Professional Documents

Culture Documents

Control Accounts Q1

Uploaded by

Tadiwa ChikatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Control Accounts Q1

Uploaded by

Tadiwa ChikatiCopyright:

Available Formats

Control Accounts and Reconciliation Question 1

QUESTION 1 – Control Accounts and Reconciliation (1003)

Salman has extracted the balances from his sales ledger as 31 July 2004 and the total was Rs.

17,200, which has been inserted as trade debtors in the trial balance. The trial balance does not

agree, neither does the schedule of debtors with the balance on the sales ledger control account.

An examination of the records revealed the following errors;

1. The discount allowed column in the cash book has been overcast by Rs. 200.

2. An invoice for a sale to Omer has been completely omitted from the books. The invoice is for

Rs. 84.

3. Goods returned by Saad, which had been invoiced to him in the sum of Rs. 160, had been

correctly entered in the sales returns book, but debited to his account as Rs. 106.

4. Goods with a selling price of Rs. 1,000 had been sent on “Sales or Return” to Javed.

Although Javed has not yet indicated his intention to purchase the goods, the transaction

has been entered in the sales day book.

5. A bad debt of Rs. 50 has been written off in the sales ledger but this item was not entered in

the journal.

Required

(a) The sales ledger control account, showing clearly the original balance on the account at 31

July 2004 and the entries required adjusting the account for the above items.

(b) A calculation of Salman’s corrected trade debtors figure at 31 July 2004.

ANSWER 1 – Control Accounts and Reconciliation (1003)

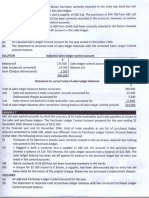

Part (a)

Receivable Control A/c

Rupees Rupees

Bal. b/d (bal. figure) 16,784 Goods on sale or return (4) 1,000

Discount over-casted (1) 200 Bad debts (5) 50

Sales invoice omitted (2) 84 Balance c/d (see part b) 16,018

17,068 17,068

Part (b)

Reconciliation Rs.

Total of list of balance before adjustments 17,200

Add: further debit – Omer (2) 84

Sales return recorded on wrong side with wrong amount (106+160) (3) (266)

Sales wrongly recorded (4) (1,000)

16,018

Page 1 of 1 (kashifadeel.com)

You might also like

- CH 07Document4 pagesCH 07flrnciairnNo ratings yet

- Chapter 2 ROE 1Document17 pagesChapter 2 ROE 1adityatiwari122006No ratings yet

- Form 704 Sales Tax Audit ReportDocument55 pagesForm 704 Sales Tax Audit Reportmaahi7No ratings yet

- Soal Latihan Chapter 7 TM 1-2Document6 pagesSoal Latihan Chapter 7 TM 1-2Antonius Sugi Suhartono100% (1)

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarNo ratings yet

- Question Paper Financial Accounting (MB131) : January 2005Document32 pagesQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNo ratings yet

- Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NoDocument12 pagesAudit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NosuniljaithwarNo ratings yet

- Scan 0002Document1 pageScan 0002Shoaib AslamNo ratings yet

- CH 07Document4 pagesCH 07Rabie HarounNo ratings yet

- Vat R2 2016 - 2017Document4 pagesVat R2 2016 - 2017Hotel sapphireNo ratings yet

- Correction of Errors and Suspsense Acs Homewok AnswersDocument4 pagesCorrection of Errors and Suspsense Acs Homewok AnswersCharisma CharlesNo ratings yet

- BPP F3 KitDocument7 pagesBPP F3 KitMuhammad Ubaid UllahNo ratings yet

- Cashflow TestDocument7 pagesCashflow Testnoor ul anumNo ratings yet

- Accounting Adjustments and Financial StatementsDocument5 pagesAccounting Adjustments and Financial StatementsJunkoNo ratings yet

- Error Correction Journal EntriesDocument8 pagesError Correction Journal EntriesTeo Yu XuanNo ratings yet

- - 如何改錯 correction of errorsDocument32 pages- 如何改錯 correction of errors20/21-5B-(05) HoMeiYi/何美誼No ratings yet

- Control Accounts Q8 PDFDocument3 pagesControl Accounts Q8 PDFRyanNo ratings yet

- Acc Class Test 2008Document9 pagesAcc Class Test 2008Zaafir CotoballyNo ratings yet

- 04 Understanding Balance Sheets - Cash Flow StatementsDocument58 pages04 Understanding Balance Sheets - Cash Flow StatementsRoy GSNo ratings yet

- Sample Paper - Accountancy XI Term 2Document3 pagesSample Paper - Accountancy XI Term 2Manaswi WareNo ratings yet

- Worksheet RoeDocument2 pagesWorksheet RoeJaijeet SinghNo ratings yet

- 09-DOH2020 Part2-Observations and RecommDocument100 pages09-DOH2020 Part2-Observations and RecommPamela Ledesma SusonNo ratings yet

- Financial Accounting RecordsDocument7 pagesFinancial Accounting RecordsbangoangoNo ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Company Accounts and IAS (Paper f3)Document7 pagesCompany Accounts and IAS (Paper f3)ASISHAHEENNo ratings yet

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDocument57 pagesTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDhruv ThakkarNo ratings yet

- Financial of The Balance Sheet: BOOK - II (20 Marks)Document13 pagesFinancial of The Balance Sheet: BOOK - II (20 Marks)sanskriti kathpaliaNo ratings yet

- Guidelines For CADocument24 pagesGuidelines For CAAnjuElsaNo ratings yet

- NPO, Partnership & Co Acc A/c CalculationsDocument6 pagesNPO, Partnership & Co Acc A/c CalculationsMaulik ThakkarNo ratings yet

- Fall 2009 Past PaperDocument4 pagesFall 2009 Past PaperKhizra AliNo ratings yet

- Answer The Following Questions: (1×5)Document4 pagesAnswer The Following Questions: (1×5)Zikrur RahmanNo ratings yet

- Control & Reconciliation - WorksheetDocument3 pagesControl & Reconciliation - WorksheetRegina Dori FlowerastiaNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Chapter 4 Control Account & Their ReconciliationDocument13 pagesChapter 4 Control Account & Their ReconciliationSyed MunibNo ratings yet

- Financial and Compliance Audit Observations and RecommendationsDocument151 pagesFinancial and Compliance Audit Observations and RecommendationshedayaNo ratings yet

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyNo ratings yet

- Model Question Paper: Financial Accounting (CFA510)Document25 pagesModel Question Paper: Financial Accounting (CFA510)akshayatmanutdNo ratings yet

- (193.86KB) Chapter 4 MultiDocument2 pages(193.86KB) Chapter 4 MultigretNo ratings yet

- Financial Accounting CFA510 October 2008Document23 pagesFinancial Accounting CFA510 October 2008rain06021992No ratings yet

- 1st Semester Dec 2021 PDFDocument8 pages1st Semester Dec 2021 PDFroshanNo ratings yet

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaNo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Financial Accounting Control Accounts and Error CorrectionDocument20 pagesFinancial Accounting Control Accounts and Error Correctionmaki1106No ratings yet

- CBSE Grade 11 Accounts Practice Paper 234521Document8 pagesCBSE Grade 11 Accounts Practice Paper 234521The DealerNo ratings yet

- Chapter 5 ExercisesDocument8 pagesChapter 5 ExercisesRaihan Rohadatul 'AisyNo ratings yet

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleNo ratings yet

- Understanding Inventory ManagementDocument12 pagesUnderstanding Inventory ManagementBona MisbaNo ratings yet

- Gonya Company S Chart of Accounts Includes The Following SelecteDocument1 pageGonya Company S Chart of Accounts Includes The Following SelecteM Bilal SaleemNo ratings yet

- L4 - ABFA1163 FA II (Student)Document4 pagesL4 - ABFA1163 FA II (Student)Xue YikNo ratings yet

- SCH 3Document8 pagesSCH 3suniljaithwarNo ratings yet

- SuspenseDocument2 pagesSuspenseDipankar MallickNo ratings yet

- Preparing Financial StatementsDocument18 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Study unit 13 E-tutor questionDocument2 pagesStudy unit 13 E-tutor questionzinesunduzaNo ratings yet

- Control account errorsDocument2 pagesControl account errorsKingsley MweembaNo ratings yet

- Midterm Exam On Sep 2017 Answer Keys For MorningDocument16 pagesMidterm Exam On Sep 2017 Answer Keys For MorningBuntheaNo ratings yet

- Form 704Document179 pagesForm 704navnath13146720No ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Fy AppDocument7 pagesFy AppTadiwa ChikatiNo ratings yet

- 2022 2024 Syllabus UpdateDocument2 pages2022 2024 Syllabus UpdateTadiwa ChikatiNo ratings yet

- The People of TodayDocument1 pageThe People of TodayTadiwa ChikatiNo ratings yet

- Modlin 9 QuestionsDocument13 pagesModlin 9 QuestionsTadiwa ChikatiNo ratings yet

- N2102LETTERDocument1 pageN2102LETTERTannishk MankarNo ratings yet

- N 21 IslandsDocument2 pagesN 21 IslandsTadiwa ChikatiNo ratings yet

- MS For SprinklerDocument78 pagesMS For Sprinklerkarthy ganesanNo ratings yet

- Impact of MusicDocument15 pagesImpact of MusicSterling GrayNo ratings yet

- Progress Test 1B (Units 1-3)Document6 pagesProgress Test 1B (Units 1-3)SvetlanaNo ratings yet

- Tools for Theft InvestigationDocument15 pagesTools for Theft InvestigationMalagant EscuderoNo ratings yet

- WWII 2nd Army HistoryDocument192 pagesWWII 2nd Army HistoryCAP History Library100% (1)

- ADL Report "Attacking" Press TVDocument20 pagesADL Report "Attacking" Press TVGordon DuffNo ratings yet

- Mrs. Dunia Halawi HarbDocument18 pagesMrs. Dunia Halawi HarbsallykamareddineNo ratings yet

- Underwater Cutting and Welding Equipment - 89250054 - AbDocument38 pagesUnderwater Cutting and Welding Equipment - 89250054 - AbAhmed Adel100% (1)

- How To Comp For A Vocalist - Singer - The Jazz Piano SiteDocument5 pagesHow To Comp For A Vocalist - Singer - The Jazz Piano SiteMbolafab RbjNo ratings yet

- Visa Vertical and Horizontal Analysis ExampleDocument9 pagesVisa Vertical and Horizontal Analysis Examplechad salcidoNo ratings yet

- Multimedia ExerciseDocument1 pageMultimedia ExercisemskgghNo ratings yet

- GJ ScriptDocument83 pagesGJ ScriptKim LawrenceNo ratings yet

- TheoryDocument34 pagesTheoryPrashant SahNo ratings yet

- An Introduction To Insurance AccountingDocument86 pagesAn Introduction To Insurance AccountingTricia PrincipeNo ratings yet

- Ceramic Foam Filter PDFDocument4 pagesCeramic Foam Filter PDFPaen ZulkifliNo ratings yet

- B.sc. Microbiology 1Document114 pagesB.sc. Microbiology 1nasitha princeNo ratings yet

- Ice Hockey BrochureDocument2 pagesIce Hockey BrochurekimtranpatchNo ratings yet

- Oscillator Types and CharacteristicsDocument4 pagesOscillator Types and Characteristicspriyadarshini212007No ratings yet

- 35th Bar Council of India Moot Court MemorialDocument17 pages35th Bar Council of India Moot Court MemorialHarshit Mangal100% (3)

- 3gpp Cdrs Specs AlcatelDocument337 pages3gpp Cdrs Specs AlcatelPatrick AdinaNo ratings yet

- Lion King RPHDocument4 pagesLion King RPHFauzan AzizNo ratings yet

- Kisan Seva Android Application: ISSN 2395-1621Document4 pagesKisan Seva Android Application: ISSN 2395-1621Survive YouNo ratings yet

- Guide to Preparing STEM Fellowship ApplicationsDocument14 pagesGuide to Preparing STEM Fellowship ApplicationsNurrahmiNo ratings yet

- SGT Vacancy ListDocument196 pagesSGT Vacancy ListSusheelabaiNo ratings yet

- CSC340 - HW3Document28 pagesCSC340 - HW3Daniel sNo ratings yet

- Hydraulic Caliper Service Manual MM0266Document27 pagesHydraulic Caliper Service Manual MM0266LUKASNo ratings yet

- September/News/Septiembre 2013: P.O. Box 44 WWW - Hecatomberecords.esDocument7 pagesSeptember/News/Septiembre 2013: P.O. Box 44 WWW - Hecatomberecords.eshecatomberecordsNo ratings yet

- Margie's Group Travel Presents The Sparks Rebellion 1855-1857Document12 pagesMargie's Group Travel Presents The Sparks Rebellion 1855-1857fcmitcNo ratings yet

- Administrator Guide: Document Version 3.6.1Document76 pagesAdministrator Guide: Document Version 3.6.1App PackNo ratings yet

- Child Rights and Juvenile Justice in India MedhaDocument23 pagesChild Rights and Juvenile Justice in India MedhaLaw ColloquyNo ratings yet