Professional Documents

Culture Documents

Correct Answer For Assg 4

Uploaded by

Olivia The0 ratings0% found this document useful (0 votes)

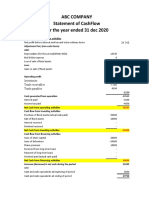

13 views2 pagesThe document contains two statements of cash flows for a company for the year ended 30 June 2013. The first statement shows cash flows from operating, investing and financing activities. Net cash from operating activities was $46,000. Cash used for plant was $25,000. Net cash from financing activities was $17,000 from proceeds of borrowing offset by dividends paid.

The second statement also shows cash flows from operating, investing and financing activities. Net cash from operating activities was $137,000 after adjusting profit for non-cash items. Cash used for plant was $106,000. Net cash used in financing activities was $78,000 from dividends paid exceeding proceeds from borrowing.

Original Description:

Original Title

correct answer for assg 4

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains two statements of cash flows for a company for the year ended 30 June 2013. The first statement shows cash flows from operating, investing and financing activities. Net cash from operating activities was $46,000. Cash used for plant was $25,000. Net cash from financing activities was $17,000 from proceeds of borrowing offset by dividends paid.

The second statement also shows cash flows from operating, investing and financing activities. Net cash from operating activities was $137,000 after adjusting profit for non-cash items. Cash used for plant was $106,000. Net cash used in financing activities was $78,000 from dividends paid exceeding proceeds from borrowing.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesCorrect Answer For Assg 4

Uploaded by

Olivia TheThe document contains two statements of cash flows for a company for the year ended 30 June 2013. The first statement shows cash flows from operating, investing and financing activities. Net cash from operating activities was $46,000. Cash used for plant was $25,000. Net cash from financing activities was $17,000 from proceeds of borrowing offset by dividends paid.

The second statement also shows cash flows from operating, investing and financing activities. Net cash from operating activities was $137,000 after adjusting profit for non-cash items. Cash used for plant was $106,000. Net cash used in financing activities was $78,000 from dividends paid exceeding proceeds from borrowing.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

ACCG871 Advanced Corporate Accounting

Olivia The

43211178

Weekly Assignment Questions

Exercise 19.8 page 738

Statement of Cash Flows

for the year ended 30 June 2013

Cash flows from operating activities

cash receipts from customers 676000

cash paid to suppliers and employees -605000 (483+62+74-12+2-5)

cash generated from operations 71000

interest paid -4000

income taxed paid -21000

net cash from operating activities 46000

cash flows from investing activities

plant -25000

cash flows from financing activities

proceeds from borrowing 40000

dividends paid -23000

net cash from financing activities 17000

net increase in cash and cash equivalents 38000

cash and cash equivalent at beginning of year 30000

cash and cash equivalents at end of year 68000

Exercise 19.12 page 740

Statement of Cash Flows

for the year ended 30 June 2013

cash flows from operating activities

profit before tax 138000

adjustment for :

depreciation 30000

gain on sale of plant -7000

interest expense 6000

decrease in account receivable 6000

increase in inventory -44000

decrease in prepayments 5000

increase in accounts payable 46000

increase in accrued liabilities 5000

cash generated from operations 185000

interest paid -5000

income taxes paid -43000

net cash from operating activities 137000

cash flows from investing activities

plant -106000

cash flows from financing activities

proceeds from borrowing 2000

dividends paid -80000

net cash from financing activities -78000

net increase in cash and cash equivalents -47000

cash and cash equivalent at beginning of year 96000

cash and cash equivalents at end of year 49000

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeDocument5 pagesCash Flow Statement Format: Add: Non-Cash Charges / Non-Business Expesnes Less: Non-Business IncomeTharani NagarajanNo ratings yet

- Cochin MarineDocument4 pagesCochin MarineSivasaravanan A T100% (1)

- Statement of Cash FlowsDocument42 pagesStatement of Cash FlowsCelina PamintuanNo ratings yet

- Numericals FinalDocument3 pagesNumericals FinalM. JAHANZAIB UnknownNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- Net Loss - 13402 DAP 34790 Dec Rec 1245 Inc Inve 5766 Dec Acc 445 6211 22633 - 16422Document8 pagesNet Loss - 13402 DAP 34790 Dec Rec 1245 Inc Inve 5766 Dec Acc 445 6211 22633 - 16422chinmaiNo ratings yet

- Cash FlowDocument13 pagesCash FlowAbdul Hadi SheikhNo ratings yet

- Cash Flow 2020 SpringDocument2 pagesCash Flow 2020 SpringPravin Sagar ThapaNo ratings yet

- Cash FlowDocument1 pageCash FlowMary Ann PorcelNo ratings yet

- Chapter 17 Cash FlowDocument13 pagesChapter 17 Cash FlowToni MarquezNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Adjustments To Reconcile Net Income To Net Cash Provided by Operating ActivitiesDocument4 pagesAdjustments To Reconcile Net Income To Net Cash Provided by Operating ActivitiesTasim IshraqueNo ratings yet

- Cash Flow (Direct Method) Particulars Amount Amount Operating ActivitiesDocument2 pagesCash Flow (Direct Method) Particulars Amount Amount Operating ActivitiesAmit Kumar AroraNo ratings yet

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDocument4 pagesPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNo ratings yet

- Cebu Car Tech Cash Flow (FINAL)Document1 pageCebu Car Tech Cash Flow (FINAL)Amirp LunaNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- 01 eLMS Activity 3 - ARGDocument2 pages01 eLMS Activity 3 - ARGJilliane MaineNo ratings yet

- Aimel Hasan (20I-0203) - BS (A&f) - (CA2 Project Submission)Document4 pagesAimel Hasan (20I-0203) - BS (A&f) - (CA2 Project Submission)AimelNo ratings yet

- Today'S Lesson: Preparing Cash Flow StatementDocument3 pagesToday'S Lesson: Preparing Cash Flow StatementTAFARA MUKARAKATENo ratings yet

- SAmple SCFDocument2 pagesSAmple SCFMylene SantiagoNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Book 2Document2 pagesBook 2Joyce NoblezaNo ratings yet

- Tugas PAKDocument4 pagesTugas PAKTedo Arsa NanditamaNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- Gould Corporation - Cash FlowDocument1 pageGould Corporation - Cash FlowYasir RahimNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Cashflow Statement 5Document5 pagesCashflow Statement 5TAFARA MUKARAKATENo ratings yet

- Viva Accouting (079,095,099)Document7 pagesViva Accouting (079,095,099)vbn7rdkkntNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Cash Flows StatementDocument2 pagesCash Flows StatementWambo MonsterrNo ratings yet

- Group 2Document8 pagesGroup 2Gaurav SinghNo ratings yet

- SituationsDocument8 pagesSituationsAn Trần Thị HảiNo ratings yet

- North Mountain NurseryDocument1 pageNorth Mountain Nurserychandel08No ratings yet

- Latihan CH 1 EA-DDocument18 pagesLatihan CH 1 EA-DBeLoopersNo ratings yet

- Quiz 2. MIDTERM (Cash Flow Statement)Document3 pagesQuiz 2. MIDTERM (Cash Flow Statement)Gila AbrazaldoNo ratings yet

- Problem No 1Document5 pagesProblem No 1shabNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementSara KarenNo ratings yet

- Annisa Nabila Kanti - Task 17Document4 pagesAnnisa Nabila Kanti - Task 17Annisa Nabila KantiNo ratings yet

- Audit CompletionDocument5 pagesAudit CompletionEunice CoronadoNo ratings yet

- Cash FlowDocument3 pagesCash FlowErica BrionesNo ratings yet

- 206 Working AssignmentDocument1 page206 Working AssignmentMichael A. AlbercaNo ratings yet

- Statement of Cash FlowsDocument3 pagesStatement of Cash FlowsNihar MadkaikerNo ratings yet

- Ia T23 AnsDocument2 pagesIa T23 Ansckwai0603No ratings yet

- Vogue Co. JournalDocument8 pagesVogue Co. JournalParvathaneni KarishmaNo ratings yet

- UBER ValuationDocument41 pagesUBER ValuationShrey JainNo ratings yet

- Net Cash Flow From Operating ActivitiesDocument3 pagesNet Cash Flow From Operating ActivitiesRydel CuachonNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Quiz 2. Midterm (Cash Out Statement) : Cash Flow From Operating ActivitiesDocument4 pagesQuiz 2. Midterm (Cash Out Statement) : Cash Flow From Operating ActivitiesGila AbrazaldoNo ratings yet

- Pembahasan Chapter 14Document8 pagesPembahasan Chapter 14Ai TanahashiNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- Nica Company Income Statement As of February 17, 2018 RevenuesDocument10 pagesNica Company Income Statement As of February 17, 2018 RevenuesRoselyn JavierNo ratings yet

- 7 Cash Flow TemplateDocument2 pages7 Cash Flow TemplateshanNo ratings yet

- Bharat ChemicalDocument6 pagesBharat ChemicalgauravpalgarimapalNo ratings yet

- Accounting AdjustmentDocument6 pagesAccounting AdjustmentIzzat AzriNo ratings yet