Professional Documents

Culture Documents

A. Funding of Public School

Uploaded by

GelberNavarra100%(1)100% found this document useful (1 vote)

125 views8 pagesPublic schools

Original Title

Public School

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPublic schools

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

125 views8 pagesA. Funding of Public School

Uploaded by

GelberNavarraPublic schools

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

A.

Funding of Public School

Section 34. National Funds - public school shall continue

to be funded primarily from national funds

Section 35. Financial Aid and Assistance to Public

Secondary Schools – the national government shall extend

financial aid and assistance to public secondary schools

Section 36. Share of Local Government – Provinces, cities,

municipalities and barangays shall appropriate funds in

their annual budget for operations and maintenance of

public secondary schools

Section 37. Special Education Fund – the proceeds of the

special education fund accruing local governments shall be

used exclusively for the purpose

Section 38. Tuition and Other School Fees – secondary

and post secondary schools may charge tuition and other

school fees to improve facilities or to accommodate more

students

Section 39. Income from Other Sources – Government

supported educational institution may receive grants,

legacies, donations and gifts for purposes allowed by

existing laws

B. Funding of Private Schools

Section 40. Funding of Private School – Private school

maybe funded from their capital investments or equity

contributions, tuition fees and other school charges

Section 41. Government Assistance – the government

may provide aid to the programs of private school in

the form scholarship or grants or loans

Section 42. Tuition and other School Fees – Each private

school shall determine its rate of tuition and other school

fees and charges

Section 43. Income from other Sources – any private

school duly recognize by the government may receive grant

and legacy, donation, gifts or device

Section 44. Institutional Fund – like tuition fees, and other

school charges as well as other income of schools

C. Incentives to Education

Section 45. Declaration of Policy – it is the policy of the

State in the pursuit of its national educational

development goals to provide an incentive program to

encourage the participation of the community in the

development in educational sector

Section 46. Relating to School Property – real property,

such as land, buildings and other improvements thereon

and exclusively for educational purposes

Section 47. Relating to Gifts or Donations for Schools – All

gifts or donations of any school recognized by the

government shall not subjected to tax

Section 48. Relating to Earnings from Established

Scholarship Funds – All earnings from the investment that

are used to fund additional scholarship are exempt from

the tax until scholarship fund is fully liquidated

Section 49. School Disposal Program – all gains realized

from the sale shall the sale shall be considered exempt from

the tax if the total proceeds of the sale are reinvested in a

new or existing duly established school

Section 50. Conversion of Educational Foundations – an

educational institution may convert itself into non stock,

nonprofit educational foundation

D. Assistance to Students

Section 51. Government Assistance to Students – the

government shall provide financial aid assistance to financially

disadvantage and deserving students

Section 52. Grant of Scholarship pursuant to Existing Laws –

Educational institutions shall be encouraged to grant scholarship

to students pursuant to the provision of existing law

Section 53. Assistance from the Private Sector – the private

sector, especially educational institution, business and industry,

shall be encourage to grant financial assistance to student,

especially those undertaking research in the field of science &

technology

Thank You!

Caroline B. Lariba

Reporter

You might also like

- Science 8 Teachers GuideDocument230 pagesScience 8 Teachers GuideMichelle Gonzales Caliuag86% (142)

- Agri-Crop GRADE 10 TG PDFDocument46 pagesAgri-Crop GRADE 10 TG PDFJr Magbanua94% (32)

- Post Test in Filipino: Education Program Supervisor/LRMS ManagerDocument5 pagesPost Test in Filipino: Education Program Supervisor/LRMS ManagerFia Jean Nadonza Pascua100% (1)

- Leveled Readers in FilipinoDocument24 pagesLeveled Readers in FilipinoMarvin BlancoNo ratings yet

- FarmersAssociation Constitution&Bylaws EnglishDocument10 pagesFarmersAssociation Constitution&Bylaws EnglishGelberNavarra100% (1)

- Fertilizer Materials and Calculation: Nutrient ManagementDocument26 pagesFertilizer Materials and Calculation: Nutrient ManagementJebjeb C. BrañaNo ratings yet

- Modular Teaching PDFDocument3 pagesModular Teaching PDFKazumi GraceAnnNo ratings yet

- PPST - RP - Module 6Document38 pagesPPST - RP - Module 6Leodejoy Ruiz TulangNo ratings yet

- Guidelines On The Redesigned/ Strengthened Tech-Voc Education Program (Stvep) Support FundDocument28 pagesGuidelines On The Redesigned/ Strengthened Tech-Voc Education Program (Stvep) Support FundDarwin AbesNo ratings yet

- Sample Works PDFDocument18 pagesSample Works PDFRemryan R. RebutazoNo ratings yet

- ChoirDocument7 pagesChoirTodd E. L. UychocdeNo ratings yet

- Teachers Role in Promoting Literacy and NumeracyDocument50 pagesTeachers Role in Promoting Literacy and NumeracyKim AlcatNo ratings yet

- Reflection On Speech of Vice President Sara DuterteDocument1 pageReflection On Speech of Vice President Sara DuterteGirlie Mae FloresNo ratings yet

- Grade 6 DLL ENGLISH 6 Q1 Week 3Document10 pagesGrade 6 DLL ENGLISH 6 Q1 Week 3Jess Ica D-BalcitaNo ratings yet

- 19.5 Forerunners of SociologyDocument12 pages19.5 Forerunners of SociologyNiña Sanvi100% (1)

- Temporary Progress Report Card For Elementary (Annex 4)Document1 pageTemporary Progress Report Card For Elementary (Annex 4)MARILYN CANLAPANNo ratings yet

- Matrix of Learning Resources Available in EsP Grade 6Document9 pagesMatrix of Learning Resources Available in EsP Grade 6Manuel ManaloNo ratings yet

- Philosophy of Education Comprehensive ExamDocument3 pagesPhilosophy of Education Comprehensive ExamJuanito Jr Icalla100% (1)

- Webinar On Basic Scriptwriting For Television-Based InstructionDocument38 pagesWebinar On Basic Scriptwriting For Television-Based InstructionWendy ArnidoNo ratings yet

- Kra 1 Kra 2 Kra 3 Kra 4 Kra 5Document9 pagesKra 1 Kra 2 Kra 3 Kra 4 Kra 5Genesis Anne GarcianoNo ratings yet

- SELF ASSESSMENT TOOL FOR T1 T3 by MOY Sta Rosa NHSDocument3 pagesSELF ASSESSMENT TOOL FOR T1 T3 by MOY Sta Rosa NHSJulius MaderiaNo ratings yet

- Tugdan Nhs-Letter Request To SDSDocument4 pagesTugdan Nhs-Letter Request To SDSRandy MusaNo ratings yet

- TOGA Form Observation ToolDocument2 pagesTOGA Form Observation ToolBai Noriene100% (2)

- Cav Form 3Document1 pageCav Form 3Lilian May Sorote AndoNo ratings yet

- The Legend of CalapiDocument3 pagesThe Legend of CalapiMA. THELMA B. EBIASNo ratings yet

- Kras Objectives Weight PER KRA Score Means of VerificationDocument5 pagesKras Objectives Weight PER KRA Score Means of VerificationBelinda Lapsit100% (1)

- Daily Lesson Log A.PDocument1 pageDaily Lesson Log A.Pgilbertmalcolm100% (5)

- Guidelines Assessing Student PerformanceDocument2 pagesGuidelines Assessing Student PerformanceoranisouthNo ratings yet

- Effectiveness of Marungko and Fuller Approach for Grade 5 Non-ReadersDocument26 pagesEffectiveness of Marungko and Fuller Approach for Grade 5 Non-ReadersMarianer MarcosNo ratings yet

- Matrix of Curriculum Standards (Competencies), With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodDocument7 pagesMatrix of Curriculum Standards (Competencies), With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodKesh AceraNo ratings yet

- Pedagogical Approaches 1Document27 pagesPedagogical Approaches 1Donah Borbon- ElamparoNo ratings yet

- Quarter Final Grade Remarks 1 2 3 4 Core Values Behavior Statements Quarter 1 2 3 4Document2 pagesQuarter Final Grade Remarks 1 2 3 4 Core Values Behavior Statements Quarter 1 2 3 4Carlyn Joy Tejones Funcion0% (1)

- Cot RPMSDocument3 pagesCot RPMSMars CabanaNo ratings yet

- SPG Constitution and by LawsDocument13 pagesSPG Constitution and by LawsRichie Macasarte100% (1)

- Strategies for Active Learning and Differentiated Instruction in FilipinoDocument44 pagesStrategies for Active Learning and Differentiated Instruction in FilipinoLeah Mae PanahonNo ratings yet

- Reading Intervention Action Plan For Frustration and Non-Readers SY 2020-2021Document2 pagesReading Intervention Action Plan For Frustration and Non-Readers SY 2020-2021December Cool100% (1)

- DepEd Order 8 Classroom Assessment GuideDocument2 pagesDepEd Order 8 Classroom Assessment GuideAilljim Remolleno ComilleNo ratings yet

- Republic of the Philippines Department of Education Weekly ReportDocument2 pagesRepublic of the Philippines Department of Education Weekly ReportWilliam Felisilda100% (1)

- Tunas Elementary Workweek ReportDocument9 pagesTunas Elementary Workweek ReportKristine Barredo100% (2)

- LAC Session 4 Module 1 Lesson 3Document34 pagesLAC Session 4 Module 1 Lesson 3earl gie campayNo ratings yet

- Rubrics For MTBDocument1 pageRubrics For MTBNor-Jaina Musa Mina-CalulongNo ratings yet

- Comprehensive Exam - Foundations of EducationDocument8 pagesComprehensive Exam - Foundations of EducationRicky JR Gomez100% (1)

- The Impacts of Happy School Movement (Research)Document3 pagesThe Impacts of Happy School Movement (Research)Jonald Domingo MacasioNo ratings yet

- Project Work Plan and Budget Matrix Filipino Department School Year 2019-2020Document1 pageProject Work Plan and Budget Matrix Filipino Department School Year 2019-2020EdlynNacionalNo ratings yet

- Implement BEIS & LIS TrainingDocument6 pagesImplement BEIS & LIS TrainingRONALEEN MISLANGNo ratings yet

- The Kingfisher and The CatDocument2 pagesThe Kingfisher and The CatArdeur Nedyam Gubot100% (1)

- EFD 501 Course OutlineDocument3 pagesEFD 501 Course OutlineMia Cristialen100% (1)

- Reformulated Regional Research AgendaDocument15 pagesReformulated Regional Research AgendaJeramie Gatmaitan AsistioNo ratings yet

- Curriculum Evaluation at The School or School System LevelDocument5 pagesCurriculum Evaluation at The School or School System LevelFeliza GarciaNo ratings yet

- DepEd LAC Training Enhances Test ConstructionDocument3 pagesDepEd LAC Training Enhances Test ConstructionJuliet AlanNo ratings yet

- Guiding Teachers on Supporting Students with Visual ImpairmentsDocument5 pagesGuiding Teachers on Supporting Students with Visual ImpairmentsCharie Enrile-JaleNo ratings yet

- Identifying Point-of-View in NarrativesDocument3 pagesIdentifying Point-of-View in NarrativesCristel Gay MunezNo ratings yet

- Tayutay: A Strategic Intervention Material in Filipino - 7Document1 pageTayutay: A Strategic Intervention Material in Filipino - 7Vivian Madera100% (1)

- Environmental Activity PlanDocument2 pagesEnvironmental Activity PlanNomer SolivenNo ratings yet

- LAC-MINUTES-Orientation On The Preparation of School Forms andDocument2 pagesLAC-MINUTES-Orientation On The Preparation of School Forms andGinalyn Oliva GanteNo ratings yet

- Lac Session Utilization of Reading MaterialsDocument47 pagesLac Session Utilization of Reading MaterialsMariannette NavarroNo ratings yet

- English 5Document25 pagesEnglish 5Menchie Salvana BaringNo ratings yet

- Estratehiya Sa Pagtuturo NG FilipinoDocument40 pagesEstratehiya Sa Pagtuturo NG FilipinoChelsea Anne PermejoNo ratings yet

- Lesson Exemplar in Science 1 (Melc)Document6 pagesLesson Exemplar in Science 1 (Melc)jal bayaniNo ratings yet

- Ae Chapter 1-3Document73 pagesAe Chapter 1-3Mark Anthony VirayNo ratings yet

- Department of Education: Republic of The PhilippinesDocument4 pagesDepartment of Education: Republic of The PhilippinesJOSEPHINE HUNTERNo ratings yet

- NWC Modules MELCS AlignmentDocument13 pagesNWC Modules MELCS AlignmentMary Claire EnteaNo ratings yet

- Degrees of Adjectives Lesson Exemplar in English 5Document1 pageDegrees of Adjectives Lesson Exemplar in English 5NOLIVIE B. DIZONo ratings yet

- NarrativeDocument3 pagesNarrativeGelberNavarraNo ratings yet

- Department of Education Caraga Administrative Region Division of Butuan CityDocument2 pagesDepartment of Education Caraga Administrative Region Division of Butuan CityGelberNavarraNo ratings yet

- Tools and Equipments..Document26 pagesTools and Equipments..GelberNavarraNo ratings yet

- 2020 Commiment of ChaperonDocument1 page2020 Commiment of ChaperonGelberNavarraNo ratings yet

- A. Funding of Public SchoolDocument8 pagesA. Funding of Public SchoolGelberNavarra100% (1)

- Scouting Hand & Whistle SignalsDocument2 pagesScouting Hand & Whistle SignalsReine Chiara B. Concha94% (33)

- Various Forms of Media: Reporter: Alfredo M. GriñoDocument11 pagesVarious Forms of Media: Reporter: Alfredo M. GriñoGelberNavarraNo ratings yet

- Report Mam Canda HingpitDocument10 pagesReport Mam Canda HingpitGelberNavarraNo ratings yet

- Student'S Record: Written WorksDocument2 pagesStudent'S Record: Written WorksMaKenJi EscalanteNo ratings yet

- Constitution & By-LawsDocument14 pagesConstitution & By-LawsYan Yan YanNo ratings yet

- Report Mam Canda - GrenoDocument20 pagesReport Mam Canda - GrenoGelberNavarraNo ratings yet

- Tools and Equipments..Document26 pagesTools and Equipments..GelberNavarraNo ratings yet

- Various Forms of Media: Reporter: Alfredo M. GriñoDocument11 pagesVarious Forms of Media: Reporter: Alfredo M. GriñoGelberNavarraNo ratings yet

- Constitution & By-Laws (1) - 1Document13 pagesConstitution & By-Laws (1) - 1GelberNavarraNo ratings yet

- Grade 4-6 - Summary Final GradesDocument12 pagesGrade 4-6 - Summary Final GradesArnel TanNo ratings yet

- Classroom Management PrinciplesDocument1 pageClassroom Management PrinciplesGelberNavarraNo ratings yet

- Join Our NGO FormDocument3 pagesJoin Our NGO FormGelberNavarraNo ratings yet

- Tools and EquipmentsDocument26 pagesTools and EquipmentsGelberNavarraNo ratings yet

- Constitution & By-LawsDocument14 pagesConstitution & By-LawsYan Yan YanNo ratings yet

- Lifetime Membership: Student Society For Global Health Membership Application FormDocument2 pagesLifetime Membership: Student Society For Global Health Membership Application FormGelberNavarraNo ratings yet

- Lesson 2 School and Community Relations ReportDocument17 pagesLesson 2 School and Community Relations ReportGelberNavarraNo ratings yet

- Composition Scheme SEC 10 - GST PDFDocument20 pagesComposition Scheme SEC 10 - GST PDFTushar SinghNo ratings yet

- Basics & House Property - SolutionDocument6 pagesBasics & House Property - Solutionvishwajeetpatil0542No ratings yet

- Reply To Communication For Payment Before Issue of SCNDocument2 pagesReply To Communication For Payment Before Issue of SCNCAAniketGangwalNo ratings yet

- Lipc C250872923Document1 pageLipc C250872923Vineet HegdeNo ratings yet

- Dezhao Li: Earnings StatementDocument1 pageDezhao Li: Earnings StatementAnna LiNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- PURCHASE ORDER TITLEDocument1 pagePURCHASE ORDER TITLESubrata ParaiNo ratings yet

- Find It.Document2 pagesFind It.Bane LazoNo ratings yet

- CIR Vs SC JohnsonDocument2 pagesCIR Vs SC JohnsonArra Balahadia dela PeñaNo ratings yet

- CA Resale CertificateDocument1 pageCA Resale Certificateali razaNo ratings yet

- MA Economics Entrance CourseDocument10 pagesMA Economics Entrance Courseabhishek thakur0% (1)

- Barangay Appropriation OrdinanceDocument5 pagesBarangay Appropriation OrdinanceArman BentainNo ratings yet

- Qatar Tax Law 2009Document18 pagesQatar Tax Law 2009Jitendra NagvekarNo ratings yet

- HRA Declaration Form for Sukanta College StaffDocument1 pageHRA Declaration Form for Sukanta College StaffArunabha_GNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- Midterm Exam IntaxDocument16 pagesMidterm Exam IntaxIyarna Yasra100% (1)

- Union Public Service Comission IES ISS Exam Notification 2011 ProspectusDocument7 pagesUnion Public Service Comission IES ISS Exam Notification 2011 ProspectusUdyoga VartamanamuNo ratings yet

- AEC7 - Tañote - BSA-2A - Assignment 1Document3 pagesAEC7 - Tañote - BSA-2A - Assignment 1Daisy TañoteNo ratings yet

- RPH Taxation ReportDocument38 pagesRPH Taxation ReportLois SabadoNo ratings yet

- Presentation On Taxation of The Microfinance IndustryDocument23 pagesPresentation On Taxation of The Microfinance IndustryFranco DurantNo ratings yet

- Business taxes and VAT explainedDocument4 pagesBusiness taxes and VAT explainedHyascintheNo ratings yet

- Anticipated Final AccountDocument1 pageAnticipated Final AccountJelson RumuarNo ratings yet

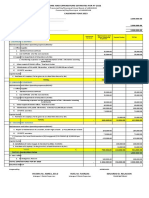

- Proposed SEF Budget CY 2023Document2 pagesProposed SEF Budget CY 2023Dihsie LauronNo ratings yet

- Deduction for health insurance and medical expenditureDocument2 pagesDeduction for health insurance and medical expenditureRavish ShakyaNo ratings yet

- RA No. 10963: Train LawDocument3 pagesRA No. 10963: Train LawSephora SequiñoNo ratings yet

- Foreign Status Certificate Individual Tax FormDocument1 pageForeign Status Certificate Individual Tax FormAndrew Christopher CaseNo ratings yet

- Moredo, Eloisa Joy R Payroll Workshop: Alaras, Arla Gabrielle (A0012)Document15 pagesMoredo, Eloisa Joy R Payroll Workshop: Alaras, Arla Gabrielle (A0012)Eloisa Joy MoredoNo ratings yet

- Methodology Financial and Economic Project Analyses Decision Making Tool - en - 2 PDFDocument374 pagesMethodology Financial and Economic Project Analyses Decision Making Tool - en - 2 PDFpasman caniagoNo ratings yet

- CommunityPlanning Toolkit-Scottish+++++Document24 pagesCommunityPlanning Toolkit-Scottish+++++Munguongeyo IvanNo ratings yet

- Onnorokom Solutions LTDDocument3 pagesOnnorokom Solutions LTDYeamin KaziNo ratings yet