Professional Documents

Culture Documents

Estt Amendaments Leena

Uploaded by

ashwani kumar0 ratings0% found this document useful (0 votes)

6 views4 pagesas

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentas

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesEstt Amendaments Leena

Uploaded by

ashwani kumaras

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

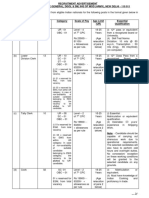

Sl.

Rules/ Chapter Changes/Amendments Rationale Provisions in Other CPSEs Remarks

No.

Travelling Allowance:

Allowances

A Clause 10.4.1: We can add “Transfer” To make it more specific

(Chapter - X)

in the given list

Employees on tour face

difficulty in getting hotel

Lodging charges need to

accommodation as per

be revised periodically,

their entitlement. For

say once in every two

example cities like Satara,

years.

which is under 'other

location', does not have

Dearness Allowance: Star rating as per

any company approved

Clause 10.5.2 (3): Lodging charges reputed online portal

hotel nor star category

fixed at each level for both specified such as Make my Trip,

hotel of ITDC and the

and other locations may be revised Trivago etc. should be

minimum rates which

considered for settling

they charge are in the

the bill. (as suggested

range of Rs. 2000-2500/- .

by Shri G. Krishna

The maximum lodging

Kumar, GM I/c, MECON,

amount fixed for this

Mumbai)

location is limited to Rs.

1700/- for E4 to E6 grade.

Forwarding of

Nothing is mentioned in

Applications of Applications from employees against SAIL: The manual has specified about

the manual of MECON in

Employees for whom disciplinary/judicial this case in one of its clause under

B such situation. We may

outside proceedings is pending can be "Forwarding of applications in

specify it for further

Employment included different situations".

clarity.

(XVII)

As per my knowledge

these advances are not

Is the House Building advance and given nowadays.

Grant of Advance

C advance for Motor Car purchase still Moreover, banks provide

to Employees (XI)

relevant? easy loans for the same

and employees can avail

it through banks easily.

Sl.

Rules/ Chapter Changes/Amendments Rationale Provisions in Other CPSEs Remarks

No.

D Transfer &

Benefits SAIL: Railway containers/one full 8

(Chapter-XIV) - wheeler wagon/one full truck or

Specifically container (Receipts to be produced)

regarding

transfer expenses NTPC: Transportation by road through

The Railway billing truck is as per the rate fixed by the

system is very old and we Company per km. They have fixed the

Transportation of personal effect: need to check for the rates grade wise and as per Transportation charges

Clause 14.3.2 (iii) which states that existing system. classification of cities. For example: for sending the personal

employees are entitled to actual Moreover, the diesel For X & Y class cities (as per Govt. of belonging from house at

expenditure on transportation of his prices have increased way India guidelines, at level E5, the rate is old HQ to Railway

personal effects by one full truck beyond which was Rs. 46.90 per km (.0078kg/km). For Station for loading in

through any contractor of our choice, prevailing at the time of goods train, weight of the goods in kgs the train is not included

on production of money receipts, making these rules. is fixed. in the transportation

limited to the cost of Railway Fare by Transportation of charges by Railway

Passenger train personal belongings by HAL: The actual expenditure incurred container. Same is the

Change/Amendment: Limitation may truck has become very shall be reimbursed subject to a case with charges at

be removed.The clause 14.3.2 may be expensive. Presently, the ceiling of twice the maximum amount new HQ for transporting

amended to railway containers/one cost of transportation by admissible for carrying the items by belongings from Railway

full 8 wheeler wagon/one full truck or truck is more than double Rail. Station to new

container the amount which is residence.

reimbursed. ONGC: may draw actual limited to full

(First-hand experience) truck admissible on transportation of

maximum entitled weight by goods

train and additional amount of not

more than 25% thereof. For goods

train, weight of the goods in kgs is

fixed.

Transportation of one 4-wheeler / 2 Same as above SAIL: By truck: Equivalent to

wheeler: passenger train freight charges.

Clause 14.3.3 (ii): By truck - limited to

passenger train freight charges NTPC: Transportation of vehicle (one

Sl.

Rules/ Chapter Changes/Amendments Rationale Provisions in Other CPSEs Remarks

No.

four-wheeler or two-wheeler) by

roadthrough carrier/truck shall be

reimbursed subject to maximum of Rs.

12.75 per km for 1000 km or Rs. 12.75

Change / Amendment: transportation

per km for actual distance, whichever

by road through truck may be as per

is more, subject to production of

some rate per km fixed after scanning

receipts of actual expenditure.

the market for the rates charged by

Movers & Packers.

ONGC: Reimbursement shall be at

rates fixed by Region/Corporate

Admn. in consultation with attached

finance or at actuals whichever is less.

Transportation of one 4-wheeler / 2 SAIL: if by own car, 3 road mileages

wheeler: (including transportation of car) based

Clause 14.3.3 (iii) which states on proof of travel

transportation of vehicle by own

propulsion limited to passenger train NTPC: For employees in E4 & above

freight. Also Clause 14.3.1 (c) states grades, the reimbursement shall be

Clarity to be provided in

an employee travelling in his own car restricted for one 4 wheeler to Rs.

the case of

on transfer will be paid (i) Actuals or 10/- per km through the shortest

transportation of

entitled road mileage for self and Same as above route + actual Toll taxes + Driver

vehicle by own, if clause

family subject to a maximum of charges @ Rs. 1500/- for each 500 km

14.3.3 (iii) is in addition

three road mileages, whichever is less of transport of conveyance or part

to clause 14.3.1 (c )

where the journey between two thereof on submission of receipt. For

places are not connected by rail/air (ii) other employees, reimbursement shall

Actuals or entitlements by rail/air be restricted to rates as per their

whichever is less where the journey entitlement given in the TA rules of

between two places are connected by the Company separately + actual toll

rail/air taxes against production of receipt.

Journey time:

Clause 14.6 (e ): instead of joining

time, journey time should be written.

Guest House accommodation: As per

the prevailing practice, provision

Sl.

Rules/ Chapter Changes/Amendments Rationale Provisions in Other CPSEs Remarks

No.

should be specified for free Guest

House accommodation on permanent

transfer for initial days (15 days), if

required.

To motivate employees to

Incentive Scheme

go for additional

for Acquiring

Old scheme of two increments for qualification. The fixed

Additional As suggested by Shri P.

additional qualification may be amount given presently is

E Educational/Prof Kumbhare, GM (Elect.),

implemented or the amount presently very less and cost of

essional MECON, Mumbai

given may revised. acquiring any

Qualifications

qualification is much

(Chapter-XXXI)

more.

You might also like

- Amendment No 56 To The SOP of RVNLDocument2 pagesAmendment No 56 To The SOP of RVNLRVNLPKG6B VBL-GTLM100% (1)

- Reimbursement Claim CircularDocument4 pagesReimbursement Claim CirculargovindNo ratings yet

- 3.VSP-67 - Addendum-2Document2 pages3.VSP-67 - Addendum-2Hitesh KoolwalNo ratings yet

- Army Recruitment 2023Document1 pageArmy Recruitment 2023bna24 newsNo ratings yet

- Given Cod Espe These Under Column Advertisement: ConcernedDocument2 pagesGiven Cod Espe These Under Column Advertisement: Concernedsaiqa farooqNo ratings yet

- Parcel BF QRDocument5 pagesParcel BF QRGunina GNo ratings yet

- Tendernotice 1Document13 pagesTendernotice 1harpinder.nitjNo ratings yet

- 3.3. Wage, Rent and ProfitDocument1 page3.3. Wage, Rent and ProfitMaria Fernanda Pedraza DiazNo ratings yet

- 110 of 1985 MaduraiDocument2 pages110 of 1985 MaduraiSomenath SinghNo ratings yet

- DisbursementDocument4 pagesDisbursementAhmed Abdel HamidNo ratings yet

- Solar Netmeter Flow ChartDocument1 pageSolar Netmeter Flow Chartvijay sagar ReddyNo ratings yet

- Pre-Bid Query Response - Cloud Services RFP - 20102023Document32 pagesPre-Bid Query Response - Cloud Services RFP - 20102023Anshuman MohantyNo ratings yet

- Recruitment Advertisement Additional Directorate General, Dgol & SM, Ihq of Mod (Army), New Delhi - 110 011Document7 pagesRecruitment Advertisement Additional Directorate General, Dgol & SM, Ihq of Mod (Army), New Delhi - 110 011pshantanu123No ratings yet

- Tendernotice 1Document13 pagesTendernotice 1harpinder.nitjNo ratings yet

- INSURANCE CORPORATION EMPLOYEES' STATE PROVIDES GUIDELINES ON RELEASE OF FUNDS FOR BUILDING REPAIRSDocument3 pagesINSURANCE CORPORATION EMPLOYEES' STATE PROVIDES GUIDELINES ON RELEASE OF FUNDS FOR BUILDING REPAIRSPavan JvNo ratings yet

- I&wd NadiaDocument3 pagesI&wd Nadiasvc.rphNo ratings yet

- Tendernotice 1Document13 pagesTendernotice 1harpinder.nitjNo ratings yet

- SOP MiscellaneousDocument20 pagesSOP MiscellaneousI KanthNo ratings yet

- DoP PreBid QuriesDocument2 pagesDoP PreBid Quriessaurav1206No ratings yet

- Application Form MsmeDocument3 pagesApplication Form Msmechandan4allNo ratings yet

- Trolley Path DeficiencyDocument89 pagesTrolley Path DeficiencyRam BabuNo ratings yet

- Commercial Proposal - RHR 20.03.2023Document4 pagesCommercial Proposal - RHR 20.03.2023JOhnNo ratings yet

- Gar 14a LegalDocument4 pagesGar 14a LegalpumkhawpauvaNo ratings yet

- Minutes of Prebid Meeting - Hirola RWSSDocument24 pagesMinutes of Prebid Meeting - Hirola RWSSgaurang22No ratings yet

- 2016 - 4 - Hppcltravelling Allowance FormDocument2 pages2016 - 4 - Hppcltravelling Allowance FormAkash SinghNo ratings yet

- FM-PX - Ca-Pw-00017 - 02 - C PDFDocument47 pagesFM-PX - Ca-Pw-00017 - 02 - C PDFBaha ShehadehNo ratings yet

- June, 2018Document9 pagesJune, 2018manas dasNo ratings yet

- Advertisement For WebsiteDocument12 pagesAdvertisement For Websitesandeep patilNo ratings yet

- Sex 3Document4 pagesSex 3ajitmirdha2008No ratings yet

- Tendernotice 1 PDFDocument47 pagesTendernotice 1 PDFgoutammandNo ratings yet

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Client Name: ExchangeDocument1 pageAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Client Name: ExchangeNithiyanantham BcomcaNo ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- Corrigendum To The Terms of Reference For Engagement of Transaction Adviser in NAFEDDocument7 pagesCorrigendum To The Terms of Reference For Engagement of Transaction Adviser in NAFEDdhanjeetsingh85No ratings yet

- Ebbill Compressed-1Document1 pageEbbill Compressed-1testNo ratings yet

- New Exchange/Segment Activation Request Form: To, Angel Broking LimitedDocument2 pagesNew Exchange/Segment Activation Request Form: To, Angel Broking LimitedasdfNo ratings yet

- Summary of ContractsDocument1 pageSummary of ContractsDang GVNo ratings yet

- Ta Da FormatDocument1 pageTa Da FormatVikram KanojiyaNo ratings yet

- GFORM - 015 Risk Assessment - HRDocument5 pagesGFORM - 015 Risk Assessment - HRsumanNo ratings yet

- Lessor Accounting (IFRS 16)Document1 pageLessor Accounting (IFRS 16)Innocent MakayaNo ratings yet

- Ifrs 15Document109 pagesIfrs 15gauravNo ratings yet

- Long-form article on India's reservation policy and asset monetization planDocument1 pageLong-form article on India's reservation policy and asset monetization plantesterNo ratings yet

- Price Change Visa Yolo JapanDocument1 pagePrice Change Visa Yolo JapanFatih FauzanNo ratings yet

- Meter Reading and Field Supervision Jobs Delhi Jal BoardDocument3 pagesMeter Reading and Field Supervision Jobs Delhi Jal BoardBhgfdNo ratings yet

- Tour Expense FormatDocument1 pageTour Expense FormatPreetam DashNo ratings yet

- Annual Report of IOCL 157Document1 pageAnnual Report of IOCL 157Nikunj ParmarNo ratings yet

- Tudy Buddy: Ifrs 15 - Revenue From Contracts With CustomersDocument2 pagesTudy Buddy: Ifrs 15 - Revenue From Contracts With CustomersAbdullah Al Amin MubinNo ratings yet

- Insights Into ECLDocument12 pagesInsights Into ECLHunal Kumar MautadinNo ratings yet

- DPA40093 MFRS123 Borrowing Cost Sesi II 2021 2022Document19 pagesDPA40093 MFRS123 Borrowing Cost Sesi II 2021 2022Ruzaini AhmadNo ratings yet

- NJLJ 080204 SpirgelDocument3 pagesNJLJ 080204 SpirgelflastergreenbergNo ratings yet

- Dalkhola MunicipalityDocument12 pagesDalkhola MunicipalityHarish Kumar MahavarNo ratings yet

- Tendernotice 1Document21 pagesTendernotice 1harpinder.nitjNo ratings yet

- Qery SwitchgearDocument42 pagesQery SwitchgearDeepak kumarNo ratings yet

- Transfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheDocument1 pageTransfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheRAHUL VIMALNo ratings yet

- RECRUITMENT ADVERTISEMENT FOR VARIOUS POSTSDocument5 pagesRECRUITMENT ADVERTISEMENT FOR VARIOUS POSTSTushar JadhavNo ratings yet

- Kaithal 2021-22 NEWDocument29 pagesKaithal 2021-22 NEWSHIVANIYA SINGHNo ratings yet

- Application Form For MSEsDocument6 pagesApplication Form For MSEshithimNo ratings yet

- Hand Receipt Voucher FormDocument1 pageHand Receipt Voucher FormJAIDEV PRASADNo ratings yet

- Let Us Recapitulate: I. Tax Deduction at SourceDocument16 pagesLet Us Recapitulate: I. Tax Deduction at SourceVishalNo ratings yet

- Cheat Sheet For Final Summary PDFDocument2 pagesCheat Sheet For Final Summary PDFQuy TranNo ratings yet

- YIFYStatus.comDocument1 pageYIFYStatus.comrishi reddyNo ratings yet

- YTS / YIFY Torrent Sites & ProxiesDocument1 pageYTS / YIFY Torrent Sites & ProxiesTindusNiobetoNo ratings yet

- Incentives Individual Incentives: 1) Piece Rate Work Plan I) Taylor's Differential Piece Rate System - F.W TaylorDocument6 pagesIncentives Individual Incentives: 1) Piece Rate Work Plan I) Taylor's Differential Piece Rate System - F.W Taylorashwani kumarNo ratings yet

- Maharani by Ruskin BondDocument87 pagesMaharani by Ruskin BondMehak Bhatia60% (5)

- Premature Retirement Policy - 24.11.21 - ProposedDocument5 pagesPremature Retirement Policy - 24.11.21 - Proposedashwani kumarNo ratings yet

- Comparison Pre Mature Retirement Policy 22.01.2022Document22 pagesComparison Pre Mature Retirement Policy 22.01.2022ashwani kumarNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash Memoashwani kumarNo ratings yet

- Estt Amendaments PragyaDocument1 pageEstt Amendaments Pragyaashwani kumarNo ratings yet

- Pre Mature Retirement Policy OLDDocument3 pagesPre Mature Retirement Policy OLDashwani kumarNo ratings yet

- Per Session 2 WB 1.0Document77 pagesPer Session 2 WB 1.0ashwani kumarNo ratings yet

- Torrent Downloaded From DemonoidDocument1 pageTorrent Downloaded From Demonoidmailas33No ratings yet

- This Is The File Made by Ashwani KumarDocument1 pageThis Is The File Made by Ashwani Kumarashwani kumarNo ratings yet

- Assadsd Asdsads AsddDocument1 pageAssadsd Asdsads Asddashwani kumarNo ratings yet

- 95 Topic For Tool Box TalkDocument125 pages95 Topic For Tool Box Talkanisaan75% (4)

- Fire StrategyDocument3 pagesFire StrategyMuros IntraNo ratings yet

- APT 2017 Time, Speed & Distance Worksheet with 25 QuestionsDocument26 pagesAPT 2017 Time, Speed & Distance Worksheet with 25 QuestionsTMD100% (1)

- Shopping CenterDocument14 pagesShopping Centertintinchan100% (1)

- Steel Post Thrie-Beam Guardrail (Modified Blockout) (Sgr09B)Document1 pageSteel Post Thrie-Beam Guardrail (Modified Blockout) (Sgr09B)jcvalenciaNo ratings yet

- SpeedhumpDocument1 pageSpeedhumpCarlos MakheleNo ratings yet

- Rfi Summary 21 June 2023 PKG 2Document2 pagesRfi Summary 21 June 2023 PKG 2gulshan giriNo ratings yet

- Bomber Crash Bransgore 1952Document3 pagesBomber Crash Bransgore 1952droshkyNo ratings yet

- Four Wheel, Three Mode Steering System - 3Document9 pagesFour Wheel, Three Mode Steering System - 3Tejzas Parab100% (1)

- Kia Optima HybridDocument2 pagesKia Optima HybridrOberT PaTelNo ratings yet

- Ac139 13Document14 pagesAc139 13AlfredoAlarconNo ratings yet

- Iloilo City Regulation Ordinance 2005-072Document5 pagesIloilo City Regulation Ordinance 2005-072Iloilo City CouncilNo ratings yet

- Paragraphs For Half Yearly Examination JSC-2020 Our School MagazineDocument4 pagesParagraphs For Half Yearly Examination JSC-2020 Our School MagazineAdolf HitlerNo ratings yet

- Product Range: A Quick ReferenceDocument44 pagesProduct Range: A Quick Referencewirat9wisawaNo ratings yet

- Electrical: 1. Regulatory PracticeDocument8 pagesElectrical: 1. Regulatory PracticeJoo LimNo ratings yet

- Panama Driving Test Questions 2020Document48 pagesPanama Driving Test Questions 2020ScribdTranslationsNo ratings yet

- O1. AcelDocument1 pageO1. AcelPreparation CELENo ratings yet

- PDF VehicleDocument9 pagesPDF Vehicleamateur123456No ratings yet

- Nia Up32gn 1236Document4 pagesNia Up32gn 1236Dheeraj PandeyNo ratings yet

- DIY Recumbent BikeDocument34 pagesDIY Recumbent Bikejfm70006688No ratings yet

- Hed Cycling Products: Tech ManualDocument44 pagesHed Cycling Products: Tech ManualyehNo ratings yet

- 5E Serija - BrosuraDocument8 pages5E Serija - BrosuraNina LaketicNo ratings yet

- GMMeffect PDFDocument12 pagesGMMeffect PDFram6265790No ratings yet

- Electric and water requirements for concrete batch plantDocument8 pagesElectric and water requirements for concrete batch plantWael WaelNo ratings yet

- Brinas VsDocument9 pagesBrinas VsClaribelle Dianne Rosales ManriqueNo ratings yet

- Q1 Mod 2 TVL Automotive Servicing Grade 12 For TeacherDocument19 pagesQ1 Mod 2 TVL Automotive Servicing Grade 12 For TeacherDarey ReyesNo ratings yet

- 1547708711खड्केटारि-पञ्चासे दोबिल्ला सडक DPR (Volume-1)Document134 pages1547708711खड्केटारि-पञ्चासे दोबिल्ला सडक DPR (Volume-1)Anil GautamNo ratings yet

- Grove GMK 4090aDocument12 pagesGrove GMK 4090aMarco Torres HenrriquezNo ratings yet

- IDOT Culvert Manual 2017Document157 pagesIDOT Culvert Manual 2017azsxdcfvgbNo ratings yet

- Dulegaunda Lamagaun 20 TH November 2018Document132 pagesDulegaunda Lamagaun 20 TH November 2018Deepak YadavNo ratings yet