Professional Documents

Culture Documents

Direct Salesforcevs Independent Reps

Uploaded by

Supriya MurdiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Direct Salesforcevs Independent Reps

Uploaded by

Supriya MurdiaCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/343917088

Direct Salesforce Versus Independent Reps: A Strategic Choice Across a Business

Life Cycle

Article · August 2020

CITATIONS READS

3 819

1 author:

Dr. Pankaj M. Madhani

ICFAI Business School

240 PUBLICATIONS 1,190 CITATIONS

SEE PROFILE

All content following this page was uploaded by Dr. Pankaj M. Madhani on 27 August 2020.

The user has requested enhancement of the downloaded file.

Direct Sales force versus Independent Reps: A

Strategic Choice across Business Life Cycle

Pankaj M. Madhani , Ph.D.

ICFAI Business School (IBS)

Introduction

The sales force represents a significant investment for most organizations. For example, U.S.

companies alone spend an estimated $800 billion on their sales forces each year (Zoltners, Sinha

& Lorimer, 2008). Sales force compensation costs represent a large percentage of total costs for

most sales organizations. To improve profitability, many sales organizations have begun to

closely scrutinize the role of their sales force and its overall compensation costs. In this situation,

an important issue for human resource (HR) manager is that of properly designing pay structure -

how much of that pay should be fixed (salary) versus variable (commission).

The structure and composition of a sales force varies widely from one sales organization to

another. If organizations adapt to changing circumstances, they are likely to be more successful

(Duncan & Flamholtz, 1982). The organization must adjust its overall systems to fit with the

changed external and internal environment (Madhani, 2010a). Accordingly, sales force

compensation strategy of the sales organization should in turn be adjusted to support the changed

business life cycle and structure of the sales organization as well as external environmental

factors such as customers, territory and competitive response. Rebalancing of fixed and variable

pay in compensation structure offers HR managers enough flexibility to deal with market

variability and organizational changes such as business life cycle stages. Business life cycle

stages are likely to be a key determinant of compensation strategies and their effectiveness in

achieving organizational goals.

A sales force structure of an organization must be well organized if it is to sell the products and

services efficiently and effectively to satisfy customer needs. Sales force structure decisions

influence how customers see the organization and affect the selling skills and knowledge level

required of salespeople, which in turn affect recruitment, training, and compensation structure of

WorldatWork Journal Third Quarter | 2014

Electronic copy available at: http://ssrn.com/abstract=2505942

the sales force. Each sales organization must structure its sales force to fit the unique needs of the

organization and its management (Aspley, 1956). If the sales force structure is adaptive, the

sales organization can react quickly to market dynamics without a major structural overhaul and

disruption of selling process. The effective sales force structure adapts to evolving business

needs. As sales force structuring is considered as an art, sales organizations do not have

scientifically developed algorithms for optimal sales force structure decisions. (Madhani, 2012).

Direct Sales force versus Independent Reps

Sales outsourcing refers to shifting a sales organization's sales activities in part or as a whole to

an independent third party (Ross, Dalsacem & Anderson, 2005). By outsourcing of a sales

function sales organization uses external resources to limits its risk exposure. Turning fixed costs

of a sales organization into variable costs is one of the most important reasons why sales

organizations outsource the sales function. Sales employees who contract their services are

called indirect sales force, manufacturers’ representatives or independent reps whereas, those

who are employed directly by the sales organization are often called in-house or direct sales

force. Independent reps or agents represent almost 50% of the business-to-business and upper-

channel sales (Barrett, 1986) and over 37% of all customer contacts by manufacturers (Churchill,

Ford & Walker, 1997).

Sales organization with complex, heterogeneous, high margin products with long sales

cycle are more efficient with direct sales force. Similarly, a large number of

geographically distributed and widely dispersed customers, frequently ordering small

quantities, may be more efficiently served by several reps than by direct sales force.

Use of direct sales force is associated with large size organization, larger average orders, more

complex products requiring technical service and less standard products (Anderson, 1985). If the

product is of low unit value, standard, well-accepted in the market, ordered in small quantities

and/or frequently re-ordered, reps may be the best choice (Powers, 1991). The reps are better

choice when the product is new and has no established demand, or the product is infrequently

purchased (Hawes, Strong & Winick, 1996). There is a considerable debate on reconsideration of

direct sales force vis-à-vis reps in a sales force structure (Taylor, 1981). Hence, this research

looks into this aspect and studies impact of business life cycle on choice of sales force structure.

Sales force Structure across Business Life Cycle: An Introduction

Choosing the proper sales force structure of direct sales force versus reps depends on

customer or product characteristics as well as stages of business life cycle also. Stages

of business life cycle lend sales organizations themselves to direct sales force, w hile

others to reps or indirect channel partners. The more influence a salesperson has on

the sale, the more important is a direct sales force for the sales organization.

WorldatWork Journal Third Quarter | 2014

Electronic copy available at: http://ssrn.com/abstract=2505942

High

Growth

stage

Growth and Profit

Potential Maturity

stage

Start-up

stage

Decline

stage

Low

Independent Direct

Reps Sales force

Sales force Structure

Figure 1: Growth Potential and Profit Potential across Business Life Cycle

(Source: Matrix developed by author)

As shown in Figure 1, start-up and decline stages of the business life cycle are characterized by

low growth and profit potential while growth and maturity stages of the life cycle are

characterized by high growth and profit potential. Accordingly reps are preferred in start-up and

decline stages while direct sales forces are preferred in growth and maturity stages of the

business life cycle. In start-up stage of business life cycle, there is lot of uncertainty. Business

risk is a central determinant of an organization’s value in terms of the present value of the risk-

adjusted future profit. It is affected by various parameters such as price, variable costs, operating

costs and the stability of demand (Halil & Hodgin, 2003). Business risk has a negative impact on

the operation or profitability of a given organization. A business risk can be the result of internal

conditions as well as some external factors. Internal conditions such as higher operating fixed

costs affect an organization’s value by increasing the variability of returns. When it comes to

external factors that can create an element of business risk, one of the most predominant risks is

that of a change in demand for the goods and services offered by the organization (Madhani,

2010b).

As business risk is high during start up and decline stages of business life cycle, sales

organizations should keep low operating leverage (Figure 2). The degree of operating leverage

(DOL) is a function of the organization’s cost structure in terms of the relationship between fixed

costs and total costs. An organization that has high operating leverage (high fixed costs relative

to total costs) will also have higher variability in earnings before interest and taxes (EBIT) than a

similar organization with low operating leverage. The more operating leverage (fixed costs/total

costs), the more profits will vary with changing sales revenues.

WorldatWork Journal Third Quarter | 2014

In growth stage sale organization’s operating income is increasing at increased rate whereas

uncertainty and business risk is moderating. Similarly during maturity stage, uncertainty is low,

and business risk is also low. While in decline stage uncertainty and business risk is high again.

Hence during period of low business risk, high operating leverage is preferred while during

period of high business risk, low operating leverage is preferred. Accordingly reps are preferred

in start-up and decline stages while direct sales forces are preferred in and maturity stages of the

business life cycle. Deployment of reps will decrease operating leverage for sales organization,

as reps work on commission only basis. As direct sales force represents fixed costs for a sales

organization, its deployment will increase operating leverage.

Independent Sales force Direct

Reps Structure Sales force

High

Low High

Growth

Stage

Operating leverage

Business Risk

Maturity

Stage

Start-up

Stage

Decline

Stage

High Low

Low Sales Revenue High

Figure 2: Relationship of Business risk and Operating Leverage across Business Cycle

(Source: Matrix developed by author)

By reducing the business risk, the cost of capital of the organization is also reduced, thus

increasing the economic value of the firm (Madhani, 2009). Hence, the reps are most preferred

choice for the sales organization in uncertain environment (Williamson, 1979).

Types of Direct Sales force: Generalist versus Specialist

Effective sales force structure design involves finding the right balance between generalized and

specialized sales roles. Generalists sales force are typically deployed in sales organizations that

are either in their start-up stage of life cycle establishing their presence in the market or trying to

cut costs in the decline phase of their business life cycle. During start-up stage of life cycle, the

reps have a strong influence on the sales. However, for large accounts that buy on contract,

reps are usually less effective than direct sale force (Anderson & Trinkle, 2005). Hence, sales

WorldatWork Journal Third Quarter | 2014

organizations may employ a small contingent of in-house direct sales force to service very large

or key sales accounts, while permitting smaller accounts to be serviced by reps. Most start-up

sales forces are comprised of a relatively small number of generalist direct sales force who sell a

narrow product line to a limited number of target market segments along with larger proportion

of reps (Figure 3).

Similarly, during decline stage products are more efficiently handled by reps or

channel partners since their costs are lower and less fixed. During growth and

maturity stage of life cycle direct sales force is preferred. As businesses grow during

growth stage of life cycle, the sales forces have to call on prospects in a broader set of markets as

their product portfolio expands. This presents sales organizations with two challenges related to

sales force: specialization as well as size.

Independent Sales force Direct

Reps Structure Sales force

High

Big Big

Growth

Stage

Maturity

Sales force Size

Sales Revenue

Stage

Start-up

Stage

Decline

Stage

Small

Small

Generalist Specialist

Type of Sales force

Figure 3: Sales force Size and Structure across Business Life Cycle

(Source: Matrix developed by author)

In a generalist sales organization, each representative or account manager sells an organization’s

entire, but usually limited, product line to customers who typically are all in the same industry,

thus providing a single point of business contact to customers. Generalist sales force would be

expected to engage in all types of sales activities for all of the products and to sell to all of the

customers. While specialist sales force would be expected to engage in a limited set of selling

activities for only a portions of the organization's products and would be selling only to a certain

group of customers.

WorldatWork Journal Third Quarter | 2014

Sales forces specialize in different ways such as by product, customer, geography or function

within the sales process and industry vertical. Specialization by industry vertical is

recommended when a sales force with deep industry knowledge represents a

competitive advantage over a generalist sales force with similar offerings. When sales

organizations plan specialization, choice of appropriate methods should be dictated by overall

sales strategy of the organization and stages of business life cycle. Product specialization is

most effective when vast knowledge is required to sell the product in the market.

Product specialists are technical experts who know the products inside out.

Customer specialization makes sales force structure more market driven and focus on

select group of customers. Specialization by geography is the least complicated

specialization and focuses on geographic territories. Sales force specialization by

functions is illustrated by the delineation between the “Hunter” and “Farmer” roles of

the sales force. Hunters typically focus on new sales, while farmers cultivate current

customer relationships to drive revenue growth. Depending on stages of business life

cycle, a sales force may contain a mixture of generalist and specialist sales force.

Sales force Structure during Various Stages of Business Life Cycle

Start-up Stage

In this stage, the primary responsibility of the salesperson is to overcome initial customer

resistance to the new product and the focus is on communicating product performance. Hence, a

higher level of product knowledge is required by the salesperson to explain the benefits of the

product to customers (Madhani, 2011). When product demand is uncertain, employing a direct

sales force is a risk as it happens with sales organizations in start-up stage of business life cycle.

Hence, deployment of reps can help sales organizations in better management of business risk as

reps; if they do not perform as expected; their compensation costs in the form of commission are

minimal.

A new product launch by sales organization always carries a certain level of business risk as

profitability projections are low and liquidity positions are strained. Hence, by engaging reps for

new product introduction, sales organizations can obtain a trained sales force immediately and

virtually with no fixed cost. Sales organization in start-up stage of business life cycle are

challenged to grow the business, yet often have limited funding and face considerable

uncertainty about the future. In this stage of business life cycle outsourcing is preferred option

for sales organization. In this stage, reps are likely to be more effective than direct sales force as

they are skilled, experienced and create synergy for customers as they offer multiple product

line. Reps visit a wide range of customers to get them more interested in the product and are

responsible for looking at the early adopters, as they may be willing to pay a higher price. Reps

can afford to call on small accounts because they have multiple lines thereby absorbing high

travel time between different accounts. Reps have established contacts and relationships and are

less expensive to sales organizations relative to direct sales force.

Reps are better options for small, seasonal or volatile products with - environmental uncertainty,

and sparse territories where high travel costs may not warrant direct sales force. Start-up sales

organizations can enter markets rapidly by working along reps that have sales expertise,

influence over sales channels, and relationships with potential customers. Reps have experience

WorldatWork Journal Third Quarter | 2014

that the start-up sales organization cannot replicate quickly enough, such as established customer

relationships or product and market expertise by employing direct sales force. Hence,

deployment of reps also helps the start-up sales organization to learn about the market in order to

build its own direct sales force successfully in the future.

Growth Stage

The growth stage is characterized by a rapidly growing organization, expanding its niche in the

market. By this stage, the organization has achieved a degree of success; the previous concern

for survival has largely been overcome, and the organization is actively involved in exploiting

expansion opportunities. During the growth stage, the organization focuses on selling and

increasing product demand and market share in the market. Large new investment is likely in this

period. During this stage, the organization is growing in products, customers, sales volumes,

geographic contact and number of sales employees.

The sales force structure that works during growth stage of a business life cycle when the

business is growing is different from what works, during start-up stage. In growth stage when

sales volume is high enough so that overall cost of direct sales force is less than the cost of reps,

direct sales force is preferred. In this stage, as products are established in the market, repeat sales

become a larger proportion of overall sales, customers will require service and support, adding to

sales force’s workloads. As such selling and supporting tasks grow beyond the salespeople’s

capacity to perform their jobs, they are likely to drop the customers, products, and selling

activities that are most difficult to manage. Unfortunately, what they drop may be lucrative or

strategic opportunities for the business. At this point, companies need to set up specialist sales

forces (Zoltners, Sinha, & Lorimer, 2006).

Maturity Stage

Direct sales forces classically are used by mature sales organizations with great effectiveness as

they are most effective at selling compatible products to one market. Hence, sales organizations

are frequently structured into autonomous divisions or profit centers, each with its own line of

products and may have its own direct sales force, responsible only for its product line. However,

if such profit centers simply cannot afford the fixed costs of a direct sales force to provide the

necessary market coverage for introducing new products in particular segment they may deploys

reps. As the size and complexity of the organization increase, it needs multifaceted, versatile and

high performance sales employees to face a more competitive environment (Chen & Hsieh,

2005). Hence, such sales organizations may opt for direct sales force if, it can attract and hold

sales force talents, market is highly concentrated geographically, it has very few customers or

sales volume is large enough that sales organizations can afford to employ large direct sales

force. Sales organizations monitor and manage their own reputation as it is one of the factors

affecting the structure of the sales organization (Weiss, Anderson & MacInnis, 1999).

The maturity stage is the relatively flat period in the business life cycle that follows the rapid

growth period. An organization at the maturity stage of the business life cycle is experiencing

slower but more consistent growth in its market. In this stage, organizations have stability and

efficiency as their goal. As organizations mature, they focus more on defending their existing

product niches. In the maturity stage, products and services start to lose their advantage,

competition intensifies and profit margins erode. In this stage, organizations emphasize retaining

WorldatWork Journal Third Quarter | 2014

customers, serving existing segments and increasing the efficiency and effectiveness of the sales

force. During this period, the organization has achieved the greatest economies of scale in its life

cycle and is able to generate steady and predictable profits. In the maturity stage of business life

cycle, the environment becomes more stable and predictable in comparison with the growth

stage.

Decline Stage

Although the maturity stage can be extended through proper management action, internal and

external factors or both may force the organization at any time to enter the decline stage

(Whetten, 1980). During this stage, the organization begins to stagnate as markets dry up and

product demand decreases. The decline stage of the business life cycle is characterized by a

decrease in organization’s resource base. In this stage, organizations are experiencing reductions

in market share, reduced product demand and even financial losses because of a variety of

reasons, such as ineffective management practices, changes in market environments or stiff

competition. At this stage, organizations’ strategies emphasize retaining and serving existing

customers and segments.

Some of the most obvious signs of the decline stage include declining sales relative to

competitors, disappearing profit margins and debt loads that continue to grow year after year.

When a renewal or revival of the organization is not likely and further decline is inevitable, sales

organizations can only ensure that they remain profitable for as long as possible. In this situation,

organizations should use their salespeople to service the most profitable, loyal and strategically

important customers while discarding unprofitable product lines or territories.

In this stage, the size of the sales organization’s direct sales force was reduced substantially, and

remaining small group of direct salesforce began to focus exclusively on value-based selling to

large, most profitable and strategically important customers or product lines. By using less-

expensive selling resources, sales organizations can continue selling efficiently to some customer

segments. Hence, to preserve profitability sales organizations utilize reps or selling partners to

cover some market segments at less cost. In this stage of business life cycle, improving the

efficiency of sales forces are critical. Sales organizations use generalist sales force when repeat

sales are not the major portion of the sales. Hence in this stage, sales organizations shift their

sales force structure by moving from specialty sales force to generalist sales force.

Direct Sales force versus Independent Reps: An Economic Analysis

The direct sales force of a sales organization is difficult to set up, slow to get up to speed and

treated predominantly as a fixed cost comprising of salesperson, sales managers and information

systems. Overhead cost of the direct sales force includes base salaries, taxes and other fringe

benefits such as vacations and medical coverage, training costs, travel and other selling expenses

and sales management overhead. On the other hand, as reps are paid commission on realized

sales they represent variable cost for the sales organization. Outsourcing turns largely fixed costs

of a sales organization into mostly variable costs as commissions paid to reps are a fraction of

sales. Thus, if the product doesn’t sell, costs are minimal. Using reps avoids the significant fixed

capital costs and ongoing costs of building and running a direct sales force.

WorldatWork Journal Third Quarter | 2014

The decision of a sales organization whether to engage direct sales force or reps is generally

influenced by the cost of serving the same level of sales. Sales organizations use reps until their

sales are large enough for them to afford a direct sales force. The convergence of direct sales

force cost and commission paid to reps plays an important role in the initial decision of sales

organization to use direct sales force or reps in the sales force structure as it analyze a path of

least total costs. Such convergence is viewed in the terms of selling cost and sales revenue and is

stated by following formula:

Where:

OHd = Overhead cost of the direct sales force

Cd = Variable pay (Commission) of direct sales force

Cr = Commission of Reps

S = Sales revenue during life cycle of a business

As shown in figure 4, sales revenue changes across life cycle of a business. During start-up as

well as decline stages of a business life cycle, sales revenue (Ss or Sd) remain on lower side.

Similarly, during growth as well as maturity stage of life cycle, sales revenue (Sg or Sm) remain

on higher side. Sales revenue during growth and maturity stages are considerably higher

compared to start-up and decline stages of business life cycle (Sm > Sg > Sd > Ss).

Business Life Cycle Stages

Start-up Growth Maturity Decline

Where

Sm = Sales during maturity

stage

Sm

Sg = Sales during growth

Sales Revenue (S)

Sg stage

Sd = Sales during decline

Sd stage

Ss = Sales during start-up

Ss

stage

Time

Figure 4: Typical Stages of Business Life Cycle

(Source: Chart developed by author)

When this relationship is diagrammed as shown in Figure 5, it can be seen that the cost of reps

(Cr) rises in direct proportion to increases in sales (S) as sales costs of reps are primarily in the

form of commissions (Cr). Figure 5, represents the convergence of direct sales force cost and

commission of reps for mix pay plan (variable pay along with base salary) of direct sales force.

For mix pay plan, the cost of direct sales force includes sales overhead, such as base salaries and

WorldatWork Journal Third Quarter | 2014

overhead costs of sales support (OHd) as well as commission (Cd) paid to the direct sales force.

The two cost lines would converge at point ‘O’, where the cost of the two sales force strategies

would be equal (OHd + Cd = Cr). The point ‘O’ is also called as indifference point and shows

equilibrium of the sales commission (variable pay) paid to the reps versus selling costs

associated with a direct sales force in a sales organization.

Cr

Sales Compensation ($)

Break Point

D

O

Cd

Where

Sg = Sales during growth stage

OHd

Sm = Sales during maturity stage

Ss = Sales during start-up stage

Sd = Sales during decline stage

R Ss Sd S Sg Sm

(Low sales revenue) (High sales revenue)

Sales Revenue ($)

Figure 5: Sales Revenue (S) of Sales Organization across Business Life Cycle

(Source: Chart developed by author)

Therefore, based on a purely economic decision, during period of low sales such as in start-up or

decline stages of business life cycle, sales organization would use reps to gain sales at a lower

cost as denoted by line RO and would continue using reps as long as their commission costs (Cr)

remained lower than the costs associated with a direct sales force (OHd + Cd). As shown in

figure, the least cost paths are RO and OD where cost of direct sales force is OHd + Cd.

Once the sales organization’s sales volume is high enough as in growth and maturity stages of

business life cycle that the commission or variable pay paid to the reps (Cr) for that volume are

greater than the total fixed cost and variable costs (OHd + Cd) that the sales organization

estimates for a direct sales force, the sales organization should switch to a direct sales force as it

is more economical. Hence, if sales exceeded point ‘O’, then the sales organization would

convert sales force structure to a direct sales force to maintain the lower economic costs as

denoted by line OD. Hence, after break point ‘O’, sales organization will switch over to direct

sales force as cost line OD represents least cost path. Hence, when sales revenue is high (as in

growth and maturity stages of business life cycle) and above break point, direct sales force is

deployed and when sales revenue is low (as in start-up and decline stages of business life cycle)

and below break point, reps are used.

WorldatWork Journal Third Quarter | 2014

Sales organizations should be large enough as in growth and maturity stage of business life cycle

to deploy direct sales force for intensive coverage of all geographic markets. Otherwise they may

be spread too thinly for optimum territory coverage. Hence, when sales organizations in start-up

stage or decline stages of business life cycle can't afford fixed costs of a larger direct sales force

to give the intensive coverage, reps are better choice as they operates on a pure commission plan

(‘pay for results only’) and also enhance cash flow and profitability. This single evaluation,

however, reflects only the economic aspect of the sales force structure decision to deploy direct

sales force or reps. However, all organizations should not choose direct sales force or reps in

sales force structure based on these criteria only. Other important non economic factors in

selection of sales force structure are their relative performance in sales coverage/sales generation

and the costs/revenue effects during the process of switching from reps to direct sales force and

vice versa.

Direct Sales force versus Independent Reps: An Economic Approach

As calculated in following illustration, considering reps instead of direct sales force in the sales

force structure of a sales organization has resulted in an increase in variable costs, a decrease in

fixed costs, along with a decrease in operating leverage. Reps (who work on commission or

variable compensation) also help to reduce breakeven point (BEP) which results in the sales

organization being able to be profitable faster. Hence, the break even quantity and operating

leverage will be lower for the sales organization that has used reps instead of direct sales

employees in its sales force structure, as calculated in following example. If cost of coordination

with reps is not considered then fixed costs of sales organization will be zero and subsequently

BEP will also be zero.

Illustration

To illustrate, impact of sales force structure on operating leverage and BEP assume that a sales

organization considers both options of employing direct sale force and reps as shown in Table -1.

Sales organization in ‘direct sale force’ option, employs internal sales employees on mix pay

plan (fixed pay:$22,000 & commission: 2%) while in another option of ‘reps’, sales organization

deploys independent reps on commission only basis (at 13.94% commission on sales). The

indifference point or break point occurs at sales volume of 60,000 units. At this point, cost of

direct sales force and cost of reps are equal (cost to sales ratio will be same for both the options)

(Scenario 1, Table 1). Below this point, cost of direct sales force will be higher than cost of reps

(Scenario 2, Table 1) while above this point cost of reps will be higher than cost of the direct

sales force (Scenario 3, Table 1). As reps are self-employed, there are no overhead costs

attributable to the sales organization. ‘Reps’ option of sales organization has a lower DOL

(degree of operating leverage), lower marker risk and its profits vary less with changes in sales

volume.

WorldatWork Journal Third Quarter | 2014

Table 1: Sales force Structure and Financial Performance: Various Scenarios

Scenario 1 Scenario 2 Scenario 3

Sales force Sales Organization Sales Organization Sales Organization

Structure (At (Below (Above

Indifference point) Indifference point) Indifference point)

Step Direct Direct Direct

No. Calculation Sales Reps Sales Reps Sales Reps

force force force

60,000 60,000 30,000 30,000 120,000 120,000

1 Unit sales (Monthly)

24 24 24 24 24 24

2 Unit selling price ($)

12 12 12 12 12 12

3 Unit variable cost ($)

22,000 0 22,000 0 22,000 0

4 Fixed pay (salary) ($)

150,000 0 150,000 0 150,000 0

5 Selling overhead ($)

172,000 0 172,000 0 172,000 0

6 Total Fixed cost = (4) + (5) ($)

2 13.94 2 13.94 2 13.94

7 Variable pay (%)

28800 200800 14400 100400 57600 401601

8 Variable pay = (1) x (2) x (7) ($)

0.48 3.35 0.48 3.35 0.48 3.35

9 Variable pay /unit = (8)/(1) ($)

12.48 15.35 12.48 15.35 12.48 15.35

10 Total variable cost/unit = (3) + (9) ($)

11.52 8.65 11.52 8.65 11.52 8.65

11 Unit contribution Margin = (2) – (10) ($)

691200 519200 345600 259600 1382400 1038399

12 Contribution margin = (1) x (11) ($)

0.48 0.36 0.48 0.36 0.48 0.36

13 Contribution margin ratio = (11)/(2)

748800 920800 374400 460400 1497600 1841601

14 Total variable cost = (1) x (10) ($)

920800 920800 546400 460400 1669600 1841601

15 Total cost = (6) + (14) ($)

1440000 1440000 720000 720000 2880000 2880000

16 Total revenue = (1) x (2) ($)

EBIT (earnings before interest and tax) = 519200 519200 173600 259600 1210400 1038399

17

(16) - (15) ($)

DOL (Degree of operating leverage) = 1.33 1.00 1.99 1.00 1.14 1.00

18

(12)/(17)

Decline in EBIT on 20 % decrease 26.63 20.00 39.82 20.00 22.84 20.00

19

in Sales = 20 x (18) (%)

358333 0 358333 0 358333 0

20 BEP (Break Even Point) = (6)/(13) ($)

0.639 0.639 0.759 0.639 0.580 0.639

21 Cost to sales ratio = (15)/(16) (%)

WorldatWork Journal Third Quarter | 2014

(Source: Calculated by author)

A critical requirement of such economic analysis is a complete and precise estimation of the total

fixed costs associated with the direct sales force as well as accurate forecasting of sales revenue.

In the earlier illustration, it is assumed that a direct sales force can achieve an increase in sales

volume with no increase in the number of sales people. Such analysis is a cost based steady-state

analysis. It means that sales organization had either considerable slack resource at the beginning

or a large improvement in the sales organization’s selling efficiency over a time. In reality, cost

curve will not vary directly with sales as considered in the illustration. Essentially, fixed costs of

sales will increase with increase in sales. Fixed costs are not fixed at a given level in perpetuity

(Guiltinan, 1974). In fact, fixed costs are only semi fixed. They are fixed within a range of

relevant factors such as sales volume or the number of customers. As the relevant factor

increases or decreases, the associated fixed cost becomes unfixed as investment must be made or

reduced and is fixed again at the new higher or lower level.

Direct Sales force versus Independent Reps: Strategic Choice at Indifference Point

As calculated in Table 1, at indifference point there is no difference in choice of direct sales

force or independent reps as cost to sales ratio will remain same. However, magnitude and

timing of cash flow will have major impact on liquidity position of the company. Independent

reps usually bear all sales expenses and are the manufacturer's exclusive salespeople for a

defined set of customers (Anderson & Schmittlein, 1984) and usually do not take title or

possession of the product, which is usually shipped directly to the buyer or user by each

manufacturer (Heide & John, 1988). Also, they are not paid when they receive the sales order

but they are normally paid in terms of commission when the product is shipped or when the

organization is paid. However the direct sales forces are paid by sales organization every month

in terms of base salary, whatever the sales in anticipation that they will perform. Hence,

deployment of reps sharply improves cash flow position of the company compared to direct sales

force. Especially for long selling cycle, this can be a significant difference for a sales

organization with the direct sales force, as they are paid salary, before the sale actually takes

place. In reality, these amounts of commission and salary paid during different time interval are

not the same, given the time value of money. Hence, this opportunity cost results in decrease in

cash flow for a sales organization on deployment of direct sales force as explained below with an

illustration.

Illustration

A sales organization is selling complex, technology intensive, big ticket item to a government

organization. The selling cycle for this product is long and takes 8 months to close the sell. The

selling price of a product package is $0.5 million. The sales organization is evaluating the

options of “direct sale force” (D) versus “reps” (R). In option D, sales organization is hiring sales

employee at annual salary of $60,000. While in option R, 10% commission is paid to reps on the

realized sales. The weighted average cost of capital (WACC) for the sales organization is 14%.

WorldatWork Journal Third Quarter | 2014

Option D

A A A A A A A A A A

Time-line

0 1 2 3 4 5 6 7 8 9

PV = $47,483

Where A = Annuity

= $60,000 /12

= $5,000 (paid to sales force as a salary in the beginning of each month)

Present value (PV) of this cash flow (annuity due) is given by following formula:

Where i = 0.14/12

= 0.01167

and n = 10

Hence, PV = $47,483

Option R

$50,000

Time-line

0 1 2 3 4 5 6 7 8 9

PV = $45,042

PV of reps option can be found by following formula:

Where FV (Future value) = $50,000

i = 0.01167

and n = 9

Hence, PV = $45,042

As rep is paid commission amount in full 30 days after the sale, payment to rep is considered

only after 9 months. However, with the direct sales force, this amount is paid as salary at

beginning of every month, before the sale actually takes place, say, after 8 months. The

difference in the cash flow in this simplified example is $2,441($47,483 - $45,042): a 5.42 %

difference. Although sales organization spends the same nominal amount $50,000, the payment

WorldatWork Journal Third Quarter | 2014

timing is different and hence it causes improvement in cash flow. It means as sales organization

is able to pay its sales force more slowly, it is a positive for cash flow and improve cash flow of

the organization. The lesson here is that all dollars paid out are not the same; their value depends

also on when they are paid out.

Discussion and Research Implications

To succeed in the long term, sales organizations must re-evaluate their sales force structure

across the business life cycle. Sales force structure decisions are important for a sales

organization as consequences of such decision errors are likely to affect a sales organization not

just in current year, but for many years to come. Sales force structure is related to

compensation management, distribution channels, territory management. No matter

how well sales organization hire and train their sales force, inefficient sales force

structure during life cycle of the business will prevent sales forces from reaching full

productivity.

It is hard for sales organizations to isolate the effect of the sales force from all the other effects in

the marketplace that might cause sales to go up or down. These effects include pricing,

advertising, sales promotions, along with changes in distribution, market needs, and competitive

behavior. However, the sales force is a strategic lever of the sales organization for improving

sales growth, market share and profitability. Sales force represents expensive and important

HR assets for the sales organization, as it requires full productivity to be competitive

in the market place. Management of sales force structure is a key factor and if implemented

correctly, can act as a catalyst in synergizing the efforts of a sales force leading to many positive

outcomes for the sales organization in terms of increased revenue; reduced compensation cost

and enhanced profitability.

In times of recession and/or cost-cutting, the use of independent reps typically increases. After

the economic downturn of 2001, Intel, Texas Instruments, Cirrus Logic and Hunt Wesson have

switched from direct sales force to reps for some or all of their major product lines. Also many

companies chose to use reps after spinning off a division (e.g. the semiconductor operation for

Motorola; the Airpax for Phillips (Knowledge@Wharton, 2002). Cherry Electrical Products,

Waukegan, Illinois based company has very fruitful experience working with an outsourced sales

force. They estimated that building direct sales organization from the ground up would cost them

a total of $5.7 million for a direct sales force compared to the $2.6 million they paid in reps’

commissions (Foster, 2004).

A sales organization's decision whether to serve a sales territory with a rep or a direct sales force

is evolutionary in nature as an organization and its market change, the appropriate configuration

of the selling function changes (DuBois & Grace, 1987). Hence, even a sales organization that

had initially ‘appropriately’ selected reps may find that changing circumstances have made a

direct sales force more preferable in the sales force structure. There are many strategic issues in

selection of sales force structure: fixed versus variable cost to sales ratio, type of sales territories

(Dominant versus marginal), availability of trained and experienced sales force, product

characteristics and order size, short term versus long term selling approach, channel relationship

and stability of relationship (Madhani, 2012).

WorldatWork Journal Third Quarter | 2014

Conclusion

Sales force structure refers to the differing roles that internal sales force (direct sales force) and

external selling partners (independent reps) should play. Sales force structure is critical for the

sales organization because they determine how quickly sales forces respond to market

opportunities, influence sales people’s performances and affect sales organization’s revenues,

compensation costs and profitability. A sales organization that does not link evolving sales force

structure as it passes through different stages of business life cycle is placing itself at

considerable risk in implementing an effective sales force management and compensation policy.

Although, sales organizations devote considerable time and money to manage their sales forces,

few focus much thought on how the sales force structure needs to change over the life cycle of a

business.

ABOUT THE AUTHOR

Pankaj M. Madhani Ph.D. (pmadhani@iit.edu) earned bachelor’s degrees in chemical

engineering and law, a master’s degree in business administration from Northern Illinois

University, a master’s degree in computer science from Illinois Institute of Technology in

Chicago, and a PhD in strategic management from CEPT University. He has more than 27 years

of corporate and academic experience in India and the United States. During his tenure in the

corporate sector, he was recognized with the Outstanding Young Managers Award. He is now

working as an associate professor at ICFAI Business School (IBS) where he received the Best

Teacher Award from the IBS Alumni Federation. He is also the recipient of the Best Mentor

Award. He has published various management books and more than 200 book chapters and

research articles in several referred academic and practitioner journals such as The European

Business Review. He is a frequent contributor to World at Work Journal (published 3 articles)

and Compensation & Benefits Review (published 13 articles). His main research interests include

sales force compensation, corporate governance, and business strategy.

REFERENCES

1. Anderson, E. M. 1985. “The Salesperson as outside agent or employee: A transaction

cost analysis.” Marketing Science. 4(3): 234-254.

2. Anderson, E. M., and Schmittlein, D. C. 1984. “Integration of the sales force: An

empirical examination.” The Rand Journal of Economics. 15(3): 385-395.

3. Anderson, E. M., and Trinkle, B. 2005. Outsourcing the sales function: The real costs of

field sales. Ohio, OH: Thompson/South-Western.

4. Aspley, J. C. 1956. Sales Manager's Handbook (7th ed.). Chicago, IL: Dartnell

Corporation.

5. Barrett, J. 1986. “Why major account selling works.” Industrial Marketing Management.

15(1): 63-73.

6. Chen, H. M., and Hsieh, Y. H. 2005. “Incentive reward with organizational life cycle

from competitive advantage viewpoint.” Human Systems Management. 24(2):155-163.

7. Churchill, G.A., Ford, N.M., and Walker, O. C., Jr. 1997. Sales Force Management. (5th

ed.). Chicago, IL: Irwin.

8. Duncan, C. E., and Flamholtz, E. G. 1982. “Making the transition from entrepreneurship

to a professionally managed firm.” Management Review. 71(1): 57-62.

WorldatWork Journal Third Quarter | 2014

9. Foster, J. 2004. “The economic benefit of working with reps.” The IAPD magazine.

August/September.

10. Guiltinan, J. P. 1974. “Planned and evolutionary changes - in distribution channels.”

Journal of Retailing. 50(2):79-103.

11. Halil, K., and Hodgin, R. 2003. “Enhancing clarity and completeness of basic financial

text treatments on operating leverage.” Journal of Economics and Finance Education.

2(1): 35-45.

12. Hawes, J. M., Strong, J. T., and Winick, B. S. 1996. “Do closing techniques diminish

prospect trust?” Industrial Marketing Management. 25(5): 349-360.

13. Heide, J. B., and John, G. 1988. “The role of dependence balancing in safeguarding

transaction-specific assets in conventional channels.” Journal of Marketing. 52(1): 20-35.

14. Madhani, P. M. 2012. “Managing sales force compensation: The strategic choice between

direct sales force and independent reps.”, Compensation & Benefits Review. 44(2):86-99.

15. Madhani, P. M. 2011. “Restructuring fixed and variable pay in sales organizations: A

product life cycle approach.” Compensation & Benefits Review. 43(4): 245-258.

16. Madhani, P. M. 2010a. “Realigning fixed and variable pay in sales organizations: An

organizational life cycle approach.” Compensation & Benefits Review. 42(6): 488-498.

17. Madhani, P. M. 2010b. “Rebalancing fixed and variable pay in a sales organization: A

business cycle perspective.” Compensation & Benefits Review. 42(3):179-189.

18. Madhani, P. M. 2009. “Sales employees compensation: An optimal balance between

fixed and variable pay.” Compensation & Benefits Review. 41(4): 44-51.

19. Making the case for outside sales rReps. Knowledge@Wharton. 2002 (January 30).

20. Powers, T. L. 1991. Modern Business Marketing. St. Paul, MN: West Publishing

Company.

21. Ross,W. T., Dalsace, F., and Anderson, E. 2005. “Should you set up your own sales force

or should you outsource it? Pitfalls in the standard analysis.“ Business Horizons. 48(4):

23-26.

22. Taylor, T. 1981. “A raging ‘rep’ idemic.” Sales & Marketing Management. 133(6):33-35.

23. Weiss, A.M., Anderson E. M., and MacInnis, D. J. (1999). “Reputation management as a

motivation for sales structure decisions.” Journal of Marketing. 63(4): 74-89.

24. Whetten, D. A. 1980. “Organizational decline: A neglected topic in organizational

science.” Academy of Management Review. 5(4):577-588.

25. Williamson, O. E. 1979. “Transaction-cost economics: the governance of contractual

relations.” Journal of Law and Economics. 22: 233-262.

26. Zoltners, A. A., Sinha, P., and Lorimer, S. E. 2008. “Sales force effectiveness: A

framework for researchers and practitioners.” Journal of Personal Selling & Sales

Management. 28(2): 115-131.

27. Zoltners, A. A., Sinha, P., and Lorimer, S. E. 2006. “Match your sales force structure to

your business life cycle.” Harvard Business Review. 84(7-8): 80-89.

WorldatWork Journal Third Quarter | 2014

View publication stats

You might also like

- Tri Merge-Instructions 2Document11 pagesTri Merge-Instructions 2Samson Fortune92% (12)

- The SWOT Analysis: A key tool for developing your business strategyFrom EverandThe SWOT Analysis: A key tool for developing your business strategyRating: 3.5 out of 5 stars3.5/5 (10)

- 0 DTE MEIC - January 16, 2023 by Tammy ChamblessDocument19 pages0 DTE MEIC - January 16, 2023 by Tammy Chamblessben44No ratings yet

- Competitive Profile MatrixDocument4 pagesCompetitive Profile MatrixDikshit KothariNo ratings yet

- Swot: Project Guidelines: Dev Shroff Std-12 Div.-D Roll No.Document36 pagesSwot: Project Guidelines: Dev Shroff Std-12 Div.-D Roll No.rgembkfmvkrevm jrogj gygrgnhughn rn njh gklhglutrNo ratings yet

- External AnalysisDocument8 pagesExternal AnalysisYasmine MancyNo ratings yet

- SWOT) Analysis, Marketing Process, Marketing PlanDocument24 pagesSWOT) Analysis, Marketing Process, Marketing PlanSagar Patil100% (2)

- Zs Mktcov SlsresoptDocument9 pagesZs Mktcov SlsresoptgeniusMAHINo ratings yet

- IPC - Advance PaymentDocument1 pageIPC - Advance PaymentMohamed MujreebNo ratings yet

- Case Study Interview TechniquesDocument8 pagesCase Study Interview Techniquesedpeg1970No ratings yet

- The General EnvironmentDocument5 pagesThe General EnvironmentLawal Idris AdesholaNo ratings yet

- Review QuestionsDocument6 pagesReview QuestionsArjina Arji0% (1)

- Card ConfirmationDocument1 pageCard Confirmationkilo6954No ratings yet

- Motivational Factors For FMCG CompanyDocument32 pagesMotivational Factors For FMCG Companyvedshree22No ratings yet

- Journal of Personal Selling & Sales ManagementDocument18 pagesJournal of Personal Selling & Sales ManagementMoqaNo ratings yet

- How To Do A SWOT Analysis?Document4 pagesHow To Do A SWOT Analysis?Neel ManushNo ratings yet

- Strategic Management Exam - 1Document6 pagesStrategic Management Exam - 1Rahiana AminNo ratings yet

- Motivational Factors For Sales Representatives of FMCG CompanyDocument32 pagesMotivational Factors For Sales Representatives of FMCG CompanyUmbertoNo ratings yet

- Bes Group Assignment 2Document8 pagesBes Group Assignment 2HR Michael KiemaNo ratings yet

- ENVIRONMENTAL SCANNING SUBTOPIC 1: SWOT, PEST and Value Chain AnalysisDocument5 pagesENVIRONMENTAL SCANNING SUBTOPIC 1: SWOT, PEST and Value Chain AnalysisMA. FRANCHESKA BALTAZARNo ratings yet

- Neo Axel M. Bmec1 AssignmentsDocument4 pagesNeo Axel M. Bmec1 AssignmentsAxel NeoNo ratings yet

- Integrated Case Study 1Document3 pagesIntegrated Case Study 1FS BitNo ratings yet

- SWOT AnalysisDocument10 pagesSWOT AnalysisRizwan KhanNo ratings yet

- Q4. What Is Strategic Business Unit? What Are Conditions Required For Creating An Sbu? How Is Performance of Sbu Measured? What Are The Advantages and Disadvantages of Creating Sbus?Document4 pagesQ4. What Is Strategic Business Unit? What Are Conditions Required For Creating An Sbu? How Is Performance of Sbu Measured? What Are The Advantages and Disadvantages of Creating Sbus?Jitendra AshaniNo ratings yet

- Originality of ReportDocument17 pagesOriginality of ReportTharaniya RajaratnamNo ratings yet

- Enable Your Growth Strategy BlogDocument5 pagesEnable Your Growth Strategy BlogDavid KnopflerNo ratings yet

- Pfizer: Case Study ReportDocument31 pagesPfizer: Case Study ReportMaham ShahidNo ratings yet

- Lecture 2 Aditional Reading SWOT PEST 3C's Porter Generic 5 FactorsDocument29 pagesLecture 2 Aditional Reading SWOT PEST 3C's Porter Generic 5 FactorsMacqwin FernandesNo ratings yet

- Sample CorporateDocument31 pagesSample CorporateMaham ShahidNo ratings yet

- Sales On TeleDocument9 pagesSales On TeleFarfoosh Farfoosh FarfooshNo ratings yet

- Swot Analysis Research Paper PDFDocument6 pagesSwot Analysis Research Paper PDFefgncpe8100% (1)

- Management Theory and Practice....Document8 pagesManagement Theory and Practice....Navdeep SharmaNo ratings yet

- Adv & MKT Risk - SSIJMAR, Vol2no2, 2013.32Document21 pagesAdv & MKT Risk - SSIJMAR, Vol2no2, 2013.32sdmisraNo ratings yet

- Review of Related LiteratureDocument6 pagesReview of Related LiteratureRoselyn PamaNo ratings yet

- 195-Tekst Artykułu-343-1-10-20190821 PDFDocument13 pages195-Tekst Artykułu-343-1-10-20190821 PDFPeptoni FontNo ratings yet

- Q1: A) To What Extent Has Web Technology Changed The 5 Forces of The Retail Industry?Document6 pagesQ1: A) To What Extent Has Web Technology Changed The 5 Forces of The Retail Industry?priyank1256No ratings yet

- ABA Unit ThreeDocument31 pagesABA Unit Threeeleasewalker22No ratings yet

- Chapter 4Document11 pagesChapter 4Bedri M AhmeduNo ratings yet

- Chapter 3 Industry and Competitive AnalysisDocument44 pagesChapter 3 Industry and Competitive AnalysisNesley Vie LamoNo ratings yet

- Industry Versus Firm Effects What Drives Firm PerfDocument23 pagesIndustry Versus Firm Effects What Drives Firm PerfNurdahi GökcanNo ratings yet

- Time:Two Hours) (Maximum: MARKS: 40Document13 pagesTime:Two Hours) (Maximum: MARKS: 40Umang RajputNo ratings yet

- SM ModelDocument8 pagesSM ModelSJ INFO TECH & SOLUTIONNo ratings yet

- 1.5.2 Strategy As Position: Why Strategy Execution FailsDocument12 pages1.5.2 Strategy As Position: Why Strategy Execution Failsmpweb20No ratings yet

- Mission and Vision StatementsDocument5 pagesMission and Vision StatementsSachin SinghNo ratings yet

- Environmental Characteristics Firm CharacteristicsDocument3 pagesEnvironmental Characteristics Firm CharacteristicskattisalluNo ratings yet

- Summary Session 1 & 2Document18 pagesSummary Session 1 & 2love bhagatNo ratings yet

- The Effects of Personality Traits and Motivations On Performance of Salespeople The Mediating Effects of Organizational Commitment and CompensationDocument8 pagesThe Effects of Personality Traits and Motivations On Performance of Salespeople The Mediating Effects of Organizational Commitment and CompensationEditor IJTSRDNo ratings yet

- ActivityDocument8 pagesActivityAnge DizonNo ratings yet

- BSP Short Questions From First Five ChaptersDocument4 pagesBSP Short Questions From First Five ChaptersKashfmmNo ratings yet

- 4 - Zoltners, Sinha, and Lorimer - JPSSM - 2012 - Breaking The Sales Force Incentive AddictionDocument16 pages4 - Zoltners, Sinha, and Lorimer - JPSSM - 2012 - Breaking The Sales Force Incentive AddictionAdarsh Singh RathoreNo ratings yet

- SWOT AnalysisDocument13 pagesSWOT AnalysisvicNo ratings yet

- Sales Entrepreneur: A New Generation of Challenges and Opportunities, TheDocument10 pagesSales Entrepreneur: A New Generation of Challenges and Opportunities, TheManas SarkarNo ratings yet

- The Process of Strategic PlanningDocument4 pagesThe Process of Strategic Planningyaasir_7868868No ratings yet

- Elements of Micro EnvironmentDocument3 pagesElements of Micro EnvironmentDimpleNo ratings yet

- Tree of Goals in Management: ForbesDocument6 pagesTree of Goals in Management: Forbeszgurea2No ratings yet

- Business Environment Unit 4Document8 pagesBusiness Environment Unit 4Kainos GreyNo ratings yet

- A) Corporate GovernanceDocument5 pagesA) Corporate Governancenicks012345No ratings yet

- SalesDocument28 pagesSalesKopal GothwalNo ratings yet

- Key Factors Report PDFDocument8 pagesKey Factors Report PDFAbhishek RudraNo ratings yet

- A.I.-Business DevelopmentDocument58 pagesA.I.-Business DevelopmentMuralidhar PanchagniNo ratings yet

- Use Appropriate Analysis Framework and Methodology in (ABM - BES12-Ia-c-2)Document8 pagesUse Appropriate Analysis Framework and Methodology in (ABM - BES12-Ia-c-2)Aimee Lasaca100% (1)

- Problems Encounter of A Channel ManagerDocument1 pageProblems Encounter of A Channel ManagerJena CamangegNo ratings yet

- Targeted Tactics®: Transforming Strategy into Measurable ResultsFrom EverandTargeted Tactics®: Transforming Strategy into Measurable ResultsNo ratings yet

- The Kingsmen IIM B VFDocument19 pagesThe Kingsmen IIM B VFSupriya MurdiaNo ratings yet

- Group 2 SDM Presentation - ALDIDocument10 pagesGroup 2 SDM Presentation - ALDISupriya MurdiaNo ratings yet

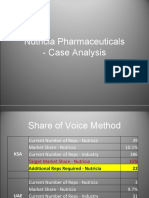

- Session 10 Case Analysis Nutricia PharmaceuticalDocument8 pagesSession 10 Case Analysis Nutricia PharmaceuticalSupriya MurdiaNo ratings yet

- SDM NutriciaDocument11 pagesSDM NutriciaSupriya MurdiaNo ratings yet

- Managing Salesforce Compensation During The Growth Stage: A Financial Modelling ApproachDocument16 pagesManaging Salesforce Compensation During The Growth Stage: A Financial Modelling ApproachSupriya MurdiaNo ratings yet

- Creative Lab: Overcoming The Global-Local Challenge in Communication'Document24 pagesCreative Lab: Overcoming The Global-Local Challenge in Communication'Supriya MurdiaNo ratings yet

- Group 4 Amazon - Com (2021) VFDocument8 pagesGroup 4 Amazon - Com (2021) VFSupriya MurdiaNo ratings yet

- Hult@IIMB Information DocumentDocument6 pagesHult@IIMB Information DocumentSupriya MurdiaNo ratings yet

- Cisco Systems: Managing The Go-To-Market EvolutionDocument14 pagesCisco Systems: Managing The Go-To-Market EvolutionSupriya MurdiaNo ratings yet

- Group 2 AldiDocument9 pagesGroup 2 AldiSupriya MurdiaNo ratings yet

- Cultural Symbolism - Group 6Document20 pagesCultural Symbolism - Group 6Supriya MurdiaNo ratings yet

- Eximius Oc: Name Phone Email ID VerticalDocument3 pagesEximius Oc: Name Phone Email ID VerticalSupriya MurdiaNo ratings yet

- Cisco - Group 1Document10 pagesCisco - Group 1Supriya MurdiaNo ratings yet

- Disseration ReportDocument98 pagesDisseration ReportSupriya MurdiaNo ratings yet

- Exchange Committee - TaskDocument1 pageExchange Committee - TaskSupriya MurdiaNo ratings yet

- Brainpan Innovations Disease Matrix 161213Document25 pagesBrainpan Innovations Disease Matrix 161213Supriya MurdiaNo ratings yet

- Product at Sharechat - Strategy at Oyo - Consulting at Indus, PWCDocument1 pageProduct at Sharechat - Strategy at Oyo - Consulting at Indus, PWCSupriya MurdiaNo ratings yet

- Celebrate The Sea Festival SCMP ArticleDocument1 pageCelebrate The Sea Festival SCMP ArticleSupriya MurdiaNo ratings yet

- Revisiting Secretary ProblemDocument25 pagesRevisiting Secretary ProblemSupriya MurdiaNo ratings yet

- Andersen, Fusari, Todorov - 2015 - ECON - Parametric Inference and Dynamic State Recovery From Option PanelsDocument65 pagesAndersen, Fusari, Todorov - 2015 - ECON - Parametric Inference and Dynamic State Recovery From Option PanelsSupriya MurdiaNo ratings yet

- Sample CV 3Document1 pageSample CV 3Supriya MurdiaNo ratings yet

- Helping Hands All AdminsDocument2 pagesHelping Hands All AdminsSupriya MurdiaNo ratings yet

- HCCB Case Competition: Elevator PitchDocument3 pagesHCCB Case Competition: Elevator PitchSupriya MurdiaNo ratings yet

- Executive StatementDocument2 pagesExecutive StatementSupriya MurdiaNo ratings yet

- Zero Beta PresentationDocument57 pagesZero Beta PresentationSupriya MurdiaNo ratings yet

- Negotiable Instruments Case DigestsDocument3 pagesNegotiable Instruments Case DigestsJr MateoNo ratings yet

- Jcien.2023.176.2.web Small-20230420121947Document52 pagesJcien.2023.176.2.web Small-20230420121947Ashutosh Chandra DwivediNo ratings yet

- Topic 5 - Chapter 7 ClassDocument39 pagesTopic 5 - Chapter 7 ClassNoluthando MbathaNo ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- New Signature Update FormDocument3 pagesNew Signature Update FormKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- Chap 5 IAS 36 Impairment of AssetsDocument37 pagesChap 5 IAS 36 Impairment of Assetsjanay martinNo ratings yet

- Chapter 6 Incremental AnalysisDocument28 pagesChapter 6 Incremental AnalysisMaria JosefaNo ratings yet

- CH 1a - Introduction To Supply Chain & Logistics ManagementDocument31 pagesCH 1a - Introduction To Supply Chain & Logistics ManagementHamza SaleemNo ratings yet

- Dimensioni Tenute SKF: SKF Fork Seals SizesDocument2 pagesDimensioni Tenute SKF: SKF Fork Seals SizesGaetano GiordanoNo ratings yet

- Chapter 2 E-CommerceDocument1 pageChapter 2 E-CommerceUday AdhikariNo ratings yet

- Empowered 4x - Final PresentationDocument22 pagesEmpowered 4x - Final Presentationapi-386295949No ratings yet

- Chapter 2: Demand & SupplyDocument4 pagesChapter 2: Demand & SupplyRujean Salar AltejarNo ratings yet

- A Study On The Financial Statement Analysis of Selected Indian Tyres CompaniesDocument11 pagesA Study On The Financial Statement Analysis of Selected Indian Tyres CompanieskomalNo ratings yet

- IOS CertDocument1 pageIOS CertSHYAMNo ratings yet

- 11 & 12 Economics Split-UpDocument9 pages11 & 12 Economics Split-UpMadhuryaNo ratings yet

- Chapter 16 2021Document2 pagesChapter 16 2021Rabie HarounNo ratings yet

- MICRO AND SMALL ProjectDocument17 pagesMICRO AND SMALL ProjectJapgur Kaur100% (1)

- Financial Profiling ExampleDocument8 pagesFinancial Profiling ExampleWasim SNo ratings yet

- Entrepreneurship DevelopmentDocument26 pagesEntrepreneurship DevelopmentAkanksha NalawadeNo ratings yet

- Business Finance Module 6Document11 pagesBusiness Finance Module 6Kanton FernandezNo ratings yet

- Ch14.doc AccountingDocument45 pagesCh14.doc AccountingYAHIA ADELNo ratings yet

- Consumer Behaviour Case StudyDocument6 pagesConsumer Behaviour Case Studyhiralpatel3085100% (1)

- CBM Module 2Document3 pagesCBM Module 2Valdez AlyssaNo ratings yet

- Building A Transformative Pedagogy in Vocational EducationDocument22 pagesBuilding A Transformative Pedagogy in Vocational EducationShakira UmarNo ratings yet

- LeanDocument16 pagesLeanMuhammad Nauman AnwarNo ratings yet

- Cambridge University PressDocument31 pagesCambridge University PressPaco Corona FloresNo ratings yet