Professional Documents

Culture Documents

Summer Analyst - Credit Risk

Uploaded by

S hjjvuvj0 ratings0% found this document useful (0 votes)

13 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageSummer Analyst - Credit Risk

Uploaded by

S hjjvuvjCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Make things possible.

GOLDMAN SACHS

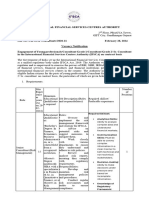

2024 SUMMER ANALYST OPPORTUNITIES

ABOUT GOLDMAN SACHS

At Goldman Sachs, we connect people, capital and ideas to help solve problems for our clients. We are a leading global

financial services firm providing investment banking, securities and investment management services to a substantial

and diversified client base that includes corporations, financial institutions, governments and individuals.

ABOUT OUR ROLES IN CREDIT RISK

The Risk division at Goldman Sachs serves as a control function that oversees activities of the first line businesses. We

identify the risks incurred through business activity, establish and ensure compliance with the risk appetite. Credit

Risk is a central part of Goldman Sachs' risk management framework, with primary responsibility for assessing,

monitoring, and managing credit risk at the Firm. Credit professionals protect the firm’s capital by using in-depth

knowledge of our clients, markets, and trading products to make decisions on acceptable level of firm’s risk appetite.

JOB RESPONSIBILITIES LOCATION

The responsibilities may include the following: Bengaluru | India

• Credit analysis of counterparties like Funds,

Corporates and Financial institutions and

recommending appropriate internal risk BASIC QUALIFICATIONS

rating for each counterparty and setting At Goldman Sachs, we think who you are makes you

credit limits. better at what you do. We seek out people with all types

• Spreading historical and projected financials of skills, interests and experiences. Curious, collaborative

in Credit systems including peer comparison and driven? Let's chat. Here are some of the qualities we

to identify trends. look for:

• Managing product risk, including credit limit • Master’s degree in business with an undergraduate

and settlement risk monitoring, limit focus on quantitative field, commerce or economics

exception management, stress testing, risk • Strong analytical and quantitative skills and ability to

exposure analysis and post-trade risk understand mechanics of derivative products

management processes. • Experience with, or keen interest to develop expertise

• Understanding credit and margin terms in in, financial markets, economics, and risk management

documentation to protect against defaults. • Communication & Interpersonal Skills

• Leveraging the knowledge to assess risk of • Strong Sense of Teamwork & Commitment to Excellence

transactions, portfolio analysis and stress • Intellectual Curiosity, Passion, and Self-Motivation

testing. • Integrity, Ethical Standards and Sound Judgment

• Working collaboratively with Risk Engineering

on projects to improve the firm’s systems, to APPLICATION PROCESS

manage big data and to design and automate

existing infrastructure. Its compulsory for all the students to apply on the link in

• Preparing materials to guide interactions with order to complete their application. For detailed

firm external governing bodies such as instructions on the hiring process kindly get in touch with

regulators and industry bodies. your college placement committee

• Developing and managing relationships

with Sales and Trading.

goldmansachs.com/careers

© 2023 The Goldman Sachs Group, Inc. All rights reserved. Goldman Sachs is an equal opportunity employment/affirmative action employer

Female/Minority/Disability/Vet.

You might also like

- M 10 - Deloitte - Enterprise Risk AssessmentDocument4 pagesM 10 - Deloitte - Enterprise Risk AssessmentPradhnya SononeNo ratings yet

- BlackRock 2020-2021 Risk & Quantitative Analysis Job DescriptionDocument2 pagesBlackRock 2020-2021 Risk & Quantitative Analysis Job DescriptionJuliano Aleoni FerreiraNo ratings yet

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- ERM Risk Assessment FactsheetDocument2 pagesERM Risk Assessment FactsheetbadrhaNo ratings yet

- The 8 Steps of Credit Risk ManagementDocument42 pagesThe 8 Steps of Credit Risk ManagementSudershan ThaibaNo ratings yet

- BPS FinDocument11 pagesBPS FinABHITESH MANGOTRANo ratings yet

- Property Risk Engineering ConsultingDocument2 pagesProperty Risk Engineering Consultingyerrisiddappa KNo ratings yet

- Risk Health Check: When Is Yours?Document12 pagesRisk Health Check: When Is Yours?Ibrahim SalimNo ratings yet

- Enterprise Risk Management and Emerging RisksDocument63 pagesEnterprise Risk Management and Emerging RisksShuyuan LuNo ratings yet

- RiskproBrochure2021 210405 151013Document44 pagesRiskproBrochure2021 210405 151013Sir JohnNo ratings yet

- Chief Risk Officer Job Description Sample 3Document2 pagesChief Risk Officer Job Description Sample 3ozlemNo ratings yet

- Credit RatingDocument3 pagesCredit Ratingsanjay parmar100% (4)

- Commercial Lending: 35 HoursDocument2 pagesCommercial Lending: 35 HoursExplore with TejuNo ratings yet

- Risk Risk Analytics TeamDocument2 pagesRisk Risk Analytics TeamCOMPETITIVE GURU JINo ratings yet

- Starz Risk and Actuarial Manager JDDocument3 pagesStarz Risk and Actuarial Manager JDGodknowsNo ratings yet

- Tabeth Mutevhe PDFDocument6 pagesTabeth Mutevhe PDFBrian RuzvidzoNo ratings yet

- Edu Individual Life AnnDocument2 pagesEdu Individual Life AnnpfvNo ratings yet

- Job Title: Department: Location: Job SummaryDocument1 pageJob Title: Department: Location: Job SummarySejal MishraNo ratings yet

- Credit Rating FmsDocument16 pagesCredit Rating Fmsdurgesh choudharyNo ratings yet

- JD - Senior Credit Risk ManagerDocument3 pagesJD - Senior Credit Risk ManagerAlexNo ratings yet

- Risk Assessment & RatingsESRM OfficerDocument2 pagesRisk Assessment & RatingsESRM OfficerBoyi EnebinelsonNo ratings yet

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- CSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHDocument4 pagesCSI Black Belt in Credit Risk Management - Financial Analysis Master Class (Singapore), Featuring Mr. TOMMY SEAHCFE International Consultancy GroupNo ratings yet

- Acorn Leadership TalkDocument5 pagesAcorn Leadership TalkIndresh Singh SalujaNo ratings yet

- Credit Risk Management, Portfolio LevelDocument13 pagesCredit Risk Management, Portfolio LevelDanielNo ratings yet

- Isaca Webinar - Managing Innovation Risk - 121875Document20 pagesIsaca Webinar - Managing Innovation Risk - 121875sa9317982No ratings yet

- What and Why A CRO?: Arnout Van Der VeerDocument14 pagesWhat and Why A CRO?: Arnout Van Der VeerPrimeEzzyNo ratings yet

- Dennis Huntsman RsDocument2 pagesDennis Huntsman Rsapi-651158614No ratings yet

- JD - Credit ManagerDocument2 pagesJD - Credit Managersanket patilNo ratings yet

- Satyaki Dey ResumeDocument2 pagesSatyaki Dey Resumesatyaki.d.deyNo ratings yet

- Job Description - Acuity Knowledge PartnersDocument3 pagesJob Description - Acuity Knowledge PartnersSachin ShikotraNo ratings yet

- Internal Audit - Business - JD - Campus SIDocument3 pagesInternal Audit - Business - JD - Campus SIAditya BartakkeNo ratings yet

- JD Deloitte Analyst Trainee Risk&FinancialAdvisoryDocument3 pagesJD Deloitte Analyst Trainee Risk&FinancialAdvisoryganduharami702No ratings yet

- Chuck Nwokocha: Presented byDocument41 pagesChuck Nwokocha: Presented byJan Dave OgatisNo ratings yet

- JD - Arcesium - IMI New DelhiDocument2 pagesJD - Arcesium - IMI New DelhiAnish DasNo ratings yet

- Boardroom Questions: Fortify Your Business: Risk Management Should Be Embedded Within The Culture of The OrganizationDocument2 pagesBoardroom Questions: Fortify Your Business: Risk Management Should Be Embedded Within The Culture of The OrganizationpeteNo ratings yet

- Global Markets - Prime Services - FO Risk JDDocument3 pagesGlobal Markets - Prime Services - FO Risk JDKushagroDharNo ratings yet

- IIRSM Fellowship Assessment Guidance - FINAL 11may20Document7 pagesIIRSM Fellowship Assessment Guidance - FINAL 11may20Deepu RavikumarNo ratings yet

- Business SWOT Analysis Template PDF Download PDFDocument2 pagesBusiness SWOT Analysis Template PDF Download PDFSabhaya ChiragNo ratings yet

- CCRA - BrochureDocument4 pagesCCRA - BrochureHarveyNo ratings yet

- Risk ManagementDocument44 pagesRisk ManagementJane GavinoNo ratings yet

- JD - 23014382 - MRMDocument2 pagesJD - 23014382 - MRMVamsiNethalaNo ratings yet

- Role Profile: Descriptions - Help With Defining Certified PersonsDocument3 pagesRole Profile: Descriptions - Help With Defining Certified PersonsEnsuida HafiziNo ratings yet

- Analytics & Risk: Together, We Help More and More People Experience Financial Well-BeingDocument11 pagesAnalytics & Risk: Together, We Help More and More People Experience Financial Well-BeingRaditya Amara JaluNo ratings yet

- JD - Credit Model ValidationsDocument2 pagesJD - Credit Model Validationssumit sinhaNo ratings yet

- Credit Rating at MBDocument26 pagesCredit Rating at MBGitanjali JoshiNo ratings yet

- Portfolio Manager - Sawgrass Asset Management, LLCDocument1 pagePortfolio Manager - Sawgrass Asset Management, LLCMarshay HallNo ratings yet

- (REVIEWER) BME2 Module 1Document3 pages(REVIEWER) BME2 Module 1Rico Delos ReyesNo ratings yet

- Session-I Enterprise Risk Management - COSO SDocument20 pagesSession-I Enterprise Risk Management - COSO SanandkumardasNo ratings yet

- Cgma Competency Framework 2019 Edition Business SkillsDocument10 pagesCgma Competency Framework 2019 Edition Business SkillsVictor WeiNo ratings yet

- BlackRock 2023-2024 Business Management Job DescriptionDocument2 pagesBlackRock 2023-2024 Business Management Job Descriptionbluelion638No ratings yet

- Week 1 Slides Personal LendingDocument48 pagesWeek 1 Slides Personal LendingYee TanNo ratings yet

- Advertisement For The Position of Young Professional Consultant Grade 1 Consultant Grade 2 SR Consultant at Ifsca 3 2802202405124401032024065232Document8 pagesAdvertisement For The Position of Young Professional Consultant Grade 1 Consultant Grade 2 SR Consultant at Ifsca 3 2802202405124401032024065232Kittu ChaurasiaNo ratings yet

- Credit Risk Management in BanksDocument34 pagesCredit Risk Management in BanksDhiraj K DalalNo ratings yet

- Corporate Governance Risk Compliance FrameworksDocument12 pagesCorporate Governance Risk Compliance Frameworks424282622No ratings yet

- Credit RatingsDocument16 pagesCredit RatingsMBA...KID100% (2)

- Entrepreneurial Characteristics and CompetenciesDocument18 pagesEntrepreneurial Characteristics and CompetenciesFernandez Khery Jane G.No ratings yet

- Startup VentureDocument45 pagesStartup VentureMAA KI AANKH0% (1)

- Deloitte Risk and Financial Advisory - JD - Techno-Functional Role - 5thaugust2020Document3 pagesDeloitte Risk and Financial Advisory - JD - Techno-Functional Role - 5thaugust2020Subindu Halder100% (1)

- PRMIA: Practices for Credit and Counterparty Credit Risk Management: A Primer for Professional Risk Managers in Financial ServicesFrom EverandPRMIA: Practices for Credit and Counterparty Credit Risk Management: A Primer for Professional Risk Managers in Financial ServicesNo ratings yet

- Summary of The Development On Philippine Science and TechnologyDocument3 pagesSummary of The Development On Philippine Science and TechnologyTRIXIEJOY INIONNo ratings yet

- SH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGDocument5 pagesSH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGthe advantis lkNo ratings yet

- SlumsDocument12 pagesSlumsGeetakshri Jajoria33% (3)

- Content LicensingDocument11 pagesContent LicensingNB Thushara HarithasNo ratings yet

- Eric H Monkkonen Police in Urban America 1860 1920 Interdisciplinary Perspectives On Modern History 2004 PDFDocument233 pagesEric H Monkkonen Police in Urban America 1860 1920 Interdisciplinary Perspectives On Modern History 2004 PDFHispania fcsNo ratings yet

- A Brief History of AntiDocument2 pagesA Brief History of AntiHoa ThanhNo ratings yet

- Street Art From The Underground: After Pei Protests N.Y.U. Plan, Supermarket Site Is New FocusDocument28 pagesStreet Art From The Underground: After Pei Protests N.Y.U. Plan, Supermarket Site Is New FocusTroy MastersNo ratings yet

- Complaint of Terrorist Activity To NIADocument5 pagesComplaint of Terrorist Activity To NIAVikram BuddhiNo ratings yet

- Documents of The First International 1871-1872Document639 pagesDocuments of The First International 1871-1872documentos ot1No ratings yet

- 7HR01 - Assessment BriefDocument8 pages7HR01 - Assessment BriefRibhah ShakeelNo ratings yet

- Intentional InjuriesDocument29 pagesIntentional InjuriesGilvert A. PanganibanNo ratings yet

- Army Institute of Law, MohaliDocument11 pagesArmy Institute of Law, Mohaliakash tiwariNo ratings yet

- Personal Data SheetDocument4 pagesPersonal Data SheetEdmar CieloNo ratings yet

- Dissertation PrelimnariesreportDocument5 pagesDissertation PrelimnariesreportHarshita BhanawatNo ratings yet

- Ambush MarketingDocument18 pagesAmbush Marketinganish1012No ratings yet

- 10.3.11 Packet Tracer - Configure A ZPFDocument4 pages10.3.11 Packet Tracer - Configure A ZPFFerrari 5432No ratings yet

- Daniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSDocument2 pagesDaniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSJhunalyn AlvaradoNo ratings yet

- IMNPD AssignmentDocument49 pagesIMNPD AssignmentSreePrakash100% (3)

- SM Project For McomDocument38 pagesSM Project For McomSamar AsilNo ratings yet

- Breaking News English Newtown and The NraDocument3 pagesBreaking News English Newtown and The NraAngel Angeleri-priftis.100% (1)

- LAW 3100 - Persons & Family Relations - JD 33. G.R. No. 221029 - Republic vs. Manalo - Case Digest 8Document5 pagesLAW 3100 - Persons & Family Relations - JD 33. G.R. No. 221029 - Republic vs. Manalo - Case Digest 8John Kenneth ContrerasNo ratings yet

- Assignment: Problem-Solving ProcessDocument3 pagesAssignment: Problem-Solving ProcessApril Joyce SamanteNo ratings yet

- Salvation Accomplished and AppliedDocument2 pagesSalvation Accomplished and AppliedJose L GarciaNo ratings yet

- Louis BegleyDocument8 pagesLouis BegleyPatsy StoneNo ratings yet

- Court TranscriptDocument13 pagesCourt Transcriptrea balag-oyNo ratings yet

- The Correlation Between Poverty and Reading SuccessDocument18 pagesThe Correlation Between Poverty and Reading SuccessocledachingchingNo ratings yet

- Abaga Loiweza C. BEED 3A Activity 4.ADocument4 pagesAbaga Loiweza C. BEED 3A Activity 4.ALoiweza AbagaNo ratings yet

- The Legal Environment of Business: A Managerial Approach: Theory To PracticeDocument15 pagesThe Legal Environment of Business: A Managerial Approach: Theory To PracticeSebastian FigueroaNo ratings yet

- 5 Species Interactions, Ecological Succession, Population ControlDocument8 pages5 Species Interactions, Ecological Succession, Population ControlAnn ShawNo ratings yet

- Introduction To Internet of Things Assignment-Week 9Document6 pagesIntroduction To Internet of Things Assignment-Week 9Mr.M. ArivalaganNo ratings yet