Professional Documents

Culture Documents

Rancon Infrastructure and Engineering Ltd. Rancon Real Estate Division 31 October'19

Uploaded by

Joni alauddin0 ratings0% found this document useful (0 votes)

70 views9 pagesOriginal Title

31 October'19, EBM

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

70 views9 pagesRancon Infrastructure and Engineering Ltd. Rancon Real Estate Division 31 October'19

Uploaded by

Joni alauddinCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

RANCON INFRASTRUCTURE AND ENGINEERING LTD.

Rancon Real Estate Division

31 October’19

Snapshot of Company’s ongoing product

Internal Audit Review of Ongoing project

Line Hard ware (BDT 84.65 crore)

1.5 MCCB (BDT31.39 crore)

River Crossing Tower (BDT 13.54 crore)

Presented by :

INTERNAL AUDIT, RANCON GROUP

INTERNAL AUDIT October 31, 2019

OVERALL REVIEW OUTCOME:

Status as on 28 October 2019

• Line hardware (84.65 crore project): First line hardware project still not completed though

it was supposed to complete by 15 October’19

• 1.5 MCCB (31.39 crore project): Only 4.5 % (Galvanizing ) and 16 % (fabrication) of recent

project has been completed (in ton) though the whole project was supposed to be completed

by 9 Dec’19

• Rivers crossing tower project (13.54 Crore): 12 % of the project has been completed,

project completion date 21 August’20

Almost 45 ton zinc of current project (1.5 MCCB) has been used in previous project ( 84.65 crore

BDT), the estimated market price of which BDT 1.21 crore. Annexure-01

Overall RIEL profitability: RIEL overall profitability may turn into losses if we fail to complete the

project within 31st December’19 Annexure-02

No formal JV agreement between RIEL and Mollah Traders for ‘river crossing tower project’ though

project signed with REB 21st August’19 and project work started accordingly Annexure-03

As per last EBM, RIEL expected to be awarded 10 tenders in three categories, while only 1 tender has

been achieved till to date, which may turn to loss company up-to 30 June’20. Annexure-04

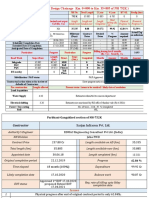

Rancon Infrastructure and Engineering Limited

Project: 1.5 MCCB

Statement of ZINC Consumption

As on 30 October 2019

Amount in

Particulars

(Kg)

Total Purchased 76,893.0

Stock in Hand 4,781.0

Already Issued 72,112.0

Less: Stock required in BATH (Furnace)* 10,000.0

Used in Production 62,112.0

Assumption

Used in 1st Contract (BDT 84.84 Crore) 45,000.0

Used in 2nd Contract (BDT 31.40 Crore) 17,112.0

Used in Production 62,112.0

* Information Provided by RIEL Management.

Rancon Infrastructure and Engineering Ltd

Overall estimated company profitability

Considering following date

As per RIEL As per IA. project closing on

Tender No.Of Project

Particulars Floating Project WO Value closing on 9 31 December'19 15 January'20

Time s Dec'19

Amount(TK) Amount(TK) Amount(TK) Amount(TK)

Existing Line Hardware Jan'19 2 313,951,784 24,367,609 17,309,809 12,016,444

Existing Cross Arm Apr'19 1 46,939,500 2,122,779 1,629,276 1,258,525

Existing River Crossing

Aug'19 3 78,938,205 - - -

Tower

Total Projected profit - 439,829,489 26,490,389 18,939,085 13,274,969

Head Office Expense - - - 12,000,000 12,000,000 12,000,000

Finance Cost on RPL

- - - 7,000,000 7,000,000 7,000,000

Loan

Total - - - 7,490,389 (60,915) (5,725,031)

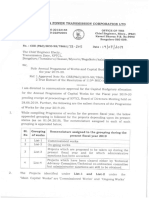

1. No formal JV agreement between RIEL & Mollah Traders:

Contract agreement has been signed with REB on 21st day of August’19, As per the contract,

river crossing project has to be completed by 21st day of August’20 and NOA issued by REB

on 25-07-19, but no formal contract has been signed with sole JV party, Mollah traders. JV

agreement usually states rules and responsibility of each party to the contract, as well as time

place of execution. However, no such formal agreement has been signed till our review date

29-09-19

Potential risk(s) consequences:

Lack of clarity whether contract term have been agreed

Lack of clarity about roles & responsibility of each party

Some terms of contact may agree, but others are not

Business relationship may severely hampered if dispute arise

Recommendation

We recommend that a formal contract agreement should be signed before implementation of

contract clearly stating obligation & responsibilities, performance, liabilities of each party to

the contract to avoid misunderstanding about future dispute between the party.

Revised Profitability of all project including expected up-to Q2 2020 BDT Crore

Tender Floating Delivery No. of

WO Value Q4 2019 Q1 2019 Q2 2019 Total

Time Time Projects

Existing Line Hardware 19-Jan 19-Nov 2 31.4 2.44 2.44

19-Sep 20-Feb

Projected Line Hardware Dec 19 and Q4

20-Jun 2 36 2.79 2.79

20

Line Hardware Sub-total 4 67.4 2.44 0 2.79 5.23

Existing Cross Arm 19-Apr 19-Nov 1 4.7 0.22 0.22

19-Sep 20-Feb

Projected Cross Arm Dec 19 and Q4

20-Jun 3 15 0.68 0.68

20

Cross Arm Sub-total 4 19.7 0.22 0 0.68 0.9

Existing River Crossing Tower 19-Jun 20-Jun 3 7.9 0.48 0.48

Projected River Crossing

19-Aug 20-Sep 1 4.05 0.56 0.56

Tower

River Crossing Tower Sub-

4 11.95 0 0 1.04 1.04

total

Total Project Profit from All

21 99.05 2.66 0 4.51 7.17

Projects

Head Office Expenses 1.2 1.2 1.2 3.6

Finance cost on RPL Loan 0.7 0.7 0.7 2.1

Total Projected Profit from

21 165.48 0.76 (1.90) 2.61 1.47

Q4 19 to Q2 20

Loss from Existing Line

18-Jan 19-Sep 5 84.64 (3.86)

Hardware Project up to Sep

Total Projected Profit up to

26 250.12 0.76 (1.90) 2.61 (2.39)

Q2 2020

Thank you

Md. Nazrul Kabir Chowdhury

GHIA

Md. Siddiqur Rahaman

Manager, IA. Real Estate Division

S.M. Ala uddin

Asst. Manager. Rancon Real Estate Division

You might also like

- MRT IPC -5 -8+9Document6 pagesMRT IPC -5 -8+9mr.raihan.sslNo ratings yet

- Cluster Progress Report - Sfurti (PPDC Agra)Document6 pagesCluster Progress Report - Sfurti (PPDC Agra)GUB PROJECTNo ratings yet

- Job Description ACE (CRS) Landed Value (CRS) QTY Savings Rate Savings Total Savings (CRS) Savings %Document2 pagesJob Description ACE (CRS) Landed Value (CRS) QTY Savings Rate Savings Total Savings (CRS) Savings %rahulNo ratings yet

- Monthly Report Jan 2020Document36 pagesMonthly Report Jan 2020Abdullah Al MarufNo ratings yet

- Ricemill ProjectDocument16 pagesRicemill Projectbishnuds25No ratings yet

- C3A - Monthy Report - Swing Studio DG006 30 DECDocument26 pagesC3A - Monthy Report - Swing Studio DG006 30 DECimad.ha017No ratings yet

- 039 Weekly ReportDocument48 pages039 Weekly Reportaristeo garzonNo ratings yet

- Subcontract Schedule (Actual Vs Scheduled)Document2 pagesSubcontract Schedule (Actual Vs Scheduled)EricNo ratings yet

- Cost Estimation Chapter 19Document3 pagesCost Estimation Chapter 19Fong Chee KietNo ratings yet

- LTCC Work BookDocument49 pagesLTCC Work BookHannah NolongNo ratings yet

- Cma-Krishnaveni Upvc Profiles PDFDocument22 pagesCma-Krishnaveni Upvc Profiles PDFtechnopreneurvizagNo ratings yet

- Construction Progress Report for Small Mammals EnclosureDocument21 pagesConstruction Progress Report for Small Mammals EnclosuretofikkemalNo ratings yet

- Construction Progress Report for Small Mammals EnclosureDocument21 pagesConstruction Progress Report for Small Mammals EnclosuretofikkemalNo ratings yet

- Jalna Division: Wadigodri-Dhangerpimpari NH 753H Length 30.39Document8 pagesJalna Division: Wadigodri-Dhangerpimpari NH 753H Length 30.39Sangram MundeNo ratings yet

- 28 7 20 DISPUTE 3 Contr's Position Statment DraftDocument31 pages28 7 20 DISPUTE 3 Contr's Position Statment DraftArshad MahmoodNo ratings yet

- AV Line - SINDocument1 pageAV Line - SINJonnyKhan7No ratings yet

- Assessment of Working Capital Requirements Form I: AS ON 27.05.08Document11 pagesAssessment of Working Capital Requirements Form I: AS ON 27.05.08SAP CONSULTANT FIORINo ratings yet

- 1st Quarter Demand of Fund 2023-24 Hingol + Sindh (15,20,25,40) 18.07.2023 With Hingol 296 MillionDocument12 pages1st Quarter Demand of Fund 2023-24 Hingol + Sindh (15,20,25,40) 18.07.2023 With Hingol 296 MillionsaibaNo ratings yet

- T815 BQsum (TA5) PCG 101221 (Rev.02)Document28 pagesT815 BQsum (TA5) PCG 101221 (Rev.02)azim azrulNo ratings yet

- BMD PPT For 18.08.2020Document2 pagesBMD PPT For 18.08.2020Sangram MundeNo ratings yet

- The Procurement Of: Bidding DocumentDocument156 pagesThe Procurement Of: Bidding DocumentKrishna NiraulaNo ratings yet

- Weekly Progress and Status ReportDocument3 pagesWeekly Progress and Status ReportAbdulrahman MansiNo ratings yet

- IPC - 122 Shitoljhorna Khal RW DraftDocument73 pagesIPC - 122 Shitoljhorna Khal RW DraftArif AbedinNo ratings yet

- Rental & Subcontractor Status ReportDocument2 pagesRental & Subcontractor Status ReportHhgcp EMNo ratings yet

- BLW Data 2020-21Document42 pagesBLW Data 2020-21Abhinav MauryaNo ratings yet

- Commercial Bldg Construction ProjectDocument76 pagesCommercial Bldg Construction ProjectArjay AletaNo ratings yet

- Mescon Construction Monthly Report: Project:-Package I, Lot Ii Block: - Library & MainstoreDocument47 pagesMescon Construction Monthly Report: Project:-Package I, Lot Ii Block: - Library & Mainstoreኢትዮጵያ የ 3ሺ አመት እመቤትNo ratings yet

- ReportDocument81 pagesReportPrabhakar No oneNo ratings yet

- MPR Package - 6 AprilDocument28 pagesMPR Package - 6 AprilRayNo ratings yet

- FHFHFDDocument2 pagesFHFHFDAaron WilsonNo ratings yet

- Request For InspectionDocument24 pagesRequest For InspectionCampos Silcam SilvioNo ratings yet

- Contractors Performance 2Document4 pagesContractors Performance 2Habtamu Desalegn100% (3)

- KK PNW CVL MERCUSUAR 2023 005bDocument115 pagesKK PNW CVL MERCUSUAR 2023 005bdavid mks gresikNo ratings yet

- Kolde to Khetia highway project status and issuesDocument2 pagesKolde to Khetia highway project status and issuesDipak PatelNo ratings yet

- Management Accounting ConceptsDocument12 pagesManagement Accounting ConceptsManan ShahNo ratings yet

- 69796bos55750 p1Document34 pages69796bos55750 p1Dj babuNo ratings yet

- DAY WORK SCHEDULES AND RATESDocument5 pagesDAY WORK SCHEDULES AND RATESAbdul ThurabNo ratings yet

- CORRECTED RA Bill-04 (DS Construction)Document4 pagesCORRECTED RA Bill-04 (DS Construction)RASCON BUILDNo ratings yet

- Monthly Progress Report May 2021Document331 pagesMonthly Progress Report May 2021Mukhtiar AliNo ratings yet

- 25547252Document203 pages25547252Nuru TwahaNo ratings yet

- SPCL Offer 9 (New) - 03.12.09Document55 pagesSPCL Offer 9 (New) - 03.12.09ptn999No ratings yet

- Crescent Project Schedule Narrative Rev.00-310717Document11 pagesCrescent Project Schedule Narrative Rev.00-310717Mohamed El-shaarawiNo ratings yet

- Inspection Report ClaycreteDocument10 pagesInspection Report Claycretemusa aaronNo ratings yet

- C3A - Monthy Report - Swing Studio DG006 30 DECDocument26 pagesC3A - Monthy Report - Swing Studio DG006 30 DECimad.ha017No ratings yet

- Status Report For The Month of Nov 2022Document11 pagesStatus Report For The Month of Nov 2022AshebirNo ratings yet

- Special Repairs of Critical Sections Along Ado - Eekiti-Aramoko-Itawure-Osun State Border in Ekiti StateDocument15 pagesSpecial Repairs of Critical Sections Along Ado - Eekiti-Aramoko-Itawure-Osun State Border in Ekiti StateAremu OluwafunmilayoNo ratings yet

- Country Management Report UAEDocument4 pagesCountry Management Report UAEMuhammad MuneebNo ratings yet

- BSR Central ProvinceDocument128 pagesBSR Central ProvinceIsuru UddikaNo ratings yet

- BW6 Bidders Conference Consolidated - RENEWABLE ENERGYDocument58 pagesBW6 Bidders Conference Consolidated - RENEWABLE ENERGYLutherOldaNo ratings yet

- ANRD-INF-MFC-FA-5765-0002 - 001 - Planning PackageDocument4 pagesANRD-INF-MFC-FA-5765-0002 - 001 - Planning PackageSudeepDPoojaryNo ratings yet

- Monthly Progress Report No. 1 PDFDocument52 pagesMonthly Progress Report No. 1 PDFlyu tingNo ratings yet

- Chintan Shivir: Production Planning of With Enabling ConditionsDocument25 pagesChintan Shivir: Production Planning of With Enabling ConditionsKudlappa DesaiNo ratings yet

- Forecast and Actual Construction Demand (To Date)Document2 pagesForecast and Actual Construction Demand (To Date)Kai Qi TayNo ratings yet

- Call Report: Thyssenkrupp Elevator QATARDocument3 pagesCall Report: Thyssenkrupp Elevator QATARChaimaNo ratings yet

- Weekly report GARP Jan9-jan15-2014Document82 pagesWeekly report GARP Jan9-jan15-2014Jundi HusenNo ratings yet

- May 2020 - NERCHOWK-PANDOH PROJECTDocument12 pagesMay 2020 - NERCHOWK-PANDOH PROJECTViswanatham MarellaNo ratings yet

- Gas and Coal Reserve & Production: February 2020Document44 pagesGas and Coal Reserve & Production: February 2020Hydrosys InnovationNo ratings yet

- Global Cement Project AnnexuresDocument19 pagesGlobal Cement Project AnnexuresAamir AzizNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Transaction Review RKPL, Draft ReportDocument13 pagesTransaction Review RKPL, Draft ReportJoni alauddinNo ratings yet

- Transaction Audit Report RKPLDocument1 pageTransaction Audit Report RKPLJoni alauddinNo ratings yet

- Strictly ConfidentialDocument2 pagesStrictly ConfidentialJoni alauddinNo ratings yet

- Internal Audit ReportDocument4 pagesInternal Audit ReportJoni alauddinNo ratings yet

- Reinsurance Guidelines - Ir Guid 14 10 0017Document11 pagesReinsurance Guidelines - Ir Guid 14 10 0017Steven DreckettNo ratings yet

- CaseDigest Report 1 PDFDocument5 pagesCaseDigest Report 1 PDFJude A. PadilloNo ratings yet

- Corporation Code EssentialsDocument8 pagesCorporation Code EssentialsYolly Diaz100% (1)

- Credit Transactions Lecture NotesDocument8 pagesCredit Transactions Lecture NotesjeviloricoNo ratings yet

- Agent Commission Agreement - Gil TuplanoDocument3 pagesAgent Commission Agreement - Gil TuplanoBobby BilloteNo ratings yet

- Remoteness of DamagesDocument9 pagesRemoteness of DamagesHarleen CaurNo ratings yet

- BLR 211 - FdeDocument23 pagesBLR 211 - FdeDjunah Arellano100% (1)

- Instant Download Practical Strategies For Technical Communication With 2016 Mla Update 2nd Edition Markel Solutions Manual PDF Full ChapterDocument11 pagesInstant Download Practical Strategies For Technical Communication With 2016 Mla Update 2nd Edition Markel Solutions Manual PDF Full Chaptersiennamurielhlhk100% (4)

- Formation of the contract - the offer chapterDocument14 pagesFormation of the contract - the offer chaptermariam raafatNo ratings yet

- General Escrow InstructionsDocument5 pagesGeneral Escrow InstructionsndevereauxNo ratings yet

- Dissent of Dr. Mustafa Al-Zarqa: Contract and Stand of Islamic Shari'ah) - You Are Aware of ItDocument3 pagesDissent of Dr. Mustafa Al-Zarqa: Contract and Stand of Islamic Shari'ah) - You Are Aware of ItKhalid ShahNo ratings yet

- Merrill Lynch Futures v. Court of AppealsDocument3 pagesMerrill Lynch Futures v. Court of Appealsmaginoo69No ratings yet

- Marine Insurance ActDocument31 pagesMarine Insurance ActSasi DharanNo ratings yet

- Real Estate Mortgage SampleDocument4 pagesReal Estate Mortgage SampleNievelita OdasanNo ratings yet

- Essentials of a Valid ContractDocument3 pagesEssentials of a Valid Contracthwh huiNo ratings yet

- Mb0035 Ebook (Laob)Document147 pagesMb0035 Ebook (Laob)Maan Iqbal SinghNo ratings yet

- Enterprise Law Final AssignmentDocument10 pagesEnterprise Law Final Assignmentasad ihsanNo ratings yet

- Contingency Recruitment Service and Fee Agreement Inc. ("Recruiter" or "We") and ("Client"), (Collectively, The "Parties") - ServicesDocument2 pagesContingency Recruitment Service and Fee Agreement Inc. ("Recruiter" or "We") and ("Client"), (Collectively, The "Parties") - ServicesBhie IgnacioNo ratings yet

- SERVICE AGREEMENT Adv Shafi KsaDocument2 pagesSERVICE AGREEMENT Adv Shafi Ksamohammed shafiNo ratings yet

- Vehicle Bill of SaleDocument2 pagesVehicle Bill of SaleZou CongjunNo ratings yet

- Small Claims Tribunals Pre-Filing Assessment AcknowledgementDocument1 pageSmall Claims Tribunals Pre-Filing Assessment AcknowledgementSalauddeenNo ratings yet

- BUS 360 Company LawDocument30 pagesBUS 360 Company LawNavid Al Faiyaz ProviNo ratings yet

- JSW Steel Ltd. V. AI Ghuriar Iron and Steel LLC.: CaseDocument6 pagesJSW Steel Ltd. V. AI Ghuriar Iron and Steel LLC.: Casemohini sonkarNo ratings yet

- Accounting For Corporation - Basic ConsiderationsDocument49 pagesAccounting For Corporation - Basic ConsiderationsAlessandraNo ratings yet

- Multiple choice exam on pledge and mortgageDocument2 pagesMultiple choice exam on pledge and mortgageab galeNo ratings yet

- Contract of Lease With Option To PurchaseDocument3 pagesContract of Lease With Option To PurchaseNeilJuan JuanNo ratings yet

- HRM PresentationDocument24 pagesHRM Presentationpathakak1982No ratings yet

- Another Partnership DeedDocument5 pagesAnother Partnership DeedgakarunNo ratings yet

- Spherical Roller Bearings: DimensionsDocument4 pagesSpherical Roller Bearings: Dimensionskamal arabNo ratings yet

- National Life Insurance AssignmentDocument13 pagesNational Life Insurance Assignmentshaira kabir100% (1)