Professional Documents

Culture Documents

Assignment 2

Uploaded by

Abhinav MukherjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2

Uploaded by

Abhinav MukherjeeCopyright:

Available Formats

WEEKLY EXERCISE #2

Case –National Bank for Financing Infrastructure Plans to Raise ₹30K Cr Via Long Term

Bond & Lend ₹4L Cr

Background

Nabfid is a government-backed development financial institution that started

operations last year with Rs 20,000 crore capital and a Rs 5,000-crore grant from the

government.

Nabfid has granted in-principal approvals to proposals of Rs 50,000 crore, and final

sanctions have crossed Rs 25,000 crore, with road and energy being the major sectors.

Nabfid is chaired by veteran banker KV Kamath, who headed ICICI during its DFI

days. And has appointed Mr Rajkiran Rai as Managing Director of the Bank.

The infrastructure sector in India is expected to grow at a CAGR of 15% over the next

five years, driven by government initiatives and private investments.

1. MD Rajkiran Rai has announced in month of June 2023, that the company plans to

create a subsidiary that will offer credit enhancement to infrastructure borrowers,

including urban bodies. It will use our equity capital of Rs 20,000 crore to lend up

to Rs 4 lakh crore by March 2026. We intend to raise Rs 30,000 crore this year

through long-term bonds.” He also said that the company has given in-principle

approvals for projects worth Rs 50,000 crore, and has sanctioned more than Rs

25,000 crore, mainly in road and energy sectors.

2. Drivers: Nabfid has a strong backing from the government, which enhances its

creditworthiness and reputation. Nabfid has a clear vision and strategy to lend to

the infrastructure sector, which has high growth potential and social impact.

Nabfid has access to low-cost funds from the government grant, which reduces its

cost of capital.

Risks: Nabfid faces competition from other DFIs and banks that also lend to the

infrastructure sector. Nabfid may face regulatory or political uncertainties that could

affect its operations or profitability. Nabfid may face project delays or defaults from

its borrowers in the infrastructure sector, which could impair its asset quality and cash

flow."

Action Mr RajKiran has taken to engage you as Investment Banker to execute this bond

issuance are:

Hire you as an investment bank as an underwriter and advisor for the bond issuance.

Prepare a prospectus that outlines Nabfid’s business model, financial performance,

growth prospects, risk factors, etc.

Obtain regulatory approvals from SEBI and RBI for the bond issuance.

Conduct roadshows and meetings with potential investors, such as insurance

companies, pension funds, sovereign wealth funds, etc., to market the bond.

Vivek Suman, CFA Page|1

Price and allocate the bond according to market demand and supply conditions.

Day 1: In your role as an Investment Banker on the Nabfids Bond issuance, you will develop

recommendations for the following:

Formulate recommendations and action plan.

3. What is your final answer or solution to your client’s problem or question,

provide why Bond is more suitable instrument over Equity? Analyze the

information and data. What are the main drivers and risks that affect your

client’s bond issuance?

What are the trade-offs and alternatives that your client has to consider?

Ans : Bonds are more suitable over Equity as issuer’s ownership will not get diluted

further and their funds requirement also get fulfilled by raising bonds in market.

Main drivers of bond issuance:

1. Interest rates: Changes in interest rates directly impact the cost of borrowing for

issuers. Lower interest rates can make bond issuance more attractive for issuers as

they can obtain funds at a lower cost.

2. Creditworthiness: Clients with high credit ratings can raise funds more easily

3. Market conditions: The overall market conditions including investor demand for

bonds, economic conditions, and liquidity in market play important role in

success of bond issuance.

4. Purpose of issuance: The purpose for using funds can influence investor interest

and perception of bond’s risk

Risks associated with bond issuance:

1. Interest rate risk

2. Credit risk

3. Market risk

4. Liquidity risk

5. Currency risk, etc

Client can use trade-offs and alternatives like bank loans, convertible bonds,

commercial papers, etc

4. Provide which kind of Bond and its features you believe is suitable for the

same Bond type: Bond Tenure: Years Feature:

You can use charts, tables, graphs, etc., to illustrate your recommendations. Your

recommendation is based on the reasons: List your reasons while answer the

above question.

Ans:

Vivek Suman, CFA Page|2

Bond Type: Long term bonds (Infrastructure projects generally take 10-20 years in

completion of projects hence it will allow sufficient time for company to generate

revenue from project and repay to borrowers

Bond Tenure: 10-20 years

Features: Fixed interest rate and high credit rating along with offering tax benefit to

investors. Lower default risk as it is backed by goverement

Day 2: In your role as an Investment Banker working on Nabfids Bonds, develop the Term

Sheet and Bond Valuation, assuming your recommendation is the following:

Recommendation "Based on our analysis, we recommend that Nabfid should issue a 10-year

bond with a coupon rate of 8%, which would raise Rs 30,000 crore. This would enable

Nabfid to achieve its lending target of Rs 4 lakh crore by March 2026 with an internal rate of

return (IRR) of 12%. Your recommendation is based on the reasons: List your reasons while

answer the above question.

Work as Investment Banker at Nabfid's Bank on the following two important Bond

Floatation tasks.

1. Prepare a term sheet highlighting feature for a proposed bond prospectus that needs

your input?

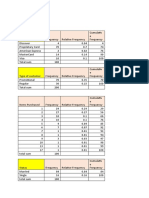

2. Create an excel sheet that values the above 10 years bond and reflects the range of

bond prices (NPV) and Yield To Maturity (YTM) in the term sheet?

You can use Standard Term sheet template for Bond floatation and Bond YTM &

Valuation Calculator attached

Ans : Excel attached

Vivek Suman, CFA Page|3

You might also like

- Credit Appraisal EssentialsDocument62 pagesCredit Appraisal EssentialsHimanshu Mishra100% (1)

- Commercial and Industrial LoansDocument36 pagesCommercial and Industrial LoansAngela ChuaNo ratings yet

- Chapter 1: Auditing and Internal ControlDocument19 pagesChapter 1: Auditing and Internal ControlJeriel Andrei RomasantaNo ratings yet

- Procurement PolicyDocument7 pagesProcurement Policytess100% (2)

- Credit Recovery ManagementDocument75 pagesCredit Recovery ManagementSudeep Chinnabathini75% (4)

- Case Study On A Diamond PersonalityDocument14 pagesCase Study On A Diamond PersonalityAbhinav Mukherjee100% (2)

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Project FinancingDocument43 pagesProject FinancingRahul Jain100% (1)

- Loan SyndicationDocument7 pagesLoan SyndicationYasir ArafatNo ratings yet

- Satish Summer HR Project For MBA in MumbaiDocument77 pagesSatish Summer HR Project For MBA in MumbaiSatish P.Goyal80% (46)

- Case Study ON MM Marketing Company-Territory and Quotas For A New ProductDocument11 pagesCase Study ON MM Marketing Company-Territory and Quotas For A New ProductAbhinav Mukherjee75% (4)

- CHAPTER I Principles of Lending Types of Credit FacilitiesDocument6 pagesCHAPTER I Principles of Lending Types of Credit Facilitiesanand.action0076127No ratings yet

- Credit Risk Management at SbiDocument66 pagesCredit Risk Management at Sbipradeep singh0% (3)

- Assignment 2 InvestmentBanking2023Document5 pagesAssignment 2 InvestmentBanking2023Abhinav MukherjeeNo ratings yet

- 3.foreign Loan SyndicationDocument19 pages3.foreign Loan SyndicationAPOLLO BISWASNo ratings yet

- Loan Syndication ProcessDocument17 pagesLoan Syndication Processsujata_patil11214405No ratings yet

- Understanding Auto Loan Customer NeedsDocument51 pagesUnderstanding Auto Loan Customer Needssarvesh.bharti71% (7)

- Auto Loan Customer Needs ReportDocument51 pagesAuto Loan Customer Needs Reportankit0225No ratings yet

- Understanding Loan SyndicationDocument5 pagesUnderstanding Loan SyndicationFarhan Ashraf SaadNo ratings yet

- Chap 1: IntroductionDocument43 pagesChap 1: IntroductionShubakar ReddyNo ratings yet

- Union Bank Credit Appraisal Project ReportDocument43 pagesUnion Bank Credit Appraisal Project Reportkamdica42% (12)

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Managing Credit RisksDocument18 pagesManaging Credit RisksJAY SHUKLANo ratings yet

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- DAIBB Lending - 1Document40 pagesDAIBB Lending - 1Md Alim100% (1)

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentrohanpujariNo ratings yet

- State Bank of Mysore Credit Risk ManagementDocument7 pagesState Bank of Mysore Credit Risk ManagementPatel AmitNo ratings yet

- Banking and InuranceDocument15 pagesBanking and InuranceJai BharathNo ratings yet

- Understanding Bank Lending Products and Credit DecisionsDocument7 pagesUnderstanding Bank Lending Products and Credit Decisionsscbihari1186No ratings yet

- Eco 306 MB BankDocument11 pagesEco 306 MB BankKhánh Mai Lê NguyễnNo ratings yet

- 08 - Part A - Introduction of Credit RatingDocument21 pages08 - Part A - Introduction of Credit RatingfindarifineblNo ratings yet

- PF.docxDocument16 pagesPF.docxadabotor7No ratings yet

- Union Bank of IndiaDocument43 pagesUnion Bank of IndiaBalaji GajendranNo ratings yet

- Financing RequirementDocument5 pagesFinancing RequirementZinck HansenNo ratings yet

- Axis Bank's MSME lending policyDocument5 pagesAxis Bank's MSME lending policyhiteshmohakar15No ratings yet

- Mfi TP Q&aDocument25 pagesMfi TP Q&amonizaNo ratings yet

- Project-Kotak BankDocument63 pagesProject-Kotak BankAli SaqlainNo ratings yet

- Dissertation On Debtors ManagementDocument8 pagesDissertation On Debtors ManagementWriteMyPapersAtlanta100% (1)

- Discuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Document5 pagesDiscuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Pradeeba ChinnaduraiNo ratings yet

- Interim Report ModifiedDocument37 pagesInterim Report ModifiedsrikanthkgNo ratings yet

- Report On Funds RaisingDocument28 pagesReport On Funds RaisingNikita MajiNo ratings yet

- How long to become a crorepati investing Rs 10,000 monthlyDocument10 pagesHow long to become a crorepati investing Rs 10,000 monthlyShravya T SNo ratings yet

- Project Financing Risk AnalysisDocument9 pagesProject Financing Risk AnalysisBalaji GajendranNo ratings yet

- UNIT 2 Process and DocumentationDocument27 pagesUNIT 2 Process and DocumentationAroop PalNo ratings yet

- Internship Report On Credit Policy of Brac Bank LTDDocument54 pagesInternship Report On Credit Policy of Brac Bank LTDwpushpa23No ratings yet

- Chapter 5 Credit Management Policy of JBLDocument20 pagesChapter 5 Credit Management Policy of JBLMd. Saiful IslamNo ratings yet

- 5th & 6th Sesion - Debt IssueDocument25 pages5th & 6th Sesion - Debt IssueSuvajitLaikNo ratings yet

- Term Loan ReportDocument15 pagesTerm Loan ReportBhakti ShindeNo ratings yet

- Credit Guides (4)Document35 pagesCredit Guides (4)Subramanian NadarNo ratings yet

- Teaching Notes Project Finance Appraisal Highway: SynopsisDocument17 pagesTeaching Notes Project Finance Appraisal Highway: SynopsisAkriti BhardwajNo ratings yet

- PobDocument24 pagesPobgillyhicksNo ratings yet

- Appraisal: Introduction To CreditDocument44 pagesAppraisal: Introduction To CreditVijay TendolkarNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- FRM 7Document22 pagesFRM 7AkashNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Map Region IndiaDocument5 pagesMap Region IndiaAbhinav MukherjeeNo ratings yet

- Notice CSP 2021 Engl 04032021Document161 pagesNotice CSP 2021 Engl 04032021BonjourNo ratings yet

- Agent Nateur - Organic de 8853771Document6 pagesAgent Nateur - Organic de 8853771Abhinav MukherjeeNo ratings yet

- Modern Annual Report by SlidesgoDocument52 pagesModern Annual Report by Slidesgorut visitacionNo ratings yet

- Key Aspects of Innovation in Defence SectorDocument9 pagesKey Aspects of Innovation in Defence SectorAbhinav MukherjeeNo ratings yet

- Meta Platforms, Inc.: FORM 10-KDocument171 pagesMeta Platforms, Inc.: FORM 10-Komar cortezNo ratings yet

- Cases in MarketingDocument8 pagesCases in MarketingSanya KapoorNo ratings yet

- Case Analysis: Apple Food Products (AFP)Document3 pagesCase Analysis: Apple Food Products (AFP)Dinah Marie Adventurado0% (1)

- Music Store Sales Visualization 2008-2012Document1 pageMusic Store Sales Visualization 2008-2012NehaNo ratings yet

- Employee Training & Development: Presented byDocument18 pagesEmployee Training & Development: Presented byAbhinav MukherjeeNo ratings yet

- Sample CourseDocument3 pagesSample CourseAbhinav MukherjeeNo ratings yet

- Lets Define InnovationDocument5 pagesLets Define Innovationmuskan singlaNo ratings yet

- IMC Case Study Link RqQ9aPY9zCDocument1 pageIMC Case Study Link RqQ9aPY9zCAbhinav MukherjeeNo ratings yet

- Apple Food Products: Gulshan Maheshwari, PGP 21058 Kriti Jain, PGP Mayuri Relehan, PGPDocument9 pagesApple Food Products: Gulshan Maheshwari, PGP 21058 Kriti Jain, PGP Mayuri Relehan, PGPAbhinav MukherjeeNo ratings yet

- Kotler - Mm15e - Inppt - 01 (11 Files Merged)Document321 pagesKotler - Mm15e - Inppt - 01 (11 Files Merged)Abhinav MukherjeeNo ratings yet

- Solution BADocument4 pagesSolution BAAbhinav MukherjeeNo ratings yet

- Ports Industry: An Economic ProfileDocument1 pagePorts Industry: An Economic ProfileAbhinav MukherjeeNo ratings yet

- Solution BADocument4 pagesSolution BAAbhinav MukherjeeNo ratings yet

- Employee Training & Development: Lorem Ipsum DolorDocument16 pagesEmployee Training & Development: Lorem Ipsum DolorAbhinav MukherjeeNo ratings yet

- SBE12 CH 08Document48 pagesSBE12 CH 08Abhinav MukherjeeNo ratings yet

- Normal Distribution Solutions-20190717110538 PDFDocument11 pagesNormal Distribution Solutions-20190717110538 PDFAbhinav MukherjeeNo ratings yet

- Regent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Document68 pagesRegent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Arjun SalwanNo ratings yet

- Surf Excel - Marketing Diary Consumer Buying BehaviourDocument1 pageSurf Excel - Marketing Diary Consumer Buying BehaviourMoiz RajputNo ratings yet

- Barclays Shared Services Chennai SiteDocument4 pagesBarclays Shared Services Chennai SiteAtula SinghNo ratings yet

- International Business AssignmentDocument5 pagesInternational Business Assignmentkanika joshiNo ratings yet

- A Business Plan - RickshawDocument16 pagesA Business Plan - RickshawMehtab Hussain SyedNo ratings yet

- ArmaniDocument5 pagesArmanichinmaya.parija100% (2)

- World: Lard - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Lard - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Hercules Hivolt Project Report - FinalDocument62 pagesHercules Hivolt Project Report - FinalSubhamay BiswasNo ratings yet

- ABM - BF12 IIIc D 10Document25 pagesABM - BF12 IIIc D 10iancris267No ratings yet

- Kul 6 Dan 7 Job Order CostingDocument22 pagesKul 6 Dan 7 Job Order Costingkhoirul anwar assidiqNo ratings yet

- Ias 37 - Provisions Contingent Liabilities and Student VersionDocument7 pagesIas 37 - Provisions Contingent Liabilities and Student Versionbianca8abrahamNo ratings yet

- Legal - Borrowing Powers, Majority Powers and Minority RightsDocument21 pagesLegal - Borrowing Powers, Majority Powers and Minority RightsSailesh NallapothuNo ratings yet

- SWOT Analysis (Session 4)Document12 pagesSWOT Analysis (Session 4)Bhagabat Barik100% (1)

- Book Keeping AccountancyDocument8 pagesBook Keeping AccountancyNarra JanardhanNo ratings yet

- A Case Study On The Views of AirLand Taxi Company On The Presence of Uber in Cebu City - Implications For Marketing StrategiesDocument92 pagesA Case Study On The Views of AirLand Taxi Company On The Presence of Uber in Cebu City - Implications For Marketing StrategiesCybil YbanezNo ratings yet

- Barclays India 2021 - MBA GradDocument3 pagesBarclays India 2021 - MBA GradHARSH MATHURNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document2 pagesGujarat Technological University: W.E.F. AY 2018-19akshat sodhaNo ratings yet

- Matex2832FA 20230920032600PMDocument12 pagesMatex2832FA 20230920032600PMKumar SNo ratings yet

- Iom Quality NotesDocument8 pagesIom Quality Notesowuor PeterNo ratings yet

- Management Process - FYBBIDocument49 pagesManagement Process - FYBBIRitika Harsh PathakNo ratings yet

- Project Report FOR 1000 MT Cold Storage: Details of Project Cost and Means of FinanceDocument11 pagesProject Report FOR 1000 MT Cold Storage: Details of Project Cost and Means of FinancePraveenKDNo ratings yet

- Invitation To Bid: General GuidelinesDocument29 pagesInvitation To Bid: General GuidelinesRenier Palma CruzNo ratings yet

- Design & Redesign of Work Systems: Dr. Sumita Mishra AsbmDocument16 pagesDesign & Redesign of Work Systems: Dr. Sumita Mishra AsbmPreeti KumariNo ratings yet

- Dhiraj's Final ReportDocument93 pagesDhiraj's Final Reportraazoo19No ratings yet

- Merchandising Buying and Handling ProcessDocument1 pageMerchandising Buying and Handling ProcessLannie GarinNo ratings yet

- Business PlanDocument10 pagesBusiness PlanJohn Erol AlmiranteNo ratings yet

- 4p's, STPDocument9 pages4p's, STPoluwafunmilolaabiolaNo ratings yet