Professional Documents

Culture Documents

Topic 3 - The Baldwin Example

Topic 3 - The Baldwin Example

Uploaded by

QTKD-1TC-18 Pham Ngoc Khanh LinhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 3 - The Baldwin Example

Topic 3 - The Baldwin Example

Uploaded by

QTKD-1TC-18 Pham Ngoc Khanh LinhCopyright:

Available Formats

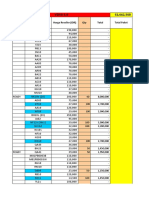

INPUT

Depreciation $ 20,000 Tax 34%

Selling price $ 20

Pro. Cost $ 10

Year 0 1 2 3

Initial Investment

Machine cost $ (100,000)

Opp. cost (Land) $ (150,000)

NWC requirement $ (10,000)

Total $ (260,000)

Terminal CFs

Salvage value

Recover (Land)

Operating CFs

Sales units 5,000 8,000 12,000

Sales Rev. $ 100,000 $ 160,000 $ 240,000

Production cost $ 50,000 $ 80,000 $ 120,000

EBITDA $ 50,000 $ 80,000 $ 120,000

Operating CFs $ 39,800 $ 59,600 $ 86,000

Requirement in NWC $ 10,000 $ 16,000 $ 24,000 $ 20,000

Change in NWC $ (6,000) $ (8,000) $ 4,000

Total CFs $ (260,000) $ 33,800 $ 51,600 $ 90,000

4 5

$ 19,800

$ 150,000

10,000 6,000

$ 200,000 $ 120,000

$ 100,000 $ 60,000

$ 100,000 $ 60,000

$ 72,800 $ 46,400

$ 12,000 $ -

$ 8,000 $ 12,000

$ 80,800 $ 228,200

You might also like

- ЗАДАЧІ МЕDocument39 pagesЗАДАЧІ МЕСтаніслав Велікдус0% (1)

- Chap 10 and 11 HomeworkDocument4 pagesChap 10 and 11 HomeworkVo Phuc An (K17 HCM)No ratings yet

- Budget Adistec CL 2024 03 - 01 - 2024 (V6.0)Document25 pagesBudget Adistec CL 2024 03 - 01 - 2024 (V6.0)Robinson ConchaNo ratings yet

- Ejercicios Varios de Costos EstructuralesDocument57 pagesEjercicios Varios de Costos EstructuralesBreyner VegaNo ratings yet

- Fe 1Document2 pagesFe 1son28294No ratings yet

- NPV ProfileDocument2 pagesNPV Profilejiya.ca24No ratings yet

- Ejercicio Punto de EquilibrioDocument2 pagesEjercicio Punto de EquilibrioYeraldin Acevedo CastroNo ratings yet

- Ejemplo Curva SDocument18 pagesEjemplo Curva SisraelalvaradomenNo ratings yet

- Depreciacion en ExcelDocument11 pagesDepreciacion en Excelrafaeltejeiro1121No ratings yet

- Data Saving 2018 - 2019Document118 pagesData Saving 2018 - 2019jacy lifeNo ratings yet

- P13-26:27 - Capital StructureDocument13 pagesP13-26:27 - Capital StructureJhoni LimNo ratings yet

- Caja de Flujo-2Document3 pagesCaja de Flujo-2Sepulveda CrishnaNo ratings yet

- Precios de Lavados 04.03.2023Document11 pagesPrecios de Lavados 04.03.2023jorge loveraNo ratings yet

- BEP Chart and TableDocument3 pagesBEP Chart and TableVAISALY S MBANo ratings yet

- Formatos Don Jose v.2Document19 pagesFormatos Don Jose v.2jose ignacio gomez obandoNo ratings yet

- МодульDocument2 pagesМодульBerezhnyyOleksandr OleksandrNo ratings yet

- ПР4 РосичТТ37 5 ВарDocument8 pagesПР4 РосичТТ37 5 ВарКаринаNo ratings yet

- Análise MilhasDocument6 pagesAnálise Milhasemersonacba123No ratings yet

- Ejercicio MF 3Document3 pagesEjercicio MF 3Carlos CortesNo ratings yet

- PRACTICADocument4 pagesPRACTICAEdgar de la cruzNo ratings yet

- Taller de Apalancamiento 2 4 de MayoDocument28 pagesTaller de Apalancamiento 2 4 de Mayojuly gonzalezNo ratings yet

- Mercaderia: CMV VentasDocument4 pagesMercaderia: CMV VentasMilagros MacielNo ratings yet

- Analisis Puertos JUNIO 2022Document109 pagesAnalisis Puertos JUNIO 2022elihuNo ratings yet

- Construction in ProgressDocument2 pagesConstruction in ProgressCelina DerlaNo ratings yet

- Min Cuadra2Document2 pagesMin Cuadra2Angeles Angeles Darina SilmarNo ratings yet

- DistrubucionDocument6 pagesDistrubucionNARLY SALINASNo ratings yet

- СР БЛ.1. Т.4. ЗадачаDocument3 pagesСР БЛ.1. Т.4. Задачаvmarinko50No ratings yet

- CombingDocument6 pagesCombingMark Ceddrick MioleNo ratings yet

- Bono Bullet EstructuraDocument2 pagesBono Bullet EstructuraDIEGO MUÑOZ MOLINANo ratings yet

- Практика 5Document6 pagesПрактика 5dariapohasiiNo ratings yet

- Kalkulator Estimasi Angsuran Biasa - EB31102023Document18 pagesKalkulator Estimasi Angsuran Biasa - EB31102023fah viNo ratings yet

- В7Document4 pagesВ7Александр КирилловNo ratings yet

- تقرير عائد المبيعاتDocument1 pageتقرير عائد المبيعاتMohammed AljapreNo ratings yet

- Ejercicio en Clases PEPDocument11 pagesEjercicio en Clases PEPCamila Retamal ValenzuelaNo ratings yet

- $B$1 $B$2 $B$4 $B$5 $B$6 $B$7 $B$8 $B$9 $B$10 $B$11 $B$12 $B$13Document4 pages$B$1 $B$2 $B$4 $B$5 $B$6 $B$7 $B$8 $B$9 $B$10 $B$11 $B$12 $B$13Milana TenenevaNo ratings yet

- Kas Makan PBJDocument17 pagesKas Makan PBJSeptian Dwi WicaksonoNo ratings yet

- Tabla Auxilio Mutuo Carga Vigencia 01 Nov 2022Document5 pagesTabla Auxilio Mutuo Carga Vigencia 01 Nov 2022Gabriela GNo ratings yet

- Actividad Costos Por ProcesosDocument3 pagesActividad Costos Por ProcesosJohan Suarez GutierrezNo ratings yet

- Graph DerDocument6 pagesGraph DerzZl3Ul2NNINGZzNo ratings yet

- Практична робота №5Document2 pagesПрактична робота №5Анна ЮзьківNo ratings yet

- PptoDocument4 pagesPptoDI ConstruccionesNo ratings yet

- Тема 9 КФЗ практ 1Document7 pagesТема 9 КФЗ практ 1pass.dinn3No ratings yet

- Cafetin 2022Document4 pagesCafetin 2022Julian Carrillo pardoNo ratings yet

- Konsep Program MotorDocument22 pagesKonsep Program MotorCesiii CimilikitiNo ratings yet

- Jatim Februari 2020Document70 pagesJatim Februari 2020Kredit Plus SidoarjoNo ratings yet

- БУХDocument25 pagesБУХУК-01 Одрина ОлександрNo ratings yet

- Tablas de Fletes 2022 Vs 2023 (Autoguard)Document2 pagesTablas de Fletes 2022 Vs 2023 (Autoguard)rafael gutierrezNo ratings yet

- Sem 8Document3 pagesSem 8Albeanu Romina PaulaNo ratings yet

- Tabla VentasDocument9 pagesTabla VentasEdwin SolorzanoNo ratings yet

- задачі епDocument6 pagesзадачі епІрина ГерасименкоNo ratings yet

- Libro 2Document6 pagesLibro 2Luis enrique morenoNo ratings yet

- Ahorro 2024 en 29 RetosDocument29 pagesAhorro 2024 en 29 Retostais carolina orellana suñigaNo ratings yet

- Catalogo Bermudas CaballeroDocument36 pagesCatalogo Bermudas Caballerojacke2003282No ratings yet

- Calculo Auto SubastaDocument3 pagesCalculo Auto SubastaChristian PerelloNo ratings yet

- Economía - Camila VivasDocument13 pagesEconomía - Camila VivasAlejandro BarreraNo ratings yet

- Analise de InvestimentoDocument2 pagesAnalise de InvestimentoIngrid OliveiraNo ratings yet

- Costo de Jóvenes Experimentados de EuropaDocument3 pagesCosto de Jóvenes Experimentados de EuropaAlexis CáceresNo ratings yet

- Burning CostDocument8 pagesBurning CostdanhanNo ratings yet

- Taller 3 PresupuestoDocument3 pagesTaller 3 Presupuestocarolina montenegroNo ratings yet