Professional Documents

Culture Documents

Notes On Banking Law

Uploaded by

blahblahblahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes On Banking Law

Uploaded by

blahblahblahCopyright:

Available Formats

IFRS 15- REVENUE RECOGNITION

1. The contract has COMMERCIAL SUBSTANCE

2. The Entity can identify the PAYMENT TERMS

3. The parties to the contract have APPROVED the Contract

4. The entity can identify each party's RIGHTS regarding goods or services to be rendered

5. It is PROBABLE that the entity will collect the consideration to which it will be entitled

CONTRACTS DOES NOT EXIST IF

BOTH OF THE FOLLOWING ARE TRUE

1. Contract is UNPERFORMED

2. Both seller and the buyer can TERMINATE the contract WITHOUT PENALTY

STEP 1: IDENTIFY THE CONTRACT

1. Performance of either party may give rise to a CONTRACT ASSET OR LIABILITY

CONTRACT ASSET CONTRACT LIABILITY

❌ Buyer : No payment or performance ✔️ Buyer : With Payment

✔️Seller : already performs ❌ Seller : No performance

illustrative problem

AUGUST 1, 2028 - NO ENTRY

SEPT. 30,2028

Contract asset/ AR 80,000

Sales 80,000

#

COGS 65,000

Inventory 65,000

OCT. 31, 2028

Cash 80,000

Contract Asset 80,000

#

AUGUST 1, 2028 - NO ENTRY

SEPT. 30,2028

Cash 80,000

Contract Liability/ def rev. 80,000

#

OCT. 31, 2028

Contract Liability/ Def. Rev 80,000

sales 80,000

#

COGS 65,000

Inventory 65,000

CONTRACT ASSET VS RECEIVABLE

CONTRACT ASSET RECEIVABLE

is the entity's right to consideration the entity's right to consideration

in exchange for goods or services that is UNCONDITIONAL

transferred to a customer -

CONDITIONAL

JANUARY 1, 2028 - NO ENTRY

FEBRUARY 12, 2028

contract asset 50,000

Sales 50,000

JULY 31, 2028

Accounts receivable 100,000

Sales 50,000

Contract Asset 50,000

Sept. 8,2028

Cash 100,000

Accounts receivable 100,000

CONTRACT MODIFICATION TWO SCENARIOS IN CONTRACT

is the change in the scope or price (or MODIFICATION

both) of a contract that is approved

by the parties to the contract 1. Creates New Contract

change order 2. Modifies the Existing contract

variation

amendment

RECOGNITION OF NEW CONTRACT

There will be 2 contract

1. The scope of the contract increases because of the addition of promised good or

services THAT ARE DISTINCT

The customer can benefit from good or service

The entity's promise to trnsfer the good or service to the

customer is SEPARATELY IDENTIFIABLE from other promises

in the contract

1. The proce of the contract increases by an amount of consideration that reflects the

entity's standalone selling prices of the additional promised goods or services and any

appropriate ADJUSTMENTS TO THE PRICE

ORIGINAL PERFOMANCE ( 20,000 * 200) 4,000,000

OBLIGTION

ADDITIONAL PO ( 10,000 * 180) 1,800,000

TOTAL REVENUE AFTER

MODIFICATION 5, 800,000 (1)

to satisfy original contract

50,000 * 200 = 1,000,000 (2)

to satisfy new PO

50,000 * 180 = 900,000 (3)

MODIFICATION OF THE EXISTING CONTRACT

There will be 1 contract

An entity shall account for the existing contract modification as if it were part of the existing

contract if the remaining goods or services are NOT DISTINCT

ORIGINAL PERFOMANCE ( 20,000 * 200) 4,000,000

OBLIGTION

ADDITIONAL PO ( 10,000 * 180) 1,800,000

TOTAL REVENUE AFTER

MODIFICATION 5, 800,000 (1)

Revenue (After contract modification)

Blended price = Total performance obligation

5,800,000

30,000

= 193

Revenue = 5,000 * 193

= 965,000 (2)

STEP 2 : IDENTIFY THE SEPARATE PERFORMANCE OBLI

PERFORMANCE OBLIGATION

A promise in a contract to provide a product or service to a customer

DISTINCT - separate performance obligation

NOT DISTINCT- combine the performance obligation

ANSWER: 1 ANSWER: 2

STEP 3 : IDENTIFY THE TRANSACTION PRICE

TRANSACTION PRICE

Amount of consideration to which an entity expects to be entitled in exchange for

transferring promised goods or services to a customer.

when determining the TRANSACTION PRICE, an entity

shall consider the effects of the folowing:

Variable consideration

Existence of a significant financing component

Noncash Considerations

Consideration payable to a customer

VARIABLE CONSIDERATION

Occurs when part of the Contract Price depends on the OUTCOME OF A FUTURE EVENT

THE ENTITY SHALL ESTIMATE THE AMOUNT OF VARIABLE CONSIDERATION

METHODS OF ESTIMATING VARIABLE CONSIDERATION

EXPECTED VALUE APPROACH MOST LIKELY APPROACH

Appropriate if an entity has a Appropriate if the contract has

LARGE number of contracts with ONLY TWO possible Outcomes

similar characteristics

sum of all possible possible amount which

transaction transaction

= amounts multiplied to price = has has the highest

price their corresponding

chance of occurence

probability

EXPECTED VALUE APPROACH

POS amount 1 (50k +30k) 80,0000* 70% = 56,000

POS amount 2 (50k + 0 ) 50,0000 * 30% = 15,000

TRANSACTION PRICE 71,000

MOST LIKELY APPROACH

TRANSACTION PRICE 80,000

EXPECTED VALUE APPROACH

POS amount 1 (100k + 50k) 150 M* 60% = 90 M

POS amount 2 [100k + (50M * 90 %) 145 M* 30% = 43.5 M

POS amount 3 [100k + (50M * 80 %) 140 M* 10% = 14 M

TP 147.5 M

MOST LIKELY APPROACH

TTP 150 M

EXISTENCE OF SIGNIFICANT

FINANCING COMPONENT

the entity should consider the time value of money

the vaule of money few years ago is not the same few years ago,

and the value of money today is not the same few years from now

PAYMENT IS MORE THAN ONE YEAR

TRANSACTION PRICE (order of priority)

1. Cash Price Equivalent

2. PV of Future NCIFs

SALES 300,000

COGS (200,000)

GP 100,000

SALES ( 500,000 * .683) 341, 500

COGS (200,000)

GP 141,500

NON CASH CONSIDERATION

transaction FV of the NON CASH

price = consideration received

CONSIDERATION PAYABLE

TO A CUSTOMER

Consideration payable to customer for payment of distinct goods or services from

customers shall be accounted in the same way that it accounts for other purchases

from supplier.

Unless, consideration payable to the customer is higher that the Fair value of goods or

services, or the fair value cannot be reasonably estimated.

SELLER BUYER

also a SUPPLIER

consideration paid to a customer

(if we buy to a customer)

CONSIDERATION PAID vs FAIR VALUE

= difference , is accounted as REDUCTION

OF TRANSACTION PRICE

= NO PROBLEM

FV ( cannot be fairly estimated) = ZERO , the total of consideration paid to the

customer is treated as REDUCTION OF THE TP

STEP 4 : ALLOCATE TRANSACTION PRICE TO THE

SEPARATE PERFORMANCE OBLIGATION

Does not apply with SINGLE PERFORMACE OBLIGATION

Allocation basis - relative Fair value or stand alone seling price of each performance

obligation

If the stand-alone selling price is not directly observable, an entity shal estimate the

stand alone selling price.

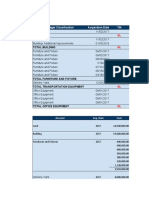

TRANSACTION PRICE RELATIVE FV/ STAND ALONE SP ALLOCATE

PO 1 White Board 1,522,500 1,065,750

PO 2 Installation

PO 3 Training

P1,522,500 435,000

217,500

304,500

152,250

2,175,000 1,522,500

RELATIVE * TP / TOTAL RFV

METHODS OF ESTIMATING STAND ALONE SELLING PRICE

ADJUSTED MARKET COST PLUS A RESIDUAL APPROACH

ASSESSMENT APPROACH MARGIN APPROACH

can only be used if stand

We consider the prices Cost + Mark up alone sp/ RFV is

of Competitors HIGHLY UNCERTAIN

RELATIVE FV/

TRANSACTION ALLOCATE

STAND ALONE SP

PRICE

const

100 m

130 M 36, 585,366

Main 21 M 25,609,756

Operate 31M 37, 804,878

82 M 100 M

RELATIVE * TP / TOTAL RFV

ALLOCATE

RELATIVE FV/

TRANSACTION ALLOCATE

STAND ALONE SP

PRICE

const const 30,000,000

100 m

130 M 34, 722, 222

Main Main 21,000,000

21 M 24, 305, 556

Operate Operate 49,000,000

35. 4M 40,972,222

100 M

86.4 M 100 M

SASP = 29.5 M * 120%

= 35, 400,000

RELATIVE * TP / TOTAL RFV

STEP 5 : RECOGNIZE REVENUE WHEN EACH

PERFORMANCEOBLIGATION IS SATISFIED

WAYS ON SATISFYING A PERFORMANCE OBLIGATION

SATISFACTION SATISFACTION

OVER THE PERIOD OF TIME AT A POINT IN TIME

obligation DOES NOT END after After delivering the good or rendering

rending of service the service , the entity will NO

LONGER HAVE OBLIGATION

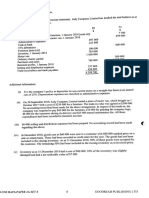

STEP 1 : IDENTIFY THE CONTRACT

between Globe and Rain

STEP 2 : IDENTIFY THE SEPARATE PERFORMANCE OBLI

PO 1: Handset

PO 2: Network Service

STEP 3 : IDENTIFY THE TRANSACTION PRICE

Monthly Payment ( 2499 * 24 months) 59,976

cashout 46,800

Transaction Price 106, 776

STEP 4 : Allocate the Transaction price to the separate

performance obligation

Transaction Price RFV Allocate

82,990

PO 1: Handset

PO 2: Network Service 106,776 35,568

74, 743

32,033

118,558 106,776

1482 * 24 month

STEP 5 : Recognize Revenue when each Performance

Obligation is Satisfied

PO 1: Handset ( at a point in time) 74, 743 = recognize 74, 743

PO 2: Network Service (over the period of time) 32, 033 / 24 months = 1335 per month * 10 13, 350

Transaction Revenue 88, 093

You might also like

- DT - Consignment Sales and Revenue From Contracts - Answer KeyDocument5 pagesDT - Consignment Sales and Revenue From Contracts - Answer Keyjessicayabutpangilinan252No ratings yet

- Accounts Homework SolutionsDocument67 pagesAccounts Homework SolutionsKunal BhansaliNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- You Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Document4 pagesYou Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Nguyễn GiangNo ratings yet

- Beach Club Class C Share TermsDocument2 pagesBeach Club Class C Share TermsMia NungaNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- 6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)Document3 pages6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)karenNo ratings yet

- Inventory 1Document8 pagesInventory 1Ren AikawaNo ratings yet

- Revision Question Computer ScienceDocument1 pageRevision Question Computer ScienceIGO SAUCENo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- Problem 4Document11 pagesProblem 4Caila Nicole ReyesNo ratings yet

- Sal NDocument2 pagesSal NJame Paul GalgaoNo ratings yet

- Name of Buyer: - : List Price 850,000.00 Other Charges 7,000.00Document3 pagesName of Buyer: - : List Price 850,000.00 Other Charges 7,000.00Mia NungaNo ratings yet

- BNC Share ALL TermsDocument3 pagesBNC Share ALL TermsMia NungaNo ratings yet

- Inventory Estimation and LCNRV Sample ProblemsDocument3 pagesInventory Estimation and LCNRV Sample Problemsaldric taclanNo ratings yet

- Of Financial PositionDocument3 pagesOf Financial PositionIrah LouiseNo ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts Questionadityatiwari122006No ratings yet

- Formation, Operation, Dissolution Short Summary With ProblemsDocument3 pagesFormation, Operation, Dissolution Short Summary With ProblemsdumpNo ratings yet

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Bits and Pieces LTDDocument1 pageBits and Pieces LTDAndrea SalazarNo ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- AssessmentDocument1 pageAssessmentVhiena May EstrelladoNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- Test SolutionDocument4 pagesTest SolutionDibyani DashNo ratings yet

- Chapter 3 Problem 7Document5 pagesChapter 3 Problem 7Marinella LosaNo ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- PPE Investments Working PaperDocument15 pagesPPE Investments Working PaperMarriel Fate CullanoNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- TAX-10-INSTALLMENT-DEFERRED-PAYMENT-METHOD-OF-REPORTING-INCOME (With Answers)Document4 pagesTAX-10-INSTALLMENT-DEFERRED-PAYMENT-METHOD-OF-REPORTING-INCOME (With Answers)Kendrew SujideNo ratings yet

- Intro To Final Acc. ProblemsDocument11 pagesIntro To Final Acc. ProblemsDheer BhanushaliNo ratings yet

- Sale and Leaseback DiscussionDocument16 pagesSale and Leaseback DiscussionRyll BedasNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- Blue Book - Set 8-7Document1 pageBlue Book - Set 8-7Anna TungNo ratings yet

- Class Work NAME: - SECTIONDocument1 pageClass Work NAME: - SECTIONpalashndcNo ratings yet

- Gabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuDocument3 pagesGabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuGJ MendozaNo ratings yet

- Latihan - Aset Tidak Berwujud-JAWABDocument7 pagesLatihan - Aset Tidak Berwujud-JAWABAndreas HottoNo ratings yet

- 1 Insurance ClaimDocument10 pages1 Insurance ClaimBAZINGA100% (1)

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklBaiq Melaty Sepsa WindiNo ratings yet

- AnswersDocument10 pagesAnswersmonster gamerNo ratings yet

- Ppe Post TestDocument31 pagesPpe Post TestMarie MagallanesNo ratings yet

- Buhatan, ArkelDocument5 pagesBuhatan, ArkelMae GonatoNo ratings yet

- Answer All Four QuestionsDocument8 pagesAnswer All Four QuestionsTawanda Tatenda HerbertNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Konsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatDocument7 pagesKonsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatMuhammad FadhilNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- SorceryDocument1 pageSorceryblahblahblahNo ratings yet

- SurodonDocument1 pageSurodonblahblahblahNo ratings yet

- Erogenous ZonesDocument1 pageErogenous ZonesblahblahblahNo ratings yet

- Notes - Lesson 1Document3 pagesNotes - Lesson 1blahblahblahNo ratings yet

- Prelim TopicDocument6 pagesPrelim TopicblahblahblahNo ratings yet

- Control Balance of PaymentsDocument1 pageControl Balance of PaymentsblahblahblahNo ratings yet

- Notes - Lesson 2Document1 pageNotes - Lesson 2blahblahblahNo ratings yet

- Exchange Rate SystemDocument1 pageExchange Rate SystemblahblahblahNo ratings yet

- Obtain Resources and BenefitsDocument1 pageObtain Resources and BenefitsblahblahblahNo ratings yet

- Methods of Generating Ideas: 1. Focus Groups Impact On IntentionsDocument1 pageMethods of Generating Ideas: 1. Focus Groups Impact On IntentionsblahblahblahNo ratings yet

- Factor Proportions TheoryDocument2 pagesFactor Proportions TheoryblahblahblahNo ratings yet

- Political Stability & PerformanceDocument1 pagePolitical Stability & PerformanceblahblahblahNo ratings yet

- "Endo", Globalization and The SouthDocument3 pages"Endo", Globalization and The SouthblahblahblahNo ratings yet

- Role of Global Cities in The GlobalizationDocument2 pagesRole of Global Cities in The GlobalizationblahblahblahNo ratings yet

- Embargoes Can Mean Limiting or The Act of BanningDocument1 pageEmbargoes Can Mean Limiting or The Act of BanningblahblahblahNo ratings yet

- 8 P'sDocument1 page8 P'sblahblahblahNo ratings yet

- Risk Categories of Business RiskDocument3 pagesRisk Categories of Business RiskblahblahblahNo ratings yet

- Features of Global CitiesDocument3 pagesFeatures of Global CitiesblahblahblahNo ratings yet

- Cycle of Poverty in The PhilippinesDocument2 pagesCycle of Poverty in The PhilippinesblahblahblahNo ratings yet

- Jatin Aggarwal: Data EngineerDocument1 pageJatin Aggarwal: Data EngineerAkashNo ratings yet

- Swot Final ProjectDocument14 pagesSwot Final ProjectApurva SinghNo ratings yet

- ABC Automotive Inc Collective AgreementDocument43 pagesABC Automotive Inc Collective AgreementshawnNo ratings yet

- Instant Download Latest Canadian Nursing Leadership and Management 1st Edition Gaudine Test Bank PDF Full ChapterDocument31 pagesInstant Download Latest Canadian Nursing Leadership and Management 1st Edition Gaudine Test Bank PDF Full Chapterthuyhai3a656100% (8)

- LMI Presenatation 1Document36 pagesLMI Presenatation 1HoLinhNo ratings yet

- Corporate Objectives, Strategy and Structure: Prepared By: Ms. Nelda A. Rosima InstructorDocument27 pagesCorporate Objectives, Strategy and Structure: Prepared By: Ms. Nelda A. Rosima InstructorValerie Kaye FamilaranNo ratings yet

- MIS MqcsDocument124 pagesMIS MqcsFaiz AliNo ratings yet

- Assignment (26 Batch)Document6 pagesAssignment (26 Batch)Brand AtoZNo ratings yet

- Democratizing Instant Fulfillment For Indonesian E-Commerce & SmesDocument25 pagesDemocratizing Instant Fulfillment For Indonesian E-Commerce & SmesIdam Idhamkhalik100% (1)

- Katrina's ResumeDocument2 pagesKatrina's ResumeTestyNo ratings yet

- Course Outline in Transformational LeadershipDocument3 pagesCourse Outline in Transformational LeadershipRoi Jason De TorresNo ratings yet

- Business Ethics - Activity 1Document3 pagesBusiness Ethics - Activity 1Charlou CalipayanNo ratings yet

- Samples For Credcard 1Document8 pagesSamples For Credcard 1dpkrajaNo ratings yet

- GRACoL Vs SWOPDocument8 pagesGRACoL Vs SWOPTrần NamNo ratings yet

- Intermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions ManualDocument20 pagesIntermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions Manualslokekrameriabfofb1100% (22)

- Quality Health Services: A Planning GuideDocument64 pagesQuality Health Services: A Planning GuideEdwar RusdiantoNo ratings yet

- PNB Foreclosed Properties in Dagupan Auction Flyer For 2016-06-16 FinalDocument4 pagesPNB Foreclosed Properties in Dagupan Auction Flyer For 2016-06-16 FinalkennymontenegroNo ratings yet

- 024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002Document5 pages024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002wewNo ratings yet

- Tax RTP 2 Nov 2020Document41 pagesTax RTP 2 Nov 2020KarthikNo ratings yet

- MCQs With Answers On RBIDocument6 pagesMCQs With Answers On RBIRupeshNo ratings yet

- Marketing of Financial Services June 2022Document11 pagesMarketing of Financial Services June 2022Rajni KumariNo ratings yet

- EN - Registration Form International Patients - V20181227Document3 pagesEN - Registration Form International Patients - V20181227OlegseyNo ratings yet

- Business Communication & Report Writing: Jeta MajumderDocument87 pagesBusiness Communication & Report Writing: Jeta MajumderShahadat HossainNo ratings yet

- Computerized Accounting Imp QuestionsDocument2 pagesComputerized Accounting Imp Questionskullu100% (2)

- Case 01 Buffett 2015 F1769Document36 pagesCase 01 Buffett 2015 F1769Josie KomiNo ratings yet

- Adam Khoo - Value Momentum Investing May 2020 Newsletter PDFDocument16 pagesAdam Khoo - Value Momentum Investing May 2020 Newsletter PDFHp TeeNo ratings yet

- Answer 1 To 4Document6 pagesAnswer 1 To 4MUHAMMAD BILAL RAZA SHAHZADNo ratings yet

- Capacite - Open PositionDocument3 pagesCapacite - Open PositionAdnan SayyedNo ratings yet

- Unit 1 Calculation of Tax LiabilityDocument10 pagesUnit 1 Calculation of Tax LiabilitySupreet UdarNo ratings yet

- Declaration of Special Economic ZonesDocument1 pageDeclaration of Special Economic ZonesChristina TambalaNo ratings yet