThe Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Unit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDocument14 pagesUnit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDhanu ShriNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- OBE - COST QB With ANSWERS - FINALDocument92 pagesOBE - COST QB With ANSWERS - FINALPavi NishaNo ratings yet

- Final Cmac Q.paper (B, Rec Live)Document4 pagesFinal Cmac Q.paper (B, Rec Live)NomiNo ratings yet

- 102.COAP - .L I Question CMA Special Examination 2021novemberDocument4 pages102.COAP - .L I Question CMA Special Examination 2021novemberleyaketjnuNo ratings yet

- Project Case Study - Acc116 Oct-Feb 2023Document5 pagesProject Case Study - Acc116 Oct-Feb 2023Vishnu MenonNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- 59 Tea StallDocument2 pages59 Tea StallPrashant Sunali C'naNo ratings yet

- Cost Grand Test 2Document4 pagesCost Grand Test 2moniNo ratings yet

- AFIN210 Sample QuestionDocument3 pagesAFIN210 Sample QuestionWilliam C ManelaNo ratings yet

- Lecture 2 - Cost Concepts - QDocument5 pagesLecture 2 - Cost Concepts - Q1231402960No ratings yet

- 05 Financial Accounting Auditing Paper IV Cost Accounting Introduction and Basic ConceptsIDOL REV 201600037223Document13 pages05 Financial Accounting Auditing Paper IV Cost Accounting Introduction and Basic ConceptsIDOL REV 201600037223Mohit ParekhNo ratings yet

- Bac B203 - Cost AccountingDocument4 pagesBac B203 - Cost AccountingCarol NzauNo ratings yet

- Cost Accounting 3Document3 pagesCost Accounting 3sharu SKNo ratings yet

- Acct202Exam 1 - 2Document9 pagesAcct202Exam 1 - 2Tanvir AhmedNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- 9 Ledger WSDocument4 pages9 Ledger WSSaeed MahmoodNo ratings yet

- 9609 MW Otg Script+i p3Document9 pages9609 MW Otg Script+i p3Saeed MahmoodNo ratings yet

- Lesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Document15 pagesLesson Plans: Subject: Accounting (7707) Teacher's Name: Saeed Mahmood Class: X C For 2 Week of January 2020Saeed MahmoodNo ratings yet

- Businesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andDocument6 pagesBusinesses in The Tertiary Sector Spend Millions of Dollars Each Year On Social Media andSaeed MahmoodNo ratings yet

- 9 Revision OADocument12 pages9 Revision OASaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 MYE 20-21 Grade 9 PDFDocument10 pages7707 MYE 20-21 Grade 9 PDFSaeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document1 pageBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- Beaconhouse School System: Attendance For The Month of December-2019Document2 pagesBeaconhouse School System: Attendance For The Month of December-2019Saeed MahmoodNo ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- 7100 Consumer Credit PDFDocument16 pages7100 Consumer Credit PDFSaeed MahmoodNo ratings yet

- 7707 Grade 11 December 2020 PDFDocument10 pages7707 Grade 11 December 2020 PDFSaeed MahmoodNo ratings yet

- Chapter Eleven: Sampling: Design and ProceduresDocument28 pagesChapter Eleven: Sampling: Design and ProceduresSaeed MahmoodNo ratings yet

- Chapter 1Document29 pagesChapter 1Saeed MahmoodNo ratings yet

- Chapter Twenty-Four: International Marketing ResearchDocument20 pagesChapter Twenty-Four: International Marketing ResearchSaeed MahmoodNo ratings yet

- Final Quality AssuranceDocument39 pagesFinal Quality AssuranceSaeed MahmoodNo ratings yet

- Marketing Research SubjectiveDocument2 pagesMarketing Research SubjectiveSaeed MahmoodNo ratings yet

- Hina Naveed Sumission#4 Nishat Power LTDDocument10 pagesHina Naveed Sumission#4 Nishat Power LTDSaeed MahmoodNo ratings yet

- Nishat ISDocument11 pagesNishat ISSaeed MahmoodNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Operating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsDocument5 pagesOperating Fixed Assets Capital Work in Progress Major Spare Parts and Stand by EquipmentsSaeed MahmoodNo ratings yet

- Revenue Growth AnalysisDocument6 pagesRevenue Growth AnalysisSaeed MahmoodNo ratings yet

- 24.02.2023 - Tender For Project Management Consultancy ServicesDocument88 pages24.02.2023 - Tender For Project Management Consultancy ServicesArichandran ANo ratings yet

- Squadstack Competition PitchDocument1 pageSquadstack Competition Pitchsharmil_jainNo ratings yet

- Guagua National Colleges Graduate School Master's in Business AdministrationDocument25 pagesGuagua National Colleges Graduate School Master's in Business AdministrationLee K.No ratings yet

- Project Report On Design of Intersection PDFDocument19 pagesProject Report On Design of Intersection PDFBhaskar KumarNo ratings yet

- Capital Budgeting (R)Document32 pagesCapital Budgeting (R)KRISHNENDU JASHNo ratings yet

- Book 2 Go Kiss D WorldDocument7 pagesBook 2 Go Kiss D Worldtinytiya298317100% (1)

- Brought To You by Global ReportsDocument72 pagesBrought To You by Global ReportsJonathan OngNo ratings yet

- Freelance Blueprint PDFDocument12 pagesFreelance Blueprint PDFChinedu OkekeNo ratings yet

- A Study On Consumer Buying Behaviour Towards FMCG ProductsDocument22 pagesA Study On Consumer Buying Behaviour Towards FMCG ProductsRohit SharmaNo ratings yet

- Mariano Marcos State University BSPT 1-A, NSTP 01 Rodessa Van Micah C. EderDocument2 pagesMariano Marcos State University BSPT 1-A, NSTP 01 Rodessa Van Micah C. EderJan Crizza Dale R. FrancoNo ratings yet

- Fin242 Chapter 1 Latest April 2021Document14 pagesFin242 Chapter 1 Latest April 2021laurenNo ratings yet

- Met A Guide To Full Funnel Sales Part 3Document2 pagesMet A Guide To Full Funnel Sales Part 3Suffyan SadiqNo ratings yet

- Mcqs LedgerDocument10 pagesMcqs LedgerUsama SaadNo ratings yet

- CB Draft 1Document7 pagesCB Draft 1SHIVAM RAJUKANo ratings yet

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Document11 pagesCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNo ratings yet

- Bid Documents 2022Document17 pagesBid Documents 2022Arlene VillarosaNo ratings yet

- Ansoff MatrixDocument3 pagesAnsoff MatrixpawanNo ratings yet

- Merck Case AnalysisDocument4 pagesMerck Case Analysisc2ugly0% (2)

- RRC - CaseDocument15 pagesRRC - CaseFrancis VonNo ratings yet

- Unicorn Startups Case StudiesDocument39 pagesUnicorn Startups Case StudiesPranay Singh RaghuvanshiNo ratings yet

- Direct Investment and Collaborative StrategiesDocument23 pagesDirect Investment and Collaborative StrategiesShirley Low50% (2)

- Envision Motors: Invoice Cum Bill of SupplyDocument1 pageEnvision Motors: Invoice Cum Bill of SupplyEnvision MotorsNo ratings yet

- CSC 2019 Annual ReportDocument100 pagesCSC 2019 Annual ReportchinoytanNo ratings yet

- EnDocument19 pagesEnyetsedawNo ratings yet

- Terms of Contract GEG - DisplayDocument31 pagesTerms of Contract GEG - DisplaySaheed LawansonNo ratings yet

- Gross Price ListDocument120 pagesGross Price ListMark Philip BaliwisNo ratings yet

- MKT318m - Group Assignment BriefDocument3 pagesMKT318m - Group Assignment BriefNgocLOiNo ratings yet

- Geeta Associations & Maharshatra DirectoriesDocument12 pagesGeeta Associations & Maharshatra DirectoriesREACHLaw Chemical Regulatory Training Services0% (1)