Professional Documents

Culture Documents

Valuation Analyst - Complex Securities and Portfolio Valuation Group - Greece (Stout)

Uploaded by

pkasarakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Analyst - Complex Securities and Portfolio Valuation Group - Greece (Stout)

Uploaded by

pkasarakCopyright:

Available Formats

C/dialogues is a mobile marketing company offering a unique omnichannel interactive experience with

outperforming conversions, based on Language AI between its global partners and their customers. The

company specializes in the design & implementation of large-scale mobile marketing campaigns for mobile

operators worldwide using advanced Linguistic AI approach.

We are seeking to employ a

Valuation Analyst – Complex Securities & Financial Instruments and Portfolio Valuation

(Job Code: VA/10.2023)

C/dialogues has partnered with a global investment bank and advisory firm to look for a Valuation Analyst.

This individual will be an employee of C/dialogues assigned to work as a contractor for Stout.

General Purpose: In recent years, with the rapid development of derivatives markets and innovative financial

products, Stout’s corporate clients utilize them ever more extensively to hedge risks, manage their capital

structure and cash flow, compensate employees, and participate in capital markets transactions. Given this

increasing complexity, accounting regulations place a significant emphasis on fair value measurements of

these instruments to help investors understand and manage their risk.

Stout’s Complex Securities & Financial Instruments and Portfolio Valuation teams provide analysis and

valuation related to complex securities and other financial instruments for financial reporting, tax and

regulatory compliance, risk management and hedging assessments, transaction support and corporate

strategy. Stout has established best practices for valuation procedures specific to portfolios of numerous

companies and with multiple securities per company.

Stout uses reliable valuation methodologies coupled with sophisticated techniques from quantitative finance

to assist clients in understanding and valuing financial derivatives and other complex securities. Stout works

on a wide variety of projects, giving team members the opportunity to gain exposure to a broad range of

securities and situations.

Major Duties and Responsibilities:

• Develop valuation models to value a variety of financial instruments using option pricing theory,

interest rate and credit models, Monte Carlo simulation, binomial trees, contingent claims analysis,

and other financial engineering techniques.

• Ability to multi-task and communicate effectively with colleagues and clients in consultative

settings.

• Develop and maintain professional relationships with colleagues and clients; identify and address

client needs; and deliver clear requests for information.

• Prepare reports that communicate findings and recommendations to clients concisely and

effectively.

• Take ownership of projects, while working collaboratively with other team members.

Knowledge, Skills & Abilities:

• Strong derivative and financial modeling skills with the ability to create valuation and financial

models based on a description of a financial asset, an agreement, or an operational and financial

business plan.

• Knowledge of numerical techniques such as Monte Carlo simulation, lattice techniques, and finite

difference methods.

• Strong quantitative and problem-solving skills.

• Programming experience in languages such as R, VBA, Python.

• Knowledge of Bloomberg analytics and S&P CapIQ preferred.

• CFA designation or participation in the CFA program will be considered a plus.

• General understanding of the valuation methodologies used in financial markets preferred.

• Ability to work in a fast-paced, team-oriented, and collaborative work environment that is deadline

and budget oriented.

• Excellent multi-tasking, planning and organization skills, along with strong attention to detail.

• Significant interest in understanding and enhancing your knowledge of financial markets and

investments.

• Ability to communicate technical, financial, and modeling concepts in a manner that is easily

understand to clients and staff.

• Strong written and verbal communication and presentation skills.

Work Location:

Positions available in Athens and Thessaloniki. Remote working options might be available depending on

mutual agreement between all parties. This position is expected to have certain working-hours that overlap

with the U.S. Stout CSFI and PV teams, based on mutual discussion/decision.

The specific statements shown in each section of this description are not intended to be all-inclusive. They

represent typical elements and criteria necessary to successfully perform the job.

Please submit your CV to: Jobs@cdialogues.com or https://careers.cdialogues.com

referring the Job Code, until 3/11/2023

All applications are considered as strictly confidential

You might also like

- The Certified Project Portfolio ManagerFrom EverandThe Certified Project Portfolio ManagerRating: 5 out of 5 stars5/5 (1)

- Northern Arc - JD0Document6 pagesNorthern Arc - JD0SDDDDNo ratings yet

- Real Estate Resume SampleDocument7 pagesReal Estate Resume Samplec2qvmxnk100% (1)

- Will My Senior Work Title Help My ResumeDocument5 pagesWill My Senior Work Title Help My Resumetxnetrekg100% (1)

- Financial Services ResumeDocument7 pagesFinancial Services Resumevkggkayhf100% (1)

- Best Price Resume ReviewsDocument4 pagesBest Price Resume Reviewse7dhewgp100% (1)

- Resume Sample For Quantity SurveyorDocument5 pagesResume Sample For Quantity Surveyorc2znbtts100% (1)

- Experienced Private Equity ResumeDocument7 pagesExperienced Private Equity Resumepqdgddifg100% (2)

- JD - WTW India - ICT - Graduate (Actuarial) Analyst PDFDocument2 pagesJD - WTW India - ICT - Graduate (Actuarial) Analyst PDFArnav BhardwajNo ratings yet

- Resume Format Quantity SurveyorDocument5 pagesResume Format Quantity Surveyorafllwqlpj100% (1)

- Costing Manager ResumeDocument5 pagesCosting Manager Resumebetevopelah3100% (2)

- Merger and Acquisition ResumeDocument7 pagesMerger and Acquisition Resumeafiwhhioa100% (2)

- Consulting Specific ResumeDocument6 pagesConsulting Specific Resumeafjwduenevzdaa100% (2)

- Real Estate Skills ResumeDocument7 pagesReal Estate Skills Resumeiuhvgsvcf100% (2)

- KGS Research - Assistant ManagerDocument4 pagesKGS Research - Assistant ManagervvkguptavoonnaNo ratings yet

- Asset Management ResumeDocument8 pagesAsset Management Resumeebqlsqekg100% (1)

- Real Estate Analyst ResumeDocument8 pagesReal Estate Analyst Resumeujsqjljbf100% (2)

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Head - Investments and M&A, Kotak Mahindra BankDocument32 pagesHead - Investments and M&A, Kotak Mahindra BankRahulNo ratings yet

- Business Aircraft AnalystDocument2 pagesBusiness Aircraft AnalystjamesbrentsmithNo ratings yet

- Real Estate Investor ResumeDocument8 pagesReal Estate Investor Resumevdwmomrmd100% (1)

- Treasurer ResumeDocument6 pagesTreasurer Resumeafjwfealtsielb100% (2)

- StateStreet RDPDocument3 pagesStateStreet RDPKOTHAPALLI VENKATA JAYA HARIKA PGP 2019-21 BatchNo ratings yet

- Construction Experience ResumeDocument6 pagesConstruction Experience Resumef5dthdcd100% (2)

- Handling Money ResumeDocument4 pagesHandling Money Resumefqh4d8zf100% (1)

- Agile ResumeDocument5 pagesAgile Resumec2z7wekb100% (1)

- Bank of America - Analyst S&CADocument2 pagesBank of America - Analyst S&CAJigar PitrodaNo ratings yet

- GCP Cloud Engineering DirectorDocument2 pagesGCP Cloud Engineering Directorak4784449No ratings yet

- Resume AnalysisDocument7 pagesResume Analysisafdnaaxuc100% (1)

- Business AnalystDocument3 pagesBusiness Analystvinoth510No ratings yet

- Digital Asset Manager ResumeDocument6 pagesDigital Asset Manager Resumezehlobifg100% (2)

- Real Estate ResumeDocument5 pagesReal Estate Resumeafjwftijfbwmen100% (2)

- GTM - Associate - JD - PDFDocument2 pagesGTM - Associate - JD - PDFBhavya AggarwalNo ratings yet

- JPMC How We Do Business' PrinciplesDocument2 pagesJPMC How We Do Business' Principlessumit sinhaNo ratings yet

- Bid Manager ResumeDocument7 pagesBid Manager Resumeitvgpljbf100% (2)

- Resume For Economics InternshipDocument7 pagesResume For Economics Internshipbcrqhr1n100% (2)

- Resume For Undp JobDocument7 pagesResume For Undp Jobkqgcnxejd100% (2)

- Thesis Equity ResearchDocument7 pagesThesis Equity Researchtiffanymillerlittlerock100% (1)

- CRS - Risk ModellingDocument2 pagesCRS - Risk ModellinggauravroongtaNo ratings yet

- Economics Student ResumeDocument5 pagesEconomics Student Resumefhtjmdifg100% (2)

- Analyst Agilequity 23023 05 16Document4 pagesAnalyst Agilequity 23023 05 16zvishavane zvishNo ratings yet

- How To Put Contract Work On ResumeDocument6 pagesHow To Put Contract Work On Resumec2mtjr7c100% (1)

- Insurance Resume DatabaseDocument4 pagesInsurance Resume Databaseafjwdryfaveezn100% (2)

- Sample Resume For Executive Director PositionDocument6 pagesSample Resume For Executive Director Positionzehlobifg100% (2)

- Rental Resume TemplateDocument5 pagesRental Resume Templateafjwsbgkjdhkwz100% (2)

- Product Analyst ResumeDocument7 pagesProduct Analyst Resumedmipdsekg100% (1)

- Construction Resume SamplesDocument7 pagesConstruction Resume Samplesafjzcgeoylbkku100% (2)

- Senior Manager ResumeDocument6 pagesSenior Manager Resumec2q5bm7q100% (1)

- Resume in Banking IndustryDocument4 pagesResume in Banking Industryidyuurvcf100% (2)

- Financial Services Professional ResumeDocument4 pagesFinancial Services Professional Resumecnkokuekg100% (1)

- JD Data Analyst CapgeminiDocument2 pagesJD Data Analyst CapgeminiShivansh KansalNo ratings yet

- Corporate ResumeDocument5 pagesCorporate Resumeafaydebwo100% (2)

- Finance Resume Relevant CourseworkDocument7 pagesFinance Resume Relevant Courseworkguj0zukyven2100% (2)

- Corporate Restructuring ResumeDocument4 pagesCorporate Restructuring Resumephewzeajd100% (2)

- Management Trainee - Markets Business ManagementDocument3 pagesManagement Trainee - Markets Business ManagementsanjeevNo ratings yet

- Resume Contract WorkDocument8 pagesResume Contract Workafjwfealtsielb100% (2)

- Curriculum Vitae English EconomistDocument5 pagesCurriculum Vitae English Economiste6zwz633100% (1)

- Intern RM Final 1Document2 pagesIntern RM Final 1Ayush BhattNo ratings yet

- Help For Writing A Couples ResumeDocument7 pagesHelp For Writing A Couples Resumepqdgddifg100% (2)

- Financial Consultant ResumeDocument8 pagesFinancial Consultant Resumepqdgddifg100% (2)

- 2023 - 11 - 30 Snam Our Journey To Decarbonization - SnamDocument19 pages2023 - 11 - 30 Snam Our Journey To Decarbonization - SnampkasarakNo ratings yet

- Telikh Ergasia CheckedDocument19 pagesTelikh Ergasia CheckedpkasarakNo ratings yet

- The Thesis Examines The Delignitization Process in Greece and The Transition To A LowDocument1 pageThe Thesis Examines The Delignitization Process in Greece and The Transition To A LowpkasarakNo ratings yet

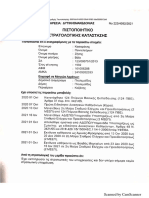

- ΠΙΣΤΟΠΟΙΗΤΙΚΟ ΣΤΡΑΤΟΛΟΓΙΚΗΣ ΚΑΤΑΣΤΑΣΗΣDocument2 pagesΠΙΣΤΟΠΟΙΗΤΙΚΟ ΣΤΡΑΤΟΛΟΓΙΚΗΣ ΚΑΤΑΣΤΑΣΗΣpkasarakNo ratings yet

- WISP Application FormDocument21 pagesWISP Application FormAllison BowlerNo ratings yet

- Trading ManualDocument24 pagesTrading Manualehsan453100% (1)

- Chapter 2: Negotiable InstrumentsDocument59 pagesChapter 2: Negotiable InstrumentsHafiz Ahmad100% (1)

- BillDocument1 pageBillreetakamboj278No ratings yet

- Economic Value AddedDocument9 pagesEconomic Value AddedLimisha ViswanathanNo ratings yet

- Acer Philippines. vs. CIRDocument27 pagesAcer Philippines. vs. CIRFarina R. SalvadorNo ratings yet

- Non-Current Assets Held For SaleDocument20 pagesNon-Current Assets Held For Salerj batiyegNo ratings yet

- Accounting Basics: Recording TransactionsDocument8 pagesAccounting Basics: Recording TransactionsRegina Bengado100% (1)

- Account Modification in SAPDocument5 pagesAccount Modification in SAPnetra14520No ratings yet

- Literature Review of HDFCDocument5 pagesLiterature Review of HDFCc5t6h1q5100% (1)

- 1 - Income Tax IntroductionDocument7 pages1 - Income Tax IntroductiondjNo ratings yet

- Modular Programme Assignment Cover SheetDocument16 pagesModular Programme Assignment Cover SheetvitaNo ratings yet

- Van Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876Document2 pagesVan Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876bashNo ratings yet

- Earnest Money AgreementDocument2 pagesEarnest Money AgreementAtty. Jefferson B. YapNo ratings yet

- FINAL MBA Syllabus - 2nd Semester For AGBSDocument20 pagesFINAL MBA Syllabus - 2nd Semester For AGBShardeep009No ratings yet

- Certificate for claiming house rent allowanceDocument1 pageCertificate for claiming house rent allowanceTally AnuNo ratings yet

- Dividend Policy and Firm's Profitability: Evidence From Ethiopian Private Insurance CompaniesDocument6 pagesDividend Policy and Firm's Profitability: Evidence From Ethiopian Private Insurance Companieskefiyalew BNo ratings yet

- Latihan Tugas ALK - Prospective AnalysisDocument3 pagesLatihan Tugas ALK - Prospective AnalysisSelvy MonibollyNo ratings yet

- An Overview of Financial ManagementDocument13 pagesAn Overview of Financial ManagementJobeah D CaballeroNo ratings yet

- MyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankDocument1 pageMyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankNikita GandotraNo ratings yet

- Exercises on Utility Functions, Risk Aversion, and Portfolio ChoiceDocument22 pagesExercises on Utility Functions, Risk Aversion, and Portfolio ChoicemattNo ratings yet

- The Following Securities Are in Pascual Company S Portfolio of L PDFDocument1 pageThe Following Securities Are in Pascual Company S Portfolio of L PDFAnbu jaromiaNo ratings yet

- Assingnment of International Trade Law ON Payment of International SalesDocument15 pagesAssingnment of International Trade Law ON Payment of International SalesManik Singh KapoorNo ratings yet

- Bullion Research Center Gold Analysis in UrduDocument8 pagesBullion Research Center Gold Analysis in UrduKaleem UllahNo ratings yet

- Price List Block-I: Aparna Infrahousing Private LimitedDocument1 pagePrice List Block-I: Aparna Infrahousing Private LimitedPradeep JagirdarNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet

- Klarna DealsDatabseExportDataDocument18 pagesKlarna DealsDatabseExportDataGreg AdamsNo ratings yet

- Florida LLC Operating Agreement TemplateDocument16 pagesFlorida LLC Operating Agreement TemplateCarol100% (2)

- Presentasi Company Valuation Method Project On PT. SampoernaDocument30 pagesPresentasi Company Valuation Method Project On PT. SampoernaGicchiNo ratings yet

- Guarantors Statement FormDocument5 pagesGuarantors Statement FormVeerababu AdapaNo ratings yet