Professional Documents

Culture Documents

Insurance

Uploaded by

Issam AzarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance

Uploaded by

Issam AzarCopyright:

Available Formats

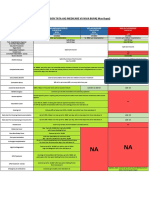

Medical Plans for Individuals & Families in Fresh

USD

Fresh Payment guarantees no extra charges upon hospital admission

Golden Care Full Golden Care Reduced Golden Care Basic

Network Network Network

Area of cover Lebanon

Networks available Full Network on direct billing Full Network on direct billing

Full Network on direct

excluding: CMC, AUBMC, Rizk, excluding: Bellevue and All

billing

Bellevue University Hospitals*

Inpatient benefits

Classes First (A) - Second (B) - Semi Private (SK)

Limit per year A: $300,000

Unlimited for all classes B: $200,000

SK:$100,000

Deductible per in

claim (Optional) N/A

Emergency room Full Cover.

Exclusions covered up to Full Cover

$100

Maternity

(not applicable for

Junior single)

Full cover after 180 days of

Full cover after 365 days of enrollment

For couples enrollment

For single mother Full cover after 12 months

Not covered

of enrollment, for all classes

Free of charge new

born baby (Bébé Covered from day one Covered after 14 days, if eligible

Securite)

Epidural Covered

Incubator & Unlimited days,

10 days up to $4,000

nursery up to $30,000

Screening test for

Up to $200 Not covered

baby

Congenital cases All cases covered up till the age of 7 and up to

All cases covered up till the

for babies born at A: $10,000 per year

age of 12 and with no

Securite (Bébé B: $7,000 per year

financial limit

Securite) C: $5,000 per year

Congenital cases All cases covered up till the

for babies not born age of 12 and with no Not covered

at Securite financial limit

Parent

accommodation at

hospital for Covered

children below 16

years

Home Care

In-hospital treatments administered at home are covered

Prosthesis

Unlimited, Up to $10,000 per year,

Due to accident

as per TPA’s tariff as per TPA’s tariff

Securite Assurance V8. 2021| [2]

Golden Care Full Golden Care Reduced Golden Care Basic

Network Network Network

Up to $30,000 per year, as

Due to sickness Up to $7,000 per year, as per TPA’s tariff

per TPA’s tariff

Orthesis

Due to accident Up to $500 Not covered

Due to sickness Up to $500 Not covered

Additional

Inpatient benefits

Dialysis for acute

Covered for all needed

renal failure,

sessions during 1st initial Up to 3 sessions during 1st initial admission

excluding

admission

“arteriovenostomy”

Sleep disorder Polysomnography is

Not covered

disease covered

Sleep Apnea Up to $5,000

Not covered

Surgery

Parkinson Up to $5,000 (In & Out) Not covered

Epilepsy Up to $5,000 (In & Out) Not covered

New treatments,

medical

Up to $5,000 (In & Out) Not covered

techniques,

surgeries & tests

Rehabilitation for a

Up to $2,000 Not covered

covered case

Breast Covered if due to a covered partial or complete breast excision due to breast cancer (within 6 months

reconstruction of sickness)

Infertility Covered after 12 months of

enrolment and up to $3,000 Covered after 12 months of enrolment and up to $1,000 per year. As

per year, for all classes. As per TPA’s tariff

per TPA’s tariff

Cornea transplant Surgery is covered. Cost of

Not covered

cornea is excluded

Cardio vascular

Unlimited Up to $20,000

diseases

Coronary stent

Covered up to sickness prosthesis limit

Valves

Work related

Covered Not Covered

accident

Bone marrow Up to $30,000 per lifetime.

aspiration & organ As per TPA’s tariff. Cost of Up to $10,000 per lifetime. As per TPA’s tariff. Cost of organ is excluded

transplant surgery organ is excluded

Bariatric surgery

related to morbid Up to $7,500 per lifetime.

Not covered

obesity (e.g. Sleeve As per TPA’s tariff

and bypass)

Cancer Diseases Unlimited Up to $ 20,000

Tropical Disease

(specific diseases as

Covered Not covered

per general

conditions)

Sexually

transmitted

diseases (specific Up to $15,000 per year Not covered

diseases as per

general conditions)

Psychiatric disorder In-hospital treatment

covered up to $10,000 per Not covered

year after 12 month of

Securite Assurance V8. 2021| [3]

Golden Care Full Golden Care Reduced Golden Care Basic

Network Network Network

enrolment with a maximum

of 30 days of hospitalization

Hospital daily For entrepreneurs <60

income years; $50/day starting the

Not covered

2nd day & up to 7 days per

year

Morgue/Burial

expenses Up to $3,000 Up to $ 1,000 for adherents aged 64 and below

Epidemic /

Pandemic Up to $30,000 Up to $10,000

Diseases

Out of hospital

Direct billing as per NEXT CARE preferred network

benefits

Ambulatory

Option 1 Unlimited, 100% coverage N/A

Option 2

Unlimited, 85% coverage Up to $2,500 per year, 85% coverage

Amniocentesis Covered Not covered

Morphological

Once per pregnancy

Echography

Triple test Covered once per pregnancy

Dental panoramic Covered if due to a covered accident and up to 9 months after the accident occurred

MRI Covered, subject to a prior approval

Thallium

Covered, subject to a prior

myocardial Not covered

approval

Scintigraphy

Pet scan Covered, subject to a prior approval

VCT 64 Covered, subject to a prior

Not covered

approval

Genetic test Up to $1,000 per year Not covered

OCT Covered, subject to a prior approval

Osteodensitometry

(for insured aged 50y & Covered for a specific medical reason in private diagnostic centers

above)

Physiotherapy &

25 sessions per year 15 sessions per year

Kinesitherapy

Pre-Marital test Covered Not covered

Doctor Visit N/A

(N/A for Junior single)

Prescription drugs

(not applicable for Junior N/A

single)

Additional Benefits

Waiver of medical We waive the medical

premium of family premium of the family for a

(for adherents period of the policy year

Not covered

below 65 years) and 1 additional year in

case of death, terminal

illness, or total disability of

the bread winner

Family discount Applicable for Family of 3 & Plus

Junior single special

Special rate for people between 18 and 35 years who are single

rate

Life style discount For every Km you run outdoor, earn $0.5, up to $100 per year. To be monitored by your Nike+ App,

linked to your Facebook account

Rental of medical

Up to 1 month rental Not covered

supplies

Securite Assurance V8. 2021| [4]

Golden Care Full Golden Care Reduced Golden Care Basic

Network Network Network

Guaranteed

720 days, lifetime subject to an observation period of 180 days for new members

renewability

Pre-Existing

conditions Covered after 1 year for new members

In Hospital

Tests related to

Covered up to $100, once

preexisting cases Not covered

per year from day 1

for new insured

Upgrades on

Observation period 180

renewal

days for maternity and Observation period 365 days for maternity and preexisting conditions

(e.g. class and

preexisting conditions

product)

Extension of

coverage at the

Up to 30 days N/A

expiry date and

while in hospital

Claims outside of

Lebanese Claim processed on reimbursement basis and as per NEXT CARE‘s Lebanese network rates and subject

territories or to 30% excess

outside of network

Travel insurance Worldwide excluding USA, Canada, Australia & Japan

Travel insurance up Covers 24/7 help desk.

to 65 years Covers death abroad,

repatriation of mortal

remains, up to $10,000.

Covers 24/7 help desk. Covers death abroad, repatriation of mortal

Covers accidental and acute

remains, up to $10,000.

sickness not due to any Pre-

Covers accidental and acute sickness not due to any Pre-Existing

Existing condition, up to

condition, up to €30,000 per trip and up to 5 days per year. Card should

€30,000 per trip and up to

be requested at least 48 hours before traveling

90 days per year. Card

should be requested at

least 48 hours before

traveling

Travel insurance 66

Covers 24/7 help desk. Covers death abroad, repatriation of mortal remains, up to $10,000

years and above

Private

transportation

Covered Not covered

service/ private

ambulance

Accidental death

Covered, for $10,000

Natural Death

Covered, for $10,000

All University Hospitals include:

American University of Beirut Medical Center, Hammoud Hospital University Medical Center, Hopital Libanais Geitaoui, Hopital

Universitaire Dar Al Amal, Rafik Hariri University Hospital RHUH, St. George Hospital - University Medical Center - Rizk Hospital,

Mount Lebanon Hospital, Hotel-Dieu De France.

Securite Assurance V8. 2021| [5]

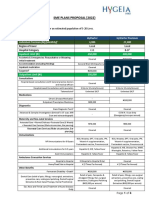

Medical Plans for SMEs in Fresh USD

Up to 50 employees

Tailor made products are available for SMEs as well as companies above 50 employees. Please refer to the

company.

Fresh Payment guarantees no extra charges upon hospital admission

Full Network Full Network Reduced Network

Class A Class A Class B Class SK Class A Class B Class SK

Area of cover Lebanon

Full Network on direct billing excluding

Networks available Full Network on direct billing CMC, AUBMC, Rizk, Bellevue, St. Georges

Orthodox

Inpatient benefits

Limit per year $300,000 $250,000 $150,000 $200,000 $150,000 $100,000

Full cover.

Exclusions

Emergency room Full cover Full cover

covered up to

$100

Covered from day 1 for existing

Covered from day 1 for existing employees and

Maternity employees and after 365 Days for new

after 280 Days for new employees

employees

Normal Delivery $5,000 $4,000 $3,000 $4,000 $3,000 $2,000

Cesarean Delivery $7,500 $6,000 $5,000 $6,000 $4,500 $3,500

Legal abortion $2,500 $2,000 $1,750 $2,000 $1,500 $1,250

Maternity complications $6,000 $5,000 $4,000 $5,000 $4,000 $3,000

Free of charge new born baby

Covered from day one Covered after 14 days, if eligible

(Bébé Securite)

Epidural Covered

Incubator & nursery Covered

Screening test for baby Up to $200 Up to $100

Congenital cases for babies born 3 cases per year covered up to $5,000 each and 3 cases per year covered up to $3,000

at Securite (Bébé Securite) up till the age of 12 each and up till the age of 12

Congenital cases for babies not 3 cases covered up to $3,000 each and up till 3 cases covered up to $2,000 each and up

born at Securite the age of 12 till the age of 12

Parent accommodation at hospital

Covered

for children below 12 years

Prosthesis

Up to Up to Up to Up to Up to

Due to accident Unlimited $20,000 $15,000 $20,000 $15,000 $10,000

per year per year per year per year per year

Up to Up to Up to Up to Up to

Up to $20,000

Due to sickness $15,000 $10,000 $15,000 $10,000 $7,500

per year

per year per year per year per year per year

Additional Inpatient benefits

Covered for all needed sessions during 1st initial Up to 3 sessions during 1st initial

Dialysis for acute renal failure

admission admission

Sleep disorders disease Polysomnography is only covered

Covered due to a covered partial or complete breast excision due to breast cancer (within 6

Breast reconstruction months of sickness) up to

$8,000 $6,000 $5,000 $6,000 $5,000 $4,000

Covered from day 1 for existing employees and after 12 months for new employees

Infertility

up to $2,000 per year and $4,000 lifetime up to $1,500 per year and $3,000 lifetime

Cornea transplant Surgery is covered. Cost of cornea is excluded

Coronary stent Covered up to sickness prosthesis limit

Valves Covered up to sickness prosthesis limit

Work related accident Covered Not covered

Bone marrow aspiration & organ The share that is supplementary to NSSF up to

Not covered

transplant surgery $15,000 per lifetime. Cost of organ is excluded

Bariatric surgery related to morbid

up to $7,500 per lifetime Not covered

obesity (e.g. Sleeve and bypass)

Securite Assurance V8. 2021| [9]

Full Network Full Network Reduced Network

Class A Class A Class B Class SK Class A Class B Class SK

Cancer including chemotherapy &

Covered

radiotherapy

Tropical Disease (specific diseases as per

Covered

general conditions)

Sexual transmitted diseases (specific

Up to $5,000 lifetime Not covered

diseases as per general conditions)

Psychiatric disorder Up to

In-hospital treatment $1,000/year

after 12 Not covered Not covered

month of

enrolment

Morgue/Burial expenses Up to $2,000 Up to $1,000

Epidemic / Pandemic Diseases Up to $30,000 Up to $10,000

Out of hospital benefits

Ambulatory

Out 85% or 100% Unlimited Up to $3,000 Up to $2,000

Amniocentesis Covered Not covered

Morphological Echography Covered Covered

Triple test Covered Not covered

Dental panoramic Covered Covered

MRI Covered Covered

Thallium myocardial Scintigraphy Covered Not covered

Pet scan Covered Not covered

VCT 64 Covered Not covered

OCT Covered Not covered

Osteodensitometry (for insured aged

Covered Covered

50y & above)

Physiotherapy & Kinesitherapy 15 sessions per year 10 sessions per year

Pre-Marital test Covered Not covered

Doctor Visit Up to USD 700 Up to USD 500

Prescription drugs 85% or 100% Covered Covered

Medicines registered & approved by the

Covered Covered

Ministry of Health

Treatment of acute diseases Covered Covered

Vaccines Not Covered Not covered

Chronic medicines Not Covered Not covered

Dermatological products Up to USD 700 Up to USD 500

Additional benefits

Guaranteed renewability 720 days lifetime subject to an observation period of 180 days for new members

Pre-Existing conditions $4,000 $2,500 $1,500 $2,000 $1,500 $1,000

Upgrades on renewal(e.g. class and

Observation period 365 days for maternity and preexisting conditions

product upgrade)

Extension of coverage at the expiry date

Up to 30 days Up to 15 days

and while in hospital

Claim processed on reimbursement basis and as per NEXtCARE’ s Lebanese network

Claims outside of network

rates and subject to 30% excess

Home Care In-hospital treatments administered at home are covered

Rental of medical supplies Up to 1 month rental Not covered

Private transportation service/private

Covered Not covered

ambulance

Accidental Death Covered, for $10,000

Natural Death Covered, for $10,000

Bundle with property all risk and benefit from a reduced rate of $1 per SQM to insure

Property All Risk Bundle

your office

Securite Assurance V8. 2021| [10]

You might also like

- Axa QuoteDocument2 pagesAxa QuoteDanny OtNo ratings yet

- Health Insurance Options for Asia Care Plus InternationalDocument3 pagesHealth Insurance Options for Asia Care Plus InternationalKabyar MayNo ratings yet

- Star health comprehensive plan summaryDocument26 pagesStar health comprehensive plan summaryMeenu SinghNo ratings yet

- Fhpv23apr231218j7r2 Veasna UkDocument6 pagesFhpv23apr231218j7r2 Veasna UkSela SinNo ratings yet

- Medical Inssurance AA+BenefitsDocument2 pagesMedical Inssurance AA+BenefitsCarlo MeNo ratings yet

- J-CARE INDIVIDUAL MEDICAL INSURANCEDocument8 pagesJ-CARE INDIVIDUAL MEDICAL INSURANCEGennady HaadjiNo ratings yet

- Copression Between Comprhensive & Care PDFDocument1 pageCopression Between Comprhensive & Care PDFsatishlad1288No ratings yet

- Inspire Benefit Table: Effective 1 January 2021Document3 pagesInspire Benefit Table: Effective 1 January 2021Marian PNo ratings yet

- Protect What You Treasure Most: HealthDocument12 pagesProtect What You Treasure Most: HealthNelly HNo ratings yet

- Comparison Tata Aig Medicare Vs Niva BupaDocument1 pageComparison Tata Aig Medicare Vs Niva BupaTikekar ShubhamNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Category B FlyerDocument8 pagesCategory B FlyerHarishNo ratings yet

- Brochure - EZCare (Nov 2022)Document11 pagesBrochure - EZCare (Nov 2022)Darren ChenNo ratings yet

- Tata INsurance AnalysisDocument13 pagesTata INsurance AnalysisSomil GuptaNo ratings yet

- Prepaga 2017 RB Medical Elite - Rev7Document4 pagesPrepaga 2017 RB Medical Elite - Rev7Jrac JoalNo ratings yet

- ReAssure_SSDocument2 pagesReAssure_SSAmit Kumar KandiNo ratings yet

- Care Advantage & Protect Plus BrochureDocument4 pagesCare Advantage & Protect Plus BrochureAnushka UpadhyayNo ratings yet

- Madison Betterlife Benefit Summary - RevisedDocument9 pagesMadison Betterlife Benefit Summary - RevisedJacob AgutuNo ratings yet

- Hygeia HMO SME Plans Proposal - 2022 - FinalDocument4 pagesHygeia HMO SME Plans Proposal - 2022 - FinalBanks C. GeorgeNo ratings yet

- Special Care and Adultbasic: Comparison ChartDocument1 pageSpecial Care and Adultbasic: Comparison ChartjhsmalankaNo ratings yet

- Balsam Leaflet en PDFDocument8 pagesBalsam Leaflet en PDFEng. Waleed AhmedNo ratings yet

- Table of Benefits-Oasis Investment2Document18 pagesTable of Benefits-Oasis Investment2ppdeepakNo ratings yet

- Category B Emirates Insurance PDFDocument5 pagesCategory B Emirates Insurance PDFDonald HamiltonNo ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- GlobalCare Health Plan Benefits at a GlanceDocument7 pagesGlobalCare Health Plan Benefits at a GlanceIrwanto AyongNo ratings yet

- AIA HS Gold Elite BrochureDocument12 pagesAIA HS Gold Elite BrochureBensam JoysonNo ratings yet

- Guard - Me Benefit Summary 2018Document2 pagesGuard - Me Benefit Summary 2018Luna AdonayNo ratings yet

- Chi - Health Elite Plus CoveragesDocument1 pageChi - Health Elite Plus CoveragesVikram VermaNo ratings yet

- HyBasic Plans Proposal - 2021CDocument3 pagesHyBasic Plans Proposal - 2021CRotimi Shitta-BeyNo ratings yet

- Brochure__with__policyDocument2 pagesBrochure__with__policysanthoshreddyb986No ratings yet

- Eb 2019 Oe Guideplussbc GenericDocument19 pagesEb 2019 Oe Guideplussbc GenericCybernaughtNo ratings yet

- Good Health Series - Softlogic LifeDocument3 pagesGood Health Series - Softlogic LifeVidya Rajawasam Mba Acma100% (1)

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- Care Freedom One Pager-1Document2 pagesCare Freedom One Pager-1kkNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Schedule of Benefits - Basic (Abu Dhabi) PlanDocument1 pageSchedule of Benefits - Basic (Abu Dhabi) PlanSenathipathi KalimuthuNo ratings yet

- Proposal For Group Mediclaim Insurance Total Premium (Rs. Excluding GST) Total Premium (Rs. Including GST)Document3 pagesProposal For Group Mediclaim Insurance Total Premium (Rs. Excluding GST) Total Premium (Rs. Including GST)rajts singhNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Niva ReAssure SS v11Document2 pagesNiva ReAssure SS v11CHELLASWAMY RAMASWAMYNo ratings yet

- Health & Dental Handout JUN17Document2 pagesHealth & Dental Handout JUN17Darius YangNo ratings yet

- APA Jamii Plus Family Medical Cover BrochureDocument8 pagesAPA Jamii Plus Family Medical Cover BrochureADANARABOW100% (1)

- Jamii Plus Brochure NewDocument5 pagesJamii Plus Brochure NewDe KingmakerNo ratings yet

- Edelweiss BrochureDocument6 pagesEdelweiss BrochureHLSNo ratings yet

- J Care Medical Insurance BenefitsDocument8 pagesJ Care Medical Insurance BenefitssolomonNo ratings yet

- PDF Document Icici Midi ClamDocument48 pagesPDF Document Icici Midi Clam3sanjaypatilNo ratings yet

- Apollo Munich (Rs - 21,815) Aditya Birla (Rs - 23,090) Bajaj Allianz (Rs - 24,172) Max Bhupa (Rs - 22,799) Star Family Health (Rs - 21,105)Document4 pagesApollo Munich (Rs - 21,815) Aditya Birla (Rs - 23,090) Bajaj Allianz (Rs - 24,172) Max Bhupa (Rs - 22,799) Star Family Health (Rs - 21,105)shankar29No ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Cat A - TobDocument3 pagesCat A - Tobit cleancoNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!rajatshrimalNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3megha mazumdarNo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3arya aroraNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document2 pagesReassurance at Every Step: Keeps Giving You More!ASHOK NAGESHWARANNo ratings yet

- Flexi Dubai All ProductDocument10 pagesFlexi Dubai All ProductMuhammad SiddiuqiNo ratings yet

- COMPLETE HEALTH INSURANCE WITH COVID COVERAGEDocument2 pagesCOMPLETE HEALTH INSURANCE WITH COVID COVERAGEPRADEEP GUPTANo ratings yet

- Niva ReAssure SS v3Document2 pagesNiva ReAssure SS v3Arun GoyalNo ratings yet

- Happy Family Floater - Policy NewDocument45 pagesHappy Family Floater - Policy Newpooja singhalNo ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- View Maxima Product Deck SlideDocument17 pagesView Maxima Product Deck SlideSandeep MalhotraNo ratings yet

- 360 Degree Postural Medicine and Diabetes Type 1 & 2From Everand360 Degree Postural Medicine and Diabetes Type 1 & 2No ratings yet

- Graphic Design Services Pricing ListDocument7 pagesGraphic Design Services Pricing ListIssam AzarNo ratings yet

- Living in CanadaDocument1 pageLiving in CanadaIssam AzarNo ratings yet

- Warranty Template 1Document1 pageWarranty Template 1Issam AzarNo ratings yet

- FFP Iqs InfoproDocument41 pagesFFP Iqs InfoproIssam AzarNo ratings yet

- International Transcript RequestDocument2 pagesInternational Transcript RequeststoppopNo ratings yet

- HTTP WWW - SaskimmigrationcanadaDocument1 pageHTTP WWW - SaskimmigrationcanadaShuai ZhangNo ratings yet

- MOW Procurement Management Plan - TemplateDocument7 pagesMOW Procurement Management Plan - TemplateDeepak RajanNo ratings yet

- Introduction To Financial Planning Unit 1Document57 pagesIntroduction To Financial Planning Unit 1Joshua GeddamNo ratings yet

- 2019 Implementasie-SamsatdiBaliDocument10 pages2019 Implementasie-SamsatdiBaliDiannita SusantiNo ratings yet

- INSYS - EBW Serie EbookDocument4 pagesINSYS - EBW Serie EbookJorge_Andril_5370No ratings yet

- Kidney, bladder & prostate pathology slides explainedDocument20 pagesKidney, bladder & prostate pathology slides explainedNisrina Nur AzisahNo ratings yet

- Map Project Rubric 2018Document2 pagesMap Project Rubric 2018api-292774341No ratings yet

- Password ManagementDocument7 pagesPassword ManagementNeerav KrishnaNo ratings yet

- BOOK-Deva-Oracle MaterialDocument177 pagesBOOK-Deva-Oracle MaterialPAVANN TNo ratings yet

- Application of Gis in Electrical Distribution Network SystemDocument16 pagesApplication of Gis in Electrical Distribution Network SystemMelese Sefiw100% (1)

- Reprocessing Guide: Shaver Handpiece TrayDocument198 pagesReprocessing Guide: Shaver Handpiece TrayAnne Stephany ZambranoNo ratings yet

- 21st Century Literary GenresDocument2 pages21st Century Literary GenresGO2. Aldovino Princess G.No ratings yet

- Dream Life - Allan HobsonDocument307 pagesDream Life - Allan HobsonJose MuñozNo ratings yet

- A New Aftercooler Is Used On Certain C9 Marine Engines (1063)Document3 pagesA New Aftercooler Is Used On Certain C9 Marine Engines (1063)TASHKEELNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- Greek Myth WebquestDocument9 pagesGreek Myth Webquesthollyhock27No ratings yet

- 0 Plan Lectie Cls XDocument3 pages0 Plan Lectie Cls Xevil100% (1)

- Daftar Pustaka DaniDocument3 pagesDaftar Pustaka Danidokter linggauNo ratings yet

- Transformers Obj Questions PDFDocument8 pagesTransformers Obj Questions PDFphaniputta100% (2)

- Sand Compaction MethodDocument124 pagesSand Compaction Methodisaych33ze100% (1)

- Rolls-Royce M250 FIRST Network: 2015 Customer Support DirectoryDocument76 pagesRolls-Royce M250 FIRST Network: 2015 Customer Support Directoryale11vigarNo ratings yet

- St. Francis de Sales Sr. Sec. School, Gangapur CityDocument12 pagesSt. Francis de Sales Sr. Sec. School, Gangapur CityArtificial GammerNo ratings yet

- CD 1 - Screening & DiagnosisDocument27 pagesCD 1 - Screening & DiagnosiskhairulfatinNo ratings yet

- The Accidental AddictsDocument6 pagesThe Accidental AddictsnorthandsouthnzNo ratings yet

- Mla 8 Mla Citation PageDocument4 pagesMla 8 Mla Citation Pageapi-458274061No ratings yet

- 01 The-Mckinsey-Edge-Hattori-En-26154Document5 pages01 The-Mckinsey-Edge-Hattori-En-26154Waqar AhmedNo ratings yet

- T WiZ60Document6 pagesT WiZ60leon liNo ratings yet

- Neutron SourcesDocument64 pagesNeutron SourcesJenodi100% (1)

- All Creatures Great and SmallDocument4 pagesAll Creatures Great and SmallsaanviranjanNo ratings yet

- Gfk-1383a 05012Document108 pagesGfk-1383a 05012occhityaNo ratings yet

- V14 EngDocument8 pagesV14 EngJamil PavonNo ratings yet