Professional Documents

Culture Documents

Atty. Antonio Jonathan G. Jaminola

Uploaded by

Xirkul Tupas0 ratings0% found this document useful (0 votes)

104 views1 pageThe letter is requesting assistance regarding tax liabilities owed by Rey G. Tupas due to tax discrepancies. The letter writer's brother, who previously handled the family business and tax issues, passed away recently. It was unfortunate that the brother did not properly communicate with their father about resolving the issue within the prescriptive period. They are now trying to settle the tax liabilities before the June 2021 tax amnesty deadline and are requesting any suggestions for alternative remedies from the Regional Director of the Bureau of Internal Revenue.

Original Description:

Original Title

Lucky Mae

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe letter is requesting assistance regarding tax liabilities owed by Rey G. Tupas due to tax discrepancies. The letter writer's brother, who previously handled the family business and tax issues, passed away recently. It was unfortunate that the brother did not properly communicate with their father about resolving the issue within the prescriptive period. They are now trying to settle the tax liabilities before the June 2021 tax amnesty deadline and are requesting any suggestions for alternative remedies from the Regional Director of the Bureau of Internal Revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views1 pageAtty. Antonio Jonathan G. Jaminola

Uploaded by

Xirkul TupasThe letter is requesting assistance regarding tax liabilities owed by Rey G. Tupas due to tax discrepancies. The letter writer's brother, who previously handled the family business and tax issues, passed away recently. It was unfortunate that the brother did not properly communicate with their father about resolving the issue within the prescriptive period. They are now trying to settle the tax liabilities before the June 2021 tax amnesty deadline and are requesting any suggestions for alternative remedies from the Regional Director of the Bureau of Internal Revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

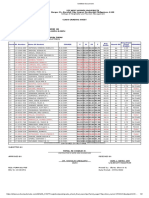

March 15, 2021

ATTY. ANTONIO JONATHAN G. JAMINOLA

Regional Director

Bureau of Internal Revenue

Revenue Region 12 – Bacolod City

Dear Atty. Jaminola,

Good day!

I am writing this letter in behalf of my father REY G. TUPAS with TIN:

149-759-821 pertaining to his tax liabilities due to tax discrepancies.

My brother RHEAN CHRISTIAN P. TUPAS is the one that is handling

the case and knows the details of the same since he managed our business

however our family till this day continuously mourns since he joined our

Creator last New Year’s Day.

It is unfortunate to know that the BIR’s decision becomes final and

executory since my aforementioned brother did not, or at least late in

communicating the case to our father to save the latter from stress and

depression. The case should have been easily resolved by filing a protest

within the prescriptive period since it is just a mathematical error on the part

of the accountant; my brother, being merely a High School graduate, had no

idea about the rules, laws, and the whole tax system and had chosen inaction

that caused trouble that we are trying to resolve to this day.

As a result of the abovementioned, my father is required to settle his tax

liabilities and we were informed that we could still avail the tax amnesty on

or before June 2021. Hence we are doing our best in order for us to settle the

same as soon as possible before the tax amnesty deadline, the most would be

any day this June. Thanks for your kind consideration and patience and any

suggestion for alternative equitable remedies are well appreciated.

ATTY. RE CHARLES P. TUPAS

09178500558

You might also like

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Property Tax BillDocument2 pagesProperty Tax BillAnonymous GF8PPILW5No ratings yet

- Demand Letter SampleDocument2 pagesDemand Letter SampleNicoleNo ratings yet

- Demand Letter-Utang PerfectDocument2 pagesDemand Letter-Utang PerfectElijahBactolNo ratings yet

- Zzzpsgiolepfrp: Document Instructions PackageDocument9 pagesZzzpsgiolepfrp: Document Instructions PackageMaitri DoshiNo ratings yet

- HM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Document15 pagesHM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Toni Mirosanu100% (1)

- Request To ReturnDocument2 pagesRequest To ReturnXirkul TupasNo ratings yet

- Overpayment M249802319Document2 pagesOverpayment M249802319Simon ChownNo ratings yet

- Demand LetterDocument1 pageDemand LetterSimeon SuanNo ratings yet

- Important Information - M269602760Document2 pagesImportant Information - M269602760jason masciNo ratings yet

- Letter-of-Request-for - Looseleaf 2Document1 pageLetter-of-Request-for - Looseleaf 2Pat Dela CruzNo ratings yet

- Demand Letter - Rachelle VillaramaDocument2 pagesDemand Letter - Rachelle VillaramaAraceli Gloria-Francisco100% (1)

- Unsecured and Personal Property TaxesDocument10 pagesUnsecured and Personal Property TaxesRodolfo BecerraNo ratings yet

- Bir Letter Request2019Document1 pageBir Letter Request2019katherine aquinoNo ratings yet

- RefundDocument2 pagesRefundJess AcostaNo ratings yet

- Tax Verification Script 9.22Document2 pagesTax Verification Script 9.22Kyle SanfordNo ratings yet

- Customer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyDocument3 pagesCustomer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyawalNo ratings yet

- OIC-Revenue District Officer: BIR Building, Macabulos Drive, San Roque, Tarlac CityDocument1 pageOIC-Revenue District Officer: BIR Building, Macabulos Drive, San Roque, Tarlac CityPat Dela CruzNo ratings yet

- Demand Letter RoblesDocument1 pageDemand Letter RoblesKevin SerranoNo ratings yet

- FAO Reco Account Payable J285611951Document3 pagesFAO Reco Account Payable J285611951dotaemumNo ratings yet

- Outcome of Our ReviewDocument1 pageOutcome of Our ReviewEduardo Aguirre ArenasNo ratings yet

- Demand LetterDocument2 pagesDemand LetterYakisoba RamenNo ratings yet

- Buy AppointmentDocument1 pageBuy Appointmentjuliet_emelinotmaestroNo ratings yet

- Anexo-RYS-002.06 - Formato Examen de Inglés - Ctax CaseDocument2 pagesAnexo-RYS-002.06 - Formato Examen de Inglés - Ctax CasePsic Casandra PerezNo ratings yet

- Letter of RequestDocument1 pageLetter of RequestОлександра ТкаченкоNo ratings yet

- Mr. Jayvee T. Mamauag: Christian Greetings!Document2 pagesMr. Jayvee T. Mamauag: Christian Greetings!nicholoNo ratings yet

- Email DraftsDocument4 pagesEmail DraftsKainat Siddique - 85201/Officer Parent Relations/BSEYNo ratings yet

- June 20, 2021Document2 pagesJune 20, 2021Gilbert D. AfallaNo ratings yet

- 17 - Period of Prescription For The Audit of All Internal Revenue Taxes by The BIRDocument3 pages17 - Period of Prescription For The Audit of All Internal Revenue Taxes by The BIRAris DuroyNo ratings yet

- Letter of AuthorizationDocument1 pageLetter of AuthorizationWinston YutaNo ratings yet

- From 1 April, You Can Keep More of Your Benefit When You're Working or Getting Other IncomeDocument2 pagesFrom 1 April, You Can Keep More of Your Benefit When You're Working or Getting Other IncomeJason KettleNo ratings yet

- Letter To DostDocument1 pageLetter To Dostkival231No ratings yet

- Agreement Letter For Compound TaxDocument1 pageAgreement Letter For Compound TaxHajie RosarioNo ratings yet

- Tax Information: Collecting CustomerDocument2 pagesTax Information: Collecting Customeramitkap00rNo ratings yet

- Lynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusDocument2 pagesLynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusPomelo PinkNo ratings yet

- CJ Transnational Philippines IncDocument1 pageCJ Transnational Philippines IncNico Ong GubancoNo ratings yet

- Kurdan Printhub Trading Inc.: BIR Building, Macabulos Drive, San Roque, Tarlac CityDocument1 pageKurdan Printhub Trading Inc.: BIR Building, Macabulos Drive, San Roque, Tarlac CityPat Dela CruzNo ratings yet

- 07 - Inquiry For The Deadline of Submission of TIMTADocument2 pages07 - Inquiry For The Deadline of Submission of TIMTAAhyz DyNo ratings yet

- Sample Letter To Landlord To Request Rent Relief or Payment PlanDocument3 pagesSample Letter To Landlord To Request Rent Relief or Payment PlanS P JaladharanNo ratings yet

- The Q Word: Balance DueDocument5 pagesThe Q Word: Balance DueCenter for Economic ProgressNo ratings yet

- Chestionar Financia ClubDocument3 pagesChestionar Financia ClubAlexandra ZahariaNo ratings yet

- Apology LetterDocument1 pageApology LetterNyledoj AdanacNo ratings yet

- Letter of Concession To The BIRDocument1 pageLetter of Concession To The BIRAndrew PanganibanNo ratings yet

- GMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Document4 pagesGMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Monica SorianoNo ratings yet

- Mail Merge (Word)Document1 pageMail Merge (Word)Jezza G. PlangNo ratings yet

- Presented By:: Get Answers To Your Income Tax Most Frequently Asked QuestionsDocument1 pagePresented By:: Get Answers To Your Income Tax Most Frequently Asked QuestionsScott CoursonNo ratings yet

- Marestila Jay R A Semestral ProjectDocument9 pagesMarestila Jay R A Semestral ProjectJoel Jr.No ratings yet

- DECLARATIONDocument2 pagesDECLARATIONPENUBALLI KRISHNACHAITANYANo ratings yet

- Department of The Treasury Internal Revenue Service: DateDocument2 pagesDepartment of The Treasury Internal Revenue Service: DateAlex CovertNo ratings yet

- Mr. and Mrs. Tiburcio Colon/Nenita ColonDocument1 pageMr. and Mrs. Tiburcio Colon/Nenita ColonMark Joseph DelimaNo ratings yet

- Ronron Biycle-Position LetterDocument4 pagesRonron Biycle-Position LetterMeynard MagsinoNo ratings yet

- FilledDocument11 pagesFilledMatias SantillanNo ratings yet

- QC TreasurerDocument2 pagesQC TreasurerFrozen RawNo ratings yet

- ComplianceDocument1 pageComplianceFrankie MendezNo ratings yet

- Request For Refund PAREB DavaoDocument1 pageRequest For Refund PAREB DavaoJjr BacongcoNo ratings yet

- 2nd Demand Letter Johnson AlmendarezDocument1 page2nd Demand Letter Johnson AlmendarezChino CabreraNo ratings yet

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Penalties For Late Filing of Tax ReturnsDocument3 pagesPenalties For Late Filing of Tax Returnsghingker_blopNo ratings yet

- Facebooknewsletter 0411Document4 pagesFacebooknewsletter 0411Nicky HanshawNo ratings yet

- Tugas DREAM JOBDocument1 pageTugas DREAM JOBJesselyne AsNo ratings yet

- Complaint LetterDocument1 pageComplaint LetterREn GallarinNo ratings yet

- Prelims - 2cDocument1 pagePrelims - 2cXirkul TupasNo ratings yet

- Ccje Class Record Template 2021Document16 pagesCcje Class Record Template 2021Xirkul TupasNo ratings yet

- CS Lead18232020 2021Document4 pagesCS Lead18232020 2021Xirkul TupasNo ratings yet

- Skull Island Attendance - 3-12-22 - 2aDocument2 pagesSkull Island Attendance - 3-12-22 - 2aXirkul TupasNo ratings yet

- School Personnel Line Up 2022Document14 pagesSchool Personnel Line Up 2022Xirkul TupasNo ratings yet

- Plea BargainingDocument1 pagePlea BargainingXirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Sti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Document2 pagesSti West Negros University Burgos ST., Bacolod City, Negros Occidental, Philippines, 6100Xirkul TupasNo ratings yet

- Judicial Affidavit: Direct ExaminationDocument4 pagesJudicial Affidavit: Direct ExaminationXirkul TupasNo ratings yet