Professional Documents

Culture Documents

Circular 132017

Uploaded by

BOURBON explorerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular 132017

Uploaded by

BOURBON explorerCopyright:

Available Formats

12Apr1711:53 p.

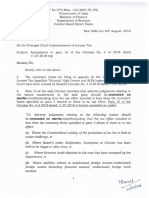

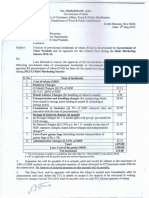

Circular Ho. 1312017

F. No: 500/0712017-FT & TR-Y

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

Foreign Tax & Tax Research - II

FT & TR-Y Division

Hew Delhi , dated 11.04.2017

Subject: Clarification regardirl'£l liability to income-tax in India for a non-resident seafarer

receiving remuneration in HRE (Non Resident External) account maintained with an Indian

Bank.

Representation s have been received in the Board that income by way of salary, received by non-

resident seafarers, for services rendered outside India on-board foreign ships, are being subjected

to tax in India for the reason that the salary has been received by the seafarer into the NRE bank

account maintained in India by the seafarer.

2. The matter has been exam ined in the Board. Section 5(2)(a) of the Income-tax Act provides

that only such income of a non-resident shall be subjected to tax In India that is either received or

Is deemed to be received in India. It is hereby clarified that salary accrued to a non-resident

seafarer for services rendered outside India on a foreign ship shall not be included in the total

income merely because the said salary has been credited in the NRE account maintained with an

Indian bank by the seafarer. J_______4-)

.~hJan;;-

Under Secretary (FTliTR-V)

To

(a) Chairman, Members and all other Officers of the Central Board of Direct Taxes.

(b) Pro CCIT/Pr.DGIT/CCIT/DGIT with a request to circu late the same amongst aU Offkers in

their Region I Charge.

(e:1 Commissioner (Media 6: Technical Poli cy) and Official Spokesperson, CBOT.

(d) Addl Director General of Income-tax (PR, PP &: Oll

(e) ITCC Section of CBDT (3 copies)

(f) ADG (Systems)-IV for uploading on t he Departmental website.

(9) Databa~ e Cell fo r uploadill8 on the IRS Officers website.

Ih) Hindi cell of Department of Revenue, for Hindi translation_

til Guard File. J~ ,r

(Sub ash Janga\a)

Under Se retary (FTflTR·V)

Page 1 of 1

You might also like

- Income Tax: Information On This Page Is Provided by Shakun & Company (Services) Private Limited, New Delhi, India ToDocument1 pageIncome Tax: Information On This Page Is Provided by Shakun & Company (Services) Private Limited, New Delhi, India ToसचिनरावतNo ratings yet

- Amendment Circular 3 2018Document2 pagesAmendment Circular 3 2018sandeepNo ratings yet

- Revised Pay Scales For Clerical Staff No. 5102009 5FP1.983 Dated 15.12.2011 PDFDocument2 pagesRevised Pay Scales For Clerical Staff No. 5102009 5FP1.983 Dated 15.12.2011 PDFParvesh ShahiNo ratings yet

- TA DA EnglishDocument2 pagesTA DA Englishfci ag3No ratings yet

- AP HFAPoA 20081250 CompressedDocument5 pagesAP HFAPoA 20081250 CompressedThappetla SrinivasNo ratings yet

- ,, Wffi9: Asset DatedDocument18 pages,, Wffi9: Asset DatedFarhana Lukman DSNo ratings yet

- Double TPADocument2 pagesDouble TPASweta agarwalNo ratings yet

- Circular 14 2020Document2 pagesCircular 14 2020NESL WebsiteNo ratings yet

- RMC 9-2018 - Mandatory Requirements For All Economic Zone Developers or Operators PEZA For The Processing of ECARDocument1 pageRMC 9-2018 - Mandatory Requirements For All Economic Zone Developers or Operators PEZA For The Processing of ECARzooeyNo ratings yet

- RMC 9-2018Document1 pageRMC 9-2018chris mendoNo ratings yet

- Instruction No 20 PDFDocument2 pagesInstruction No 20 PDFHimanshu BangiaNo ratings yet

- I I I I I I I I: Lok Nayak Bhawan, 3 Floor, Khan M Rket Ew Elh, Dated Decem Er, 2 15Document1 pageI I I I I I I I: Lok Nayak Bhawan, 3 Floor, Khan M Rket Ew Elh, Dated Decem Er, 2 15mithunsarker883No ratings yet

- Circular 103 DocumentDocument12 pagesCircular 103 DocumentVivek ChauhanNo ratings yet

- PaymentArrears 70443258Document3 pagesPaymentArrears 70443258SJS GSSS Kot-PlahariNo ratings yet

- 2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingDocument1 page2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingRaj A KapadiaNo ratings yet

- Circular No 18 2021Document2 pagesCircular No 18 2021vijayNo ratings yet

- Annex 7 - Fund Utilization Report (FUR) - UpdatedDocument2 pagesAnnex 7 - Fund Utilization Report (FUR) - UpdatedBeth Solis AngelNo ratings yet

- GFR 12 - A: LL - J:t0.. A.1Document2 pagesGFR 12 - A: LL - J:t0.. A.1reshmaNo ratings yet

- "4" Amnesty On: Tax De!Inqllencies IlllDocument2 pages"4" Amnesty On: Tax De!Inqllencies IlllRonald Allan Valdez Miranda Jr.No ratings yet

- Office": Ministry Division)Document2 pagesOffice": Ministry Division)kaus9199No ratings yet

- Circular25 2017Document2 pagesCircular25 2017SHIVAM BHATTACHARYANo ratings yet

- Ntni Itr Final 2021 PDFDocument4 pagesNtni Itr Final 2021 PDFmario j padillaNo ratings yet

- Abolition 0001Document13 pagesAbolition 0001Anurag MishraNo ratings yet

- Government of Andhra Pradesh: G.O.Rt - No: - DatedDocument2 pagesGovernment of Andhra Pradesh: G.O.Rt - No: - DatedChintham ReddyNo ratings yet

- RDAO No. 1-2018 PDFDocument1 pageRDAO No. 1-2018 PDFLou StellarNo ratings yet

- OM No. 91-2021 (Notification of TWAs)Document2 pagesOM No. 91-2021 (Notification of TWAs)Christine Joyce TaluaNo ratings yet

- OM 06 Oct 2022 Reg 2017 IDA Pay ScalesDocument1 pageOM 06 Oct 2022 Reg 2017 IDA Pay ScalesnameishebestNo ratings yet

- Ta FinminDocument1 pageTa FinminKamal SutharNo ratings yet

- Order 119 MiscComm 31 1 24Document6 pagesOrder 119 MiscComm 31 1 24Mmkpss Sriram Sista MmkpssNo ratings yet

- RMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Document2 pagesRMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Bien Bowie A. CortezNo ratings yet

- Air Crto Khi 17.10.18Document27 pagesAir Crto Khi 17.10.18Hamid AliNo ratings yet

- Bunching of StagesDocument8 pagesBunching of StagesLeo PrabhuNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Bureau of Internal Revenue: Republic of The PhilippinesDocument1 pageBureau of Internal Revenue: Republic of The PhilippinesChristelle Ayn BaldosNo ratings yet

- Paper 4 Taxation May 12Document12 pagesPaper 4 Taxation May 12raviNo ratings yet

- Circular 57 DocumentsDocument9 pagesCircular 57 DocumentsPratyush RaychaudhuriNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021lara.zestoNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021REX FABERNo ratings yet

- NR ZBG: Republic Department Finance of InternalDocument1 pageNR ZBG: Republic Department Finance of InternalAlden Christopher LumotNo ratings yet

- Dated:: Oflndia MioistryDocument2 pagesDated:: Oflndia MioistryNitish BhardwajNo ratings yet

- CBDT Income Tax Circular 16 2022Document2 pagesCBDT Income Tax Circular 16 2022sandeep100% (1)

- Circular 08feb2011Document2 pagesCircular 08feb2011Manoj Prasad SinghNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- 5% of MSP 4% of MSPDocument2 pages5% of MSP 4% of MSPP DNo ratings yet

- Circular 81 DocumentDocument3 pagesCircular 81 DocumentAn JaanaNo ratings yet

- Bureau of Internal RevenueDocument6 pagesBureau of Internal RevenueJb GuabNo ratings yet

- Of of To Of: The - :-TheDocument5 pagesOf of To Of: The - :-TheTusharr KapoorNo ratings yet

- Ministry: File IndiaDocument13 pagesMinistry: File IndiaNarayanaNo ratings yet

- OM Dated 06.01.2022 EngDocument2 pagesOM Dated 06.01.2022 EngSantuNo ratings yet

- 4851 FDocument2 pages4851 FPritam BasuNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocument1 pageflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresNo ratings yet

- MobStaffCarDrivr PDFDocument1 pageMobStaffCarDrivr PDFSanjeev KumarNo ratings yet

- Of The of I TBR Firr of Two: FinanceDocument5 pagesOf The of I TBR Firr of Two: FinanceANURAG SINGHNo ratings yet

- Balance of PaymentDocument19 pagesBalance of PaymentvineethvasudevanNo ratings yet

- BIR Form 1702-RTDocument4 pagesBIR Form 1702-RTAljohn Sechico BacolodNo ratings yet

- Penn State Right-To-Know Report 2011Document66 pagesPenn State Right-To-Know Report 2011veblenNo ratings yet

- RMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsDocument2 pagesRMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsMiming BudoyNo ratings yet

- GO 29 SignedDocument4 pagesGO 29 SignedRaghuramNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Romero V Estrada DigestDocument1 pageRomero V Estrada DigestPamela PrietoNo ratings yet

- Co-Ownership Ong Tan v. Rodriguez GR 230404 January 31, 2018 1 Division: Tijam, JDocument2 pagesCo-Ownership Ong Tan v. Rodriguez GR 230404 January 31, 2018 1 Division: Tijam, JApril John LatorzaNo ratings yet

- Honda CB450 K0 Parts List ManualDocument130 pagesHonda CB450 K0 Parts List ManualBrandon Parsons100% (1)

- Legal Ethics and Practical Exercises DigestDocument10 pagesLegal Ethics and Practical Exercises Digestalma vitorilloNo ratings yet

- Promises During The Elections and InaugurationDocument3 pagesPromises During The Elections and InaugurationJessa QuitolaNo ratings yet

- Professional Practice of Accounting With AnswerDocument12 pagesProfessional Practice of Accounting With AnswerRNo ratings yet

- 005 SPARK v. Quezon City G.R. No. 225442Document28 pages005 SPARK v. Quezon City G.R. No. 225442Kenneth EsquilloNo ratings yet

- VergaraDocument13 pagesVergaraAurora Pelagio VallejosNo ratings yet

- Case Report Cirilo Paredes V EspinoDocument2 pagesCase Report Cirilo Paredes V EspinoJordan ProelNo ratings yet

- Introduction Business EthicsDocument24 pagesIntroduction Business EthicsSumit Kumar100% (1)

- 1 Dealer AddressDocument1 page1 Dealer AddressguneshwwarNo ratings yet

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Document2 pagesOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandNo ratings yet

- Wind River Energy Employment Terms and ConditionsDocument2 pagesWind River Energy Employment Terms and ConditionsyogeshNo ratings yet

- Track Changes of Doctrine and Covenants Section 8Document2 pagesTrack Changes of Doctrine and Covenants Section 8Bomo NomoNo ratings yet

- Cdi 4 Organized Crime 2020 Covid ADocument66 pagesCdi 4 Organized Crime 2020 Covid AVj Lentejas IIINo ratings yet

- OCA v. DANILO P. GALVEZDocument11 pagesOCA v. DANILO P. GALVEZFaustina del RosarioNo ratings yet

- Scott Gessler Appeal of Ethics Commission Sanctions - Opening BriefDocument56 pagesScott Gessler Appeal of Ethics Commission Sanctions - Opening BriefColorado Ethics WatchNo ratings yet

- Navarro Vs DomagtoyDocument3 pagesNavarro Vs Domagtoykvisca_martinoNo ratings yet

- Samandar Bagh SP College Road, Srinagar: Order No: S14DSEK of 2022Document1 pageSamandar Bagh SP College Road, Srinagar: Order No: S14DSEK of 2022Headmasterghspandrathan GhspandrathanNo ratings yet

- Document 5Document6 pagesDocument 5Collins MainaNo ratings yet

- Peshawar PresentationDocument21 pagesPeshawar PresentationsamNo ratings yet

- Global Network: Brazil The PhilippinesDocument1 pageGlobal Network: Brazil The Philippinesmayuresh1101No ratings yet

- Miaa Vs CA Gr155650 20jul2006 DIGESTDocument2 pagesMiaa Vs CA Gr155650 20jul2006 DIGESTRyla Pasiola100% (1)

- Subercaseaux, GuillermoDocument416 pagesSubercaseaux, GuillermoMarco Cabesour Hernandez RomanNo ratings yet

- Situational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VanceDocument22 pagesSituational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VancePedroNo ratings yet

- BeerVM11e PPT Ch11Document92 pagesBeerVM11e PPT Ch11brayanNo ratings yet

- Fraud Detection and Deterrence in Workers' CompensationDocument46 pagesFraud Detection and Deterrence in Workers' CompensationTanya ChaudharyNo ratings yet

- Beta Theta Pi InformationDocument1 pageBeta Theta Pi Informationzzduble1No ratings yet

- Analysis Condominium RulesDocument12 pagesAnalysis Condominium RulesMingalar JLSNo ratings yet

- Solicitor General LetterDocument6 pagesSolicitor General LetterFallon FischerNo ratings yet