Professional Documents

Culture Documents

Assignment 2 InvestmentBanking2023

Uploaded by

Abhinav MukherjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2 InvestmentBanking2023

Uploaded by

Abhinav MukherjeeCopyright:

Available Formats

WEEKLY EXERCISE #2

Investment Banking Program 2023

Module 2 & 3

“Finance Fundamentals & Fixed Income”

ROLE PLAY SESSION

June 2023

Session by: Vivek Suman, CFA

Week Duration: 03/06/23-04/06/23

Vivek Suman, CFA Page |1

Learning Objective:

To understand the role and functions of a financial institution in the Financial System

by an infrastructure sector participant.

To apply financial concepts and tools, to apply concept bond valuation, YTM, etc., to

a current real-world scenario.

To develop critical thinking and problem-solving skills to advise a client – “Nabfid’s

Chairman KV Kamath & MD Rajkiran Rai” on a strategic decision.

To enhance communication and presentation skills to deliver clear and convincing

recommendations.

Case Instructions:

You should only use the information that was given to you in the class and during the

feedback session for this exercise. You don’t need to do any extra reading. The goal

of this exercise is to test your understanding and application of the concepts that

were taught in the session.

Read the scenario carefully. Then, in your roles, discuss your ideas and opinions on

how the company can respond to the criticisms and enhance its corporate social

responsibility efforts.

Vivek Suman, CFA Page |2

Case –National Bank for Financing Infrastructure Plans to Raise ₹30K Cr Via Long Term

Bond & Lend ₹4L Cr

Background

Nabfid is a government-backed development financial institution that started

operations last year with Rs 20,000 crore capital and a Rs 5,000-crore grant from the

government.

Nabfid has granted in-principal approvals to proposals of Rs 50,000 crore, and final

sanctions have crossed Rs 25,000 crore, with road and energy being the major

sectors.

Nabfid is chaired by veteran banker KV Kamath, who headed ICICI during its DFI days.

And has appointed Mr Rajkiran Rai as Managing Director of the Bank.

The infrastructure sector in India is expected to grow at a CAGR of 15% over the next

five years, driven by government initiatives and private investments.

MD Rajkiran Rai has announced in month of June 2023, that the company plans to

create a subsidiary that will offer credit enhancement to infrastructure borrowers,

including urban bodies. It will use our equity capital of Rs 20,000 crore to lend up to

Rs 4 lakh crore by March 2026. We intend to raise Rs 30,000 crore this year through

long-term bonds.” He also said that the company has given in-principle approvals for

projects worth Rs 50,000 crore, and has sanctioned more than Rs 25,000 crore,

mainly in road and energy sectors.

Drivers: Nabfid has a strong backing from the government, which enhances its

creditworthiness and reputation. Nabfid has a clear vision and strategy to lend to the

infrastructure sector, which has high growth potential and social impact. Nabfid has

access to low-cost funds from the government grant, which reduces its cost of

capital.

Risks: Nabfid faces competition from other DFIs and banks that also lend to the

infrastructure sector. Nabfid may face regulatory or political uncertainties that could

affect its operations or profitability. Nabfid may face project delays or defaults from

its borrowers in the infrastructure sector, which could impair its asset quality and

cash flow."

Vivek Suman, CFA Page |3

Action Mr RajKiran has taken to engage you as Investment Banker to execute this bond

issuance are:

Hire you as an investment bank as an underwriter and advisor for the bond issuance.

Prepare a prospectus that outlines Nabfid’s business model, financial performance,

growth prospects, risk factors, etc.

Obtain regulatory approvals from SEBI and RBI for the bond issuance.

Conduct roadshows and meetings with potential investors, such as insurance

companies, pension funds, sovereign wealth funds, etc., to market the bond.

Price and allocate the bond according to market demand and supply conditions.

Day 1: In your role as an Investment Banker on the Nabfids Bond issuance, you will develop

recommendations for the following:

Formulate recommendations and action plan.

1. What is your final answer or solution to your client’s problem or question, provide

why Bond is more suitable instrument over Equity? Analyze the information and

data. What are the main drivers and risks that affect your client’s bond issuance?

What are the trade-offs and alternatives that your client has to consider?

2. Provide which kind of Bond and its features you believe is suitable for the same

Bond type:

Bond Tenure: Years

Feature:

You can use charts, tables, graphs, etc., to illustrate your recommendations. Your

recommendation is based on the reasons: List your reasons while answer the above

question.

Vivek Suman, CFA Page |4

Day 2: In your role as an Investment Banker working on Nabfids Bonds, develop the Term

Sheet and Bond Valuation, assuming your recommendation is the following:

Recommendation "Based on our analysis, we recommend that Nabfid should issue a 10-year

bond with a coupon rate of 8%, which would raise Rs 30,000 crore. This would enable Nabfid

to achieve its lending target of Rs 4 lakh crore by March 2026 with an internal rate of return

(IRR) of 12%. Your recommendation is based on the reasons: List your reasons while answer

the above question.

Work as Investment Banker at Nabfid's Bank on the following two important Bond Floatation

tasks.

1. Prepare a term sheet highlighting feature for a proposed bond prospectus that needs

your input?

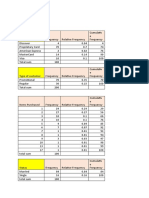

2. Create an excel sheet that values the above 10 years bond and reflects the range of

bond prices (NPV) and Yield To Maturity (YTM) in the term sheet?

You can use Standard Term sheet template for Bond floatation and Bond YTM &

Valuation Calculator attached

Vivek Suman, CFA Page |5

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Assignment 2Document3 pagesAssignment 2Abhinav MukherjeeNo ratings yet

- Project-Kotak BankDocument63 pagesProject-Kotak BankAli SaqlainNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- FRM 7Document22 pagesFRM 7AkashNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Interim Report ModifiedDocument37 pagesInterim Report ModifiedsrikanthkgNo ratings yet

- Statement of The Problem: - : PageDocument14 pagesStatement of The Problem: - : PageNivedita NandaNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Trust Funds and Fiscal Risks in the North Pacific: Analysis of Trust Fund Rules and Sustainability in the Marshall Islands and the Federated States of MicronesiaFrom EverandTrust Funds and Fiscal Risks in the North Pacific: Analysis of Trust Fund Rules and Sustainability in the Marshall Islands and the Federated States of MicronesiaNo ratings yet

- Auto Loan Customer Needs ReportDocument51 pagesAuto Loan Customer Needs Reportankit0225No ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- Understanding Auto Loan Customer NeedsDocument51 pagesUnderstanding Auto Loan Customer Needssarvesh.bharti71% (7)

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Research Paper On Credit Appraisal in BanksDocument7 pagesResearch Paper On Credit Appraisal in Banksh02ngq6c100% (1)

- Loan Syndication ProcessDocument17 pagesLoan Syndication Processsujata_patil11214405No ratings yet

- FMBO_QB_CAIIDocument2 pagesFMBO_QB_CAIIVishnu vardhan GollaNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- DAIBB Lending - 1Document40 pagesDAIBB Lending - 1Md Alim100% (1)

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- Union Bank Credit Appraisal Project ReportDocument43 pagesUnion Bank Credit Appraisal Project Reportkamdica42% (12)

- Chap 1: IntroductionDocument43 pagesChap 1: IntroductionShubakar ReddyNo ratings yet

- Icici Home Loan FinanceDocument78 pagesIcici Home Loan FinanceParshant GargNo ratings yet

- Credit AppraisalDocument89 pagesCredit AppraisalSkillpro KhammamNo ratings yet

- Credit Appraisal ProcessDocument43 pagesCredit Appraisal ProcessAbhinav Singh100% (1)

- Kanishk Tatiya - MIP - Interim ReportDocument14 pagesKanishk Tatiya - MIP - Interim ReportKanishk TatiyaNo ratings yet

- Blackbook Project On Credit AppraisalDocument95 pagesBlackbook Project On Credit AppraisalMausam PanchalNo ratings yet

- Project FinancingDocument43 pagesProject FinancingRahul Jain100% (1)

- Competitor Analysis and Customer Satisfaction ReportDocument94 pagesCompetitor Analysis and Customer Satisfaction ReportShahzad SaifNo ratings yet

- Banking and InuranceDocument15 pagesBanking and InuranceJai BharathNo ratings yet

- Credit Appraisal EssentialsDocument62 pagesCredit Appraisal EssentialsHimanshu Mishra100% (1)

- State Bank of Mysore Credit Risk ManagementDocument7 pagesState Bank of Mysore Credit Risk ManagementPatel AmitNo ratings yet

- Chapter 5 Credit Management Policy of JBLDocument20 pagesChapter 5 Credit Management Policy of JBLMd. Saiful IslamNo ratings yet

- Literature Review of Credit Scheme of SbiDocument9 pagesLiterature Review of Credit Scheme of Sbiafmzxppzpvoluf100% (1)

- Project ReportDocument77 pagesProject ReportPiyush MaheshwariNo ratings yet

- Enhancing The Value Proposition of Priority Banking in India"Document11 pagesEnhancing The Value Proposition of Priority Banking in India"Alexander DeckerNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument87 pagesCredit Appraisal and Risk Rating at PNBVishnu Soni100% (2)

- Table of Content: HDFC BankDocument23 pagesTable of Content: HDFC BankSyedNo ratings yet

- Credit ManagementDocument503 pagesCredit ManagementGudavalli John Raja Abhishek100% (1)

- A Project Report On Credit AppraisalDocument107 pagesA Project Report On Credit AppraisalPrabhakar Kunal87% (115)

- Project Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Document63 pagesProject Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Nitesh AgrawalNo ratings yet

- Literature Review On Credit Risk Management in SbiDocument6 pagesLiterature Review On Credit Risk Management in Sbic5qrve03No ratings yet

- Credit Appraisal PNBDocument48 pagesCredit Appraisal PNBURMI0% (1)

- Mutual Fund Industry Analysis and Performance ComparisonDocument102 pagesMutual Fund Industry Analysis and Performance ComparisonSiddharth MalikNo ratings yet

- Credit Recovery ManagementDocument75 pagesCredit Recovery ManagementSudeep Chinnabathini75% (4)

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet

- Commercial Banking and Role of RBIDocument9 pagesCommercial Banking and Role of RBIRishi exportsNo ratings yet

- A Comparative Analysis On Public and Private Mutual FundsDocument72 pagesA Comparative Analysis On Public and Private Mutual FundsMadhuri Tripathi80% (5)

- A Project Report On Credit AppraisalDocument167 pagesA Project Report On Credit AppraisalParm Sidhu50% (4)

- Axis Bank Report Nayak Oo007Document74 pagesAxis Bank Report Nayak Oo007gajraj40No ratings yet

- Advertising and Personal SellingDocument14 pagesAdvertising and Personal Sellingaryansachdeva2122002No ratings yet

- A Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of IndiaDocument34 pagesA Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of Indiaarcherselevators0% (1)

- MT 2 NPADocument30 pagesMT 2 NPAPri AgarwalNo ratings yet

- Notice CSP 2021 Engl 04032021Document161 pagesNotice CSP 2021 Engl 04032021BonjourNo ratings yet

- Modern Annual Report by SlidesgoDocument52 pagesModern Annual Report by Slidesgorut visitacionNo ratings yet

- Agent Nateur - Organic de 8853771Document6 pagesAgent Nateur - Organic de 8853771Abhinav MukherjeeNo ratings yet

- Lets Define InnovationDocument5 pagesLets Define Innovationmuskan singlaNo ratings yet

- Map Region IndiaDocument5 pagesMap Region IndiaAbhinav MukherjeeNo ratings yet

- Sample CourseDocument3 pagesSample CourseAbhinav MukherjeeNo ratings yet

- Music Store Sales Visualization 2008-2012Document1 pageMusic Store Sales Visualization 2008-2012NehaNo ratings yet

- Meta Platforms, Inc.: FORM 10-KDocument171 pagesMeta Platforms, Inc.: FORM 10-Komar cortezNo ratings yet

- Case Analysis: Apple Food Products (AFP)Document3 pagesCase Analysis: Apple Food Products (AFP)Dinah Marie Adventurado0% (1)

- Key Aspects of Innovation in Defence SectorDocument9 pagesKey Aspects of Innovation in Defence SectorAbhinav MukherjeeNo ratings yet

- Apple Food Products: Gulshan Maheshwari, PGP 21058 Kriti Jain, PGP Mayuri Relehan, PGPDocument9 pagesApple Food Products: Gulshan Maheshwari, PGP 21058 Kriti Jain, PGP Mayuri Relehan, PGPAbhinav MukherjeeNo ratings yet

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- Cases in MarketingDocument8 pagesCases in MarketingSanya KapoorNo ratings yet

- Employee Training & Development: Presented byDocument18 pagesEmployee Training & Development: Presented byAbhinav MukherjeeNo ratings yet

- Ports Industry: An Economic ProfileDocument1 pagePorts Industry: An Economic ProfileAbhinav MukherjeeNo ratings yet

- Case Study ON MM Marketing Company-Territory and Quotas For A New ProductDocument11 pagesCase Study ON MM Marketing Company-Territory and Quotas For A New ProductAbhinav Mukherjee75% (4)

- IMC Case Study Link RqQ9aPY9zCDocument1 pageIMC Case Study Link RqQ9aPY9zCAbhinav MukherjeeNo ratings yet

- SBE12 CH 08Document48 pagesSBE12 CH 08Abhinav MukherjeeNo ratings yet

- Kotler - Mm15e - Inppt - 01 (11 Files Merged)Document321 pagesKotler - Mm15e - Inppt - 01 (11 Files Merged)Abhinav MukherjeeNo ratings yet

- Employee Training & Development: Lorem Ipsum DolorDocument16 pagesEmployee Training & Development: Lorem Ipsum DolorAbhinav MukherjeeNo ratings yet

- Case Study On A Diamond PersonalityDocument14 pagesCase Study On A Diamond PersonalityAbhinav Mukherjee100% (2)

- Solution BADocument4 pagesSolution BAAbhinav MukherjeeNo ratings yet

- Solution BADocument4 pagesSolution BAAbhinav MukherjeeNo ratings yet

- Normal Distribution Solutions-20190717110538 PDFDocument11 pagesNormal Distribution Solutions-20190717110538 PDFAbhinav MukherjeeNo ratings yet

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- Role of a CFODocument2 pagesRole of a CFOWilsonNo ratings yet

- Module 2 - Slide PresentationDocument10 pagesModule 2 - Slide PresentationJovan SsenkandwaNo ratings yet

- Credit Documentation StandardsDocument12 pagesCredit Documentation StandardsAurangzeb MajeedNo ratings yet

- LCAR Unit 20 - Appraising Real Estate - 14th EditionDocument58 pagesLCAR Unit 20 - Appraising Real Estate - 14th EditionTom BlefkoNo ratings yet

- What Is A Unit Investment Trust (UIT) ?Document2 pagesWhat Is A Unit Investment Trust (UIT) ?KidMonkey2299No ratings yet

- Legal Ethics Case AnalysisDocument2 pagesLegal Ethics Case AnalysisRayBradleyEduardoNo ratings yet

- List of 573 Properties For Mega e Auction 22-10-2021!18!22Document36 pagesList of 573 Properties For Mega e Auction 22-10-2021!18!22Dharmaraj ParamasivamNo ratings yet

- SocGen - On Our Minds (China) 12152021Document9 pagesSocGen - On Our Minds (China) 12152021irvinkuanNo ratings yet

- MC 100 - Annotation of MortgageDocument3 pagesMC 100 - Annotation of MortgageRafael JuicoNo ratings yet

- Filipinas Marble vs. IACDocument2 pagesFilipinas Marble vs. IACPia Janine ContrerasNo ratings yet

- Blackbook FinalDocument86 pagesBlackbook Finalgunesh somayaNo ratings yet

- Modes of Project FinancingDocument81 pagesModes of Project FinancingjasiaahmedNo ratings yet

- Types of Credit Instruments & Its FeaturesDocument22 pagesTypes of Credit Instruments & Its Featuresninpra94% (18)

- Self PPT On Money and CreditDocument15 pagesSelf PPT On Money and CreditTripti SinghaNo ratings yet

- OBLICON Case Digest 2Document12 pagesOBLICON Case Digest 2Horcrux RomeNo ratings yet

- What House? Property and Mortgage Magazine - May 2012Document58 pagesWhat House? Property and Mortgage Magazine - May 2012Sonya BruccianiNo ratings yet

- Chapter 3 Accounting 1 26-12-2023Document7 pagesChapter 3 Accounting 1 26-12-2023maxamadaxmad365No ratings yet

- Auto Balance Sheet Format With Trial BalanceDocument42 pagesAuto Balance Sheet Format With Trial BalancemuditNo ratings yet

- NBFCs Explained: What is an NBFC and Key Differences from BanksDocument49 pagesNBFCs Explained: What is an NBFC and Key Differences from BanksMalavika MadhuNo ratings yet

- Lecture Notes 3 - Unpaid Seller To Consumer - S ActDocument106 pagesLecture Notes 3 - Unpaid Seller To Consumer - S ActIan Pol FiestaNo ratings yet

- BS in Real Estate Management Thesis Topic on Real Estate EconomicsDocument7 pagesBS in Real Estate Management Thesis Topic on Real Estate EconomicsDanielle Edenor Roque PaduraNo ratings yet

- 2021 (2) January Amanda2Document6 pages2021 (2) January Amanda2Amanda ConryNo ratings yet

- CDO Powerpoint SubPrime PrimerDocument45 pagesCDO Powerpoint SubPrime PrimerFred Fry100% (39)

- Free Banquet Hall Business Plan TitleDocument1 pageFree Banquet Hall Business Plan Titlesolomon100% (1)

- CA Inter FM ECO Question BankDocument495 pagesCA Inter FM ECO Question BankHarshit BahetyNo ratings yet

- Financial Accounting Theory - Test Bank 80102016 - 2Document7 pagesFinancial Accounting Theory - Test Bank 80102016 - 2Allie LinNo ratings yet

- Chapter 1 Introduction To Financial MarketDocument19 pagesChapter 1 Introduction To Financial MarketyebegashetNo ratings yet

- Business Day - Insights - Credit Management - February 2021Document2 pagesBusiness Day - Insights - Credit Management - February 2021SundayTimesZANo ratings yet

- 1 Motion in Opposition To Substitute Party PlaintiffDocument5 pages1 Motion in Opposition To Substitute Party Plaintiff1SantaFeanNo ratings yet

- FIN222 Lecture 2: Recording 1: AnnouncementDocument12 pagesFIN222 Lecture 2: Recording 1: AnnouncementStephanie BuiNo ratings yet