Professional Documents

Culture Documents

Sample ITR Page 2

Sample ITR Page 2

Uploaded by

Eduardo BallesterCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample ITR Page 2

Sample ITR Page 2

Uploaded by

Eduardo BallesterCopyright:

Available Formats

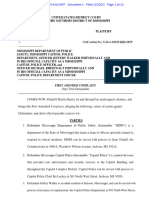

BIR Form No.

1701v2018 Page 1 of 1

BIR Form No.

1701 Annual Income Tax Return

January 2018 (ENCS) Individuals (including MIXED Income Earner), Estates and Trusts

Page 2

TIN Taxpayer/Filer's Last Name

444 803 873 000 BALLESTER

PART IV - Background Information of Spouse

1 Spouse's Taxpayer Identification Number (TIN) - - - 2 RDO Code

3 Filer's Spouse Type Single Proprietor Professional Compensation Earner

4 Alphanumeric Tax Code (ATC) II012 Business Income-Graduated IT Rates II014 Income from Profession-Graduated IT Rates II013 Mixed Income-Graduated IT Rates

II011 Compensation Income II015 Business Income-8% IT Rate II017 Income from Profession-8% IT Rate II016 Mixed Income-8% IT Rate

5 Spouse's Name (Last Name, First Name, Middle Name)

6 Contact Number 7 Citizenship

8 Claiming Foreign Tax Credits? Yes No 9 Foreign tax number (if applicable)

10 Income EXEMPT from Income Tax? Yes No 11 Income subject to SPECIAL/PREFERENTIAL RATE? Yes No

[If yes, fill out also consolidation of ALL activities per Tax Regime (Part X)] [If yes, fill out also consolidation of ALL activities per Tax Regime (Part X)]

Graduated Rates

12A Method of Deduction (choose one)

Itemized Deduction Optional Standard Deduction (OSD)

12 Tax Rate* (Choose Method of Deduction in Item 12A)

[Sec. 34(A-J), NIRC] [40% of Gross Sales/Receipts/Revenues/Fees [Sec. 34(L), NIRC]]

(choose one)

8% in lieu of Graduated Rates under Sec. 24(A) & Percentage Tax under Sec. 116 of NIRC

[available if gross sales/receipts and other non-operating income do not exceed Three million pesos (P3M)]

PART V - Computation of Tax

Schedule 1 - Gross Compensation Income and tax Withheld (Attach Additional Sheet/s, if necessary)

On Items 1 and 2, enter the required information for each of your employer/s and mark (X) wether the information is for the Taxpayer or the Spouse. On Item 3A, enter the

Total Gross Compensation and Total tax Withheld for the Taxpayer and on Item 3B, for the Spouse. (DO NOT enter Centavos; 49 Centavos or less drop down; 50 or more round up)

a.Name of Employer

Taxpayer MSEUFCI

1

Spouse b. Employer's TIN 123 123 123 0000

Taxpayer

2

Spouse b. Employer's TIN

(Continuation of Table Above) c. Compensation Income d. Tax Withheld

1 359,184.00 14,249.00

2 0.00 0.00

Gross Compensation Income and Total Tax Withheld for

3A TAXPAYER (To Part V Schedule 2 Item 4A and Part VII Item 5A)

359,184.00 14,249.00

Gross Compensation Income and Total Tax Withheld for

3B SPOUSE (To Part V Schedule 2 Item 4B and Part VII Item 5B)

0.00 0.00

Schedule 2 - Taxable Compensation Income (DO NOT enter Centavos; 49 Centavos or less drop down; 50 or more round up)

Particulars A. Taxpayer/Filer B. Spouse

4 Gross Compensation Income (From Part V Schedule 1 Item 3Ac/3Bc) 359,184.00 0.00

5 Less: Non-Taxable / Exempt Compensation 37,938.00 0.00

6 Taxable Compensation Income (Item 4 Less Item 5) 321,246.00 0.00

7 Tax Due-Compensation Income (Item 6 x applicable Income Tax Rate) 14,249.00 0.00

Schedule 3 - Taxable Business Income (If graduated rates, fill in items 8 to 24; if 8% flat income tax rate, fill in items 25 to 30)

3.A - For Graduated Income Tax Rates

8 Sales/revenues/receipts/Fees 235,078.00 0.00

9 Less: Sales Returns, Allowances and Discounts 0.00 0.00

10 Net Sales/Revenues/Receipts/Fees (Item 8 Less Item 9) 235,078.00 0.00

11 Less: Cost of Sales/Services (applicable only if availing Itemized Deductions) 0.00 0.00

12 Gross Income/(Loss) from Operation (Item 10 less Item 11) 235,078.00 0.00

Less: Deductions Allowable under Existing Laws

13 Ordinary Allowable Itemized Deductions (From Part V Schedule 4 Item 18) 0.00 0.00

Special Allowable Itemized Deductions (From Part V Schedule 5 Item 3 and/or Item

14 6) 0.00 0.00

Allowable for Net Operating Loss Carry Over (NOLCO) (From Part V Schedule 6

15 Item 8 and/or Item 13) 0.00 0.00

16 Total Allowable Itemized Deductions (Sum of Items 13 to 15) 0.00 0.00

OR

17 Optional Standard Deduction (OSD) (40% of Item 10) 94,031.00 0.00

18 Net Income/(Loss) (If Itemized: Item 12 Less Item 16; If OSD: Item 10 Less Item 17) 141,047.00 0.00

Add: Other Non-Operating Income (specify below)

19 0.00 0.00

20 0.00 0.00

Amount Received/Share in Income by a Partner from General Professional

21 Partnership (GPP) 0.00 0.00

22 Total Other Non-Operating Income (Sum of Items 19 to 21) 0.00 0.00

23 Taxable Income-Business (Sum of Items 18 and 22) 141,047.00 0.00

24 Total Taxable Income - Compensation & Business (Sum of Items 6 and 23) 462,293.00 0.00

Total Tax Due-Compensation and Business Income (under graduated rates)

25 (Item 24 x applicable income tax rate) (To Part VI Item 1) 45,573.00 0.00

file:///C:/Users/saktongpogi/AppData/Local/Temp/%7B0C5F8753-EEDC-4B09-A276-412... 6/4/2020

You might also like

- Non Domestic Mail Postage 2 CentsDocument2 pagesNon Domestic Mail Postage 2 Centsbind1967100% (10)

- Contract of Total Power Exchange (BDSM 24/7 Slavery Contract)Document3 pagesContract of Total Power Exchange (BDSM 24/7 Slavery Contract)Hannelore Biddulph64% (25)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1701A Annual Income Tax ReturnDocument1 page1701A Annual Income Tax ReturnmoemoechanNo ratings yet

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- 1701A Annual Income Tax ReturnDocument3 pages1701A Annual Income Tax ReturnWa37354No ratings yet

- BIR Form No. 1701Document4 pagesBIR Form No. 1701blesypNo ratings yet

- 1701Document6 pages1701Dolly BringasNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- Sana MabagoDocument1 pageSana MabagojoystambaNo ratings yet

- Religious Fundamentalism and ConversionDocument13 pagesReligious Fundamentalism and ConversionJames Kirubakaran Isaac100% (1)

- Scholarship LetterDocument1 pageScholarship LetterJohn Lesther PabiloniaNo ratings yet

- FAQ AS9101-2016 (Mar. 2018) PDFDocument6 pagesFAQ AS9101-2016 (Mar. 2018) PDFArmand LiviuNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Philippine Popular Culture Quiz 2Document3 pagesPhilippine Popular Culture Quiz 2James Marasigan Ambas100% (3)

- सांख्य एवं योग दर्शन श्रीराम शर्माDocument170 pagesसांख्य एवं योग दर्शन श्रीराम शर्माsumiitmishraNo ratings yet

- Land Development Handbook, 4th EditionDocument913 pagesLand Development Handbook, 4th EditionrobertslandholdingsNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- OSD 3rd QuarterDocument2 pagesOSD 3rd QuarterMariela MirandaNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document5 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaNo ratings yet

- Science, Technology & SocietyDocument2 pagesScience, Technology & SocietyJohn Lesther Pabilonia100% (1)

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- 1701osd 2018 101224Document7 pages1701osd 2018 101224Janeth Tamayo NavalesNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document4 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Rhomel HemorNo ratings yet

- 1701 Doc FabianDocument2 pages1701 Doc FabianCristopher NacinoNo ratings yet

- 1701 Annual Income Tax Return: Rogelio D. GonzalesDocument1 page1701 Annual Income Tax Return: Rogelio D. GonzalesJoshua CarzaNo ratings yet

- Legal AspectDocument34 pagesLegal Aspect잔잔No ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- Annual Income Tax ReturnDocument6 pagesAnnual Income Tax Returnirene deiparineNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Annual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT RatesDocument1 pageAnnual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT Ratesmary grace villasenorNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- 1701 P4.1Document2 pages1701 P4.1asteriaswan14No ratings yet

- 1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsDocument2 pages1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsVince Alvin DaquizNo ratings yet

- Chatto PT 3Document2 pagesChatto PT 3LabLab Chatto0% (1)

- BIRForm1701 Old FormDocument6 pagesBIRForm1701 Old FormKristine VelardeNo ratings yet

- OSD 2nd QuarterDocument2 pagesOSD 2nd QuarterMariela MirandaNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- Annual Income Tax Return: BrianDocument4 pagesAnnual Income Tax Return: BrianChristine ViernesNo ratings yet

- Miflores 1701A 2023Document3 pagesMiflores 1701A 2023catherine aleluyaNo ratings yet

- Bir Forms 1700Document3 pagesBir Forms 1700Tony Rose ArzagaNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- Bir Forms 1701Q 1701 2316 2307 1700Document11 pagesBir Forms 1701Q 1701 2316 2307 1700Geene CastroNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- 1701Q Jan 2018 Final Rev2Document2 pages1701Q Jan 2018 Final Rev2Balot EspinaNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationVincent John RigorNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationDeebees Marie Erazo TumulakNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument2 pages1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNo ratings yet

- POWIBA NOTICE CORPORATE TAX AssessmentDocument2 pagesPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNo ratings yet

- 1700 June 2013 Page 2Document1 page1700 June 2013 Page 2AdyNo ratings yet

- GSTR9 27aasfp7032r1za 032020Document9 pagesGSTR9 27aasfp7032r1za 032020sharad agarwalNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Clarysse Faye VidalloNo ratings yet

- 1701A Jan 2018 v5 With RatesDocument5 pages1701A Jan 2018 v5 With RatesGretchen CaasiNo ratings yet

- 1601c FormDocument8 pages1601c FormPingLomaadEdulanNo ratings yet

- GSTR4 06abops7789p1z8 2019-20Document3 pagesGSTR4 06abops7789p1z8 2019-20Suresh Kumar KumawatNo ratings yet

- 1701 Mixed TemplateDocument11 pages1701 Mixed TemplateDaniel B. MalillinNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- Post-Competency 13Document2 pagesPost-Competency 13John Lesther PabiloniaNo ratings yet

- Post-Competency 9 - General Botany (BSBIO1B-ABCamata)Document1 pagePost-Competency 9 - General Botany (BSBIO1B-ABCamata)John Lesther PabiloniaNo ratings yet

- Ceo QuizDocument1 pageCeo QuizJohn Lesther PabiloniaNo ratings yet

- Activity 11Document4 pagesActivity 11John Lesther PabiloniaNo ratings yet

- Video Advocacy On NationalismDocument3 pagesVideo Advocacy On NationalismJohn Lesther PabiloniaNo ratings yet

- Is A Large, Artificial Dam That Is Constructed With Natural Excavated Materials or Industrial Waste MaterialDocument2 pagesIs A Large, Artificial Dam That Is Constructed With Natural Excavated Materials or Industrial Waste MaterialJohn Lesther PabiloniaNo ratings yet

- In The Aftermath of Duterte's War: A Public Policy PerspectiveDocument31 pagesIn The Aftermath of Duterte's War: A Public Policy PerspectiveJohn Lesther PabiloniaNo ratings yet

- Topic 6.1 Government Service Insurance System: CoverageDocument3 pagesTopic 6.1 Government Service Insurance System: CoverageJohn Lesther PabiloniaNo ratings yet

- ScriptDocument6 pagesScriptJohn Lesther PabiloniaNo ratings yet

- Scholarship PacketDocument11 pagesScholarship PacketJohn Lesther PabiloniaNo ratings yet

- Activity Sheet On My PortraitDocument1 pageActivity Sheet On My PortraitJohn Lesther PabiloniaNo ratings yet

- Activity 4 - Worksheet On Formation of IonsDocument2 pagesActivity 4 - Worksheet On Formation of IonsJohn Lesther PabiloniaNo ratings yet

- TASKING RECORDS - GroupingsDocument6 pagesTASKING RECORDS - GroupingsJohn Lesther PabiloniaNo ratings yet

- Classic Pumpkin Pie Recipe InfographicDocument1 pageClassic Pumpkin Pie Recipe InfographicJohn Lesther PabiloniaNo ratings yet

- Go Fish Lab 2017Document3 pagesGo Fish Lab 2017John Lesther PabiloniaNo ratings yet

- Versatile Entity PDFDocument28 pagesVersatile Entity PDFJohn Lesther PabiloniaNo ratings yet

- Performance Task - Pabilonia - SC2CDocument18 pagesPerformance Task - Pabilonia - SC2CJohn Lesther PabiloniaNo ratings yet

- Classic Pumpkin Pie Recipe Infographic PDFDocument2 pagesClassic Pumpkin Pie Recipe Infographic PDFJohn Lesther PabiloniaNo ratings yet

- RRLDocument3 pagesRRLJohn Lesther PabiloniaNo ratings yet

- 2garog Chapter 2Document8 pages2garog Chapter 2John Lesther PabiloniaNo ratings yet

- Plant Reaction in Exposure To Various Liquids Which Affect Their GrowthDocument10 pagesPlant Reaction in Exposure To Various Liquids Which Affect Their GrowthJohn Lesther PabiloniaNo ratings yet

- Lesson PlanDocument1 pageLesson PlanJohn Lesther PabiloniaNo ratings yet

- NancyDocument1 pageNancyJohn Lesther PabiloniaNo ratings yet

- Daily Report WFH - Luky Dwiyanto - 20032020 PDFDocument1 pageDaily Report WFH - Luky Dwiyanto - 20032020 PDFLuky DwiyantoNo ratings yet

- SGC MembersDocument7 pagesSGC MembersCharity Anne Camille PenalozaNo ratings yet

- Julian, Mary Joy M. (03 Worksheet 1)Document3 pagesJulian, Mary Joy M. (03 Worksheet 1)Joysi JulianNo ratings yet

- Assignments 1 and 2 ACL 3632Document16 pagesAssignments 1 and 2 ACL 3632PetrinaNo ratings yet

- Florida Administrative CodeDocument64 pagesFlorida Administrative CodeGillianNo ratings yet

- Private Company Internal ControlsDocument4 pagesPrivate Company Internal ControlsRicky Marbun Lumban GaolNo ratings yet

- HSMC (RDAP) NOTES - Unit IIIDocument18 pagesHSMC (RDAP) NOTES - Unit IIIAkankshaguptaNo ratings yet

- FXZone - CJC Markets 100 USD Welcome Bonus - EdyDocument2 pagesFXZone - CJC Markets 100 USD Welcome Bonus - EdyIka Novita SariNo ratings yet

- Admin Law Practice Test-IiDocument17 pagesAdmin Law Practice Test-IiMohit KumarNo ratings yet

- Gorbachev PresentationDocument28 pagesGorbachev PresentationpoNo ratings yet

- Handouts in SS5Document21 pagesHandouts in SS5MariaMessiah FutotanaNo ratings yet

- Lesson PlanDocument7 pagesLesson Planapi-511274979No ratings yet

- Pasulka ARDC ComplaintDocument11 pagesPasulka ARDC ComplaintChris HackerNo ratings yet

- German CrisisDocument3 pagesGerman CrisisRăzvan NeculaNo ratings yet

- China Calls For Full Implementation of BRI Projects Free Malaysia Today (FMT)Document4 pagesChina Calls For Full Implementation of BRI Projects Free Malaysia Today (FMT)Fong KhNo ratings yet

- Six Educational Approaches To Conflict and PeaceDocument22 pagesSix Educational Approaches To Conflict and Peacefranciscorh1202No ratings yet

- A History of The Quynelds in Lancaster, Yorkshire and Hampshire From 1260 To 1413Document16 pagesA History of The Quynelds in Lancaster, Yorkshire and Hampshire From 1260 To 1413trevorskingle100% (1)

- 2022 Cookbook TOCDocument26 pages2022 Cookbook TOCViorel RodidealNo ratings yet

- Harris FileDocument33 pagesHarris Filethe kingfish100% (1)

- Activity #2 RiphDocument3 pagesActivity #2 RiphDanielle LosanesNo ratings yet

- Malayan VDocument9 pagesMalayan VoabeljeanmoniqueNo ratings yet

- After Occupy. Economic Democracy For The 21st CenturyDocument305 pagesAfter Occupy. Economic Democracy For The 21st CenturyjorgecierzoNo ratings yet

- Beti Bachao Beti PadhaoDocument6 pagesBeti Bachao Beti PadhaokulsudhirNo ratings yet