Professional Documents

Culture Documents

Falcon Commercials - Plantix - Program Commercials

Uploaded by

Mohit YadavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Falcon Commercials - Plantix - Program Commercials

Uploaded by

Mohit YadavCopyright:

Available Formats

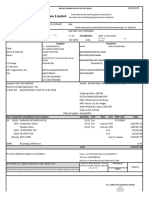

Falcon Commercials - Plantix

Commercials: Co-branded Prepaid Card Program

S No. Line Item Scope & Description Applicable Amount (INR) Payment Terms / Frequency Plantix Comment

1 Partner Account Setup

Falcon Card issuance and management platform

Card processing platform (including card host, processing) - One-time for program set up and go We are ok with the amount and will pay the same

Physical and Digital Card Issuance on 50-50 basis. Will pay 50% amount after the

Card account generation, hosting, Rupay / Visa / Mastercard live efforts and API-based integrations agreement and pay rest once we start the

Platform;

connectivity and life cycle management with bank INR 5,00,000 200,000 with partner systems partnership.

A Payment Processing; Mandatory

Back office support including recon, chargeback processing, etc. - Partner shall pay one-time fee at the

BIN & Relationship Management with

Multiwallet product set up, API-based integration for 3D secure time of signing of this agreement

Partner Bank

password authentication - Work shall commence after fee is paid.

KYC platform and verification services

2 Monthly Platform Subscription

- To be invoiced monthly - We are not okay with the fixed amount. Let’s

0 to 3rd month (Cooling off period): NIL keep this as a certain percentage of volume.

Monthly minimum fees, mutually agreed upon with the Partner, to - To be adjusted in Falcon’s

A Monthly Minimum Billing Mandatory 4th to 12th month: INR 25,000 PM

be paid based on volume commitments interchange revenue share if client

13th month onwards: INR 50,000 PM

meets monthly volume commitments

3 User Fees

Minimum KYC – NIL - There should be no fee for KYC (OTP-

eKYC (OTP-based Aadhaar KYC) - INR 5 Based). As we are not comfortable for the

same.

(inclusive of taxes)

Per user, one-time. - We are ok with biometric KYC.

A User KYC Multiple KYC options are available based on the client’s preference. Mandatory cKYC – INR 4

*CKYC cost may vary

Biometric KYC - Device Cost INR 2500

(One time) + INR 250 (Yearly)

At actuals There should be no fee.

B NEFT/IMPS/UPI Connectivity to bank’s pipelines for money transfers Optional Per transaction fee

INR 5

Standard Per Card cost for GPR EMV card No fee should be applicable

is as follows: - Cards to be procured by Falcon on

10K: INR 50 behalf of the client.

10K – 25K: INR 48 - Minimum order quantity for co-branded

Physical Co-branded Cards: EMV (GPR); Magstripe (Gift

25K – 50K: INR 46 cards is 10,000.

C Card Procurement Card); NCMC; procured with welcome letter, envelope, and Optional

>50K – 1 lac: INR 44 - Courier cost shall be borne by the client

bank T&C Virtual Cards: delivered to front end app / portal

1 lac+: TBD for delivering cards to end users.

through APIs

- Card kit cost will be extra based on

Note: Card cost may differ based on the extent of the customization

quantity and quality chosed by the client.

4 Transaction Fees

A ATM Withdrawal Charged at actuals by the banking partner Optional INR 22 - Per transaction success or fail No charges on ATM withdrawal

ATM Inquiry (Balance No charges for enquiry

B For user to check Balance and Transaction history at physical ATM Optional INR 5

and Transaction History)

Chargeback / Dispute - Processing of a dispute by a cardholder It should be as minimal as INR 5 to 10.

C Charged by network Mandatory INR 35

Processing / Investigations Fee with network

D ACS/3D Secure Fee Charged for ecomm transactions 3D secure gateway Mandatory INR 0.25 - Including OTP SMS cost Ok with this

- Per SMS, if partner decides to procure via No charges for SMS

E SMS Charges If required by partner for end customer communication Optional INR 0.14

Falcon’s existing integrated vendors

5 Revenue Share

We are ok with these commercials

- Based on single tier prevailing on the

aggregated volume for the relevant month,

excluding ATM withdrawals.

< 25 Cr. 60% - Income sharing to be reviewed every

Interchange income on all spends shall be shared with the partner

A Interchange Revenue Share Mandatory 25 to 50 Cr. 65% quarter and is subject to change depending

based on monthly volumes.

>50 Cr. 70% on aggregated volume

- A flat fee of 25 bps shall be charged on

emerging merchant category (fuel,

utility, education, hospitals, etc.)

Important Terms & Conditions

One-time fees to be paid upfront: 50% upon signing of agreement (PO), 50% upon Go live

For any additional feature or platform development (change requests), Falcon will charge a rate of INR 15,000 per man per man day for 8 hours shift. This is subject to an increase as per changes in the market rate.

All fees shall be charged subject to applicable taxes including Goods and Services Tax.

Contract term considered is 3 years.

Arrears in payments overdue for more than 3 months will incur 10% penalty per month till paid.

API integration involves standard set of APIs covering card / wallet and transaction lifecycle; Card management system involves standard set of features covering enterprise admin & user transaction lifecycle.

All other additional services requested by Partner not listed above will be chargeable based on mutual agreement and signed addendums.

These commercials are subject to standard rate cards of third parties, such as bank, network, etc., and may change.

All terms will be subject to the terms and conditions finally executed by the Partner and Falcon.

Above information is not an invoice and only an estimate of services/goods described above.

Payment will be collected in prior to provision of services/goods described in this quote.

Thank you for your interest in Falcon! We look forward to growing a strong partnership with

you.

Galaxy Building, Behind 32nd Milestone Off NH 8, Sector 15 4th Floor, Gurugram, Haryana 122001

1800-120-5483 | contact@falconfs.com

You might also like

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsFrom EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsNo ratings yet

- Fsi Breakout Track Payments Transformation With AwsDocument22 pagesFsi Breakout Track Payments Transformation With AwsKidie NobiNo ratings yet

- Bharat Bill Payments System: Cash Management ServicesDocument8 pagesBharat Bill Payments System: Cash Management ServicesGaurav GuptaNo ratings yet

- PrefrDocument2 pagesPrefrsoniNo ratings yet

- Marie Jan Pacana Owner Beauty Fantasie: Prepared byDocument3 pagesMarie Jan Pacana Owner Beauty Fantasie: Prepared byNecky SairahNo ratings yet

- RG Brochure 17 13-10-2022Document8 pagesRG Brochure 17 13-10-2022GOODS AND SERVICES TAXNo ratings yet

- Online Data Entry Projects (Copy Paste - Data Mining: Work)Document4 pagesOnline Data Entry Projects (Copy Paste - Data Mining: Work)Mani KantaNo ratings yet

- B) Quote For Pvt. Ltd. AMCDocument1 pageB) Quote For Pvt. Ltd. AMCManish ReddyNo ratings yet

- KB231212CZRZY - KFS & Sanction LetterDocument9 pagesKB231212CZRZY - KFS & Sanction Letterthummaudaykiran123No ratings yet

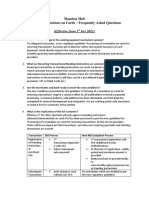

- Mandate Hub Standing Instructions On Cards - Frequently Asked QuestionsDocument4 pagesMandate Hub Standing Instructions On Cards - Frequently Asked QuestionsHarpreet singh SinghNo ratings yet

- Mdes - Final CaseDocument7 pagesMdes - Final CaseReshmi VarmaNo ratings yet

- Mobile App Features For Customer & Service ProviderDocument10 pagesMobile App Features For Customer & Service ProviderRajpriya SolankiNo ratings yet

- HPCL Campaign Flyer EnglishDocument2 pagesHPCL Campaign Flyer Englishneeraj guptaNo ratings yet

- Bayarind E-Wallet Binding 2022Document15 pagesBayarind E-Wallet Binding 2022Steven AdrianusNo ratings yet

- Payroll Guidelines and FAQs - V1Document15 pagesPayroll Guidelines and FAQs - V1Shiva Kant VermaNo ratings yet

- POS Rental - Reply SlipDocument1 pagePOS Rental - Reply SlipIsabelle Che KimNo ratings yet

- Agent's Servicing Handbook v1.1 - New Business and UnderwritingDocument26 pagesAgent's Servicing Handbook v1.1 - New Business and UnderwritingAlyssaBerdolaga100% (5)

- Assisted Application: PA-NTB FlowDocument19 pagesAssisted Application: PA-NTB FlowShradhaNo ratings yet

- Commercial Proposal - RHR 14.02.2023Document3 pagesCommercial Proposal - RHR 14.02.2023JOhnNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNo ratings yet

- Exsamples Bus ModelsDocument2 pagesExsamples Bus ModelsAdamNo ratings yet

- Waada Bank Partnership Presentation - 071023Document13 pagesWaada Bank Partnership Presentation - 071023Ali SaadNo ratings yet

- Yahoo Mail: 41046486 Hitesh Mehta 405CDDFY967166Document4 pagesYahoo Mail: 41046486 Hitesh Mehta 405CDDFY967166Shilu JadhavNo ratings yet

- 05 DigiBanker Activation SheetDocument1 page05 DigiBanker Activation SheetleodegarioporralNo ratings yet

- Ayala Coop Loan ApplicationDocument2 pagesAyala Coop Loan ApplicationRANDOMDUDEOFFICIALNo ratings yet

- Example 1: 5-Step Model: Step 1: Identify The Contract With A CustomerDocument4 pagesExample 1: 5-Step Model: Step 1: Identify The Contract With A CustomerJhon SudiarmanNo ratings yet

- HDFC BankDocument6 pagesHDFC BankShrishNo ratings yet

- IFRS15 5-Stepmodel ExampleDocument4 pagesIFRS15 5-Stepmodel ExampleMyo NaingNo ratings yet

- Web App Development Proposal & Contract To HFLDocument12 pagesWeb App Development Proposal & Contract To HFLmalawianboiNo ratings yet

- Prority Mid Version XviiDocument2 pagesPrority Mid Version XviiKartik ShuklaNo ratings yet

- Platform: Reconciliation Operations Made EasyDocument5 pagesPlatform: Reconciliation Operations Made EasyRishi SrivastavaNo ratings yet

- Axis Priority SalaryDocument5 pagesAxis Priority SalarymanojNo ratings yet

- Angel One ProfileDocument2 pagesAngel One ProfileAyush VermaNo ratings yet

- Guidelines For Vendor Pre-QualificationDocument7 pagesGuidelines For Vendor Pre-Qualificationrhizza basilioNo ratings yet

- Start-Up ProductsDocument1 pageStart-Up ProductsamiteshnegiNo ratings yet

- Mexico Tax Invoicing Add-OnDocument58 pagesMexico Tax Invoicing Add-OnBogna PiNo ratings yet

- Kfs LTFDocument1 pageKfs LTFsamarth guptaNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S Registeredarnav kumarNo ratings yet

- Process NoteDocument5 pagesProcess NoteMcnet WideNo ratings yet

- Word - MAADocument3 pagesWord - MAAVaibhavNo ratings yet

- Citi Payments Insights DemoDocument9 pagesCiti Payments Insights DemoRONYNo ratings yet

- Screen Flow According To New SRS Is As Follows: Group HomeDocument4 pagesScreen Flow According To New SRS Is As Follows: Group HomeSunil SoniNo ratings yet

- NACH V1.3 - 29122017 - For Preferred DateDocument2 pagesNACH V1.3 - 29122017 - For Preferred DateMadhumita DuttaNo ratings yet

- Letter of Engagement (P)Document6 pagesLetter of Engagement (P)Artemio BacsalNo ratings yet

- Aio Product PrezDocument7 pagesAio Product PrezsaersetsarrNo ratings yet

- POSTPAID SIGNATURE PHYSICAL SERVICE APPLICATION FORM PSAF ChecklistDocument2 pagesPOSTPAID SIGNATURE PHYSICAL SERVICE APPLICATION FORM PSAF ChecklistMJSM MSJMNo ratings yet

- Private-Banking-Signature-July-Dec-23 JS BankDocument4 pagesPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNo ratings yet

- Automatic Posting For Cash Discount Granted - SAP BlogsDocument13 pagesAutomatic Posting For Cash Discount Granted - SAP BlogsSandip AvhadNo ratings yet

- Shahrukh Broadband BillDocument3 pagesShahrukh Broadband BillShah Rukh SNo ratings yet

- Commercial Proposal - Hans HR - 05.12 (UAE)Document3 pagesCommercial Proposal - Hans HR - 05.12 (UAE)JOhnNo ratings yet

- Traditional Banks Vs RazorpayxDocument8 pagesTraditional Banks Vs RazorpayxSabarish RockersNo ratings yet

- Commercial Mastercard OnlineAppDocument4 pagesCommercial Mastercard OnlineApptechhorizon.osamaNo ratings yet

- KFS - Islamic - CarFinance Jul Dec 2023Document1 pageKFS - Islamic - CarFinance Jul Dec 2023crkriskyNo ratings yet

- Comparison Among The Mobile Applications of Various Banks: EftchequesDocument8 pagesComparison Among The Mobile Applications of Various Banks: EftchequesRahul ChaturvediNo ratings yet

- Kfs 3000Document1 pageKfs 3000PAVAN GHOLAPNo ratings yet

- National Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDDocument3 pagesNational Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDMuhammad TauseefNo ratings yet

- PKFS Advance Salary PDFDocument3 pagesPKFS Advance Salary PDFMuhammad Tauseef100% (1)

- SAP S4HANA POC-Consumption Based Billing ScenarioDocument24 pagesSAP S4HANA POC-Consumption Based Billing ScenarioVIJAY VADGAONKARNo ratings yet

- CreditCard I PDS ENGDocument10 pagesCreditCard I PDS ENGsamweeNo ratings yet

- Sanction Letter FAST7186877785851539 775883241168816Document4 pagesSanction Letter FAST7186877785851539 775883241168816yogeshmepindiaNo ratings yet

- Abdu M Ali 5222 Trojan Ave # 206 SAN DIEGO CA 92115-5274Document3 pagesAbdu M Ali 5222 Trojan Ave # 206 SAN DIEGO CA 92115-5274Abdu M AliNo ratings yet

- Provisional Receipt 2019 20 IDocument1 pageProvisional Receipt 2019 20 IPriyanka VermaNo ratings yet

- Pop 6Document30 pagesPop 6josh cruzNo ratings yet

- Module 04 - Income Tax ComplianceDocument21 pagesModule 04 - Income Tax ComplianceMark Emil BaritNo ratings yet

- Works Contract Under GST (Bare Framework)Document6 pagesWorks Contract Under GST (Bare Framework)Sanjay DwivediNo ratings yet

- Checking Account Statement: Nicholas Askevin Stanley W5101 Sunset DR MERRILL, WI 54452Document7 pagesChecking Account Statement: Nicholas Askevin Stanley W5101 Sunset DR MERRILL, WI 54452sam ujuNo ratings yet

- 1600 August 2022Document1 page1600 August 2022Analyn DomingoNo ratings yet

- Case #26 CIR v. CTA and Smith Kline (1984) (Digest)Document4 pagesCase #26 CIR v. CTA and Smith Kline (1984) (Digest)Leslie Joy PantorgoNo ratings yet

- Gains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Document11 pagesGains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Mylene SantiagoNo ratings yet

- Estatement20200915 000084862 PDFDocument3 pagesEstatement20200915 000084862 PDFReal NurulNo ratings yet

- Arul Karthi - MR PNQ BLR 03th Dec 21 - 6e - FCCBLR02DEC21A2151Document1 pageArul Karthi - MR PNQ BLR 03th Dec 21 - 6e - FCCBLR02DEC21A2151Arun KumarNo ratings yet

- Perfect Match PDFDocument1 pagePerfect Match PDFtutikaNo ratings yet

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- Bitumen VG-30-3Document2 pagesBitumen VG-30-3Morya RonakNo ratings yet

- Home Budget PlannerDocument137 pagesHome Budget Plannerjiguparmar1516No ratings yet

- Bill TriDocument1 pageBill TrifajarNo ratings yet

- Assignment02 PDFDocument2 pagesAssignment02 PDFAilene MendozaNo ratings yet

- Textbook SolutionDocument61 pagesTextbook SolutionmmNo ratings yet

- Format of Cash Flow StatementDocument3 pagesFormat of Cash Flow StatementMoses Fernandes100% (1)

- OpTransactionHistory06 03 2024Document37 pagesOpTransactionHistory06 03 2024krishnachaitanya0505No ratings yet

- Black Money Act 2015Document16 pagesBlack Money Act 2015Dharshini AravamudhanNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Ibiz 033801001211566 20240101 20240110 1704849543546313014Document1 pageIbiz 033801001211566 20240101 20240110 1704849543546313014nurlelianaNo ratings yet

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoNo ratings yet

- CPAR Fringe Benefit TaxDocument5 pagesCPAR Fringe Benefit TaxNikki75% (4)

- Assignment 3Document4 pagesAssignment 3Anna Mae NebresNo ratings yet

- E StatementDocument3 pagesE StatementEvin JoyNo ratings yet

- Sumit PassbookDocument5 pagesSumit PassbookSumitNo ratings yet

- Bida-Tech Company Chart of Accounts Account Naccount NameDocument66 pagesBida-Tech Company Chart of Accounts Account Naccount NameTrisha Mae Mendoza MacalinoNo ratings yet

- Alphalist of Employees Q1-2021 FINALDocument84 pagesAlphalist of Employees Q1-2021 FINALvivian deocampoNo ratings yet