Professional Documents

Culture Documents

Practical Accounting 2 - Solution

Uploaded by

Mazikeen DeckerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practical Accounting 2 - Solution

Uploaded by

Mazikeen DeckerCopyright:

Available Formats

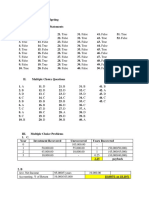

CRC-ACE REVIEW SCHOOL

The Professional CPA Review School

735-9031 / 735-8901

Practical Accounting Problems 2 RE HERMOSILLA/BN CASTUCIANO

1st Preboard Examination - Solutions October 2007

1. The answer is letter A

Cost Method

200,000 – ( 30,000 x 20% ) = P 194,000

Equity Method

200,000 + ( 30,000 – 10,000 ) – 36,000 = P 184,000

2. The answer is letter D

3. The answer is letter D

Share in Net Loss ( 100 T x 25% ) 25,000

Amortization ( 150,000 x 10% ) 15,000

Investment Loss 40,000

4. The answer is letter B

Acquisition Cost 550,000 or BV ( 1,600 + 100 – 120 ) 25%

395,000

Share in NI ( 200 T – 100 ) 25% 25,000 UE 150,000

Dividends ( 120 T x 25% ) (30,000) CV

545,000

CV 545,000

5. The answer is letter A

CNI

PL NI for the year 300,000

SNI ( 120,000 x 4/12 ) 40,000

Share in NI in 8 months

January to August 31 ( 120 T x 8/12 x 25% ) 20,000

CNI 360,000

6. The answer is letter B

MINI

( 120 t x 4/12 ) 40% 16,000

7. The answer is letter D

8. The answer is letter B ( 40% direct holdings + [ ( 80 x 15% ) ] = 52%

9. The answer is letter B

10. The answer is letter C

Total COS of T & S 800,000

UP beg ( 20 T x 30% ) ( 6,000)

Inter – Co. Sales (110,000)

UP – end ( 30 T x 30% ) 9,000

Consolidated COS 693,000

11. The answer is letter D

Total Amortization Expense per books 190,000

Amortization ( 196T – 180T ) / 10 …….. 1,600

Total 191,600

12. The answer is letter A

13. The answer is letter B 40,000 = 25,000 + 10% (NI – B – S )

40,000 = 25,000 + 10% (NI – 15,000 – 125,000)

40,000 = 25,000 + .INI – 14,000

40,000 – 11,000 = . INI

CRC-ACE/P2: 1st Pre-board Solution (October 2007 Batch Page 2

29,000 = . INI

290,000 = NI

14. The answer is letter A

TCC TAC

R 200 (8)

J 100 (12) 88,000

G 100 20 120

400 0 400

Bonus to Gen = 5,000

Share of J in the residual profit ( 50,000 x 40 % ) = 20,000

15. The answer is letter D

Equity balance of E 50,000

Amount Paid 46,000

Bonus to C & D 4,000

C 120,000 + ( 3/5 x 4,000) 122,400

D 60,000 + ( 2/5 x 4,000) 61,600

16. The answer is letter A

R E H Total

Equity 32,000 24,900 15,000 71,900

Loss (12,000) ( ) ( ) ( 24,000)

CAFD 20,000 _________ _________ 47,900

Proceeds = 47,900 + 20,000 – 6,000 = 61,900

17. The answer is letter B

Dennis Brisbane Ric Total

15,000 10,000 10,000 35,000

(5,000) (5,000)

( 200 ) ( 200 )

100 50 50 200

9,900 10,050 10,050 30,000

(12,500) ( 6,250) (6,250) (25,000)

( 2,600 ) _________ _________ 5,0000

18. The answer is letter B

A B C D Total

60 40 30 10 140

(15) (15)

1.5 .900 .300 .300 3

46,500 40.900 30,300 10,300 128,000

(49,000) (29,400) (9,800) (9,800) (98,000)

ANS ( 2,500) 11,500 20,500 500 30,000

2,500 ( 1,500) (.500) (500)

0 10T 20 0 30T

19. The answer is letter A

GI ( 150 – 40 + 10 ) 120,000

Expenses 20,000

NI 100,000

D E F

Share 50,000 30,000 20,000

E/D 40,000 (10,000) _______

Inc in Cap 90,000 20,000 20,000

20. The answer is letter C

J K L Total

88,000 62,000 56,000 206,000

CRC-ACE/P2: 1st Pre-board Solution (October 2007 Batch Page 3

58.6 ( 29,300) ( 29,300) ( 117.2 )

29,400 32,700 26,700 88,800

21. The answer is letter C

Allocation Made

R J V Total

Sal 20 15 - 35

Bonus 1667 - - 1.667

Bal 3333 6666 23,334 33,3333

Total 25,000 70T

Should be

Sal 20 15 - 35

Bal ( 500 ) ________ ________ ( 5 )

19,500 ________ ________ ( 5 )

Decrease by 5,500

22. The answer is letter D

Cap. bal. 350 200 90 640

Adj. ( 50 ) ( 30 ) (20) (100)

Bal. 300 170 70 540

TCC TAC

G 300 ( 30 ) 270

N 170 ( 8) 162

L 70 30 108

F 270 270

810 810 (540 / 2/3 )

23. The answer is letter A

Equity of retiring partner 200,000

Amount Paid 225,000

Share in Revaluation/GW 25,000

÷ .5

Total 50,000

x ½

Share of Remaining Partners 25,000

Cap. of Remaining Partner s 200,000

Total 225,000

24. The answer is letter D

25. The answer is letter C

26. The answer is letter C

27. The answer is letter D

28. The answer is letter B

29. The answer is letter C

30. The answer is letter D

31. The answer is letter C

32. The answer is letter B

33. The answer is letter D

34. The answer is letter B

35. The answer is letter D

36. The answer is letter D

37. The answer is letter C

38. The answer is letter A

TCC TAC

J 40 ( 3 ) 37,000

CRC-ACE/P2: 1st Pre-board Solution (October 2007 Batch Page 4

In 30 ( 1.8 ) 28,200

IZ 20 ( 1.2 ) 18,800

R 30 6 36

120 0 120 [ 90/ (1 – 5/6 x 30 ) ]

39. The answer is letter C

146, 000 – 106,000 + 2,000 = P 42,000

40. The answer is letter D

( 39,386 – 4,286 ) / .3 = P 117,000

41. The answer is letter A

COI - 40,000

FV of NA ac’d 33,880

GW 6,120

42. The answer is letter D or 100% of Subsidiary SHE.

43. The answer is letter A

Total NI ( 60 + 30 ) 90,000

Amortization

30,000 / .6 = 50,000 / 15 ( 3,333 )

12,000 / .6 = 20,000 / 40 ( 500 )

CNI P 86,167

44. The answer is letter B

COST 200,000

Share in NI ( 120 T x 60 % ) 72,000

Div ( 70 T x 60 % ) ( 42,000 )

Amortization

8,000 + ( 4/15 x 30 T ) + ( 4/40 12T ) ( 17,200 )

CV 212,800

45. The answer is letter A

Net Assets FV 1,300,000/100 = 13,000 P/S shares

GW

Annual NI 481,000

Normal Earnings 195,000

Excess 286,000

÷ .2

GW to be issued C/S 1,430,000

x 30%

Prem. payable in cash 429,000

reh/cel

You might also like

- Practical Accounting 2 - SolutionDocument5 pagesPractical Accounting 2 - SolutionjaysonNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- (BA 118.1) Mock 1st LE AKDocument6 pages(BA 118.1) Mock 1st LE AKAiryleenVarquezNo ratings yet

- Partners (Because TAC TCC PAC (New)Document5 pagesPartners (Because TAC TCC PAC (New)BromanineNo ratings yet

- Solution Partnership OperationsDocument3 pagesSolution Partnership OperationsStella SabaoanNo ratings yet

- Group 1Document9 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- Group 1Document11 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- 1.) Answer: 1 050 000: Prelim Bring Home ExamDocument12 pages1.) Answer: 1 050 000: Prelim Bring Home ExamMary Joy CabilNo ratings yet

- AK Mock BA 99.2 1st LEDocument4 pagesAK Mock BA 99.2 1st LEBromanineNo ratings yet

- Francisco, Nicole Anne O. 4 Yr - BSA Sir SimbilloDocument4 pagesFrancisco, Nicole Anne O. 4 Yr - BSA Sir SimbilloNicole FranciscoNo ratings yet

- Solution Manual For Managerial Economics 6th Edition For KeatDocument7 pagesSolution Manual For Managerial Economics 6th Edition For KeatBiancaNortonmtckNo ratings yet

- Chapter 11 SolutionsDocument22 pagesChapter 11 SolutionsSrijon Moitra100% (1)

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)Document6 pagesQuiz 1 Answers and Solutions (Partnership Formation and Operation)cpacpacpaNo ratings yet

- Sample FE Exam Problems Solutions 11. What To Do: Find The Capitalized Cost of Infinite Cash Flow SequenceDocument3 pagesSample FE Exam Problems Solutions 11. What To Do: Find The Capitalized Cost of Infinite Cash Flow SequenceSurya Ch VenkataNo ratings yet

- Chapter 9 Solutions - Engineering Economy 7 TH Edition. Leland Blank and Anthony TarquinDocument22 pagesChapter 9 Solutions - Engineering Economy 7 TH Edition. Leland Blank and Anthony TarquinYousif AlzarooniNo ratings yet

- Basics of Engineering Economy 2nd Edition Blank Solutions ManualDocument23 pagesBasics of Engineering Economy 2nd Edition Blank Solutions Manualtrevorkochrjknxboiwm100% (10)

- Mas 1st PB October 2022 Suggested SolutionDocument8 pagesMas 1st PB October 2022 Suggested SolutionAsnifah AlinorNo ratings yet

- AK Mock BA 141 1st LEDocument3 pagesAK Mock BA 141 1st LEElmer BonakNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Engineering Economy Solution of HW2: Exercise 1Document5 pagesEngineering Economy Solution of HW2: Exercise 1Moe ShNo ratings yet

- Cost Volume Profit Analysis (CVP) / Break Even AnalysisDocument10 pagesCost Volume Profit Analysis (CVP) / Break Even AnalysisTaymoor AliNo ratings yet

- Ea1 Probs 1Document6 pagesEa1 Probs 1Kim CarreraNo ratings yet

- Management Services (MS) : ND ST RDDocument3 pagesManagement Services (MS) : ND ST RDKindred WolfeNo ratings yet

- ReSA SLU AFAR Midterm Exam ANSWER KEYDocument10 pagesReSA SLU AFAR Midterm Exam ANSWER KEYAira Mugal OwarNo ratings yet

- Preliminary Solutions Exam FEB12003X (Group 1 / Group 2)Document5 pagesPreliminary Solutions Exam FEB12003X (Group 1 / Group 2)Henryck SpierenburgNo ratings yet

- Final Assignment AstDocument6 pagesFinal Assignment AstAngelica CerioNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- Engineering Economy Solved ProblemsDocument6 pagesEngineering Economy Solved ProblemsAngel OñaNo ratings yet

- Solutions and DiscussionsDocument4 pagesSolutions and DiscussionsChryshelle LontokNo ratings yet

- Part18 SolutionsDocument2 pagesPart18 SolutionsMuhammad AliNo ratings yet

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- SECTION 2 Finance Section: (Total Marks: 31Document3 pagesSECTION 2 Finance Section: (Total Marks: 31Danish AliNo ratings yet

- Chapter 2 Partnership Operations 2021 EditionDocument17 pagesChapter 2 Partnership Operations 2021 Editionregine bacabagNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationGeraldine MayoNo ratings yet

- Problem 5Document5 pagesProblem 5Jenika AtanacioNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- 6 AdvacDocument4 pages6 AdvacAlayka LorzanoNo ratings yet

- Decesion MakingDocument11 pagesDecesion MakingShoaib NaeemNo ratings yet

- Chapter 2 Teachers Manual Afar Part 1Document9 pagesChapter 2 Teachers Manual Afar Part 1cezyyyyyyNo ratings yet

- Answer Key Chapter 20Document4 pagesAnswer Key Chapter 20NCTNo ratings yet

- Chapter 12Document25 pagesChapter 12Muhammad Umair KhalidNo ratings yet

- AK Mock BA 118.1 2nd LEDocument6 pagesAK Mock BA 118.1 2nd LEBromanineNo ratings yet

- Problem 6 - Partnership OperationDocument5 pagesProblem 6 - Partnership OperationShaira UntalanNo ratings yet

- Property, Plant, and EquipmentDocument4 pagesProperty, Plant, and EquipmentKris Hazel RentonNo ratings yet

- Construction ContractsDocument9 pagesConstruction ContractsMichael BongalontaNo ratings yet

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- HW FIN201-Chapter5-10-12-13&14-VONG-BOPHADocument8 pagesHW FIN201-Chapter5-10-12-13&14-VONG-BOPHABopha vongNo ratings yet

- Revision - 29 Aug, 28 Aug 2022Document9 pagesRevision - 29 Aug, 28 Aug 2022Kartik SujanNo ratings yet

- Audit Probs 4 (Final Exam)Document6 pagesAudit Probs 4 (Final Exam)YameteKudasaiNo ratings yet

- PROBLEM 12-10 ANSWER: C. 1,800,000 SolutionDocument2 pagesPROBLEM 12-10 ANSWER: C. 1,800,000 SolutionJessica Cabanting OngNo ratings yet

- Problem Exercises On Profit MaximizationDocument2 pagesProblem Exercises On Profit MaximizationMarilou GabayaNo ratings yet

- ATI TEAS Calculation Workbook: 300 Questions to Prepare for the TEAS (2023 Edition)From EverandATI TEAS Calculation Workbook: 300 Questions to Prepare for the TEAS (2023 Edition)No ratings yet

- Chapter 5-Dayag-TheorisDocument1 pageChapter 5-Dayag-TheorisMazikeen DeckerNo ratings yet

- Chapter 5 - Dayag - MCS 48-57Document4 pagesChapter 5 - Dayag - MCS 48-57Mazikeen DeckerNo ratings yet

- Chapter 5 - Dayag - MCS ComputationDocument4 pagesChapter 5 - Dayag - MCS ComputationMazikeen DeckerNo ratings yet

- Chapter 5 - Dayag - MCS 81-88Document4 pagesChapter 5 - Dayag - MCS 81-88Mazikeen DeckerNo ratings yet

- Chapter 5 - Dayag - MCSDocument2 pagesChapter 5 - Dayag - MCSMazikeen DeckerNo ratings yet

- Chapter 5 - Dayag - MCS 58-80Document2 pagesChapter 5 - Dayag - MCS 58-80Mazikeen DeckerNo ratings yet

- Answers To Cost Accounting Chapter 9Document6 pagesAnswers To Cost Accounting Chapter 9Raffy Roncales0% (1)

- Problem 4: Chapter 5 - Dayag - Solution ManualDocument1 pageProblem 4: Chapter 5 - Dayag - Solution ManualMazikeen DeckerNo ratings yet

- Problem 5: Chapter 5 - DayagDocument1 pageProblem 5: Chapter 5 - DayagMazikeen DeckerNo ratings yet

- Chapter 8Document4 pagesChapter 8ALEXANDRANICOLE OCTAVIANONo ratings yet

- Chapter 5-Dayag-Problem 3Document7 pagesChapter 5-Dayag-Problem 3Mazikeen DeckerNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 10Document8 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 10oizys131No ratings yet

- Problem 4: Chapter 5 - Dayag - Solution ManualDocument1 pageProblem 4: Chapter 5 - Dayag - Solution ManualMazikeen DeckerNo ratings yet

- Chapter 12 1Document8 pagesChapter 12 1Princess Via Ira EstacioNo ratings yet

- Advanced-Accounting-Part 1-Dayag-2015-Chapter-9Document19 pagesAdvanced-Accounting-Part 1-Dayag-2015-Chapter-9trisha sacramento100% (4)

- Chapter 06Document18 pagesChapter 06Gonzales JhayVee100% (1)

- Chapter 1 - Sol Man de LeonDocument1 pageChapter 1 - Sol Man de LeonJungkookie BaeNo ratings yet

- CHAPTER 11 Answer KeyDocument8 pagesCHAPTER 11 Answer KeyEnsot Soriano33% (3)

- Chapter 7Document8 pagesChapter 7PattyNo ratings yet

- Cost Accounting Answers Chapter 5Document4 pagesCost Accounting Answers Chapter 5Raffy Roncales76% (25)

- Advanced Accounting Part 2 Dayag 2015 Chapter 14Document29 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 14jayson100% (2)

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DSarah GoNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Advanced-Accounting-Part 1-Dayag-2015-Chapter-7Document33 pagesAdvanced-Accounting-Part 1-Dayag-2015-Chapter-7trisha sacramentoNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 11Document31 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 11Girlie Regilme Balingbing50% (2)

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-18Document76 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-18allysa ampingNo ratings yet

- Chapter 17Document78 pagesChapter 17Jea BalagtasNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 13Document24 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 13Mazikeen DeckerNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 12Document17 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 12crispyy turon100% (1)

- Family Business - EMG464 Stavros Drakou S00602280Document6 pagesFamily Business - EMG464 Stavros Drakou S00602280Steven DrakouNo ratings yet

- Integrated AccountingDocument4 pagesIntegrated AccountingJennilou AñascoNo ratings yet

- Application Form Hyundai SilangDocument1 pageApplication Form Hyundai SilangChie NagañoNo ratings yet

- Shapiro CHAPTER 3 Altered SolutionsDocument17 pagesShapiro CHAPTER 3 Altered SolutionsNimi KhanNo ratings yet

- Standard Costing: A Standard Cost Is A Carefully - Unit Cist Which Is Prepared For Each Cost UnitDocument23 pagesStandard Costing: A Standard Cost Is A Carefully - Unit Cist Which Is Prepared For Each Cost UnitHarshNo ratings yet

- Key Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitSantosh Kumar RoyNo ratings yet

- Dajzhe Scott Final 2Document10 pagesDajzhe Scott Final 2api-510731620No ratings yet

- Valuations 1: Introduction To Methods of ValuationDocument17 pagesValuations 1: Introduction To Methods of ValuationNormande RyanNo ratings yet

- SI0020 SAP Fundamental: Logistics - ProcurementDocument20 pagesSI0020 SAP Fundamental: Logistics - ProcurementBinsar WilliamNo ratings yet

- Contents of Project ProposalDocument2 pagesContents of Project ProposalFatima Razzaq100% (1)

- REVISED CORPO-Board of Directors Trustees Officers 2020Document24 pagesREVISED CORPO-Board of Directors Trustees Officers 2020Prince Carl Lepiten SilvaNo ratings yet

- Audienz Overview 03 2021Document7 pagesAudienz Overview 03 2021Kevin ParkerNo ratings yet

- Acct 555 - Week 1 AssignmentDocument8 pagesAcct 555 - Week 1 AssignmentJasmine Desiree WashingtonNo ratings yet

- Financial Statement and Its AnalysisDocument5 pagesFinancial Statement and Its AnalysisMallikarjun RaoNo ratings yet

- Intellectual Property Rights - Question BankDocument14 pagesIntellectual Property Rights - Question BankKarthikNo ratings yet

- Clelland (2014) The Core of The Apple Dark Value and Degrees ofDocument31 pagesClelland (2014) The Core of The Apple Dark Value and Degrees ofTales FernandesNo ratings yet

- EntrepreneurshipDocument23 pagesEntrepreneurshipGolam MostofaNo ratings yet

- SHALDOR CONSULTING - BUSINESS CASE EX Growth+StrategyDocument5 pagesSHALDOR CONSULTING - BUSINESS CASE EX Growth+StrategyBenji PremingerNo ratings yet

- Diploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideDocument14 pagesDiploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideAnil Kumar AkNo ratings yet

- Case Study MMK SirDocument10 pagesCase Study MMK SirFarzana Akter 28No ratings yet

- Unit 7: Conversion of Accounting - Data Migration: Week 2: Conversion To SAP S/4HANA FinanceDocument8 pagesUnit 7: Conversion of Accounting - Data Migration: Week 2: Conversion To SAP S/4HANA FinanceJacekNo ratings yet

- Walt Disney Case AnalysisDocument8 pagesWalt Disney Case AnalysisPauline Beatrice Sombillo100% (2)

- NoteDocument4 pagesNotesks0865No ratings yet

- SK Resolution BACDocument7 pagesSK Resolution BACDeo Montero OrquejoNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- ISE Group 4 Business Plan 2022Document24 pagesISE Group 4 Business Plan 2022Munashe MudaburaNo ratings yet

- Presentation Slides: Contemporary Strategy Analysis: Concepts, Techniques, ApplicationsDocument11 pagesPresentation Slides: Contemporary Strategy Analysis: Concepts, Techniques, ApplicationsMonika SharmaNo ratings yet

- Basic Concept of Industrial EngineeringDocument17 pagesBasic Concept of Industrial EngineeringSanjuNo ratings yet

- Subject Matter ExpertDocument13 pagesSubject Matter ExpertAnkita RkNo ratings yet

- Domino's Pizza: The Global Leader in Pizza DeliveryDocument11 pagesDomino's Pizza: The Global Leader in Pizza DeliveryIva YarmovaNo ratings yet