Professional Documents

Culture Documents

Donor's Tax

Uploaded by

xstljvll0 ratings0% found this document useful (0 votes)

8 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesDonor's Tax

Uploaded by

xstljvllCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

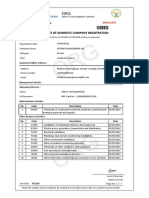

DONOR’S TAX

FORMAT OF COMPUTATION

FIRST DONATION OF THE YEAR

Gross Gift xx

Less: Exemptions/Deductions (xx)

xx

Less: Tax exempt Gift (250,000)

Net Taxable Gift xx

X Donor’s Tax Rate 6%

Donor’s Tax (due) xx

Less: Tax Credit (If applicable) xx

Donor’s Tax Payable xx

SUBSEQUENT DONATION(s) WITHIN THE

YEAR

Gross Gift, Current xx

Less: Exemptions/Deductions, Current (xx)

xx

Add: Prior gifts(s) xx

Total xx

Less: Tax Exempt Gift (250,000)

Net Taxable Gift(s) xx

X Donor’s Tax Rate 6%

Donor’s Tax Due xx

Less: Tax Paid – Prior Gift(s) (xx)

Tax Credit (if applicable) (xx)

Donor’s Tax Payable xx

GROSS GIFT

1. Direct gift

2. Gift through creation of a trust

3. Condonation of debt

4. Repudiation of inheritance:

a. SPECIFICALLY and categorically done in favor of

identified heirs

b. To the exclusion or disadvantage or other co-heirs

5. Renunciation of the SS of his/her share in the conjugal

partnership pr absolute community after the dissolution of the

marriage in favor of the heirs of the deceased spouse of any

other person/s

6. Transfer for insufficient consideration (FM > SP = taxable

gift)

EXC: RP classified as capital asset located in the PH

Gift from COMMON property – gift is taxable ONE-HALF to

each donor

Donation between H & W during marriage

GR: not taxable (VOID)

EXC: Moderate gifts between the spouses are valid

EXEMPTIONS and/or DEDUCTIONS FROM GROSS GIFT

1. Encumbrances on the property donated assumed by the

donee

2. Diminution of gift provided by the donor

3. Gifts to the Government

4. Gifts to educational, charitable, religious corporation etc.

(enumerated)

Not more than 30% of the said gift shall be used for

administrative purposes

5. Exemption under Special Laws (enumerated)

TAX CREDIT FOR DONOR’S TAX PAID TO A FOREIGN

COUNTRY

-only RESIDENT or CITIZEN can claim tax credit

Amount Deductible: LOWER of actual donor’s tax paid abroad

and limit

Only one foreign country:

Net Gift, Foreign/World Net Gift x PH Donor’s Tax

Two or more foreign countries:

Limit 1 – allowed per foreign country

Net Gift, per foreign country/World Net Gift x PH Donor’s Tax

Limit 2 – total

Net Gift all foreign countries/World Net Gift x PH Donor’s Tax

DEADLINE FOR FILING AND PAYMENT OF RETURN

Date of filing 30 days after the date the gift is

made or completed

Place of Payment Domicile of Donor

a. Authorized agent bank

b. RDO

c. RCO

d. City Treasurer or

municipality

Donor: NRA PH Embassy or Consulate

You might also like

- Study ScheduleDocument1 pageStudy SchedulexstljvllNo ratings yet

- Chapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Document68 pagesChapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Jose Dula IINo ratings yet

- Daily ScheduleDocument1 pageDaily SchedulexstljvllNo ratings yet

- November: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument2 pagesNovember: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayxstljvllNo ratings yet

- Daily RoutineDocument1 pageDaily RoutinexstljvllNo ratings yet

- Daily ScheduleDocument1 pageDaily SchedulexstljvllNo ratings yet

- Estate Tax WNDocument6 pagesEstate Tax WNxstljvllNo ratings yet

- Audit Program For InvestmentsDocument3 pagesAudit Program For Investmentsxstljvll100% (1)

- Daily RoutineDocument1 pageDaily RoutinexstljvllNo ratings yet

- CALESI Auditing Services: You Can Sleep at Night CashDocument13 pagesCALESI Auditing Services: You Can Sleep at Night CashxstljvllNo ratings yet

- Audit Program For ReceivablesDocument2 pagesAudit Program For ReceivablesxstljvllNo ratings yet

- Audit Program For Property Plant and Equipment (Grace Crop)Document5 pagesAudit Program For Property Plant and Equipment (Grace Crop)xstljvllNo ratings yet

- Audit Program For Cost of Sales (Grace Corp)Document2 pagesAudit Program For Cost of Sales (Grace Corp)xstljvll100% (1)

- ItexplosionDocument5 pagesItexplosionxstljvllNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- What Is An Information System?Document3 pagesWhat Is An Information System?xstljvllNo ratings yet

- CPAR TAX7411 Estate Tax With Answer 1 PDFDocument6 pagesCPAR TAX7411 Estate Tax With Answer 1 PDFstillwinmsNo ratings yet

- Kiven Roy T. Jimera: Fraud and Forensic Accounting, As A Requirement For Our Curriculum. One of Our Final CourseDocument2 pagesKiven Roy T. Jimera: Fraud and Forensic Accounting, As A Requirement For Our Curriculum. One of Our Final CoursexstljvllNo ratings yet

- What Is An Information System?Document3 pagesWhat Is An Information System?xstljvllNo ratings yet

- Sanitary SuppliesDocument4 pagesSanitary SuppliesxstljvllNo ratings yet

- Petition Letter AdvaccDocument3 pagesPetition Letter AdvaccxstljvllNo ratings yet

- Internal Analysis UpdateddddDocument17 pagesInternal Analysis UpdateddddxstljvllNo ratings yet

- Aao Calendar of Activities 2019 2020Document1 pageAao Calendar of Activities 2019 2020xstljvllNo ratings yet

- Cat Exam Application FormDocument1 pageCat Exam Application FormxstljvllNo ratings yet

- The Ethics of International Accounting:: Harmonization and TerrorismDocument10 pagesThe Ethics of International Accounting:: Harmonization and TerrorismxstljvllNo ratings yet

- Akay-Kalinga Centre For Street ChildrenDocument1 pageAkay-Kalinga Centre For Street ChildrenxstljvllNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business and Transfer Taxation: Tax 101 /tax 2 - Midterm ExaminationDocument2 pagesBusiness and Transfer Taxation: Tax 101 /tax 2 - Midterm ExaminationLourdios EdullantesNo ratings yet

- Bilal Kahlid Cv..Document2 pagesBilal Kahlid Cv..SaadNo ratings yet

- Chapter 3 CLCDocument24 pagesChapter 3 CLCVăn ThànhNo ratings yet

- 7B20N001Document21 pages7B20N001pbNo ratings yet

- Aep32 Prelim Exam AnswerDocument4 pagesAep32 Prelim Exam AnswerTan ToyNo ratings yet

- Assign. 2 Module 2Document9 pagesAssign. 2 Module 2Kristine VertucioNo ratings yet

- Part 1-Donor'S TaxDocument2 pagesPart 1-Donor'S TaxAllen KateNo ratings yet

- 0 Control Sheet - Charge of Tax & 4 Key ConceptsDocument1 page0 Control Sheet - Charge of Tax & 4 Key ConceptsArman KhanNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of April 2014Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of April 2014Sameer G50% (4)

- Nepal Open University Faculty of Management and Law Office of The Dean Mid Term Exam-2020 A.DDocument2 pagesNepal Open University Faculty of Management and Law Office of The Dean Mid Term Exam-2020 A.DDiksha PaudelNo ratings yet

- UntitledDocument3 pagesUntitledNisar AliNo ratings yet

- Tithe - Percentage Giving ChartDocument1 pageTithe - Percentage Giving ChartRay Anthony Rodriguez0% (1)

- Feb 2018Document1 pageFeb 2018savan anvekarNo ratings yet

- 5Document2 pages5ABDUL WAHABNo ratings yet

- Principles of Taxation 2019 ICAS IMPDocument803 pagesPrinciples of Taxation 2019 ICAS IMPVeronica BaileyNo ratings yet

- Questions No 1 PB 7.1Document2 pagesQuestions No 1 PB 7.1L iNo ratings yet

- Certificate of Domestic Company Registration: DuplicateDocument2 pagesCertificate of Domestic Company Registration: DuplicateRutagengwa GilbertNo ratings yet

- KLMinvoice 04062020Document1 pageKLMinvoice 04062020Jack RobinsonNo ratings yet

- Taxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Document4 pagesTaxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Shuaibu AhmadNo ratings yet

- Taxation BookDocument29 pagesTaxation BookbiggykhairNo ratings yet

- Ateneo Tax 2019 PDFDocument231 pagesAteneo Tax 2019 PDFKenneth MonderoNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityLecel Llamedo100% (1)

- VV Tinnie 4402 Umnga Crescent Langa 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa 7455: Contact Centrebra9tee9tiniNo ratings yet

- Financial StatementsDocument5 pagesFinancial StatementsRuthchell CiriacoNo ratings yet

- 2023 PCL Chapter 4 Income TaxDocument67 pages2023 PCL Chapter 4 Income TaxSkyNo ratings yet

- 2022-23 TDSDocument6 pages2022-23 TDSMujtabaAliKhanNo ratings yet

- Rahbar Infotech Solutions PVT - LTD.: Salary Slip For The Month ofDocument1 pageRahbar Infotech Solutions PVT - LTD.: Salary Slip For The Month ofSalman KhanNo ratings yet

- Clubbing of Income633255 - 1619331995Document16 pagesClubbing of Income633255 - 1619331995Pritam MuhuriNo ratings yet

- Calculation of Total Tax IncidenceDocument1 pageCalculation of Total Tax IncidenceRipul Nabi67% (3)

- Payroll Records January 2013: Employee Hours Overtime HoursDocument2 pagesPayroll Records January 2013: Employee Hours Overtime HoursMary Rose DiazNo ratings yet