Professional Documents

Culture Documents

Implications of The Rural Territorial Tax (RTT) On Brazilian Functionalized Property in Light of The 1988 Constitution

Implications of The Rural Territorial Tax (RTT) On Brazilian Functionalized Property in Light of The 1988 Constitution

Uploaded by

IJAERS JOURNALOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Implications of The Rural Territorial Tax (RTT) On Brazilian Functionalized Property in Light of The 1988 Constitution

Implications of The Rural Territorial Tax (RTT) On Brazilian Functionalized Property in Light of The 1988 Constitution

Uploaded by

IJAERS JOURNALCopyright:

Available Formats

International Journal of Advanced Engineering

Research and Science (IJAERS)

Peer-Reviewed Journal

ISSN: 2349-6495(P) | 2456-1908(O)

Vol-9, Issue-6; Jun, 2022

Journal Home Page Available: https://ijaers.com/

Article DOI: https://dx.doi.org/10.22161/ijaers.96.13

Implications of the rural territorial tax (RTT) on Brazilian

functionalized property in light of the 1988 Constitution

Orígenes Rosendo da Silva Neto1, Fabrício Muraro Novais2

1Master'sstudent at PPG - Postgraduate Program: Master's Degree in Agribusiness Law and Development at the University of Rio Verde

(UniRV); Specialist in Constitutional Law from the Federal University of Uberlândia (UFU); Graduated in Law from the University of

Uberaba (UNIUBE); College professor; Lawyer regularly registered with OAB/GO 44.830; e-mail origenesneto@gmail.com

2Doctor and Master in State Law from the Pontifical Catholic University of São Paulo (PUC/SP); Adjunct Professor at the State University

of Mato Grosso do Sul (UEMS) and Permanent Professor at the Professional Master's Program in Agribusiness Law and Development at

the University of Rio Verde (UniRV); Graduated in Law from the USP Law School (Largo São Francisco); former Assistant to the

President of the Federal Supreme Court (STF) and to the Minister of the Superior Court of Justice (STJ); e-mail:

fabriciomuraro@uol.com.br

Received: 12 May 2022, Abstract—This article aims to explore the basic characteristics of the

Received in revised form: 05 Jun 2022, Rural Territorial Tax - RTT - in Brazil, with a focus on achieving the

social function of property. For this, it aims to outline the main aspects of

Accepted: 10 Jun 2022,

the evolution of property rights around the globe, as well as in Brazil,

Available online: 15 Jun 2022 from the occupation of lands by the Portuguese Crown to modern times.

©2022 The Author(s). Published by AI The research method addressed is bibliographic, documentary, qualitative

Publication. This is an open access article and primarily deductive. Meanwhile, it narrates the property with

under the CC BY license inspiration in the ideals of liberalism and what are the consequences

(https://creativecommons.org/licenses/by/4.0/). arising from the development in the tax area. Therefore, it explores the

main nuances of the State's power to tax, especially with regard to the

Keywords—Property, Rural land tax, Social

RTT - when measuring the level of effectiveness of said tax, whether in its

Role, Tax extrafiscality.

fiscal or extrafiscality aspect, within the fundamental bias of the Federal

Constitution of 1988.

I. INTRODUCTION to man, its reflections on society, as well as revolving its

The property right, currently recognized by the Federal inspirations in liberal ideas.

Constitution of 1988 as a fundamental right, had a long In the meantime, the item is also dedicated to

path of development in order to arrive at the interpretations highlighting how the occupation and distribution of land in

that are correlated with it today. The owner-owner is Brazil, since the colonial period, had implications for

guaranteed his rights to private property, with the powers property on national soil, permeating a study based on the

that are inherent to him – to use, enjoy/enjoy, dispose of Land Law, the Brazilian Constitutions and the Statute of

and recover the thing, while also being subject to a legal Earth.

framework of duties to meet the so-called principle of In the item III, once the premises of property

social function of property. consolidation are overcome, the article focuses on the tax

The item II of this study proposes to delve into the issue inherent to it, specifically in rural property, through

preliminary aspects of the evolution of property around the the institution, regulation and collection of the RTT - Rural

globe, dealing with the main exponents of the theme in the Territorial Tax. For this, at first, it rescues concepts of

modern age, from the philosophers John Locke and taxation and its purposes in society, as well as the

Rousseau, who detailed basic characteristics, although Constitutional prediction and the limitations of the State to

with their distinctions, about the guarantee from property the power to tax.

www.ijaers.com Page | 136

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

Next,it will be demonstrated, through studies and from the formation of society itself, and for that very

research, which are the criteria for measuring the tax due reason, imposes a set of duties on the owner

on rural property, legislation and regulatory evolution, in (BARCELLOS, 2020, p. 89).

addition to inherent concepts, such as the definition of bare From the definitions espoused by these two of the

land value, degree of use of rural property, as well as the greatest exponents of the theory of property rights already

exceptions and incentives for the extrafiscality function of in the modern age, it is inferred that, within civil society,

the tax: preservation of native forest or cultivation of these with property there also emerges a question of

species, sustainable and adequate use of the environment, entitlements, about who can have something, to whom it

accessions (constructions, buildings), added to the belongs the right of ownership, which, in turn, implies

fulfillment of the social function of the land /property. possible social inequalities that also permeate the tax

In the item IV, as part of the conclusions, the paper system inherent to property (BARCELLOS, 2020, p. 78).

analyzes the consequences and the possible Locke's ideals emerge, as he understands that the

(in)effectiveness of the Rural Land Tax in Brazil through ownership of goods and the organization of the Liberal

data collected since the 1980s, to understand whether the State have freedom and equality as essential. When

tax is effective both in the fiscal and extrafiscality referring to capitalist society, it is notable that equality is a

functions. For this, it is still based on comparative law value that is at the heart of the concept of the Rule of Law,

research, in relation to the same type of rural tax, also so that everyone must be treated equally before the law. In

imposed in other countries. addition, private property proves to be fundamental for

carrying out free commercial transactions, and for pure

II. PROPERTY RIGHTS: HISTORICAL economic liberalism there should be no state intervention

DEVELOPMENT INCURSIONS in the economy, under penalty of distorting freedom and

private property (BARCELLOS, 2020, p. 93/96).

Man's relationship with the land goes back to the

beginnings of organized civilizations, because when Turning our gaze to the development of property in

leaving the characteristic of nomads and settling in certain Brazilian lands, it is necessary to pay attention to the

organized places for housing and cultivation, the nature of peculiarities of the occupation of the territory by the

possession and occupation arises, which modernly develop Portuguese Crown. At the time of the “discovery” of

in the right of property. that is conceived today. It is even Brazil, Portugal did not have enough dimension on the

verified that the idea of property, for some, exponent of the immense extension of land that covered the Colony,

philosopher John Locke, is a natural right of man, as therefore, in order to clear, demarcate, occupy, explore and

shown below. defend the new lands, a system of hereditary captaincies

was installed in which the donee captains held power over

Considering the modern age, Barcellos (2020, p.86)

a specific part of land.

mentions that when Locke develops the theme of property

rights, he does so with the understanding that property Fourteen hereditary captaincies were established,

encompasses the individual himself, in an absolute bias, distributed to those more fortunate and close to the

whose propagation takes place through the ideals of Portuguese Crown, with sufficient prestige and economic

liberalism. On the other hand, in contrast, based on power to try to carry out the mission that was incumbent

Rousseau's studies, Barcellos (2020, p.87) narrates that on them. However, even with the division into fourteen

property is embodied by a positive act of someone who portions of land, the territory was still more extensive than

occupies and exercises dominion over something, could be managed, which is why the captaincy system

attributing it as their own. failed.

In this vein, it is also observed that Rousseau From then on, to resolve the imbroglio, the Portuguese

establishes a premise by which the domination and Crown decided to import the Sesmarias institute to the

distribution of wealth, in greater or lesser amounts, to Colony from its Empire, although with different

specific groups, give rise to social inequalities, when it is characteristics, since on Brazilian soil, the Sesmarias

up to the State to intervene to balance the factual situation. letters were delivered so that new owners could occupy,

Meanwhile, Locke develops an ideal of the guarantee of explore, demarcate and defend the territory that was

property as inherent to the human being, including itself consigned to them, many times, until then, new and

along with the notion of life and freedom. Therefore, for “virgin” lands. Once again, permeating the inequalities

Rousseau, property is only recognized within civil society, that are perpetuated until today, the letters of Sesmarias

in such a way that there is no property without society. were delivered to the “friends of the King”, people with

While Locke marks property as a natural right, unlinked considerable wealth and power.

www.ijaers.com Page | 137

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

The Sesmarias system was also not successful in property must be subject to minimum criteria that serve the

Brazil, with sesmeiros who did not fulfill their obligations community, in addition to the owner himself.

to the Crown and other irregular occupations that spread Only after the Federal Constitution of 1988, however,

throughout the territory, until, shortly before the the property right, now considered as a fundamental right,

Independence of Brazil, still in 1822, Dom Pedro I starts to have a socialized function with greater clarity and

suspended the concession of new Sesmarias until the effectiveness regarding the measures to be taken by the

regulation of land occupation by the Constituent State in the fulfillment and effectiveness of the

Assembly. aforementioned principle. The idea of democracy is

Although the Imperial Constitution of Brazil, of 1824, strengthened, together with economic freedom and

dealt with the full right of property in its article 179, item contracting, with the guarantee of private property, but as

XXII, and providing for compensation for expropriation, long as it is based on basic principles of human dignity,

the fundamental letter did not effectively regulate the adequate exploitation of the environment and sustainable

situations already consolidated. That said, there was a development. The right to guarantee private property is not

period of time in Brazil from 1822 to 1850, called the withdrawn from the owner, but only combines the ideals of

tenure regime, without land occupation legislation or rights and duties of the individual with the community and

property rights that would bring legal certainty. which, therefore, justify the constitutional protection of the

It is in this period, with the Constitution of 1824, that State for the common good. In this vein, it can be inferred

the development of property rights in Brazil is understood, that the social function of property promotes a change in

whose first regulation was promoted by Law n. 601/1850 the right from “having property” to “being an owner”, with

(Land Law). the subjection of the characteristics and powers inherent to

the thing (BARCELLOS, 2020, p.113/115).

In the Brazilian context, the realization of lands also

led to the concentration of wealth and power in a small In summary, it appears that, in Brazil, following the

part of society, since occupations and sesmarias had parameters of implementation and development of

already been consolidated, a select elite group, which was property rights around the globe, despite the peculiarities

more aligned with the interests of the King, ended up be of Portuguese colonization, there is currently the guarantee

the most benefited, even by the lack of inspection in the of property as a fundamental right, in the terms espoused

colonial period and the precariousness of dominion titles. in art. 5, XXII, XXIII and art. 170, II, CF/1988. That is,

This situation, which should have been resolved by the property must serve a social function, subjecting its owner

Land Law by promoting the right to property, did not not only to the rights inherent to it (use, enjoy/enjoy,

obtain support from the agrarian elite, even because in the dispose of, recover), but also to the duties that advocate

following Magna Carta, the Republican Constitution of social justice for the community, uniting the economic

Brazil of 1891, the legal tax on rural properties was order, the environment, sustainable development, respect

provided for, a situation that was only addressed more for neighborhood rights and tax and labor legislation.

comprehensively in the Land Statute in 1964 (SIQUEIRA, For this reason, in terms of taxation, the institution and

2021, p.32/35). implementation of the Rural Territorial Tax - RTT,

In the meantime, around the world, due to the Second appears as an important instrument to coerce the owner in

World War, a new model of constitutionalism, with a more fulfilling the social function of the property, based on

social nature and, therefore, with room for interference in incentives to those who produce meeting the social

economic freedom, gained strength to be implemented, function and, on the other hand, on the other hand,

since it already had in the Mexican Constitution of 1917 encumbrance to those who do not satisfactorily meet such

and the German Constitution of 1919 (Weimar criteria (D'AGOSTIN and CATAPAN, 2020, p.03).

Constitution). From there, after the horrors of the world

wars, the 20th century had implications of ideals rooted in III. BASIC ASSUMPTIONS FOR REGULATION OF

social solidarity. That said, the paradigm of the Liberal THE RURAL TERRITORIAL TAX – RTT

State is changed to the Democratic State of Law, imbued

Taxation on immovable property, based on the right to

with transforming society, in an egalitarian process, which

property, or even possession, is an instrument used by

became known as the Welfare State (BARCELLOS, 2020,

various civilizations since ancient times. At that time, this

p.101/102).

type of tribute was generally instituted for purposes of tax

In terms of Brazil, with the enactment of the Land collection and also for land management, in order to

Statute, Law n. 4504/1964, there is a relevant regulation of consolidate and maintain dominion over a certain territory,

the institute of the social function of the land, by which the following the example of the Roman Empire and also,

www.ijaers.com Page | 138

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

more recently, by Napoleon. In Brazil, given the historical conquered rights: liberty, equality and property. In this

context of colonization and the resistance of the dominant vein, it is observed that property rights and taxation

agrarian elites, this type of taxation was postponed for a complement each other, since the State can only guarantee

long time (SIQUEIRA, 2021, p.48). its own bases, such as fundamental rights, through the

Humberto Ávila (2008, p.06) teaches that when required taxes, which finance them (BARCELLOS, 2020,

creating a tax there is a specified purpose within a p. . 152 and 170).

fundamental legal framework of the Federal Constitution In this wake, taxation should not be seen and rejected

of 1988, which advocates standardization through law, as depriving citizens of their rights, when, on the contrary,

guaranteeing legal certainty to the citizen by through the it is one of the ways to guarantee such foundations:

predictability and certainty of what will be charged (art. As seen, citizenship in the Democratic State

50, XXXVI), and the definition of time frames, such as the of Law can no longer be understood only as

limitation of the power to tax: the non-retroactivity of the the possession of rights, but rather as a

tax (art. 150, inc. III, a). Furthermore, it advocates the relationship of rights and duties. Within the

principle of precedence: in the case of social contributions scope of such duties, the fundamental duty

(art. 195, § 7), it is essential that they are instituted 90 days to pay taxes stands out, which has an

before collection (art. 195, § 7), while taxes can only be intimate connection with fundamental rights,

demanded if created until the end of the previous year (art. relating to them in three perspectives: the

150, item III, b). Complementarily, the author explains in guarantee against state power, the role of

more depth about the objectives of taxation: financing the cost of rights and, finally,

Taxation seeks to achieve certain purposes. acting as a mechanism for the realization of

These purposes can be analyzed from an fundamental rights. It can be said, then, that

extra-legal perspective, when examining the if democracy is compatible with the right to

causes that led the legislator to conform the property, which legitimizes inequalities - but

taxation in this or that way, or from a legal at the same time requires efforts to be made

perspective, in the event of investigating the to reduce them -, there is no violation of the

validity basis used to justify the taxation or right to property by adopting inequalities.

the distinction between taxpayers and the redistributive fiscal policies, as long as they

purpose that the distinction aims to achieve. are carried out in constitutional terms. The

This is because, since the justification and social function of property, which justifies

purpose of the distinction are different, the the inclusion of collective interests, is

legal interests that affect the subjects will be reflected in tax law with the recognition of

different and, by implication, the rules and the need to pay taxes, adding to it a link to

principles that will protect them will also be the constitutional project of transforming

different. (ÁVILA, 2008, p.06) reality. (BARCELLOS, 2020, p. 186)

Still in the objectification of taxes, Bach and De Having surpassed the basic premises in relation to

Andrade (2020, p.03) recall that the State, when creating a property taxation, we have that the RTT – Rural Territorial

new tax, primarily has the configuration called taxation, Tax was instituted in Brazil in the first Republican

that is, to seek collection purposes and with the purpose of Constitution in 1891 and today is based on art. 153, VI, of

raising funds. to promote public policies that are the Federal Constitution of 1988, and regulation in Law n.

necessary. On the other hand, there is also parafiscality, 9.393/1996. It is inferred that the RTT is imbued with both

when the tax is destined to the revenue of state-owned a taxation and extrafiscality function, since, in addition to

legal entities or linked to them. And yet, extrafiscality, raising funds, it also aims to encourage the owner in the

when the tax goes beyond the fiscal criterion, serving as a proper use of the land, attending to the social function, in

means of State intervention in the private economy and in order to avoid latifundia without production, as well as as

social relations, as is the case of the RTT - Rural real estate speculation. For this very reason, there is a

Territorial Tax. difference in the rates charged, so that unexplored rural

The idea of taxation related to the right to property properties have higher collection rates, according to

dates back to the ideals set out in the Declaration of the criteria of degree of use (D'AGOSTIN and CATAPAN,

Rights of Man and of the Citizen, dated 1789, in which it 2020, p.03/04).

was already foreseen that all citizens, according to their In order to understand the institution of the RTT in

possibilities, should contribute to the maintenance of Brazil and the method of calculation, it appears that the tax

www.ijaers.com Page | 139

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

was effectively created only in the military period, through exist, it will be classified in the municipality

the Land Statute, already providing for the collection and where most of the property is located.

extrafiscal character, in the sense that the progressiveness In addition, Cora et al (2020, p. 08) highlight the

of the collection rates was stipulated by the size and use of hypothesis of exemption from presenting the RTT for

the property. The creation of the RTT also aimed at a more those farmers who exploit land in up to 100 hectares, in

effective land regularization by allowing the identification addition to the specific cases of lots and settlements

and expropriation of unproductive rural properties. destined for agrarian reform, provided that the

However, the failures of the public power in the inspection requirements are met. basic legal criteria. Therefore, the

did not favor the effectiveness of the established objectives author explains how to calculate the tax due:

(SIQUEIRA, 2021, p.15/16).

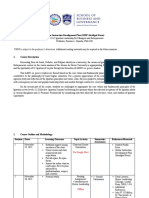

In order to carry out the calculation basis, it

A brief historical review shows that the RTT was is necessary to know what the Non-Taxable

originally provided for by the 1891 Constitution, with and Taxable Areas are, being able through

instituting competence attributed to the federated states. In this to identify means of how to carry out the

the 1946 Constitution, by Constitutional Amendment n. 5, calculation of the rural land tax. It is

the competence was conferred to the municipalities, but it necessary to know what bare land is and the

was soon modified again in 1964, during the military market value of the land, and bare land is the

period, transferring the competence of the RTT to the property by nature or natural accession,

Union, which was maintained in the current Magna Carta comprising the soil with its surface and the

of 1988. However, under the terms of art. 158, II, respective native forest, natural forest and

CF/1988, the inspection of the RTT is the responsibility of natural pasture. The RTT legislation adopts

the Union, but half of the collection is the right of the the same understanding as the civil

municipalities (art. 158, II, CF/1988). Another relevant legislation (BRASIL, 2012). According to

modification is the hypothesis that the municipalities and Law No. 9,393 (BRAZIL 1996) in its art. 8:

the Federal District establish an agreement with the “The Value of Terra Nua (VTN) is the

Federal Revenue Service so that the federated entity itself market value of the rural property, excluding

inspects and collects the entire RTT (art. 153, §4, III, market values related to: I - constructions,

CF/1988), provided that it does not constitute tax waiver or installations and improvements; II -

tax reduction (BACH and DE ANDRADE, 2020, p. 05). permanent and temporary cultures; III -

Regarding the incidence of the tax due, the provisions cultivated pastures. ” The Non-Taxable Area

of Law n. 9.393/1996, which gives the guidelines in is one that is determined by the Forests Code

relation to the RTT: and is protected for environmental

Art. 1 The Tax on Rural Territorial conservation. According to the Federal

Property - RTT, calculated annually, has as a Revenue's normative instruction, number

triggering event the property, useful domain 256, (BRASIL, 2002) the non -taxable areas

or possession of property by nature, located of rural property are: permanent

outside the urban area of the municipality, preservation; of legal reserve; of Private

on January 1 of each year. Natural Heritage Reserves of ecological

interest, thus declared by means of an act of

§ 1 The RTT is also levied on the

the competent federal or state agency, which

property declared to be of social interest for

are: ; and b) demonstrably useless for rural

the purposes of agrarian reform, as long as it

activity; of environmental easement; covered

is not transferred to the property, unless

by native, primary or secondary forests in a

there is a previous imposition of possession.

medium or advanced stage of natural

§ 2 For the purposes of this Law, rural regeneration and flooded for the purpose of

property is considered to be the continuous constituting a reservoir for hydroelectric

area, formed by one or more parcels of land, plants. According to Law No. 9,393, of

located in the rural area of the municipality. 1996, arts . 10, § 1, I and III, the RTT

§ 3 The property that belongs to more calculation basis is the Taxable Bare Land

than one municipality must be classified in Value (VTNt). The amount of the RTT to be

the municipality where the headquarters of paid is obtained by multiplying the VTNt by

the property is located and, if it does not the corresponding rate, considering the total

area and the degree of use (DU) of the rural

www.ijaers.com Page | 140

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

property. Degree of utilization is the for his life and that of his family in a dignified way, while

percentage ratio between the area effectively also conferring the contributory capacity of this citizen,

used by the rural activity and the usable area substantiating and justifying the reason for a specific tax,

of the rural property; constitutes a criterion, with the purpose, need, adequacy and proportionality of

together with the total area of the rural choice (ÁVILA, 2008, p.08/10)

property, for the determination of the RTT Considering these basic premises, when dealing with

rates. (CORA et al, 2020, p.09/10) property rights, an approach that focuses on the scope of

According to the calculation base adopted, for the the principle of the social function of land and property is

purpose of extrafiscality of the RTT, it is interesting to unavoidable. This is because functionalized property is

note that the occupied and preserved surface areas on the built in accordance with the daily actions of people

property are excluded from the taxable area, which should collectively, that is, at the same time that the Constitution

encourage the owner to maintain the native forest or even guarantees the right to property, it subjects the owner-

cultivate native species, regenerate areas that have suffered owner to a series of duties that meet, not only individual,

degradation, contributing to a sustainable and balanced but also benefits the whole society (BARCELLOS, 2020,

environment. In addition, the progressivity of the RTT is p. 122).

also supported, since the rates are defined according to a With regard to rural property, the social function is

proportionality between the size of the property and its embodied in allying the exploitation of the land in a

productivity, giving the degree of use (UD) of the property sustainable way, harmonizing the relationship between

(BACH and DE ANDRADE, 2020, p. 08/07). man and nature in the achievement of agricultural or even

For all the above, the institution of the RTT in the industrial activity that is developed in the place. In this

form of contribution with extrafiscality, shows itself as an vein, the Citizen Constitution elevated environmental

alternative permeated with good objectives and "could protection as one of its foundations, in such a way that

promote environmental preservation, stimulate economic sustainable development through a healthy and balanced

practices that generate income and work in the field, in environment must be shared with the economic order to

addition to ensuring that the social function of the earth meet the social function of property (CORA et al. al, 2020,

was fulfilled.” However, it has proved to be inefficient in p.03/04).

the Brazilian historical context, either due to the lack of For this reason, the taxation concerning the RTT –

regulatory legislation for long periods, the inefficiency in Rural Territorial Tax, takes into account environmental

the inspection and collection of the tax due or even the and sustainability criteria, including the Brazilian Forest

transfer of the State to the pressure of the ruling elites who Code:

aim not to change this scenario. Furthermore, if there were

From the study carried out, it can be

effectiveness and efficiency in the inspection of the RTT,

observed that through the Forest Code in

unproductive rural properties, kept for speculative

relation to the Rural Territorial Tax, the

purposes, could serve for expropriation for land

evidence found is that when the farmer

regularization purposes (SIQUEIRA, 2021, p.39).

fulfills the obligations related to the

environment, he can benefit from a

IV. SCOPE AND (IN) EFFECTIVENESS OF THE reduction in taxes, especially the Tax Rural

RURAL TERRITORIAL TAX (RTT) IN Territorial, thus being able to contribute to

BRAZIL: FROM TAXATION TO EXTRA- sustainability being of great value to

FISCALITY contribute to society. In order to have these

As previously exposed, the State's power to tax is benefits, it is necessary to preserve the areas,

constitutionally defined in specific situations regulated considered non-taxable in the declaration of

between articles 153 to 156 and other scattered ones. In the the territorial tax, being these areas the legal

model of the federative pact adopted in Brazil, the reserve and the permanent preservation areas

competence to tax can be of the Union, federated states, - APP, provided that these reserves are

municipalities or the Federal District. It is noteworthy that proven by suitable and skillful documents, in

taxation must adopt parameters of reasonableness and addition to the presentation of CAR. In order

proportionality, since it affects the legal circle of human to calculate the RTT calculation basis, it is

rights, such as freedom and private property, even if it is in necessary to know what the non-taxable and

order to preserve them. Therefore, the legislator taxable areas are, thus being able to identify

determines a minimum that is indispensable to the citizen the possible means for quantifying the rural

www.ijaers.com Page | 141

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

land tax. It is necessary to know what bare (2018, 2014, 2006, 2002, 1998), in 2017 the

land is and the market value of the land, bare collection amounted to R$ 1.418 billion

land is the property by nature or natural reais, which represents 0.06% of national tax

accession, comprising the soil with its revenue and 0.02% of the Domestic Product.

surface and the respective native forest, Brazilian Gross Domestic Product (GDP).

natural forest and natural pasture. The RTT This quotient has fluctuated, since 1990,

legislation adopts the same understanding as between less than 0.01% and 0.03% of GDP,

the civil legislation. (CORA et al, 2020, a record maintained in the 1996-1997

p.11). biennium. [...] On the other hand,

However, even with all the incentives, the RTT tax agribusiness, understood as the extension of

collection is very low in the national revenue, and still, the agricultural production chain, has great

taking into account its extrafiscality nature, it shows that weight in the formation of state reserves,

the Brazilian taxpayer has not felt sufficiently stimulated, equivalent to 21.4% of GDP (CNA, 2020).

since they permeate unproductive properties and without So much so that the wealth generated by this

developmental benefit, since the tax burden does not productive set is not limited to the fruits and

burden the taxpayer to the point of forcing him to meet the products of economic activity, but is

attributes of a social function. In addition, in reflected on the very surface on which it

environmental parameters, the taxpayer barely perceives develops: in this context, rural property

the correlation between the preservation of green areas on gains the quality of a speculative object.

his property and the value of the RTT, since these areas are The disparity in the amount of Brazilian collection,

subtracted, in proportion they occupy, for the calculation when it comes to the RTT, is even more evident when

of bare land, and by in turn, it has little impact on the tax compared to taxation on rural lands in other countries.

reduction value (BACH and DE ANDRADE, 2020, p. 12). While in Brazil, the RTT collection does not correspond to

The low RTT collection does not refer only to the more than 0.3% of the total, even in Latin America,

present day. As early as 1987, studies carried out by Uruguay and Chile, they collect, respectively, 6% and 4%.

Giffoni and Villela, found that the tax was inefficient in its In Anglo - Saxon America, both the United States and

fiscal function because properties were declared at a value Canada collect, on average, 5%. In Europe, in countries

much lower than what they actually corresponded to on the like France and Italy, the amount reaches 3% of the total

market. In the same sense, with regard to the extra-fiscal collected (D'AGOSTIN and CATAPAN, 2020, p.02).

function of the tax, even about 40 years after the The most diverse scholars on the subject attribute the

aforementioned study, the situation remains deteriorated: low RTT collection in Brazil to inspection or

there is no efficient inspection by the State, with the administrative factors, as Siqueira (2021, p.50) explains

consequent low adherence to providing the fulfillment of well:

the social function of property. So much so that, according Thus, due to the persistent evidence of its

to the 2017 Agricultural Census, 1% - one percent - of the low effectiveness, even after the different

establishments were large properties and corresponded to a regulations, one of the main obstacles to the

total of 47.6% of the entire area that was analyzed. This performance of the RTT is still associated

means that large landowners continue to concentrate land, with the self-declaration of the VTN by the

often without meeting the social function, and taxpayer, as it directly compromises the

maneuvering them into real estate speculation amount collected and, therefore, the

(BARCELLOS, 2020, p. 220). effectiveness of compliance of extrafiscality

Furthermore, when approaching the collection of the objectives. The declaration of the VTN by

RTT in its taxation function, Bach and De Andrade (2020, the taxpayer, in addition to compromising

p.09/10) explain in their studies the low impact that the tax the collection of the RTT, also generates

has on total national revenue, as well as, specifically, its other systemic failures, since, even if the

relation with the agribusiness sector: value is contested by public agents,

When analyzing the collection of the RTT resources are available in the legal sphere to

over recent years, it is clear that this tax is try to reverse these charges.

among those that generate the lowest Another approach that promotes failure in the approval

revenue for the State. According to data of the tax is also necessary, with the imperative that the

from the Brazilian Federal Revenue Service legislation authorizes the expropriation of unproductive

www.ijaers.com Page | 142

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

rural properties, according to art. 185, II, CF/1988. That instruments. effective in achieving the objectives assigned

said, there are taxpayers who tend to declare false to the tax, failing in the related regulatory and

information to increase the degree of use (DU) of the land administrative functions.

and, thereby, prevent an expropriation procedure, which

could even have the aim of promoting agrarian reform,

V. CONCLUSION

under the terms of art. 6 of Law no. 8.629/1993 (BACH

and DE ANDRADE, 2020, p. 15). Property consists of an essential right for the

development and evolution of the human species in

From this spectrum it is possible to conclude that the

society, whereas, for the famous philosopher John Locke,

RTT also did not prosper in Brazilian lands in the sense of

property would be a natural right, prior to man himself,

being used for land regularization, as allowed by the

elevating it as a right embedded in life and in the freedom

agrarian reform law. Considering that the concentration of

of man, which is denoted by influences of liberalism.

land in the country remains practically unchanged, in

addition to the fact that most of the national settlements On the other hand, Rousseau, also in the modern age,

did not materialize through consequences attributed to attributes to man the possibility of appropriating things and

fiscal issues, there is also the fact that the collection is having dominion over them, organizing himself in society,

inexpressive due to the lack of a system or cadaster that that is, property exists as a function of society.

integrate the characterization data of rural landowners and Both thinkers played a fundamental role in the

promote an efficient state inspection movement understanding of the aforementioned property right around

(SIQUEIRA, 2021, p.41/44). the world, even after the rise of the Welfare State, a

Meanwhile, aspects that are interconnected with the relevant model of State interference in private property

rural land tax collection rates are also out of step with the through fundamental constitutional norms that aimed at an

evolution of Brazilian society over the decades, as evolution in the human rights after the horrors of two

demonstrated in the research by Bach and De Andrade world wars.

(2020, p.15): In Brazil, given the aspects of Portuguese colonization,

Regarding the indices, it appears that the with irregular land occupations and lack of effective rules,

same ones established in 1975 are in force, the right to property emerges in the constitutional texts

without changes, in total mismatch with the from the Magna Carta of 1824, but takes greater emphasis

technological innovations of agribusiness with Law n. 601/1850 – Land Law.

and livestock activity (FRIAS; LEÃO, 2017, In the following Magna Carta, of 1891, there was

p. 15). As a result, it is possible to glimpse already a provision for the institution of a tax on rural

one of the reasons for the low collection and, properties, however, this rule did not really materialize

at the same time, a disincentive to the until the enactment of the Land Statute in 1964. It is

rational use of land in these criteria observed that the concentration of rural lands in the hands

established by the Federal Revenue Service. of an agrarian elite, with roots in the period of the Colony

An update of the minimum yields by 40%, and Empire of Brazil, was fundamental in not achieving a

reaching an average of 1.37 AU/ha, tax collection on rural lands, since, with the political

understood as similar to the contemporary influence of these actors and for financial and power

agricultural reality 32, without any other reasons, there was no interest in regularize the

change in the rules governing the ITR, aforementioned taxation.

would generate a collection of R$8.5 billion

With the regulation of the Rural Land Tax - RTT - in

(INSTITUTO ECHOLHAS, 2019, p. 42-44).

the Land Statute, two functions are denoted: the fiscal one,

In short, it is inferred that the Rural Territorial Tax - with the purpose of collecting funds for State investment

RTT - as established by Brazilian legislation, has a very in public policies and the extra-fiscal function, by which

small relationship with the total national tax collection, the objective was to encourage landowners to produce and

which, from now on, relatively mitigates its fiscal function exploit their lands in a sustainable way and in line with the

in a country whose territorial vastness is continental. On social function of property.

the other hand, in the extrafiscality aspect, the tax is not

It turns out that studies on the subject demonstrate

more successful either, since, although wrapped in

State failures in the inspection and collection of the RTT -

commendable grounds of adequacy of the land to a social

Rural Territorial Tax, considering that the method of

function and allied to the sustainable use of the

declaring the tax bases by the owner himself is deficient,

environment, the Brazilian State does not have inspection

often due to false information provided, in order to of

www.ijaers.com Page | 143

Neto et al. International Journal of Advanced Engineering Research and Science, 9(6)-2022

reducing the value of the tax or even inducing a false [5] BRAZIL. Law No. 601, of September 18, 1850. Provides

perception of a high degree of productivity of the property, for the vacant lands of the Empire. Available at:

which prevents an expropriation process for land reform <http://www.planalto.gov.br/ccivil_03/leis/l0601-

1850.htm>. Access on: 15 Sep. 2021

purposes.

[6] BRAZIL. Law No. 4,504, of November 30, 1964. Provides

In an analysis of a study compared with other for the Land Statute, and other provisions. Available at:

countries, whether in South America, North America or <http://www.planalto.gov.br/ccivil_03/leis/l4504.htm>.

Europe, it appears that the RTT collection in Brazil is Access on: 15 Sep. 2021

extremely small in relation to the total collected in the [7] CORÁ, ElisangelaFátima Andrade et al. Brazilian forest

country, being only about 0.3 per percent, while in other code and the benefits for the farmer in the rural land tax

declaration. Latin Orbis, v. 10, no. 3, p. 346-358, 2020.

nations, such as the United States and Canada, it is

Available at:

estimated, on average, 5%.

<https://revistas.unila.edu.br/orbis/article/view/2330 >.

As an instrument to guarantee property and other Access on: 15 Sep. 2021

fundamental rights, the State has the power to tax, with the [8] D'AGOSTIN, LineuErlei; CATAPAN, Anderson. Analysis

constitutional limitations that are inherent to it, and the of the effect of inspection of the social function of rural

RTT - Rural Territorial Tax is an instrument for tax properties on RTT collection. Grifos Magazine, v. 29, no.

48, p. 107-121, 2020. Available at:

collection - monetary - and also extrafiscality, that is, aims

<https://pegasus.unochapeco.edu.br/revistas/index.php/grifo

at objectives other than financial ones, such as

s/article/view/4978 > Accessed on: 15 Sep. 2021

encouraging the rational and sustainable use of land. [9] SIQUEIRA, Gabriel Pansani. The rural land tax as an

That said, weighing all the studies and research carried instrument of land management in Brazil. 2021. Available

out, it is observed that the State guarantees the right to at:

property, as one of its foundations, as long as it serves a <https://www.researchgate.net/publication/354708572_UNI

VERSIDADE_ESTADUAL_DE_CAMPINAS_INSTITUT

social function, serving the common good. However, when

O_DE_ECONOMIA_GABRIEL_PANSANI_SIQUEIRA_

verifying the scope of the RTT's effectiveness in this

O_IMPOSTO_TERRITORIAL_RURAL_ENQUANTO_U

context, normative and supervisory inefficiency is verified, M_INSTRUMENTO_DE_GESTAO_FUNDIARIA_NO_B

mitigating the relevance of the tax in the national scenario RASIL_Campinas_2021>. Access on: 14 Sep. 2021

as an instrument for tax collection or for the healthy

promotion of the social function of property.

REFERENCES

[1] AVILA, Humberto. Taxpayer Statute: content and scope.

Electronic Journal of Economic Administrative Law

(REDAE), Salvador, Brazilian Institute of Public Law, no.

12, November/December/January, 2008. Available at <

http://www.direitodoestado.com.br/redae.asp >. Accessed

on: Accessed on: 08 May.

[2] BACH, Gabriel Henrique Espiridiao Garcia; DE

ANDRADE, Thais Savedra. Fiscal and extrafiscal

ineffectiveness of the rural land property tax: possible

causes and legislative responses. PAIC notebook, v. 21, no.

1, p. 755-780, 2020. Available at: <

https://cadernopaic.fae.emnuvens.com.br/cadernopaic/article

/view/409 >. Access on: 14 Sep. 2021.

[3] BARCELLOS, Vinicius de Oliveira. Constitution, private

property and taxation: the possibility of adopting fiscal

policies aimed at sustainable development. Masters

dissertation. University of Vale do Rio dos Sinos –

UNISINOS. 2020. Available at: <

http://www.repositorio.jesuita.org.br/handle/UNISINOS/948

4 >. Access on: 13 Sep. 2021

[4] BRAZIL. [Constitution (1988)]. Constitution of the

Federative Republic of Brazil of 1988. Available at:

<http://www.planalto.gov.br/ccivil_03/constituicao/constitui

caocompilado.htm>. Access on: 14 Sep. 2021

www.ijaers.com Page | 144

You might also like

- Framework For Social Analysis: BSSW Department of Social Work College of Humanities and Social SciencesDocument12 pagesFramework For Social Analysis: BSSW Department of Social Work College of Humanities and Social SciencesAnnabelle Buenaflor87% (15)

- Culture and The Process of Social TransmissionDocument3 pagesCulture and The Process of Social TransmissionOliver AloyceNo ratings yet

- Mysteries of Capital or Mystification of Legal Property?Document6 pagesMysteries of Capital or Mystification of Legal Property?chanvierNo ratings yet

- The Mystery of Capital: Ruben AlvaradoDocument6 pagesThe Mystery of Capital: Ruben AlvaradoRuben AlvaradoNo ratings yet

- Taking Land Use Seriously Valverde 2005Document29 pagesTaking Land Use Seriously Valverde 2005Santiago González HernándezNo ratings yet

- Bouckaert What Is Property 1990 2Document28 pagesBouckaert What Is Property 1990 2Diogo AugustoNo ratings yet

- Bright Susan Land Law Themes and Perspectives Pp457 486Document29 pagesBright Susan Land Law Themes and Perspectives Pp457 486farroohaahmedNo ratings yet

- Ferry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireDocument21 pagesFerry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireFerdinandAlxNo ratings yet

- Orum, A.M. and Gatica, Y.C. (2022) - Zoning.Document5 pagesOrum, A.M. and Gatica, Y.C. (2022) - Zoning.educat1991No ratings yet

- Bringing The Concept of Property As A Social Function Into The Housing Debate - The Case of PortugalDocument21 pagesBringing The Concept of Property As A Social Function Into The Housing Debate - The Case of PortugalFelipe QueirozNo ratings yet

- Brazil 2013 WB Land and PovertyDocument36 pagesBrazil 2013 WB Land and PovertyGlobal Housing Policy IndicatorsNo ratings yet

- Legal Certainty in Providing Certificate of Land Rights From The Ministry of Justice Based On Law Number 13, 2017Document6 pagesLegal Certainty in Providing Certificate of Land Rights From The Ministry of Justice Based On Law Number 13, 2017IJAR JOURNALNo ratings yet

- A. Methodology: Condominium ActDocument13 pagesA. Methodology: Condominium ActPrei BaltazarNo ratings yet

- 29IJAERS 1220204 CO2Capture PDFDocument8 pages29IJAERS 1220204 CO2Capture PDFIJAERS JOURNALNo ratings yet

- Sukhamrit Singh Sec-A Property 8031 PAPERDocument8 pagesSukhamrit Singh Sec-A Property 8031 PAPERSukhamrit Singh ALS, NoidaNo ratings yet

- Seminar Paper: Scope of Patent RightsDocument26 pagesSeminar Paper: Scope of Patent RightsSaharsh ChitranshNo ratings yet

- Kasala Essay4Document5 pagesKasala Essay4jenkasalaNo ratings yet

- 2022 Geopolitics and The Constitution in Light of The Democratic Constitutional StateDocument24 pages2022 Geopolitics and The Constitution in Light of The Democratic Constitutional StategoesguilhermesandovalNo ratings yet

- Herald 1Document6 pagesHerald 1Fatima MufNo ratings yet

- Superficie Rights and Usufruct in Cuba - Are They Real Title InsuDocument19 pagesSuperficie Rights and Usufruct in Cuba - Are They Real Title InsuAdrian NYNo ratings yet

- Human Rights - Major Legal IssuesDocument21 pagesHuman Rights - Major Legal Issuesapi-710208868No ratings yet

- Research Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowDocument12 pagesResearch Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowshubhamNo ratings yet

- Territorios e TerritorialidadesDocument6 pagesTerritorios e TerritorialidadesNathalia Claro MoreiraNo ratings yet

- The Social Imaginary of Home Ownership and Its Effects: Reflections About Real State in BrazilDocument19 pagesThe Social Imaginary of Home Ownership and Its Effects: Reflections About Real State in BrazilAzul AraújoNo ratings yet

- Intellectual Property and Criminal Law PDFDocument291 pagesIntellectual Property and Criminal Law PDFkirtikaushik100% (1)

- LABOR LAW 1 Lesson 2Document21 pagesLABOR LAW 1 Lesson 2Henrick YsonNo ratings yet

- 125973309Document6 pages125973309lelaram thiyagarajanNo ratings yet

- Catastro Nacional-ColombiaDocument22 pagesCatastro Nacional-ColombiaSamuel Andrés Pérez CastiblancoNo ratings yet

- Fundamental Concepts of The Roman Law Author(s) : Max Radin Source: California Law Review, Mar., 1925, Vol. 13, No. 3 (Mar., 1925), Pp. 207-228 Published By: California Law Review, IncDocument23 pagesFundamental Concepts of The Roman Law Author(s) : Max Radin Source: California Law Review, Mar., 1925, Vol. 13, No. 3 (Mar., 1925), Pp. 207-228 Published By: California Law Review, IncNaomi VimbaiNo ratings yet

- The Right of State Ownership in The Civil Law of Foreign CountriesDocument33 pagesThe Right of State Ownership in The Civil Law of Foreign CountriesІрина Костянтинівна МалихінаNo ratings yet

- Analysis of The Concept of Heritage in Legal Terms: Viorica Ursu, Natalia Chiriac, Ina BostanDocument7 pagesAnalysis of The Concept of Heritage in Legal Terms: Viorica Ursu, Natalia Chiriac, Ina BostanNatalia ChiriacNo ratings yet

- Claiming The Streets. Property Rights and Legal Empowerment in The Urban Informal EconomyDocument11 pagesClaiming The Streets. Property Rights and Legal Empowerment in The Urban Informal EconomySa AngelicaNo ratings yet

- Financialization and Land Aquisitions June 2017Document32 pagesFinancialization and Land Aquisitions June 2017JM Vazquez GNo ratings yet

- Identifies Identities Der: Good Society. These Accounts Invoke The Language of Values - Which As An Important ElementDocument7 pagesIdentifies Identities Der: Good Society. These Accounts Invoke The Language of Values - Which As An Important ElementchiahaoguangNo ratings yet

- Legal Pluralism and Urban Land Tenure in India: ArticleDocument12 pagesLegal Pluralism and Urban Land Tenure in India: ArticleShikafaNo ratings yet

- MukhopadhyayDocument30 pagesMukhopadhyaypRice88No ratings yet

- Moderntrendsinlawoftorts 1Document11 pagesModerntrendsinlawoftorts 1aishaliNo ratings yet

- 7 2 Grover PDFDocument16 pages7 2 Grover PDFFerdy NugrahaNo ratings yet

- Archives and Property PDFDocument69 pagesArchives and Property PDFlavanNo ratings yet

- Sánchez Talanquer 2020Document29 pagesSánchez Talanquer 2020Gonzalo AssusaNo ratings yet

- Tee Project Land LawDocument29 pagesTee Project Land LawSaumya MotwaniNo ratings yet

- Taxation On The Preservation of PropertyDocument13 pagesTaxation On The Preservation of PropertyBiboy Armada RapistaNo ratings yet

- Guido v. Rural Progress Admin.Document5 pagesGuido v. Rural Progress Admin.glee0% (1)

- Ergen Y. An Overview of Urban and Regional Planning 2018Document173 pagesErgen Y. An Overview of Urban and Regional Planning 2018Hassan MarjiNo ratings yet

- Landscapes of Disposs - MenesesDocument15 pagesLandscapes of Disposs - MenesesRodrigo MenesesNo ratings yet

- Lawyers As Constructive IdeologistsDocument25 pagesLawyers As Constructive IdeologistsAluvusi RolexNo ratings yet

- Public Ownership of Urban LandDocument15 pagesPublic Ownership of Urban LandEDWARD BOTNo ratings yet

- Continued Eminent DomainDocument46 pagesContinued Eminent DomainMary Arabella MaluendaNo ratings yet

- Module 1. Translation and Writing Exercise.Document9 pagesModule 1. Translation and Writing Exercise.Mario GonzalezNo ratings yet

- 1JCULP111Document21 pages1JCULP111MUCIRI BRIAN WAWERUNo ratings yet

- Notes From The Mystery of Capital by Hernando DeSotoDocument8 pagesNotes From The Mystery of Capital by Hernando DeSotoPete Rodrigue100% (1)

- Kchrist6, C26gambaro4Document35 pagesKchrist6, C26gambaro4MinjinNo ratings yet

- Guido Vs RpaDocument5 pagesGuido Vs RpaKooking JubiloNo ratings yet

- Reforma EnerDocument16 pagesReforma EnerYiritzyMendiolaNo ratings yet

- Guido Vs Rural Progress AdministrationDocument11 pagesGuido Vs Rural Progress AdministrationMaphile Mae CanenciaNo ratings yet

- EC - 2019 A Different Kind of Formal Bottom-Up State-Making in Small-Scale Gold Mining Regions in Chocó, ColombiaDocument11 pagesEC - 2019 A Different Kind of Formal Bottom-Up State-Making in Small-Scale Gold Mining Regions in Chocó, ColombiaAna PaulaNo ratings yet

- 103 Lai 2015 HIDocument9 pages103 Lai 2015 HIklasek04No ratings yet

- LLB Dissertation ExamplesDocument6 pagesLLB Dissertation ExamplesWriteMyNursingPaperCanada100% (1)

- Ugo Mattei Excerpt Market State and CommonsDocument5 pagesUgo Mattei Excerpt Market State and CommonssaironweNo ratings yet

- Title To Territory in Int' LawDocument9 pagesTitle To Territory in Int' LawKELVIN A JOHNNo ratings yet

- Beef Cattle Farmers' Economic Behavior in The Minahasa Tenggara Regency, IndonesiaDocument7 pagesBeef Cattle Farmers' Economic Behavior in The Minahasa Tenggara Regency, IndonesiaIJAERS JOURNALNo ratings yet

- Analysis Damage To The Inpres Elementary School Building Village Asilulu Central Maluku RegencyDocument5 pagesAnalysis Damage To The Inpres Elementary School Building Village Asilulu Central Maluku RegencyIJAERS JOURNALNo ratings yet

- The Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaDocument4 pagesThe Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaIJAERS JOURNALNo ratings yet

- Playfulness in Early Childhood EducationDocument7 pagesPlayfulness in Early Childhood EducationIJAERS JOURNALNo ratings yet

- Business Logistics and The Relationship With Organizational SuccessDocument4 pagesBusiness Logistics and The Relationship With Organizational SuccessIJAERS JOURNALNo ratings yet

- Breastfeeding and Factors Associated With The Prevention of Childhood Obesity: An Integrative Literature ReviewDocument16 pagesBreastfeeding and Factors Associated With The Prevention of Childhood Obesity: An Integrative Literature ReviewIJAERS JOURNALNo ratings yet

- Climatic Rhythms and Prevalence of Malaria in The Municipality of Sinende in Northern BeninDocument8 pagesClimatic Rhythms and Prevalence of Malaria in The Municipality of Sinende in Northern BeninIJAERS JOURNALNo ratings yet

- Analysis of The Thermal Behavior of Masonry Concrete Block With Internal Natural Element CoatingDocument11 pagesAnalysis of The Thermal Behavior of Masonry Concrete Block With Internal Natural Element CoatingIJAERS JOURNALNo ratings yet

- Impacts On The Mental Health of Professionals in A Prisonal System in Alagoas During The Covid-19 PandemicDocument7 pagesImpacts On The Mental Health of Professionals in A Prisonal System in Alagoas During The Covid-19 PandemicIJAERS JOURNALNo ratings yet

- Enhancing Cybersecurity: The Power of Artificial Intelligence in Threat Detection and PreventionDocument6 pagesEnhancing Cybersecurity: The Power of Artificial Intelligence in Threat Detection and PreventionIJAERS JOURNALNo ratings yet

- Constructed Wetlands: Technology For Removing Drug Concentration From WaterDocument12 pagesConstructed Wetlands: Technology For Removing Drug Concentration From WaterIJAERS JOURNALNo ratings yet

- Study of The Extraction Process of The Pleurotus Citrinopileatus Mushroom and Evaluation of The Biological Activity of The ExtractDocument8 pagesStudy of The Extraction Process of The Pleurotus Citrinopileatus Mushroom and Evaluation of The Biological Activity of The ExtractIJAERS JOURNALNo ratings yet

- Water Quality Assessment Using GIS Based Multi-Criteria Evaluation (MCE) and Analytical Hierarchy Process (AHP) Methods in Yenagoa Bayelsa State, NigeriaDocument11 pagesWater Quality Assessment Using GIS Based Multi-Criteria Evaluation (MCE) and Analytical Hierarchy Process (AHP) Methods in Yenagoa Bayelsa State, NigeriaIJAERS JOURNALNo ratings yet

- Childhood/ Pediatric Cancer: Nursing Care in Oncopediatrics With A Central Focus On HumanizationDocument12 pagesChildhood/ Pediatric Cancer: Nursing Care in Oncopediatrics With A Central Focus On HumanizationIJAERS JOURNALNo ratings yet

- Associativism As Strategy of Reaching Territorial Rights, Programs, Projects and Public Policies of Rural Development: The Case of The São Francisco Do Mainã Community, Manaus, AMDocument9 pagesAssociativism As Strategy of Reaching Territorial Rights, Programs, Projects and Public Policies of Rural Development: The Case of The São Francisco Do Mainã Community, Manaus, AMIJAERS JOURNALNo ratings yet

- Design and Building of Servo Motor Portable Coconut Peller MachineDocument5 pagesDesign and Building of Servo Motor Portable Coconut Peller MachineIJAERS JOURNALNo ratings yet

- VCO Rancidity Analysis Refers To Fermentation Time That Produced by Gradual Heating MethodDocument6 pagesVCO Rancidity Analysis Refers To Fermentation Time That Produced by Gradual Heating MethodIJAERS JOURNAL100% (1)

- Mining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaDocument7 pagesMining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaIJAERS JOURNALNo ratings yet

- Morphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaDocument9 pagesMorphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaIJAERS JOURNALNo ratings yet

- Komla Uwolowudu Amegna: International Journal of Advanced Engineering Research and Science (IJAERS)Document9 pagesKomla Uwolowudu Amegna: International Journal of Advanced Engineering Research and Science (IJAERS)IJAERS JOURNALNo ratings yet

- Process Sequence Optimization and Structural Analysis of Nanoscale Heterostructure Using Compound Semiconductors AlAsSb/In0.59Ga0.41As/GaAs0.53Sb0.47Document5 pagesProcess Sequence Optimization and Structural Analysis of Nanoscale Heterostructure Using Compound Semiconductors AlAsSb/In0.59Ga0.41As/GaAs0.53Sb0.47IJAERS JOURNALNo ratings yet

- Multiprofessional Care For A Patient With Gestational DiabetesDocument12 pagesMultiprofessional Care For A Patient With Gestational DiabetesIJAERS JOURNALNo ratings yet

- Association of Bacterial Vaginosis To Atypia in Squamous Cells of The CervixDocument15 pagesAssociation of Bacterial Vaginosis To Atypia in Squamous Cells of The CervixIJAERS JOURNALNo ratings yet

- Sociodemographic and Clinical Profile of Women With Uterine Cervical Cancer Attended in An Oncological Hospital in The State of Acre, BrazilDocument9 pagesSociodemographic and Clinical Profile of Women With Uterine Cervical Cancer Attended in An Oncological Hospital in The State of Acre, BrazilIJAERS JOURNALNo ratings yet

- Humanization in Undergraduate Medical Education: The Brazilian Learner's PerspectiveDocument12 pagesHumanization in Undergraduate Medical Education: The Brazilian Learner's PerspectiveIJAERS JOURNALNo ratings yet

- Modeling of Geological and Geophysical Data, Onshore Field of Potiguar Basin, Northeastern BrazilDocument5 pagesModeling of Geological and Geophysical Data, Onshore Field of Potiguar Basin, Northeastern BrazilIJAERS JOURNALNo ratings yet

- Assessment of The Risk of Cardiovascular Diseases and Its Relationship With Heart Rate Variability in Physically Active and Sedentary IndividualsDocument13 pagesAssessment of The Risk of Cardiovascular Diseases and Its Relationship With Heart Rate Variability in Physically Active and Sedentary IndividualsIJAERS JOURNALNo ratings yet

- Detection and Control of Bacterial BiofilmsDocument15 pagesDetection and Control of Bacterial BiofilmsIJAERS JOURNALNo ratings yet

- The Psychologist's Role in The Process of Listening To Children Victims of Sexual Violence in Legal ProceedingsDocument8 pagesThe Psychologist's Role in The Process of Listening To Children Victims of Sexual Violence in Legal ProceedingsIJAERS JOURNALNo ratings yet

- Does Blended Learning Approach Affect Madrasa Students English Writing Errors? A Comparative StudyDocument12 pagesDoes Blended Learning Approach Affect Madrasa Students English Writing Errors? A Comparative StudyIJAERS JOURNALNo ratings yet

- Assignment 2 Chapter Review Case StudyDocument9 pagesAssignment 2 Chapter Review Case StudySameer RehmaniNo ratings yet

- PT ProcedureDocument12 pagesPT ProcedureLuong Ho VuNo ratings yet

- Impact Newsletter 2022-JAN EDITIONDocument14 pagesImpact Newsletter 2022-JAN EDITIONSegaran ChandrakumaranNo ratings yet

- FitzPatrick (1960) Leading British Statisticians of The Nineteenth CenturyDocument34 pagesFitzPatrick (1960) Leading British Statisticians of The Nineteenth CenturylittleconspiratorNo ratings yet

- UntitledDocument2 pagesUntitledJoshua Ciano(Cordial)No ratings yet

- Answer SheetDocument6 pagesAnswer SheetCo MattNo ratings yet

- Nietzsche and Weber On Personality and DDocument15 pagesNietzsche and Weber On Personality and DF. ANo ratings yet

- Role of Law in Society and Legal PractitionersDocument2 pagesRole of Law in Society and Legal PractitionersOBERT CHIBUYE100% (1)

- PI 10 Maret 2023Document3 pagesPI 10 Maret 2023Andy WasonoNo ratings yet

- Fraternalism and FreemasonryDocument19 pagesFraternalism and FreemasonryLuxis Pub100% (1)

- EthicsDocument6 pagesEthicsCess UrrizaNo ratings yet

- TrainingDocument16 pagesTrainingMubasher Hassan RaajaNo ratings yet

- The History of Baba Nyonya PeopleDocument2 pagesThe History of Baba Nyonya PeopleWan DalilaNo ratings yet

- Reflection - The Count of Monte CristoDocument1 pageReflection - The Count of Monte CristoDaryl Tabogoc75% (4)

- Online Instruction Development Plan Revised 2022Document8 pagesOnline Instruction Development Plan Revised 2022Mona ell sinderNo ratings yet

- The Road To (I) Dentity in Narrative of The Life of Frederick Douglass, An AmericanDocument16 pagesThe Road To (I) Dentity in Narrative of The Life of Frederick Douglass, An AmericanBobNathanaelNo ratings yet

- Mapa MNA Mediacarta InglesDocument2 pagesMapa MNA Mediacarta InglesRocío Alejandra González CortésNo ratings yet

- Ethics and Social Responsibility in International Business ExerciseDocument7 pagesEthics and Social Responsibility in International Business ExerciseJenniffer Cortez TagleNo ratings yet

- Social Structure in Early Sumi Naga SocietyDocument4 pagesSocial Structure in Early Sumi Naga SocietyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ottam TullalDocument7 pagesOttam TullalRawson Anthony GonsalvesNo ratings yet

- Parent Consent LetterDocument2 pagesParent Consent LetterGrivialde, Antonette B.No ratings yet

- Module 6 - Ucsp - Week 6Document29 pagesModule 6 - Ucsp - Week 6nathaniel nuevaNo ratings yet

- IPHP 2ND Quarter ReviewerDocument5 pagesIPHP 2ND Quarter ReviewerRosa Divina ItemNo ratings yet

- Psir MainDocument79 pagesPsir MainIAMSAJAN5No ratings yet

- Discuss Ibsen Ghosts as a Play of Ethical Rather Than Physical Debility.Document1 pageDiscuss Ibsen Ghosts as a Play of Ethical Rather Than Physical Debility.informaluse47No ratings yet

- Makdisi 2004Document17 pagesMakdisi 2004aidaniumonlineNo ratings yet

- Almaamory 2021 IOP Conf. Ser. Mater. Sci. Eng. 1090 012119Document14 pagesAlmaamory 2021 IOP Conf. Ser. Mater. Sci. Eng. 1090 012119Sheikh Abdullah SaeedNo ratings yet

- Kartilya NG Katipunan HistoryDocument2 pagesKartilya NG Katipunan HistoryRuby Jona Resuello FaderaNo ratings yet