Professional Documents

Culture Documents

Funnel Plan Translates Strategy To Plan On A Single Page

Uploaded by

King ChanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Funnel Plan Translates Strategy To Plan On A Single Page

Uploaded by

King ChanCopyright:

Available Formats

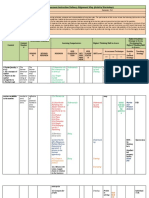

OBJECTIVES PROBLEMS WHAT TO WHOM THROUGH WHOM AGAINST WHOM

1 2 3 4 Under-perform Integrated Sales and ICT companies + Direct sales through MM DIY Inaction Local AB SFC

Attractive

Months $0.08m $0.08m $0.10m Marketing plans incl. ‘flushed’ early adopters accredited Funnel Share 4 6 3 4 3 1

Not aligned strategy, tactics, plan from other markets. Coaches.

Quarters $0.25m $0.40m $0.50m $0.50m USP 8 2 3 3 2 1

and measures. Sold as

STRATEGY

Years $1.7m $2.5m $4.0m $4.0m Lack plan ‘Funnel Camp’ (incl. pre- Pragmatic CEOs / Introducers from: CRM Recognition 1 4 3 6 1 2

Camp metrics & ‘as is’ Divisional Director + vendors & integrators, Cost 4 3 3 1 6 2

Growth stalled strategy, planning Head of Sales / trainers, VCs, trade

Prove up the demand generation strategy & plan References 7 2 3 2 5 3

internationally . workshop, document Channel + Head of associations, existing

Not closing Total 24 17 15 16 17 9

plan & oversee Marketing customers.

execution). Marketing

Poor Mktg To leverage strength's & overcome weaknesses, use Miller

Strong training sold as Funnel

Heiman’s Strategic Selling Blue Sheet to plan each opportunity,

Academy (public and

and use references early to improve lack of recognition

private).

Sales & marketing engine is underperforming

FUNNEL MODEL MATURITY OF TARGET MARKETS

M1 M2 M3 Q2 Q3 Q4 Y2 Y3 TOTAL 20% 20%

New Targets 2,955 2,336 303 981 4,182 4,289 15,682 13,073 43,801

25% 0%

Recycled prospects 0 1,358 2,652 8,623 8,623 15,719 80,049 114,978 232,002

35%

Contact received 2,955 3,694 2,955 9,604 12,805 20,008 95,731 128,051 275,803 EM DG CR

Market Focus Maturity

Interest established 148 185 148 480 520 1,000 4,648 6,403 13,532 14% 51% 36%

Gap acknowledged 35 46 37 120 120 240 1,139 1,601 3,338 Hardware vendors 20% Main street 6% 8% 6%

SIZING

Need identified 17 23 18 60 60 115 564 800 1,657 CRM integrators 35% Bowling alley 4% 25% 7%

Offer understood 13 20 16 51 51 89 469 680 1,389 CRM vendors 20% Tornado 4% 8% 8%

Preference formed 6 12 11 36 36 54 318 476 949 System integrators 25% Early market 0% 10% 15%

Decision made 4 7 8 25 25 33 218 333 653

Revenue $0.08m $0.08m $0.10m $0.40m $0.50m $0.50m $2.5m $4.0m $8.2m

Sales staff (FTEs) 3 3 3 3 4 6 7 10

Sales utilisation 87% 99% 105% 107% 80% 92% 105% 107% 98%

CAMPAIGN PLAN

New Targets (43801) Contact received (275803) Interest established (13532) Gap acknowledged (3338) Need identified (1657) Offer understood (1389) Preference formed (949) Decision made (653)

Referral

Funnel Review: Assess

Call to discuss gaps and Present one-page

health of sales and Use Miller Heiman Blue Present Replay journey -

List rental 'sell' free audit summary of journey

marketing engine Sheet to plan recommendations face- situation, gap, need,

Advance call to PA opportunity - ID to-face to key solution, ROI, proof

Desktop research The impact of under-

performing sales and Email: 1-page 'sell sheet

Letter re planning or ' for free review

PR marketing engine Highlight cost of inaction

funnel gaps Outline ROI of clear plan

TICS

TACTICS

Present findings of & skilled team Ask for the contract.

Webinars

Social media Phone call to qualify, review with key

and 'sell' free audit Email link to video

Small events testimonial

Syndication partner Partner email, DM,

banner ad & web site White papers Test against ICP

Existing house list Leave case study Set kick-off date

Selectively offer

Funnel Vision email, & You Tube Attend once or register / industry-specific

Funnel Coaches RSS (MM & partners) reference calls

download 3 times

SEO self-subs

© MATHMARKETING, 2009 WWW.MATHMARKETING.COM

You might also like

- Marketing Planning by Design: Systematic Planning for Successful Marketing StrategyFrom EverandMarketing Planning by Design: Systematic Planning for Successful Marketing StrategyNo ratings yet

- Marketing EightDocument22 pagesMarketing Eightapi-3728497No ratings yet

- SDM - Sales and Distribution ManagementDocument3 pagesSDM - Sales and Distribution Managementnavan kumarNo ratings yet

- Examining Career Development Programs For The Sales Force: Areer Evelopment RogramsDocument19 pagesExamining Career Development Programs For The Sales Force: Areer Evelopment RogramsApurva Dilip BapatNo ratings yet

- Group 3 Joydeep - Krishna Karthikeyan - Kaushik Hargun - KanavDocument8 pagesGroup 3 Joydeep - Krishna Karthikeyan - Kaushik Hargun - KanavHarshit GuptaNo ratings yet

- Course Outline PRM - 39 Academic Year 2019-20: Course Title: Term Credit Core / ElectiveDocument3 pagesCourse Outline PRM - 39 Academic Year 2019-20: Course Title: Term Credit Core / ElectivePriya AgarwalNo ratings yet

- Marketing CH 2Document70 pagesMarketing CH 2Hamza AliNo ratings yet

- Chapter - III Sales ForecastingDocument35 pagesChapter - III Sales Forecastingjamil ahmedNo ratings yet

- Bachelor of Digital Marketing Roadmap: Year 1: Explore Year 2: Experience Year 3: EngageDocument1 pageBachelor of Digital Marketing Roadmap: Year 1: Explore Year 2: Experience Year 3: EngageTuan Anh NguyenNo ratings yet

- Marketing PlanDocument22 pagesMarketing Planayya79100% (2)

- Empacito Enterprise Usiness Plan: Submitted To: Sfent-2EDocument33 pagesEmpacito Enterprise Usiness Plan: Submitted To: Sfent-2EAlyza Noeri MercadoNo ratings yet

- Appendix 2 - Business Plan Template (Local Enterprise Office Modified Template)Document17 pagesAppendix 2 - Business Plan Template (Local Enterprise Office Modified Template)Abdul KarimNo ratings yet

- Business Plan TemplateDocument19 pagesBusiness Plan TemplateRoxana MartinasNo ratings yet

- Vol 8 Iss 2Document32 pagesVol 8 Iss 2erwin6677No ratings yet

- Nestle - ZakaDocument42 pagesNestle - ZakazakavisionNo ratings yet

- Franchise Marketing ProcessDocument2 pagesFranchise Marketing ProcessSeminar Group09No ratings yet

- FINAL - PME Lesson 1Document28 pagesFINAL - PME Lesson 1Huy Nguyễn Hoàng NhậtNo ratings yet

- MPP Unit Guide - T1 2024Document6 pagesMPP Unit Guide - T1 202431221020295No ratings yet

- 2008 CRM Editorial CalendarDocument2 pages2008 CRM Editorial Calendarhtriyadi100% (1)

- Strategic Market Planning and The Evaluation of Marketing OpportunitiesDocument13 pagesStrategic Market Planning and The Evaluation of Marketing OpportunitiesShilpa KamathNo ratings yet

- Donear Industries PG Sales & Distribution Sample AnswerDocument51 pagesDonear Industries PG Sales & Distribution Sample AnswerShweta RathodNo ratings yet

- CIDAM EntrepreneurDocument3 pagesCIDAM EntrepreneurChristian100% (5)

- SAP Trade Promotion Management: RKT Workshop - TPM OverviewDocument85 pagesSAP Trade Promotion Management: RKT Workshop - TPM OverviewSuresh ReddyNo ratings yet

- Chap3 (Read Only)Document16 pagesChap3 (Read Only)thahir_n-mNo ratings yet

- ACPL Business PlanDocument19 pagesACPL Business Planshiv jangaleNo ratings yet

- Ch-02-S-Developing Marketing Strategies and PlansDocument8 pagesCh-02-S-Developing Marketing Strategies and PlansSamiul AzimNo ratings yet

- Market projection and 8 steps for marketing plan successDocument4 pagesMarket projection and 8 steps for marketing plan successAndre SanchezNo ratings yet

- Department structure and relationship chartDocument9 pagesDepartment structure and relationship chartRavina SinghNo ratings yet

- 5. BUSSINES REVIEW MEI 2021Document27 pages5. BUSSINES REVIEW MEI 2021salesaljazeerah08No ratings yet

- Ompany OGO: S B P TDocument19 pagesOmpany OGO: S B P TQueen MagnesiaNo ratings yet

- 1.3 - Handout (Full)Document64 pages1.3 - Handout (Full)Nguyen Thi Minh AnNo ratings yet

- Business Strategy-BCG Matrix-Lecture 22 Jun 2023Document23 pagesBusiness Strategy-BCG Matrix-Lecture 22 Jun 2023VibhaNo ratings yet

- Sales & Distribution ManagementDocument25 pagesSales & Distribution ManagementVaidehi ShuklaNo ratings yet

- Training Road MapDocument1 pageTraining Road Mapjeffrey chua100% (1)

- Evidencia 2 Marketing InglesDocument3 pagesEvidencia 2 Marketing IngleshumbertoNo ratings yet

- Market SegmentationDocument20 pagesMarket Segmentationfnab@hotmail.com100% (8)

- Marketing 2Document4 pagesMarketing 2Mumar Soluciones IngenierilesNo ratings yet

- IntExtCommProcessDocument1 pageIntExtCommProcessMadalina Croitoru RisteaNo ratings yet

- Sales & Marketing SOP HotelDocument26 pagesSales & Marketing SOP Hotelshweta m94% (18)

- Canon's Marketing Strategy AnalysisDocument18 pagesCanon's Marketing Strategy AnalysisMikaNo ratings yet

- 2023 CFVG 2 Sales Environment and OrganizationDocument34 pages2023 CFVG 2 Sales Environment and OrganizationDao HuynhNo ratings yet

- Annex B. Template For Regional and Division DRRM Accomplishment ReportsDocument22 pagesAnnex B. Template For Regional and Division DRRM Accomplishment ReportslarrycapaciteNo ratings yet

- Strategic Planning For Competitive AdvantageDocument63 pagesStrategic Planning For Competitive AdvantageAbdiasisNo ratings yet

- Cafe Talk PlusBase EFE 24082022Document26 pagesCafe Talk PlusBase EFE 24082022Anh ThongkctNo ratings yet

- Pantaloon MISDocument7 pagesPantaloon MISrajat_mahajan599400% (1)

- IMM - CPM - Course Material (00000002)Document96 pagesIMM - CPM - Course Material (00000002)Nayeem SheikNo ratings yet

- Marketing Environment: (Read The Textbook - Chapter 4 - Page 103-119)Document10 pagesMarketing Environment: (Read The Textbook - Chapter 4 - Page 103-119)Thảo PhươngNo ratings yet

- Company Study: Biao Agrarian Reform Cooperative (Barbco)Document14 pagesCompany Study: Biao Agrarian Reform Cooperative (Barbco)Jireh Estavas MalinucaNo ratings yet

- Planning, Sales Forecasting, and BudgetingDocument45 pagesPlanning, Sales Forecasting, and BudgetingKushagra AroraNo ratings yet

- Session Product Strategy and Zara CaseDocument6 pagesSession Product Strategy and Zara CaseacemaveNo ratings yet

- (WBS) Business - Management - Game - ENDocument21 pages(WBS) Business - Management - Game - ENwill.li.shuaiNo ratings yet

- Ch-02-S-Developing Marketing Strategies and PlansDocument8 pagesCh-02-S-Developing Marketing Strategies and PlansAshekin MahadiNo ratings yet

- Salesforce Marketing Reference Material Target To Lead 1.3 Campaign Management Executive SummaryDocument5 pagesSalesforce Marketing Reference Material Target To Lead 1.3 Campaign Management Executive SummarySadith Samanta Trejo SalcedoNo ratings yet

- PlaceDocument6 pagesPlaceaakritiNo ratings yet

- PRINCIPLES OF MKTG - TOS 1ST Quarterly Exam Proj Quadrant - FINAL 2Document2 pagesPRINCIPLES OF MKTG - TOS 1ST Quarterly Exam Proj Quadrant - FINAL 2nurskieeibrahimNo ratings yet

- Independent University, Bangladesh School of Business and Entrepreneurship (SBE) MBA Program Course OutlineDocument6 pagesIndependent University, Bangladesh School of Business and Entrepreneurship (SBE) MBA Program Course OutlineMd. Muhinur Islam AdnanNo ratings yet

- Designing Marketing Programs to Build Brand EquityDocument5 pagesDesigning Marketing Programs to Build Brand EquityAfrina KarimNo ratings yet

- Pragmatic Framework Defintitions 1812.2Document2 pagesPragmatic Framework Defintitions 1812.2ZNo ratings yet

- Strategi Tingkat Corporate: Muji Gunarto Mgunarto@binadarma - Ac.idDocument12 pagesStrategi Tingkat Corporate: Muji Gunarto Mgunarto@binadarma - Ac.idAgathaNo ratings yet

- Police Personnel Management and RecordsDocument26 pagesPolice Personnel Management and RecordsLowie Jay Mier OrilloNo ratings yet

- Resolve Error in FI Document Parking WorkflowDocument4 pagesResolve Error in FI Document Parking WorkflowManohar G ShankarNo ratings yet

- LTC Bill Form-G.a.r. 14-cDocument10 pagesLTC Bill Form-G.a.r. 14-cpraveen reddyNo ratings yet

- TDL Reference ManualDocument628 pagesTDL Reference ManualhanifmitNo ratings yet

- Research Article: Deep Learning-Based Real-Time AI Virtual Mouse System Using Computer Vision To Avoid COVID-19 SpreadDocument8 pagesResearch Article: Deep Learning-Based Real-Time AI Virtual Mouse System Using Computer Vision To Avoid COVID-19 SpreadRatan teja pNo ratings yet

- Informatica2 PDFDocument200 pagesInformatica2 PDFAriel CupertinoNo ratings yet

- RESIDENT NMC - Declaration - Form - Revised - 2020-2021Document6 pagesRESIDENT NMC - Declaration - Form - Revised - 2020-2021Riya TapadiaNo ratings yet

- Quick Start Guide: Before You BeginDocument13 pagesQuick Start Guide: Before You Beginfrinsa noroesteNo ratings yet

- Unmatched Power. Unmatched Creative Freedom.: Nvidia Quadro P6000Document1 pageUnmatched Power. Unmatched Creative Freedom.: Nvidia Quadro P6000Família FranciscoNo ratings yet

- MemTest86 User Guide UEFIDocument101 pagesMemTest86 User Guide UEFIDani CentNo ratings yet

- Ebook PDF Understandable Statistics Concepts and Methods 12th Edition PDFDocument41 pagesEbook PDF Understandable Statistics Concepts and Methods 12th Edition PDFjimmie.smith693100% (32)

- Valencia v. Sandiganbayan DIGESTDocument2 pagesValencia v. Sandiganbayan DIGESTkathrynmaydevezaNo ratings yet

- Norman Brandinger-HA With OpenSIPSDocument41 pagesNorman Brandinger-HA With OpenSIPSdragelecNo ratings yet

- 5TH International Conference BrochureDocument5 pages5TH International Conference Brochureanup patwalNo ratings yet

- Sirius-4 4 29-Manual PDFDocument49 pagesSirius-4 4 29-Manual PDFJovanderson JacksonNo ratings yet

- Labour Welfare Management at Piaggio vehicles Pvt. LtdDocument62 pagesLabour Welfare Management at Piaggio vehicles Pvt. Ltdnikhil kumarNo ratings yet

- Section 89 of CPC: Significance and Case LawsDocument10 pagesSection 89 of CPC: Significance and Case LawsPragna NachikethaNo ratings yet

- Accenture The Long View of The Chip ShortageDocument20 pagesAccenture The Long View of The Chip ShortageOso genialNo ratings yet

- Udit Sharma: Summary of Skills and ExperienceDocument2 pagesUdit Sharma: Summary of Skills and ExperienceDIMPI CHOPRANo ratings yet

- Customers' Role in Service Delivery & Self-Service TechDocument32 pagesCustomers' Role in Service Delivery & Self-Service TechSubhani KhanNo ratings yet

- RBS LogDocument1,351 pagesRBS Logsalman7467No ratings yet

- An Overview of Penetration TestingDocument20 pagesAn Overview of Penetration TestingAIRCC - IJNSANo ratings yet

- Tower Crane Safety Devices RequirementsDocument2 pagesTower Crane Safety Devices RequirementsJustin ChongNo ratings yet

- Company Profile: Our BeginningDocument1 pageCompany Profile: Our BeginningSantoshPaul CleanlandNo ratings yet

- Harvard Referencing GuideDocument73 pagesHarvard Referencing GuideCassidy WilliamsNo ratings yet

- Yazdan AminiDocument27 pagesYazdan AminiM Asif AdeliNo ratings yet

- High School Students' Characteristics Predict Science Club MembershipDocument4 pagesHigh School Students' Characteristics Predict Science Club MembershipNorma PanaresNo ratings yet

- Data CommunicationDocument2 pagesData CommunicationYzza Veah Esquivel100% (8)

- Lexmark MX32x, MX42x, MX52x, MX62x Series Disassembly of WEEE Manual v1.0 Sept-2019Document26 pagesLexmark MX32x, MX42x, MX52x, MX62x Series Disassembly of WEEE Manual v1.0 Sept-2019Fabio AntonioNo ratings yet

- The 10 Most Influential Business Women Making A Difference, 2022Document40 pagesThe 10 Most Influential Business Women Making A Difference, 2022The Inc MagazineNo ratings yet