Professional Documents

Culture Documents

Source Documents - Answers: Source Document Debit(s) Credit(s)

Source Documents - Answers: Source Document Debit(s) Credit(s)

Uploaded by

Emily XieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Source Documents - Answers: Source Document Debit(s) Credit(s)

Source Documents - Answers: Source Document Debit(s) Credit(s)

Uploaded by

Emily XieCopyright:

Available Formats

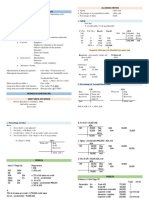

SOURCE DOCUMENTS - ANSWERS

Source Document Describe what has happened? Debit account Credit account

cash sale to a customer was made

cash sales slip CASH REVENUE

sale on account to a customer was made

sales invoice A/R REVENUE

(goods or services)

DEPENDS

WHAT YOU

BOUGHT e.g.

we bought something on account (could be

purchase invoice Equipment or A/P

an expense OR an asset

Supplies or

Advertising

Expense

-we wrote a cheque to someone for

DEPENDS

something

WHAT WAS

cheque copy -could be previously owed OR NOT CASH

PAID FOR,

might be A/P

-we received money from someone

-could be previously owed OR NOT DEPENDS,

cheques received CASH

could be A/R

EXPENSE (OF

SOME SORT,

-the bank has taken money from our

possibly

account for something

bank debit memo Interest CASH

-could be interest or bank charges or a bad

Expense or

cheque

Bank Charges

Expense)

INTEREST

-the bank has added money to our account EARNED

for something (PROBABLY,

bank credit memo CASH

-could be interest earned but could be

something

else)

Source Document Debit(s) Credit(s)

CASH SALES SLIP CASH REVENUE

(cash sale to a customer)

SALES INVOICE A/R REVENUE

(sale on account to a customer)

PURCHASE INVOICE EQUIPMENT (DEPENDS) A/P

(puchase on account by business)

CHEQUE COPY OR CANCELLED

CHEQUE

(payment made by business) A/P (DEPENDS) CASH

CHEQUE COPIES OR LIST

(payment received from customer) CASH A/R

DEBIT MEMO

(deduction from business bank account) INTEREST EXPENSE OR

BANK CHARGES CASH

CREDIT MEMO CASH INTEREST REVENUE

(increase in business bank account)

You might also like

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995No ratings yet

- Financial Accounting Formulas and NotesDocument10 pagesFinancial Accounting Formulas and NotesAntonio LinNo ratings yet

- Global Payroll Interface PDFDocument216 pagesGlobal Payroll Interface PDFsowballNo ratings yet

- Blank Tech Pack SewheidiDocument9 pagesBlank Tech Pack SewheidiRajkumar PrajapatiNo ratings yet

- Staff HandbookDocument133 pagesStaff HandbookishaanguptaNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Abm 112Document2 pagesAbm 112l mNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- Accounting Analyzing Business Transaction ReviewerDocument7 pagesAccounting Analyzing Business Transaction Reviewerandreajade.cawaya10No ratings yet

- Columban College, Inc: The Following Are The Account Titles and Their Normal BalancesDocument3 pagesColumban College, Inc: The Following Are The Account Titles and Their Normal BalancesAriaiza SanpiaNo ratings yet

- Adjusting EntriesDocument1 pageAdjusting EntriesNadifa AisyahNo ratings yet

- Two-Date Bank Reconciliation Receivables: Example Format OnlyDocument2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Onlymagic costaNo ratings yet

- Ac 506 - Pas 16Document1 pageAc 506 - Pas 16Rome SibuyasNo ratings yet

- Process Flow BarotaDocument1 pageProcess Flow Barotasaurabh_k2009No ratings yet

- TR TP Cash BudgetDocument1 pageTR TP Cash BudgetAmiera AdlynaNo ratings yet

- FY13 Revised Accounting Forms-03.04.15Document25 pagesFY13 Revised Accounting Forms-03.04.15saria.ossama.95No ratings yet

- Accounting PointsDocument4 pagesAccounting PointsLovely IñigoNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- Accounting TipsDocument5 pagesAccounting TipsMuhammad DanishNo ratings yet

- ReceivablesDocument2 pagesReceivablesSecond YearNo ratings yet

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Q2 Week 2 RECONitemsPRINTDocument19 pagesQ2 Week 2 RECONitemsPRINTxfq6tfqgtwNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementJeftonNo ratings yet

- 7 Financing and InvestingDocument1 page7 Financing and InvestingCrest TineNo ratings yet

- Money-Time Relationships and EquivalenceDocument147 pagesMoney-Time Relationships and EquivalenceGnob BertoNo ratings yet

- Chapter 5 Accounting EquationDocument8 pagesChapter 5 Accounting EquationDevam junejaNo ratings yet

- Tally Ass2Document2 pagesTally Ass2charu bishtNo ratings yet

- Cash Flow Calculator CFO SelectionsDocument12 pagesCash Flow Calculator CFO Selections202040336No ratings yet

- Pas 12: Accounting For Income TaxDocument2 pagesPas 12: Accounting For Income TaxKiana FernandezNo ratings yet

- Tabla Contabilidad Gerencial English WeekDocument5 pagesTabla Contabilidad Gerencial English WeekClaudiaNo ratings yet

- Verbs To Do With MoneyDocument2 pagesVerbs To Do With MoneyArieNo ratings yet

- FAR1Document5 pagesFAR1Rye Diaz-SanchezNo ratings yet

- Fa Transes FinalDocument36 pagesFa Transes FinalAlex VillanuevaNo ratings yet

- Afterpay Research PDFDocument33 pagesAfterpay Research PDFNikhil JoyNo ratings yet

- FABM2 (1st)Document3 pagesFABM2 (1st)7xnc4st2g8No ratings yet

- Afar - Revenue RecognitionDocument3 pagesAfar - Revenue Recognitionfarah mae raquinioNo ratings yet

- 10 Purch 11 Process ProcessDocument14 pages10 Purch 11 Process ProcessChadwick E VanieNo ratings yet

- Cash Receipts Process Flowchart: Receives Payment Receive Bank Statement andDocument11 pagesCash Receipts Process Flowchart: Receives Payment Receive Bank Statement andLara Camille CelestialNo ratings yet

- Topic 4 Double EntryDocument31 pagesTopic 4 Double Entry2023401088No ratings yet

- HeaderDocument1 pageHeadersupangkat.okNo ratings yet

- Accounting NotesDocument3 pagesAccounting Notesminthukha151No ratings yet

- Chapter - 03 - PPT (Supplementary To ISpace)Document43 pagesChapter - 03 - PPT (Supplementary To ISpace)kjw 2No ratings yet

- BBFA1103 Topic 5 Adjusting Entries - NotesDocument20 pagesBBFA1103 Topic 5 Adjusting Entries - Notesknea9999No ratings yet

- Accounting Simplified 2Document1 pageAccounting Simplified 2kala1975No ratings yet

- 1 Statement of Financial Position - Part 1Document14 pages1 Statement of Financial Position - Part 1Johann LeoncitoNo ratings yet

- Week 3 PowerpointDocument35 pagesWeek 3 PowerpointAnka MaNo ratings yet

- Accounting Equation (Compatibility Mode)Document29 pagesAccounting Equation (Compatibility Mode)MahediNo ratings yet

- IFRS 3 Business CombinationDocument5 pagesIFRS 3 Business CombinationImraz IqbalNo ratings yet

- Sales and Collection Cycle (Cash Receipts)Document6 pagesSales and Collection Cycle (Cash Receipts)Marda SclrNo ratings yet

- CorpFin 2021 Fall 2+3 (Summary)Document15 pagesCorpFin 2021 Fall 2+3 (Summary)Krisi ManNo ratings yet

- Cash Flow Cheat SheetDocument1 pageCash Flow Cheat SheetSuresh KumarNo ratings yet

- Dan Sheppard - Retail Shop Assistant: CustomerDocument4 pagesDan Sheppard - Retail Shop Assistant: CustomerErika EludoNo ratings yet

- Cash and Cash Equivalents PDFDocument7 pagesCash and Cash Equivalents PDFFritzey Faye RomeronaNo ratings yet

- Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDocument4 pagesActivity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDonabelle MarimonNo ratings yet

- Understanding & Resolving Match Exceptions: (Eprocurement & Purchasing Fundamentals Ii)Document45 pagesUnderstanding & Resolving Match Exceptions: (Eprocurement & Purchasing Fundamentals Ii)ssnnjkNo ratings yet

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- Chap 3 - Mind Map Element FSDocument1 pageChap 3 - Mind Map Element FSEli SyahirahNo ratings yet

- Open Contract Based Deposit - PW (Corporate)Document1 pageOpen Contract Based Deposit - PW (Corporate)Ram Mohan MishraNo ratings yet

- Ip Op Credit: StartDocument6 pagesIp Op Credit: StartJoemon JoseNo ratings yet

- The Complete Financial Analyst Course Trade Receivables Inventory Fixed AssetsDocument9 pagesThe Complete Financial Analyst Course Trade Receivables Inventory Fixed Assetsktan1029No ratings yet

- DOKU Sales Deck 2021Document19 pagesDOKU Sales Deck 2021Blat Rawk100% (1)

- Group 1 Accounting 1Document14 pagesGroup 1 Accounting 1Mary Jessa Ubod TapiaNo ratings yet

- Animal Intrusion DetectionDocument18 pagesAnimal Intrusion DetectionABY MOTTY RMCAA20-23No ratings yet

- Competition Between Huawei Switches and Cisco SwitchesDocument6 pagesCompetition Between Huawei Switches and Cisco SwitchesElizabeth RichNo ratings yet

- Managerial EconomicsDocument49 pagesManagerial EconomicsBhagyashri HolaniNo ratings yet

- Contract of EmploymentDocument3 pagesContract of Employmentcar3laNo ratings yet

- Data Sheet WD Blue PC Hard DrivesDocument2 pagesData Sheet WD Blue PC Hard DrivesRodrigo TorresNo ratings yet

- Bab 2 - Coal Handling PlantDocument10 pagesBab 2 - Coal Handling PlantmasgrahaNo ratings yet

- PAYE GEN 01 G16 Guide For Employers Iro Employees Tax For 2022 External GuideDocument45 pagesPAYE GEN 01 G16 Guide For Employers Iro Employees Tax For 2022 External GuideGerrit van der WaltNo ratings yet

- C1 3 - Development of An Arduino Based Identification Diagnostic and Monitoring System - ADocument51 pagesC1 3 - Development of An Arduino Based Identification Diagnostic and Monitoring System - ALeigh NavalesNo ratings yet

- Auditing and Assurance Concepts and Application 2Document15 pagesAuditing and Assurance Concepts and Application 2darlene floresNo ratings yet

- TECHNOLOGY3 AnswerDocument7 pagesTECHNOLOGY3 AnswerNashaat DhyaaNo ratings yet

- International Journal of Wireless & Mobile Networks (IJWMN)Document2 pagesInternational Journal of Wireless & Mobile Networks (IJWMN)John BergNo ratings yet

- Nineteenth Century Philippines GEC109Document7 pagesNineteenth Century Philippines GEC109Nashebah A. BatuganNo ratings yet

- Psi Mud Agitators Product SheetDocument2 pagesPsi Mud Agitators Product SheetPRASHANT KANTENo ratings yet

- Module 3 - GOVERNMENTS AND CITIZENS IN A GLOBALLY INTERCONNECTED WORLD OF STATESDocument8 pagesModule 3 - GOVERNMENTS AND CITIZENS IN A GLOBALLY INTERCONNECTED WORLD OF STATESMark Alvin S. BaterinaNo ratings yet

- Exercise 2 - Macalinao, Joshua M.Document3 pagesExercise 2 - Macalinao, Joshua M.Joshua MacalinaoNo ratings yet

- NVIDIA P40 Supported ServersDocument13 pagesNVIDIA P40 Supported ServersGomishChawlaNo ratings yet

- Designation: E1530 11Document9 pagesDesignation: E1530 11Lupita RamirezNo ratings yet

- Instruction Candidate RegnDocument5 pagesInstruction Candidate RegnRebanta BeraNo ratings yet

- Bouss2D: SMS 11.2 TutorialDocument22 pagesBouss2D: SMS 11.2 TutorialOentoeng KartonoNo ratings yet

- C.S. Nityanand Singh: Opportunities For Company Secretary Under Consumer Protection ActDocument33 pagesC.S. Nityanand Singh: Opportunities For Company Secretary Under Consumer Protection ActPrisha BauskarNo ratings yet

- Microsoft 365 Mobility and SecurityDocument2 pagesMicrosoft 365 Mobility and SecurityJyothi PrakashNo ratings yet

- Feranti EffectDocument3 pagesFeranti EffectarunmozhiNo ratings yet

- SAP SuccessFactors Onboarding - External HRIS Integration (SAP ERP HCM)Document23 pagesSAP SuccessFactors Onboarding - External HRIS Integration (SAP ERP HCM)Guido ReboredoNo ratings yet

- Probationary Officers Payment Challan 21052010Document1 pageProbationary Officers Payment Challan 21052010Sudhir ShanklaNo ratings yet

- Design of Two-Way Restrained Slab (IS456:2000)Document3 pagesDesign of Two-Way Restrained Slab (IS456:2000)BasandharaAdhikariNo ratings yet

- Five Functions of ManagementDocument2 pagesFive Functions of ManagementMariecris CharolNo ratings yet