Professional Documents

Culture Documents

Shayan Khan (20202-27032) SPACE MATRIX-1

Uploaded by

shayanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shayan Khan (20202-27032) SPACE MATRIX-1

Uploaded by

shayanCopyright:

Available Formats

Strategic Management

“SPACE MATRIX”

Submitted To: Sir Naveed Muhammad Khan

Submitted By: Shayan Khan (20202-27032)

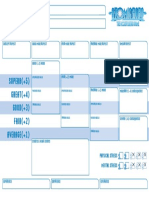

Internal Strategic Position External Strategic Position

Y Axis Financial Strength (FS) Environmental Stability

ROI = +1 (ES)

ROE= +1 Barriers to entry= -1

Profitability Ratios= Inflation= -5

+2 Technology change= -3

Activity ratios= +3 Competitive pressure=-

Leverage Ratios= +1 4

FS+ES= 1.66+ (-2.8) = Liquidity Ratio= +2 Demand variability= -1

-1.14 Average= +1.66 Average= -2.8

Competitive Advantage Industry Strength (IS)

X Axis (CA) Growth Potential= +3

Market Share= -1 Market Entry= +1

Customer Loyalty=-3 Technology

Direct Flight (point to Knowhow= +2

point)=-1 Financial Stability= +2

Huge and Young Fuel Price Stability=

Fleet=-2 +1

Service Quality =-3 Human resource

Management availability=+2

CA+IS= (-2.33+1.71) = Experience Government

-0.62 (Professionalism)=-4 Support=+1

Average = -2.33 Average= 1.71

Conservative Aggressive

+6

+4

+2

-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

-2

(-0.62,-1.14) 3.00) -4

-6 Competitive

Defensive

The graph indicates the PIAC to be in Third Quadrant which is defensive strategy quadrant

Defensive Strategies

In the defensive quadrant the company may use one of the following strategies rectifying internal

weaknesses and avoiding external threats.

STRATEGIES.

Defensive strategies include

Retrenchment

Divestiture

Liquidation

Concentric diversification.

You might also like

- The Strategic PositionDocument2 pagesThe Strategic PositionjaidsheikhNo ratings yet

- Space MatrixDocument2 pagesSpace MatrixAdam RyanNo ratings yet

- SFM Formula BookDocument29 pagesSFM Formula BookAstikNo ratings yet

- International Finance - MG760-144 Week2 Kiran Kumar Reddy Raya Homework Assignment Monroe College King Graduate SchoolDocument4 pagesInternational Finance - MG760-144 Week2 Kiran Kumar Reddy Raya Homework Assignment Monroe College King Graduate SchoolKiranNo ratings yet

- StrategiesDocument17 pagesStrategiesLiaqat AliNo ratings yet

- SPACE MATRIX NishatDocument4 pagesSPACE MATRIX NishatMohammad Wajeeh MohsinNo ratings yet

- International Finance 2Document4 pagesInternational Finance 2KiranNo ratings yet

- Binary OperationsDocument11 pagesBinary OperationsNoreen RavaneraNo ratings yet

- JP Morgan Chase & Co SLIDEDocument12 pagesJP Morgan Chase & Co SLIDESriSaraswathyNo ratings yet

- Module 5: Decisions Recognizing RiskDocument11 pagesModule 5: Decisions Recognizing RiskMarvie NivalNo ratings yet

- MG770-144 Week 2 Homework AssignmentDocument3 pagesMG770-144 Week 2 Homework AssignmentKiranNo ratings yet

- Strategic Management (MGT603) Assignment # 02Document4 pagesStrategic Management (MGT603) Assignment # 02MalikusmanNo ratings yet

- ECO 017 FormulasDocument4 pagesECO 017 Formulasitsjoyie4No ratings yet

- Asset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFDocument60 pagesAsset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFHarpreet GillNo ratings yet

- Docsity Salinas J 2012 AlgebraDocument12 pagesDocsity Salinas J 2012 AlgebraMaria Lizeth Orbenes Rodarte 3-3No ratings yet

- Incorrectly.: G (X) H (X)Document5 pagesIncorrectly.: G (X) H (X)Udbhav DikshitNo ratings yet

- DRB HICOM BERHAD Strategy AnalysisDocument8 pagesDRB HICOM BERHAD Strategy AnalysisRatna TazulazharNo ratings yet

- 17 March HWDocument4 pages17 March HWEgor SemenovNo ratings yet

- Leaving Certificate 2020 Higher Level Mathematics - Paper 1Document4 pagesLeaving Certificate 2020 Higher Level Mathematics - Paper 1Mohamed KamaraNo ratings yet

- Financial Management FormulaeDocument15 pagesFinancial Management FormulaeAsAd MehƏiNo ratings yet

- Inverse Trigonometric Functions PDFDocument134 pagesInverse Trigonometric Functions PDFɴɵʈ ɛɴɵʋɢɧNo ratings yet

- AnalysisDocument29 pagesAnalysisxaxif100% (1)

- Investment Management - Exam Example: Problem 1 (13 PT.)Document5 pagesInvestment Management - Exam Example: Problem 1 (13 PT.)Lan NgoNo ratings yet

- Seminar 2Document5 pagesSeminar 2EnnyNo ratings yet

- Space Matrix and IE Matrix of HPDocument3 pagesSpace Matrix and IE Matrix of HPSAMNo ratings yet

- Solution of Function & ITFDocument3 pagesSolution of Function & ITFrommel pawNo ratings yet

- Example ExamDocument6 pagesExample Examnnajichinedu20No ratings yet

- Chapter 1.2. Completing The Square Exercise 1BDocument15 pagesChapter 1.2. Completing The Square Exercise 1BChai MingzeNo ratings yet

- Atomic Robo Fillable CSDocument1 pageAtomic Robo Fillable CSIvan ZovkoNo ratings yet

- GREAT (+4) SUPERB (+5) : Physical Stress M Ental StressDocument1 pageGREAT (+4) SUPERB (+5) : Physical Stress M Ental StressSeadevil0No ratings yet

- GREAT (+4) SUPERB (+5) : Physical Stress M Ental StressDocument1 pageGREAT (+4) SUPERB (+5) : Physical Stress M Ental StressSeadevil0No ratings yet

- Copy-SPACE-Matrix 2 PDFDocument2 pagesCopy-SPACE-Matrix 2 PDFJasonHrvy100% (1)

- MidlandDocument1 pageMidlandcarlos.deoliveiraNo ratings yet

- Tut 04 SolnDocument6 pagesTut 04 Soln张婧姝No ratings yet

- Space Matrix MaybankDocument3 pagesSpace Matrix Maybankrizalstarz100% (15)

- Assignment of Millat Tractor Space MatrixDocument1 pageAssignment of Millat Tractor Space MatrixMaria ZulfiqarNo ratings yet

- Activity No 1ADocument1 pageActivity No 1ABeyoung GamefightNo ratings yet

- Answer The Short Answer Questions in A Separate Word Document and Clearly Show All Your WorkDocument4 pagesAnswer The Short Answer Questions in A Separate Word Document and Clearly Show All Your WorkTalhaa MaqsoodNo ratings yet

- Strategic Managment (6th Session)Document49 pagesStrategic Managment (6th Session)Omair Hamid EnamNo ratings yet

- DPP 3Document5 pagesDPP 3Rupesh Kumar SinghNo ratings yet

- Space MatrixDocument4 pagesSpace MatrixAlvinNo ratings yet

- 34 Basic Rules of AlgebraDocument4 pages34 Basic Rules of AlgebraSana khanNo ratings yet

- Midterm Exam: Module 4 Assignment 2Document11 pagesMidterm Exam: Module 4 Assignment 2lydiaross13No ratings yet

- Krispy Kreme Doughnuts Inc Competitive Profile (CPM) Matrix: Key Success Factors Weight StarbucksDocument3 pagesKrispy Kreme Doughnuts Inc Competitive Profile (CPM) Matrix: Key Success Factors Weight StarbucksPrecious Diarez PurezaNo ratings yet

- Strategy Analysis & Choice: Strategic Management: Concepts & Cases 12 Edition Fred David Nov: 2009Document45 pagesStrategy Analysis & Choice: Strategic Management: Concepts & Cases 12 Edition Fred David Nov: 2009Talha Khan SherwaniNo ratings yet

- A Goal Programming Model For Working Capital ManagementDocument4 pagesA Goal Programming Model For Working Capital ManagementBharatKathuriaNo ratings yet

- Questions For SHS Math QuizDocument1 pageQuestions For SHS Math QuizZo RenNo ratings yet

- Relations, Functions - ITF ExerciseDocument42 pagesRelations, Functions - ITF ExerciseDeep kiranNo ratings yet

- 5Document2 pages5Дмитрий СмыкNo ratings yet

- Fin552 Topic 5 Homework ExercisesDocument3 pagesFin552 Topic 5 Homework ExercisesHardy MercurialNo ratings yet

- Risk and Return2Document12 pagesRisk and Return2shovan_bhunia842No ratings yet

- Theory / Summary Session - 2015-16 New Sheet Structure For JEE (Advanced) Class - XIIDocument61 pagesTheory / Summary Session - 2015-16 New Sheet Structure For JEE (Advanced) Class - XIIPuneet JainNo ratings yet

- Mathematical Induction and Binomial Theorem - Exercise 8.3 - ClassNotesDocument1 pageMathematical Induction and Binomial Theorem - Exercise 8.3 - ClassNotesinameless2005No ratings yet

- Lucrare de Laborator 5: Universitatea Tehnică A MoldoveiDocument8 pagesLucrare de Laborator 5: Universitatea Tehnică A MoldoveiAdrian BodorinNo ratings yet

- محفظة الاوراق الماليةDocument40 pagesمحفظة الاوراق الماليةmemmemoNo ratings yet

- Basic Maths (Al)Document20 pagesBasic Maths (Al)wissam riyasNo ratings yet

- Answer Book Print PDFs PDFDocument58 pagesAnswer Book Print PDFs PDFKayla HoNo ratings yet

- Exercise - 1: Chapter-1 - FunctionDocument459 pagesExercise - 1: Chapter-1 - FunctionPlato PhilosopherNo ratings yet

- 002 Risk and ReturnDocument21 pages002 Risk and Returnjo6010clNo ratings yet

- Inverse Trigonometric Functions (Trigonometry) Mathematics Question BankFrom EverandInverse Trigonometric Functions (Trigonometry) Mathematics Question BankNo ratings yet

- Strategic Management: Internal and External Factors Evaluation MatrixDocument9 pagesStrategic Management: Internal and External Factors Evaluation MatrixshayanNo ratings yet

- SWOT Matrix Millat TractorsDocument1 pageSWOT Matrix Millat Tractorsshayan100% (1)

- Competitive Profile MatrixDocument1 pageCompetitive Profile MatrixshayanNo ratings yet

- Haleeb PDFDocument60 pagesHaleeb PDFSeema KhanNo ratings yet

- The Role of Law in Business DevelopmentDocument4 pagesThe Role of Law in Business DevelopmentPsy GannavaramNo ratings yet

- Instructions For Solo Poles: DetectorDocument2 pagesInstructions For Solo Poles: Detectorchaikal alghifariNo ratings yet

- Microsof e WaseDocument2 pagesMicrosof e Waseapi-241952519No ratings yet

- Financials WorksheetDocument3 pagesFinancials WorksheetSiddharthNo ratings yet

- Ijepa FormDocument1 pageIjepa FormnanaNo ratings yet

- Ebs 501 Ig enDocument2 pagesEbs 501 Ig enStelios KaragiannisNo ratings yet

- Duff CoDocument1 pageDuff CoAli HussainNo ratings yet

- Schedule Oct 2020 ML2-SL2-LLGDocument1 pageSchedule Oct 2020 ML2-SL2-LLGSHOAIB ARSHADNo ratings yet

- Loresheet OutForBloodDocument1 pageLoresheet OutForBloodPat MannNo ratings yet

- UCSP - Second Quarter - M07Document19 pagesUCSP - Second Quarter - M07Clyde Lester GabitoNo ratings yet

- Rasc I Retail Cashier Question BankDocument2 pagesRasc I Retail Cashier Question BankZahara MuhozaNo ratings yet

- Studentschummary 3211269571484718799Document5 pagesStudentschummary 3211269571484718799joy parimalaNo ratings yet

- SDN 101 GuideDocument10 pagesSDN 101 Guideemeka ozuomeNo ratings yet

- Final EBCL NovemberDocument686 pagesFinal EBCL Novemberelliot fernandesNo ratings yet

- Engineering Cost Estimation SampleDocument1 pageEngineering Cost Estimation SampleTty SmithNo ratings yet

- Lead SAP HCM and SuccessFactors Consultant ResumeDocument4 pagesLead SAP HCM and SuccessFactors Consultant ResumeZill HumaNo ratings yet

- The Antecedents of Middle Managers Strategic Contribution The Case of ADocument32 pagesThe Antecedents of Middle Managers Strategic Contribution The Case of ASandra BarbacenaNo ratings yet

- AfDB Grade and Salary Data - 2016Document1 pageAfDB Grade and Salary Data - 2016hoadiNo ratings yet

- Marketing 7Th Edition Levy Grewal Full ChapterDocument67 pagesMarketing 7Th Edition Levy Grewal Full Chapterthelma.foley679100% (4)

- Financial Instrument SummaryDocument6 pagesFinancial Instrument SummaryJoshua ComerosNo ratings yet

- TPA Refund ProcessDocument3 pagesTPA Refund ProcessYuan TianNo ratings yet

- Audit and Inventory Committee ReportDocument3 pagesAudit and Inventory Committee ReportGeaMary Labucay Manatad100% (1)

- Bullying, Cyberbullying and Hate SpeechDocument33 pagesBullying, Cyberbullying and Hate SpeechEve AthanasekouNo ratings yet

- Economic History of West Africa in The 19th and 20th Centuries LNDocument57 pagesEconomic History of West Africa in The 19th and 20th Centuries LNSamuel Obaji100% (1)

- Develop Wilmont's Pharmacy Drone Delivery Project Work Breakdown Structure (WBS)Document2 pagesDevelop Wilmont's Pharmacy Drone Delivery Project Work Breakdown Structure (WBS)Shkjndfhbiana dygwqNo ratings yet

- Bajaj Auto Ltd. (India) : SourceDocument5 pagesBajaj Auto Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Mepco Online Bill Hassan Raza DharallaDocument2 pagesMepco Online Bill Hassan Raza DharallaTahfuz EhsaasNo ratings yet

- 3 Pseudoscience and FinanceDocument11 pages3 Pseudoscience and Financemacarthur1980No ratings yet

- List Niec Delhi 2004 08Document4 pagesList Niec Delhi 2004 08Geet SinghalNo ratings yet

- Cost AccountingDocument22 pagesCost AccountingDani SoaveNo ratings yet