Professional Documents

Culture Documents

Digital Payments in India

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digital Payments in India

Copyright:

Available Formats

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Digital Payments in India

Shreyam Chaudhary

MBA in Marketing and Digital Marketing

Abstract:- Digital payments have become a must now a is trying to become “paperless” and “cashless” economy.

days. As we see that digitization has become the future of Digital India program has created a platform for a

the entire nation. A major boost was given to cashless knowledge-based electronic transformation in governance

payments when demonetization was announced. As for its citizen by engaging both central and state

digital media came into picture, many modes of digital government. Digital payments were encouraged in India by

payments also came in. Due to covid-19 and the Indian government after the announcement of

demonetization digital payments have grown like a bust. demonetization policy on 8th November 2016. Digital

Digital payments also got a boost due to the Covid-19 payments can also be defined as a means of electronic

pandemic.The beginning of Covid-19 pandemic gave a medium that allows consumers to make e-commerce

lot of boosts to one of the digital payment companies transactions for their purchase.

called as PaytmA new reader may not be familiar with

some of the phrases used in the realm of digital or e- The main objective of the announcement of digital

payments. This section offers a means of comprehending payments was to encourage India to be a cashless economy.

various forms of electronic payments. Payment The question that arises here is that “Has demonetization

instruments are used to make payments. One type of really helped digital payments grow?” Digital payments

payment tool is cash. Also, checks are. However, there also got a boost due to the Covid-19 pandemic. The

are many distinct titles used for comparable services, beginning of Covid-19 pandemic gave a lot of boost to one

sometimes even within the same country, making digital of the digital payment companies called as Paytm.

payments complicated. This raises the question, "Will Due to the increased use of feature phones and low-cost

the switch from cash to digital payments actually occur? smartphones, UPI transactions might have increased by

" three to four times. As a result, contactless payments in

times of emergency could have benefited migrant,

I. INTRODUCTION contract, and rural workers.

The COVID-19 effort might have been able to speed up

India's journey with digital payments, which started UPI acceptance by 1-2X.

in the early 2000s, has been nothing short of amazing! The result is a long-lasting change in behaviour brought

Digital payment methods have had spectacular development, on by the continued expansion of rural Internet users (304

increasing from 3 percent of all cash and non-monetary million monthly active users by the end of 2020).

payments in 2005 to an expected 58 percent by 2025. Physical establishments' smooth transition to accepting

Payments are made using payment instruments. Cash, for digital payments may have easily been hampered.

example, is a payment instrument. So too are checks.

As a result, there are fewer early difficulties, timely

However, when it comes to digital payments, it can be

payments improve financial position, and friction between

confusing because of the range of different terms used for

physical and online delivery decreases.

similar services, sometimes even within the same country!

In this new era of digitization, digital payments have started It's possible that NPCI's contactless and online onboarding

evolving to a vast extent. Also, we see that our country India for UPI and UPI QR was already established.

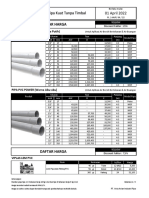

Reasons Strongly Strongly

Agree Disagree Neutral Total

For digital payments Agree Disagree

The e-payment system is the need of the Hour 13 22 0 0 8 40

The current e-payment system is stimulating 4 28 0 0 8 40

I am satisfied with the system because it is error free

6 17 6 1 10 40

overall satisfaction 8 27 0 0 5 40

Total 31 94 6 1 31

Table 1: Customer preference of digital payments

Exhibit 1 - volume9-issue4(7)-2020.pdf (ijmer.s3.amazonaws.com)

Based on a current report. It is obvious that the Additionally, this table shows that customers favor digital

impact of digital payments on customers will occur. The payments over cash payments. It may so happen that many

data in the table above plainly shows that most customers more digital payment platforms may come up and therefore

are happy with the necessity of accepting payments online. cash transactions can be replaced with online transactions.

IJISRT22SEP1081 www.ijisrt.com 1060

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

predictions(in %) year wise

Year

2005 2010 2015 2020 2025

digital payments 3 8 20 39 58

cash payments 92 89 78 60 41

other paper 5 3 2 1 1

Table 2: Predictions(in %) year wise

predictions(in %) year wise

100

90

80

70

60

50

92 89

40 78

30 60 58

20 39 41

10 20

3 5 8 3 2 1 1

0

2005 2010 2015 2020 2025

predictions(in %) year wise

digital payments 3 8 20 39 58

cash payments 92 89 78 60 41

other paper 5 3 2 1 1

digital payments cash payments other paper

Graph 1: Predictions(in %) year wise

The above graph explains that there will be a shift payment systems, e-commerce, and financial services.

from cash payments to digital payments soon. As we see Paytm is currently available in 11 Indian languages and

that by 2025, 58% of the total payments will be in digital offers online services such as mobile recharges, utility bill

form. It may so happen that by 2025 many more platforms payments, travel, movie, and event bookings, as well as in-

like Paytm may come up and therefore cash transactions can store payments using the Paytm QR code at grocery stores,

be replaced with online payment methods fruits and vegetable shops, restaurants, parking, tolls,

pharmacies, and educational institutions. Paytm is expected

One of the company which performed well as a to be worth US$16 billion by 2020, making it one of the

digital payment company is Paytm. Paytm is a Noida-based world's most valuable fintech companies.

global Indian technology company that specialises in digital

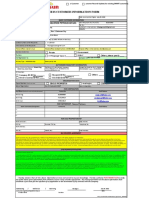

Paytm over other digital payments websites

Reach

Sno Particulars

Apps Sites

1 Paytm 39 20

2 Free Charge 26 11

3 Mobiquik 17 4

Table 3: Reach of Paytm over other digital payment platforms

IJISRT22SEP1081 www.ijisrt.com 1061

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Reach of Paytm over other digital payments

mode

50 39

percentage

40

26

30 20 17

20 11

10 4

0

1 2 3

Apps 39 26 17

Sites 20 11 4

reach through apps and websites

Apps Sites

Graph 2: Reach of Paytm over other digital payments mode

Source: Paytm market in India - Bing images

From the above data we can conclude that during the time of Most of the people logged into Paytm through its

covid-19 pandemic, Paytm had the highest share in the application.

market as compared to other digital payment platforms.

Table on the platform of digital payment people use

Sno Particular Percentage

1 Bharat Pay 0

2 Google pay 74

3 Paytm 22

4 phone pay 3.7

Table 4: Platform of digital payment people use

Digital Payment Platforms

phone pay

Paytm

Google pay

Bharat Pay

0 10 20 30 40 50 60 70 80

Bharat Pay Google pay Paytm phone pay

Series1 0 74 22 3.7

Graph 3: Digital Payment Platforms

Interpretation:- When the question was asked on the most preferred platform is Google pay. The reason here

platform that people use to make payments, the results that could be that google pay is one of the most preferred

came out were astonishing. The given graph shows that the platform.

IJISRT22SEP1081 www.ijisrt.com 1062

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Future of digital payments

Sno Particular Percentage

1 Strongly agree 48.1

2 Agree 40.7

3 Disagree 0

4 Strongly disagree 3.7

5 Neutral 7.4

Table 5: Future of digital payments

Digital payments will shape the future

Neutral

Strongly disagree

Disagree

Agree

Strongly agree

0 10 20 30 40 50 60

Strongly agree Agree Disagree Strongly disagree Neutral

Series1 48.1 40.7 0 3.7 7.4

Graph 4: Digital payments will shape the future

Interpretation:- Digital payments can also be defined as a evident that digital payments are the future of Indian

means of electronic medium that allows consumers to make economy. But as per the above graph it is quite clear that

e-commerce transactions for their purchase. It is quite digital payments will surely shape the future.

Effect on digital payments

Sno Particular Percentage

1 covid-19 55.2

2 Demonetization 17.2

3 None of the above 27.6

Table 6: Effect on digital payments

IJISRT22SEP1081 www.ijisrt.com 1063

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Impact On Digital Payments

None of the above 27.6

Demonetization 17.2

covid-19 55.2

0 10 20 30 40 50 60

covid-19 Demonetization None of the above

Series1 55.2 17.2 27.6

Graph 5: Impact on digital payments

Interpretation:- Digital payments have created a lot of buzz. we spent using certain analytics. It serves as a crucial tool

Some believe that such impact has been created due to for keeping track of our everyday bills and internet

covid-19 but on the other hand some believe that digital transactions.

payments have been impacted by demonetization. The graph Lower risk- The third advantage of digital payments is

presents that covid-19 has created a lot of impact on digital that they help to reduce the risk of losing money. This

payments. means that electronic payments are safer.

E-payment systems have emerged as a significant

II. CONCLUSION facilitating engine in the e-commerce industry. This

implies it has given the e-commerce industry a significant

Digital payments do have an impact on customers, as this

boost.

report properly points out. Different responders received a

I believe that digital payments will be the future of

survey including a set of questions. "Has demonetization

Indian economy and will also act as an aid in making the

really aided the growth of digital payments?" is the issue

economy cashless.

that arises. Because of the Covid-19 epidemic, digital

payments have gotten a boost. The outbreak of the Covid- DECLARATION

19 virus boosted the popularity of Paytm, a digital

payment company. Customers can benefit from digital I, Shreeyam Chaudhary, therefore certify that the work

payments, often known as cashless transactions, in the completed for this project, titled "Digital Payments in India

following ways. - " is exclusively based on my knowledge of the subject. All

One of the advantages of digital payment is that it makes my conclusions are based on my own study and survey data.

making online payments more convenient. This means The references made by me to previous research done by

that the payment can be made, and the transaction other students have been given due mention in the paper and

completed with only one click. in the bibliography at the end of the dissertation. I, here by

Tracking expenditures- Another significant advantage of further declare that the work done in this

digital payment is that it allows us to keep track of our

spending. This means that we can easily trace how much

IJISRT22SEP1081 www.ijisrt.com 1064

Volume 7, Issue 9, September – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

REFERENCES

[1.] Ranjith, P. V., Kulkarni, S., & Varma, A. J. (2021). A

Literature Study Of Consumer Perception Towards

Digital Payment Mode In India. PSYCHOLOGY

AND EDUCATION, 58(1), 3304-3319.

[2.] Mohd, S., & Pal, R. (2020). Moving from Cash to

Cashless: A Study of Consumer Perception towards

Digital Transactions. PRAGATI: Journal of Indian

Economy, 7(1), 1-13.

[3.] Baghla, A. (2018). A study on the future of digital

payments in India. International Journal of Research

and Analytical Reviews, 5(4), 85-89.

[4.] Eswaran, K. K. (2019). Consumer perception towards

digital payment mode with special reference to digital

wallets. Research Explorer, 22.

[5.] Singh, S., & Rana, R. (2017). Study of consumer

perception of digital payment mode. Journal of

Internet Banking and Commerce, 22(3), 1-14.

[6.] Sakthivel, N., & HS, R. N. (2020). A STUDY ON

CUSTOMERS’PERCEPTION TOWARDS

DIGITAL PAYMENTS–AN EMPIRICAL STUDY

OF TUMKUR DISTRICT. Editorial Board, 9(4), 15.

[7.] Singhal, D., & Padhmanabhan, V. (2008). A study on

customer perception towards internet banking:

Identifying major contributing factors. Journal of

Nepalese business studies, 5(1), 101-111.

IJISRT22SEP1081 www.ijisrt.com 1065

You might also like

- Florida's Final Order Against Vroom For $87,000Document5 pagesFlorida's Final Order Against Vroom For $87,000Kim BurrowsNo ratings yet

- IDFC FIRST Bank MBA Scholarship 2022-24 Selection NotificationDocument2 pagesIDFC FIRST Bank MBA Scholarship 2022-24 Selection NotificationHarshav BessariyaNo ratings yet

- ENach Brochure - Veri5Digital (Khosla Labs)Document1 pageENach Brochure - Veri5Digital (Khosla Labs)veri5digitaNo ratings yet

- Account Statement For Account:2962000100457772: Branch DetailsDocument2 pagesAccount Statement For Account:2962000100457772: Branch DetailsBest Auto TechNo ratings yet

- SBGPA-ProgGuideandApp (Revised 5-25-22)Document11 pagesSBGPA-ProgGuideandApp (Revised 5-25-22)Alexander PichardoNo ratings yet

- Endorsement HDFC Format MotorDocument3 pagesEndorsement HDFC Format MotorvasuNo ratings yet

- How Nifty! But Are NFTs Securities, Commodities, or Something ElseDocument27 pagesHow Nifty! But Are NFTs Securities, Commodities, or Something ElseRishiNo ratings yet

- Key BenefitsDocument13 pagesKey BenefitsJai HindNo ratings yet

- Karnataka Excise (Brewery) Rules, 1967Document11 pagesKarnataka Excise (Brewery) Rules, 1967anshuman1802No ratings yet

- Commodities Account FormDocument36 pagesCommodities Account FormMishab MappiNo ratings yet

- Sukanya Samriddhi Account FactsheetDocument4 pagesSukanya Samriddhi Account FactsheetMadhu DatarNo ratings yet

- E-Auction Process Document-EasunDocument36 pagesE-Auction Process Document-EasunVinod RahejaNo ratings yet

- TicketDocument2 pagesTicketChetan AgrawalNo ratings yet

- Cef Log - PreviousDocument22 pagesCef Log - PreviousNopeNoteven gonnatellyouNo ratings yet

- A Study of Indian Woman's Acceptance of Digital Financial Transactions With Specific Surveyof Woman in Education FieldDocument6 pagesA Study of Indian Woman's Acceptance of Digital Financial Transactions With Specific Surveyof Woman in Education FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- SEBI Claim Form Details for Shukul Wealth AdvisoryDocument3 pagesSEBI Claim Form Details for Shukul Wealth Advisoryandrew punekarNo ratings yet

- Grofers - PIP Form Niraj ShahDocument3 pagesGrofers - PIP Form Niraj ShahStuti GaurNo ratings yet

- WalmartcaseDocument30 pagesWalmartcaseBarret RobisonNo ratings yet

- Hemet City Manager Christopher LopezDocument19 pagesHemet City Manager Christopher LopezHemetUpdatesNo ratings yet

- Mail Ballot Application For Rhode Island General Election.Document2 pagesMail Ballot Application For Rhode Island General Election.Frank MaradiagaNo ratings yet

- Lista de Precios Grupo Lan-Ber 2022Document291 pagesLista de Precios Grupo Lan-Ber 2022Franco bucciarelliNo ratings yet

- Family's Financial Planning - Nurul Fatihah (2022923445)Document16 pagesFamily's Financial Planning - Nurul Fatihah (2022923445)nurul fatihahhhNo ratings yet

- BBPS PresentationDocument11 pagesBBPS PresentationRajkot academyNo ratings yet

- PL Power Yellow - 01 Apr 22Document9 pagesPL Power Yellow - 01 Apr 22Dunia FantasiNo ratings yet

- CV 4C Rev 04Document2 pagesCV 4C Rev 04Tantikorn JantoNo ratings yet

- HDFC ERGO Health Insurance Policy DetailsDocument4 pagesHDFC ERGO Health Insurance Policy DetailsDr Ankit PardhiNo ratings yet

- IDFC Scholarship3Document1 pageIDFC Scholarship3Harshav BessariyaNo ratings yet

- Pulsar 160 Ns Users GuideDocument2 pagesPulsar 160 Ns Users GuideaunerNo ratings yet

- Avanse App Form PDFDocument4 pagesAvanse App Form PDFSuresh DhanasekarNo ratings yet

- Bosch Sensortec Product OverviewDocument16 pagesBosch Sensortec Product OverviewAmador Garcia III100% (1)

- Unit I Cyber Law & Power of Arrest Without Warrant Under The It Acts, 2000 Q.) What Is Cyber Law? What Are Needs of Cyber Law?Document52 pagesUnit I Cyber Law & Power of Arrest Without Warrant Under The It Acts, 2000 Q.) What Is Cyber Law? What Are Needs of Cyber Law?Hatim KanchwalaNo ratings yet

- Marathon NotesDocument341 pagesMarathon NotesLokesh Agarwalla100% (1)

- Case4 - Nupetco PPT - PastelDocument45 pagesCase4 - Nupetco PPT - PastelNurul Farah Mohd FauziNo ratings yet

- Process For Registration of Password Based User On SPEED-e FacilityDocument14 pagesProcess For Registration of Password Based User On SPEED-e FacilitySathishNo ratings yet

- AIR TRANSPORT ECONOMICS Module QuestionsDocument7 pagesAIR TRANSPORT ECONOMICS Module QuestionsWiraNo ratings yet

- E Banking in India With Special Focus OnDocument38 pagesE Banking in India With Special Focus On060Suman BeheraNo ratings yet

- EcoStruxure Security ExpertDocument36 pagesEcoStruxure Security ExpertNguyen Van KhoiNo ratings yet

- CAC Meeting Notes 9.29Document30 pagesCAC Meeting Notes 9.29OANo ratings yet

- BCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Document3 pagesBCIF - Ver9 With DPA and Bill Delivery Agreement - 02022022Marilyn DelacruzNo ratings yet

- Intership Report FinalDocument34 pagesIntership Report Final720721206028 MADHESH DNo ratings yet

- Philippine Canadian Inquirer #508Document32 pagesPhilippine Canadian Inquirer #508canadianinquirerNo ratings yet

- Capstone Final Report - Natural Disaster App - FinalDocument32 pagesCapstone Final Report - Natural Disaster App - Finalapi-498485959No ratings yet

- Question - Answer (Dr. Sam) - 2007-2016Document352 pagesQuestion - Answer (Dr. Sam) - 2007-2016Mohammed ShafiNo ratings yet

- Payments To MsmeDocument3 pagesPayments To MsmeRavi PanchalNo ratings yet

- Statement of Account SummaryDocument34 pagesStatement of Account Summarysushil tripathiNo ratings yet

- In A Frictionless Incompressible Flow The Veloci...Document1 pageIn A Frictionless Incompressible Flow The Veloci...Mergen KhanNo ratings yet

- FERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesDocument165 pagesFERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesKPLC 7 NewsNo ratings yet

- Alexander Sulkowski Wiggins Federal Tax Policy - StatesDocument59 pagesAlexander Sulkowski Wiggins Federal Tax Policy - StatesFederico Ariel LópezNo ratings yet

- Understanding customer perception of UPIDocument7 pagesUnderstanding customer perception of UPINitin ChourasiaNo ratings yet

- iMAP User Guide 9 0 Issue1Document872 pagesiMAP User Guide 9 0 Issue1vasilacheaNo ratings yet

- Electronic Banking and Customer Satisfaction A Study on First Security Islami BankDocument75 pagesElectronic Banking and Customer Satisfaction A Study on First Security Islami BankMd Mostafijur RahmanNo ratings yet

- Invest India PDFDocument171 pagesInvest India PDFManoj BhojNo ratings yet

- GroupF PaymentMethodsDocument22 pagesGroupF PaymentMethodsNgân ThùyNo ratings yet

- Tremblay. Age Related Deficits in Speech ProductionDocument9 pagesTremblay. Age Related Deficits in Speech ProductionpaulyfonoNo ratings yet

- Baby Boomers and The Online Payment System: Why A BurdenDocument2 pagesBaby Boomers and The Online Payment System: Why A BurdenJoyce VilaNo ratings yet

- VDP CatalogueDocument24 pagesVDP Cataloguemr.vj4uNo ratings yet

- SV College Student Guide for Virtusa Jatayu Season-3 Project CompetitionDocument1 pageSV College Student Guide for Virtusa Jatayu Season-3 Project CompetitionSai UthejNo ratings yet

- All Great Conversations 06102020 32Document32 pagesAll Great Conversations 06102020 32Shivam ChekeNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- Group 3 ProjectDocument27 pagesGroup 3 ProjectAbhishek DhruvNo ratings yet

- Compact and Wearable Ventilator System for Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System for Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Implications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Air Quality Index Prediction using Bi-LSTMDocument8 pagesAir Quality Index Prediction using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parkinson’s Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson’s Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research Technology100% (1)

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- "Remembering The Past": ConsciousnessDocument2 pages"Remembering The Past": Consciousnessnona jean ydulzuraNo ratings yet

- Set Down Servant!: . J J J. ' F R - 'Document7 pagesSet Down Servant!: . J J J. ' F R - 'Kora LapaNo ratings yet

- Global Citizenship and Global GovernanceDocument13 pagesGlobal Citizenship and Global GovernanceDanna Francheska100% (1)

- Et in Arcadia EgoDocument5 pagesEt in Arcadia Ego69telmah69No ratings yet

- The Influence of The English Language On The Russian Youth SlangDocument10 pagesThe Influence of The English Language On The Russian Youth SlangВасилий БоровцовNo ratings yet

- Understanding National Income ConceptsDocument21 pagesUnderstanding National Income ConceptsJohn Richard RiveraNo ratings yet

- The Impact of Innovative Digital Marketing Strategy On Small Firm PerformanceDocument43 pagesThe Impact of Innovative Digital Marketing Strategy On Small Firm PerformanceFavour ChukwuelesieNo ratings yet

- Luci’s CPA Method Earn With Rewards SiteDocument3 pagesLuci’s CPA Method Earn With Rewards Sitemaster-rich0% (1)

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- Entering and Developing A Service Network: Sheena Leek and Louise CanningDocument10 pagesEntering and Developing A Service Network: Sheena Leek and Louise CanningTanisha KrunalNo ratings yet

- History and Political Science: Solution: Practice Activity Sheet 3Document9 pagesHistory and Political Science: Solution: Practice Activity Sheet 3Faiz KhanNo ratings yet

- The List: GHOST by Fred Burton PrefaceDocument3 pagesThe List: GHOST by Fred Burton PrefaceAman KhannaNo ratings yet

- Lightcyber Behavioral AnalyticsDocument4 pagesLightcyber Behavioral AnalyticsasadaNo ratings yet

- Strong WindDocument3 pagesStrong WindYuli IndrawatiNo ratings yet

- Integration of Islamic Education in Public SchoolsDocument7 pagesIntegration of Islamic Education in Public SchoolstimespergerakanNo ratings yet

- Real property dispute over notice of levy annotation (37Document15 pagesReal property dispute over notice of levy annotation (37heyoooNo ratings yet

- Conceptual Framework and Accounting Standards (Valix, peralta, valix 2020) - Identifying Accounting ProcessDocument3 pagesConceptual Framework and Accounting Standards (Valix, peralta, valix 2020) - Identifying Accounting ProcessAngel heheNo ratings yet

- Dildilian Exhibition DiyarbakirDocument1 pageDildilian Exhibition DiyarbakirArmen MarsoobianNo ratings yet

- Soriano Et Al., v. CIR Facts: The Case Involved Consolidated Petitions For Certiorari, ProhibitionDocument4 pagesSoriano Et Al., v. CIR Facts: The Case Involved Consolidated Petitions For Certiorari, ProhibitionLouise Bolivar DadivasNo ratings yet

- Nodalo - Medicard vs. CirDocument3 pagesNodalo - Medicard vs. CirGenebva Mica NodaloNo ratings yet

- An Argument For The Eastern Origins of CatharismDocument22 pagesAn Argument For The Eastern Origins of CatharismDiana Bernal ColonioNo ratings yet

- NT ADVT-NON Teaching 18022022Document9 pagesNT ADVT-NON Teaching 18022022sathishNo ratings yet

- Seirei Tsukai No Blade Dance - Volume 12 - Releasing The Sealed SwordDocument284 pagesSeirei Tsukai No Blade Dance - Volume 12 - Releasing The Sealed SwordGabriel John DexterNo ratings yet

- Big BazarDocument62 pagesBig BazarVenki GajaNo ratings yet

- MUET@UiTM2020 - Food Poisoning - Analysis & SynthesisDocument15 pagesMUET@UiTM2020 - Food Poisoning - Analysis & SynthesisNURUL FARRAH LIEYANA BT SHAMSUL BAHARINo ratings yet

- SAP PM EAM Configuration 1 1617832490Document9 pagesSAP PM EAM Configuration 1 1617832490Mayte López AymerichNo ratings yet

- Minutes Feb 28 2022Document5 pagesMinutes Feb 28 2022Raquel dg.BulaongNo ratings yet

- American Political Parties: Republicans vs. DemocratsDocument60 pagesAmerican Political Parties: Republicans vs. DemocratsSchmetterling TraurigNo ratings yet

- Nama: Yandra Febriyanti No BP: 1810531018 P2-23 1) Equity Method Entroes On Peanut Company's BooksDocument7 pagesNama: Yandra Febriyanti No BP: 1810531018 P2-23 1) Equity Method Entroes On Peanut Company's BooksYandra FebriyantiNo ratings yet

- Is 6392 1971Document62 pagesIs 6392 1971Chandra SekharNo ratings yet