Professional Documents

Culture Documents

Investment Summary

Uploaded by

21248deekshakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Summary

Uploaded by

21248deekshakCopyright:

Available Formats

INVESTMENT ACCOUNTS

1. MEANING OF INVESTMENT:

Investments are assets held by an enterprise for earning income by way

of dividends, interest and rentals, for capital appreciation, or for other

benefits to the investing enterprise.

The accounting for investments is governed by the provisions of AS-13.

Example: Inv . in shares d securities .

Inv in Gold Silver etc. ,

,

Inv in Inv in business

property ,

.

etc .

2. COST OF INVESTMENT:

Investment acquired shall be initially recognised at COST.

Cme ! : Inv .

acquired for Cmh consideration : -

Purchase price : ✗ ✗ ✗

It) F- ( stamp

xp

-

for purchase : ✗✗ ✗

duty ,

Comm . etc)

Fxx

cone ? : Inv .

acquired by exchange of other omets : -

Cost = fair value

of asset given of fair value of

Inv acquired

. .

Care ?: Inv acquired by issue

of shares

by a co : -

Fair value fair value

Cost :

of Inv acq

.

. 0

? of

shares issued .

3. RECURRING INCOME FROM INVESTMENTS:

Int income d Div . Income tofd to PIL

d d

accrues on accrues when

time basis declared / paid

by the co

CA AVINASH SANCHETI NAVIN CLASSES

.

INVESTMENT ACCOUNTS

4. MEASUREMENT OF INVESTMENT IN BALANCE SHEET:

Classification of Investment

-

CURRENT INVESTMENT -

LONG TERM INVESTMENT

d &

Inv . which are held with Inv . other than

an intention to sell within Current inv .

12 months from the dahl b

readily valued

of purchase and are at cost .

realis able .

However , if there is

tr permanent decline in

Valued at -

lost or Fmv

; lower value ,

then it shall be

d provided for 1PM .

Any diff

.

shall be charged

to PIL .

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

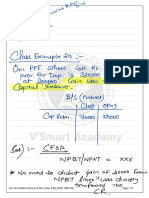

5. DISPOSAL OF INVESTMENT:

On disposal of an investment, the difference between the carrying

amount and the disposal proceeds, net of expenses is recognised in the

profit and loss statement.

PIL on sale =

[Net selling Price to

carrying Amt .

]

Bank INSP )

A/c -

Dr

PIL Alc -

Dr Closs)

to Inv .

Afc ( Carrying Amt)

TO PIL All profit )

If a part of investment is sold, then the carrying amount of investment sold

can be determined using cost formulas like FIFO or weighted average.

( Priority 1)

6. ACCOUNTING FOR INVESTMENT IN SECURITIES:

A separate Investment Account should be made for each scrip purchased.

Types of securities

Fixed income bearing Variable income bearing

☐ securities ☐ securities

d d

f. Bonds , Debentures f-

g. Equity shares

g.

. .

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

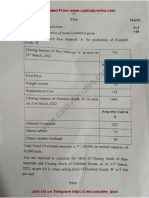

7. INVESTMENT A/c - FIXED INCOME BEARING SECURITIES:

a) Format:

Dr. Cr.

t.I.FI

Date Particulars FV Cost Int. Date Particulars FV Cost Int.

b) Cost of Investment acquired:

Price Quotations

& d

En int price com int price

to a

Price for securities total amt .

payable

excluding Interest including interest

Cum Int price =

[ F- R int price ☒ Inherent from last

IPD till date of

d

d purity

cost d

Total ant of

payable investment Expense

* f-

xp

.

like

Brokerage etc .

given in % shall be

applied

as

follows : -

(a) it basis % that

given

=)

apply on

price

to if nothing mentioned :) apply % on quotation

given .

Journal

Inv Afc - Dr LEN int price including exp ) .

✗✗

Int on Inv Afc - pr ( int ) ✗✗

To Bank At Clum Int

price ) ✗y

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

c) Periodic Interest income:

date :) Int recognised

µ On

of purchase exp

. to be

(2) On every IPD Int Inc . to be recognised

Hart IPD to current IPD)

On date sale =) Int Inc to recognised

(3) of .

be

date sale)

11Mt IPD to

of

trfd PILAK

* the net Int Income

for the

year will be to

d) Interest accrued but not due:

a) Only when IPD d Year end date are different .

b) Op bat

of Int accrued =) Dr bae of Int cot

-

.

. . .

c) U bat Int accrued =) Shown Inr cot

of

.

on on

the Cr .

side 'm U bat .

.

" "

Int accrued : last IPD to

year end

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

e) Sale of investment:

Pll on safe :

En int SP : ✗✗

e)

selling exp

✗¥

-

.

Cost

of Inv . Sold ✗✗ =) FIFO or weighted

Ay .

*

if cum Int sp is deduct inherent d show

given income ,

it on a

separate .

f) Closing balance of Investment:

✓ a

lushent Inv .

longterm Inv .

I

b

valued at

cost or fmri value at cost

lower

( Mal .

fig )

d

if FMV is lower ,

the diff -

in inv Ak

shall be trfd

to PILAK

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

7. INVESTMENT A/c - VARIABLE INCOME BEARING SECURITIES:

a) Format:

Dr. Cr.

III.

Date Particulars FV Cost Div. Date Particulars FV Cost Div.

b) Cost of Equity shares acquired:

Purchase price = ✗ ✗

F) F-

xp for porch :#

lost : XI

c) Dividend received:

F-

-

Pre acquisition dividend -

Post acquisition dividend

b w

kharida is Saal treated on income

but dividend mil dtrfd to PIL

raha hai last a

year

ka Bank Alc Dr ✗✗

-

d To Dividend All

✗✗

Reduced CPK >

from cost

of Inv .

d

Bank Ale - M ✗ ✗

to Investment AKXY

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

d) Bonus shares received on investment:

* shares recd without. consideration .

Increase

'

No

of with Nil

-

* .

shares : cost

* When the shares are sold ,

calculate PIL using

weighted avg .

cost method .

* Bonus ratio : 2 :3 : two bonus sh .

for every

3 Shares

held .

e) Right shares:

issued

* New shares

by co .

at concessional rate .

Investor has

* two

-

options

← w

Purchase the Renounce the

shares right

d d

Purchase

of Inr .

* Renouncement money

recd . is an income

d shall be trfd to PIL

( working

-

none)

None ① Cost

of Inv .

for renounce e = Renouncement

#

Amt paid

money paid

.

to Co .

(2) Exception to the treatment

of renown c. money ! .

if original shares were purchased on cum right basis and

recd

the ex

right price of shares falls then the renown

money

.

.

Shall be 1st applied to reduce the cost

of Inv .

CA AVINASH SANCHETI and any excess shall be trfd to NAVIN CLASSES

pµ .

INVESTMENT ACCOUNTS

e) Sale of investment:

PIL on sale

=

✗ ✗ ✗

Net

selling price :

Cost

e)

of Inv sold :

( XXX)

Pll on sale :)

*

If part inv . is sold =) Calculate cost using weighted

OR FIFO

avg .

.

f) Closing balance of Investment:

Same as above .

CA AVINASH SANCHETI NAVIN CLASSES

INVESTMENT ACCOUNTS

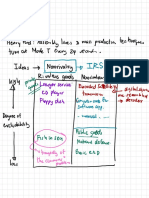

8. RECLASSIFICATION OF INVESTMENT:

-

Current to Long term Long term to Current

-

d d

value for reclassification Value for reclassification

lost on Fmv on dahl of cost or

carrying anti

reclassification ; as the cone may

whichever is lower .

be .

Conversion Deb shares

of

* to :

Eq

-

.

.

be

(a) On date of conversion

,

Int income shall recognised

from last IPD till date omen deb.com#hed

'

on on -

deb converted

(b) lost

of Eq shares recd =

Carrying amt

of .

in M

Inv .

Eq Sh .

Afc -

✗ ✗

Inv in Def ✗✗

To A/c

CA AVINASH SANCHETI NAVIN CLASSES

You might also like

- Nism Certification V-A (Mutual Fund) MOck TestDocument36 pagesNism Certification V-A (Mutual Fund) MOck TestAishwarya Adlakha100% (1)

- Conceptual Framework QuestionsDocument7 pagesConceptual Framework QuestionsALPHANo ratings yet

- Accounting Standards PDFDocument43 pagesAccounting Standards PDFSai Krishna TejaNo ratings yet

- IAS 21Document13 pagesIAS 21f9vertexlearningsolutionsNo ratings yet

- Lessee AccountingDocument7 pagesLessee AccountingYess poooNo ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- Reviewer - Intermediate Accounting Part 3Document6 pagesReviewer - Intermediate Accounting Part 3Derek Dale Vizconde NuñezNo ratings yet

- Simple Notes SBRDocument36 pagesSimple Notes SBRgongjoonimNo ratings yet

- Chapter 3 PracticesDocument21 pagesChapter 3 Practiceskakao50% (2)

- Statement of Cash FlowsDocument15 pagesStatement of Cash FlowsSanyam NarangNo ratings yet

- IAS 36Document21 pagesIAS 36f9vertexlearningsolutionsNo ratings yet

- 2.2 Audit of InvestmentsDocument1 page2.2 Audit of Investmentsantonette seradNo ratings yet

- POA Chap 7Document4 pagesPOA Chap 7Lau Chun GuiNo ratings yet

- Discounted Cashflow Valuation: Basis For ApproachDocument39 pagesDiscounted Cashflow Valuation: Basis For ApproachShivNo ratings yet

- IAS 20 goverment grantsDocument10 pagesIAS 20 goverment grantsf9vertexlearningsolutionsNo ratings yet

- Ranvle: Keeping8 Years WhihDocument6 pagesRanvle: Keeping8 Years WhihSohamNo ratings yet

- CostingDocument3 pagesCostingThuraNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- Millan 2 PDF FreeDocument10 pagesMillan 2 PDF FreeMichael Brian TorresNo ratings yet

- July 15 PDFDocument4 pagesJuly 15 PDFShimu ShahrearNo ratings yet

- Cofin - 1Document8 pagesCofin - 1Ana D. ChebacNo ratings yet

- Measuring Goodwill in SME Business CombinationsDocument2 pagesMeasuring Goodwill in SME Business CombinationsLeonardo MercaderNo ratings yet

- Chap09 - Student (Revised)Document36 pagesChap09 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Ias 38Document14 pagesIas 38Tayyaba RehmanNo ratings yet

- PDF 5 Income TaxDocument1 pagePDF 5 Income Taxmanishchd81No ratings yet

- Non ProfitDocument31 pagesNon Profitcontact.samamaNo ratings yet

- Distributions of P and L Account-1Document4 pagesDistributions of P and L Account-1NarayanNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- IND AS 116 - P2-DraftDocument2 pagesIND AS 116 - P2-DraftSarun ChhetriNo ratings yet

- Wacc Calculation SimplifiedDocument2 pagesWacc Calculation SimplifiedPranjalNo ratings yet

- NoidaDocument6 pagesNoidaAvnish KumarNo ratings yet

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- Insurance Claim SummaryDocument6 pagesInsurance Claim Summary21248deekshakNo ratings yet

- Valuation FundamentalsDocument54 pagesValuation FundamentalsMaxNo ratings yet

- Property. Plant A: ' EquipmentDocument45 pagesProperty. Plant A: ' EquipmentLhene Angcon73% (11)

- Chapter 5 PremiumsDocument10 pagesChapter 5 PremiumsBoby ZooxNo ratings yet

- Financial Reporting - Exam SheetDocument2 pagesFinancial Reporting - Exam SheetMaría Mercedes RedondoNo ratings yet

- IFRS 2 Share Based PaymentDocument19 pagesIFRS 2 Share Based PaymentVikky BehNo ratings yet

- Valuing Distressed Firms & Assets Under 40 CharactersDocument67 pagesValuing Distressed Firms & Assets Under 40 CharactersSaputra SanjayaNo ratings yet

- Reading 39 PDFDocument38 pagesReading 39 PDFKaramjeet SinghNo ratings yet

- Lesson 5 - Investment FunctionDocument37 pagesLesson 5 - Investment FunctionJulie Ann Marie BernadezNo ratings yet

- AkuisiDocument33 pagesAkuisiAndreas RendraHadiNo ratings yet

- Capital-Based Macroeconomics: Adapted From Time and Money: by Roger W. Garrison London: Routledge, 2001Document35 pagesCapital-Based Macroeconomics: Adapted From Time and Money: by Roger W. Garrison London: Routledge, 2001Claudio VargasNo ratings yet

- Microeconomics CH 6Document9 pagesMicroeconomics CH 6Mohammed Rakeen Akiel CamilNo ratings yet

- Cost of Capital - Online (Student Handouts)Document8 pagesCost of Capital - Online (Student Handouts)Saara Oxana G. SalcedoNo ratings yet

- CFI_Tutorial-2-4 (1)Document19 pagesCFI_Tutorial-2-4 (1)Ninh Thị Ánh NgọcNo ratings yet

- Business Combination - Statutory MergerDocument7 pagesBusiness Combination - Statutory Mergerma.soledad san diegoNo ratings yet

- AUDIT OF INVESTMENT - Debt SecuritiesDocument2 pagesAUDIT OF INVESTMENT - Debt SecuritiesJoshua LisingNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts ReceivableJocel CaoNo ratings yet

- Credit TransactionsDocument5 pagesCredit TransactionsDanica ZamoraNo ratings yet

- Cost Accs Reconciliation Extra SumsDocument7 pagesCost Accs Reconciliation Extra Sumspurvi doshiNo ratings yet

- TAX105 - TAX - 105C-Input TaxDocument1 pageTAX105 - TAX - 105C-Input TaxMae CarcidoNo ratings yet

- Ch 2 - Accounting for Business Combinations and Consolidated Financial StatementsDocument25 pagesCh 2 - Accounting for Business Combinations and Consolidated Financial StatementsArielle CabritoNo ratings yet

- Historical Cost vs Fair Value Model ComparisonDocument6 pagesHistorical Cost vs Fair Value Model ComparisonagusriantoNo ratings yet

- Pas 16 Property, Plant, and Equipment: PART 1: Nature and Initial Measurement of PPE Nature and DefinitionDocument8 pagesPas 16 Property, Plant, and Equipment: PART 1: Nature and Initial Measurement of PPE Nature and DefinitionBrian Daniel BayotNo ratings yet

- Ipc 1Document2 pagesIpc 1mohammad hmidanNo ratings yet

- CA Inter Accounts QP Nov 2022Document15 pagesCA Inter Accounts QP Nov 2022Partibha GehlotNo ratings yet

- Cost SKDocument13 pagesCost SKMahir BhutaniNo ratings yet

- Islamiat AssignmentDocument2 pagesIslamiat AssignmentAreej HaiderNo ratings yet

- CA-7 and CONTROL-M CommandsDocument3 pagesCA-7 and CONTROL-M Commandskirtinamrata92No ratings yet

- INDIAN WAR OF INDEPENDENCE 1857 - ORIGINAL PUBLISHERs NoteDocument19 pagesINDIAN WAR OF INDEPENDENCE 1857 - ORIGINAL PUBLISHERs NoteBISWAJIT MOHANTYNo ratings yet

- Soal PTS Kelas 6 B. INGGRIS 2022Document3 pagesSoal PTS Kelas 6 B. INGGRIS 2022SITI NUR'ARIYANINo ratings yet

- BISE MultanDocument617 pagesBISE MultanZubair NadeemNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Things Fall Apart Reading GuideDocument8 pagesThings Fall Apart Reading GuideJordan GriffinNo ratings yet

- Tatmeen - WKI-0064 - Technical Guide For Logistics - v3.0Document88 pagesTatmeen - WKI-0064 - Technical Guide For Logistics - v3.0Jaweed SheikhNo ratings yet

- Chuo CityDocument8 pagesChuo CityEfra ReyNo ratings yet

- Act 4103 - The Indeterminate Sentence LawDocument3 pagesAct 4103 - The Indeterminate Sentence LawRocky MarcianoNo ratings yet

- An Interview With Composer Shahrokh YadegariDocument2 pagesAn Interview With Composer Shahrokh YadegarimagnesmuseumNo ratings yet

- Name: Roll Number: Room No: Class: MKT1602: Student InformationDocument6 pagesName: Roll Number: Room No: Class: MKT1602: Student InformationNguyen Thi Thuy Linh (K16HL)No ratings yet

- Procedures For Connection of PV Plants To MEPSO Grid in North MacedoniaDocument17 pagesProcedures For Connection of PV Plants To MEPSO Grid in North MacedoniaAleksandar JordanovNo ratings yet

- Tower Heist PDFDocument1 pageTower Heist PDFFawziah SelamatNo ratings yet

- 5081 PDFDocument159 pages5081 PDFTemp PersonNo ratings yet

- Kwarapoly Portal - Completed ApplicationDocument3 pagesKwarapoly Portal - Completed ApplicationosinoluwatosinNo ratings yet

- Problem 12Document2 pagesProblem 12Alyssa Jane G. AlvarezNo ratings yet

- Shakespearean LanguageDocument52 pagesShakespearean LanguageBailey HarrisonNo ratings yet

- CSS Fee Structure Table Must Set in System Based On CSS's Prakas - Current Year PDFDocument1 pageCSS Fee Structure Table Must Set in System Based On CSS's Prakas - Current Year PDFsimchandoeunNo ratings yet

- David Vs ArroyoDocument2 pagesDavid Vs ArroyoAjpadateNo ratings yet

- Cos Salonshop PDFDocument3 pagesCos Salonshop PDFRahel EbottNo ratings yet

- 55 CD 383294930 Py 4Document4 pages55 CD 383294930 Py 4api-309385698No ratings yet

- Brainy kl8 Short Tests Unit 5 Lesson 5Document1 pageBrainy kl8 Short Tests Unit 5 Lesson 5wb4sqbrnd2No ratings yet

- Relationship Between Cigarette Smoking and Novel Risk Factors For Cardiovascular DiseaseDocument4 pagesRelationship Between Cigarette Smoking and Novel Risk Factors For Cardiovascular DiseaseInternational Medical PublisherNo ratings yet

- KEILMUAN DAN SENI DALM KEBIDANANDocument18 pagesKEILMUAN DAN SENI DALM KEBIDANANRizky Putri AndriantiNo ratings yet

- BankingDocument19 pagesBankingPooja ChandakNo ratings yet

- Jasa Vol. 3 (1) Jul-Sep 2013Document4 pagesJasa Vol. 3 (1) Jul-Sep 2013AdityaKumarNo ratings yet

- From Modernism To Post Modernism - Net PDFDocument40 pagesFrom Modernism To Post Modernism - Net PDFshrabana chatterjeeNo ratings yet

- 3 Factors That Contribute To Gender Inequality in The ClassroomDocument3 pages3 Factors That Contribute To Gender Inequality in The ClassroomGemma LynNo ratings yet

- Ciril Report 2019Document44 pagesCiril Report 2019Aloka MajumderNo ratings yet