Professional Documents

Culture Documents

Consolidated Life Insurence Premium Receipt FY-2022-2023-Sujan

Consolidated Life Insurence Premium Receipt FY-2022-2023-Sujan

Uploaded by

SujanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Life Insurence Premium Receipt FY-2022-2023-Sujan

Consolidated Life Insurence Premium Receipt FY-2022-2023-Sujan

Uploaded by

SujanCopyright:

Available Formats

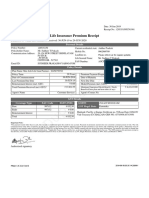

Premium Receipt

Receipt No.: 369508908APR2201 | Receipt Date: 08-APR-2022

Personal Details

Policy Number: 369508908 Email ID: sujanaloy37sn@gmail.com

Policyholder Name: Mr. Sujan N PAN Number: FUXPS3511L

Address: CM Luxury Building, Room No -108 Rajiv Gandhi Nagar, HSR Customer GSTIN: Not Available

layout,Sector-7 Current Residential State: Karnataka

Bangaluru- 560102

Karnataka

Mobile Number: 9845709749

Policy Details

Plan Name: Max Life Smart Term Plan Policy Commencement Date: 29-MAR-2021

Life Insured: Mr. Sujan N Policy Term: 38 Years Premium Payment Term: Regular

Premium Payment Frequency: Annual Date of Maturity: 29-MAR-2059 Modal Premium (incl. GST): ` 24,068.55

Late Payment Fee (incl GST): ` 0.00 Premium Received (incl. GST): ` 24,068.55

GST Details Connect for more details

Coverage Taxable SGST/UTGST CGST IGST Name

Type Value (`) Rate Amount (`) Rate Amount (`) Rate Amount (`) Internet Sales

Base 15,000.00 NA 0.00 NA 0.00 18% 2,700.00

Rider 5,397.06 NA 0.00 NA 0.00 18% 971.47

Late Payment 0.00 NA 0.00 NA 0.00 18% 0.00 Contact Number

Total GST Value: ` 3,671.47 18601205577

GSTIN: 06AACCM3201E1Z7 GST Regd. State: Haryana SAC CODE: 997132

Mudrank: Paid by e-Stamps Certificate no. 948/Issue Date: 4/04/2022/ Vide Treasury (E-CHALLAN) GRN NO.88821464

Total Sum Assured of base

plan and term rider (if any)

29-MAR-2022 to

` 2,00,00,000.00 ` 24,068.55 28-MAR-2023 29-MAR-2023

*Important Note:

1.For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk commencement starts

after acceptance of risk by us.

2.Amount received would be adjusted against the due premium as per terms and conditions of the policy.

3.Premiums may be eligible for tax benefits under section 80C/80CCC/80D/37(1) of the income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change

due to changes in legislation or government notification.

4.GST shall comprise CGST, SGST / UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing laws, shall be borne by you. For

GST purposes, this premium receipt is Tax invoice. Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%, Single Premium Annuity is 10%, Term and Health is 100%.

Authorised Signatory

PRM21V6.0 09012022 PRODUCT UIN: 104N113V04

E.&O.E 2022-04-08.03.35.14.280981

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tax Invoice: Billing Address: Regd. OfficeDocument1 pageTax Invoice: Billing Address: Regd. OfficeHorse RidingNo ratings yet

- Robinhood S-1Document396 pagesRobinhood S-1Zerohedge Janitor100% (1)

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAnkush DeNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Manual TAX 1. 2019 20 PDFDocument35 pagesManual TAX 1. 2019 20 PDFkNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Doa Mt103 Cash Transfer (Front Desk) JP 500b Euro 04 May 2020... 11Document44 pagesDoa Mt103 Cash Transfer (Front Desk) JP 500b Euro 04 May 2020... 11Pink Apple100% (1)

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Quiz No. 1Document10 pagesQuiz No. 1Gerry Carabbacan100% (2)

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- C204116729-1Document1 pageC204116729-1sukhpreetdass89686No ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Zprmrnot 22868079 21565386Document1 pageZprmrnot 22868079 21565386krishandeeptiNo ratings yet

- Max Term Insurance - TejkumarDocument1 pageMax Term Insurance - Tejkumarkokkanti tejkumarNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- ca5902ea-d8b4-40df-a092-59d082a41fb5Document56 pagesca5902ea-d8b4-40df-a092-59d082a41fb5Modicare ConsultantNo ratings yet

- Zprmrnot 22891511 4720686 PDFDocument1 pageZprmrnot 22891511 4720686 PDFVishwambhara DasaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- 368611489_20240508T072857Document1 page368611489_20240508T072857ravi kumarNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Go Digit General Insurance LTDDocument2 pagesGo Digit General Insurance LTDYODHAA GAMMERNo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Zprmrnot - 24596389 - 25915509 2Document1 pageZprmrnot - 24596389 - 25915509 2cryptoraj2501No ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Premium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023Document1 pagePremium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023avdhesh12347No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptssudheer prakashNo ratings yet

- Policy Number: 36140031206801610571: GSTIN: 06AAACN9967E2Z6Document3 pagesPolicy Number: 36140031206801610571: GSTIN: 06AAACN9967E2Z6jeet singhNo ratings yet

- Apr-Jan 24 MergedDocument10 pagesApr-Jan 24 Mergedjaythakur1523No ratings yet

- 1244313850Document1 page1244313850Sandipan MukherjeeNo ratings yet

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- APPLIED ECONOMICS Module 3 - 20240212 - 191021 - 0000Document13 pagesAPPLIED ECONOMICS Module 3 - 20240212 - 191021 - 0000Rowslin愚.No ratings yet

- 27 Small Business Investment Opportunities in NigeriaDocument9 pages27 Small Business Investment Opportunities in NigeriaGlescharlesNo ratings yet

- Varró Ádám Tornyospálcai RémDocument61 pagesVarró Ádám Tornyospálcai RémnameNo ratings yet

- Test DocumentDocument2 pagesTest Documenthimabindu.pusalaNo ratings yet

- 83456EE016049 Folio1Document1 page83456EE016049 Folio1Dee NNo ratings yet

- FAMALL InternationalDocument51 pagesFAMALL InternationalJohn Edward100% (1)

- Nairawise Mass MRKT Tier3: First City Monument Bank LimitedDocument3 pagesNairawise Mass MRKT Tier3: First City Monument Bank LimitedJoshua Akorewaye ArigbedeNo ratings yet

- Basic Terms and Principles of EconomicsDocument2 pagesBasic Terms and Principles of EconomicsJacelMaeNo ratings yet

- Attachment AMX-1 Permit For LandingDocument55 pagesAttachment AMX-1 Permit For LandingAidel Fernando Romero RojasNo ratings yet

- Notice of 46th Annual General Meeting (Post IPO)Document51 pagesNotice of 46th Annual General Meeting (Post IPO)sai kiran reddyNo ratings yet

- Facultative ReinsuranceDocument3 pagesFacultative ReinsuranceAlisha ThapaliyaNo ratings yet

- Nature of Corporate PersonalityDocument18 pagesNature of Corporate Personalitypokandi.fbNo ratings yet

- MTN Uganda Earnings AnalysisDocument7 pagesMTN Uganda Earnings AnalysisTimothy KawumaNo ratings yet

- ProblemsDocument6 pagesProblemsAarti SaxenaNo ratings yet

- Prior Disclosure ProgramDocument15 pagesPrior Disclosure ProgramCeleste Tumbokon IINo ratings yet

- Public Private Partnership in Public Administration Discipline A Literature ReviewDocument25 pagesPublic Private Partnership in Public Administration Discipline A Literature ReviewJuan GalarzaNo ratings yet

- PROJECT REPORT Merger and DemergerDocument42 pagesPROJECT REPORT Merger and Demergeryash jain0% (1)

- Ru Advanced Accounting ExerciseDocument1 pageRu Advanced Accounting Exerciseprince matamboNo ratings yet

- Isha Rani Hotel VoucherDocument1 pageIsha Rani Hotel VoucherKirti Sehgal100% (1)

- Partnership Liquidation-1Document8 pagesPartnership Liquidation-1Faith CastroNo ratings yet

- Central Excise Act, 1944: Govt. and State Govt. To Levy Various Taxes andDocument10 pagesCentral Excise Act, 1944: Govt. and State Govt. To Levy Various Taxes andShivangi VermaNo ratings yet

- Contoh PayslipDocument7 pagesContoh Payslips5tp5kmy4yNo ratings yet

- EduFin Position PaperDocument88 pagesEduFin Position PaperComunicarSe-ArchivoNo ratings yet

- Wage Order No. RBIII-23Document1 pageWage Order No. RBIII-23ECMH ACCOUNTING AND CONSULTANCY SERVICES100% (1)

- Applications of The Supply & Demand ModelDocument58 pagesApplications of The Supply & Demand ModelDal MakhaniNo ratings yet

- Budgeting SlidesDocument12 pagesBudgeting SlidesAdeel AhmadNo ratings yet