Professional Documents

Culture Documents

Tasty Bites - BQ V

Uploaded by

Andy NainggolanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tasty Bites - BQ V

Uploaded by

Andy NainggolanCopyright:

Available Formats

Tasty Bites India - BQ1

Strategic Assets Distinctive Architecture

Large category of product profile with established relationship with

major MNC QSR brands - These tend to be sticky relationships. Already has Domestic (B2B) - All major QSR brands including:

an 8+ year relationship with McDonalds McDonalds, TacoBell, KFC, Burger King, Subway ..

R&D Center (TBRC) – Constantly evolving product line, keeping up with taste Customers KFC every single veg product is from Tasty Bite ( preferred

patterns and targeting new opportunities. Emphasis on research drives supplier). Only manufacturer of Pizza McPuff (McDoanlds).

product quality and new product development. Only veg supplier to Burger King.

Acquisition by Kagome opens new possibilities with respect to distribution/ International (B2C) - US, Australia, UK - Cater to Major US

channel partnerships and even shared manufacturing retailers - Costco, Whole Foods and Others

Infrastructure in place for quality monitoring from sourcing to manufacturing to Own a 25 acre farmland on which they grow some of their

delivery. The company uses new techniques in irrigation and farming to own produce - and introduce new forms of irrigation / farming

ensure increae in yield per acre etc.

Its Ready to eat (RTE) is a very well known brand focused on mainstream Suppliers/ Vendors They source from several frozen food manufacturers as well.

American customers and available at all major Super market chains. Offers This allows them to counteract price fluctations in

Indian RTE products and Thai Sauces. vegetables.

Its emphasis on organic produce has given it a unique plank to market its Source from local farmers - Work with them in developing

products in International markets and in particular to unique segments - Eg:

Competitive know-how and also for areas social development.

expectant moms (Australia) Forces/ Establishing a long term relationship

Bargaining

Power In the US Sell through PBI (Distributor - that owns a

substantial stake in TBI) - at 30% of MRP. Need to check if

this is the norm in the sector?

Dealers/ Distributors/

Disproportionate Future? Marketing With Acquisition by Kagome in Japan access to new markets

and sales channels.

Partnership with Kagome will open up new markets - Kagome MAY look to

expand manufacturing partnerships with TBI (Outsource manufacturing to In Australia sell through Preferred Brand Australia (100%

India?) owned by Preferred Brand International - PBI)

Local competitors include Del Monte, Vista (customer also),

McCain, Kohinoor

Industry/ Competition Vista foods growig rapidly at 25% a year. - Caters mainly to

chicken and Egg - TBI only does vegetarian produce

What can go wrong? Mitigation? RTE has several brands doing well - with Gits doing well with

Indians abroad. Students / Expats etc. Imports not a real

threat to the QSR business

Food price volatality. Specifically onion, tomatoes, Frozen food storage ↗ Strong new product innovation with QSR partners. Supplying multiple varieties of

potatoes. Margins have been hit hard in the past capacity expanded. Re- patties (KFC Zinger and other patties, patties to Burger King, subway green

due to this. look at agreements? peas/chatpata chana). Sauces to dominoes, HUL, Pizza Hut.

Emphasis on product ↗ Looking at introducing Thai focused product range based on user demand and

quality and R&D very tastes. Asia Noodles - a new category has generated very positive reviews in markets

Quality issues can cause steep drop in business high New of launch and is growing rapidly

Use new solutions to

Products/

drive down costs Innovation/

As seen from the past price rise cannot be passed (farming/ logistics Branding ↗ RTE business is branded. But brand is owned by the parent company (Preferred

onto the user - Margins will be under pressure. techniques) foods). No scope of brandng elsewhere

Focus on growth and

A customer base that is relatively concentrated to an expansion of the RTE

industry - slowdown in QSR business can hurt future business - with new ↗ Kagome impact could lead to TBIs expansion into product lines familiar with their

prospects product lines business - Juices, branded sauces as an example

Tasty Bites India - BQ2

EBITDA Capital Invested EPA/Sales - future value creation lead indicator

Growth Rates Margin Turnover ROIC Capital EPA/Sales

3 Year Average 61.51% 8.59% 1.83 7.98% 61.57 -3.42% The company has invested heavily in

Business Value Drivers capex in last four years. Yet to

demonstrate sustainable value creation -

5 Year Average -11.22% 9.29% 1.88 9.60% 52.38 -2.92% TTM figures are more encouraging

though again, sustainability needs to be

Current Year* questioned.

(Annualized Data) 20.04% 14.05% 2.69 19.16% 65.05 2.29%

Global RTE Industry growth rate pegged at between 6%-7% (5 years). QSR industry in

India growing at 25% for 5 years at least. Organized large scale players are absent

Nature of Industry: Competitive Intensity? Industry Growth rates? (B2B). Fewer players. Sticky partners.

India RTE market size – 2000 Cr. Global market size – US$ 300 Billion . QSR

Business - India Market Size US$ 1 billion - Very fast growing domestic market. Major

investments plans of all QSR. A minimum of 10 years runway of growth potential

Opportunity Size: How big is the runway? How many years out? ahead.

Operating leverage will come in with better capacity utilization. Asset turnover is the

key - while it has improved yet to be seen if it can be sustained. The management is

Capital Allocation: Able to invest large Capital at high ROIC? consistently looking to move up the value chain.

Major variable is the price of inputs. In certain years Onion and tomato prices have

moved 2x to 4x from mean. Consumer discretionary spends - reflective of macro

Predictability: How many variables in the Business? economic factors the other variable

BQ Bottomline Very difficult due to quality, trust and long relationship with customers. Customer's own

Sustainability: How hard is it to dislodge from its perch? contribution to recipe development

Disprotionate Building blocks in place for disproportionate Expansion into new markets and categories. Kagome relationship can prove to be a

Future: future? Do multiple Optionalities exist? trump card

Business Strategy Capacity additions will be likely to aid growth. Capacity and ability to supply un-

& Planned Is the company likely to grow efficiently & interrupted is also key to retaining customers. Company moving to higher value added

Initiatives: emerge stronger in next 2-3 years? products like speciality sauces.

Next 2-3 years – what are the key monitorables, 1. Continued rapid growth in domestic QSR business. 2. Expansion into new markets

Key Monitorables: key health indicators? (Japan/ NZ). 3. launch of new products and their uptake. 4. Capacity addition

Near Term

Visibility: Next 2-3 years – how strong is the visbility? Strong visibity of 30% CAGR

High chances of success. Dependent to a large extent on the trends and growth of the

Long Term Visbility: 5-10 years on - how likely to survive & prosper? QSR/ HOECR market

BQ Category: Laborious? Or Disproportionate Smarts? Great Opportunities Ahead : Laborious, Category B+

Valuation Spotlight? Business Transition Managed significant business transition to its Company moved from RTE business (low growth) to QSR very efficiently + Size of

Track Record: advantage? What impresses most? opportunity

CMP: 890: 30/04/2015 Stable PE

Performance vs Current P/E or Perception captures business Trailing Range : 18x -

Perception GAP: quality/performance? How big is the GAP? PE: 25x 22x Perception/Expectation

You might also like

- CG199090 Urban Platter MacadamiaDocument12 pagesCG199090 Urban Platter MacadamiaDipanwitaNo ratings yet

- Digitally Signed by Monika Jaggia Date: 2024.01.25 17:54:01 +05'30'Document36 pagesDigitally Signed by Monika Jaggia Date: 2024.01.25 17:54:01 +05'30'dipesh.shopNo ratings yet

- Project On BritaaniaDocument9 pagesProject On BritaanialalitsinghNo ratings yet

- Procter & Gamble: AboutDocument8 pagesProcter & Gamble: AboutRamkumarArumugapandiNo ratings yet

- LT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Document2 pagesLT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Sampann PatodiNo ratings yet

- SWAD Brand - "Think Local Act Global": A Case of Vimal Agro Products Pvt. LTD., Bardoli, SuratDocument4 pagesSWAD Brand - "Think Local Act Global": A Case of Vimal Agro Products Pvt. LTD., Bardoli, Surattasnuba sinhaNo ratings yet

- Parle G Presentation (Autosaved)Document13 pagesParle G Presentation (Autosaved)Priya JoshiNo ratings yet

- Project Context, E.G Why Has This Project Arisen, What Is The Strategic FitDocument4 pagesProject Context, E.G Why Has This Project Arisen, What Is The Strategic FitNYasha mwenje100% (1)

- FinalDocument21 pagesFinalSourav pandeyNo ratings yet

- Britannia Industries LTD.: By, Group 6, Section-CDocument29 pagesBritannia Industries LTD.: By, Group 6, Section-CRushabh SavlaNo ratings yet

- TCPLDocument39 pagesTCPLKartik SharmaNo ratings yet

- Ambit Disruption-Vol 2Document9 pagesAmbit Disruption-Vol 2Mobin CheriyanNo ratings yet

- Executive (Promotions On Sustainable Packaging) : Composed By: Mareea BeasleyDocument5 pagesExecutive (Promotions On Sustainable Packaging) : Composed By: Mareea BeasleyMareea BeasleyNo ratings yet

- Food Processing Industry: Prepared By: The SwashbucklersDocument8 pagesFood Processing Industry: Prepared By: The SwashbucklersGanesh ShewatkarNo ratings yet

- Group E - PepsiCoDocument10 pagesGroup E - PepsiCoVatsal MaheshwariNo ratings yet

- Consolidated ReportDocument7 pagesConsolidated ReportPriyanka BiswasNo ratings yet

- AMM PPT BitanniaDocument14 pagesAMM PPT Bitanniaanchal tanwarNo ratings yet

- 17 Dimensions-Marketing W06Document52 pages17 Dimensions-Marketing W06freaky_kunal007No ratings yet

- Planning To Shed The Cookie Maker TagDocument18 pagesPlanning To Shed The Cookie Maker TagPrerna RathiNo ratings yet

- n0884100 BrochureDocument12 pagesn0884100 BrochureRuby JamadarNo ratings yet

- Britannia ProjectDocument29 pagesBritannia Projectapi-379642975% (8)

- Krispy Kreme Strategic PlanDocument36 pagesKrispy Kreme Strategic PlanEunice Abrenica100% (2)

- Cott Beverage UkDocument9 pagesCott Beverage UkOndina OlariuNo ratings yet

- Mondelez - Strategic AnalysisDocument8 pagesMondelez - Strategic AnalysisMallika JainNo ratings yet

- DiversificationDocument18 pagesDiversificationRohit RajNo ratings yet

- Case Analysis Coke DessertDocument8 pagesCase Analysis Coke DessertSumit JhaNo ratings yet

- Biscuit Industry: Comprehensive ReportDocument9 pagesBiscuit Industry: Comprehensive Reportsakthivel vengatasamyNo ratings yet

- FCL Company Presentation Sep17Document44 pagesFCL Company Presentation Sep17doctorNo ratings yet

- Aashirvaad AttaDocument4 pagesAashirvaad Attazeba rahemanNo ratings yet

- Team BuzzDocument5 pagesTeam BuzzRathod Darshan HareshkumarNo ratings yet

- GA2Document11 pagesGA2Saumya SharmaNo ratings yet

- Strategic ManagementDocument24 pagesStrategic ManagementMuhammad Hassaan RazaNo ratings yet

- Colgate Company AnalysisDocument2 pagesColgate Company AnalysisMichael ScofieldNo ratings yet

- Britannia Industries Limited: SynopsisDocument17 pagesBritannia Industries Limited: SynopsisSatyajit TalluriNo ratings yet

- Competitor Analysis: Competitor Brand Name Characteristics / Strategies Strengths WeaknessesDocument8 pagesCompetitor Analysis: Competitor Brand Name Characteristics / Strategies Strengths WeaknessesRepala PraveenNo ratings yet

- 1625 Operational Management CA 2Document7 pages1625 Operational Management CA 2Naman JainNo ratings yet

- Business Modelling - Snack IndustryDocument14 pagesBusiness Modelling - Snack IndustryRia SinglaNo ratings yet

- Bunge ReportDocument10 pagesBunge ReportSunday Fasina100% (1)

- Chap17 Charles Hill MarketingDocument32 pagesChap17 Charles Hill MarketinghaseebNo ratings yet

- Market Entry CaseDocument2 pagesMarket Entry CaseSanjeet KumarNo ratings yet

- SG Food - Team 2Document38 pagesSG Food - Team 2Minh NguyễnNo ratings yet

- SSD SSDDocument12 pagesSSD SSDRakesh MaheshwariNo ratings yet

- Q1-Prepare A Stepwise Plan For The Launch of Reitzel Products in India (10 Marks)Document4 pagesQ1-Prepare A Stepwise Plan For The Launch of Reitzel Products in India (10 Marks)Utkarsh SinghNo ratings yet

- IDBI Capital FMCG Sector UpdateDocument177 pagesIDBI Capital FMCG Sector UpdateHimani SinghalNo ratings yet

- Overview of Indian Packaging IndustryDocument20 pagesOverview of Indian Packaging IndustryKay Kay MenonNo ratings yet

- T1 Ibp PPT Group 9Document12 pagesT1 Ibp PPT Group 9Caroline MoralesNo ratings yet

- Respicio Group2 Presentation ABM12-3PDocument19 pagesRespicio Group2 Presentation ABM12-3PChristine RespicioNo ratings yet

- Contoh PPT Business Plan Makanan Ringan Compress - Id.enDocument17 pagesContoh PPT Business Plan Makanan Ringan Compress - Id.enita miftahussaidahNo ratings yet

- M. Bects Fod SpeciDocument7 pagesM. Bects Fod SpeciRohit KumarNo ratings yet

- Britannia BiscuitsDocument11 pagesBritannia BiscuitsGinny JonesNo ratings yet

- Long Term Visibility Template 3.0 - Britannia v2Document1 pageLong Term Visibility Template 3.0 - Britannia v2Sripathy ChandrasekarNo ratings yet

- BRITANNIADocument11 pagesBRITANNIABally SinghNo ratings yet

- RM - Group 3 - TESCO PLCDocument11 pagesRM - Group 3 - TESCO PLCRishabh SanghaviNo ratings yet

- EOS B Group 11 The Disposable Diaper Industry in 1974Document7 pagesEOS B Group 11 The Disposable Diaper Industry in 1974aabfjabfuagfuegbfNo ratings yet

- Marketing Plan FOR New Healthy Domty Kids SandwichDocument43 pagesMarketing Plan FOR New Healthy Domty Kids Sandwichmimo11112222No ratings yet

- Textile IndustryDocument14 pagesTextile Industry551VIJAYA ADITYA ERRABATINo ratings yet

- Team BckbenchersDocument14 pagesTeam BckbenchersOmar FarukNo ratings yet

- Britannia Marketing AnalysisDocument21 pagesBritannia Marketing Analysisabhijitsamanta1No ratings yet

- Porter'S Generic StrategiesDocument29 pagesPorter'S Generic StrategiesReynaldi SomantriNo ratings yet

- From Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationFrom EverandFrom Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationRating: 3 out of 5 stars3/5 (1)

- MDS Unaudited FS Q1 2023Document95 pagesMDS Unaudited FS Q1 2023Andy NainggolanNo ratings yet

- Avenue SupermartDocument21 pagesAvenue SupermartAndy NainggolanNo ratings yet

- Soa300722Document1 pageSoa300722Andy NainggolanNo ratings yet

- Bullish Mat Hold - 20220401 - 224742Document2 pagesBullish Mat Hold - 20220401 - 224742Andy NainggolanNo ratings yet

- PLAN CWM AFD OC BORONG EditDocument1 pagePLAN CWM AFD OC BORONG EditAndy NainggolanNo ratings yet

- 0cv - Tms - FixedDocument1 page0cv - Tms - FixedAndy NainggolanNo ratings yet

- 1 Prof Chauvins Instructions For Bingham CH 4Document35 pages1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Case Study On Goodearth Financial Services LTDDocument15 pagesCase Study On Goodearth Financial Services LTDEkta Luciferisious Sharma0% (1)

- Lab 2 - Permeability TestDocument9 pagesLab 2 - Permeability TestAinur NasuhaNo ratings yet

- CL200 PLCDocument158 pagesCL200 PLCJavierRuizThorrensNo ratings yet

- Controlled DemolitionDocument3 pagesControlled DemolitionJim FrancoNo ratings yet

- Advanced Physiotherapeutic SyllabusDocument1 pageAdvanced Physiotherapeutic SyllabusAnup SharmaNo ratings yet

- CUET 2022 General Test 6th October Shift 1Document23 pagesCUET 2022 General Test 6th October Shift 1Dhruv BhardwajNo ratings yet

- Astm D 1196 PDFDocument3 pagesAstm D 1196 PDFSetyawan Chill Gates0% (1)

- Anviz T5 RFID ManualDocument52 pagesAnviz T5 RFID ManualLuis Felipe Olaya SandovalNo ratings yet

- Guidelines For Plenipotentiary - 1Document6 pagesGuidelines For Plenipotentiary - 1Oladimeji Ibukun IjaodolaNo ratings yet

- Perturbation MethodsDocument29 pagesPerturbation Methodsmhdr100% (1)

- Antifraud PlaybookDocument60 pagesAntifraud PlaybookDani UsmarNo ratings yet

- 3g Node B On Ip MediaDocument79 pages3g Node B On Ip MediaBsskkd KkdNo ratings yet

- A Process Reference Model For Claims Management in Construction Supply Chains The Contractors PerspectiveDocument20 pagesA Process Reference Model For Claims Management in Construction Supply Chains The Contractors Perspectivejadal khanNo ratings yet

- DN12278 - 5008 - Indicative Cable Way Route - Rev BDocument9 pagesDN12278 - 5008 - Indicative Cable Way Route - Rev BArtjoms LusenkoNo ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentSukanya SinghNo ratings yet

- Book Speos 2023 R2 Users GuideDocument843 pagesBook Speos 2023 R2 Users GuideCarlos RodriguesNo ratings yet

- HPCL CSR Social Audit ReportDocument56 pagesHPCL CSR Social Audit Reportllr_ka_happaNo ratings yet

- Heart Rate Variability Threshold As An Alternative.25Document6 pagesHeart Rate Variability Threshold As An Alternative.25Wasly SilvaNo ratings yet

- Islamiyat ProjectDocument21 pagesIslamiyat ProjectSubhan Khan NiaziNo ratings yet

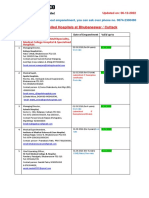

- Empanelled Hospitals List Updated - 06-12-2022 - 1670482933145Document19 pagesEmpanelled Hospitals List Updated - 06-12-2022 - 1670482933145mechmaster4uNo ratings yet

- AAR Shell ProgrammingDocument13 pagesAAR Shell ProgrammingMarimuthu MuthaiyanNo ratings yet

- Garments Costing Sheet of LADIES Skinny DenimsDocument1 pageGarments Costing Sheet of LADIES Skinny DenimsDebopriya SahaNo ratings yet

- Functions PW DPPDocument4 pagesFunctions PW DPPDebmalyaNo ratings yet

- ProjectDocument33 pagesProjectPiyush PatelNo ratings yet

- VC AndrewsDocument3 pagesVC AndrewsLesa O'Leary100% (1)

- Advantages Renewable Energy Resources Environmental Sciences EssayDocument3 pagesAdvantages Renewable Energy Resources Environmental Sciences EssayCemerlang StudiNo ratings yet

- User ManualDocument96 pagesUser ManualSherifNo ratings yet

- Level Swiches Data SheetDocument4 pagesLevel Swiches Data SheetROGELIO QUIJANONo ratings yet

- 16 Personalities ResultsDocument9 pages16 Personalities Resultsapi-605848036No ratings yet