Professional Documents

Culture Documents

IE Matrix

Uploaded by

Graciella TiffanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IE Matrix

Uploaded by

Graciella TiffanyCopyright:

Available Formats

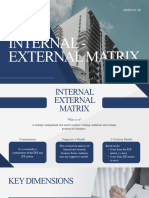

CHAPTER 6 • STRATEGY ANALYSIS AND CHOICE 189

FIGURE 6-9

The Internal–External (IE) Matrix

THE IFE TOTAL WEIGHTED SCORES

• Backward, Forward, or Horizontal Integration

• Market Penetration Strong Average Weak

• Market Development 3.0 to 4.0 2.0 to 2.99 1.0 to 1.99

• Product Development

Grow and build 3.0 2.0 1.0

4.0

High

I II III

3.0 to 4.0

3.0

THE

EFE

Medium IV V VI

TOTAL

2.0 to 2.99

WEIGHTED

SCORES 2.0

Low VII VIII IX

1.0 to 1.99

1.0

Hold and maintain Harvest or divest

• Market Penetration • Retrenchment

• Product Development • Divestiture

Source: Adapted. The IE Matrix was developed from the General Electric (GE) Business Screen Matrix. For a description of the GE Matrix see

Michael Allen, “Diagramming GE’s Planning for What’s WATT,” in R. Allio and M. Pennington, eds., Corporate Planning: Techniques and

Applications (New York: AMACOM, 1979).

The IE Matrix is based on two key dimensions: the IFE total weighted scores on the

x-axis and the EFE total weighted scores on the y-axis. Recall that each division of an

organization should construct an IFE Matrix and an EFE Matrix for its part of the orga-

nization. The total weighted scores derived from the divisions allow construction of the

corporate-level IE Matrix. On the x-axis of the IE Matrix, an IFE total weighted score of

1.0 to 1.99 represents a weak internal position; a score of 2.0 to 2.99 is considered aver-

age; and a score of 3.0 to 4.0 is strong. Similarly, on the y-axis, an EFE total weighted

score of 1.0 to 1.99 is considered low; a score of 2.0 to 2.99 is medium; and a score of

3.0 to 4.0 is high.

The IE Matrix can be divided into three major regions that have different strategy

implications. First, the prescription for divisions that fall into cells I, II, or IV can be

described as grow and build. Intensive (market penetration, market development, and

product development) or integrative (backward integration, forward integration, and

horizontal integration) strategies can be most appropriate for these divisions. Second, divi-

sions that fall into cells III, V, or VII can be managed best with hold and maintain strate-

gies; market penetration and product development are two commonly employed strategies

for these types of divisions. Third, a common prescription for divisions that fall into cells

VI, VIII, or IX is harvest or divest. Successful organizations are able to achieve a portfolio

of businesses positioned in or around cell I in the IE Matrix.

An example of a completed IE Matrix is given in Figure 6-10, which depicts an

organization composed of four divisions. As indicated by the positioning of the cir-

cles, grow and build strategies are appropriate for Division 1, Division 2, and Division

3. Division 4 is a candidate for harvest or divest. Division 2 contributes the greatest

percentage of company sales and thus is represented by the largest circle. Division

1 contributes the greatest proportion of total profits; it has the largest-percentage pie

slice.

As indicated in Figure 6-11, the IE Matrix has five product segments. Note that

Division #1 has the largest revenues (as indicated by the largest circle) and the largest prof-

its (as indicated by the largest pie slice) in the matrix. It is common for organizations to

You might also like

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Achieving Business Value from Technology: A Practical Guide for Today's ExecutiveFrom EverandAchieving Business Value from Technology: A Practical Guide for Today's ExecutiveNo ratings yet

- I II III: The Ife Total Weighted Scores Weak 1.0 To 1.99 Average 2.0 To 2.99 Strong 3.0 To 4.0 High 3.0 To 4.0Document1 pageI II III: The Ife Total Weighted Scores Weak 1.0 To 1.99 Average 2.0 To 2.99 Strong 3.0 To 4.0 High 3.0 To 4.0CosmasNo ratings yet

- Stars II Questions: Marks IDocument4 pagesStars II Questions: Marks INurul HidayahNo ratings yet

- IE Matrix: Strong Average WeakDocument1 pageIE Matrix: Strong Average WeakJay-ar Castillo Watin Jr.No ratings yet

- Selecta Ie Matrix ModelDocument1 pageSelecta Ie Matrix ModelAbegail DeLa CruzNo ratings yet

- Total Ife Rating: STRONG (3.0 - 4.0) AVERAGE (2.0 - 2.99) WEAK (1.0 - 1.99)Document2 pagesTotal Ife Rating: STRONG (3.0 - 4.0) AVERAGE (2.0 - 2.99) WEAK (1.0 - 1.99)VinNo ratings yet

- San Beda University: College of Arts and Sciences San Miguel, Mendiola, ManilaDocument8 pagesSan Beda University: College of Arts and Sciences San Miguel, Mendiola, ManilaBlanche PenesaNo ratings yet

- IE MatrixDocument5 pagesIE MatrixShereen AlobinayNo ratings yet

- IE Matrix ReportDocument14 pagesIE Matrix ReportKrisca DepalubosNo ratings yet

- Strama ReportDocument20 pagesStrama ReportRonel DadulaNo ratings yet

- Assignment 4 - Group Tran Thu ThaoDocument3 pagesAssignment 4 - Group Tran Thu ThaoPhan Nguyễn Quỳnh NhưNo ratings yet

- 6.0 Case 3Document9 pages6.0 Case 3RAY NICOLE MALINGINo ratings yet

- Internal External MatrixDocument2 pagesInternal External MatrixDEBALINA SENNo ratings yet

- I II III: in Millions of USD (Year 2013)Document6 pagesI II III: in Millions of USD (Year 2013)Karen May AlonsagayNo ratings yet

- Strat SummaryDocument2 pagesStrat SummaryMARY JOY CULTURA HUGONo ratings yet

- The Ife Total Weighted Scores: D. The Internal-External (IE) MatrixDocument1 pageThe Ife Total Weighted Scores: D. The Internal-External (IE) MatrixJasonHrvyNo ratings yet

- Internal-External Matrix (STRAMA 2)Document11 pagesInternal-External Matrix (STRAMA 2)Jenny Keece RaquelNo ratings yet

- Boston Consulting Group Matrix (BCG Matrix)Document19 pagesBoston Consulting Group Matrix (BCG Matrix)c-191786No ratings yet

- SM Part1bDocument29 pagesSM Part1bDivya Mary PhilipNo ratings yet

- Strong 3.0 To 4.0 Average 2.0 To 2.99 Weak 1.0 To 1.99: Jun Zen Ralph Yap BSA - 2 YearDocument2 pagesStrong 3.0 To 4.0 Average 2.0 To 2.99 Weak 1.0 To 1.99: Jun Zen Ralph Yap BSA - 2 YearJunzen Ralph YapNo ratings yet

- IE GE Matrix Grand StrategyDocument18 pagesIE GE Matrix Grand StrategyVignesh StrykerNo ratings yet

- Ife Efe Ie Swot (Autorecovered)Document12 pagesIfe Efe Ie Swot (Autorecovered)HeloiseNo ratings yet

- Internal External Matrix & SPACE MatrixDocument9 pagesInternal External Matrix & SPACE MatrixATUL ABNo ratings yet

- Building Up Customer Management Skills To Improve Trade Spend Efficiency and EffectivenessDocument53 pagesBuilding Up Customer Management Skills To Improve Trade Spend Efficiency and EffectivenessM BNo ratings yet

- 2022 - Chapter07 Growth UpdatedDocument30 pages2022 - Chapter07 Growth UpdatedElias MacherNo ratings yet

- Matriks Ie (Internal Eksternal)Document6 pagesMatriks Ie (Internal Eksternal)blue 0610No ratings yet

- Internal-External (IE) Matrix How Can You Improve The IE Matrix in Your Business?Document2 pagesInternal-External (IE) Matrix How Can You Improve The IE Matrix in Your Business?Althea MeodeNo ratings yet

- PARAGMILK StockReport 20230828 1022Document12 pagesPARAGMILK StockReport 20230828 1022Chetan ChouguleNo ratings yet

- Strikland Grand StrategyDocument12 pagesStrikland Grand StrategykeshavsunNo ratings yet

- ASSIGNMENT AFA II BARU LagiDocument88 pagesASSIGNMENT AFA II BARU LagiFadhilahAbdullahNo ratings yet

- Pacalna, Anifah B. (QSPM)Document6 pagesPacalna, Anifah B. (QSPM)Anifahchannie PacalnaNo ratings yet

- SM 2.4 (Matching & Decision Tools)Document13 pagesSM 2.4 (Matching & Decision Tools)brahm2009No ratings yet

- Minor ProblemsDocument6 pagesMinor ProblemsUzma SiddiquiNo ratings yet

- IFE MatrixDocument2 pagesIFE MatrixGraciella Tiffany100% (1)

- BCG - GE MATRIX-EnglishDocument34 pagesBCG - GE MATRIX-EnglishFadhel AkmalNo ratings yet

- Week 7 Strategi Choice Part B DR - Yulihasri ContiniuDocument35 pagesWeek 7 Strategi Choice Part B DR - Yulihasri ContiniuHanifaputriayediaNo ratings yet

- Final Report MGT-403Document27 pagesFinal Report MGT-403Ashrafur RahmanNo ratings yet

- Total X Axis 3.7Document7 pagesTotal X Axis 3.7Crispy IsaacNo ratings yet

- Drivers of Productivity Performance in France and GermanyDocument23 pagesDrivers of Productivity Performance in France and GermanyJonathan WenNo ratings yet

- STOXPLUSs-MA-REPORT-2018 Final TPLXXXXX 20180919171653 PDFDocument60 pagesSTOXPLUSs-MA-REPORT-2018 Final TPLXXXXX 20180919171653 PDFTai KhuatNo ratings yet

- 6.0 Case 1Document14 pages6.0 Case 1RAY NICOLE MALINGINo ratings yet

- Business 189 - Professor Shirley Presented By: Alma Rios, Jeremy Lacsa, José R. Vigil, Farhaad Sheikh, Kunal PatelDocument23 pagesBusiness 189 - Professor Shirley Presented By: Alma Rios, Jeremy Lacsa, José R. Vigil, Farhaad Sheikh, Kunal Patelmahesh.mohandas3181No ratings yet

- Mang InasalDocument9 pagesMang InasalReianne Espesor100% (3)

- David sm13 PPT 06Document23 pagesDavid sm13 PPT 06marhadiNo ratings yet

- Space Matrix and IE Matrix of HPDocument3 pagesSpace Matrix and IE Matrix of HPSAMNo ratings yet

- Case Study On RevlonDocument10 pagesCase Study On Revlonmuhammadamad8930100% (13)

- CH. 6 Strategy Analysis and Choice PDFDocument27 pagesCH. 6 Strategy Analysis and Choice PDFHadjiNo ratings yet

- StrategiesDocument17 pagesStrategiesLiaqat AliNo ratings yet

- Moolah RakersDocument10 pagesMoolah Rakersm1081eNo ratings yet

- Mm108 Topic 3Document34 pagesMm108 Topic 3Rose Shenen Bagnate PeraroNo ratings yet

- Module 4B 1Document12 pagesModule 4B 1aguilaremmanuelNo ratings yet

- Divisio N Revenue Profit EFE Scores IFE ScoresDocument3 pagesDivisio N Revenue Profit EFE Scores IFE ScoresCresenciano MalabuyocNo ratings yet

- Final Project - Strategic ManagementsDocument37 pagesFinal Project - Strategic ManagementsHira NazNo ratings yet

- Strategic Evaluation and ChoiceDocument43 pagesStrategic Evaluation and Choice820021No ratings yet

- The Matching and Decision StageDocument14 pagesThe Matching and Decision StageLouie ManaoNo ratings yet

- Segment Revenue (AED M) % Revenue Profit (AED M) % Profit IFE EFEDocument3 pagesSegment Revenue (AED M) % Revenue Profit (AED M) % Profit IFE EFEAzizi MusaNo ratings yet

- East Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthFrom EverandEast Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthNo ratings yet

- The HERO Transformation Playbook: The step-by-step guide for delivering large-scale changeFrom EverandThe HERO Transformation Playbook: The step-by-step guide for delivering large-scale changeNo ratings yet

- Po Week 4 PDFDocument3 pagesPo Week 4 PDFGraciella TiffanyNo ratings yet

- Po Week 3 PDFDocument3 pagesPo Week 3 PDFGraciella TiffanyNo ratings yet

- Po Week 3Document18 pagesPo Week 3Graciella TiffanyNo ratings yet

- Projected Income StatementDocument6 pagesProjected Income StatementGraciella TiffanyNo ratings yet

- IFE MatrixDocument2 pagesIFE MatrixGraciella Tiffany100% (1)

- Angel David Guardiola Sepulveda: Employment HistoryDocument1 pageAngel David Guardiola Sepulveda: Employment HistoryAngelD GSNo ratings yet

- ENG301 (Bc230423642)Document3 pagesENG301 (Bc230423642)shahbaz shahidNo ratings yet

- Previous and Present Compliance Situation of RMGDocument24 pagesPrevious and Present Compliance Situation of RMGMamia PoushiNo ratings yet

- About Meesho: FoundersDocument2 pagesAbout Meesho: FoundersSachin PrasannaNo ratings yet

- Information System Used by Hindustan Unilever LimitedDocument3 pagesInformation System Used by Hindustan Unilever LimitedSaanjana G PNo ratings yet

- Moneysprite Financial Viewpoint - Summer 2015Document4 pagesMoneysprite Financial Viewpoint - Summer 2015Jody SturmanNo ratings yet

- Product Line 2020Document7 pagesProduct Line 2020Da GwapingsNo ratings yet

- Intermediate Accounting TheoriesDocument12 pagesIntermediate Accounting TheoriesRayman MamakNo ratings yet

- Global Demography and MigrationDocument76 pagesGlobal Demography and MigrationTaraKyleUyNo ratings yet

- CIR Vs SONY PDFDocument2 pagesCIR Vs SONY PDFkaira marie carlosNo ratings yet

- Edoc - Tips Ch01 Financial Markets Money MarketDocument12 pagesEdoc - Tips Ch01 Financial Markets Money MarketKelvin LeongNo ratings yet

- Toast-How To Manage A Restaurant in Todays Competitive EnvironmentDocument28 pagesToast-How To Manage A Restaurant in Todays Competitive Environmentsinghishpal24374No ratings yet

- Wage and SalaryDocument30 pagesWage and Salaryaloha12345680% (5)

- Principle of Macro-Economics Mcq'sDocument6 pagesPrinciple of Macro-Economics Mcq'sSafiullah mirzaNo ratings yet

- Cost Accounting - Process CostingDocument9 pagesCost Accounting - Process CostingAll Round GURuNo ratings yet

- Sample CV FormatDocument1 pageSample CV FormatHarsh GadhiyaNo ratings yet

- Digital Transformation Template-PlayfulDocument14 pagesDigital Transformation Template-PlayfulvinothdeviNo ratings yet

- Economic SurveyDocument7 pagesEconomic SurveyAman SinghNo ratings yet

- What Is The Link Between Organisation Strateg1Document12 pagesWhat Is The Link Between Organisation Strateg1Pardeep KumarNo ratings yet

- BrochureDocument5 pagesBrochureSumay Kumar FNo ratings yet

- Parentis A Public Listed Company Acquired 600 Million Equity SharesDocument1 pageParentis A Public Listed Company Acquired 600 Million Equity SharesTaimour HassanNo ratings yet

- Business Model Pratik Katkar & Omkar BodakeDocument3 pagesBusiness Model Pratik Katkar & Omkar Bodakemanu katkarNo ratings yet

- Auditing MCQsDocument35 pagesAuditing MCQsAbdulrehman567No ratings yet

- Iso-Tc260 n0002 n2 TSP 217 HR ManagementDocument15 pagesIso-Tc260 n0002 n2 TSP 217 HR ManagementAleksandar Iloski100% (1)

- Renewable Energy 16.11.2022Document20 pagesRenewable Energy 16.11.2022Kato AkikoNo ratings yet

- Procurement - Supply Chain ManagmentDocument21 pagesProcurement - Supply Chain ManagmentIvyNo ratings yet

- Sohar University Faculty of Business International Business (BUBS4402)Document8 pagesSohar University Faculty of Business International Business (BUBS4402)AmalNo ratings yet

- HR Operations SpecialistDocument2 pagesHR Operations SpecialistMuhammad FarhanNo ratings yet

- NIFT 2019 - The Joint Venture ConceptDocument33 pagesNIFT 2019 - The Joint Venture ConceptSalil SheikhNo ratings yet

- MGT610 Business Ethics Mid Term Solved MCQs 1Document15 pagesMGT610 Business Ethics Mid Term Solved MCQs 1irtaza HashmiNo ratings yet