Professional Documents

Culture Documents

Group Project Part I

Uploaded by

Rikky AbdulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Project Part I

Uploaded by

Rikky AbdulCopyright:

Available Formats

Investment in PepsiCo, Inc.

Professor: Sunny Onyiri

Participants:

Praveen Bondalakunta(545398),

Sivaramakrishna Deevela (556024),

Rajashekhar Neelarapu,

Hitenkumar Patel

Investment in PepsiCo, Inc.

5/29/2020 AXP Internal 1

Investment in PepsiCo, Inc.

Introduction: Pepsico is American beverage, food, snack company. It’s head quarters situated in

Harrison, New York. This company formed on 1965 with the merge of pepsi-cola and frito-lay

Inc. This company has interested in snacks made up of grains and marketing and marketing

them. This company includes the Tropicana products and added Gatorade to it’s portifolio. It is a

multibillion company which has production units all over the world.

PepsiCo, Inc.

Pepsico, Inc first regular stock to in 1970 and started out changing on the New York Stock

Exchange (NYSE: Pepsico) August 25, 1972. Valuation of an is situation to the condition of the

affiliation and motive valuation. We can gather verbalizations information regarding Pespsico

from its web page or one-of-a-kind dreams like hurray and after legit due we have to pick out

which valuation methodology we continue. There can be three doable cases in the match that we

take the valuation system: -

If estimation of Pepsico,Inc inventory which get after valuation no longer absolutely the

present market valuation ($75.89) it interprets is distorted .So I will provide a to sell.

On the other hand, if estimation of - Mart stock which we get is greater indisputable than

the present market valuation it suggests stock is. Thusly, I would provide a to purchase.

Holding translates there is no to do anything. In the event that my amigo has the affords I

will underwrite my companion to hold conserving the presents. If my doesn't make

certain the offer I will propose him/her to purchase.

For reproving my accomplice air to in Pepsi-co or not, I inferred gave via me in past bits of

instances find out about and thru the ace's report.

5/29/2020 AXP Internal 2

Investment in PepsiCo, Inc.

My recommendation I would recommend me to take the lengthy in Pepsi-co Stock. Particular

side intrigue/explanation for the proportionate referenced in referenced underneath: -

Competitors: The main competitors for pepsico are Monstor bevarages, Nestle, Redbull and

britvic

Growing business: Pepsico commercial enterprise is rapidly and is filtering for expansion. It

finds occupations will enhance for a large timeframe valuation approach will display of

constantly clear open doors for progression in stock worth my advice to Pepsico Stock.

Recent developments within company: - Pepsico has declared a fifteen-billion-dollar inventory

buyback. It has in addition uncovered a for regional well worth $100 billion. Beginning Aug. 1,

the retailer is discharging bargains adjusted to class inspecting for the pinnacle gadgets, quarters

and school fundamentals (Pepsico News,2014). All such would pass on more cash to the

affiliation which would affect greater compensation.

Innovation: Pepsico has a laser-spin round discovering efficiencies and has substantial

aggregates into in-store movements. Due to sorts of progress they organized to promote the

entirety at most diminished charges (Tom Taulli,2013).

E-Commerce: Over the range of progressing years, Pepsico has firmly in this piece to lower

back heads like Amazon (AMZN) and (EBAY), yet moreover make development outside

business territories. Pepsico conventional online enterprise made by 30% (Tom Taulli,2013).

Financials: Pepsico return on really worth and net on deals has reliably (from blueprint of case

section two). In like way it has excessive duty diploma which it is in actuality (can motive

difficulty in future). This may endorse to assume not high Pepsico stock. Notwithstanding,

5/29/2020 AXP Internal 3

Investment in PepsiCo, Inc.

imperative factor is that the essential issue about Pepsico is bringing dynamically an inspiring

electricity into highlight, which is thinking blowing for any drawn-out purchase screen budgetary

position. The offers are replacing at a 17.6% to the compensation evaluation

(http://seekingalpha.com/article/2001211-wal-shop stores-evaluation).

Substantial Increase in sales: - Pepsico works regionally and all around. Wages and full scale

compensation would develop coming a long time as. Pepsico is developing and improving desire

of aspect in shut via stores, while, at the equivalent, executing a stable assessing strategy (Guan

Wang,2012). Masters that these things to do will the measure of customers and elevate the

frequent sizes. Cost and P/E levels would increase. Charts beneath exhibit the relative.

Wellspring of frameworks: http://seekingalpha.com/article/2001211-waldend-stock-appraisal

5/29/2020 AXP Internal 4

Investment in PepsiCo, Inc.

Maximizing output existing store: In 2012, Pepsico reflected that it would core its goal in

increasing the yield current shops (contributed capital). It would come up new shops at any rate

now not in speedy way. By goodness of this capital would make a plunge, Pepsico would profit

to make acquisitions, elevate advantages, and offers. Capex is progressing at any rate has as the

affiliation considerably extra absolutely enters its enterprise parts.

Wal-Mart is growing acquisitions: Pepsico bought South Africa and retail head Massmart and

United Kingdom chief Food Stores Limited in 2010.

5/29/2020 AXP Internal 5

Investment in PepsiCo, Inc.

Pepsico has broadened its advantages every 12 months and projections that it would continue

growing benefits in future years. The low payout degree of 32% likewise that it can preserve up

or increment its advantages whether pay negligence to as clever exactly proper to form.

Better then Peers: Pepsico inventory be bought to its colleagues Costco Wholesale Corporation

(COST) and Target Corp (TGT) for what it's worth generally separated and its Large wide

variety of multifaceted endeavors in like way inclines towards Pepsico to its accomplices.

Conclusion: By prudence of all the referenced above I would my associate to purchase Pepsico

Stock at cutting-edge costs: average development can be required thinking about super out

interests in CAPEX., value and staffing.

References: -

Pepsico Website,2014 recovered on August 25th 2014 from http://

https://www.pepsico.com/

Pepsico recovered on August 25th 2014 https://www.pepsico.com/

Should I Pepsico? by using Tom Taulli recovered on August 25th 2014 from

http://investorplace.com/2013/06/should-I-purchase waglPmSyT8

Is Pepsico An Investment? with the aid of Guan Wang 2012 recovered on August twenty

fifth 2014 from http://www.insidermonkey.com/blog/is-walment-11623/

5/29/2020 AXP Internal 6

You might also like

- Print Apr InsectophobeDocument272 pagesPrint Apr Insectophobekass100% (7)

- Keto+Air+Fryer+Cookbook+ +digitalDocument69 pagesKeto+Air+Fryer+Cookbook+ +digitalemily turnerNo ratings yet

- Pre-Approved Business Plan – Banks, Investors and Shareholders Cannot Resist (The Step-By-Step Guide To Get Funds For Your Business)From EverandPre-Approved Business Plan – Banks, Investors and Shareholders Cannot Resist (The Step-By-Step Guide To Get Funds For Your Business)Rating: 5 out of 5 stars5/5 (2)

- Pepsi CoDocument21 pagesPepsi CoSahar Haddad60% (5)

- Pepsi Case AnalysisDocument46 pagesPepsi Case AnalysisSonia KhanNo ratings yet

- Pepsi - Co Diversification Strategy Case AnalysisDocument36 pagesPepsi - Co Diversification Strategy Case AnalysisErri Wibowo100% (5)

- Chocolate Butter Spray - 0Document1 pageChocolate Butter Spray - 0hmodeNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- PepsiCo Strategic Analysis (Case Study)Document24 pagesPepsiCo Strategic Analysis (Case Study)Prasya Aninditya92% (12)

- Final Project PepsiDocument59 pagesFinal Project PepsiPramod Kumar0% (1)

- Consumer Behaviour of PepsiDocument123 pagesConsumer Behaviour of Pepsipuneetgupta31No ratings yet

- Placement Test BDocument8 pagesPlacement Test BGunay HasanovaNo ratings yet

- Cybersecurity and Machine LearningDocument15 pagesCybersecurity and Machine LearningRikky AbdulNo ratings yet

- Q1 - Module1 - G7 - 8 - BPP - Mangaldan NHSDocument8 pagesQ1 - Module1 - G7 - 8 - BPP - Mangaldan NHSElaeca AbenNo ratings yet

- On Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Document7 pagesOn Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Saikat BhattacharjeeNo ratings yet

- Telemedicine PPT 2Document17 pagesTelemedicine PPT 2Rikky AbdulNo ratings yet

- Tle7 - 8-He-Cookery Q1 M1 W1Document13 pagesTle7 - 8-He-Cookery Q1 M1 W1leah patalingjug100% (1)

- PepsiCo Operations Management GuideDocument15 pagesPepsiCo Operations Management GuidezeeshanNo ratings yet

- Pepsi 2Document5 pagesPepsi 2Francisco Santillán LópezNo ratings yet

- PepsicoDocument11 pagesPepsicobug_pham93% (14)

- PepsiCo Victor&AdrianaDocument4 pagesPepsiCo Victor&AdrianaAdriana BoixareuNo ratings yet

- BPP Business School Coursework Cover SheetDocument23 pagesBPP Business School Coursework Cover SheetFun Toosh345No ratings yet

- Pepsi CoDocument3 pagesPepsi CoFasiha RasheedNo ratings yet

- PepsiCo Business Strategy and Competitive Advantage Om ExDocument20 pagesPepsiCo Business Strategy and Competitive Advantage Om ExMaryferd Sisante100% (4)

- 1Document15 pages1Shahadat Hossain ShakilNo ratings yet

- Pepsico Quaker Oat AcquisitionDocument3 pagesPepsico Quaker Oat Acquisitionyashvi bansalNo ratings yet

- Pepsi PaperDocument6 pagesPepsi Paperapi-241248438No ratings yet

- Pepsi Co's Diversification Strategy in 2015Document7 pagesPepsi Co's Diversification Strategy in 2015keen writerNo ratings yet

- The Impact of Plannogram (Pog) On Sales of "Pepsi" at Guwahati Market. "Varun Beverages PVT LTD"Document79 pagesThe Impact of Plannogram (Pog) On Sales of "Pepsi" at Guwahati Market. "Varun Beverages PVT LTD"Lintu ChetryNo ratings yet

- Marketing Approach and Strateg For PepsicoDocument18 pagesMarketing Approach and Strateg For PepsicoIheonu ChichiNo ratings yet

- PepsiCo 2005 Strategic Growth PlanDocument5 pagesPepsiCo 2005 Strategic Growth PlanbibisanamNo ratings yet

- Thesis PepsiDocument8 pagesThesis Pepsibmakkoaeg100% (2)

- Vision and Mission StatementDocument4 pagesVision and Mission StatementandengNo ratings yet

- PepsiCo Strategy Implementation PlanDocument9 pagesPepsiCo Strategy Implementation Plandelphine lugaliaNo ratings yet

- Pepsi Final #5Document62 pagesPepsi Final #5Mai TranNo ratings yet

- Research Paper On PepsicoDocument7 pagesResearch Paper On Pepsicogvw6y2hv100% (1)

- FOM PepsicoDocument20 pagesFOM PepsicoAzan SandhuNo ratings yet

- AcknowledgementDocument101 pagesAcknowledgementSuman SinghNo ratings yet

- Pepsico: Pepsico, Inc. Is An American Multinational Food, Snack, and Beverage Corporation HeadquarteredDocument11 pagesPepsico: Pepsico, Inc. Is An American Multinational Food, Snack, and Beverage Corporation HeadquarteredTina chackoNo ratings yet

- Company Name: Pepsico: Presented byDocument17 pagesCompany Name: Pepsico: Presented byChristopher George CarbonNo ratings yet

- Marketing Presentation 01Document22 pagesMarketing Presentation 01fahim khanNo ratings yet

- Study of Working Capital On Pepsico.Document31 pagesStudy of Working Capital On Pepsico.Harsh Vardhan50% (2)

- Ibs ReportDocument23 pagesIbs ReportSAKIBNo ratings yet

- PepsiCo BCG Matrix AnalysisDocument10 pagesPepsiCo BCG Matrix AnalysisPraveen SharmaNo ratings yet

- BUSI4153-Group 5 - Case Analysis-PepsiCoDocument9 pagesBUSI4153-Group 5 - Case Analysis-PepsiCoJeffrey O'LearyNo ratings yet

- Literature Review PepsiDocument7 pagesLiterature Review Pepsic5qz47sm100% (1)

- PepsiCo Global Strategy AnalysisDocument5 pagesPepsiCo Global Strategy AnalysisYagnesh saiNo ratings yet

- RQ: "To What Extent Will Pepsico'S Decision To Introduce Quaker Oats Milk in India Benefit Its Growth Strategy?"Document35 pagesRQ: "To What Extent Will Pepsico'S Decision To Introduce Quaker Oats Milk in India Benefit Its Growth Strategy?"mohammed ameenNo ratings yet

- Ife and Efe PepsicoDocument7 pagesIfe and Efe PepsicoNathan Carter100% (1)

- Factors Influencing Customer'S Satisfaction Towards Beverages of PepsicoDocument32 pagesFactors Influencing Customer'S Satisfaction Towards Beverages of PepsicoBeverlie Tabañag100% (1)

- Course Name: Strategic Management Title: Submitted To:: Case Study On "Pepsico"Document13 pagesCourse Name: Strategic Management Title: Submitted To:: Case Study On "Pepsico"ashabNo ratings yet

- Mpob AssignmentDocument15 pagesMpob AssignmentArpandeep KaurNo ratings yet

- Term Paper On PepsicoDocument5 pagesTerm Paper On Pepsicoea793wsz100% (1)

- Supply Chain Management inDocument9 pagesSupply Chain Management inArjun ReddyNo ratings yet

- Pepsico Marketing Strategy SummaryDocument4 pagesPepsico Marketing Strategy SummaryHaris MusakhelNo ratings yet

- Literature Review of PepsicoDocument4 pagesLiterature Review of Pepsicotgkeqsbnd100% (1)

- Corporate Internship ReportDocument105 pagesCorporate Internship ReportAakash DixitNo ratings yet

- Marketing Matters: Pepsico'S Strategic FocusDocument7 pagesMarketing Matters: Pepsico'S Strategic Focusbha_goNo ratings yet

- PepsicoDocument9 pagesPepsicoCalvi JamesNo ratings yet

- PepsiCo's 6 Principles of Business StrategyDocument2 pagesPepsiCo's 6 Principles of Business StrategySyarifah Rifka AlydrusNo ratings yet

- Pepsi CoDocument8 pagesPepsi Cowhoisjacks100% (1)

- Pepsi-Cola Products Philippines, Inc SWOT AnalysisDocument38 pagesPepsi-Cola Products Philippines, Inc SWOT AnalysisPaula Fabi100% (6)

- Faster Company (Review and Analysis of Kelly and Case's Book)From EverandFaster Company (Review and Analysis of Kelly and Case's Book)No ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Review 3 Batch 12 1Document20 pagesReview 3 Batch 12 1Rikky AbdulNo ratings yet

- Department of Electronics and Communication EngineeringDocument13 pagesDepartment of Electronics and Communication EngineeringRikky AbdulNo ratings yet

- Review 3 Batch 12 1Document20 pagesReview 3 Batch 12 1Rikky AbdulNo ratings yet

- Soumya - Research Paper - GOOGLEDocument8 pagesSoumya - Research Paper - GOOGLERikky AbdulNo ratings yet

- Telemedicine PPT 1Document18 pagesTelemedicine PPT 1Rikky AbdulNo ratings yet

- Running Head: Security Policies 1Document4 pagesRunning Head: Security Policies 1Rikky AbdulNo ratings yet

- Cyber Security and Management AssignmnetDocument4 pagesCyber Security and Management AssignmnetRikky AbdulNo ratings yet

- Department of Electronics and Communication Engineering: Project byDocument12 pagesDepartment of Electronics and Communication Engineering: Project byRikky AbdulNo ratings yet

- Blockchain Implementation 1Document4 pagesBlockchain Implementation 1Rikky AbdulNo ratings yet

- Text BDDocument4 pagesText BDRikky AbdulNo ratings yet

- Research Paper On Organizational Analysis - VarunDocument12 pagesResearch Paper On Organizational Analysis - VarunRikky AbdulNo ratings yet

- Final ProjectDocument7 pagesFinal ProjectRikky AbdulNo ratings yet

- Research Paper On GoogleDocument6 pagesResearch Paper On GoogleRikky AbdulNo ratings yet

- Communication Styles in The WorkplaceDocument12 pagesCommunication Styles in The WorkplaceRikky AbdulNo ratings yet

- Sowmya-Research Paper On GoogleDocument4 pagesSowmya-Research Paper On GoogleRikky AbdulNo ratings yet

- Final Project - IoTDocument6 pagesFinal Project - IoTRikky AbdulNo ratings yet

- Role of Education in Mechanical Energy Copy-2Document7 pagesRole of Education in Mechanical Energy Copy-2Rikky AbdulNo ratings yet

- Amazon OrganizationsDocument9 pagesAmazon OrganizationsRikky AbdulNo ratings yet

- Amazon Organizations DiscussionDocument10 pagesAmazon Organizations DiscussionRikky AbdulNo ratings yet

- Nagasri Ari Organisational Paper 1999060 2118197368Document10 pagesNagasri Ari Organisational Paper 1999060 2118197368Rikky AbdulNo ratings yet

- Running Header: Organizational Analysis Paper 1Document12 pagesRunning Header: Organizational Analysis Paper 1Rikky AbdulNo ratings yet

- Private Sector SurvielanceDocument4 pagesPrivate Sector SurvielanceRikky AbdulNo ratings yet

- Multi-Factor Authentication - AssignmentDocument4 pagesMulti-Factor Authentication - AssignmentRikky AbdulNo ratings yet

- Nageswara Rao-Research Paper On GoogleDocument10 pagesNageswara Rao-Research Paper On GoogleRikky AbdulNo ratings yet

- BA620 - Problem SolutionDocument12 pagesBA620 - Problem SolutionRikky AbdulNo ratings yet

- CSIRT Training Sources and ResponsibilitiesDocument6 pagesCSIRT Training Sources and ResponsibilitiesRikky AbdulNo ratings yet

- Crisis Communication PlanDocument7 pagesCrisis Communication PlanRikky AbdulNo ratings yet

- Research Paper On Amazon 1Document8 pagesResearch Paper On Amazon 1Rikky AbdulNo ratings yet

- Diabetes Diet Indian CuisineDocument16 pagesDiabetes Diet Indian CuisineQ8123No ratings yet

- DLL Science 8 Digestive SystemDocument8 pagesDLL Science 8 Digestive SystemRyan GomezNo ratings yet

- Student Cookbook: Quick, Easy and Healthy Meal IdeasDocument16 pagesStudent Cookbook: Quick, Easy and Healthy Meal IdeasShaikh MeenatullahNo ratings yet

- Student booklet course 2 - Chapter 7 overviewDocument15 pagesStudent booklet course 2 - Chapter 7 overviewJeremy Mathew López MoralesNo ratings yet

- Vestige Product New Price List MRP DP BV PV 2018Document7 pagesVestige Product New Price List MRP DP BV PV 2018yrpreddy100% (6)

- CC Market AnalysisDocument2 pagesCC Market AnalysisJohnRey EstaresNo ratings yet

- Past Simple VS Past Continuous PDFDocument3 pagesPast Simple VS Past Continuous PDFdragummaxNo ratings yet

- Lesson 2.2 - 2.4Document5 pagesLesson 2.2 - 2.4brenda herrera peñaNo ratings yet

- Past Simple Vs Used ToDocument4 pagesPast Simple Vs Used ToSofiabv:3No ratings yet

- Frequency Adverbs Grammar.Document2 pagesFrequency Adverbs Grammar.Yanela Aquije Donayre50% (2)

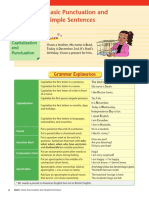

- Basic Punctuation and Simple SentencesDocument26 pagesBasic Punctuation and Simple SentencesSardar LashkaryNo ratings yet

- Ayurvedic JeevanDocument7 pagesAyurvedic JeevanAyurvedic JeevanNo ratings yet

- FSM - Cia - 3 - Group 5Document18 pagesFSM - Cia - 3 - Group 5Ritika HalderNo ratings yet

- First EXAM 2022-2023Document15 pagesFirst EXAM 2022-2023RYAN PADERONo ratings yet

- GoateryDocument49 pagesGoateryShazzad Ul IslamNo ratings yet

- E-Katalog (Pink) BELLAROSA EDISI IDUL FITRI 2021Document9 pagesE-Katalog (Pink) BELLAROSA EDISI IDUL FITRI 2021Reiza EsiNo ratings yet

- W 1 Food Where Does It Come From CBSE Class 6 WorksheetDocument3 pagesW 1 Food Where Does It Come From CBSE Class 6 WorksheetForyoutube JobsNo ratings yet

- PROTEINDocument1 pagePROTEINBharat GNo ratings yet

- Here are the answers:I. ✓II. 1. Ship of the desert (c) CamelDocument88 pagesHere are the answers:I. ✓II. 1. Ship of the desert (c) CamelManohar GarimellaNo ratings yet

- Consumer Behavior and The Marketing Strategies of Fast Food Restaurants in IndiaDocument3 pagesConsumer Behavior and The Marketing Strategies of Fast Food Restaurants in IndiaHarsha SekaranNo ratings yet

- Store Activity Oktober 2023Document30 pagesStore Activity Oktober 2023egaahadisNo ratings yet

- The Trials of Poko IslandDocument17 pagesThe Trials of Poko IslandSamarth SiddharthaNo ratings yet

- Varinder Kaur 106621 SITHPAT006 AssessmentDocument49 pagesVarinder Kaur 106621 SITHPAT006 AssessmentL MelbourneNo ratings yet

- Nutritious Millet Recipes for Healthy LivingDocument186 pagesNutritious Millet Recipes for Healthy Livingcharu duaNo ratings yet