Professional Documents

Culture Documents

New Format For OBE-SCL Lesson Plan

Uploaded by

Nur Raihan TamrianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Format For OBE-SCL Lesson Plan

Uploaded by

Nur Raihan TamrianCopyright:

Available Formats

New format for OBE-SCL Lesson Plan Oct2021

FAKULTI PERAKAUNAN

UNIVERSITI TEKNOLOGI MARA

SEMESTER: OCTOBER 2021

PROGRAM NAME : Bachelor in Accountancy

PROGRAM CODE : AC220

COURSE NAME : Accounting: Theory and Emerging Issues

COURSE CODE : FAR 661

LECTURE : 2 hrs/wk

TUTORIAL : 1 hr/wk

LECTURER : MISS SALINA BINTI ABDULLAH ROOM: KPP2 AG 19 TEL: 012-6022423

COURSE OUTCOMES

CO1 Explain development of accounting theories and conceptual framework in the accounting profession.

CO2 Perform analysis on creative accounting practices by Malaysian companies.

CO3 Evaluate impacts of emerging issues in accounting on the accounting profession in Malaysia

Lesson plan/FAR661/Oct2021 Page 1

New format for OBE-SCL Lesson Plan Oct2021

PROGRAM OUTCOMES

PO1 Apply accounting knowledge (C) and understanding in relevant organizations.

PO2 Display (P) practical skills and digital skills in accounting tasks for relevant organizations.

PO3 Demonstrate leadership, autonomy and responsibilities in providing accounting services to stakeholder (A).

PO4 Adhere to values attitudes and professionalism in societal professional engagement (A).

PO5 Collaborate with diverse team members through effective communication (A).

PO6 Provide solutions using numeracy and scientific skills (C) to accounting issues and problems.

PO7 Demonstrate lifelong learning. (A)

PO8 Demonstrate entrepreneur skills. (A)

CO-PO MATRIX

PO PO PO PO PO PO PO PO PO

1 2 3 4 5 6 7 8 9

CO /

1

CO /

2

CO /

3

Lesson plan/FAR661/Oct2021 Page 2

New format for OBE-SCL Lesson Plan Oct2021

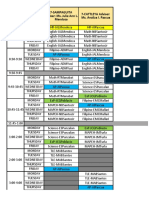

PLAN STRUCTURE

CONTACT LEARNING

NO WEEK TOPIC LECTURE/TUTORIAL COVERAGE TOPIC OUTCOME (TO) CO PO ASSESSMENT

HOURS MODEL

1 1 Introduction on Ability to:

OBE-SCL, ▪ Understand the

Entrance significance important of

survey, adopting OBE for the

course.

Assessment ▪ Recognize FACT

plan and SLT ▪ Ice breaking. Sharing of

program educational

▪ Overview of OBE. materials

objectives (PEOs). Entrance

▪ Overview of the course via

▪ Recognize FACT and Survey

lesson plan and syllabus

program outcomes information

contents.

(POs).

▪ Recognize the course

outcomes (COs).

▪ Recognize the course

topic outcomes (TOs).

Lesson plan/FAR661/Oct2021 Page 3

New format for OBE-SCL Lesson Plan Oct2021

1 Financial 3(2L, Introduction and Financial Ability to:

Regulatory 1T) Regulatory. ● Explain various

definition and other

▪ The introduction- what is roles of accounting

accounting ● Illustrate the history

▪ Development in and the development in

accounting and accounting and

accounting theory: an accounting theory.

overview ● Explain the overall

▪ The financial reporting financial accounting

environment: Malaysia environment

setting ● Explain Accounting

▪ The development of regulations (rules and

accounting concepts and guidelines);

principles. International Lecture,

PO Final exam,

perspective; Malaysian CO1 Tutorial

1 and test

perspective;

● Describe the

development of

accounting concepts

and principles –

✔ Management

contribution phase.

✔ Institution contribution

phase.

✔ Professional

contribution phase.

Lesson plan/FAR661/Oct2021 Page 4

New format for OBE-SCL Lesson Plan Oct2021

✔ Overt politicization

phase.

● Identify RECENT

Development in

Accounting Theory and

● Discuss the importance

and the limitation of

accounting history

Lesson plan/FAR661/Oct2021 Page 5

New format for OBE-SCL Lesson Plan Oct2021

2 2,3 Formulation 6 Formulation and Verification of Ability to:

and Verification (4L,2T) Accounting Theory Definition of ● Describe the

of Accounting impairment assets. characteristics of ideal

Theory theory

Part 1: ● Classify and compare

● Describe the characteristics the theories according

of ideal theory

to the assumptions

● Classify and compare the

theories- pragmatic, they rely on and how

normative, positive, they are formulated –

behavioural ✔ Pragmatic

● Formulation of Accounting ✔ Normative

Theory- deductive and

✔ Positive

inductive approach

● Formulation of Accounting ✔ Behavioural

CO1 PO1 Lecture, Final exam &

Theory – other approaches: And recommend how

Tutorial & Test

the ethical approach, the these theories

sociological approach, the contribute to the shape

economic approach, and the of accounting today.

eclectic approach.

● Describe how theories

are developed and

formulated from

deductive approach

and inductive approach

● Compare between

deductive and inductive

approach

Lesson plan/FAR661/Oct2021 Page 6

New format for OBE-SCL Lesson Plan Oct2021

● Describe how theories

are developed and

formulated from other

approaches: ethical,

sociological, economic

and eclectic approach.

Part 2:

● Positive Accounting Theory

● Understand how a positive Understand how a positive

theory differs from a theory differs from a

normative theory. normative theory.

● Be aware of the

● Principal-agent relationship; origins of Positive

Agency costs – monitoring Accounting Theory

costs; Bonding costs; (PAT).

Residual loss; ● Understand that PAT

● Accounting Theory and its uses insights from

Economic Consequences; agency theory and

The opportunistic vs. why agency theory is

efficient strategy of relevance to

financial accounting

practices.

● Be aware of the

central assumptions

of PAT.

Lesson plan/FAR661/Oct2021 Page 7

New format for OBE-SCL Lesson Plan Oct2021

● Be aware of the

meaning and nature

of agency costs.

● Understand why an

organisation can

usefully be referred to

as a ‘nexus of

contracts’.

● Be aware of what

constitutes

‘conservative’

accounting

procedures and why

conservative

accounting

procedures provide

efficient mechanisms

for minimising the

contracting costs

within an

organisation.

● Be able to identify

some of the criticisms

of PAT.

Lesson plan/FAR661/Oct2021 Page 8

New format for OBE-SCL Lesson Plan Oct2021

3 4, 5 Regulatory 6(4L,2T) Part 1: The underlying

Approach of an theories:

Accounting Introduction: Ability to:

Define the meaning of

Theory ● Describe the meaning of

‘regulation’ together with some

‘regulation’ together with

of the various theoretical

some of the various

arguments for regulating the

theoretical arguments for

practice of financial accounting.

regulating the practice of

financial accounting.

Understand some of the ● Interpret and criticise the

theories that explain why free-market perspective

regulation is initially introduced. ✔ Private economic-

based incentives Lecture & Final exam

✔ ‘Market for CO1 PO1

Tutorial &Test

managers’

✔ ‘Market for

corporate

takeovers’

✔ ‘Market for lemons’

Understand various theoretical ● Interpret and criticise the

perspectives that describe the free-market perspective

parties who are likely to gain the

greatest advantage from the

Lesson plan/FAR661/Oct2021 Page 9

New format for OBE-SCL Lesson Plan Oct2021

implementation of accounting ✔ There are theories

regulation. available to explain

Various theoretical arguments what motivates

that have been proposed in politicians/regulators

favour of reducing the extent of to introduce

regulation of financial regulation.

accounting. ✔ These theories

include:

Understand that accounting 1. public interest

standard-setting is a very theory

political process which seeks 2. capture theory

the views of a broad cross- 3. economic interest

section of financial statement group theory

users. And its potential (private interest

economic and social impacts theory)

arising from accounting

regulations.

Part 2: Financial Reporting Ability to:

Environment: Malaysia- the

Identify the key players in

financial reporting regime

Malaysia Financial

and the regulatory bodies

reporting environment:

1. Financial Reporting Act

Malaysia Financial Reporting

1997

regime: an overview

2. Financial Reporting

(Amendment) Act 2004

3. Companies Act 2016

Lesson plan/FAR661/Oct2021 Page 10

New format for OBE-SCL Lesson Plan Oct2021

4. Income Tax Act 1967

5. Guidelines of the

Securities Commission

1995

6. KLSE Listing

Requirements

submission of reports

additional disclosures

7. Bank Negara Malaysia

Role and function of some key ● Explain the importance

regulatory bodies in Malaysia: and the function of the

● FRF following key regulatory

● CCM bodies in Malaysia.

● SC

● Audit Oversight Board ● FRF

● MASB ● CCM

● Role ● SC

● Due process in issuance ● Audit Oversight

of MASB standards Board

● Other roles ● MASB

✔ Role

✔ Due process in

issuance of MASB

standards- how

Lesson plan/FAR661/Oct2021 Page 11

New format for OBE-SCL Lesson Plan Oct2021

accounting

standards are

formulated, and

Other emerging issue: issued.

Accounting Standard Overload ● Other roles

● Discuss factors that

contributed to the

standards overload

● Evaluate the potential

effects of accounting

standards overload and

potential ways to solve it.

Lesson plan/FAR661/Oct2021 Page 12

New format for OBE-SCL Lesson Plan Oct2021

4 6,7 Discussion on 6 Part 1(A): an overview of CF Ability to:

Conceptual (2L,2T) ● Describe how CF

Framework ● The development develops over time

● The debate- advantages and

● Debate about the

disadvantages

● Principle based and rule advantages and some

based standard setting critics on CF

● Recall the elements of

financial statements,

the accounting

Part 1 (b): an overview of CF- postulates and

Accounting postulates &

principles - that

principles:

● Financial statements and shaping the overall CF.

the reporting entity

Lecture & Final exam &

● Elements of financial ● Differentiate between CO1 PO1

Tutorial Test

statements principles and rule

based standard setting

– entity, going-concern, ● Recall the elements of

accounting period,

financial statements,

measurement etc.

The accounting principles – the accounting

cost, revenue, matching etc postulates and

principles - that

shaping the overall CF.

Lesson plan/FAR661/Oct2021 Page 13

New format for OBE-SCL Lesson Plan Oct2021

Part 2: CF- Malaysia Ability to:

● Characteristics of useful

financial information Understand the scope of

● An overview of CF- important findings on

recognition,

measurement and Malaysia Conceptual

disclosure concepts Framework:

● MASB role and

standard-setting due ● Objective of financial

process reporting

● Important findings on ● Qualitative and

Malaysia CF

characteristics of useful

● Concepts of capital and

capital maintenance financial information-

Similarities ✔ relevancy &

faithfully representation

✔ Enhancement of

information:

comparable,

verifiable, timely and

understandable

✔ Provide information

about: economic

resources, claims and

effects of transactions

● Explain the definition,

recognition and

Lesson plan/FAR661/Oct2021 Page 14

New format for OBE-SCL Lesson Plan Oct2021

measurement of the

elements from which

financial statements are

constructed-

● Explain the concept of

capital and capital

maintenance- an

overview

Lesson plan/FAR661/Oct2021 Page 15

New format for OBE-SCL Lesson Plan Oct2021

Part 3: CF-The measurement Ability to:

and the recognition ● Discuss the concept of

recognition and

● Recognition and de- derecognition

recognition

● Discuss the three main

● Measurement presentation

and disclosure income and

✔ The three main income and measurement systems-

capital measurement definition, concepts,

systems- Historic cost advantages, challenges

accounting, CCA , exit price and/or criticisms:

accounting ✔ Historic cost

● The definition, concept,

accounting

advantages,

challenges and ✔ Current cost

debates accounting

▪ financial capital

maintenance (the

purchasing power of

the financial capital)

▪ physical capital

maintenance (the

physical ability to

produce goods and

services)

✔ Exit price

accounting

Lesson plan/FAR661/Oct2021 Page 16

New format for OBE-SCL Lesson Plan Oct2021

5 8, 9 Creative 6(2L,2T) Creative Accounting Ability to:

Accounting Apply the relevant

accounting Theory and its

Economic Consequences;

Part 1: The Motive and the

The opportunistic vs.

theories

efficient strategy; The

● The motives behind implication on the policies

creative accounting behind the choice of

● The theories- PAT method of accounting;

and EMH

Examine the following

motives in engaging

accounting manipulation PO

from EMH and PAT 6 Lecture, Final exam &

CO2 Tutorial

perspectives: Project

✔ Bonus plan

hypothesis

✔ Debt

Contracting

✔ Political costs

Lesson plan/FAR661/Oct2021 Page 17

New format for OBE-SCL Lesson Plan Oct2021

Part 2: Earnings Management

of accounting standards. Ability to:

● Earnings ● Define creative

Management accounting

● Off-Statement of ● Define earnings

Financial Position

management

transactions

● Grey areas in ● Identify common

accounting features of earnings

● Engaging in management

management ● Understand fraudulent

discretion financial reporting, its

● The impacts of technics and

creative accounting

motivations

● Differentiate between

EM and Financial fraud

● Analyse the potential

action plans to mitigate

the creative accounting

and/or financial fraud

exercise.

Lesson plan/FAR661/Oct2021 Page 18

New format for OBE-SCL Lesson Plan Oct2021

6 10- The emerging 15 Part 1: The new technologies Ability to:

14 issues (5L,5T) New technologies ● Define and understand

✔ Are ● Data automation the introduction of the

accountant ● Blockchain

✔ new technologies

still ● Artificial Intelligence

relevant? ● Cloud computing ✔ rapid changes in

● Big data accountant’s role

✔ Rapid ✔ integrated reporting

changes in ✔ Changes in new MFRS,

accountant MPES, MPSAS

’s role ● Understand the

Part 2: Rapid changes in

accountant’s role background of the

✔ New emergence of this new

MFRS. ● Data analyst Final exam,

changes/ development. PO3 Lecture,

MPERS, ● Business Advisory Test &

● Identify the challenges CO3 Tutorial

MPSAS ● Commoditised Accounting

services and the advantages/ Presentation

✔ Integrated opportunities of the

reporting discussed topic to the

Part 3: Integrated reporting profession and

● Discuss and provide

any suggestions to help

Part 4:New MFRS,MPERS and

solving the issue.

MPSAS

Lesson plan/FAR661/Oct2021 Page 19

New format for OBE-SCL Lesson Plan Oct2021

Assessment:

Coursework:

Test 1 10%

Test 2 10%

Presentation 10%

Project 20%

50%

Final exam 50%

Total 100%

Recommended Text

● Tan L. T. (2017), Financial Accounting & Reporting in Malaysia, Vol. 1 & 2, 6th ed., CCH-Asia, Malaysia.

● Rankin, Ferlauto, McGowan, Stanton (2018), Contemporary Issues in Accounting, Wiley & Sons (2nd ed)

.

References

● Deegan, C. (2013), Financial Accounting Theory. McGraw-Hill Irwin (4th ed.)

● Belkaoui, Ahmed (2004), Accounting Theory, Business Press (5th ed.)

● Scott, W.R. (2011), Financial Accounting Theory. Prentice Hall (6th ed.).

● Lazar, J. & Huang, C.C. (2012), Malaysian Financial Reporting Standards, Revised 3rd ed., McGraw Hill: Malaysia.

● Godfrey, J, Hodgson, A, Tarca, A, Hamilton, J, Holmes, S. (2010), Accounting Theory. Wiley & Sons (7th ed.)

● MFRS and MPERs

Lesson plan/FAR661/Oct2021 Page 20

You might also like

- FAR110 - OBE Lesson Plan - Oct2022Document11 pagesFAR110 - OBE Lesson Plan - Oct2022Siti Nurul AtiqahNo ratings yet

- New Format For OBE-SCL Lesson PlanDocument10 pagesNew Format For OBE-SCL Lesson PlannorshaheeraNo ratings yet

- MAF661 OBELessonPlan October 2020 - February 2021Document9 pagesMAF661 OBELessonPlan October 2020 - February 2021Nur Dina AbsbNo ratings yet

- FAR110 - OBE Lesson Plan - Semakan Sept 2017-JHADocument13 pagesFAR110 - OBE Lesson Plan - Semakan Sept 2017-JHAyokyNo ratings yet

- Lesson Plan ACC030Document6 pagesLesson Plan ACC030Fatin AkmalNo ratings yet

- TAX267 - OBE Lesson Plan Oct2023 - Feb2024Document11 pagesTAX267 - OBE Lesson Plan Oct2023 - Feb2024NUR ATHIRAH ZAINONNo ratings yet

- Fakulti Perakaunan Universiti Teknologi Mara:: Norasmila Awang: Asmila725@uitm - Edu.my .: 04 4562562: A2 3040Document5 pagesFakulti Perakaunan Universiti Teknologi Mara:: Norasmila Awang: Asmila725@uitm - Edu.my .: 04 4562562: A2 3040Nur슈하다No ratings yet

- Acc407 - Lesson PlanDocument7 pagesAcc407 - Lesson PlanSibernet CFNo ratings yet

- OBE-SCL Lesson PlanDocument10 pagesOBE-SCL Lesson PlanMuhammad HamiziNo ratings yet

- Leading University Department of Business Administration: Course ProfileDocument4 pagesLeading University Department of Business Administration: Course ProfileDipika tasfannum salamNo ratings yet

- Advanced Financial Accounting and Reporting 2 (FAR 660) - Lesson Plan 2017Document12 pagesAdvanced Financial Accounting and Reporting 2 (FAR 660) - Lesson Plan 2017cikita6750% (2)

- Far410 New Format Obe Lesson PlanDocument9 pagesFar410 New Format Obe Lesson PlanLya MaclindaNo ratings yet

- MAF661 OBELessonPlan 20224 Semester Mac-Aug 2023Document10 pagesMAF661 OBELessonPlan 20224 Semester Mac-Aug 2023Lyana InaniNo ratings yet

- FR Outline - Graduate School Upsa 2020Document10 pagesFR Outline - Graduate School Upsa 2020biggykhairNo ratings yet

- Accounting For Partnership and Corporation: Course Code Course Title Units / TypeDocument8 pagesAccounting For Partnership and Corporation: Course Code Course Title Units / TypeAyie Rose HernandezNo ratings yet

- Lesson PlanDocument12 pagesLesson PlanIeymarh FatimahNo ratings yet

- Lesson Plan Maf551 - 11 Oktober 2021Document11 pagesLesson Plan Maf551 - 11 Oktober 2021Nur Dina AbsbNo ratings yet

- Acc516 Lesson Plan - Obe Sept 2016Document6 pagesAcc516 Lesson Plan - Obe Sept 2016jihahNo ratings yet

- (MBA ACC Major OBE CO) Financial Statement AnalysisDocument7 pages(MBA ACC Major OBE CO) Financial Statement AnalysisMahfuz Ur RahmanNo ratings yet

- FAM 2022 - Course Plan - V4Document12 pagesFAM 2022 - Course Plan - V4bharath.bkNo ratings yet

- Programme: MBA: Teaching - Learning PlanDocument8 pagesProgramme: MBA: Teaching - Learning PlanHarsh KandeleNo ratings yet

- Finman 2012Document7 pagesFinman 2012Kathie LawrenceNo ratings yet

- Outcome-based-TL - Leni-S-HelianiDocument15 pagesOutcome-based-TL - Leni-S-Helianitribowo fauzanNo ratings yet

- SAP S4HANA For Fashion and Vertical Business, Overview S4IC70 - EN - Col11 - 9Document1 pageSAP S4HANA For Fashion and Vertical Business, Overview S4IC70 - EN - Col11 - 9sam kumarNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- KBUS305 Syllabus FranklinE1Document17 pagesKBUS305 Syllabus FranklinE1TSERING LAMANo ratings yet

- Assignment 2 Kursus UKQE3001Document8 pagesAssignment 2 Kursus UKQE3001Fcking GamerzNo ratings yet

- AC4052NI Financial AccountingDocument3 pagesAC4052NI Financial AccountingBigendra ShresthaNo ratings yet

- L1 M4 Curriculum Analysis Modified 1Document27 pagesL1 M4 Curriculum Analysis Modified 1Ratnakar NutenkiNo ratings yet

- Taklimat Pelaksanaan Penyampaian Kursus UKQT3001Document17 pagesTaklimat Pelaksanaan Penyampaian Kursus UKQT3001subassamyNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- Ads514 Scheme of Work Oct23-Feb24Document12 pagesAds514 Scheme of Work Oct23-Feb24Akmal AkramNo ratings yet

- Applied Portfolio Management Ms UcpDocument4 pagesApplied Portfolio Management Ms UcpSheraz HassanNo ratings yet

- (MBA ACC Major OBE CO) Corporate Tax ManagementDocument5 pages(MBA ACC Major OBE CO) Corporate Tax ManagementMahfuz Ur RahmanNo ratings yet

- Htt315 Lesson Plan Oct23feb24Document13 pagesHtt315 Lesson Plan Oct23feb24fasehaaqileenNo ratings yet

- 2020 FMGT 1013 - Financial Management RevisedDocument9 pages2020 FMGT 1013 - Financial Management RevisedYANIII12345No ratings yet

- 2WEEK 2 - Program StudyDocument33 pages2WEEK 2 - Program Study87vr772j64No ratings yet

- 614 Course Name: Financial AccountingDocument10 pages614 Course Name: Financial AccountingShiv Shankar ShuklaNo ratings yet

- ACCT212 Course Outline 2021Document12 pagesACCT212 Course Outline 2021lukhonzimande147No ratings yet

- Taxation Syllabus 01-14-2024 SignedDocument6 pagesTaxation Syllabus 01-14-2024 SignedLiezel Jane Ambay IbañezNo ratings yet

- ACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgDocument8 pagesACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgRoschelle MiguelNo ratings yet

- BAC2684 Financial Statement Analysis - SyllabusDocument15 pagesBAC2684 Financial Statement Analysis - SyllabuspremsuwaatiiNo ratings yet

- Teaching Plan CPPRE Oct 2020 Sem REB - HBLDocument2 pagesTeaching Plan CPPRE Oct 2020 Sem REB - HBLEpic GamerNo ratings yet

- ACCT 1046 - Intermediate Accounting 1Document10 pagesACCT 1046 - Intermediate Accounting 1Rhianne ManicapNo ratings yet

- Accounting Outline 1Document4 pagesAccounting Outline 1MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Mathematics II OUTLINEDocument5 pagesMathematics II OUTLINEMuzammil ShabbirNo ratings yet

- Table 3: Summary of Information On Each Course Design Development StageDocument15 pagesTable 3: Summary of Information On Each Course Design Development StageSani Oghang PekanNo ratings yet

- BACC116 Financial Accounting 1 - S2 2015Document8 pagesBACC116 Financial Accounting 1 - S2 2015Melody AhNo ratings yet

- Engineering Project ManagementDocument34 pagesEngineering Project ManagementSafayet AzizNo ratings yet

- Scheme of Work Ads557 Mar-Aug 2022Document8 pagesScheme of Work Ads557 Mar-Aug 2022Albert KudangNo ratings yet

- Course Plan EDPDocument14 pagesCourse Plan EDPAryan PandeyNo ratings yet

- SSOM BBA Scheme and SyllabusDocument78 pagesSSOM BBA Scheme and SyllabusHippie TribeNo ratings yet

- Financial Accounting PracticesDocument6 pagesFinancial Accounting PracticesdimazNo ratings yet

- Acc C606Document9 pagesAcc C606Gailee VinNo ratings yet

- 2021 PEAC TLE-ICT Online INSET-Required Outputs, Impt URLsDocument3 pages2021 PEAC TLE-ICT Online INSET-Required Outputs, Impt URLsGynxi NekoNo ratings yet

- Teaching Plan Auditing - PAS2183 - APRIL 2023Document3 pagesTeaching Plan Auditing - PAS2183 - APRIL 2023DIVA RTHININo ratings yet

- BBA Bylaws 2022-23Document74 pagesBBA Bylaws 2022-23asifrjk11996No ratings yet

- Fundamentals of Entrepreneurship ENT102Document7 pagesFundamentals of Entrepreneurship ENT102Humaira AshrafNo ratings yet

- TOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2From EverandTOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2Rating: 5 out of 5 stars5/5 (1)

- Grammar Translation Was The Offspring of German ScholarshipDocument4 pagesGrammar Translation Was The Offspring of German ScholarshipRam ChannelNo ratings yet

- Republic Act No 7079Document2 pagesRepublic Act No 7079Ronald QuilesteNo ratings yet

- Rizal in AteneoDocument36 pagesRizal in Ateneomorla holaNo ratings yet

- HTTP Www3.Indiaresults - Com Rajasthan Uor 2010 BEd Roll ResultDocument2 pagesHTTP Www3.Indiaresults - Com Rajasthan Uor 2010 BEd Roll Resultdinesh_nitu2007No ratings yet

- Edexcel Level 5 BTEC Higher National Diploma in Business Assessment ActivityDocument7 pagesEdexcel Level 5 BTEC Higher National Diploma in Business Assessment ActivityKishan2313No ratings yet

- Hand Outs Module 4 2Document10 pagesHand Outs Module 4 2Diane Hamor100% (1)

- Andrea Nicole Valencia: Career ObjectivesDocument3 pagesAndrea Nicole Valencia: Career ObjectivesReginald TuazonNo ratings yet

- Syllabus Intro IctDocument10 pagesSyllabus Intro Ictmilyn maramagNo ratings yet

- GERONA, MARVIN B. Reflective JournalDocument6 pagesGERONA, MARVIN B. Reflective JournalMarvin GeronaNo ratings yet

- Robert Breedlove Resume 2013Document2 pagesRobert Breedlove Resume 2013breedlove23No ratings yet

- OJT AssignmentDocument3 pagesOJT AssignmentAltaf HussainNo ratings yet

- Edtpa-Ech-Assessment-Commentary 1Document6 pagesEdtpa-Ech-Assessment-Commentary 1api-407270738No ratings yet

- G11 W3 My IdentityDocument3 pagesG11 W3 My IdentitySapphire RedNo ratings yet

- Performance Appraisal: The Importance of Rater Training: DSP Dev KumarDocument17 pagesPerformance Appraisal: The Importance of Rater Training: DSP Dev KumarTeddy McNo ratings yet

- TRANSLATIONassessment CONFERENCEDocument21 pagesTRANSLATIONassessment CONFERENCEgrifonkaNo ratings yet

- My Revised Thesis Chapter 1 3.editedDocument49 pagesMy Revised Thesis Chapter 1 3.editedJeriel Baton SeguidoNo ratings yet

- CHAPTER 1 ThesisDocument10 pagesCHAPTER 1 ThesisCaesar Palma100% (1)

- Academic Regulations 2017Document18 pagesAcademic Regulations 2017Ronak PatidarNo ratings yet

- Questions 1Document3 pagesQuestions 1krp_212003No ratings yet

- Family Communication Patterns and Argumentativeness: An Investigation of Chinese College StudentsDocument15 pagesFamily Communication Patterns and Argumentativeness: An Investigation of Chinese College StudentsNana ParamitaNo ratings yet

- Cat2 LessonDocument10 pagesCat2 Lessonapi-351315587No ratings yet

- CVDocument3 pagesCVandreeamadalinaNo ratings yet

- JHS Class Program S.Y. 2021 2022 SchoolDocument26 pagesJHS Class Program S.Y. 2021 2022 SchooljunapoblacioNo ratings yet

- 06072019003840Document20 pages06072019003840Jeyanthan drjNo ratings yet

- Valuing Project ArchieveDocument11 pagesValuing Project ArchieveShravan Mundhada0% (1)

- NCBTS Volume 1 Teachingprof Socdime FS 274 315Document85 pagesNCBTS Volume 1 Teachingprof Socdime FS 274 315justin may tuyorNo ratings yet

- Questions and Framework Adapted From The Allyn & Bacon Guide To Writing, 8Document3 pagesQuestions and Framework Adapted From The Allyn & Bacon Guide To Writing, 8Kim LaceyNo ratings yet

- Close Reading Practice Sherman Alexies Superman and MeDocument4 pagesClose Reading Practice Sherman Alexies Superman and Meapi-359644173No ratings yet

- Bread and PastryDocument3 pagesBread and PastrydarlenecabridoNo ratings yet

- The NDA and The IMA...Document18 pagesThe NDA and The IMA...Frederick NoronhaNo ratings yet