Professional Documents

Culture Documents

Economics - Ann

Economics - Ann

Uploaded by

Rani Jaya Unggui0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesEconomics - Ann

Economics - Ann

Uploaded by

Rani Jaya UngguiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

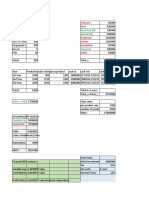

Ann purchased a 2M delivery van for her business.

The asset has an expected life of 5 years with no

residual value using a 150% declining balance with a switch over to straight line depreciation method,

what is the book value of the asset at the end of the 3rd year.

EOY BV @ beg dk for DB dk for SL BV @ end of yr

of yr

0 2M 0 0 2M

1 2M 600,000 = 2M*0.3 400,000 = 2M/5 1.4M = 2M-600k

2 1.4M 420,000 = 1.4M*0.3 350,000 = 1.4M/4980,000 =1.4M-420k

3 980K 294,000 =980K*0.3 326,666.67=980k/3

653,333.33 =980k -

326,666.76

4 653, 195,999.999=653,333.33*0.3 326,666.67= retain 326,666.66=653,333.33

333.33 because SL>DB – 326,666.67

5 326, 98,000.001=326,666.67*0.3 326,666.67=326,666.67 0

666.67 – 326,666.67

BV3= 653,333.33

Note: Kung unsa mas bigger sa dk for DB or dk for SL, mao I subtract sa BV @ beg of year

r= 15/n

= 15/5 = 0.3/30%

ANC Inc. wants to buy an equipment which costs ₱6,500,000. It is expected to have an economic life of 5

years. The equipment is estimated to generate an income of ₱2,000,000 for year 1, and then increase by

₱250,000 each year through year 5. If the equipment is purchased, ANC Inc. will depreciate it using

straight-line method to a zero-salvage value at the end of year 5. The effective income tax rate is 20%. If

ANC’s after-tax MARR is 15%, what is the after-tax PW of the company? Should they buy the equipment?

EO BTCF dk Taxable Income Income Tax ATCF

Y

0 -6.5M 0 0 0 -6.5M

1 2M 1.3M 700,000 = 2M-1.3M -140,000=700,000*.20 1.860M = 2M –

140,000

2 2.250M 1.3M 950,000 = 2.250M- 190,000=950,000*.20 2.060M=2.250M-

1.3M 190,000

3 2.500M 1.3M 1,200,000 = 240,000=1.2M*.20 2.260M=2.5M-

2.500M-1.3M 240,000

4 2.750M 1.3M 1,450,000 =

2.750M-1.3M

5 3M 1.3M 1,700,000=3M–

1.3M

You might also like

- SKF Prefix SuffixDocument7 pagesSKF Prefix SuffixNath Boyapati67% (3)

- Accounting Equation - Problems & SolutionsDocument25 pagesAccounting Equation - Problems & Solutionsgag9050% (2)

- Jaguar X 350 Workshop ManualDocument6,470 pagesJaguar X 350 Workshop Manualekj100% (2)

- Triangulation ForecastsDocument4 pagesTriangulation Forecastsramblingman50% (2)

- Case1 Colorscope Solution PPTXDocument42 pagesCase1 Colorscope Solution PPTXAmit Dixit100% (1)

- Exam 500895 - PPMC - Senior Capstone - Excel SpreadsheetDocument7 pagesExam 500895 - PPMC - Senior Capstone - Excel Spreadsheetshags100% (6)

- SCM Quiz No 2Document2 pagesSCM Quiz No 2MUHAMMAD -No ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- General Requirements For Welding of PipingDocument8 pagesGeneral Requirements For Welding of PipingMuhammedHafisNo ratings yet

- Speed Control OF WIND TURBINEDocument4 pagesSpeed Control OF WIND TURBINESHADDOWWNo ratings yet

- PPE Sample ProblemsDocument5 pagesPPE Sample ProblemsKathleen FrondozoNo ratings yet

- Tank SterilizationDocument6 pagesTank SterilizationalshamlehNo ratings yet

- Fin320 Simulation 2020 JulyDocument40 pagesFin320 Simulation 2020 JulyMohd Azmezanshah Bin Sezwan100% (1)

- Comparative Study of Education in Kenya and Japan: What Can Kenya Learn?Document25 pagesComparative Study of Education in Kenya and Japan: What Can Kenya Learn?dulluamos78% (27)

- The Dilemma at Day ProDocument7 pagesThe Dilemma at Day ProQistinaNo ratings yet

- Design of T-Beam BridgeDocument39 pagesDesign of T-Beam BridgePanha PorNo ratings yet

- PROPOSED MARKING GUIDE Set 2 - Case StudyDocument7 pagesPROPOSED MARKING GUIDE Set 2 - Case StudyBosz icon DyliteNo ratings yet

- Forex and Derivatives Tutorial 2Document3 pagesForex and Derivatives Tutorial 2CHEONG LIM CHUANo ratings yet

- 3.0 Strategic Finance Projections & EvaluationDocument6 pages3.0 Strategic Finance Projections & EvaluationFatin Zafirah Binti Zurila A21A3251No ratings yet

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Same Questions - F303 - 1st MidDocument5 pagesSame Questions - F303 - 1st MidRafid Al Abid SpondonNo ratings yet

- Turbo Widget Case SolutionDocument2 pagesTurbo Widget Case Solutionshivam chughNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- Quadruple A SDN BHDDocument14 pagesQuadruple A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- Candy Live Policy-2.05Document5 pagesCandy Live Policy-2.05Gesang FirmansyahNo ratings yet

- Income Statement For 3 YearsDocument5 pagesIncome Statement For 3 YearsATticFistNo ratings yet

- Internet Related Industries. The Internet Has Made Many Markets Closer ToDocument2 pagesInternet Related Industries. The Internet Has Made Many Markets Closer Tojetro mark gonzalesNo ratings yet

- Acc 116 Revision MaterialDocument4 pagesAcc 116 Revision MaterialNurul NajihaNo ratings yet

- PT Mekar Jaya Work Sheet Per 31 Dec 2017Document14 pagesPT Mekar Jaya Work Sheet Per 31 Dec 2017Putudevi FebriadnyaniNo ratings yet

- ASSIGNMENT BBAW2103 - Financial AccountingDocument13 pagesASSIGNMENT BBAW2103 - Financial AccountingMUHAMMAD NAJIB BIN HAMBALI STUDENTNo ratings yet

- Decision Theory Expected ValuesDocument4 pagesDecision Theory Expected Valuesmichean mabaoNo ratings yet

- Amirul Hisyam Bin Hashim - 2019654486 - Ap2465aDocument12 pagesAmirul Hisyam Bin Hashim - 2019654486 - Ap2465aICAMMMNo ratings yet

- Group 2 Cash Budget N4ba2503Document3 pagesGroup 2 Cash Budget N4ba2503nuraz3169No ratings yet

- Quotation FormDocument4 pagesQuotation FormAlina PhanNo ratings yet

- Task Accounting in Acition (AP1)Document5 pagesTask Accounting in Acition (AP1)Elvin VinnNo ratings yet

- Madison Super Draft Figures '000 Madison Super Year 0 1 2 3 4 5 YearDocument3 pagesMadison Super Draft Figures '000 Madison Super Year 0 1 2 3 4 5 Yearabubakar321No ratings yet

- Robinsons Bank Convert To Cash Processing FeesDocument1 pageRobinsons Bank Convert To Cash Processing FeesGen MacaleNo ratings yet

- Reward ProgramDocument8 pagesReward ProgramMercie AzarconNo ratings yet

- Iin Dwi Novita Sari Area 1 Sumsel 2 10202-Bayung Lencir Marketing ExecutiveDocument6 pagesIin Dwi Novita Sari Area 1 Sumsel 2 10202-Bayung Lencir Marketing ExecutivePitri YanitaNo ratings yet

- FR9&10 Leases (PracticeANS)Document17 pagesFR9&10 Leases (PracticeANS)duong duongNo ratings yet

- Bank Reconciliation SampleDocument11 pagesBank Reconciliation SampleShaira BaltazarNo ratings yet

- Daftar StockDocument57 pagesDaftar StockJohnNo ratings yet

- Spot - Future) (Ending-Beginning)Document8 pagesSpot - Future) (Ending-Beginning)DR LuotanNo ratings yet

- Internal Rate of ReturnDocument3 pagesInternal Rate of ReturnRohit SethNo ratings yet

- Taxes and Depreciation: MacrsDocument20 pagesTaxes and Depreciation: MacrsRonald GibsonNo ratings yet

- Name: Abdirashiid Kadar Abdi Class: 2D Shift: Morning Id: 1818726Document7 pagesName: Abdirashiid Kadar Abdi Class: 2D Shift: Morning Id: 1818726abdirashiidNo ratings yet

- A Investment in Website Development: B-I Office & Operating ExpensesDocument15 pagesA Investment in Website Development: B-I Office & Operating ExpensesvaibhavmahajanNo ratings yet

- Practical Test Finance & AccountingDocument7 pagesPractical Test Finance & AccountingAlbert CandraNo ratings yet

- Table2 5Document3 pagesTable2 5Alexander 'Tory' HinchliffeNo ratings yet

- Maternity Benefit CalculatorDocument5 pagesMaternity Benefit CalculatorJoanna KarlaNo ratings yet

- Lokoja Wall and Floor Tiles RemainingDocument34 pagesLokoja Wall and Floor Tiles RemainingshaokinoNo ratings yet

- 2002 DecemberDocument7 pages2002 DecemberSherif AwadNo ratings yet

- FINAL DDA Fajar RahmatullahDocument2 pagesFINAL DDA Fajar RahmatullahRajasa RahmanNo ratings yet

- Electricity Bill Advertising: Software RentDocument5 pagesElectricity Bill Advertising: Software RentHasiburNo ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- Financials - Dhobhi BhaiyaDocument9 pagesFinancials - Dhobhi Bhaiyaprince joshiNo ratings yet

- Accounting Equation - Philips Truck RentalDocument2 pagesAccounting Equation - Philips Truck RentalIshanNo ratings yet

- Cash Budget Fin420 - Ba250 Group 4Document9 pagesCash Budget Fin420 - Ba250 Group 4nuraz3169No ratings yet

- Market Analysis: YR Actual Sales YR Actual SalesDocument5 pagesMarket Analysis: YR Actual Sales YR Actual SalesMittal GaglaniNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- TaxationDocument11 pagesTaxationkhowcatherine2000No ratings yet

- Computation SVMVRCDocument8 pagesComputation SVMVRCJennaNo ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet

- Laboratory Exercises in Astronomy: Solutions and AnswersFrom EverandLaboratory Exercises in Astronomy: Solutions and AnswersNo ratings yet

- Doh 5211 PDFDocument2 pagesDoh 5211 PDFJussiNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument39 pagesCash Flow Estimation and Risk AnalysisRanyDAmandaNo ratings yet

- Assignment No: 4: Green Propulsion: Trends and PerspectivesDocument10 pagesAssignment No: 4: Green Propulsion: Trends and PerspectivesAbhishek jNo ratings yet

- Ilano v. Hon. Espanol, G.R. No. 161756, 16 December 2005Document6 pagesIlano v. Hon. Espanol, G.R. No. 161756, 16 December 2005Jessamine OrioqueNo ratings yet

- TDL Language EnhancementsDocument111 pagesTDL Language EnhancementsJasim MuhammedNo ratings yet

- 4-Bus Mixing Console L Series Mixers: General Description FeaturesDocument3 pages4-Bus Mixing Console L Series Mixers: General Description FeaturesBanda SBANo ratings yet

- OptiX PTN 950 Packet Transport Platform Product BrochureDocument6 pagesOptiX PTN 950 Packet Transport Platform Product BrochureJaime JaraNo ratings yet

- NetView For ZOS Programming PipesDocument394 pagesNetView For ZOS Programming Pipesrobhal01No ratings yet

- Plastmix GDocument2 pagesPlastmix Gmohab hakimNo ratings yet

- Dynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedDocument33 pagesDynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedShaurya KumarNo ratings yet

- Numerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodDocument5 pagesNumerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodGokma Sahat Tua SinagaNo ratings yet

- Historical Collection Efficiency From 1990 To 2010Document55 pagesHistorical Collection Efficiency From 1990 To 2010Merlie Oyad LandocanNo ratings yet

- Historical Questions & Answers On SNF Consolidated BillingDocument2 pagesHistorical Questions & Answers On SNF Consolidated BillingKarna Palanivelu100% (2)

- Macro Economics: Euro Turns 20: Lessons From Two Decades of Single Currency SystemDocument17 pagesMacro Economics: Euro Turns 20: Lessons From Two Decades of Single Currency SystemNishan ShettyNo ratings yet

- Qra HPCL Jalandhar Ird-Draft r1Document92 pagesQra HPCL Jalandhar Ird-Draft r1PABNo ratings yet

- MSDS Desmanol PDFDocument6 pagesMSDS Desmanol PDFARIKANo ratings yet

- Karan ResumeDocument1 pageKaran Resumeganeshji loNo ratings yet

- Application WindowDocument2 pagesApplication Windowpatriciomaryrose557No ratings yet

- CRM Documentation v1Document9 pagesCRM Documentation v1Miciano Renjan BrowneyesNo ratings yet

- 10 Practical Applications Of: Geographical Information SystemsDocument28 pages10 Practical Applications Of: Geographical Information SystemsMrinal GourNo ratings yet

- Earning Outcomes: LSPU Self-Paced Learning Module (SLM)Document20 pagesEarning Outcomes: LSPU Self-Paced Learning Module (SLM)Jamie Rose AragonesNo ratings yet

- Document (1) 1Document1 pageDocument (1) 1abdularejNo ratings yet

- Manual LPI - PW ENG. (весы 8 зд) pdfDocument14 pagesManual LPI - PW ENG. (весы 8 зд) pdfАлександр ГончарNo ratings yet