Professional Documents

Culture Documents

Tax Audits & Investigations - Common Issues and Highlights

Uploaded by

Peter Ho0 ratings0% found this document useful (0 votes)

5 views2 pagesThis document provides information about an upcoming webinar on tax audits and investigations hosted by the Chartered Tax Institute of Malaysia. The webinar will feature two speakers from KPMG and Deloitte and will provide an overview of managing tax audits and investigations in the current environment. Topics will include focus areas of tax audits, interplay with case law, and a question and answer session. The webinar is offered for 2 CPD points and provides registration information and payment details.

Original Description:

Original Title

00675_Tax Audits & Investigations - Common Issues and Highlights (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about an upcoming webinar on tax audits and investigations hosted by the Chartered Tax Institute of Malaysia. The webinar will feature two speakers from KPMG and Deloitte and will provide an overview of managing tax audits and investigations in the current environment. Topics will include focus areas of tax audits, interplay with case law, and a question and answer session. The webinar is offered for 2 CPD points and provides registration information and payment details.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesTax Audits & Investigations - Common Issues and Highlights

Uploaded by

Peter HoThis document provides information about an upcoming webinar on tax audits and investigations hosted by the Chartered Tax Institute of Malaysia. The webinar will feature two speakers from KPMG and Deloitte and will provide an overview of managing tax audits and investigations in the current environment. Topics will include focus areas of tax audits, interplay with case law, and a question and answer session. The webinar is offered for 2 CPD points and provides registration information and payment details.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

F

TAX AUDITS & A CTIM WEBINAR SERIES

INVESTIGATIONS Date: 13 October 2020, Tuesday

Time: 10.00 am – 12.00 pm

- COMMON ISSUES & HIGHLIGHTS Event Code: 20WE/004

SPEAKERS Join us for an interactive

discussion on IRB’s Tax

SOH LIAN SENG

Audits and

Council Member, Chartered Tax Institute of Malaysia

Investigations in the

Soh Lian Seng leads the Tax Dispute Resolution practice at KPMG in

Malaysia, and brings over 25 years of experience advising local and current environment

multinational corporations on tax advisory and compliance, specialising

on tax audit and investigation across different sectors. His negotiation

skills and problem solving acumen are well recognised by clients,

supported by the numerous resolved cases Lian Seng has secured in

major dispute resolution engagements. Under his leadership, KPMG Tax

Services in Malaysia was named the 2019 Tax Dispute & Resolution

Firm of the Year by the International Tax Review. In addition to this

role, Lian Seng is also the firm’s Head of Korea Business Practice and

leads the Capital Allowances Review Team at KPMG in Malaysia.

TOPIC OUTLINE:

STEFANIE LOW

Council Member, Chartered Tax Institute of Malaysia

Managing IRB’s tax audits

Stefanie Low is an Executive Director of Deloitte Tax Services Sdn Bhd and investigations in

and co-leads the Tax Audit and Investigation practice. Stefanie was

formerly an advocate and solicitor and has more than 18 years of

experience in tax and legal practice. Stefanie focuses on corporate tax

current environment

compliance, tax advisory, tax audit, tax investigation and dispute

resolution. She has extensive experience in tax structuring, tax due

Focus Areas

diligence, mergers and acquisitions, cross border transactions,

infrastructure projects including reviewing tax assumptions, Interplay with case law

Q&A / Key Takeaways

agreements and documentation.

Registration is on individual basis. Registration on behalf of

other participant is not allowed Please note that the CPD

points awarded qualify for

Please ensure that the login name is the same name given 2 CPD the purpose of application

for registration purpose.

POINTS and renewal of tax agent

The webinar access link will be e-mailed to successfully license under Section 153,

registered participants 3 day before the commencement of Income Tax Act, 1967

the event.

Event Code: 20WE/004

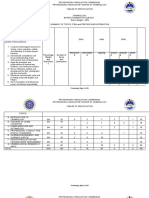

REGISTRATION FORM

Please retain original copy for your record. | Please photocopy for additional delegates. |Registration can be

made via fax/email

TAX AUDITS & INVESTIGATIONS – COMMON ISSUES & HIGHLIGHTS

REGISTRATION FEES

PARTICIPANT’S DETAILS CTIM / ACCA Member RM 95.40

Name :

I/C Number :

Non - Member RM 127.20

Membership No. : CTIM Member *The registration fees is inclusive of 6% Service Tax

ACCA Member effective 1 March 2019

Non-Member Registration of participants will be confirmed upon

Company : receipt of full payment.

Designation :

Address :

TERMS & CONDITIONS

Attendance will be recorded based on participant’s

login and logout time.

Tel Number : The certificate of Attendance will be issues to

webinar participants in accordance to the guidelines

Fax Number :

issued by the Ministry of Finance.

H/P Number :

Webinar fees are non-refundable and non-

Email Address : transferable once reservation has been confirmed.

No refund will be given for cancellation or

PAYMENT METHODS withdrawals received within less than 5 working

days of the event.

Online payment via JomPay

The webinar access link will be e-mailed 3 days

Biller Code: 21790 before commencement of the event upon receipt of

Ref-1: 20WE/004 full payment. In the event that you do not receive

Ref-2: Mobile Number the access link, please contact us immediately.

Jompay online via Internet or Mobile Banking with your Current, Saving or Credit

Card account Please note that this link is provided to the

registered fully paid participant only. The access link

Cheque No should not be provided to and be used by a third

For amount of RM party.

(all cheque should be made payable to “CTIM-CPE”)

CONTACT DETAILS

Master/Visa Credit Card for amount of RM

Tel No. : 03 – 2162 8989

Credit Card Number: Fax No. : 03 – 2162 8990

- - - Address :

Cardholder’s Name Expiry Date: Chartered Tax Institute of Malaysia

(as per credit card) B-13-1, Megan Avenue II

No. 12, Jalan Yap Kwan Seng

50450 Kuala Lumpur

Cardholder’s Signature:

CONTACT PERSONS

Ms Jaslina Ext 119 | jaslina@ctim.org.my

(Signature must correspond with the speciment signature on card) Ms Yus Ext 121 | yusfariza@ctim.org.my

Ms Zaimah Ext 131 |zaimah@ctim.org.my

You might also like

- Analysis of Recent Tax & Custom CasesDocument2 pagesAnalysis of Recent Tax & Custom CasesPeter HoNo ratings yet

- Pathway TaxAgentDocument3 pagesPathway TaxAgentJonathan Pang Peng HuatNo ratings yet

- Explains The Procedures in Making The Business LegalDocument6 pagesExplains The Procedures in Making The Business LegalBerlin AlcaydeNo ratings yet

- Taxfry Franchise ProposalDocument37 pagesTaxfry Franchise ProposalDatta ShindeNo ratings yet

- DVC Company ProfileDocument10 pagesDVC Company ProfileDv AccountingNo ratings yet

- Partnership Characteristics and Registration RequirementsDocument4 pagesPartnership Characteristics and Registration RequirementsJulle Lester PamaNo ratings yet

- MCA21 - Company Master DetailsDocument1 pageMCA21 - Company Master DetailsHimanshu ThakkarNo ratings yet

- Startup ServicesDocument1 pageStartup ServicesSooday JhaveriNo ratings yet

- LLP-Guide To Limited Liability Partnership Registration in Malaysia-3ecpaDocument7 pagesLLP-Guide To Limited Liability Partnership Registration in Malaysia-3ecpalbuan2003No ratings yet

- KamakshiDocument10 pagesKamakshiDRACONo ratings yet

- Nline Ncome AX Eturn Iling: O I T R FDocument1 pageNline Ncome AX Eturn Iling: O I T R FAsadUllahNo ratings yet

- MATERI - SFC Tax Morning Briefing 21 July 2022 - Persiapan Peradilan Di Pengadilan PajakDocument45 pagesMATERI - SFC Tax Morning Briefing 21 July 2022 - Persiapan Peradilan Di Pengadilan PajaksusilawatiNo ratings yet

- Munawar Hussain - TufailDocument4 pagesMunawar Hussain - TufailRukhshindaNo ratings yet

- Audio Conferencing Form - Final V2Document2 pagesAudio Conferencing Form - Final V2Mostafizur RahmanNo ratings yet

- McTechk StartUp Session May 2023Document25 pagesMcTechk StartUp Session May 2023mira shahNo ratings yet

- Advisory Strategy CompetencyDocument16 pagesAdvisory Strategy CompetencyRajdeep SharmaNo ratings yet

- CT - FlyerDocument1 pageCT - FlyerShaima Al SanadNo ratings yet

- STP Reg ChecklistDocument3 pagesSTP Reg Checklistlovingboy22No ratings yet

- SSTPGV 1Document5 pagesSSTPGV 1api-474744842No ratings yet

- Company Profile PanigrahiDocument24 pagesCompany Profile PanigrahiNishantNo ratings yet

- Prakash Jhunjhunwala & Co LLP: Chartered AccountantsDocument9 pagesPrakash Jhunjhunwala & Co LLP: Chartered AccountantsKinshuk SinghNo ratings yet

- Draft Invoice Taiwan LPDocument8 pagesDraft Invoice Taiwan LPKhinci KeyenNo ratings yet

- Income Tax Return AMANDocument35 pagesIncome Tax Return AMANNadeem ChoudharyNo ratings yet

- Withholding Tax - Apr2020 - KhiDocument2 pagesWithholding Tax - Apr2020 - KhiadnanNo ratings yet

- Presentation Intership ReportDocument17 pagesPresentation Intership ReportNeeru SinghNo ratings yet

- IBF Company RegistrationDocument12 pagesIBF Company RegistrationSharjeel RafaqatNo ratings yet

- B2B Hub Proposal FX LicenseDocument35 pagesB2B Hub Proposal FX LicenseAmiranNo ratings yet

- Comey AuditDocument5 pagesComey AuditDanny ChaitinNo ratings yet

- KPMG Tax Data Hub BrochureDocument2 pagesKPMG Tax Data Hub BrochuremaheshbangaliNo ratings yet

- For Any Assignment - Obtain Engagement Letter: NamasteDocument21 pagesFor Any Assignment - Obtain Engagement Letter: NamasteVineet AgrawalNo ratings yet

- Bir Citizen'S Charter: CD Technologies Asia, Inc. © 2021Document60 pagesBir Citizen'S Charter: CD Technologies Asia, Inc. © 2021Jay MirandaNo ratings yet

- LHDNM-CTIM Tax Forum 2021Document2 pagesLHDNM-CTIM Tax Forum 2021Abdul Mukhriz Abdul RashidNo ratings yet

- MJ Consulting Engagement Letter TemplateDocument4 pagesMJ Consulting Engagement Letter TemplateAndrew FergusonNo ratings yet

- What Is Professional Tax RegistrationDocument1 pageWhat Is Professional Tax Registrationparpella accountingNo ratings yet

- Startup India RegistrationDocument1 pageStartup India RegistrationadityaNo ratings yet

- Int ReportDocument35 pagesInt Reportnithishkumar7833No ratings yet

- Wa0009.Document2 pagesWa0009.rupeshkrishna81No ratings yet

- Our Values & CommitmentDocument5 pagesOur Values & CommitmentVipul SharmaNo ratings yet

- PSAK 72 - 73 DelloiteDocument5 pagesPSAK 72 - 73 Delloitevalentina kurniaNo ratings yet

- Id Aud Psak 72 73 Seminar PDFDocument5 pagesId Aud Psak 72 73 Seminar PDFDhani Firman SetiawanNo ratings yet

- Contract Management: Workshop OnDocument1 pageContract Management: Workshop OnNaveed ShaheenNo ratings yet

- BP0373-Audio-Visual Equipment Trading License - Mainland Dubai-SunnyDocument9 pagesBP0373-Audio-Visual Equipment Trading License - Mainland Dubai-SunnyAzeemiAsifNo ratings yet

- Tax Accountant: Closes: July 9, 2021Document3 pagesTax Accountant: Closes: July 9, 2021joanmubzNo ratings yet

- MOL RegulationsDocument82 pagesMOL RegulationsHadji RietaNo ratings yet

- RANK Group ProfileDocument16 pagesRANK Group ProfileRupeshNo ratings yet

- Gitchia Tentative ProposalDocument3 pagesGitchia Tentative Proposalbhatti.arslan1947No ratings yet

- TO: MMS Co. Lebanon: Number of Pages: 5 (Included This Page)Document3 pagesTO: MMS Co. Lebanon: Number of Pages: 5 (Included This Page)Elias JarjouraNo ratings yet

- This Study Resource Was: Lecture NotesDocument9 pagesThis Study Resource Was: Lecture NotesKristine Lirose BordeosNo ratings yet

- R Daga & Company: Chartered AccountantsDocument12 pagesR Daga & Company: Chartered AccountantsAdesh NaharNo ratings yet

- Bhanu Pratap SinghFinal Report FinalDocument40 pagesBhanu Pratap SinghFinal Report FinalYash BajajNo ratings yet

- Business Permit and Licensing Services - MainDocument7 pagesBusiness Permit and Licensing Services - MainMecs NidNo ratings yet

- Management of a Public Accounting PracticeDocument14 pagesManagement of a Public Accounting Practiceshyrah1rose1dingalanNo ratings yet

- Imperial AgencyDocument2 pagesImperial AgencySwift DataNo ratings yet

- Kelinha Profile 2019 PDFDocument60 pagesKelinha Profile 2019 PDFkelvin twabeNo ratings yet

- Brief Profile: Tax24.in, Tax24 Advisory ServicesDocument7 pagesBrief Profile: Tax24.in, Tax24 Advisory Servicessushil KumarNo ratings yet

- Annex A1 - SME Packages_Service Supplement Form_eGov Direct (1)Document1 pageAnnex A1 - SME Packages_Service Supplement Form_eGov Direct (1)libraryNo ratings yet

- Nidhi Company RegistrationDocument8 pagesNidhi Company RegistrationKamal DeenNo ratings yet

- Establishing and Maintaining An Accounting PracticeDocument7 pagesEstablishing and Maintaining An Accounting PracticeMohammad Muariff BalangNo ratings yet

- Limited Liability Partnership: Emerging Corporate Form"Document32 pagesLimited Liability Partnership: Emerging Corporate Form"Adv Bhavik A SolankiNo ratings yet

- Belastingboekhouding voor Beginners: Een Toegankelijke HandleidingFrom EverandBelastingboekhouding voor Beginners: Een Toegankelijke HandleidingNo ratings yet

- Professional Skills Teaching (Specimen Paper)Document3 pagesProfessional Skills Teaching (Specimen Paper)Peter HoNo ratings yet

- 2021 TG Q1 Tax GuardianDocument60 pages2021 TG Q1 Tax GuardianPeter HoNo ratings yet

- (Case Study) - 25 Marks - Yew Co (Questions)Document2 pages(Case Study) - 25 Marks - Yew Co (Questions)Peter HoNo ratings yet

- Place of Doing Business-Converted - p1Document1 pagePlace of Doing Business-Converted - p1Peter HoNo ratings yet

- Unit 8 PresentationDocument1 pageUnit 8 PresentationPeter HoNo ratings yet

- GITAChecklistDocument1 pageGITAChecklistPeter HoNo ratings yet

- EPSM Unit 1 Ethics and ProfessionalismDocument22 pagesEPSM Unit 1 Ethics and ProfessionalismPeter HoNo ratings yet

- EPSM Unit 3 Innovation and ScepticismDocument18 pagesEPSM Unit 3 Innovation and ScepticismPeter HoNo ratings yet

- EPSM Unit 4 Commercial AwarenessDocument24 pagesEPSM Unit 4 Commercial AwarenessPeter HoNo ratings yet

- EPSM Unit 2 Personal EffectivenessDocument24 pagesEPSM Unit 2 Personal EffectivenessPeter HoNo ratings yet

- EPSM Unit 7 Data AnalyticsDocument27 pagesEPSM Unit 7 Data AnalyticsPeter HoNo ratings yet

- EPSM Unit 6 Communication and Interpersonal SkillsDocument33 pagesEPSM Unit 6 Communication and Interpersonal SkillsPeter HoNo ratings yet

- EPSM Unit 5 Leadership and Team WorkingDocument22 pagesEPSM Unit 5 Leadership and Team WorkingPeter HoNo ratings yet

- Citro, F. C. (2015) - Surveys and Polling Ethical AspectsDocument6 pagesCitro, F. C. (2015) - Surveys and Polling Ethical AspectsOscar Rufino Cholan ValdezNo ratings yet

- Brexit and State Pensions: Briefing PaperDocument31 pagesBrexit and State Pensions: Briefing PaperCícero M.No ratings yet

- Stephen JuegoDocument3 pagesStephen JuegoBangsa Qu RashNo ratings yet

- FAA Issues AD for Replacing Torso Restraint System BucklesDocument10 pagesFAA Issues AD for Replacing Torso Restraint System BucklesMegha ChaudharyNo ratings yet

- Agreement PreviewDocument7 pagesAgreement PreviewKumar utsavNo ratings yet

- Bioethics Session 15 SASDocument4 pagesBioethics Session 15 SASSandyNo ratings yet

- Fact SheetsDocument4 pagesFact SheetsALVIN GERALDENo ratings yet

- EdañoDocument6 pagesEdañoRicardo EdNo ratings yet

- Worksheet Crime PunishmentDocument2 pagesWorksheet Crime PunishmentEmmaNo ratings yet

- The 2019 Amendments to the Rules of Civil ProcedureDocument88 pagesThe 2019 Amendments to the Rules of Civil ProcedureCons BaraguirNo ratings yet

- Certificate of CommitmentDocument1 pageCertificate of CommitmentRobbie Rose Lava100% (1)

- Criminology Board Exam Tables of SpecificationDocument12 pagesCriminology Board Exam Tables of SpecificationJomarie Calesterio Magbo-oNo ratings yet

- Driver Salary ReimbursementDocument1 pageDriver Salary ReimbursementMM0% (2)

- Oblicon - 111. Bpi v. Fernandez, G.R. 173134, Sept. 2, 2015Document2 pagesOblicon - 111. Bpi v. Fernandez, G.R. 173134, Sept. 2, 2015Abdullah JulkanainNo ratings yet

- Rules and regulations for Philippine naturalizationDocument7 pagesRules and regulations for Philippine naturalizationHestia VestaNo ratings yet

- Https Dua7c.com Students Student Print1.Php Exam Id 12Document1 pageHttps Dua7c.com Students Student Print1.Php Exam Id 12Mohammad RaqeebNo ratings yet

- Legal Internship - SEBIDocument2 pagesLegal Internship - SEBIKriti SinghNo ratings yet

- Real Estate Salesperson SyllabusDocument51 pagesReal Estate Salesperson SyllabusRajaNo ratings yet

- Santos - Rizal LawDocument1 pageSantos - Rizal LawJamesss PatrickNo ratings yet

- Law MatrixDocument7 pagesLaw MatrixJimbo ManalastasNo ratings yet

- Bridging Borders - A Reflective Journey of Interviewing A Student Studying AbroadDocument3 pagesBridging Borders - A Reflective Journey of Interviewing A Student Studying AbroadGina Sy-lunaNo ratings yet

- FE Unand Midterm Exam TipsDocument2 pagesFE Unand Midterm Exam TipsZakyaNo ratings yet

- Villanueva Vs CastanedaDocument5 pagesVillanueva Vs CastanedaPrincess Loyola TapiaNo ratings yet

- Voltas Split AC Quotation for NSIC OfficeDocument1 pageVoltas Split AC Quotation for NSIC OfficeairblisssolutionsNo ratings yet

- Nicholas II or Nicholas The Bloody 1Document9 pagesNicholas II or Nicholas The Bloody 1Yaryna DrabykNo ratings yet

- SJCSHS Form 2 - SWORN AFFIDAVITDocument1 pageSJCSHS Form 2 - SWORN AFFIDAVITGlance BautistaNo ratings yet

- National Law Institute University, BhopalDocument19 pagesNational Law Institute University, BhopalPrabhav SharmaNo ratings yet

- Case CommentaryDocument20 pagesCase CommentarySiddharth SajwanNo ratings yet

- AbandonedDocument2 pagesAbandonedRenzo SantosNo ratings yet

- Ho3 Items of Ppe Used in RD ActivitiesDocument2 pagesHo3 Items of Ppe Used in RD Activities21100257No ratings yet