Professional Documents

Culture Documents

CTC Structure - 5 - 6 - 920211014173358

CTC Structure - 5 - 6 - 920211014173358

Uploaded by

piyush rawatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CTC Structure - 5 - 6 - 920211014173358

CTC Structure - 5 - 6 - 920211014173358

Uploaded by

piyush rawatCopyright:

Available Formats

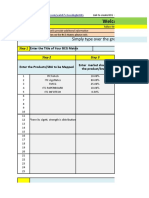

SI.NO.

Components Conditions

1 CTC Cost to Company - Total Salary

2 Fixed Salary Constant salary credit to the employee

3 Variable Salary Incentive Pay - Target or Goals Achieve

Paid to the employee based on the

4 Basic Salary company location - 3 Category = Urban,

Semi-Urban and Rural

DA = Inflation taken place in the econom.

5 Dearness Allowance

Condition

HRA = Rent allowance provided to the

6 House Rent Allowance

employee for their accomd. Purpose

CA = Home to company premises and

7 Conveyance Allowance

Vice Versa

MA = Baisc expenses medical happen to

8 Medical Allowance

the employee in monthly

LTA = Once in Two Years - Rembur. On

9 Leave Travel Allowance

your travel and accomdation

CEA = Money give to the employee for

10 Child Education Allowance their childrens education - Maximum 2

Kids

CEA = Money give to the employee for

11 Child Hostel Allowance their childrens hostel facility - Maximum

2 Kids

PF - Saving plan for the employee - Two

Contribution - Employee and Employer -

12 Provident Fund

Employee Cancel = Monthly Basic Salary

should be more than Rs. 15,001/-

Gratuity = Saving Purpose - Employee

13 Gratuity should complete 4.8 Years in the same

company - Eligible for Gratuity

ESIC = Below Rs. 21,000/ Per Month -

14 ESIC Medical Purpose - Employee contribution

and Employer Contribution

PT = Employee who will be covered

under Professional - PT to the respective

15 Professional Tax

state government - performing

professionalism

TDS = Tax Deduction at Source -

Monetary transaction - Tax need to be

16 TDS

paid - Employee Need to pay TAX to

Employer

17 Gross Salary Addition part of your CTC Components

18 Net Salary After the Deduction

19 Grade Pay / Special Allowance Adjust amount

Formula

CTC = Fixed salary + Variable Salary

FS = CTC - Variable Pay

VP = CTC - Fixed Salary

Urban = 50% of CTC or FS; Semi-

Urban = 40% of CTC or VP; Rural =

30% or 35% of CTC or VP

DA = 17% of Basic Salary

HRA = 40% of (BS+DA)

CA = Rs. 19,200/- Per annum = Rs.

1,600/- Per Month

MA = Rs. 15,000//- Per Annum = Rs.

1,250/- Per Month

LTA = 1 Month of your BS

CEA = 100*2*12 = Rs. 2,400/-

Perannum

CHA = 300*2*12 = Rs.7,200/-

Perannum

PF = 12% of (BS + DA)

Gratuity = 4.81% of Basic Salary

ESIC = 4% of Gross Salary (Employee

= 0.75% Employer = 3.25%)

PT = Rs. 2,500/- Per Annum (11Months

= Rs. 200/- 12th Month Rs. 300/-)

Depends according to the income tax

process

GS = CTC Components

(BS+DA+HRA+CA+MA+LTA+CEA+

CHA+Grade Pay)

Net Salary = GS - Deducation

(PF+GRATUITY+ESIC+TDS+PT)

GP = CTC - CTC Component

(BS+DA+HRA+CA+MA+LTA+CEA+

CHA+PF+GRATUITY+ESIC)

SI.NO. Components

1 CTC

2 Fixed Salary

3 Variable Salary

4 Basic Salary

5 Dearness Allowance

6 House Rent Allowance

7 Conveyance Allowance

8 Medical Allowance

9 Leave Travel Allowance

10 Child Education Allowance

11 Child Hostel Allowance

12 Provident Fund

13 Gratuity

14 ESIC

15 Professional Tax

16 TDS

17 Gross Salary

18 Net Salary

19 Grade Pay / Special Allowance

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hide & Seek MKT MiniDocument15 pagesHide & Seek MKT Minipiyush rawatNo ratings yet

- HRM PartDocument9 pagesHRM Partpiyush rawatNo ratings yet

- CTC Break Up - PGDM 1Document16 pagesCTC Break Up - PGDM 1piyush rawatNo ratings yet

- CTC StructureDocument81 pagesCTC Structurepiyush rawatNo ratings yet

- HRM Mini Prateek KhandelwalDocument17 pagesHRM Mini Prateek Khandelwalpiyush rawatNo ratings yet

- Final Project PresentationDocument25 pagesFinal Project Presentationpiyush rawatNo ratings yet

- Mcdonald'S Case Study: Prepared By: Isha Aggarwal Section: PGDM 1Document11 pagesMcdonald'S Case Study: Prepared By: Isha Aggarwal Section: PGDM 1piyush rawatNo ratings yet

- BCG TemplateDocument7 pagesBCG Templatepiyush rawatNo ratings yet

- Titan AR 2021-22Document326 pagesTitan AR 2021-22piyush rawatNo ratings yet

- Final Project TitaneyeplusDocument16 pagesFinal Project Titaneyepluspiyush rawatNo ratings yet

- Zero Session - 5 - 6 - 920220722101336Document20 pagesZero Session - 5 - 6 - 920220722101336piyush rawatNo ratings yet

- Linkedin Case StudyDocument10 pagesLinkedin Case Studypiyush rawatNo ratings yet

- Session 2 Ba (2) - 5 - 6 - 920220803152202Document17 pagesSession 2 Ba (2) - 5 - 6 - 920220803152202piyush rawatNo ratings yet

- LinkedIn PIYUSHDocument10 pagesLinkedIn PIYUSHpiyush rawatNo ratings yet

- STP New - 5 - 6 - 920220722152102Document38 pagesSTP New - 5 - 6 - 920220722152102piyush rawatNo ratings yet

- Infosys and ItcDocument18 pagesInfosys and Itcpiyush rawatNo ratings yet

- Linkedin Case StudyDocument8 pagesLinkedin Case Studypiyush rawatNo ratings yet

- SafyDocument20 pagesSafypiyush rawatNo ratings yet

- GodrejDocument15 pagesGodrejpiyush rawatNo ratings yet

- SajhfghDocument22 pagesSajhfghpiyush rawatNo ratings yet

- Comparative Study of Financial Statement of Adani Ports V/S Ultratech CementDocument21 pagesComparative Study of Financial Statement of Adani Ports V/S Ultratech Cementpiyush rawatNo ratings yet

- Manufacturing Sector-KDocument9 pagesManufacturing Sector-Kpiyush rawatNo ratings yet

- Managerial Economics: Elasticity of DemandDocument6 pagesManagerial Economics: Elasticity of Demandpiyush rawatNo ratings yet